TLDR

This comprehensive DeFi liquidity pool guide will explore various platforms, advantages, disadvantages, and crucial aspects.

A liquidity pool is a communal pool of cryptocurrencies or tokens in a smart contract. Its purpose is to enable seamless trading between assets on a decentralized exchange (DEX).

Unlike traditional financial markets, with buyers and sellers, numerous decentralized finance (DeFi) platforms employ automated market makers (AMMs). These mechanisms permit the automatic and unrestricted trading of digital assets by utilizing liquidity pools.

What is a liquidity pool?

Liquidity pools play a vital role in the thriving DeFi ecosystem. They serve as a fundamental technology. They enable various functionalities, including automated market makers, borrowing and lending protocols, yield farming, synthetic assets, on-chain insurance, crypto market liquidity, and crypto gaming.

At its core, the concept of a liquidity pool is straightforward. It involves pooling funds together in a digital repository. However, the true potential lies in the permissionless nature of these pools. In a permissionless environment, anyone can contribute to the pool.

The continuous iterations and advancements in using liquidity pools have led to innovation within the DeFi space. Interestingly, this innovation has revolutionized the way we engage with decentralized finance.

These asset pools have revolutionized how we engage with decentralized finance. They provide a versatile and adaptable foundation for a wide range of applications. The ongoing evolution of DeFi showcases the dynamic nature of this technology. It also highlights its potential for shaping the future of finance.

How do liquidity pools work?

Crypto liquidity pools are designed to incentivize providers to stake their assets in the pool. Typically, providers earn trading fees and crypto rewards from the exchanges where they pool their tokens.

Users who add enough assets to a pool receive liquidity provider (LP) tokens as a reward. LP tokens have value and can be used within the DeFi ecosystem for various purposes.

Liquidity providers receive LP tokens in proportion to the amount of liquidity they contribute to the pool. When a trade occurs in the pool, a fraction of the fee is distributed among the holders of LP tokens based on their proportionate share. Liquid providers must destroy LP tokens to retrieve their contributed liquidity and accrued fees.

They maintain fair token market value using Automated Market Maker (AMM) algorithms. These algorithms ensure that the prices of tokens in the pool remain relative. Different protocols may use slightly different algorithms.

For example, Uniswap pools employ a constant product formula to maintain price ratios for crypto tokens, while many DEX platforms use similar models. This algorithmic approach helps maintain crypto market liquidity by managing the cost and percentage of tokens as demand fluctuates.

Why are liquidity pools important in DeFi?

Let’s explore the application of liquidity pools and their importance in the DeFi space.

Enable users to trade on DEXs

Liquidity pools are crucial in facilitating decentralized exchange trading (DEXs). They are needed for the difference in slippage.

Users can deposit their digital assets into a liquidity pool, a collective pool of tokens held in a smart contract.

They receive pool tokens in return, representing equal value to their pool share. These pool tokens can then be traded on the DEX, enabling users to participate in decentralized trading.

Eliminate middlemen and centralized entities.

Liquidity pools leverage Automated Market Makers (AMMs) to establish prices and match buyers and use by eliminating the need for go-betweens.

This decentralized approach enhances privacy and efficiency in commerce activities, empowering users with more control over their assets.

Liquidity providers get incentives.

Liquidity pools offer attractive incentives for liquidity providers (LPs). LPs are users who contribute their digital assets to the pool, increasing the available amount for trading.

When LPs lock their tokens into the smart contract, they become eligible to earn rewards. These rewards come from a portion of tokens locked and the trading fees generated from transactions within the pool.

This incentivizes users to supply more liquidity to the pool, as they can earn passive income from idle digital assets. The presence of LPs helps facilitate smooth trading activity on the DEX, benefiting all participants involved.

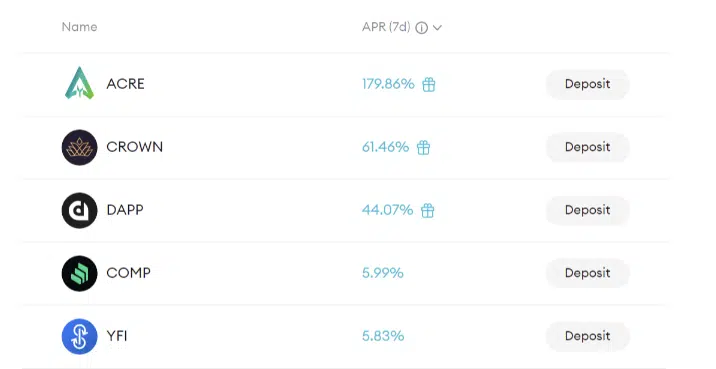

Top liquidity pools in the crypto space

Here are some of the top liquidity pool providers in the crypto space. Each has its advantages and disadvantages. Let’s explore this in detail.

Uniswap

Uniswap stands out as one of the top liquidity pools due to its significantly high trading volume alone. Notably, it facilitates decentralized exchange between Ethereum and ERC-20 tokens in a 1:1 ratio.

