Coinpanda Review of 2024: The Ultimate Crypto Tax Solution?

TLDR

In this review of Coinpanda, you’ll go through a detailed review of this crypto tax platform, covering its features and more. Amid the many CoinPanda reviews, this one stands to be completely genuine, unbiased, and informative.

IRA and other tax agencies and financial entities classify cryptocurrencies under taxable assets, so you must pay crypto taxes to adhere to the law. Nevertheless, calculating taxes can be challenging, given the highly volatile nature of this asset.

This is precisely where CoinPanda comes to aid. CoinPanda is one of the best crypto tax software providers that lets you calculate taxes for all your crypto transactions, calculate accurate taxes per your country’s laws, and offer a hassle-free crypto tax solution.

Who Should Use CoinPanda?

It is suitable for beginner traders as it constantly updates when to pay cryptocurrency taxes. From having the option to request a feature in the Support Forum to report buggy backend implementation to discuss the crypto taxes over the discord channel, you can do much on this crypto tax software.

However, the software’s pricing for advance traders deviates when you exceed 3000 crypto transactions. It implies that the platform is ideal for low-volume crypto traders.

So, if you’re looking for something that supports calculating taxes for over 3000 crypto transactions, you may have to try another tax platform or switch to CoinPanda’s Satoshi plan.

Coinpanda Review: Exchange integrations

The crypto tax software integrates transaction history correctly for over 800 exchanges.

Some of these exchanges are:

- Binance

- Bitfinex

- Bitbay

- Coinbase Pro

- Gemini

- Kraken

- Poloniex

- Robinhood

- Bybit

- Etoro

- Bittrex, and many more.

What Makes CoinPanda a Good Choice?

CoinPanda supports legitimacy, reliability, and trustworthiness. This completely safe and legit tax software has become a go-to choice for many crypto enthusiasts. If you need to avoid paying taxes for all your transactions while enjoying the benefits of crypto trades, this platform is for you.

CoinPanda software comes with a lifetime free plan for all its users. The free plan enables everyone to try and enjoy the benefits of all the platform features.

You can access a trade history file, and the free plan allows you to review imported transactions, import data from supported wallets and exchanges, and track your complete crypto portfolio. You’ll only have to pay for the platform when you need to download the tax reports.

Depending on the number of transactions you did during a previous tax year, CoinPanda has a price structure that it can give. The import of transactions and portfolio of tax tracking are two examples of free features. On the other hand, viewing your tax computations and downloading and exporting your tax paperwork and forms require payment.

Coinpanda security

The CoinPanda team always prioritizes its users’ confidentiality and security. It deploys high-end encryption technology to ensure optimal safety and protection of its users’ data. The following reasons state why CoinPanda has emerged as a reliable, trustworthy tax software in the crypto community:

- Your payment information is not saved. Instead, CoinPanda uses Stripe, a renowned payment processing system, to handle transactions.

- Amazon Web Services hosts the data and services for CoinPanda (AWS). Amazon’s services are secure—and this security applies to users of those services as well—is evident to anyone, even the most seasoned IT expert.

- The team constantly strives to find and fix bugs in the CoinPanda program. Updates are frequently published as a result.

- The experts on the CoinPanda team are fiercely interested in the cryptocurrency world. These individuals know numerous facets of online and cryptocurrency technologies and have run successful businesses.

- Therefore, you may be confident that you’re in capable hands.

What Countries Are Supported?

Unlike other crypto tax platforms, CoinPanda supports 65+ Countries. Anyone living in countries like the USA, Canada, United Kingdom, Australia, New Zealand, Ireland, Germany, Switzerland, Austria, France, Spain, Italy, Norway, Sweden, Denmark, Finland, Japan, South Africa, South Korea, Thailand, Singapore, and Malaysia and many, can enjoy this other tax platform’s benefits.

