CoinTracker Review 2024: Is it The Top Crypto Tax Tool?

TL;DR

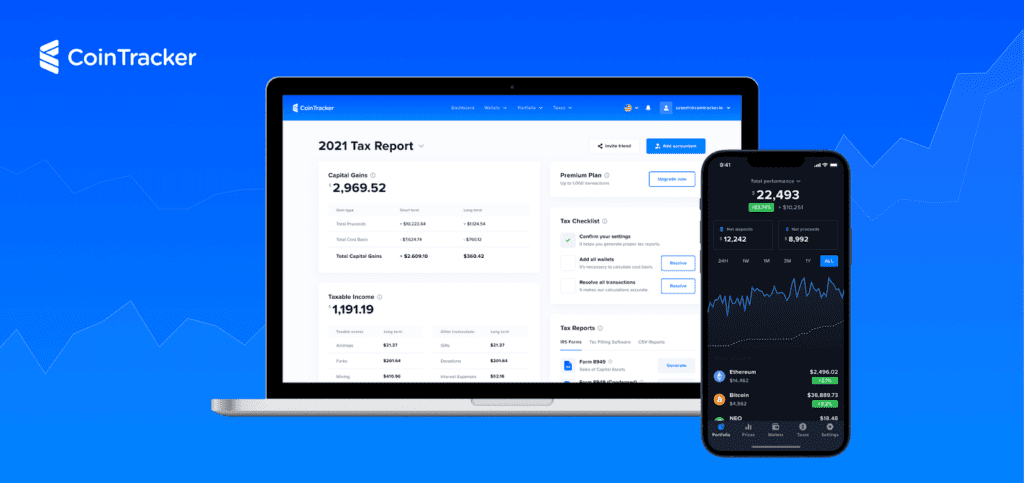

- This CoinTracker review guides you on how to keep track of cryptocurrency and NFT transactions to create IRS-compliant crypto tax reports like Form 8949 and 1040 Schedule D.

- It costs $53 to $539/year, with over 500 wallet integrations & exchanges.

CoinTracker Overview

| Aspects | Details |

|---|---|

| Coinweb Rating | ⭐⭐⭐⭐ (4.6) |

| Price | $53 – $539 |

| Supported Exchanges & Wallets | 500+ |

| Supported Cryptocurrencies | 10,000+ |

| Top Features | Tax Tracking, Portfolio Tracker, Cost Basis Accounting Methods, Fee Tracking |

| Launched In | 2017 |

| Founded By | Chandan Lodha and Jon Lerner in |

| Headquartered In | San Francisco, California |

What is CoinTracker?

CoinTracker is tax software that keeps track of your transactions across blockchains and wallets to create tax reports like IRS Form 8949.

Headquartered in San Francisco, CoinTracker was founded by Chandan Lodha and Jon Lerner in 2017.

CoinTracker has reached 100,000 users and has achieved a key milestone of syncing 175,000 wallets/exchanges. At the time of writing, it has $20B in transaction volume, and $600M has been claimed in capital losses through the platform.

CoinTracker Review: Advantages

Let’s explore the advantages:

