CoinTracking 2024 Review: The Best Tax Software For You?

TLDR

We have made an in-depth Cointracking review for you to better understand all the features and their benefits.

CoinTracking is an essential tool for traders and crypto companies that need to generate tax reports. It simplifies keeping track of your trades across all exchanges, especially if you conduct a high volume of transactions or use trading bots.

This easy-to-use crypto tax software is accessible from any device and lets you request crypto tax reports quickly. With a free package, you can try the basic features before upgrading to the premium version, which offers even more value.

If you’re tired of keeping track of your trades across multiple exchanges, this review will show you that CoinTracking is the perfect solution.

Who Should Use CoinTracking?

For Crypto Traders

CoinTracking remains one of the most popular crypto tax reporting software used by millions of crypto traders across 100+ countries. It has over 1.3 million active users because of its widespread support across crypto exchanges and wallets.

The CoinTracking software supports exchanges like Binance, Kraken, Huobi, Coinbase, Bittrex, and others. It also supports legacy exchanges via CSV that are non-operational.

The CoinTracking app offers access to professional tax advice for HODLers. This is possible because of a combination of the support unit on the CoinTracking website, Enrolled Agents, and other law professionals.

CoinTracking supports various tax data formats, including Canada’s CRA, UK’s HMRC, and other cost-based accounting tax reporting methods. It supports 12 other tax calculation methods, including the commonly used FIFO and LIFO cost-basis accounting methods.

CoinTracking also doubles as a powerful tool for keeping track of airdrops, salary income, mining income, lost funds, hacked funds, donations, and so much more. It helps crypto users identify all transactions across various exchanges, filter them out, and analyze historical data for audit purposes.

CoinTracking helps users arbitrage traders, day traders, and traders who utilize bots to track crypto portfolios and keep accurate historical data for tax report purposes, maintaining compliance with various tax laws and regulating the space.

Supported Platforms

- 91 crypto exchanges

- 31 crypto wallets to import data from

- Legacy support for 21 closed exchanges

For Cryptocurrency Companies

Several crypto companies use CoinTracking to serve their users and expand their range of services to include creating tax reports. CoinTracking helps these companies keep track of clients’ portfolios through a unified interface.

It also gives these companies enough information through which they can, as tax reporting platforms offer advisory services to clients about various trading strategies and their tax implications.

Tax firms and crypto tax advisors can also use CoinTracking to share data quickly and efficiently. This is, of course, only available to CoinTracking Corporate users. After CoinTracking’s report, these companies can use basic cost accounting methods to modify the results.

What Makes CoinTracking an Excellent Choice

Simplistic User Interface

CoinTracking users are greeted with a reasonably simple, self-explanatory dashboard with immediate access to interactive charts, trading data, trend tools, and more. Users can easily navigate different pages and tools and request support whenever needed with just a few simple clicks.

It even has crypto tax advisors and doubles as a cryptocurrency portfolio manager; however, it only has data-collecting tax features and is non-custodian.

CoinTracking Review: Features

Personal Analysis

The average crypto trader uses 2-5 crypto exchanges and wallets. The more exchanges you register and utilize, the more difficult it becomes to track your earnings and crypto transactions. CoinTracking gives you a digital fluid currency and crypto portfolio and management system with several features, including transaction comparison across crypto exchanges and wallets, audits, profit & loss calculation across platforms, interactive charts, cumulative trading history, and more.

Highlights:

- Profit/loss reports

- On-demand audit reports

- 25 customizable crypto reports

- Realized and unrealized gains (reports)

Tax Declaration

There are also tax liabilities in several countries worldwide where the use/trade of cryptocurrencies is legal. Some countries have passed legislation allowing them to collect tax on all your work. CoinTracking will enable you to compile complete data on crypto transactions, export it, and submit it to the relevant agencies every tax year, ensuring you remain compliant with crypto tax. e.g., IRS Notice 2014-21 is an income tax act that expressly provides guidelines for taxing digital currencies in the US.

