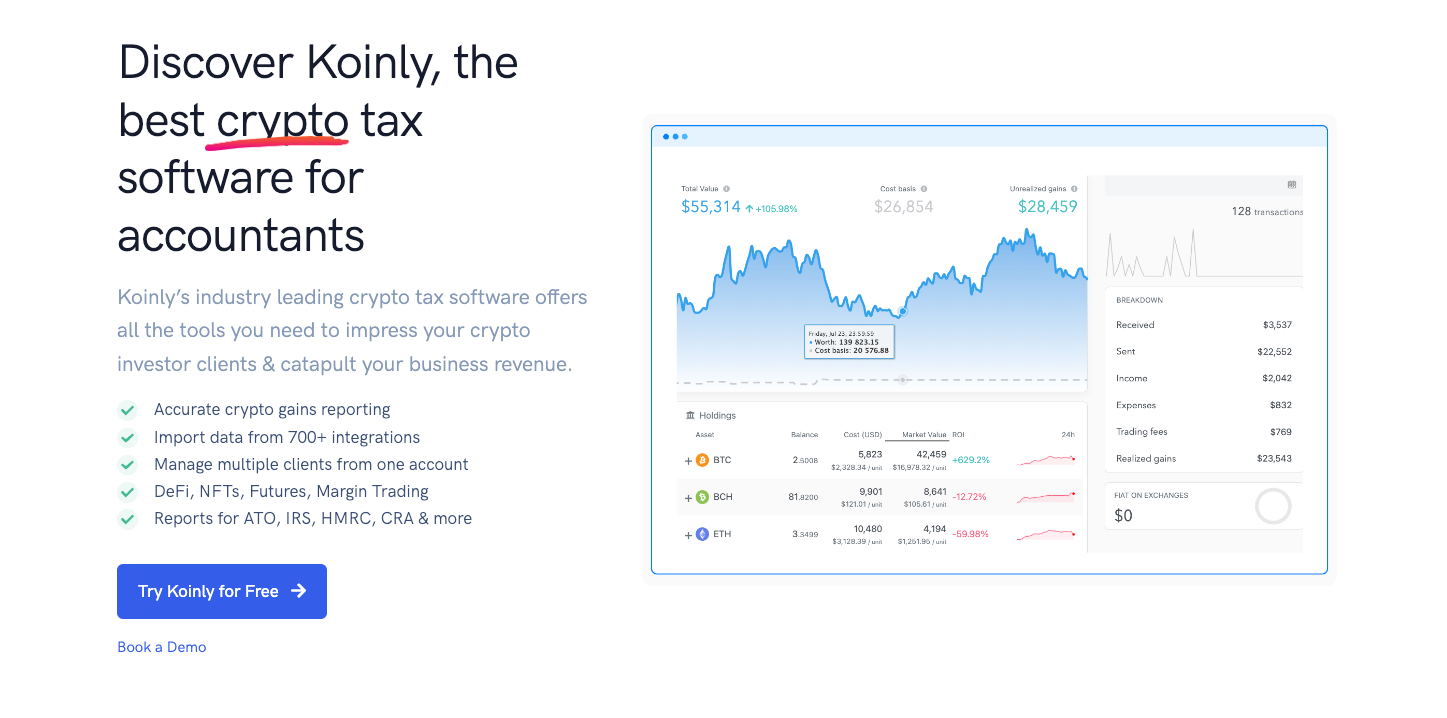

Koinly Review 2024: The Best Tax Software For Your Trades?

TLDR

This Koinly Review will give you the good, bad, and ugly about the best crypto tax software. A minor weakness is that it does not accept crypto payments and may be too expensive.

The major strength is that Koinly is developed to help users solve the challenge of computing crypto taxes by automatically your tax. It can achieve this by using API to integrate exchanges and wallets. You can also import your transaction using CSV files.

Koinly supports more than 700 different integrations, including major exchanges and wallets. It also has wide geographical availability on four continents. The intuitive software can generate multiple localized tax reports. The tax software is also popular for its portfolio tracking feature.