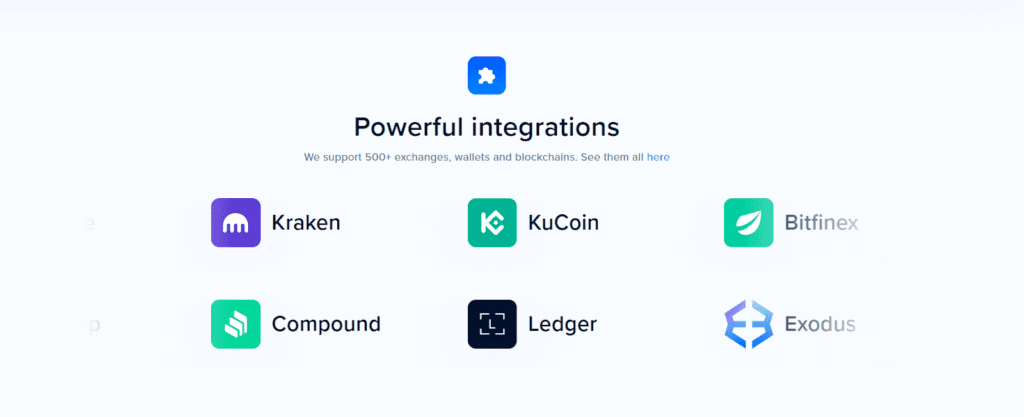

Support for 500+ wallets & exchanges

CoinTracker has covered your crypto portfolio, linking 500+ crypto wallets and exchanges, 10,000+ cryptocurrencies, and 8,000+ blockchains.

For traders who are more inclined toward the DeFi market, they can seamlessly integrate and add exchanges like dYdX, Compound Finance, and 1inch

It supports popular exchanges like Binance, Kraken, Gemini, Coinbase, and BitFinex.

Some supported cryptocurrency wallets are MetaMask, Exodus, Ledger, Trezor and TrustWallet.

Handles tax compliance

CoinTracker removes the hassle of exporting your crypto tax data in formats recognized by top companies, including H&R Block, TaxAct, and TurboTax.

This gives you better portfolio visibility. On top of all that, you have the convenience of easily downloading reports in formats (CSV) suitable for fast filing with the Inland Revenue Service (IRS).

If you’re filing crypto taxes during the tax season, this is handy, but it comes at around $53 for 100 transactions. But you will have to pay more for unlimited reports (even from any past tax year).

Portfolio Tracker

CoinTracker’s Portfolio Tracking lays out your crypto assets from different wallets into a user-friendly dashboard—free for monitoring up to 5 wallets.

Whether you use exchanges or trade across chains, the base plan (30 wallet addresses) or pro plan (1000 wallet addresses) covers most degen traders.

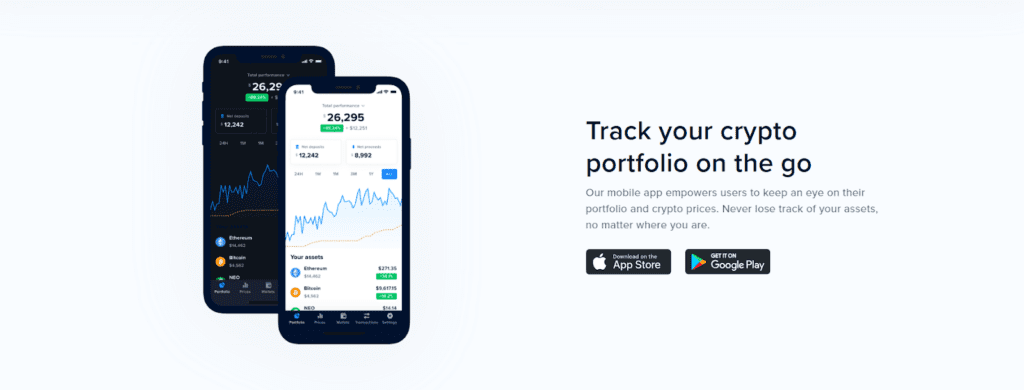

Mobile app

CoinTracker has a practical mobile app for iOS and Android to help you manage crypto assets on the go. While the interface is intuitive, there are no practical key features like charting tools and a dark mode (a must for night owls like me).

Another drawback is the absence of a time-period adjustment for your transaction history. Despite these limitations, the mobile app does its job.