Even the German Income Tax Act expressly gives provisions and guidelines for users to follow. The German tax declaration and that of the US are just two examples of countries that have made guidelines available to their citizens.

Highlights:

- Supports tax reports for 100+ countries

- Reports for capital gains, mining, income, etc.

- Supports over 13 tax methods

- Allows tax report export for CPAs and the tax office.

Coin Charts and Trend Tool

CoinTracking supports and provides charts and trend tools for personal analysis that help you make major decisions about your trades and trade outcomes. It gives you charts of over 23k+ cryptocurrencies across multiple exchanges and wallets.

Highlights:

- Supports chart history for 23,239 cryptocurrencies

- Real-time prices for all coins

- Shows top coins by trades and volume

- Displays coin statistics and coin trends and helps you perform correct analysis.

Trade Imports

CoinTracking allows users to import trade data from over ninety-one crypto exchanges and 31 crypto wallets. Users have two primary methods of importing trade data; CSV file upload and API imports. Users can only utilize the CSV upload feature on the free plan, while every other paid plan allows for API imports.

With CoinTracking, users can export their trade reports in multiple formats, including CSV, PDF, Excel, etc. Users can also download charts and trends as PNG, SVG, PDF, or JPG. CoinTracking also allows users to export tax reports in WISO, Drake, TaxACT, Form 8949, and TurboTax.

Highlights:

- Exports in multiple file formats; PDF, Excel, etc.

- It is a crypto tax software that allows direct blockchain sync

- Supports automatic import via APIs

- Import all your transactions from 91+ exchanges.

High-Level Security & Encryption

The CoinTracking app keeps your assets secure by being a non-custodian application. Users can only view trading data but not initiate transactions from the Cointracking app. Users will also enjoy two-factor authentication, API data encryption, trade backups, and an option to restore trade backups.

Highlights:

- 2-factor authentication via e-mail and phone number.

- API and data encryption

- create and restore personal trade backups

- No direct access to your exchanges is required.

- Non-custodian

Premium Support

CoinTracking has a well-structured support system that attends swiftly to any support ticket users open. It is important to note that paid plans are prioritized; however, this doesn’t suggest that they neglect free plan users. Users can also share their accounts with tax professionals who subscribe to CoinTracking Corporate within a few clicks(they have a better experience than most average users).

Highlights:

- Complaint with crypto tax laws for over 100 countries

- The full-service team carries out tax reviews

- Easy guides and detailed tutorials.

Trusted Partners

Opening a CoinTracking Account

Get started with CoinTracking with these quick steps.

Step 1: Visit the CoinTracking website

Set up your CointTracking account with a few simple clicks.

First, visit the official Cointracking website here. To view a quick demo of what to expect, hit the [Cointracking Live Demo] button.

You’ll be given an instant dashboard to view a dummy portfolio. You will also get a prompt to register for free at the top of your screen.

You can skip the live demo and create a free account.

Step 2: Sign up

Enter your username, password & e-mail, and hit the [Sign Up Now] button, and you’ll be given the free plan by default.

Select your currency, language, and time zone(optional). You can also toggle the newsletter button. You will get a maximum of 3 newsletters per year.

Afterward, hit the [Add or import your transactions now] button to hop on to the next step.

Step 3: Import Trade Data

Now enter the coins and your trades. You can join them manually or click on the logo of any exchange to import your transactions directly. Some exchanges support API and CSV import options, while others support only one.

- CSV Only: Abra, ACX, Ascend, Bison, Bitcoin Suisse, Coinmetro, etc.

- API Only: Bibox, Bithumb, Bitso, Bitvavo, CoinSpot, etc.

- API & CSV: Binance, Binance.us, Bitfinex, gate.io, etc.