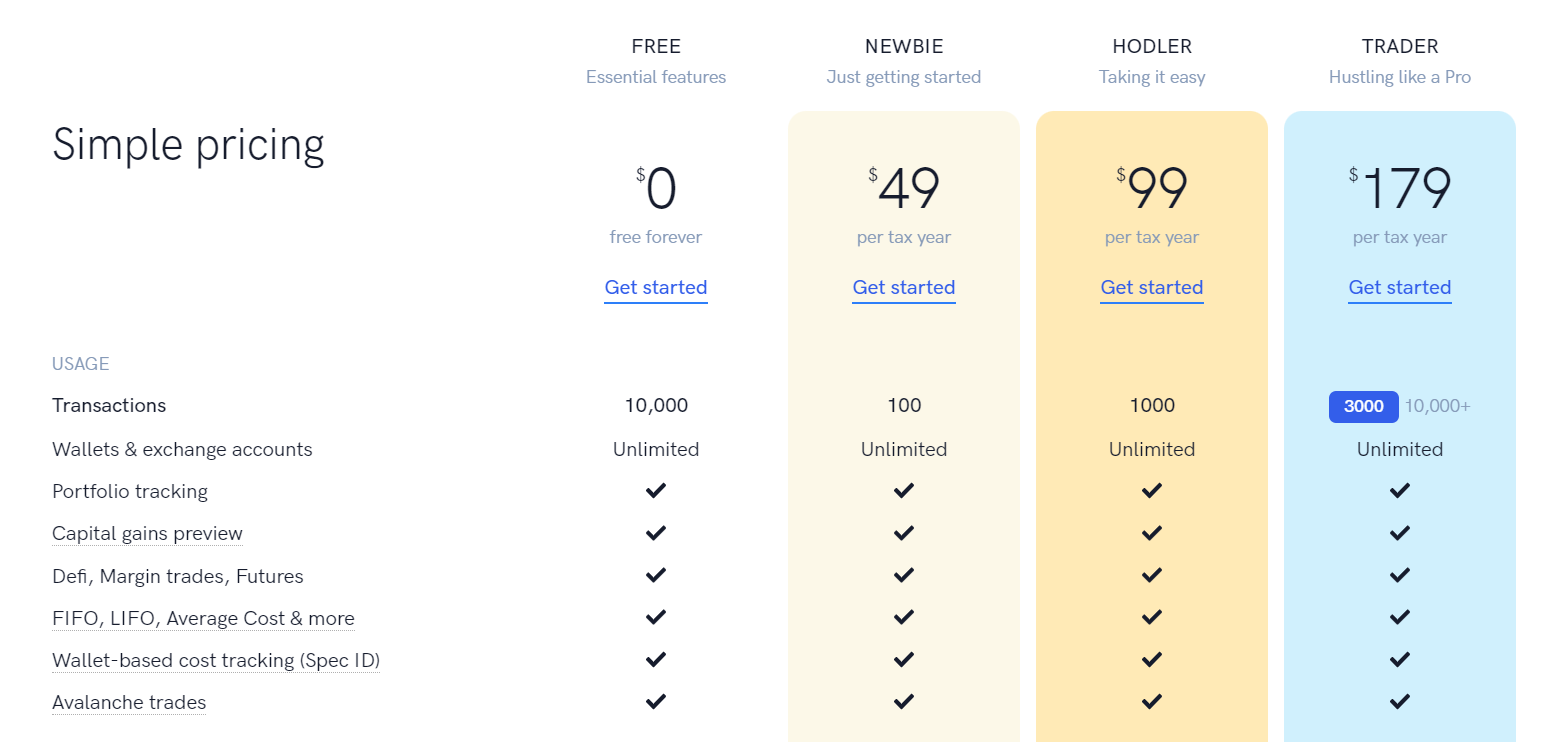

There are four subscription plans for Koinly, including the free plan. The paid subscription ranges from $49 – $279 annually.

What is Koinly?

Perhaps, the one universally accepted truth is that taxes are a nightmare. If you agree with fiat currency taxation, you will also agree that crypto taxes are even more challenging to calculate.

Koinly comes in handy as a crypto tax software for calculating and reporting your crypto transactions for any given period. Koinly integrates wallets and exchanges into its platform and calculates your tax based on your trading, staking, and mining activities.

The crypto tax software helps you eliminate the time-consuming and difficult task of assembling your tax reports from multiple transactions. It automatically imports transactions from the integrated exchange accounts and calculates the gain and losses, which leads to your final tax report.

Who Should Use Koinly?

Anyone involved in crypto trading and other related activities can find Koinly to be a useful tool. It is highly recommended for corporate bodies or professional accountants who work with crypto investors.

The tax software can assist these categories of people in putting together a tax report from extensive and numerous crypto transactions. It can import transaction history from different crypto exchanges.

Koinly can also be used by individual traders as well. The software works the same way for everyone and can generate tax reports based on the data imported from the integrated exchanges.

New Users

Based on the features of Koinly, it is more designed for crypto investors and enthusiasts who already have some level of crypto transactions across different exchanges. It requires you to integrate your exchanges, wallets, etc., where you have carried out trading, staking, mining, or investing.

While it might not be entirely suitable for people just starting their crypto journey, it is still simple to use when you have some level of crypto transactions. The software also lets you calculate your tax as far back as five years, and you can still catch up on any tax payment you missed.

What Countries Are Supported?

Koinly is a versatile software and supports various countries over 4 continents. It popularly supports USA and Canada in North America. It also supports Australia and New Zealand in Oceania.

European countries widely enjoy the support of Koinly. These include the UK, Sweden, Finland, Germany, Netherlands, Spain, France, Italy, Lichtenstein, Malta, Estonia, Czech Republic, Denmark, Norway, Austria, and Ireland.

Countries in Asia are not left out, as Koinly supports South Korea, Japan, and Singapore. In addition to these countries, Koinly creates tax reports for the following accounting methods:

- First In, First Out (FIFO)

- Last In First Out (LIFO)

- Highest Cost

- Lowest Cost

- Shared Pool

- Average Cost Basis

What Integrations Are Supported?

