TDLR

Bitcoin is an encrypted digital asset comprising decentralized transactions created in 2009 by the mysterious Satoshi Nakamoto. Its secure and peer-to-peer system allows users to make safe financial exchanges without relying on centralized entities such as banks or governments. The Bitcoin public ledger actively stores and verifies every digital exchange, guaranteeing the security of each transaction against tampering.

The blockchain network, consisting of a distributed ledger storing data across computers, provides blockchain security for Bitcoin.

Its main benefits include the ability to transfer money online securely, near-instant transaction speeds, anonymity when making payments, and lower fees than traditional payment networks.

To buy and hold Bitcoin from a well-reputed platform, users must register an account and fund it via bank account transfer or cryptocurrency deposit.

Introduction

Bitcoin is a digital currency, enabling users worldwide to access it securely without dependence on central banking systems. The system tracks all transactions and creates new units by solving complex mathematical equations, removing the need for outside intermediaries. This concept is a part of Bitcoin basics for beginners.

Millions of computers connected to the Bitcoin network manage the cryptocurrency through code. This makes the currency more robust and resilient than fiat currencies, vulnerable to manipulation from central interests.

The establishment of Bitcoin aimed to revolutionize global payments by offering a cost-effective, secure alternative to traditional currency. By functioning without government regulation or supervision, Bitcoin allows individuals to send money as conveniently as they were sending an e-mail to acquaintances or relatives.

Bitcoin, designed to transform global payments, has successfully done so. Yet, time and time again, this cryptocurrency continues to surprise us with its versatility by transforming the way we view digital money transactions online. Bitcoin’s creator also has changed our conventional concept of payment systems, as boundaries between countries are no longer an obstacle.

Problems, Solutions, and Use

Problems with the current financial market

The current financial market is encountering a variety of obstacles. With the accelerated integration of technology, classic companies could become outmoded by 2030. Fintech startups are springing up and providing solutions focusing on one specific aspect or action while striving to do it flawlessly.

Rigorous legal regulations often hinder the financial sector from creating unique products and developing effective marketing or branding strategies.

Solutions to the problems

Cryptocurrency is a viable solution to the various issues confronting modern financial markets. Bitcoin works oppositely to traditional money. Bitcoin transactions happen nearly instantly, enabling swift payment processing and removing the necessity for long waiting periods for clearance.

Its use of blockchain technology ensures transparency and reliability in the exchange of funds. Cryptocurrency allows anyone with access to the internet and the requisite knowledge to invest and trade without fear of censorship or manipulation from external institutions.

Use cases for Bitcoin

1. Digital Payments

Bitcoin has changed fiat transfers by introducing a decentralized payment system, erasing traditional financial institutions’ need for involvement. This drastically enhances user experience by fewer transaction fees and making cryptocurrency transactions faster and more secure. Unlike other digital payment methods, the Bitcoin network is far superior regarding reliability and security, two crucial elements regarding online money transfers.

Bitcoin’s decentralized nature prevents potential fraud and double spending, which is particularly beneficial in online shopping scenarios where ensuring only one purchase is critical. It offers a secure and efficient solution that gives users the trust they need when making digital payments online.

2. Trading goods and services

The widely acknowledged safety and transaction speed of the Bitcoin network actively facilitates the seamless exchange of goods and services. As a result, several businesses have begun to recognize this currency as a legitimate mode of payment, with some e-commerce platforms even accepting it exclusively. In addition, the currency is also employed to remunerate services like website hosting and domain registration.

3. Banking the unbanked

The rise of Bitcoin has changed the banking system, providing more people with easier access to financial services. Current reports show that modern banking capabilities elude more than 1.4 billion “unbanked” adults worldwide, as they cannot open checking or savings accounts.

Bitcoin has become a new way of banking for these unbanked individuals by offering financial access regardless of location or circumstance.

4. Store of value

Bitcoin is becoming an increasingly popular store of value. Advanced blockchain technology makes Bitcoin transactions incredibly secure, making it a much safer way to store wealth than traditional investments.

Bitcoin transactions are also completely private, allowing users to transfer funds without the need for a financial institution or government interference. This increases the security of one’s holdings and provides convenience and peace of mind, knowing that no one but themselves is monitoring one’s savings.