Disadvantages of CoinPanda

High Fees for Tax Reporting

The CoinPanda Satoshi plan lets you perform crypto tax reporting for up to 20,000 transaction histories drawn at $389. Although this plan is excellent yet somewhat expensive, you can always find some other crypto tax software that supports tax calculation for complete transaction history drawn at the same price or a considerable number of transactions at a lower price.

For instance, CoinLedger – a crypto tax product – supports tax reporting for unlimited weekly and monthly transactions at $299. Compared to CoinPanda’s Satoshi plan, it is $90 less, and you get unlimited transactions.

CoinPanda Review: Top Features

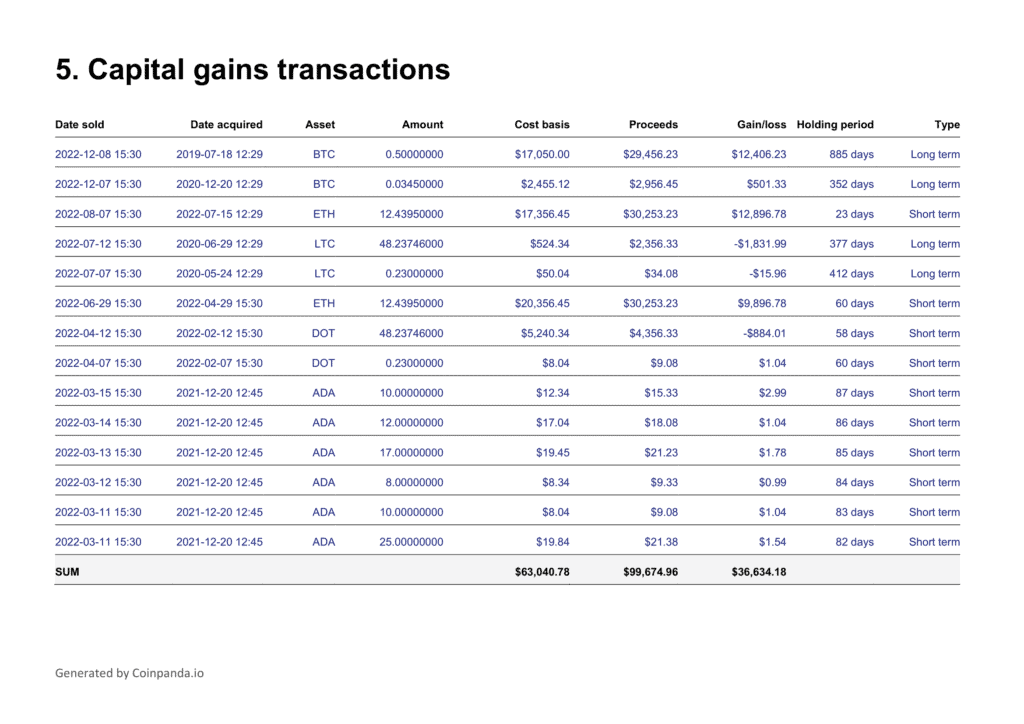

Capital Gains Reports

Capital gain reports are among the most beneficial features of this single crypto tax tool. It exhibits your crypto transaction histories – losses and profits – in an online spreadsheet. For every transaction, the spreadsheet comes with ten columns.

The columns include Date Acquired, Amount, Date Sold, Asset, Proceeds, Cost Basis, Notes, Gains or Losses, Transaction Type, and Holding Period. This tax report covers spot trades and entails margin and futures trading transaction history. But remember that not all tax reports work in this way.

Since it ensures coverage for all your taxable crypto assets, the capital gains report enables you to skip any chance of double loss if the crypto is sold at a loss that tax year. It means reducing capital gains and paying fewer taxes in the subsequent financial year.

So, you can keep going and trading without the fear of becoming bankrupt if you use this crypto tax reporting software.

