TLDR

This guide will give you the best crypto trading bots available in 2024 to make choosing what works for your trading strategy easy.

Crypto trading bots are computer programs that buy and sell cryptocurrency automatically.

These bots have many benefits. Their most important features are precise buy and sell orders, removing emotions leading to mistakes, speeding up trading, making faster decisions, and automating the day trading process.

Crypto trading bots can be categorized as trend trading bots, arbitrage trading bots, coin lending trading communities, free cryptocurrency trading bots, and market-making bots. The majority of trading bots, however, take no action beyond sending signals or algorithms, assessing risks, and executing trades. In this guide, you have a few great options for free and premium crypto trading bots if you want to begin using crypto trading bots.

Crypto trading bots; the best bots for 2024

Intelligent crypto traders use trading bots to automate algorithmic trading, minimize risk, and grow profits while limiting losses.

Crypto trading bots are software programs that operate online and accomplish tasks more efficiently than humans.

A bot is anyone who interacts with a website or user scans content for keywords, or does other tasks on behalf of the owner, such as trading cryptocurrency.

Here are the best crypto trading bots for 2024 for you to consider:

1. 3Commas

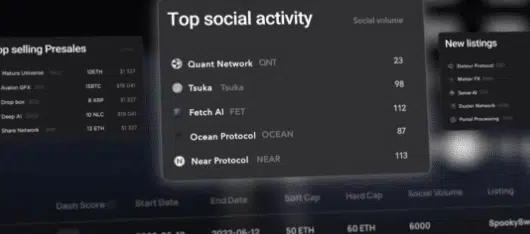

3Commas social trading platform provides users with various tools and features to help create complex trading algorithms and strategies that can be quickly executed in the market.

It also allows for the automation of certain processes and the customization of the parameters of the trading strategies to suit the user’s individual goals and preferences.

3Commas allows traders to place trades with an automated system, which helps to remove the guesswork and human error from the equation.

Their user interface is easy, even for those new to options trading.

Furthermore, their blog provides advanced insights into the crypto market that can help traders make informed decisions. In short, 3Commas offers an all-in-one solution for crypto traders of all levels.

Pros and cons of using 3Commas

Pros

- Great numbers of popular exchanges are available.

- Act as the trading academy for traders at the beginning stage.

- Easily accessible globally.

Cons

- Smart bots are not included in the fee plan of the bot.

- It is not recommended for bot traders at the beginning stage.

Exchanges:

Bittrex, Bitfinex, Bitstamp, Binance, Binance Futures, Binance Margins, Binance US, Bybit, Bybit Futures, BitMEX, Crypto.com, Deribit, Gate.io, Gate.io Futures, Gemini, Huobi, Kraken, KuCoin, OKX, Poloniex

Fees: The fee ranges from $0 to $99 per month.

Programming Language: User interface, no need for programming.

For an easy setup for 3Commas, click [Get Started].

More details

3Commas is a trading bot platform that enables you to develop a bot with curing-edge trading capabilities from the ground up. It executes trades on your behalf on 20+ leading cryptocurrency exchanges. UI is easy, has a simple registration process, and all features are accessible on their mobile app.

-

Supports 16 cryptocurrency exchanges.

-

Worldwide service for crypto lovers.

-

Paper, automatic, margin, and social trading.

-

Fantastic hosting service.

-

All functions are available via mobile apps.

-

Stiff in price.

-

Can be complicated for beginners.

-

No desktop app is available.

2. Cryptohopper

Cryptohopper is considered the best free crypto trading bot for those just starting in crypto trading and, overall, the best crypto trading bot for crypto trading.

It is an excellent platform since it offers 100+ tokens on 15 exchanges and is popular with over half a million users. Because of this, its packages cater to a wide range of needs.