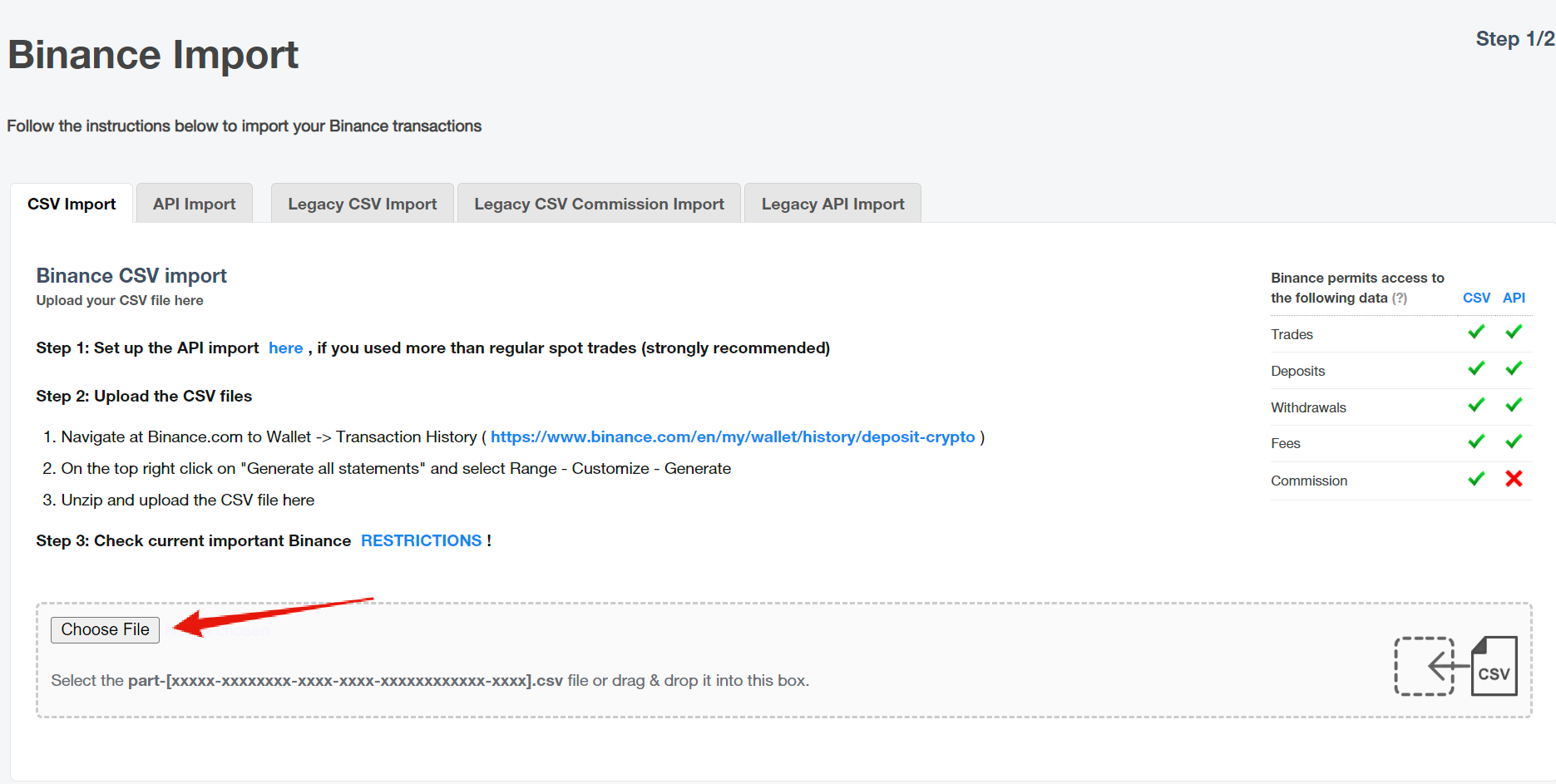

To import CSV files, follow the instructions given. Each exchange has a guide on how to download your CSV file.

Hit the [Choose File] button, select the CSV file, and upload it. Your trading history and data will be uploaded.