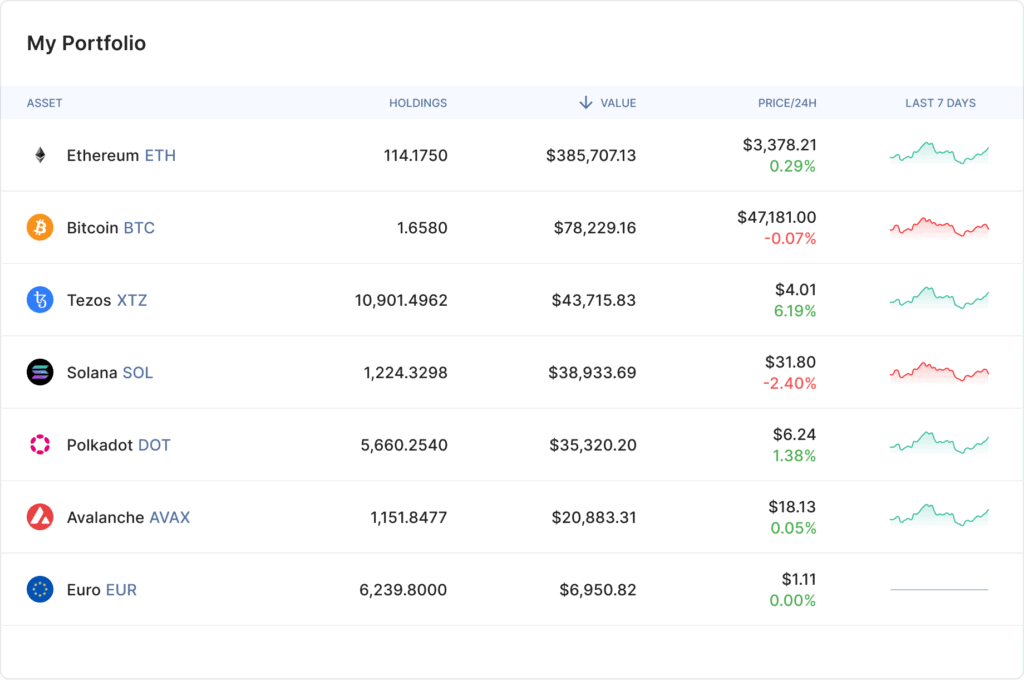

Portfolio Tracking

This excellent and timely support from CoinPanda enables all platform users to keep track of and manage their portfolios. The portfolio tracker feature automatically syncs transaction history from every exchange and wallet you own.

In this manner, even if they’re dispersed over numerous crypto businesses, you can accurately determine how much you possess and the taxable amount. The portfolio tracker feature is included in their free plan. It has several additional features to help users who want to maximize their portfolios.

Portfolio Tracking Features include:

Analytics: It lets you track your cryptocurrency portfolio and understand where you incurred profit or loss. This feature also enables seamless analysis of your trading and investing habits and reveals mistakes or flaws you may not know about.

Search Tool: This powerful, robust tax report tool can browse all your transaction history. The device can select specific associated transactions, wallets, coins, exchanges, etc.

Margin Trading Tracking: Using this application, you can track all your margin transactions throughout all cryptocurrency exchanges that support margin trading. Several well-known exchanges include FTX, Bybit, Binance, and Bitmex.

Tax Preview: This tool assists you in tax loss harvesting preventing costly errors by informing you of the impact of a trade’s outcome on your tax obligations before it occurs.

Key Tax Reports: Additionally, CoinPanda enables you to create and file tax returns and records for your capital gains and earnings automatically. These tax reports can also be downloaded and filled in in local tax documents like Schedule D and Form 8949.

Tax Reduction: This effective tool has one objective: to minimize the tax you still have to pay. It is an effective tool and undoubtedly among the greatest ones available.