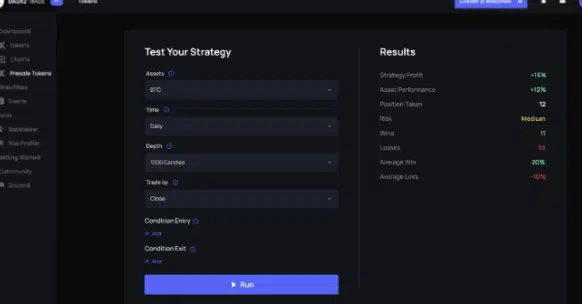

There are a lot of features available for beginners to enjoy in this crypto bot trading tool platform, including educational resources, templates, copy bots, and signals; however, the experts can also enhance their work by designing and backtesting their unique strategies on this crypto trading toolbox, and user-friendly features of Cryptohopper make it the best choice for users.

Pros and cons of using Cryptohopper:

Pros

- There is no requirement for the codes.

- Provides free starter plans.

- The platform is established using an amazing and enormous database.

Cons

- It charges extra fees for the signals.

- Users are unable to use phone support.

Exchanges

Binance, Bittrex, Bitvavo, Coinbase Pro, Crypto.com, Binance US, Bitfinex, Bitpanda Pro, HitBTC, Huobi Pro, KuCoin, Kraken, OKX, Poloniex,

Fees: Cryptohopper costs around 0$ to almost 99$ per month and offers various user discounts.

Programming language: User interference and no programming is required in Cryptohopper.

3. HaasOnline

Haasonline is suggested as the best crypto trading bot for technical day traders looking to develop and optimize their automated crypto trading bot platforms and systems.

In the past, HaasOnline was popular among users interested in writing their scripts and wanted to operate the best crypto trading bot locally.

However, HaasOnline is a pricy option for traders and does not provide free trial options for users.

The recent trade server cloud option of HaasOnline has made it more favorable for users. Users can access the crypto trading bot wherever and wherever they want by using the bots of their choice.

Moreover, HaasOnline also offers edge computing for futures bots, which provides low latency compared to other users’ trading terminals by making the bots closer to the other exchanges’ trade servers.

Pros and cons of using HaasOnline

Pros

- Trader bots are pre-built.

- Lower latency is maintained using edge computing.

- Offers simulation engines and robust backtesting.

Cons

- Not a recommended option for beginners.

- It does not provide free trial options.

Exchanges:

CEX.io, Coinbase Pro, Deribit, Binance, Binance Futures, Binance.US, Bitfinex, BitMEX, bitpanda Pro, Bitstamp, Bittrex, ByBit, Gemini, HitBTC, Huobi, Ionomy, Kraken, Kraken Futures, Kucoin, Mandala, OkCoin, OKX, Pionex.

Fees: The fee package ranges between .006 BTC to .014 BTC for three months.

Programming language: HaasScript.

4. Gunbot

Gunbot is repeatedly suggested for technically skilled users interested in feature-rich crypto trading bots.

Moreover, it provides traders with a considerable degree of control over the trading bot platforms. Gunbots are more demanding to use since they have multiple features, but it is perfect if you want to learn how to use a crypto trading bot.

The price justifies the features that Gunbot offers to its users. This tool is designed for the advanced trades who are interested and comfortable in coding their scripts.

The working principle of Gunbot is different since it consists of a one-time purchase software system. However, users can resell the licenses if they find the crypto trading bot bad. Moreover, Gunbot offers active community support and pre-built scripts for traders.

Pros and cons of using Gunbot

Pros

- Provides amazing control for the traders.

- Consists of a one-time purchase method.

- A well-established platform consisting of an enormous user base.

Cons

- Consist of difficult learning skills.

- The mobile app is rudimentary and only allows users to check the various activities of the crypto trading bot.

Exchanges:

Bittrex, CEX, Coinbase Pro, Gate.io HitBTC, Huobi Global, Kraken, Kraken Futures, MEXC, Beaxy, Binance, Binance Futures, Binance US, Bybit, Bitfinex, Bitmex, Bitmex Testnet, Bitstamp, okGunbot, OKX, Poloniex, Txbit, others through CCXT library.

Fees: Lifetime licenses consist of the range between 0.14BTC to 0.04BTC.

Programming language: Javascript or user interface.