An advantage of Uniswap is its open-source nature, allowing individuals to launch new pools for any token without fees. Transitioning to its fee structure, Uniswap charges a competitive exchange fee of 0.3%.

The fascinating part is that liquidity providers earn a share of these fees based on their stake in the pool. Users deposit their crypto assets and receive Uniswap tokens in return for participating.

Pros

- All ERC20 tokens are supported.

- Earn passive rewards.

- Low fees for most transactions (~0.3%).

Cons

- There is no insurance coverage for lost crypto incidents.

- No mobile trading application is available.

More details

Uniswap is a user-friendly cryptocurrency exchange with competitive fees for all trading levels. It enables direct crypto trading from digital wallets, supports options and futures contracts for BTC and ETH, and offers advanced trading features for experienced traders and institutional clients.

-

Full transparency and open-source code.

-

No KYC process.

-

All ERC20 tokens are supported.

-

Earn passive rewards by providing liquidity.

-

Low fees for most transactions (~0.3%).

-

No option for fiat-to-crypto transactions.

-

Challenging for inexperienced crypto traders.

-

No insurance coverage for lost crypto incidents.

-

No mobile trading application available.

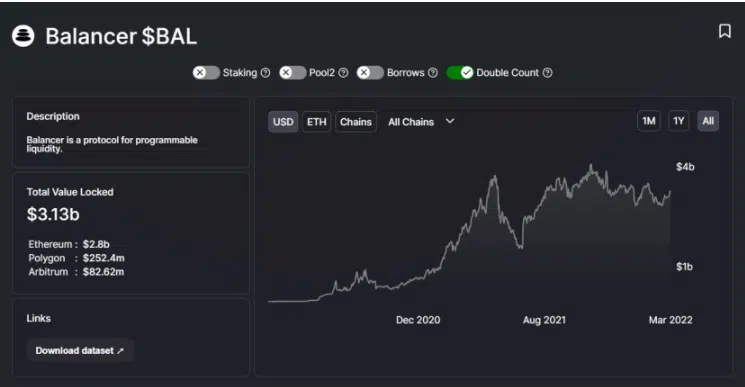

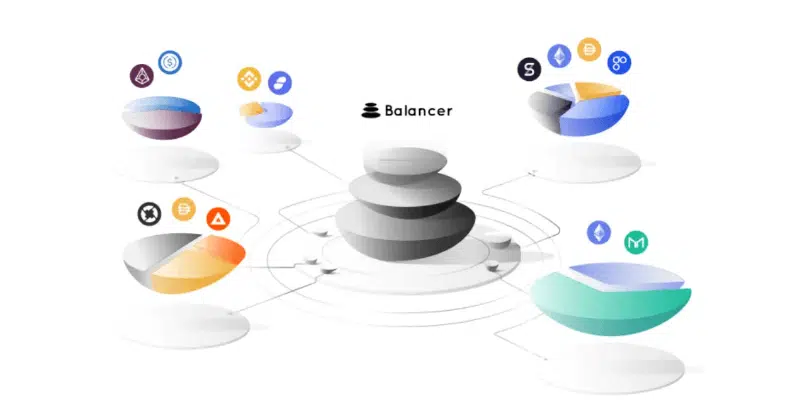

Balancer

Balancer is another notable addition to the top crypto liquidity pools. This Ethereum-based pool acts as a non-custodial portfolio manager and price sensor.

Users benefit from the ability to customize pools and earn trading fees by adding or removing digital assets. Balancer’s modular pooling protocol is a key strength, supporting various private, smart, and shared pool options.

Owners of liquidity pools in Balancer have complete control over providing and adjusting parameters in private pools, while shared pools have fixed settings and parameters. Finally, Balancer introduced liquidity mining, rewarding providers with BAL governance tokens.

Pros

- Reduced gas fees.

- Enhance capital efficiency.

- Enabled arbitrage with zero-tokens starting capital.

- Accessibility to custom AMMs.

Cons

- Limited only to ERC-20 Tokens.

- No mobile application is available.

- Not beginner-friendly.

- Unregulated DEX.

Curve Finance

Curve Finance is a top contender for the best liquidity mining pools. Operating on Ethereum, Curve is a decentralized pool focusing on stablecoin trading. Its notable advantage lies in minimizing slippage thanks to using non-volatile stablecoins.

Although Curve Finance currently doesn’t have a native token, the possibility of a CRV token cannot be ruled out. The platform offers seven diverse pools, each with its own ERC-20 pair. This lets users quickly swap between crypto assets and stablecoins, including Compound, sBTC, PAX, BUSD, and more.

Pros

- Versatile swaps.

- Low fees.

- Non-custodial.

Cons

- Requires a good handle on wallets and moving crypto around.

- More effort to understand the platform.

Bancor

Bancor distinguishes itself by utilizing algorithmic market-making methods and smart tokens. It ensures efficient liquidity provision and accurate pricing. One of its notable features is maintaining a constant ratio among connected tokens while adjusting token supply when necessary.

