TLDR

Crypto futures refer to a type of trade where two parties agree to trade a crypto asset at a predetermined price in the future. Crypto futures trading allows investors to gain exposure to the crypto market with higher leverage. This guide will give you an overview of our experts’ top futures trading strategies.

Trading crypto futures profitably requires a good strategy based on an individual investor’s preferences and long-term goals.

The 5 best futures trading strategies include:

- Going long or short

- The pullback strategy

- Breakout trading strategy

- Spread trading strategies

- Range trading strategies.

Best Futures Trading Strategies

Crypto investors use several futures trading strategies. Each has its strengths and weaknesses. Here are the 5 best futures trading strategies:

1. The Pullback strategy

The pullback strategy is focused on capitalizing on price pullbacks to make profitable trades. Price pullbacks occur when the price of a contract breaks either below or above the resistance and support level, then reverses and goes back to the broken level.

The common ways of capitalizing on the price pullback strategy include:

- Entering a long position in the uptrend direction of an underlying commodity, once the price breaks above a resistance level, reverse and return to that resistance level.

- Entering a short position in the direction of an underlying downtrend when the price breaks below a support level in an uptrend, reverses, and then comes back to that support level, thus creating a pullback

2. Going Long or Short position

This is one of the most basic futures trading strategies for crypto. Going long refers to buying a contract, hoping the underlying asset will increase in value. If it does, the trader profits by selling the asset at a higher price.

Going short is holding contracts and expecting the underlying assets to reduce the price. To choose an excellent long or a short position, traders need significant technical analysis to predict market moves.

With leveraged trading, investors can increase the size of potential profits and mitigate against losses, thus making the most out of trading opportunities.

3. Breakout futures trading strategies

The breakout trading strategy involves trying to catch market volatility when the price level breaks out of an established trading range.

Breakouts are common in the crypto market and can be identified using several trend lines and market indicators. The breakout trading strategies are widespread among day traders.

Sometimes, breakouts lead to market volatility rising because of several pending orders. A common breakout trading strategy is to go short when the price breaks below support and go long when the resistance levels are broken.

4. Spread futures trading strategies

Spread trading aims to capitalize on price changes of different futures contracts on trending markets in multiple exchanges.

In spread trading, investors buy a futures contract and sell the same futures contract at a later date. As a result, both contracts in a spread trading strategy usually have different expiration dates.

The main advantage of spread trading is reduced risk. Each spread acts as a hedge. Another benefit of spread trading is that the effects of spread trading are pretty minimal.

5. Range Trading futures strategy

Range trading often goes hand in hand with day trading. It involves trading a futures contract within a specific price range. The requirements are more technical analysis, but they carry higher risks.

What are Crypto Futures

A futures contract is an agreement between two parties to purchase financial instruments at a fixed price to be delivered later. Futures contracts hedge assets and commodities against changing market conditions that might affect their future price.

Crypto-day trading futures are similar to stock futures, and they allow investors to gain exposure to the changing price levels of cryptocurrencies without holding the underlying asset.