5. Coinrule

Coinrule is an automated crypto trading bot that teaches traders the basics of trading, such as risk management, technical analysis, and portfolio management.

It also provides traders with rules that can be used to make automated trading strategies and decisions without coding skills.

With Coinrule, users can easily create and monitor automated trading strategies without needing any coding knowledge.

The platform offers a wide range of rules, leverage strategies, and personalized training for more experienced traders.

Pros and cons of using Coinrule

Pros

- No programming is required.

- Numerous popular exchanges are accessible on this trading bot

- Paper trading and backtesting are available via free accounts.

Cons

- No mobile app is available to use by the traders.

- Users are required to have some basic understanding and familiarity with advanced trading rules.

Exchanges:

More than 15 of the most popular exchanges, including BitPanda Pro, Bitstamp, Kraken, BitMex, Binance, Coinbase Pro, OKX, HitBTC, and KuCoin.

Fees: $0 – $449.99 is charged for using the bots.

Programming Language: User interface. No programming language knowledge is needed.

More details

Coinrule is an excellent platform with more than 250 automated trading rules and advanced algorithms. One of the significant advantages of Coinrule is that its users don't require coding expertise; thus making it easy to use and highly customizable. However, the absence of a mobile app and the limited number of exchange APIs supported are disadvantages.

-

Minimal fee with no locked commissions.

-

Access to exchanges and marketplaces.

-

Auto trading rule implementation strategies.

-

Access to the 34 best crypto trading bots.

-

Simulated market for testing trading strategies.

-

Decentralized exchanges are not supported.

-

Only supports 40 cryptocurrencies.

-

API integration with only 15 exchanges is available.

-

No mobile app.

6. Trality

Trality is the best option for traders familiar with Python and interested in writing their crypto trading bot code.

Python API of Trality makes it different from the other trading bots, allowing traders to develop bots using familiar languages and libraries.

Intelligent autocomplete and backtesting, debugging, and, soon, rebalancing are among the features Trinity offers its customers.

This bot could be faster in introducing new features and exchanges. However, its other unique features, including easy-to-use Python integration and detailed documentation, make it a transparent and accessible option for traders.

Pros and cons of using Trality:

Pros

- Trality is cloud-based and offers end-to-end encryption.

- The customization of trader bots is available, and users can also rent the trader bots.

Cons

- Beginners are not going to be able to operate it properly

- Provides a minimal number of exchanges.

- The mobile app is not available.

Exchanges:

Binance, Binance.US, Bitpanda, Coinbase Pro, and Kraken.

Fees: Fee ranges from €0 – €59.99 per month.

Programming Languages: Python.

7. TradeSanta

Tradesanta is ideal for those new to trading, as it allows them to learn and use cutting-edge trading automation tools and an integrated trading platform.

It is considered an affordable and approachable crypto trading bot due to its unique features, including mobile and desktop interfaces, risk management tools, and a pre-built template.

TradeSanta support chat is a massive advantage to novice traders, as they can get answers to their questions right away. This allows users to get up to speed faster and start trading more confidently without worrying about making mistakes.

Pros and cons of using TradeSanta

Pros

- Consists of a straightforward bot creation process.

- Provides affordable plans for their traders.

- Provides an exceptional degree of support.

Cons

- A three-day free trial is available for” maximum” plans.

- Not recommended for advanced traders.

Exchanges:

Binance, Binance Futures, ByBit Coinbase Pro, HitBTC, Huobi, OKX.

Fees: $0 – $70 is charged per month for using the bot.

Programming Language: User interface, no programming required.

8. Pionex

Pionex trading bot helps to automate the trading process and can provide insight into the market, allowing traders to make more accurate decisions.

These processes can be customized to fit the trader’s specific goals and are easy to set up and use.

Moreover, the Pionex trading bot provides access to 16 free trading bots built into the Pionex exchange, including a grid bot, DCA, and arbitrage bots.

The crypto trading bot platform built into the exchange improves the user experience. Users don’t need to search for a platform from multiple providers and then integrate it into their exchange.

The $0 price tag is also very attractive since users don’t have to pay additional fees to use the bots.