Costs and Fees

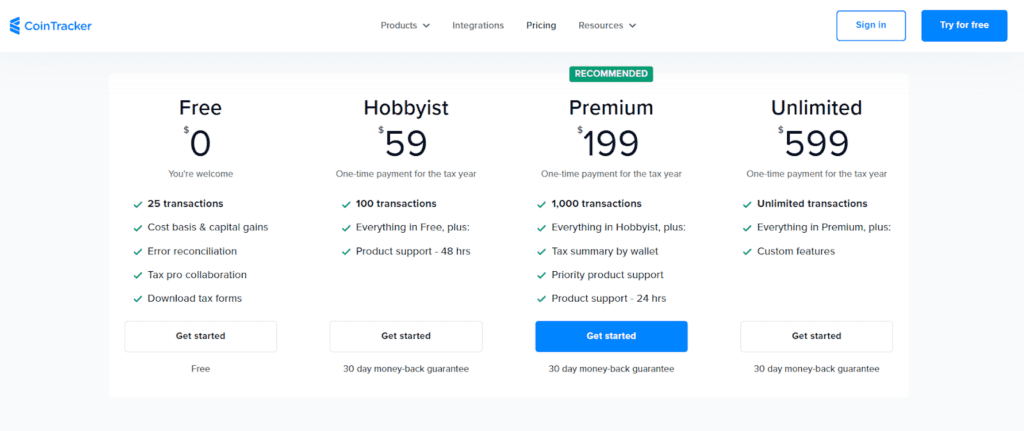

CoinTracker offers two primary products: the Tax Plan and the Portfolio Tracking subscription.

Tax plan

| Tax Plan | Price | Transactions | Features |

|---|---|---|---|

| Free | Free | 25 | Cost basis & capital gains, Error reconciliation, Tax pro collaboration, Download/Prepare tax forms |

| Hobbyist | $53 | 100 | Cost Basis Accounting Methods & Everything in Free, plus Product support – 48 hrs |

| Premium | $179 | 1000 | Everything in Hobbyist, plus Tax summary by wallet, Priority product support, Product support – 24 hrs |

| Unlimited | $539 | Unlimited | All features, including cost basis, are available in Premium, Custom Features |

Portfolio Tracking Plan

Unlike one-time purchases for tax plans, Portfolio Tracking operates on a flexible monthly subscription package. You can choose to upgrade, downgrade, or cancel your plan anytime.

Let’s break down the plans:

| Plan | Price | Features |

|---|---|---|

| Free | $0/Month | Daily portfolio updates + Portfolio allocation |

| Enthusiast | $14/Month | See current portfolio + Tax Report + Daily updates + Portfolio allocation + Margin Trading + Priority email support + Performance over time + IRS Form + Performance by crypto |

| Pro | $99/Month | Everything in Enthusiast Plan +Tax loss harvesting |

How to get started with CoinTracker?

Follow these steps to start with CoinTracker in just minutes:

More details

CoinTracker, priced between $53 to $539, is a solid tool for investors looking for a tax-compliant crypto portfolio. It supports 10,000+ tokens, 500+ exchanges and wallets, and 8,000+ blockchains. With AICPA recognition and SOC 2 compliance, it is a safe choice for all levels of crypto traders.

-

500+ exchanges and wallets.

-

10,000+ crypto assets supported.

-

NFT & DeFi management.

-

SOC 2 compliant app.

-

Crypto portfolio tracking across chains.

-

Limited free features.

-

Limited customer support responsiveness.

-

Occasional calculation errors.

-

Tough setup process for beginners.