5. Hedge against inflation

Bitcoin has become a good option for savers looking to hedge their finances against inflation. In contrast to traditional investments like stocks and bonds, Bitcoin’s decentralized structure ensures its value doesn’t depend on the economic strength of any single country. This makes it a handsome prospect in regions where inflation and currency devaluation are common occurrences.

6. Anti Corruption

Bitcoin has become an excellent option to consider for those looking to fight against corruption. Its decentralized structure and cryptographic technology make it impossible for any third party to add or tamper with records, meaning that every transaction is secure and verifiable. This helps to eliminate possible intermediaries, who often play a role in corrupt activities.

How does Bitcoin work

How Bitcoin is structured

The Bitcoin network provides a secure, decentralized platform for financial transactions without the need for oversight from any single governing entity. Built on dependable technology and dedicated to providing users with transparent information about every transaction.

This cryptocurrency has specific security that guarantees reliable cryptocurrency exchange and validates transactions. People can send Bitcoin to each other using mobile apps or their computers. It’s almost similar to sending cash digitally.

Bitcoin blockchain’s structure actively links recent transactions into blocks and appends them to an existing chain, spreading it across the entire network.

From its inception, each block in the Bitcoin chain has carried specific data, such as transaction details and a timestamp marking when it joined the blockchain, starting with the 2009 Genesis Block. By doing this, users can trust their digital records are secure and verifiable by anyone.

How Bitcoin is organized

Bitcoin is created, distributed, traded, and stored using the blockchain, which has a decentralized ledger system. It differs from established forms of money because it works without needing a third party or central authority. Transactions occur on the Bitcoin blockchain, maintained by computers distributed worldwide.

Miners ensure the security and integrity of the Bitcoin ledger by collecting and verifying transaction data, and they receive newly issued Bitcoin as a reward for their efforts. Despite this system’s complexity, new transactions occur quickly and securely as miners use their computing power to mine new bitcoins and confirm them every few minutes.

As an asset, Bitcoin allows investors and users of new technology to access financial markets in ways unavailable before its invention.

How to Mine Bitcoin

By 2140, experts estimate that all Bitcoin will be in circulation, resulting in no new coins released through mining. Miners might need to depend on transaction fees instead. Meanwhile, there are various methods for mining Bitcoin, some of which include:

Using a computer with a powerful graphics card

With the proper tools, mining Bitcoin can be a profitable venture. By harnessing a powerful computer with an advanced graphics card, you guarantee the accuracy that records Bitcoin transactions and gains considerable profits in newly created Bitcoin.

When you solve a complex mathematical problem related to validating transactions on the Bitcoin blockchain, you receive a reward in BTC based on the prevailing market rate.

Using an ASIC miner

With the intent to boost their opportunities for success in Bitcoin mining, more and more miners are now capitalizing on advanced ASICs. Application-specific integrated circuit machines differ from standard computers with GPUs because they are specifically designed for Bitcoin mining.

While they may be more expensive than most computers, they are reliable and deliver superior results. This improved efficiency can result in a far greater return on investment when using them for Bitcoin mining.

Joining a mining pool

By joining a Bitcoin mining pool, you can combine your resources and increase your chances of earning a new BTC with the other group members. Required initial investments are lower since, typically, each miner only contributes their computing power towards achieving a target hash rate.

You can mine using specialized equipment or even regular computers. When participating in a mining pool, miners share rewards based on their individual contributions to the mining and computing power, enabling everyone to benefit equally from the process.

Cloud mining

You can do cloud mining if you don’t want the hassle of maintaining and managing mining equipment. With cloud mining, you rent computing power from a cloud mining service and let them handle hosting and managing the kit for you.

Plus, you can start working immediately without any lengthy setup time – perfect for those impatient to earn Bitcoin.

In addition to being convenient and easy to manage, this type of mining is also cost-effective, as some services charge reasonable fees so that you can mine without having to make significant investments.

Trusted Partners

Bitcoin’s Basic features

Following are some of the basic features of Bitcoin:

Fixed supply

As Bitcoin has a predetermined and finite supply of 21 million coins, it stands out from other assets for its “hard asset” quality. Thus, more investors are investing in this valuable cryptocurrency as part of market capitalization and their global economic strategies.

This complex asset character is one attribute that adds value to Bitcoin’s investment potential, hence making it an attractive choice for those seeking various opportunities worldwide.