Bancor Relay, the pool associated with Bancor, offers the Bancor stablecoin. Moreover, Bancor facilitates data transfers between different blockchain networks using BNT. This feature makes it preferred for simplifying cross-chain operations between ETH and EOS.

Pros

- It does not have bids, asks, market makers, or takers.

- ERC-20 tokens supported.

Cons

- No margin trading.

- Not for beginners.

What factors to consider when choosing a liquidity pool?

Several factors should be taken into consideration to make an informed decision when selecting pools:

- Daily trading volume: Assess the daily trading volume in a pool. Higher trading volume indicates more active participation, potentially resulting in better liquidity and lower slippage when executing trades.

- Token price divergence: Consider the price divergence of tokens. Lower price divergence suggests a more stable and efficient pool, reducing the risk of impermanent loss for providers.

- Existing liquidity: Examine the amount of liquidity already present in the pool. Higher liquidity implies a deeper market, making buying or selling tokens easier without significant price impact.

- Harvest health ratio: Evaluate the harvest health ratio, which reflects the sustainability and profitability of yield farming opportunities in the liquidity pool. A healthy harvest ratio indicates that users can earn consistent rewards without excessive risk or overexposure.

Advantages of liquidity pools

Here are some of the advantages of using these DeFi products.

Automatic exchange

One of the critical advantages of liquidity pools is that users do not have to worry about finding a trading partner who shares their interest in cryptocurrency. All exchanges within the liquidity pool occur automatically through smart contracts.

Eliminates unfavorable trading conditions

In traditional cryptocurrency trading, you frequently encounter individuals who command high selling prices or offer minimal buying amounts. This situation can lead to less-than-ideal trading conditions.

Conversely, liquidity pools in DeFi provide a solution to this challenge. Acting as autonomous market makers, they adjust the value of deposited funds in line with the current market exchange rate, thus ensuring a more balanced and fair trading environment.

Circular asset acquisition

Users on crypto exchanges do not acquire assets through direct trading. Instead, they obtain assets from an existing liquidity pool already funded. These assets are generated based on exchange rates, creating a circular process.

Reduced market impact

Liquidity pools significantly reduce market impact. Gone are sellers demanding exorbitant prices or buyers seeking substantial discounts.

Transactions within liquidity pools are smoother due to the constant updating of asset values by exchange rates. Lastly, this stability ensures fairer and more efficient trading conditions.

Drawbacks of liquidity pools

Let’s discuss the drawbacks of liquidity pools.

Scam Liquidity Pools

Failure to consider the risks associated with smart contracts can lead to significant losses. When you put assets in a liquidity pool, the smart contract becomes the custodian of your funds. It effectively eliminates the need for intermediaries.

However, systemic errors or vulnerabilities in the smart contract can result in permanent loss of funds, such as through a flash loan exploit.

Risky price change

Participating in an automated market maker (AMM) liquidity pool exposes you to the risk of temporary loss.

Unlike holding onto assets, this type of loss can result in actual monetary loss and vary in magnitude. Conduct thorough research before investing in double-sided liquidity pools to understand and mitigate this risk.

Access risk

Please exercise caution when dealing with projects that allow developers to modify pool rules at their discretion.

Developers may have privileged access to the smart contract code, such as an executive code. It could enable them to manipulate or exploit the pool, potentially resulting in the misappropriation of funds.

What are the risks involved in liquidity pools?

Liquidity pools, like any investment, carry risks, particularly in DeFi. However, the increasing popularity and capital deployment in liquidity pools has led to more safeguards through well-coded smart contracts. Still, it’s essential to be aware of the risks involved:

Bugged smart contracts

There is a risk of hackers exploiting vulnerabilities in the smart contract governing the pool, potentially draining the assets. Investing in audited liquidity pools reduces the likelihood of engaging with a vulnerable smart contract.

High slippage due to low liquidity

Low liquidity can result in high slippage, causing significant price differences between intended and executed trades. Setting slippage limits on trading pairs can mitigate this risk but may affect transaction speed.

Impermanent loss

Impermanent loss is where the value of the pool’s tokens fluctuates with the underlying asset’s price. This loss can occur if the asset price decreases and never recovers or when users buy from the pool at a lower price and sell elsewhere, resulting in a permanent loss.

Final verdict

The rise of crypto liquidity pools boosts overall growth in the crypto markets and DeFi. Liquidity pools enable decentralized trading and eliminate the wait for transaction-matching orders. Smart contracts enable customizable and efficient crypto liquidity pool programming.

Liquidity pools attract more users, addressing trust issues in crypto trading. Understanding the functionalities of different crypto liquidity pools before deciding is crucial.

A liquidity pool in DeFi is a collection of funds locked in a smart contract that automatically facilitates trades between different assets on a decentralized exchange (DEX).

Liquidity pools play an essential role in crypto, ensuring the necessary liquidity for decentralized exchanges. They allow users to trade digital assets seamlessly and without the need for traditional exchanges or intermediaries.

The risks involved in liquidity pools include vulnerabilities in smart contracts that hackers can exploit. Plus, the high slippage due to low liquidity and impermanent loss for liquidity providers when the value of the underlying assets fluctuates.