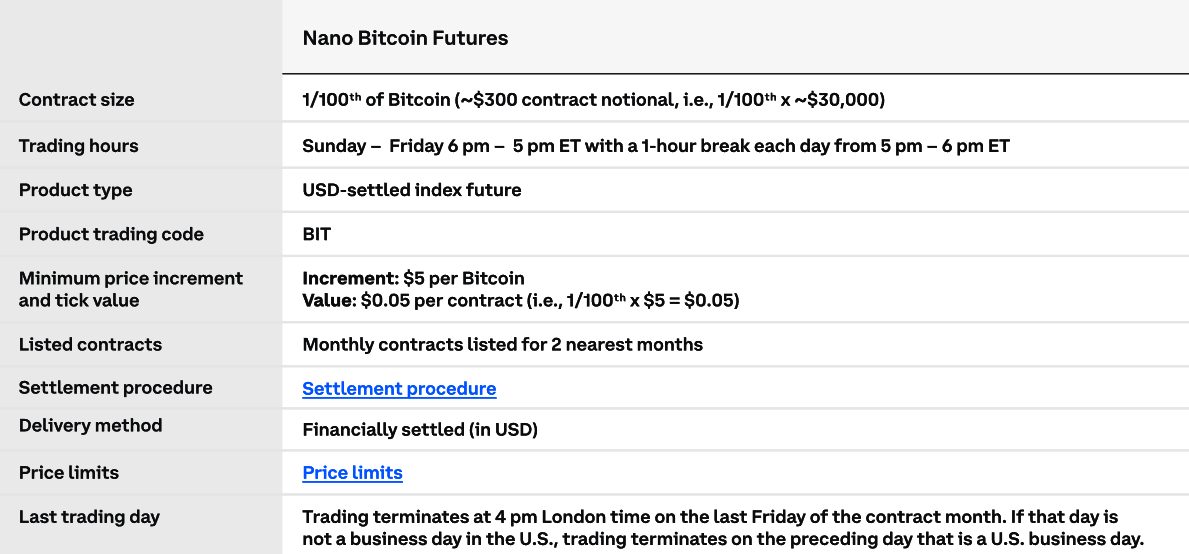

Crypto futures trading was introduced in 2017 by the Chicago Mercantile Exchange. Since then, they have steadily gained acceptance as a financial instrument because they allow investors to participate in the crypto market with reduced risk.

Crypto futures contracts allow investors to use leverage to increase their profits. Leveraging refers to borrowing against your investment, allowing a futures trader to enter larger positions despite having little capital.

How Do Crypto Futures Work

Crypto futures contracts are somewhat different from traditional stock futures. In traditional futures trading, most contracts expire when the asset must be delivered or paid in cash.

In crypto, maintaining a long-term futures position requires rolling over contracts. Rolling over means selling the shorter contract and buying a longer one to keep the position open.

Keeping the position open in a rollover requires cash settlements because one position is closed at the same time another is opened. Liquidity is important.

Most futures contracts in crypto rely on perpetual futures with no expiration date. Perpetual futures contracts are closed and reopened each day to match the spot price of the underlying asset.

In perpetual futures, a daily settlement fee is required from the difference in the spot price paid to either the contract’s buyer or seller in a process known as funding.

During funding, if the spot price goes below the contract value, the seller receives the difference in fee. On the other hand, if the spot price goes above the contract value, the buyer collects the difference. The funding process takes place every 8 hours on crypto futures markets.

Futures Trade like a Professional

Crypto Futures trading is undoubtedly more complex than traditional futures. It requires significant knowledge and understanding of how the market changes over time and how it is affected by external factors.

Here are a few main factors to consider when an investor wants to start trading futures:

Finding the Right futures trading strategies

The right futures trading strategy has to be customized to fit an individual’s psychological traits, short and long-term objects, and risk appetite. Some steps to find the right futures trading strategies include:

- List your goals: List your long-term and short-term goals to help you understand your trading plan. In addition, it helps to show you trends you should avoid. This also enables you to make better trading decisions. For instance, trying to capitalize on a short-term trend might hurt your portfolio if your investing strategy involves holding long futures contracts for a long time.

- Creating a futures trading plan: A trading plan can be the difference between an amateur trader and a professional. It helps reduce risks while maximizing profits according to your trading preferences. All futures trading strategies should contain a detailed plan for how an investor opens or closes trade positions. They should also contain entry and exit indicators, stop loss and take profit functionalities, and position sizing.

A powerful futures trading strategy benefits investors by helping them complete more trades and reduce anxiety while trading. They also allow investors to trade futures while significantly improving their trading skills.

Learning how to do a fundamental analysis

This determines the fair market value of asset classes like crypto futures. Fundamental analysis involves reading charts and data from other markets.

Risk management

Managing risks is a crucial skill that dramatically affects a trader’s profitability in the crypto futures market. A trader’s risk appetite will also affect their trading goals.

For instance, a trader with a long-term perspective might opt for little risk not to lose their investment, while investors participating in short trades like day trading futures can opt for higher risk.

Personal trade preferences

Customizing trade parameters to fit the strategy you’ve adopted. E.g., take profit and stop loss features. This helps investors to automate their trading.

Learn how to read charts

Successful trading of crypto futures requires access to real-time information that helps investors to make better trades.