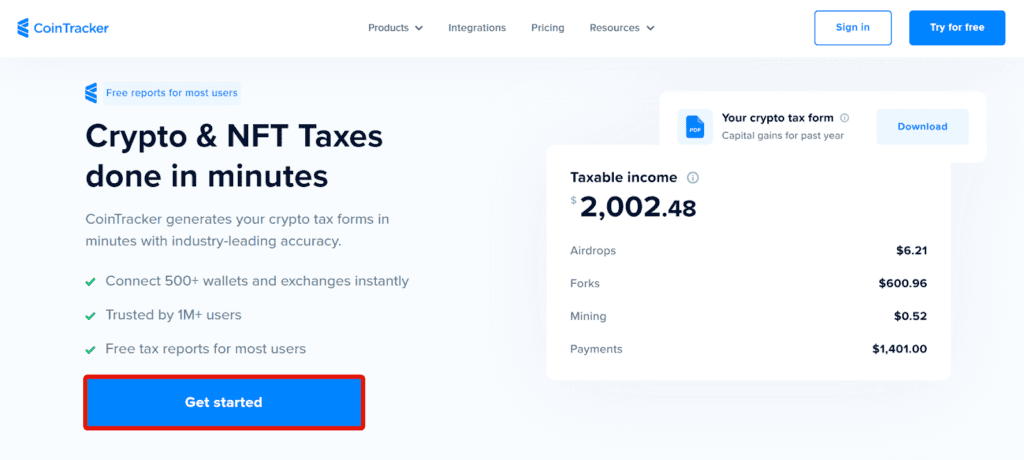

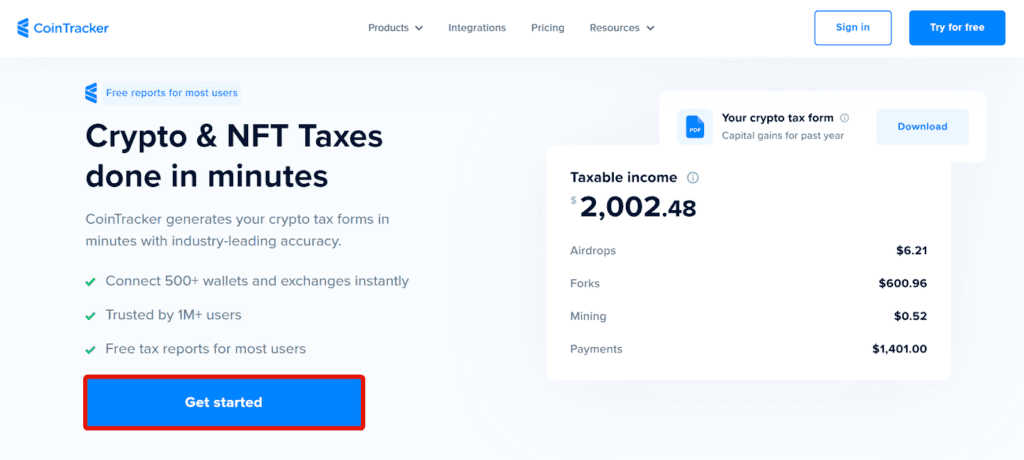

Step 1: Visit the website

Head to CoinTracker’s website and click the [Get Started] button in the middle of the screen.

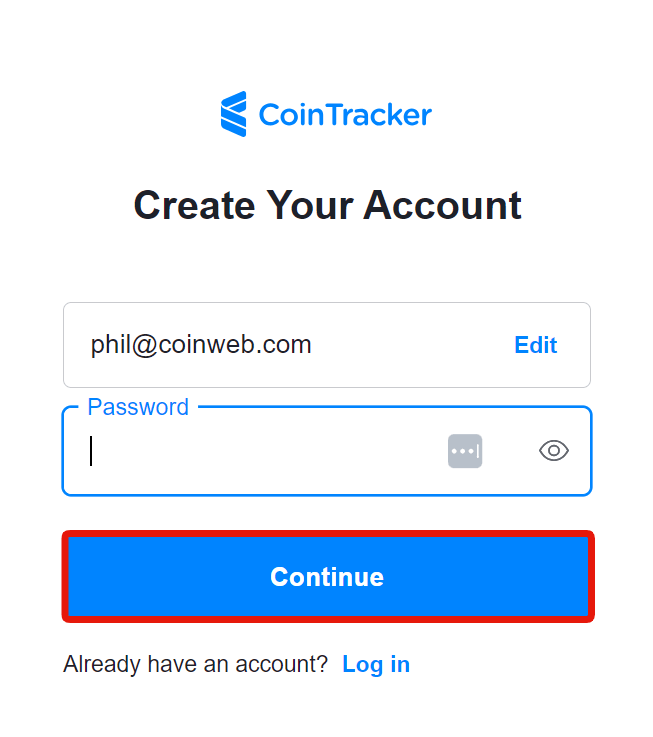

Step 2: Enter e-mail address

Next, enter your email, choose a secure password to create a CoinTracker account, and hit [Continue].