Pros and cons of Pionex

Pros

- Trading bots are already built-in in the exchange.

- It does not include a monthly fee; the transaction fee is also significantly low.

Cons

- It offers significantly fewer features in paid and free plans than competitor bots.

- Withdraw is not available with fiat currency.

Exchanges:

Pionex (arbitrage is on spot futures)

Fees: No monthly fee is included in this grid trading bot, but it takes a .05% trading fee on every grid trading bot transaction.

Programming Language: User interface, no programming required.

More details

Established in 2019, the crypto trading platform is the first to introduce built-in trading bots for investors and traders. The exchange is integrated with 16 automated trading bots for free! The user-friendly interface, innovative mobile app, and low trading fees have all contributed to the increasing popularity of the Pionex exchange.

-

16 built-in trading bots with detailed tutorials.

-

Aggregates liquidity from Binance and Huobi.

-

120 different cryptocurrencies.

-

Trading fee of 0.05% on each transaction.

-

Easy-to-use mobile app.

-

Limited flexibility to modify the built-in bots.

-

No demo account

-

No desktop app is available.

-

No withdrawals in fiat currency.

9. Ichibot

Since the trading bot is coded using typescript, Ichibot allows developers to access and control more complex trading strategies.

The command line interface makes it easier to debug the code, making it an excellent choice for experienced developers who want to customize their trading bot.

Ichibot is considered a trading tool rather than a bot. It does not make any trading decision without the interference of the operator.

With Ichibot, users can program their custom trade algorithms and test them against historical data to see how they would have performed in the past.

Furthermore, users can also backtest their strategies to see if they would be profitable in the future. This allows users to accurately analyze their strategies’ risks and rewards before executing them in the market.

Pros and cons of using Ichibot

Pros

- Power users can enjoy using this trading bot.

- It provides the opportunity for the technical users to make their trading bot and also provides them complete control of their trading bot.

- There are no charges for using this trading bot.

Cons

- Average users are unable to use this bot

- The number of exchanges available is limited.

Exchanges:

Binance, Bybit, and GlobeDX.

Fees: None.

Programming Language: The programming language is a CLI (Command Line Interface) but written in typescript.

10. Stoic

Stoic allows users to develop a customized portfolio strategy that best fits their individual goals and risk tolerance while providing access to various investment options.

Additionally, users can take advantage of the latest market insights and research to make informed decisions.

The trading bot uses predictive analytics to generate trading signals and execute trades on behalf of the user. It can analyze the market and spot patterns and trends that can be used to inform its decisions.

It also applies advanced risk management strategies to help users optimize their portfolios and maximize their returns.

You have these features:

- A long-only index strategy for the top 30 altcoins.

- A fixed-income algorithm.

- A long-short active trading strategy.

- It also helps automatically rebalance your portfolio based on forecasts obtained from a network of 180,000 financial professionals.

Pros and cons of Stoic

Pros

- They support automatic and manual trade.

- Consists of expert-developed trading algorithms.

- Provides a mobile app for monitoring purposes.

Cons

- It is more oriented toward protecting assets and is not considered ideal for use in bull markets.

- Exchanges are limited to Binance.

Exchange:

Limited exchanges only, including Binance and Binance.US.

Fees: $9 – $25 is charged monthly, including 5% of the annual deposit fee.

Programming Language: None, mobile app.

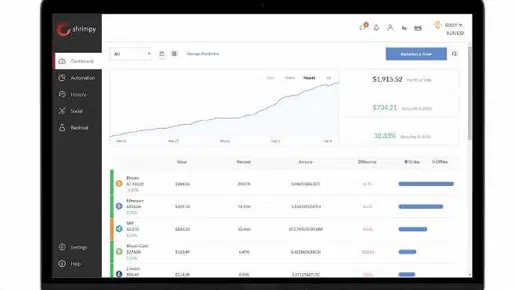

11. Shrimpy (Closed)

Shrimpy is appreciated by people interested in managing their long-term crypto profile with social trading tools.

The bot allows interaction with other traders, follows their portfolios, and copies their strategies. This enables users to learn from experienced traders and benefit from the knowledge of an entire community.

