TLDR

Defi Liquidity mining is a form of yield farming where users contribute tokens to smart contracts, providing liquidity for trading platforms and lending protocols. In return for distributing tokens, users get a reward.

Traders pay fees to the pool, and liquidity providers receive additional tokens as a reward. In some cases, users may also receive liquidity tokens as a reward. Defi liquidity mining is profitable for low-capital investors and crypto holders to invest in the ecosystem and cryptocurrency markets. It is also a great way to create passive income.

This guide will explore everything you need to know about Defi liquidity mining, including its benefits and risks. In addition, it gives the most popular protocols for liquidity mining, such as Uniswap, PancakeSwap, and SushiSwap.

What is Liquidity mining?

To understand liquidity mining, first, we must understand what liquidity means and how it can be mined.

Liquidity means how easily one can buy or sell an asset without causing severe changes to the asset’s price. Many traditional assets are liquid, which can easily be converted for cash. However, the case is different for cryptocurrencies because of the limited amount of cash locked up in a particular cryptocurrency, among other factors.

The most liquid asset in the cryptocurrency market is Bitcoin because it is the most popular coin. However, most assets in the crypto market are not generally liquid. Users must provide liquidity to exchanges and lending protocols to facilitate trading activities. Liquidity miners lend their crypto assets to these Defi platforms in need of liquidity in exchange for extra tokens and rewards.

Liquidity mining helps keep the crypto trading ecosystem alive by easing the trading process. Instead of investors trading directly with each other, they can trade with the liquidity pool.

Deep Liquidity pools are more stable than small ones – meaning small liquidity pools are affected more by large transactions than deep liquidity pools. As a result, small liquidity pools are more prone to manipulations by whales.

How Liquidity Mining Works

Liquidity mining is part of a group of passive income-earning opportunities known as yield farming. It involves locking up your tokens in a pool to provide liquidity for exchanges engaged in crypto trading. Some protocols provide liquidity mining as an option to distribute their tokens fairly between users.

Liquidity miners make tokens available for daily crypto trading activities, and lending crypto assets is integral to the crypto finance ecosystem. Liquidity miners provide liquidity to centralized crypto exchanges, lending protocols, and decentralized exchanges.

What is a liquidity pool?

Liquidity pools consist of smart contracts called Automated Market Makers (AMMs). AMM(s) trade, regulated by a computer algorithm. AMM(s) do not stop trading as their trading is automated. Liquidity providers contribute tokens to the pool for rewards like extra coins and governance tokens.

Digital assets are deposited in currency pairs at a balanced ratio in liquidity pools. The most common ratios include 50:50, 70:30, and 90:10.

The most common currency trading pairs include USDT/ETH, BTC/GBP, ETH/BTC, and many more.

AMMs control their price through a system of demand and supply of the currency pairs. The pool always maintains a constant balance of the trading pair while adjusting the price by balancing the demand and supply for either of the currencies within the trading pair.

For instance, let us use a 50:50 currency pair of Ethereum and Cardano. Every time someone purchases Ethereum, it causes the price of ETH to rise due to the decreased supply of ETH in the pool. At the same time, it causes the price of ADA to fall because the pool now has more ADA.

This simple formula allows AMMs to swap tokens between individuals and pools, thus supplying liquidity to the general crypto market. In addition, some AMMs may offer liquidity to custom market makers, thus giving users greater control of their liquidity pools.

Liquidity Provider Tokens (LP-tokens)

Many protocols and decentralized exchanges in liquidity mining are non-custodial, meaning they don’t hold onto an investor’s tokens. Instead, liquidity providers are always in control of their coins thanks to LP tokens representing their total percentage share of the liquidity pool.

When liquidity miners deposit tokens, they are given Pool Share tokens representing the total value and percentage of liquidity their tokens represent. When they choose to withdraw the LP tokens, they receive the percentage of liquidity their tokens contributed to the pool.

If that is confusing, we’ll describe it with an example.

For instance, if Tom contributes $100 to a Liquidity mining pool valued at $1000, he automatically gets 10 % of the pool’s LP tokens. This represents his 10% ownership of the pool’s LP tokens.

Since he has proved 10%, he will also earn 10% of the rewards given to the liquidity providers.