Disinflationary

Bitcoin’s disinflationary feature effectively addresses deflationary issues related to traditional currencies. As predetermined supply thresholds are reached, Bitcoin’s reward for miners is reduced by half.

When Bitcoin was first introduced, the block reward was 50 bitcoins per block. After every four years, this amount has been halved. The most recent halving reduced the reward to 6.25 bitcoins for each block mined.

For a transaction block to be added to the Bitcoin blockchain, it must be verified by most Bitcoin holders. The unique codes and cryptographic keys that recognize users’ wallets and transactions must conform to the correct encryption pattern.

Incentive driven

The economic foundation of the Bitcoin network is centered on motivating its key players – the miners. They receive resources to safeguard and preserve the Bitcoin network for a monetary incentive they acquire by engaging in Proof-of-Work (PoW). This process involves competition among them to attach new blocks to the Bitcoin blockchain.

This ingenious system incentivizes miners. It allows them to be awarded for ensuring the safety of the blockchain network and keeping it functioning correctly. This captivating economic feature safeguards against those looking to exploit the system. Their attempts are futile since they cannot profit from this endeavor.

Peer-to-peer

Bitcoin is extraordinary in its capacity to function unencumbered by a third party’s required proof of work. This is possible thanks to Bitcoin’s decentralized system, which permits nodes within the network to authenticate each transaction.

These nodes then broadcast and propagate this information, meaning an intermediary isn’t necessary for commerce.

This feature is essential in contexts such as financial transactions in which trust and reliability of peer transactions are paramount. In essence, by cutting out the necessity for a third party, blockchain technology maximizes trust and security for peer transactions between all users within a network.

Pseudo-anonymous

Bitcoin transactions are distinct from other types of digital payments as they provide a way for users to keep private keys and perform pseudo-anonymous transfers.

In contrast to delivering identity details, the user’s wallet is only related to alphanumeric Bitcoin addresses that are randomly created. This approach makes Bitcoin transactions private and secure for both parties involved.

It is difficult to trace any particular Bitcoin transaction back to a person. Also, it allows users to remain anonymous while using Bitcoin. Pseudo-anonymous transactions ensure privacy between two parties, increasing the attraction of using cryptocurrencies like Bitcoin over traditional banking methods.

Advantages of Bitcoin

Following are some of the advantages of Bitcoin:

1. Reduced possibility of identity theft

With Bitcoin, identity theft risk is significantly reduced as it operates on a decentralized digital currency system. Individuals do not have to provide personal information when making purchases or other transactions with Bitcoin, which further safeguards your security.

Because no financial or banking information is saved throughout these transactions, it’s more difficult for personal details and data to be compromised. Bitcoin provides users with an extra layer of protection by allowing them to make payments online without exposing their identities, thus raising confidence in digital payments while ensuring people feel safe about the security of their information.

2. Direct transfer

Bitcoin transactions no longer require third-party involvement, meaning people can transfer funds quickly and directly. This process not only speeds up transactions but also eliminates the worries associated with giving out private communication or financial data to a third party, which can reduce the chances of identity theft and other similar issues.

Bitcoin users can bypass the intermediary and transfer large sums of money inexpensively, all while enjoying secure transmission.

3. Greater liquidity

Greater liquidity is one of the most significant benefits of Bitcoin, making it perfect for individuals and businesses looking to move funds quickly, affordably, and securely. Not only does it provide users with fast and cost-effective transactions, but it also offers more flexibility regarding the usage and stability of one’s balance.

4. International transactions

One of Bitcoin’s major advantages is its liquidity, which is the ease of quickly exchanging or converting it into cash or other assets. This liquidity helps maintain low transaction costs, with some fees being completely waived or only a fraction of traditional financial institution fees.

Further, transferring allows for seamless and almost instant global liquidity that wasn’t feasible before the advent of cryptocurrencies. With liquidity being such an essential factor when using any form of payment system, more and more people are embracing BTC as a form of currency due to its high liquidity.

5. Security

Bitcoin stands out for its security, leveraging robust encryption technology to safeguard funds stored or transferred through the system.

Every transaction is recorded in a decentralized Bitcoin ledger that can be seen publicly, with all modifications visible. This blockchain ledger allows users to monitor information about their Bitcoin and guarantee its security. The miners’ computers must also authenticate each transaction before it’s included on the blockchain for extra protection.