Through copy trading, traders automatically execute the same trades as other traders. It gives new users the advantage of high-performing traders’ success without spending time and energy figuring out their trading strategy.

Shrimpy’s has a leaderboard that features successful traders. This enables users to earn monthly income by posting successful trades for others.

Shrimpy’s has many features, including its engaged community and many supported exchanges, making it an attractive platform for traders worldwide.

Pros and cons of using Shrimpy

Pros

- Competitive Pricing.

- Copy socially focused trading.

Cons

- No mobile app is available.

- Customer support is also limited.

Exchanges:

Bibox, Binance, Gate.io, Gemini, HitBTC, Huobi Global, Binance US, Bitfinex, Bitmart, Bitstamp, Bittrex, Bittrex Global, CEX, io, Coinbase Pro, Kraken, KuCoin, OKX, Poloniex.

Fees: $0-$49 is charged monthly and includes some annual discounts for the traders.

Programming Language: User interface, no programming required.

Crypto Trading Bot: What is this?

In the crypto world, trading bots are computer programs that automate the process of trading and analyzing the crypto market.

These programs place orders for buys and sells on behalf of traders. Managing portfolios and analyzing technical data are both involved in trading communities.

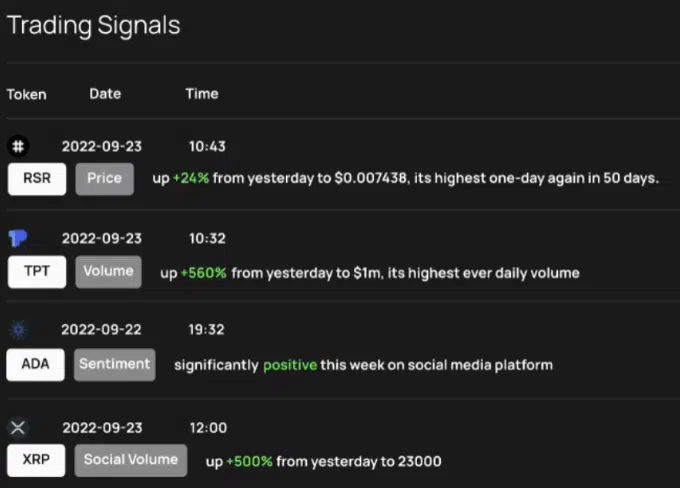

Using algorithmic strategies, it executes trading strategies optimally to capture profit from volatility.

In automated trading bots, preprogrammed trading strategies and algorithms execute trades.

A decision is based on prevailing market conditions, such as volume, time, orders, and trading price movements in the crypto market. Trading bots are fine-tuned to meet the high-frequency trading preferences of crypto traders.

Crypto Trading Bots: How Do They Work?

Understanding the different profitable crypto bot trading strategies and types of crypto bots available is essential to understanding how the best crypto trading bots work.

Here are some details about how to automate your trading bots’ work. Allowing trading robots on crypto exchanges remains a heated debate among traders. The hardware and software requirements for most crypto bots are specific.

Crypto trading bots come in many forms. Some are free to use, while others require large subscription and usage fees.

They typically download a unique code from the platform’s developers to set up automated trading bot platforms on the cryptocurrency exchanges that the trader chooses. It is still essential that Bitcoin traders decide when to trade their digital coins, even though the best Bitcoin trading bots can help them.

Crypto trading bots are not a way to make money fast but rather a way to automatically win all trades. For traders to make money from successful trades, they must invest time, effort, and knowledge.

Multiple features of crypto trading bot

Here is the list of the following advanced features of crypto trading platforms in detail:

Security

Undoubtedly, reliability and security are some of the most critical aspects of advanced trading bots.

Trade bots usually directly access the user’s crypto trade strategies and funds on multiple cryptocurrency exchanges.

Losing funds can quickly happen if you choose an unreliable bot with mediocre security measures.

Security measures are also an essential aspect of reliable crypto bots. It is possible to ensure safety by creating an API key for a reputable crypto exchange. The API key gives relevant permissions related to bot trading.