When he withdraws his contribution from the liquidity pool, the trade protocol, or the automated market maker, he hands in his LP tokens in exchange for native tokens for his contribution.

Individuals who participate in liquidity mining can claim governance tokens/governance privileges, which increase a person’s voting rights on a blockchain network. In our example, Tom gets governance tokens depending on his contribution to the blockchain.

Trusted Partners

How to Mine Liquidity on Uniswap

Before providing liquidity to Uniswap to earn rewards, you need a Web 3 wallet. Since the DEX is Ethereum-based, you need a wallet that supports the Ethereum network. MetaMask is one of the most popular options for Ethereum.

If you don’t have Metamask, follow this easy step-by-step guide.

Step 1: Connect your wallet

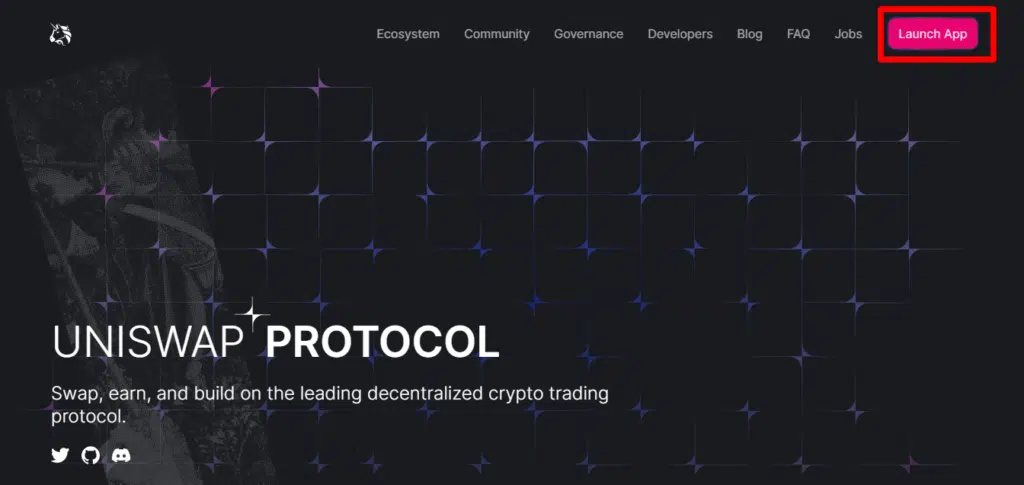

Visit the Uniswap website.

Click on [Connect] in the top right corner.

![Click on [Connect] in the top right corner.](https://coinweb.com/wp-content/uploads/2023/04/c5fb2a8f9d953fd5a2cd4bbc9634bcca-1024x446.png.webp)

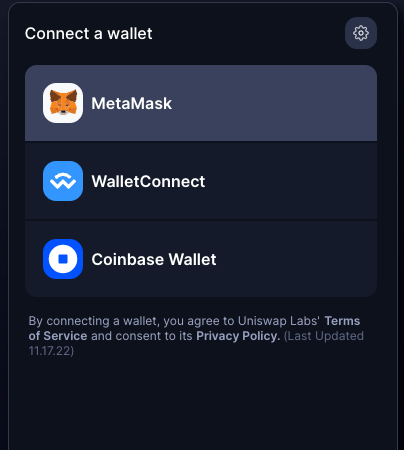

Step 2: Select MetaMask

You will get a list of wallets to choose from. Select the wallet of your choice. In this example, we will connect MetaMask on the wallet list to UniSwap. Select [MetaMask].

Step 3: Confirm the connection

A pop-up window in your Metamask will show, and you will be asked to confirm the connection.

Great! Now, your MetaMask is connected. You should be able to see your balance and your wallet address at the top of the page.