Knowing how to read charts makes traders more effective, as they can better predict trends and market changes that might affect the prices of crypto futures.

Investors should understand critical aspects of candlesticks, resistance, and support levels. Investors should also learn to identify moving averages and strength indices.

Stay up to date with market news

Financial instruments are greatly affected by socioeconomic changes. A great example is the war in Ukraine, which caused gas prices to skyrocket, leading to inflation that affected the crypto market in 2022.

By staying up to date with the latest financial media around the globe, investors can better predict the best times to enter and exit trade positions.

Reviewing various exchanges

Various exchanges and trade platforms have different prices for the same assets, including crypto futures. By going through different exchanges, day traders can capitalize on price differences to increase profits and reduce losses.

Please note that unregulated exchanges are generally riskier than their regulated counterparts, so investors should exercise more caution when trading futures using an unregulated exchange.

Make changes when and where necessary.

When trading futures in the crypto market, it is necessary to make changes where necessary. This is why staying up to date with current market events is essential because it helps you adjust your trade positions.

Market conditions change regularly, affecting the price of a futures contract, so investors should be ready to respond to such changes quickly.

How to Start Trading Crypto Futures on Bybit

Here is a step-by-step guide on how to futures trade with Bybit. You can easily do so by clicking the [Get Started] button:

More details

Bybit is a leading futures trading platform globally, offering up to 100x leverage and attracting users who prefer to remain anonymous. With a presence in 180+ countries, it is renowned for its efficiency and unique features in cryptocurrency derivatives trading.

-

The platform offers up to 100x leverage trading.

-

Strong educational resources.

-

Diverse markets for traders, spot, perp, and futures.

-

Risk-free demo accounts to explore all key features.

-

TradingView integration.

-

The platform is difficult for beginners to navigate.

-

It does not offer a quality spot trading feature.

-

The NFT marketplace is limited in terms of options.

-

Security is of the gold industry standard.