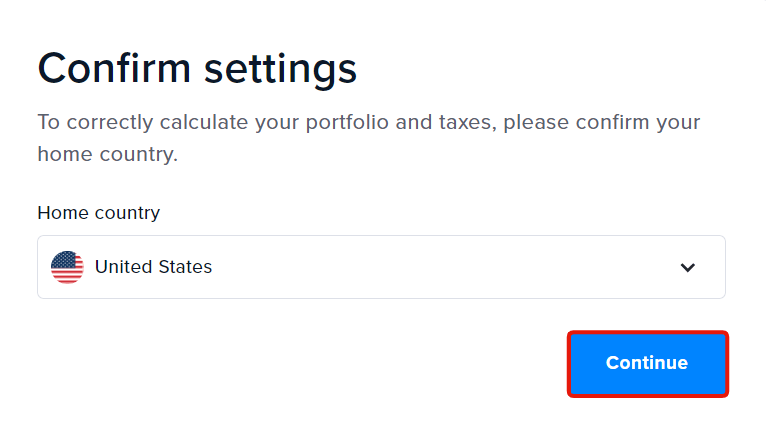

Step 3: Confirm email address

Confirm your e-mail through a confirmation link sent to your inbox.

When done with that, confirm your home country and tap [Continue].

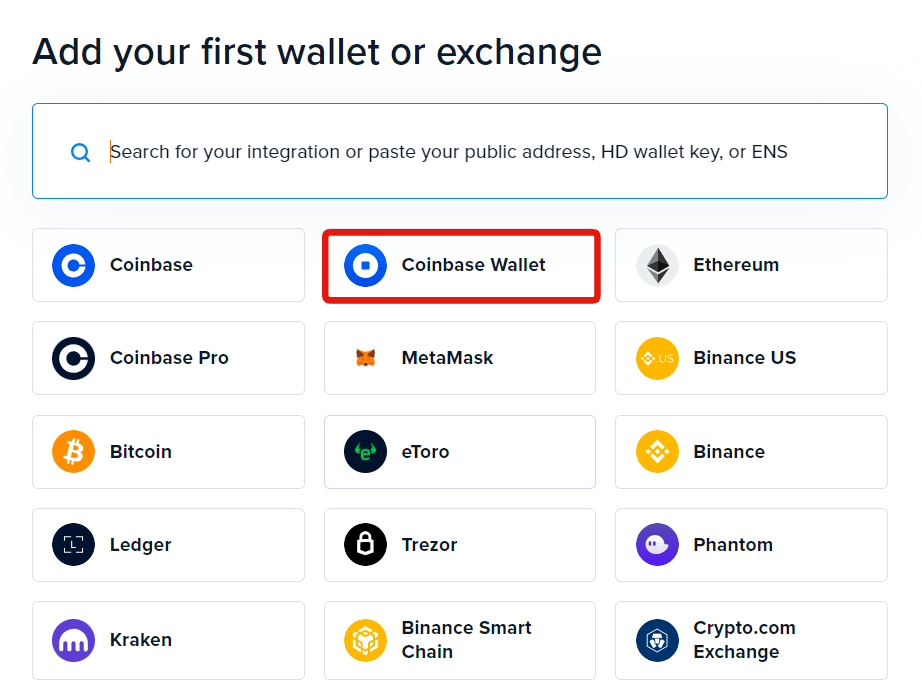

Step 4: Pick your wallet

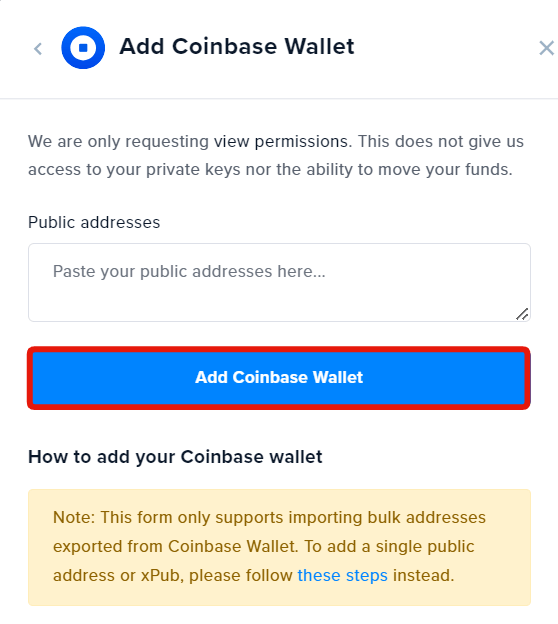

Then, you will be welcomed to a dashboard. There, you will see multiple wallet and exchange options. You can select any, but we chose [Coinbase wallet] for this review.

Step 5: Add the address

Finally, enter your public wallet address to integrate it and tap [Add Coinbase Wallet] successfully.

Congratulations! You are all set to track your transactions and download IRS-compliant security forms for filing taxes.

CoinTracker Review: Key Features

Here are some key features:

Tax Reports

CoinTracker eases filing your crypto taxes with practical reporting and export features:

- Form 8949: It neatly organizes your crypto sales and dispositions on Form 8949, separating them into long-term and short-term gains and losses.