Liquidity mining on Uniswap requires a few extra steps:

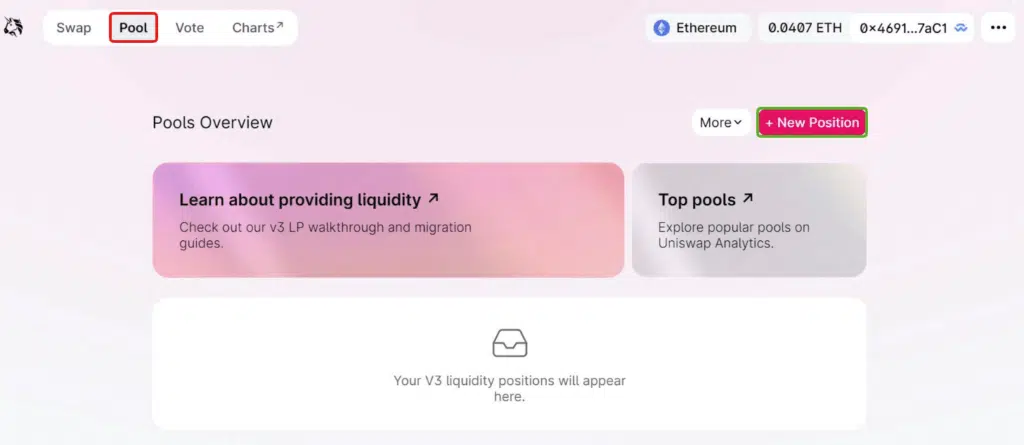

Step 4: Select Pool

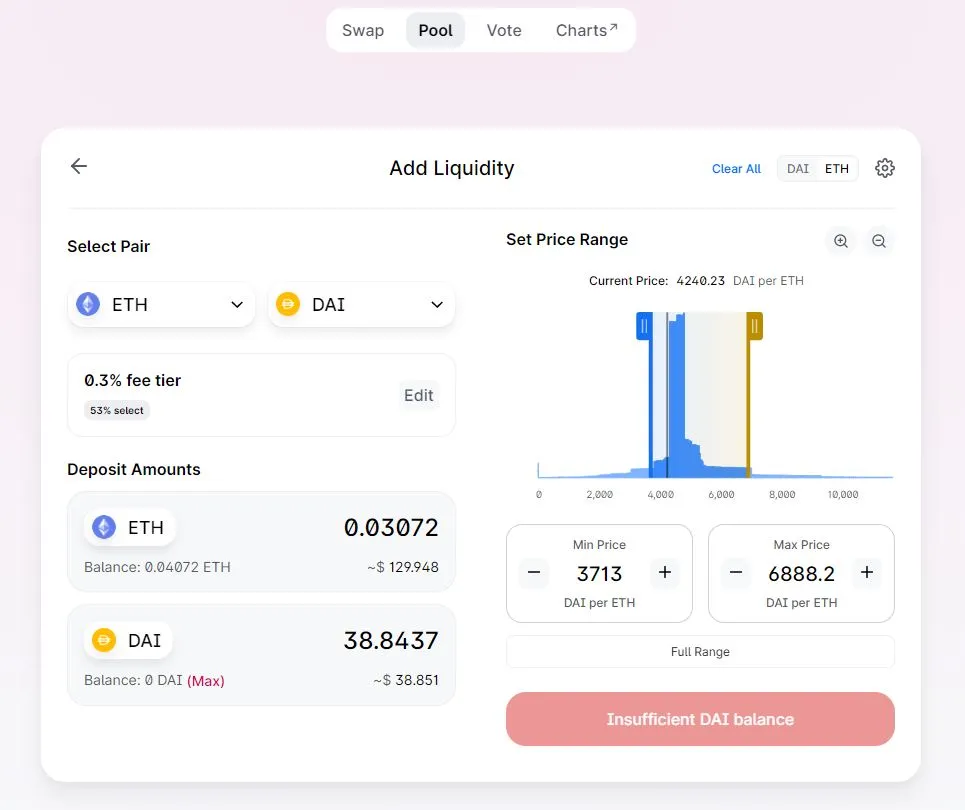

On the top of the page, go to [Pool] and click + [New Position] to select the trading pair you wish to submit as liquidity.