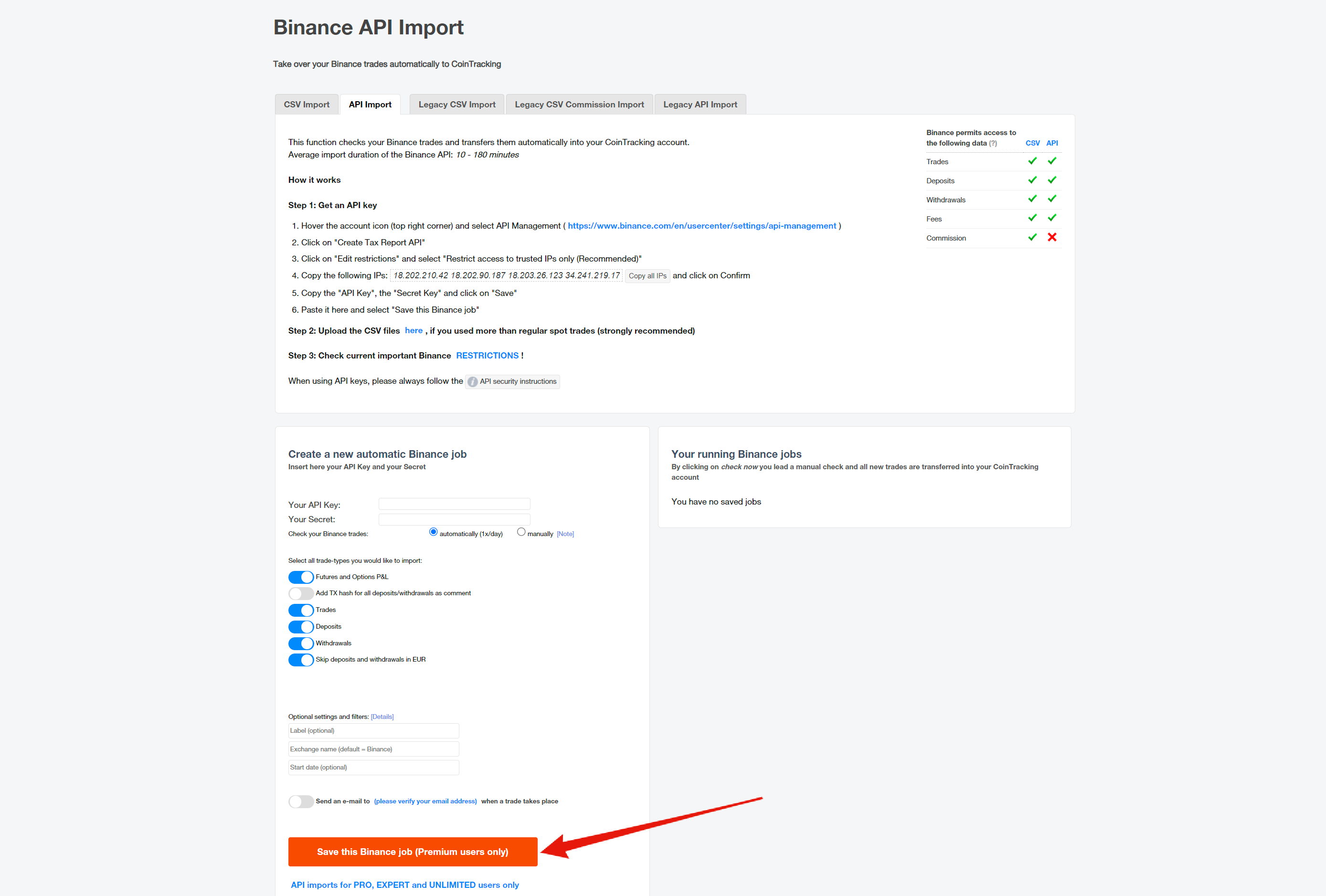

To import your data via API (strongly recommended), You have to subscribe to one of the paid plans. Afterward, select an exchange or wallet of your choice. Each crypto exchange or wallet has a step-by-step guide. Follow the guide, and you can now enjoy the full benefits of utilizing the CoinTracking app.

Step 4: Generate tax reports.