- Schedule D: CoinTracker takes care of the nitty-gritty details of IRS Form 1040 Schedule D, summarizing your capital gains and losses for a hassle-free tax filing experience.

- CSV Export: CoinTracker provides a user-friendly spreadsheet in CSV format for straightforward upload of your crypto transactions.

- Tax-Loss Harvesting: With the $99/month Pro subscription, CoinTracker helps minimize your capital gains taxes by identifying strategies to offset profits with losses through tax-loss harvesting.

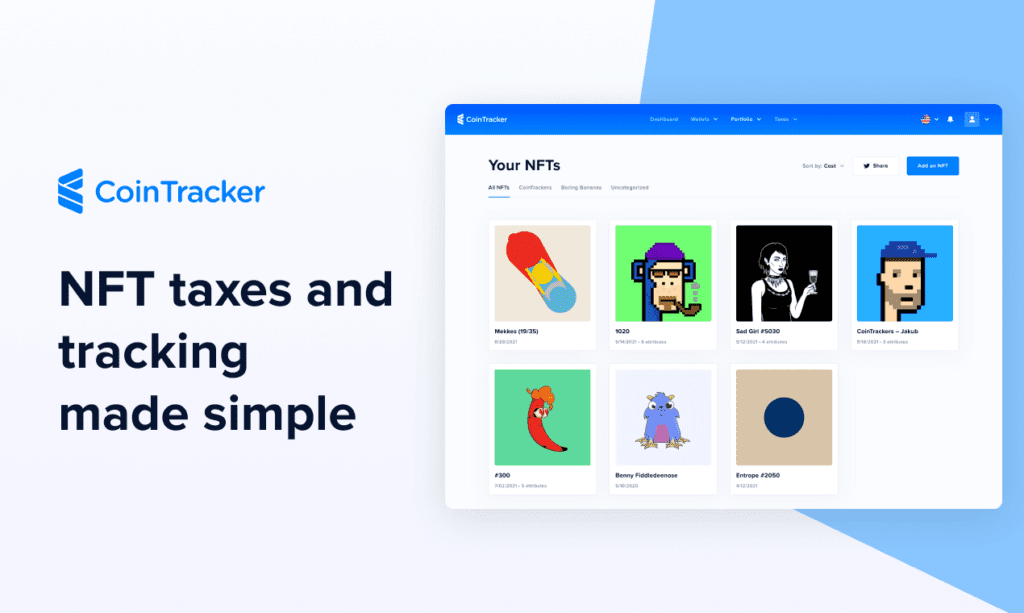

NFT Management

NFT Center simplifies your NFT transactions with an all-in-one platform. It includes a user-friendly tax calculator for gains, losses, and necessary tax reports.

Moreover, the integration with major NFT marketplaces like OpenSea, Coinbase, SuperRare, and Nifty Gateway, solidifies CoinTracker as the go-to toolkit for NFT traders seeking user-friendly tracking and management.