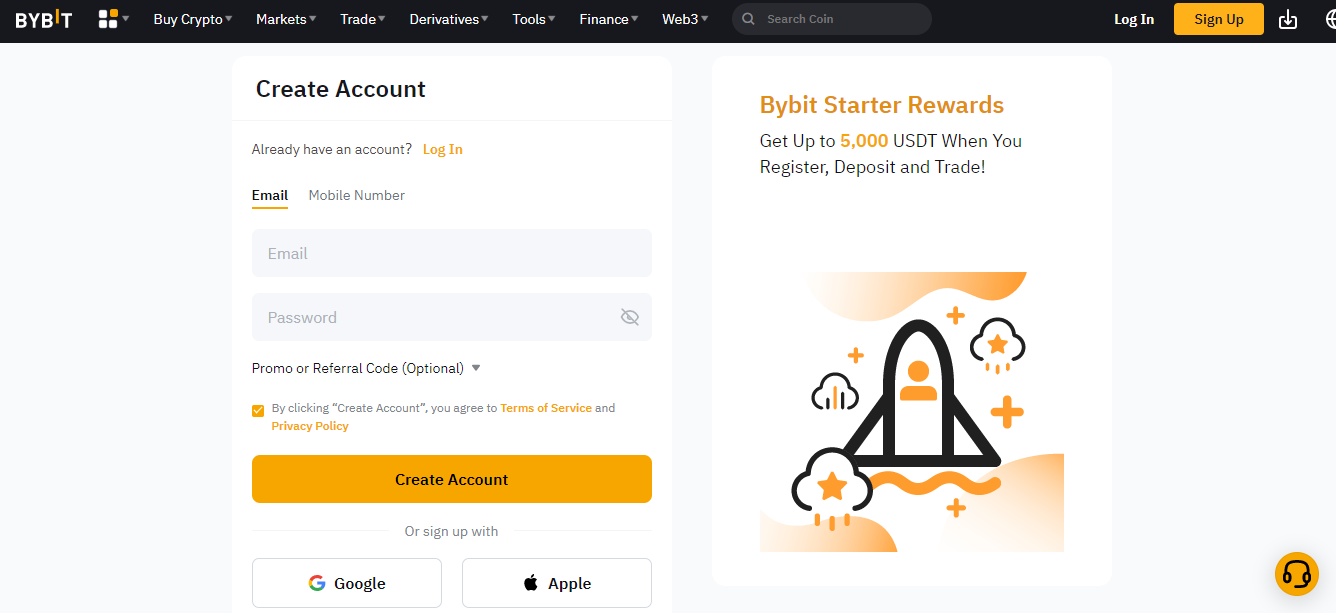

Step 1: Open a Bybit account

The first step is opening an account with Bybit. You can register an account through the Bybit website or their mobile app, which is available on Android and iOS phones.

Click the [Sign Up] button in the upper right corner, type in your e-mail and a strong password, and go ahead and click [Create Account].

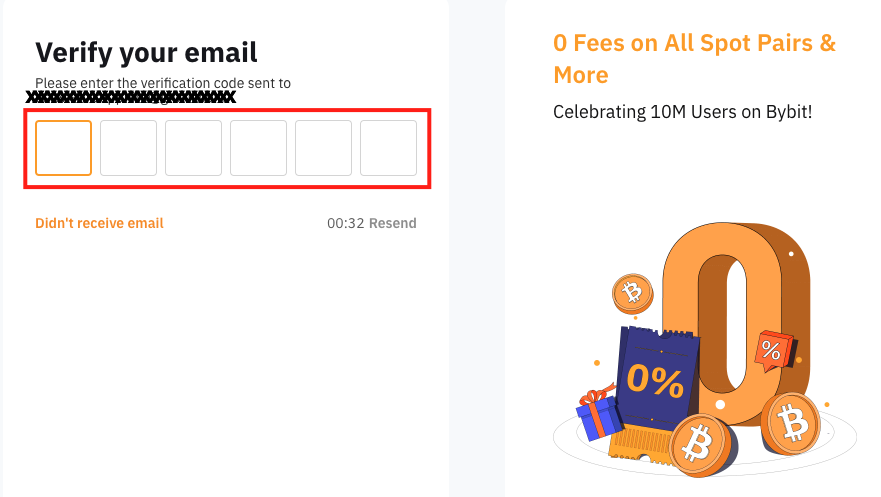

Step 2: Get your account verified

Enter the verification code sent to your e-mail inbox.