Cost Basis: As stated, cost basis computation determines an asset’s original acquisition price. It is utilized to determine how much money was spent buying a commodity before losses or profits are realized. When determining cost basis, CoinPanda uses one of four different techniques. The techniques are:

- FIFO – First In, First Out

- ACB – Average Cost Basis

- LIFO – Last In, First Out

- HIFO – Highest In, First Out

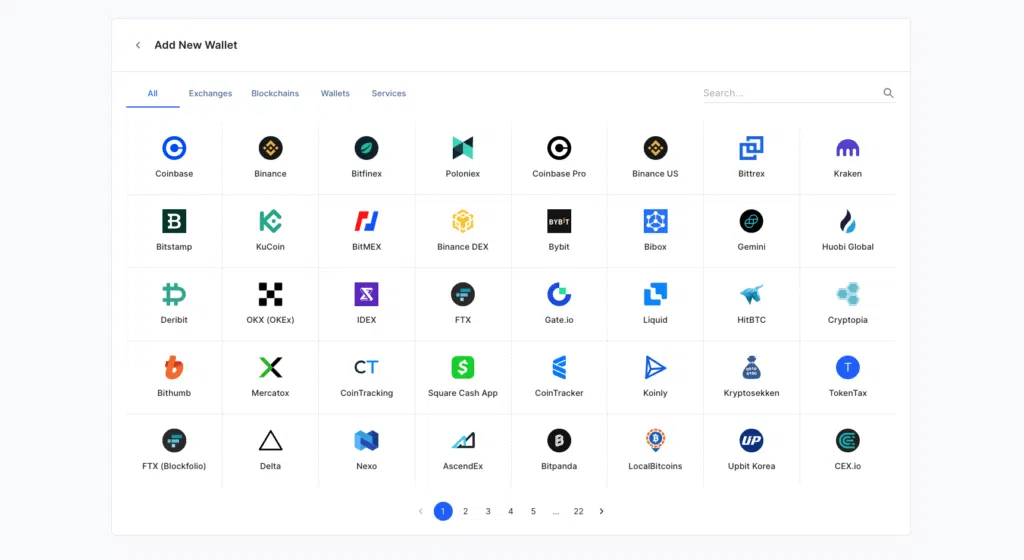

Adding Transactions

You can add transactions on this crypto tax reporting platform in various ways. For starters, manual adjustments can be made to add those transactions. However, this can be hectic and time-consuming.

If not, you can go for the API and CSV integrations. You can connect your API import tool with your wallets or opt for CSV data import options where you can import trade transactions as XLSX or CSV files.

CoinPanda enables you to establish as many wallets as necessary to arrange your portfolio. For any wallet or exchange you have been using, you can build a new wallet; ensure to import every one of your transactions so that your whole portfolio is accurately reflected.

On your request, it is also possible to add unregistered exchanges. Notifying customer service representatives on the CoinPanda forum often only requires 4-5 days.

Once it imports each crypto transaction, the cryptocurrency tax calculator automatically computes your tax report. You may have to wait fifteen to twenty minutes for this process to complete. Your tax statements and reports can be exported in any format once it is done.

Opening a CoinPanda Account

CoinPanda is typically a crypto tax reporting tool that calculates accurate taxes for all your crypto transactions. But how does it operate? You must first create an account on the platform, which is entirely free.

You need to import your cryptocurrency transactions into the site after joining up. Whatever the amount of time you have spent on trading, CoinPanda will quickly and easily compute your capital gains and taxes.

Step 1: Visit Coinpanda

Visit the official Coinpanda website to sign up. Click the [Start for free] or [Get Started] button.

Sign up using your Coinbase or Google account, add your name, e-mail, and password, and click [Sign up].

Step 2: Add Your Wallet

CoinPanda uses wallets to manage your cryptocurrency transactions. You can make a wallet for every exchange you’ve used (such as Coinbase, Binance, etc.),

- One for each of your hardware wallets (such as Trezor or Ledger),

- One for each Bitcoin or Ethereum address,

- One for each app you’ve used (crypto.com, Uphold, Delta, etc.).

You can add more than one wallet if necessary for the exchange/blockchain/app. Transactions may be easily imported and automatically synced with the usage of wallets. Tax calculations are independent of how you keep your wallets organized.

All transactions must be imported, which is the only factor that matters. You can add your first wallet by going to the [Wallets] page, clicking [Add new wallet], and then following the instructions on the screen that appears.