6. Anonymity and transparency

Bitcoin is an excellent digital currency due to its anonymous and transparent benefits. Users can effortlessly send payments to any person in the world securely without fretting about identity fraud or depreciation of value. With a Bitcoin wallet, users can quickly make transactions with no worries.

Transactions are recorded on a public ledger, meaning every user can audit them. This ensures extra security for users and transparency throughout the payment system itself. In addition, its anonymity means it offers users complete financial privacy; no one will know about your transactions but you.

7. High return potential

For the investor looking to take a risk, Bitcoin presents an incredibly lucrative reward potential. The past few years of volatility have given its investors highs and lows, allowing them to make tremendous profits should they time their investment right.

When investing in Bitcoin, investors seek quick and high returns that few other markets can offer. With unpredictability and high potential returns, Bitcoin is becoming a more popular investment strategy among the technologically savvy crowd.

8. Push system

Another benefit of Bitcoin is its push system, providing security that other payment options don’t offer. Unlike other payment systems, which allow chargebacks in certain situations, with Bitcoin, once it’s sent and received, the transaction cannot be reversed or altered by either party involved in the Bitcoin transaction.

This makes Bitcoin akin to cash in that it works much like cash in the sense that once you give someone money, you can’t get it back – similarly, if you send someone Bitcoin, they now have access to that amount of value, and there is no way to recall or claw back the funds.

Disadvantages of Bitcoin

Scams and frauds

With the intricate nature of cryptocurrency, many people lack comprehension of what bitcoin is and how to leverage it appropriately and are vulnerable to scams such as BTC savings accounts or false investments.

The risk of exploitation is even greater with numerous deceptive websites and mobile apps that appear authentic.

Black market activity

Bitcoin’s anonymity can also be used for nefarious reasons. Unfortunately, taking advantage of cryptocurrency in several illegal activities such as cyber hacking, drug dealing, and even black market arms sales is possible.

BTC transactions are recorded in public ledgers, but the individual or group behind them remains unknown due to their anonymity. Users can use a single Bitcoin wallet multiple times and don’t have to utilize government-issued IDs, which is why it has become a preferred payment method on the dark web.

Volatility

Bitcoin’s price and value are highly unpredictable due to the crypto markets’ volatile nature and several headline-making news perceived as wrong by investors, questions over its future value and potential uses, and security breaches.

Although not guaranteed to succeed long-term, understanding Bitcoin’s volatility can help potential investors make educated decisions when investing their money.

Cyberhacking

Cyber hacking is a major concern in the Bitcoin ecosystem, and ransomware criminals have increasingly used the currency to extort money from their victims. Often, they can remain untraceable since Bitcoin processes anonymously and lacks full regulation, making them difficult to trace even when authorities intervene.

No Government Regulations

Without the oversight of a central bank, investing in Bitcoin can be risky. Without government regulations to protect investors and provide transparency into what they’re getting into regarding such transactions, anyone considering putting their money behind this digital currency should tread carefully.

Unfortunately, it also means that each transaction you make is not legally protected, and most are irreversible. This makes Bitcoin especially vulnerable to fraud or theft, leading some investors to avoid conducting transactions using cryptocurrency altogether.

Limited Use

Due to the limited acceptance of Bitcoin, it can be difficult for those who possess this currency to find places to spend it. Most major corporations have yet to accept Bitcoin payments; even those doing so only offer this option in select locations.

This limits the potential customer base for any store that is willing to accept Bitcoin as well as hurts the practicality of using this form of payment; when one carries Bitcoin but cannot use it just about anywhere they wish, it’s not much different than carrying around excess weight in one’s wallet.

Wallets Can Be Lost

Digital wallets offer a convenient and secure method for BTC transactions. However, the wallet may be lost if the associated hard drive is irreparably damaged due to a virus or crash. In such cases, funds within the wallet become irretrievable, highlighting the importance of taking precautions when handling a digital wallet.

Security measures such as backing up data regularly and using the most up-to-date virus protection are essential in protecting a wallet from permanent loss.

Unknown Technical Flaws

The risk of unknown technical flaws is a significant drawback of the Bitcoin system. Because it is still so new, devastating possibilities could lie just under the surface. If someone with ill intent exploited a previously undetected glitch or weakness, they would have the opportunity to reap significant financial rewards while destroying the economy and breaking faith with all those who had chosen Bitcoin to invest in.