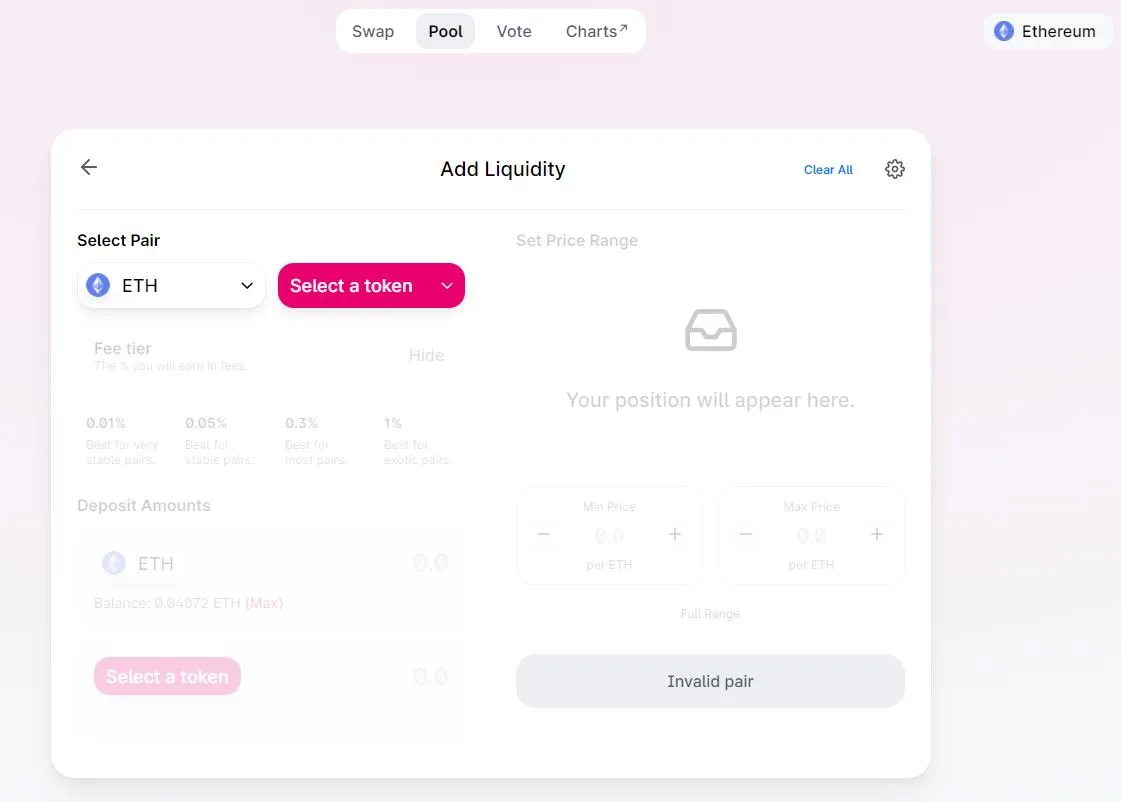

Here, you should select a pair; an example would be ETH/DAI. Select a pool type based on the preferred fee for the liquidity provider. Each provider fee may differ between 0.3-1%.

Step 5: Select the amount for the Liquidity pool

Next, select the amount of liquidity you want to provide that pool. Please note that you must provide a fixed ratio supply liquidity for each trading pair.

Step 6: Confirm supply and approve the transaction

After confirming the selected amount for both crypto assets, you must approve the transaction by paying gas fees.

To finalize the process, click [Supply], which will give you LP tokens in your wallet in return for the contribution to the liquidity pool.

Advantages of liquidity mining

The several advantages that make liquidity mining attractive to investors include the following:

Low Barrier To Entry

Liquidity mining is a great investment strategy for low-capital investors because it is affordable for many people. To be successful, users must research to find stable exchanges that offer competitive rewards. In addition, since most liquidity mining occurs in the Defi ecosystem, most LP tokens can also be used for yield farming on other platforms.

Passive income

The first main benefit of participating in liquidity mining is that it’s a great way of earning passive income. The volume of trading fees is very high thanks to high trading activity in the crypto market. That is reflected in the reward for providing liquidity.

Build and support communities by providing liquidity

Some liquidity providers are rewarded with governance tokens, allowing governance token holders to propose and vote on changes within a blockchain space. The more governance tokens a person holds, the higher their voting power.

Risks associated with liquidity mining

Liquidity mining has significant risks that can severely hurt an investor’s portfolio. Some of the most common risks associated with liquidity mining include:

Market instability

The first risk liquidity providers deal with is market instability. Crypto assets are generally famous for being one of the most volatile assets in the world. As a result, holding crypto assets is risky because the market could easily crash, or tokens could be severely devalued.