Reliability

To manage portfolios effectively, traders should look for several key features in trading bots and advanced tools.

Reliability is an essential part of crypto trading bots.

If the trading bot suddenly goes offline, traders can lose out on great opportunities since the cryptocurrency market never stops.

Hence, choosing a trading bot run by a reliable trading platform with a well-established track record is crucial. By reading user reviews, feedback, and testimonials, traders can better understand the bot’s trustworthiness and reliability.

Mobile Apps

Traders can monitor their bots on the go easily with mobile support. Most bots have a mobile app that offers all of the functionality and features of their browser version.

Free Trial

There are several free bots on our list that users can use for a free trial to automate their profitable trades.

A free trial is the best option if you’re a beginner or want to check out the bots before spending money on them.

Profitability

You can generate profit through crypto trading bots by automating your trading process.

Traders of all levels can benefit from the best crypto trading bots, whether advanced traders or beginners.

Before adopting a trading bot platform, traders should do extensive research and assess the profitability factor because an unreliable platform might not generate enough profit for users.

Transparency

To earn profits from automated trading software, transparency is an essential factor to consider. By working with a trustworthy developer and having a transparent website, traders can avoid mishaps, such as losses and hidden trading fees.

What are the Main trading techniques for Crypto Trading bots?

The bots use specific trading strategies to execute trades automatically. These include:

Momentum Trading

When using this trading technique, traders keep a short-term position and sell it at the trading price’s peak just before the crash. It is also referred to as the trend-following mechanism.

It is perfect for buying crypto assets when the market is experiencing a wave of bullish momentum and selling them when that momentum turns negative.

The premise behind this trading approach is that prices would inevitably increase above the predicted average before falling. The finest cryptocurrency bot can help monitor market conditions and decide the ideal time to sell a position. Entry and exit timing are, therefore, crucial in momentum trading.

Mean reversion

Traders can revert a crypto trading bot to average value if their price diverges from an average price using a mean reversion strategy.

The philosophy behind this trading strategy is based on buying low and selling high.

Crypto trading bot strategies buy and sell crypto coins according to price movements. For example, if a crypto coin drops below the market average, it buys; if it rises, it sells.

Arbitrage Bot

In cryptocurrency arbitrage bots, lower prices are bought, and higher prices are sold. Traders can utilize a variety of arbitrage methods while trading cryptos.

Through arbitrage trading, profits are made from buying and selling cryptocurrencies on significant cryptocurrency exchanges.

There is no dependence on the performance of the market, so there is a relatively low risk associated with it. The only requirement is to move quickly and smartly to take advantage of the crypto market’s price differences.

Market-Making

It helps traders prevent large fluctuations in prices by implementing a market-making strategy.

In the same way that grid trading bots create liquidity in the market, market-making good trading bots do the same.

However, by placing trade orders on both sides of the order book, they perform nearly at market pricing and generate modest profits.

Copy Trading

This means that beginner traders can copy the strategies of more experienced and professional traders. In contrast, experienced traders can earn additional income from the fees they receive for allowing others to copy their trades.

This makes it easier for traders to follow successful traders without analyzing the market manually and provides experienced traders a new way to monetize their expertise.

The leaderboard and gamification elements provide an incentive to update and refine their trading strategies continually. In contrast, the social trading community offers a forum for traders to discuss and collaborate on their trading strategies.

Copy trading allows beginners to follow the trades of experienced traders, allowing them to learn from the mistakes and successes of those traders. This allows them to learn the ropes of the trading world without the trial and error of learning the most advanced trading indicators and tools.

Sandwich Bots

The Sandwich Bots strategy allows the bots to make quick profits while simultaneously driving up the coin’s price.

This gives the bot an advantage over other traders, as it can buy the currency at a lower price and sell it at a higher price than other traders are willing to pay.

Advantages and disadvantages of using cryptocurrency trading bots

There are advantages and disadvantages to using cryptocurrency trading bots to make trading decisions. Let’s look at the advantages first.