To actively address these risks, conduct comprehensive research and testing on systems, client software, and protocols to bolster consumer confidence in their investments’ security.

Here are some risks associated with investing in Bitcoin:

Regulatory risk

Regulatory risk is an undeniable concern when it comes to investing in Bitcoin. The lack of uniform regulations around virtual currencies poses risks associated with longevity, liquidity, and universality.

The constantly evolving regulatory landscape around digital assets leaves investors uncertain about the potential long-term value of their investments. Therefore, investors must keep abreast of changes in legislation or potential upcoming regulations that could dramatically alter the equation.

Security risk

Investing in BTC can be a risky venture due to potential security risks. While offering potential investors the freedom of anonymous transactions, this anonymity also puts them at risk as all Bitcoin exchanges are digital, making them vulnerable to hackers, malicious Bitcoin software, and operational malfunctions.

Bitcoin investors must be mindful of several high-profile cases where caution was disregarded. Like any currency, Bitcoin’s value depends on its security, necessitating extra precautions to safeguard against potential threats.

Insurance risk

Insurances such as SIPC or FDIC do not cover Bitcoin or other digital currencies, making protecting one’s investment in any negative occurrence challenging. Fortunately, for some crypto exchanges, third-party insurance can help shield an investor from unfortunate circumstances.

As such, investors may want to research the available insurance choices when considering whether or not to invest in this increasingly popular asset.

Fraud risk

Investing in Bitcoin also carries a certain amount of risk for fraud. The digital infrastructure of a blockchain is built to provide security. However, the potential for criminal activity still exists. This risk became apparent in July 2013 when the Securities and Exchange Commission (SEC) took legal action against an individual operating a Bitcoin-linked Ponzi scheme.

Investors must exercise caution before investing their assets and resources in cryptocurrencies since the absence of regulation makes them susceptible to fraudulent activities that could go unpunished.

Market risk

Market risk is a prominent factor when considering an investment in Bitcoin. Like any other commodity, its value can increase or decrease based on economic forces and market speculation. Before 2022, many people believed Bitcoin prices would keep climbing and began buying BTC to hold, but after the price of Bitcoin fell at the end of 2021, the scenario changed.

Market volatility for Bitcoin can be especially jagged; it is subject to extreme highs and lows due to heavy trading volume on various cryptocurrency exchanges. For example, the Consumer Financial Protection Bureau reported that the Bitcoin price dropped 61 percent in one day in 2013 and then again 80 percent in one day later that year.

How to buy Bitcoin with eToro

You must follow the steps below to buy Bitcoin from an exchange.

Step 1: Sign up for eToro

More details

eToro is a popular online trading platform for crypto assets, stocks, and ETFs, featuring low fees and a user-friendly interface. With a free eToro wallet and social features like messaging boards, users can copy experienced traders and access numerous assets. Take a look at what makes this platform perfect for starting your trading journey.

-

Provides an attractive, communal atmosphere.

-

Offers zero commission on ETFs.

-

Extensive selection of educational resources.

-

Mobile app with trading features.

-

Smooth account opening and bank transfer.

-

Limited number of cryptocurrencies.

-

Limited customer support.

-

No crypto-to-crypto trading pairs.

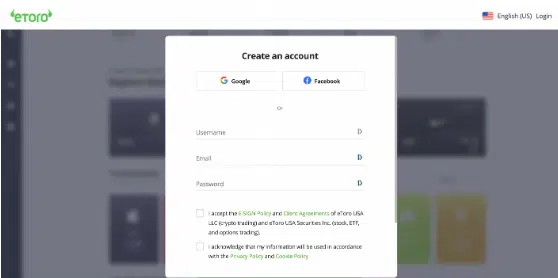

To begin your investment journey in cryptocurrency, make an account on eToro.

eToro offers three options for creating an account: sign up with a Google account or Facebook or manually fill in information such as username, e-mail address, and password.