As an example of market instability, Bitcoin was valued at over $65,000 by November 2021; almost eight months later, it dropped more than 60%. Other protocols and altcoins dropped more than 90-97%.

Price manipulation | Liquidity Mining scam (s)

Another significant risk of participating in liquidity mining is the manipulation of prices by whales. There are several ways traders manipulate coin prices by facilitating trades or executing unique trades designed to manipulate trading activity and thus coin price.

A good example is whale wall spoofing when traders place large orders to create a fake buy or sell wall in an exchange’s order books.

For instance, if whales wanted a bullish sentiment, they could place large buying orders in the Automated market maker, thus tricking others into thinking there is a positive price movement.

As more investors rush to buy, the whale sells their token, and the last one is “holding” the bag. To avoid price manipulations, each liquidity provider should only use established liquidity mining pools with a strong reputation. Another good tip is to look for reviews of a liquidity pool before signing up.

Security risks

The lucrativeness of liquidity mining makes it a target for hackers and scammers. Scammers and hackers have messed with the protocol’s smart contracts to allow them to withdraw funds from liquidity pools.

There have been cases where developers of DeFi protocols will wait until liquidity providers have invested in the pool before withdrawing all the funds. One of the most common examples is the Compounder finance scam, where the project’s owners stole $11 million from its smart contracts.

This kind of scam is called a rug pull, and they are common because the cryptocurrency industry remains largely unregulated. A good way to prevent rug pulls is to avoid new protocols that offer extremely high interest rates on your investment.

Impermanent loss

Impermanent loss refers to a kind of unrealized opportunity cost where the price of your deposited crypto assets changes compared to when they were deposited – meaning the liquidity providers get less dollar value at withdrawal time compared to the time of deposit.

The basic idea behind impermanent loss is that sometimes, holding the token in a wallet would have been more valuable than providing liquidity. Sometimes, the impermanent loss is insignificant because the profits liquidity providers earn from trading fees offset the effects of impermanent loss.

How To Get Started with Liquidity Mining

Find a trusted platform.

The next step is to research and find a reputable liquidity mining protocol that’s easy to navigate and has a strong reputation. Liquidity providers should ensure that they verify any platform before depositing any funds.

There are several ways to review a liquidity mining protocol – looking at their cybersecurity certificates, reading their online reviews, and joining communities of other liquidity providers who can suggest the best platforms.