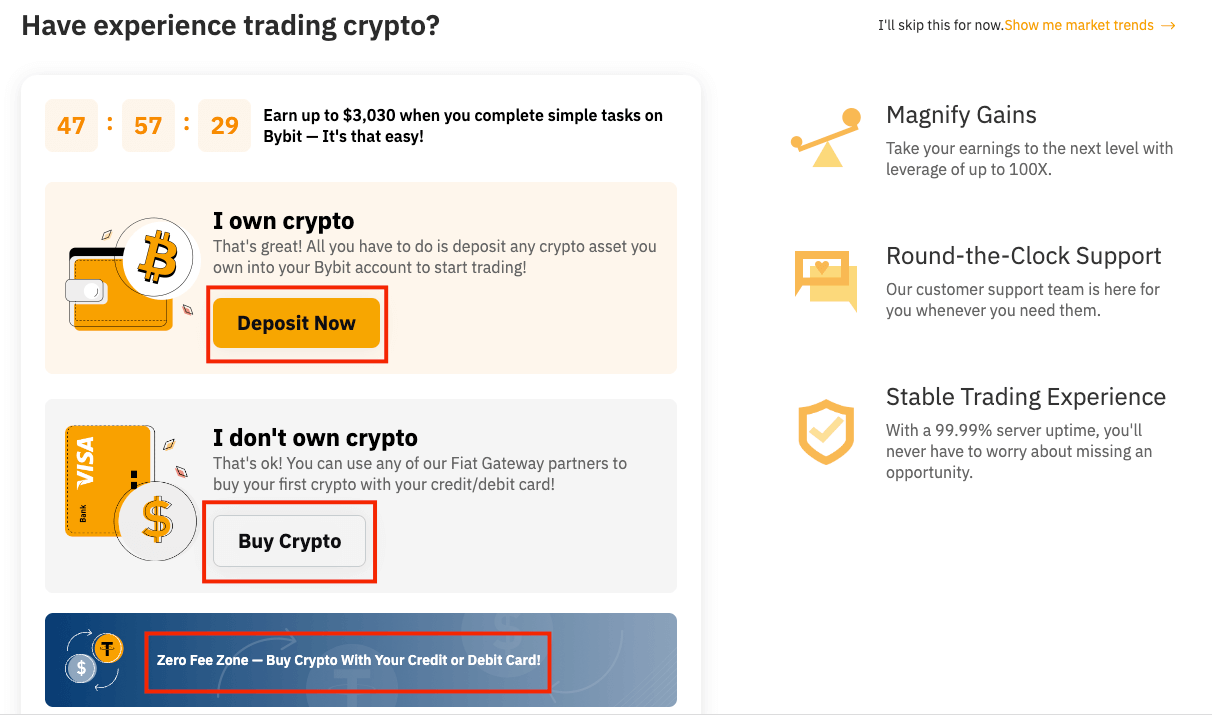

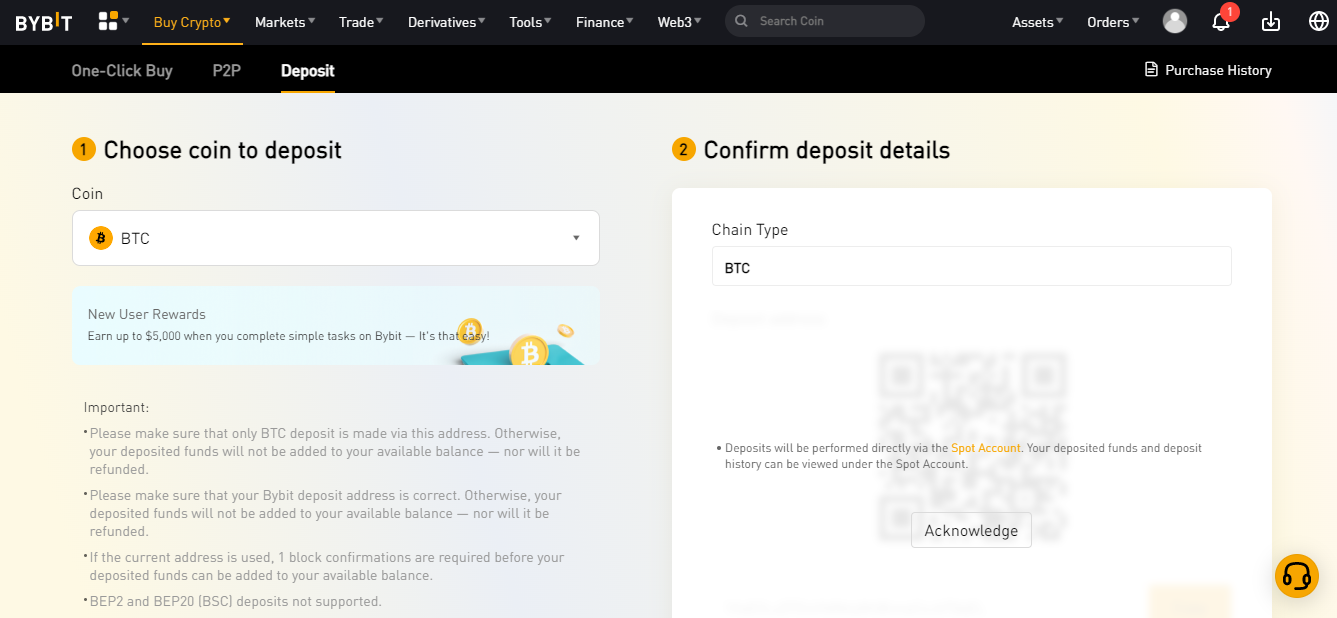

Step 3: Deposit or Buy Crypto

Once registered to Bybil, you’ll be redirected to the [Deposit/Buy Crypto] page. On mobile, you’ll be redirected to the home page. There, you can select from the list of cryptocurrencies supported by Bybit.

If you don’t have crypto, click on the option to [Buy your first crypto].