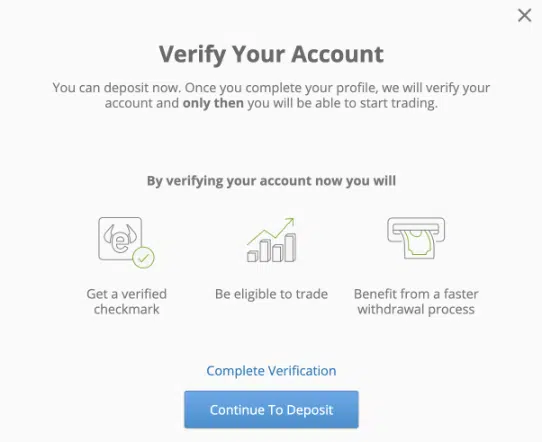

Step 2: Account verification

After creating your account, provide the correct personal details and validate your e-mail address and phone number. To validate debit card transactions, use the code sent to each as proof of verification.

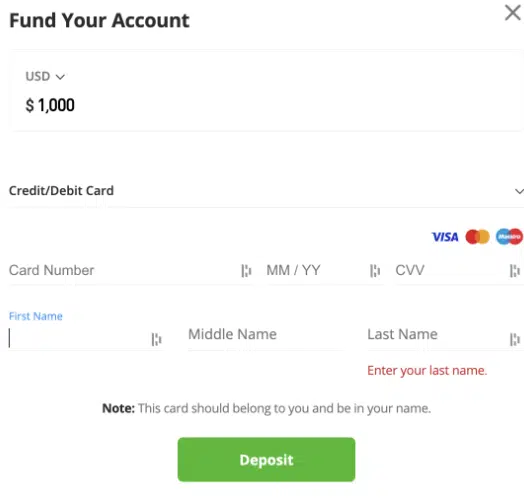

Step 3: Deposit fiat currency

Verifying your account allows you to easily add funds with any debit card, VISA, or Mastercard. eToro offers multiple debit card payment options for deposits.

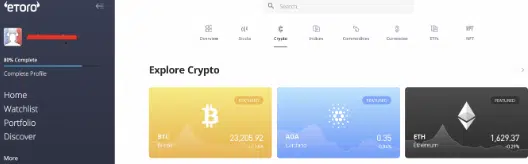

Step 4: Go to the crypto page

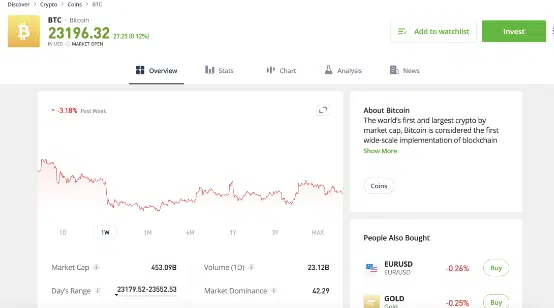

Head to your account’s dashboard and click [Discover] to proceed with the buying process. You can choose crypto from various investment opportunities ranging from stocks, indices, commodities, etc.

Step 5: Choose Bitcoin and click Invest

You can easily select your desired cryptocurrency from the crypto page, i.e., Bitcoin. View complete information about the coin on this page, including stats, charts, analysis, and even recent news reports.

After that, you can buy Bitcoin by clicking the [Invest] button.

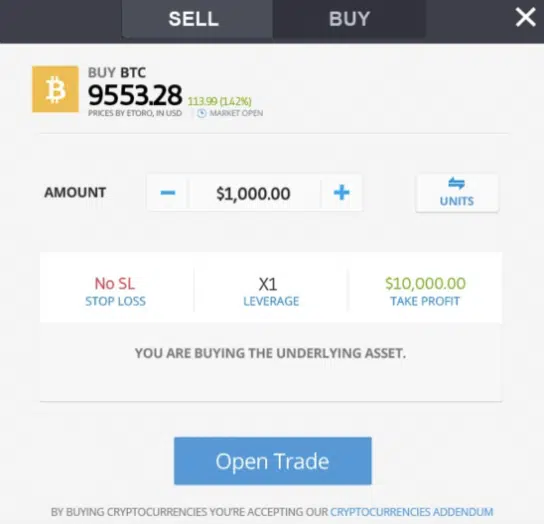

Step 6: Make your first Bitcoin purchase

To purchase Bitcoin, type the amount you wish to spend to buy Bitcoin.

Finally, Click [Open Trade], and your transaction for Bitcoin will be completed quickly and easily.

How to store Bitcoin?

You need to have a cryptocurrency wallet or storage to use your Bitcoin. Wallets contain public and private keys that work together to validate transactions. There are multiple options for storing BTC:

Hot storage

Hot storage is beautiful for those wanting quick and easy digital asset access. You can buy or sell Bitcoin with just a few clicks by leaving your funds in hot storage.