Safety and Security

CoinTracker is recognized by The American Institute of CPAs (AICPA) and has a SOC 2 compliant certification (voluntary compliance standard).

Plus, it ensures regular audits and mandates employee background checks. The platform is fortified with SQL injection filters and token-based two-factor authentication, ensuring robust security measures.

Customer Support

CoinTracker provides priority customer support only to users subscribed to their paid plans.

For free plans, it has a friendly AI bot for quick resolutions, and I had a positive experience with it.

For general questions (fees and how-to), Chatoshi gave the right answers and even threw in a link to a related article. If your queries are technical, it may not give you the best answer concisely.

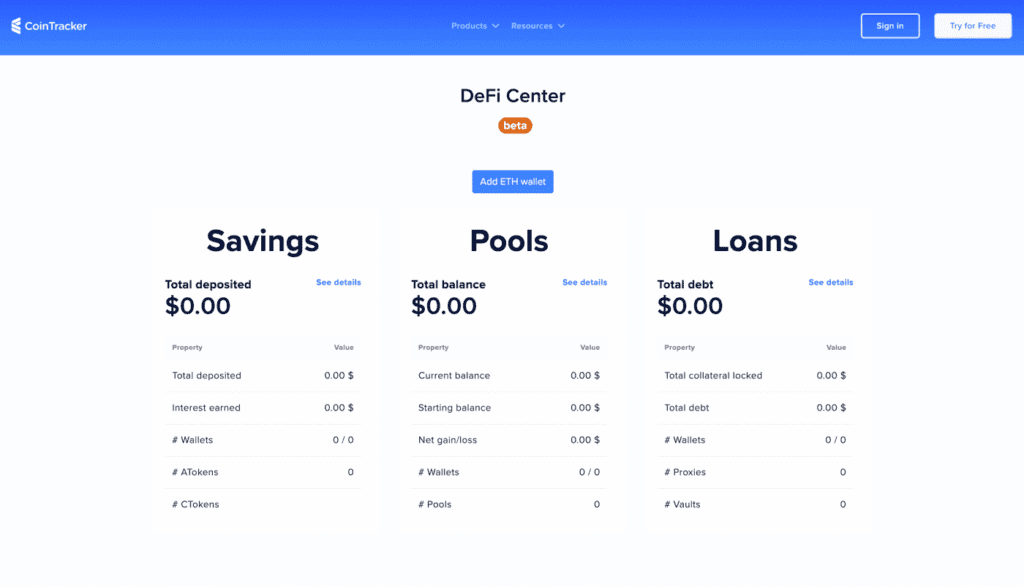

Decentralized Finance (DeFi) center

CoinTracker’s DeFi hub makes life easy, providing in-depth insights into:

- Liquidity pools

- Revealing interest earned

- Any outstanding loans

- Essential statistics for smart investment performance

Compared to other tools like Accointing, CoinTracker is more effective in calculating Annual Percentage Yields (APY) and monitoring staking durations.

Additionally, It tracks your staking rewards (NFTs & tokens) and offers real-time prices on your staked assets’ performance. With this, you don’t have to juggle different browser tabs.

Who should use CoinTracker?

Here is who we think should use it:

New crypto traders

CoinTracker’s pricing makes it a solid pick for people just starting with a moderate number of transactions (up to 25). So, if you fall within this bracket, you get a free wallet-friendly solution for managing your crypto taxes without breaking the bank.

Advanced traders

CoinTracker helps you automate tax reporting and portfolio tracking in one app if you don’t want to record your crypto trades manually. It easily syncs up with supported exchanges like Binance and Coinbase, handling transaction data for trades and staking income.

Even if you use DEXs, It has covered you for accurate reporting with the necessary tax documents on supported tokens and exchanges like Uniswap.

Drawbacks of CoinTracker

Here are some potential deal-breakers:

- Limited features in the free version: The free version of CoinTracker limits access to more advanced tools for cryptocurrency portfolio management and trading.

- Calculation errors: CoinTracker occasionally makes some calculation errors in decentralized finance (DeFi), which could lead to not-so-accurate financial insights and tax reports.