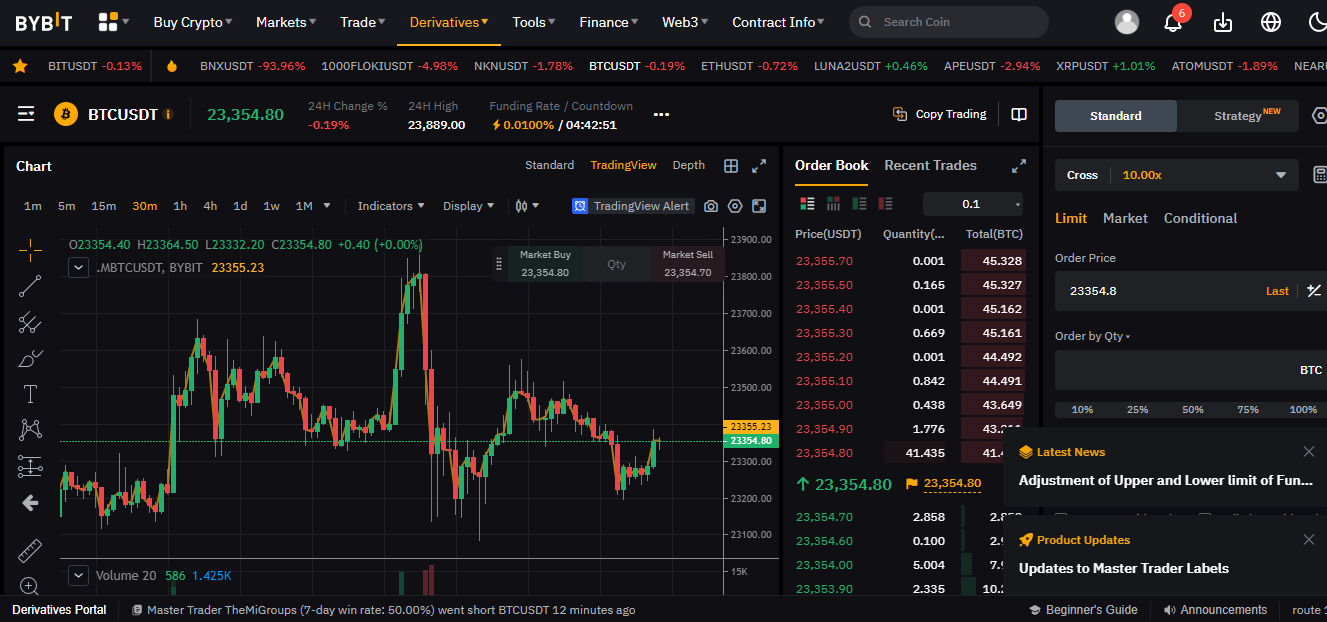

Step 4: Start trading futures

Once the account is funded, click the [Derivatives] tab and start trading futures! Here, you can choose between different currency trading pairs.

Once selected, you can finalize the trade by pressing the [Buy] button!

Voila!

Choosing a crypto futures trading broker

When choosing a crypto futures broker, investors should select platforms that give them access to the best tools to give them an edge over other traders. The following factors help investors select the best futures trading broker.

Regarding futures trading, speed, timing, and access to market data are key factors that affect the success of trades.

24-Hour trade support

A crypto Futures market is almost always open, so having a platform that gives you live support, especially during market hours, is significant.

Adequate trading platform

Before choosing a trading broker, investors should ensure that the broker offers a futures trading platform that caters to their needs. For example, some traders like to read multiple charts while making trades; others are good to go with just one chart. Charts help investors to conduct technical analysis so they don’t lose money quickly. Choosing the right broker will make the crypto futures trading experience smoother. It will also allow investors to make the best possible trade.

Margins

Choosing a trade broker with attractive margins can help increase a trader’s profits. They also help traders manage their capital more effectively. For example, some (crypto) futures brokers offer $500 margins on liquid mini contracts and $50 on liquid micro contracts. While margins offered by crypto futures brokers are generally attractive, unregulated crypto exchanges offer the highest margins available for crypto futures.