What makes hot storage so attractive is its simplicity; there’s no need for complicated hardware or software setups. Hot wallets are accessible from anywhere if you have a device and an internet connection. Crypto enthusiasts who don’t mind the slightly elevated risk factor can join the millions of users who store their BTC in hot wallets.

Cold storage

Cold storage provides a secure and convenient way to store Bitcoin. With cold storage, you don’t need to be concerned about your funds being held in an online account or remembering complex passwords. It works like a thumb drive; you always download the encrypted device and keep it with you.

Cold storage guarantees that your assets are safe from cyber-criminals, so you can rest assured that your digital currency is safely stored.

Summary

The emergence of Bitcoin has caught the attention of many people. The world’s first decentralized currency allows users to send bitcoins and receive money worldwide without a central governing body.

Its primary benefits are low-cost transactions, user privacy, and no chargebacks or frauds. In addition to these features, it offers structure and organization that allows users to verify transactions and prevent double-spending coins.

To protect investments, investors should be aware of mining Bitcoin, which involves solving complex mathematical problems to get rewarded with Bitcoin. The usability of Bitcoin is vast due to its economic features, making it a smooth transition for digital payments with its fixed supply and pricing model based on free market forces.

Despite all these advantages, investors should be aware of several risks, such as market volatility and possible exchanges/wallet hacks that could cause irreparable losses.

Understanding how to store Bitcoin quickly and effectively is essential for new and experienced investors to keep assets secure from hackers and malicious activities. Various FAQs can be referred to for further clarification regarding this cryptocurrency when making an investment decision.

Recommended reads:

Investing in Bitcoin offers an enticing opportunity to grow your wealth substantially. That said, it is not for the faint of heart, as it requires a certain level of knowledge and tenacity to be successful with cryptocurrency trading. Over its decade-long history, Bitcoin's value has often seen drastic fluctuations that can easily unsettle even seasoned investors.

Before investing in Bitcoin, you must understand the potential risks of cryptocurrency trading. Make sure to have a financial safety net to cover any losses incurred from these volatile assets should your investments not pay off.

In short, Bitcoin may be a good investment for those willing to brave the marketplace volatility and take calculated risks for potential returns.

Mining Bitcoin is a complex process requiring robust and specialized hardware. A general guideline is that it typically takes around 10 minutes to create one BTC using a strong processor. However, this will depend on the specific hardware in use.

Factors like the hash rate, or number of calculations per second, of the processing device and other components can significantly affect the time it will take to mine one Bitcoin.

The Bitcoin network of miners makes money by validating blocks and verifying transactions on the web. Miners are rewarded for these services with freshly minted Bitcoin each time a block is validated.

Minted Bitcoin can be exchanged through reputable cryptocurrency exchanges for conventional currencies, like USD. As Bitcoin's legitimacy is increasing, as more merchants and retailers accept it as a form of payment, users can make purchases without needing to access their bank accounts.

Miners process transactions across a global network of computers and are rewarded with new Bitcoin when these transactions are verified. There's something quite attractive about the idea of self-generating currency, but it does come at a cost for the miners as; as confirming each transaction and creating new Bitcoin, they also incur hefty electricity bills to keep their computers running around the clock. It can be a risky business, too; if a miner loses an internet connection or experiences hardware failure, then their work will have been for nothing.

It is dependent on perspective. Some might think all money needs to be backed by a government or central authority; still, since Bitcoin is decentralized, relying solely on its technology and community of users to govern it, it doesn't fit into this definition.

As more people become comfortable with digital cash, they may accept Bitcoin as a legitimate payment between two parties without relying on a third party like banks or other financial institutions. From this lens, there's no denying that Bitcoin qualifies as money in many ways – it can be exchanged for goods and services electronically; it acts as legal tender for certain transactions such as tax payments; and its value increases over time due to its limited supply.

Investing in Bitcoin holds potential rewards. However, it is essential to remember that risks are involved. The market risk here is one of the most influential ones to consider before making any decision with your money. It should not be overlooked and requires thorough consideration before investing in this asset class.

It's also important to be aware of regulatory risks; obstacles and laws surrounding cryptocurrencies should be considered depending on your country. Similarly, cyber security is another area investors must remain vigilant about before buying and holding Bitcoin.