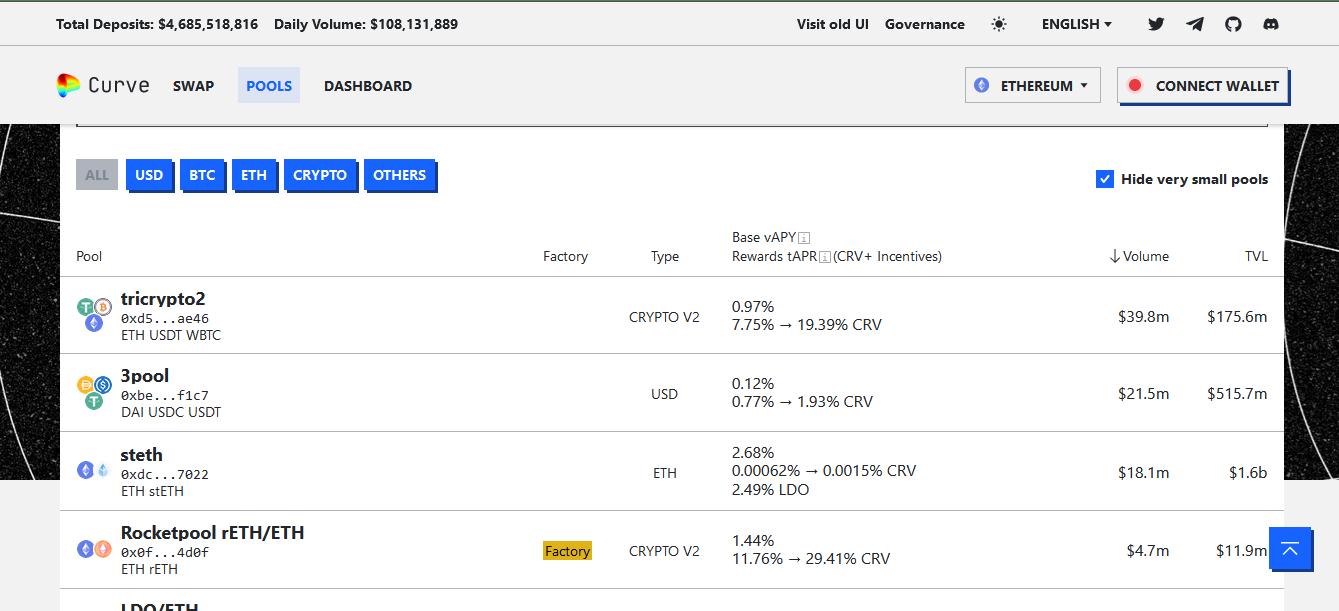

The most common liquidity mining providers in the Defi space are UniSwap, CurveFinance, and SushiSwap, among others.

Decide the trading pairs.

Liquidity pools often support several currency pairs, e.g., BTC/ETH, SHIB/BTC, and ADA/ETH. When choosing different token pairs, choose options with high trade demand.

The easy way to do this is to check the trading activities of individual crypto assets. Coins with high daily trade volume will have more demand on AMMs.

Deposit Funds

Fund your account to start trading on the AMM. You can purchase the crypto assets individually and then deposit them into mining pools on a decentralized exchange.

Trading fees for liquidity providers

Most rewards earned from liquidity mining come directly from trading fees charged by a decentralized exchange. Liquidity providers can check how much they stand to earn as passive income by going through the Liquidity mining protocol’s whitepaper.

Crypto Liquidity Mining vs. Yield farming vs. Staking

Investors might notice significant similarities among crypto liquidity mining, yield farming, and staking. Let’s review the differences and how investors can choose the best option.

Yield farming is a general name for investing money into a Defi protocol to earn a yield. In essence, liquidity mining is a form of yield earning, but the latter focuses on lending protocols and centralized exchange (s). In contrast, liquidity mining focuses on providing liquidity to aid trading on a decentralized exchange.

Many yield farmers earn passive income by using interest from liquidity mining as collateral for taking loans, which are further re-invested as loans to others or through trading.

Staking, conversely, refers to locking up tokens in a pool to be selected for the transaction validation and verification process. Stakers help keep a blockchain network secure and are rewarded with extra tokens for their contribution.

One difference between staking and yield farming is that staking happens on more established blockchains like Cardano, Ethereum, and Algorand. In contrast, yield farming is more common among new and upcoming decentralized finance protocols.

This makes crypto yield-farming more prone to rug-pull scams while staking is relatively safer. Many other risks associated with liquidity mining are also associated with staking, so traders should be careful when designing an investment strategy.

Yield farmers are also at risk of liquidation when the value of the collateral used to borrow assets for trading drops severely, and the protocol starts selling the assets to recoup their losses. A market crash like that of 2022 can cause a string of liquidations that will leave many Defi tokens valueless as the market value of their protocols crashes.

Conclusion

Liquidity mining involves lending cryptocurrencies to lending protocols and exchanges to help facilitate trading. It involves providing cryptocurrencies in trading pairs to ease the trading of such currencies on exchanges. Liquidity mining is an excellent source of income for investors because of its relatively low barrier to entry. It’s an excellent choice for low-capital investors.

However, it bears significant risks like impermanent loss, price manipulation, and market instability. Liquidity mining is part of an overall concept called Yield farming – which involves leveraging crypto funds to earn passive income from a decentralized ecosystem of exchanges and protocols. Some of the best platforms for liquidity mining include Uniswap and Convex Finance.

Liquidity mining involves crypto holders lending their assets to a decentralized exchange and receiving rewards in return. Typically, these rewards come from trading fees generated by token swaps made by traders.

While liquidity mining can be rewarding, it also carries risks. Liquidity pools are susceptible to impermanent loss, which occurs when a significant price change causes an imbalance in the token ratio within the pool (e.g., a 50:50 split of ETH/USDT becomes uneven). This could lead to a loss of the funds you invested.

Liquidity mining offers a way to generate passive income from crypto assets that would otherwise be held without any additional benefits. By becoming a liquidity provider, a crypto investor can contribute to the growth of the emerging Decentralized Finance (DeFi) market while also earning returns.