Affordable commissions and fees

The commissions and fees the broker offers affect the overall size of an investor’s profit. Brokers who offer more services and have better infrastructure generally charge more than regular brokers. However, it is essential to know that some brokers especially cater to professional traders. Naturally, low-commission brokers offer lower support for an investor’s trading account.

Mobile compatibility

Having a trading platform that grants instant access to the crypto futures market is necessary, so choosing brokers with a mobile-compatible platform is essential. Such platforms enable investors to trade futures contracts by giving them access to the markets and their orders from anywhere in the world and at any time.

Some of the most common futures trading platforms that help beginners and advanced traders buy or sell futures include Bybit, Bitmex, OKX, Binance, CME group, Phemex, and Charles Schwab.

More details

Bybit is a leading futures trading platform globally, offering up to 100x leverage and attracting users who prefer to remain anonymous. With a presence in 180+ countries, it is renowned for its efficiency and unique features in cryptocurrency derivatives trading.

-

The platform offers up to 100x leverage trading.

-

Strong educational resources.

-

Diverse markets for traders, spot, perp, and futures.

-

Risk-free demo accounts to explore all key features.

-

TradingView integration.

-

The platform is difficult for beginners to navigate.

-

It does not offer a quality spot trading feature.

-

The NFT marketplace is limited in terms of options.

-

Security is of the gold industry standard.

More details

OKX crypto exchange supports over 300 digital assets and over 80 fiat currencies. It is accessible in over 100 countries and territories across the world. It has one of the highest trading volumes in the crypto world and is a fantastic mobile app that offers all services on the go. The trading fees are very low. Its major drawback is its unavailability in certain countries.

-

Supports numerous tokens.

-

Great Mobile app.

-

Extensive educational resources.

-

Provision of multi-lingual services.

-

Geographical limitation.

-

KYC limitations.

Benefits of trading futures in crypto

Investing in crypto futures has several advantages, making it an attractive financial instrument to many traders. Below are some of the most common benefits:

Exposure to the market without holding tokens

Crypto trading is generally risky, especially in an unregulated crypto market. The risks associated with coin trading dissuade many investors, including institutional investors.

Crypto futures allow these investors to participate in the market without any direct exposure – meaning investors don’t have to worry about holding tokens in a wallet.

Furthermore, crypto futures exist in a regulated market and are handled by large investment firms compliant with SEC regulations.

Crypto futures are treated as securities, unlike regular cryptocurrencies, which makes them safer to invest in, especially as investors can expect more protection for their assets.

Leverage trading

Leverage means using borrowed money to increase a trading position beyond what is available from an individual’s account balance.

For instance, a $100 trade with a 1:10 leverage would total $1000. If the price moves 1%, you’ll be in a $10 profit vs. a spot trade where you would get $ 1 on a similar price movement. The accounts are re-balanced once the trade is over, and the trader’s profits are reflected in their accounts.