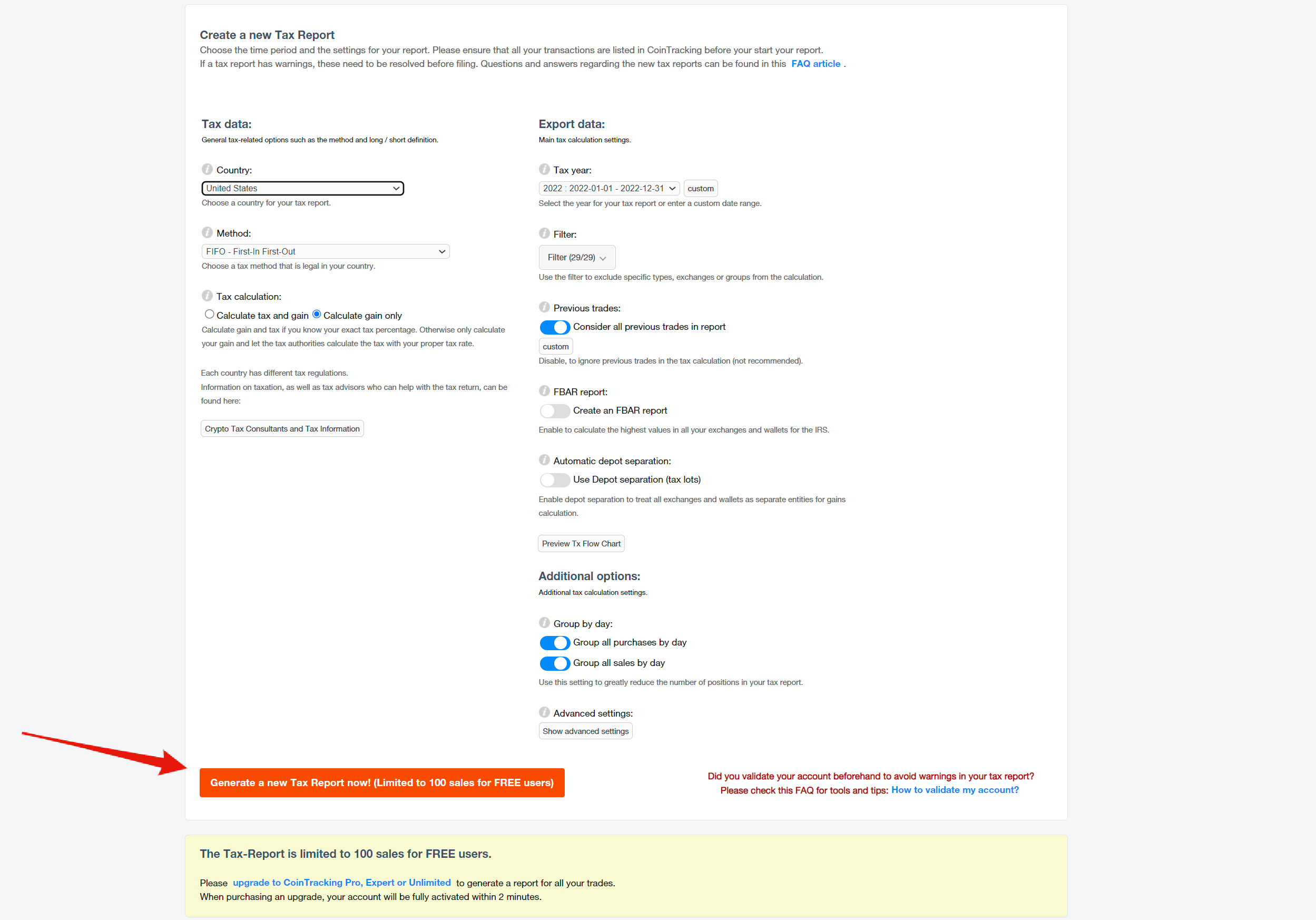

To generate tax reports, go to your dashboard, navigate the [Main menu], hover your mouse over [Tax Report], and select [Tax Report].