- Complicated setup process: If you are new, the initial setup process of CoinTracker may be somewhat complicated (like I did). Adding wallets or crypto exchanges manually might pose a challenge.

- Limited customer support: While the pro plans offer quick response times, this might be a deal-breaker for people who use a free plan (like me).

CoinTracker’s Alternatives

Koinly vs. CoinTracker

With $49 – $179/Year, Koinly is the most suitable option if CoinTracker is a little expensive. Plus, it offers 700+ wallet and exchange integrations, making it a suitable choice for pro traders.

More details

Koinly is one of the top leading crypto tax software. It leverages automation to directly import crypto transactions from supported integrations and calculate gains and losses to determine tax implications. Koinly supports more than 700 integrations and is available in over 20 countries and functions using the tax law of the supported countries. The use of Koinly is flexible and also functions as a portfolio tracker, giving an overview of all your assets in one place.

-

Multiple tax reports.

-

Numerous country support.

-

Easy to use.

-

Flexible plans.

-

Wide integration support.

-

Does not accept cryptocurrency payments.

-

Slightly expensive.

CoinPanda vs. CoinTracker

If you are looking for more integrations than CoinTracker, CoinPanda offers 800+ integrations for just $49 – $189/Year, making it a cost-effective pick.

More details

Coinpanda supports tax calculations for all crypto transactions. It is undoubtedly one of the best crypto tax software providers for all transactions. It has a simple, user-friendly, and convenient integration with a reasonable pricing model. That's not all; the pricing model is also suitable for users. CoinPanda is one of the best crypto tax software tools for all experienced and beginner crypto traders who seek a reliable, responsive platform.

-

Wide range of crypto exchange.

-

User-friendly, simple, and convenient integrations.

-

Reasonable and competative pricing model.

-

CSV and API integrations.

-

Excellent customer support team

-

Not all tax reports work.

-

Lengthy processing time for tax calculations.

Accointing vs. CoinTracker

Unlike CoinTracker, for just $49 – $499/Year, you can get a maximum of 50,000 transactions per report with Accointing. Plus, it supports over 400 integrations and has country-specific crypto tax options.

More details

Accointing serves dual purposes as a crypto tax software and a portfolio manager. The software allows users to link their exchanges and wallets and import transaction data from the connected exchange and wallet. The process is fully automated and secured. You can enjoy Accointing with any of the four plans and a full refund based on the 30-day money-back guarantee policy.

-

Effective tax management.

-

Privacy and security.

-

Supports multiple exchanges and wallets.

-

Desktop and mobile apps.

-

Limited transactions allowed.

| Tax app | Prices | Integrations | Portfolio Tracking |

|---|---|---|---|

| CoinTracker | $53 – $539/Year | 500+ | Yes |

| Koinly | $49 – $179/Year | 700+ | Yes |

| CoinPanda | $49 – $189/Year | 800+ | Yes |

| Accointing | $49 – $499/Year | 400+ | Yes |

Our Verdict

With its user-friendly interface and extensive support for various exchange accounts, CoinTracker stands out in the market. It streamlines the tax information from various platforms, offering reports and auto-filling IRS forms.

It also monitors other crypto assets, including NFTs, across DeFi apps, offering tax compliance. Compared to other apps, getting tax forms from CoinTracker is expensive. However, it has a better value proposition with a wide range of tax calculation features.

CoinTracker is primarily used for tracking and managing cryptocurrency portfolios, offering features for tax reporting and portfolio tracking.

Yes, CoinTracker is SOC 2 compliant and has encryption of API keys, SQL injection filters, and token-based 2FA.

CoinTracker offers a free plan with limited features and additional premium plans with advanced features.

Yes, CoinTracker offers premium plans ($53 – $539/Year) with varying features, which come with associated costs. It allows you to monitor incoming and outgoing transactions across wallets and chains.

No, CoinTracker is not a wallet. It is a platform designed for tracking crypto investments on Coinbase and other exchanges, providing tools for tax reporting and portfolio analysis.