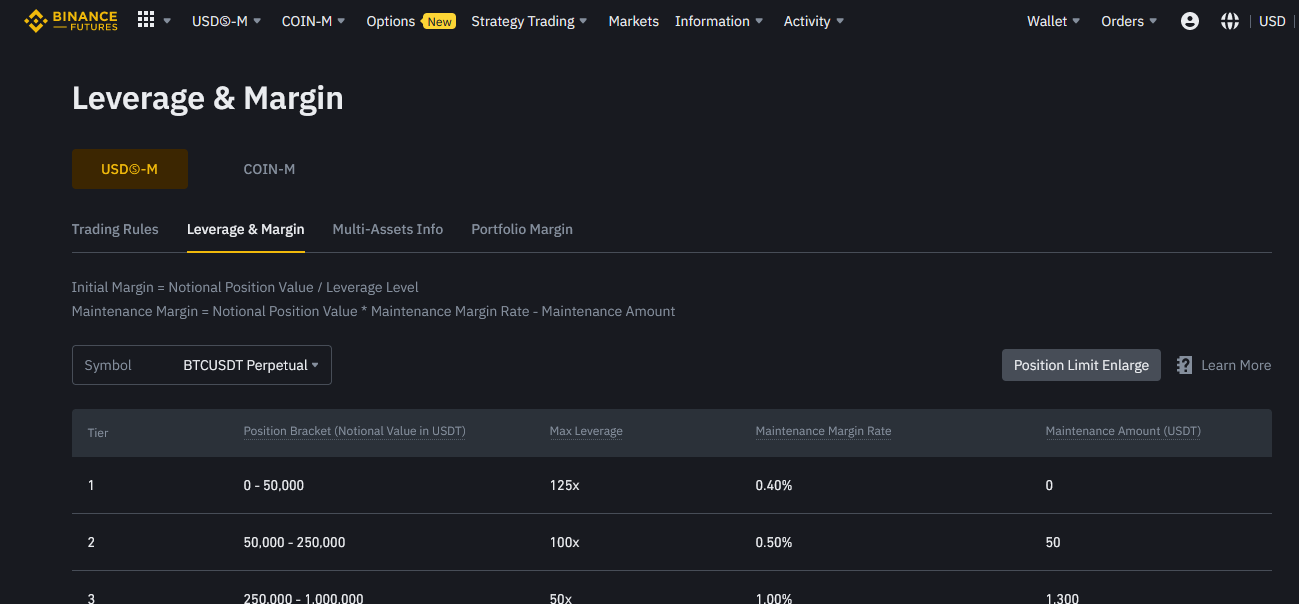

Crypto futures are renowned for their unusually high leverage, attracting many investors because traders can control significant positions with little capital. Some crypto futures on exchanges like Bybit and Binance often give leverages as high as 100x.

Investment flexibility

The crypto market remains inaccessible primarily to institutional money managers because of a lack of regulation and market volatility. Investment managers are generally not allowed to invest in unregulated exchanges.

Investment managers get more flexibility with a crypto futures contract because it can be obtained on regulated exchanges.

Disadvantages of Crypto Futures

Of course, like index futures, crypto trading futures are not without significant risks. Some of these include:

Compound losses

Leverage is advantageous because it allows investors to make significantly more profits than the original investment. But, simultaneously, they could damage an investor’s portfolio if the trade goes the other way.

For instance, if trader A uses high leverage on a trade expecting the price to go up and the price does the opposite, they could lose their entire funds. The danger of leverage going badly is why margin calls are so frequent when holding long-term positions.

A margin call refers to a request by a broker for additional cash so they can keep an investor’s position open because the initial margin deposit is insufficient.

Forced liquidations

Liquidation refers to a scenario where an exchange closes an open trade position because the market volatility has moved against that position, and it risks going bankrupt.

Liquidations are more common in crypto trade futures. Since there are no central clearing parties, margins must be maintained, or the exchange closes them down. If liquidation is done for a gain, the exchange’s insurance fund will be paid the profit to help protect against counter-party risks.

Liquidations are particularly damaging when large positions are repeatedly being closed down, thus creating a ripple effect on increasing further reduction in price levels.

Risks associated with using unregulated exchanges

Many futures trading exchanges have significant price differences compared to regulated ones. Using such exchanges might present security problems for futures traders.

Summary

Trading crypto futures is a great way to gain exposure to the crypto market without bearing too much risk. Crypto futures are traded like regular securities, making them safer investment options for crypto investors. However, crypto futures trading still carries significant risks thanks to the volatile nature of the crypto market.

Investors use various strategies when trading futures, including the Pullback strategy, going long or short, range trading, breakout futures, and spread trading strategies. Using these strategies requires understanding and market experience. However, they are pretty effective in futures trading. Any investor strategy should align with their trading philosophy and risk appetite.

Creating a Futures Trading Strategy

1. Long: Purchase futures to profit from rising prices.

2. Short: Sell futures contracts to profit from falling prices.

3. Spread: Buy various futures contracts concurrently and profit when the relative price difference expands (or contracts).

Leverage the preferred tax rates on futures trades, adhering to the 60/40 rule. This rule implies that 60% of net gains on futures trading are considered long-term capital gains, while the remaining 40% are treated as short-term capital gains and taxed as ordinary income.

A savvy investor can potentially earn significant returns in futures trading, as they essentially trade with 10x the exposure compared to regular stocks.