Scroll down to that part of the page where you’ll find the new tax report button under the heading ‘Create a new Tax Report.‘ Select all the relevant options, especially the mandatory options.

After the tax report button selecting the relevant fields, hit the [Generate a new Tax Report now] button. Note that as a free user, you are limited to 100 sales as specified on CoinTracking.

Step 5: Submit the Tax Report

After downloading your tax report, you can conveniently submit it to the relevant authorities as stipulated within the documents or guidelines of the Income Tax Act or your country’s tax laws.

CoinTracking Review: Pricing

Free Plan Highlights

- Six features unlocked

- Limited to 200 transaction data

Pro Plan Highlights – $127/year

- 13 features unlocked

- automatic import

- costs $10.58 (billed monthly) – Totalling $127

- limited to 3,500 transactions

Expert Plan Highlights – $381/year

- 13 features unlocked

- $18 – $31.77 (billed monthly) – Totalling $216 – $381.27

- limited to 20,000 – 100,000 transactions

- Automatic blockchain imports

Unlimited Plan Highlights – $1220/year

- All 17 features are unlocked

- $63.56 (billed monthly) – Totalling $1,220.34

- Unlimited transactions

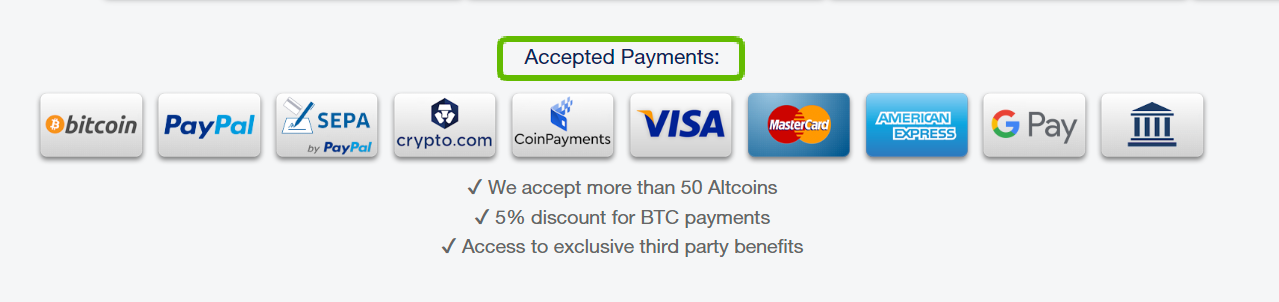

Accepted Payment Options

CoinTracking accepts the following payment methods

- Bitcoin

- Paypal

- SEPA

- Crypto.com

- CoinPayments

- VISA

- MasterCard

- American Express

- G Pay

- Local Bank

Summary

To summarize the CoinTracking review, CoinTracking is excellent software that inclusive enough for newbies to generate tax reports without knowledge of crypto tax software. Instead of manually creating tax reports and filling out tax forms, CointTracking creates ready-to-submit tax reports.

In addition, CoinTracking has a simplistic user interface that contains interactive charts and trend tools that you can learn with the ‘how-to’ videos provided on the platform. You can easily import your exchange account from the list of exchange platforms available to you. Good enough, there are over 91 exchanges to pick from.

The only downside to the CoinTracking app is the pricing. Creating a capital gains report is excellent, but if you’re just getting started, investing this much in creating tax reports might not be on your list of choices; however, if you can afford it, it’s worth every penny.

Creating an account with CoinTracking only takes a few simple steps. Good luck!

CoinTracking examines your trades and produces up-to-date reports on your profit and loss, coin value, realized and unrealized gains, tax reports, and many other metrics.

Cointracking.info is a secure platform that ensures complete data security with features such as API encryption and two-factor authentication. It integrates with TurboTax for a hassle-free tax filing experience. How does Cointracking.info work?

You can delete transactions at the top of the Enter Coins page, either individually, in groups, or entirely. To delete a single transaction, select the box beside it and a delete button will appear.