Advantages of using cryptocurrency trading bot

Increased the speed of work

In crypto trading markets, the speed of making decisions dramatically affects trading. Bots help users to enhance their quality to place orders quickly. If you cannot make the trades on time, you have more chances to face losses. Bots work more efficiently and quickly as compared to a human.

Efficiency and accuracy

Crypto trading bots enhance the efficiency of the results and help people who lack multitasking make precise decisions. Using the best crypto trading bots, users can enhance their strategies to analyze marketing trends and conditions without using the human-emotional approach to eliminate possible errors.

Automatically investment feature

There are multiple reasons behind failure in making investments, including panic, FOMO, and stress while making the decisions. As trading bots do not make any decisions emotionally, it is always advisable for traders to invest their time and money in trading bots to make wise decisions.

Running period

A human can’t watch the trading market for 24 hours to examine investments. That’s why trading bots come in handy to take notice of market investments all the time. This increases your chances of not missing any golden opportunity in making investments.

Disadvantages of using cryptocurrency trading bot

Let’s now look at the disadvantages of using trading bots.

Not for inexperienced traders

Trading bots consist of multiple features and complex operating systems. Users must have the proper skills and knowledge to operate the best trading bots. Using trading bots without any knowledge and experience can lead to loss. Hence, trading bots are not recommended for beginners or non-experienced traders.

Requires monitoring

Bots may not be able to predict market movements fully and may not be able to respond quickly enough to sudden changes in price, leaving traders exposed to potential losses. Furthermore, bots cannot make informed decisions as they do not have access to the same level of information that a trader has.

No guarantee of making a profit

Investments are required to access and use the trading bots, but that does not mean the profit is guaranteed. Hence, traders need to make a wise decision considering the need to use trading bots profitably and utilizing them to automate the trades.

Security issues

The security measures of trading bots are questionable and can lead to some damage. Hackers can access your funds through the API keys and your personal information.

Additionally, some bots may be programmed incorrectly, leading to losses if the bot executes a trade against the trader’s wishes.

Reasons to consider using crypto trading bots

Even though many risks are associated with using trading bots, multiple reasons justify investing your money in trading bots.

Automated Functioning

Automated crypto trading bots have the capability of monitoring markets 24/7 and executing trades based on a predetermined set of rules. These bots can also quickly analyze vast amounts of data, allowing them to identify trends and make predictions that can help increase profits. This eliminates the risk of emotional decisions that could lead to significant losses.

Crypto Trading Strategy

Trading bots enable users to utilize different crypto trading strategies as these bots are programmed to tackle multiple scenarios. Mean reversion, momentum trading, arbitrage, market-making, copy trading features, sandwich bots, and others are among the most common crypto trading bot strategies.

Conclusion

Free crypto trading bots are prevalent in the crypto market because of their many advantages. As a result, thousands of automated crypto exchanges and trading bots have been developed, making it difficult to choose the best one.

This guide contains detailed information about the best crypto trading bots available in the market to make it easy to choose multiple crypto exchanges and trading bots.

Since cryptocurrency trading bots require almost no technical knowledge, they should be designed with beneficial features.

The best crypto trading bots can be used by traders, which are cost-efficient and allow beginners to start their journey in cryptocurrency trading bots profitable platforms. Crypto trade bots’ decisions are considered perfect and make trading bots profitable since they do not get much affected by human emotions and make and analyze their decision according to the available data and situation of the market.

However, investing in trading bots does not guarantee that you will not face loss or are only bound to make a profit.

Happy trading!

Yes, but not all. The effectiveness of professional crypto bot trading depends on the design of the bots, which should incorporate prediction, automation, and order execution technologies to generate profits through cryptocurrency trading.

While crypto bot trading can be highly lucrative when executed correctly, many available services on the market do not yield substantial returns after considering transaction fees and monthly charges. Therefore, selecting the appropriate service provider or creating your own is essential for achieving success in this field.

While bot trading is legal in both cryptocurrency and stock markets, not all brokers allow it. However, it is important to note that any activities deemed illegal in traditional trading are also illegal in cryptocurrency trading.