There is a potential that even though they support over 500+ exchanges, apps, wallets, and blockchains, they may not yet support a business or wallet you use regularly.

In this situation, you get two choices:

- Manually add your transactions

- Submit a feature request in their forum, and the platform will later add support.

The request typically takes 4-5 days, and they constantly introduce new exchanges.

Step 3: Import Transactions

You should import all your transactions now that you’ve added your wallets, you can access the below page by selecting Coinbase from the Wallets page, and you will notice a button labeled [Auto-sync data] for exchanges that enable API.

You can connect to the API by clicking this button, enabling CoinPanda to synchronize your transactions for you automatically.

This approach is advised since it increases the likelihood that your whole transaction history will be correctly imported. Whenever you hit the blue [Sync Wallet] icon after establishing an API connection, CoinPanda will automatically sync your subsequent transactions.

You may also upload CSV files by selecting the Import data from the file button. For exchanges or applications without API support, CoinPanda advises utilizing this method. Additionally, you can upload our default Excel file.

The platform requires your whole transaction history throughout all exchanges from all years to compute your capital gains appropriately. Send them a note in the Live Chat if you need assistance or have any queries about how to import transactions.

Step 4: Calculating Capital Gains

Following the addition of your first transaction, CoinPanda will automatically compute your capital gains by obtaining market rates for your cryptocurrency holdings.

While CoinPanda performs calculations, “Calculations are continuing…” in the message box in the bottom left corner.

You will get the text “Your tax computations have been completed!” once the calculations are finished. This proves that CoinPanda has accurately calculated all transactions’ capital gains. Your full tax return reports can now be exported safely, as explained in the following step.

Step 5: Downloading And Exporting Tax Reports

You can get a snapshot of your capital gains and any cryptocurrency acquired or transferred on the Tax Reports page.

You can access some of this data for free, but if you’ve made over 25 transactions, you’ll have to subscribe to any of their tax programs to see your total capital gains and obtain tax reports, and you can get all tax reports and forms for free if you have fewer than that.

You can obtain various tax reports from CoinPanda and tax forms relevant to each jurisdiction. For instance, you must download IRS Form 8949 and IRS Schedule D if you are a US citizen.

After receiving your tax reports, you only need to prepare and submit your annual tax return as usual.

Coinpanda Review: Pricing

The CoinPanda platform provides an entirely free portfolio tracker for its users. The free plan lets you connect unlimited exchanges and wallets to enjoy hassle-free importing of all crypto transactions.

After importing all transactions successfully on the platform for free, you’ll have to switch to their premium plan. With one of their premium plan upgrades, you can view all tax calculations and download any tax report in PDF or Doc format.

Once you upgrade to any paid plan, you are entitled to lifetime access. You can download as many tax reports as you want for that year.

Here is an overview of some of their most popular pricing models:

- Free Plan – Free For 25 Transactions

- Holder Plan – $49 For 100 Transactions

- Pro Plan – $189 For 3000 Transactions

- Satoshi Plan – $389 For 20,000 Transactions

Summary

Cryptocurrencies are fast becoming legally recognized assets in many parts of the world. This is good as it will eventually drive mainstream crypto adoption, which has been the dream of many crypto enthusiasts.

However, this adoption comes with increased regulations, as in other parts of the financial world. Therefore, it is essential to know how much tax you are liable to pay on your crypto endeavors and choose the best way to pay it.

This Coinpanda review explains one of the most popular tools for calculating and exporting tax forms. Considering its various features, advantages, and disadvantages, would you say CoinPanda is the right tool for you?

Your crypto assets will remain secure if you adhere to the API key creation guidelines because all exchanges have read-only access integrated.

With Coinpanda, you can import all your transactions by connecting as many wallets and exchanges as you like, using their 100% free portfolio tracker.

CoinTracker doesn't provide live chat support to any of its users, and email support is only available to those who've upgraded to the Premium plan, which is priced at $199/year. Conversely, Coinpanda offers free support to all users, regardless of whether or not they've upgraded their tax plan.