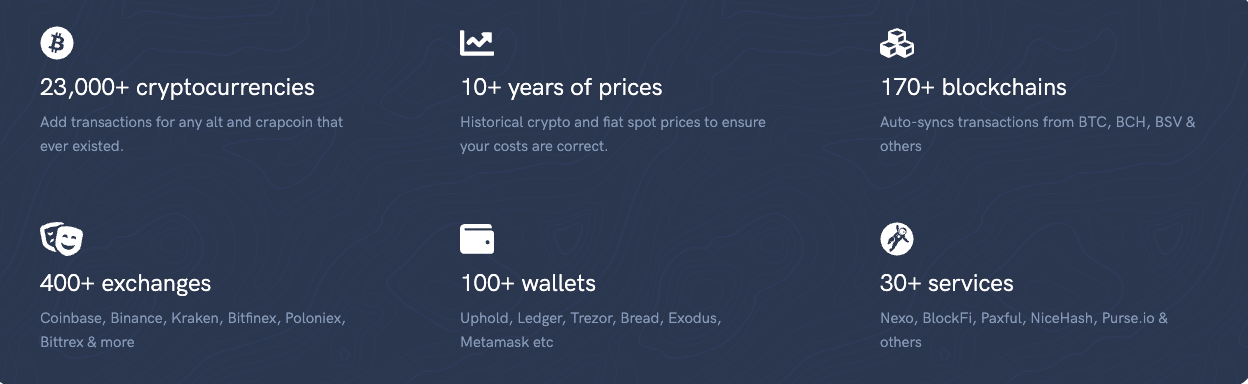

The Koinly review shows that Koinly is the best crypto tax software in terms of how widely it supports integrations. It supports over 23,000 cryptocurrencies, literally any cryptocurrency that has ever existed.

It also supports the integration of over 400+ exchanges and 100+ wallets. This increases the number of transactions Koinly automatically imports to generate tax reports. It also integrates with self-custodial and DEXes to help you automatically import all of your transactions.

The services of Koinly are also extended to work as a portfolio tracker. It supports the integration of CoinTracking, Delta, etc., accounts to enable active portfolio tracking. Koinly lets you track your cost across all connected wallets using either a universal or wallet-based cost-tracking technique.

Integrations with NFT and DeFi Protocols

When we mention that Koinly is the best regarding integrations, we mean it in every sense of the word. Its integration superpower does not end with only exchanges and wallets. It also supports the integration of NFT and DeFi protocols.

You can automatically import NFT transactions (ERC-721 and ERC-1155) for most EVM-based blockchains. The technical team is still working on providing support for other blockchain services.

Koinly also supports automatic imports of trades and transactions on DeFi platforms such as PancakeSwap, Uniswap, Sushiswap, Value, Balancer, etc.

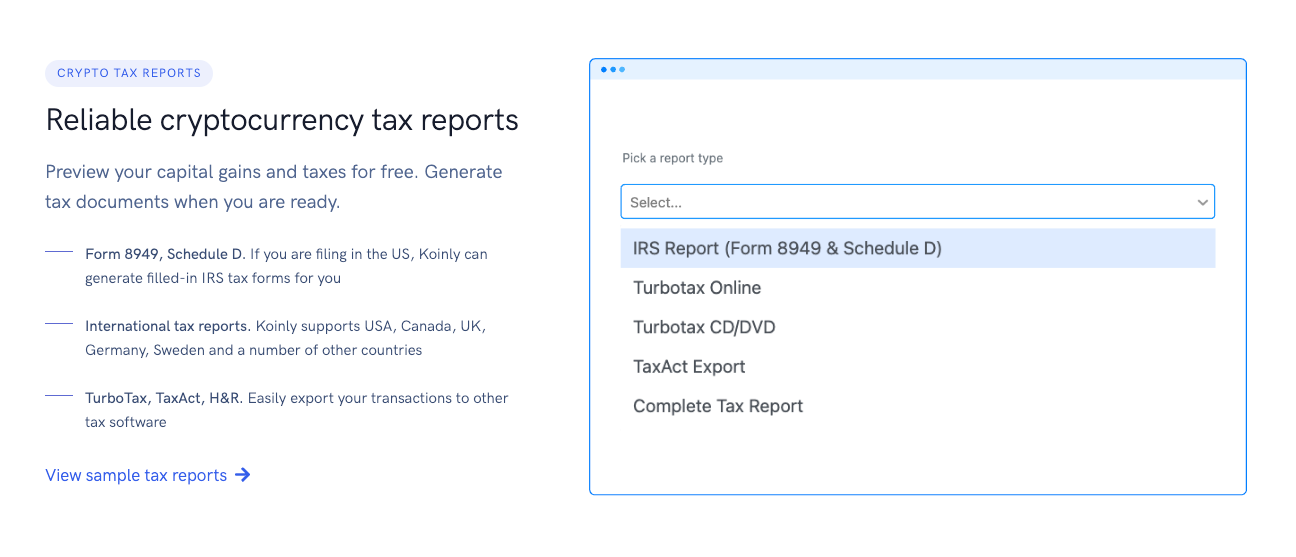

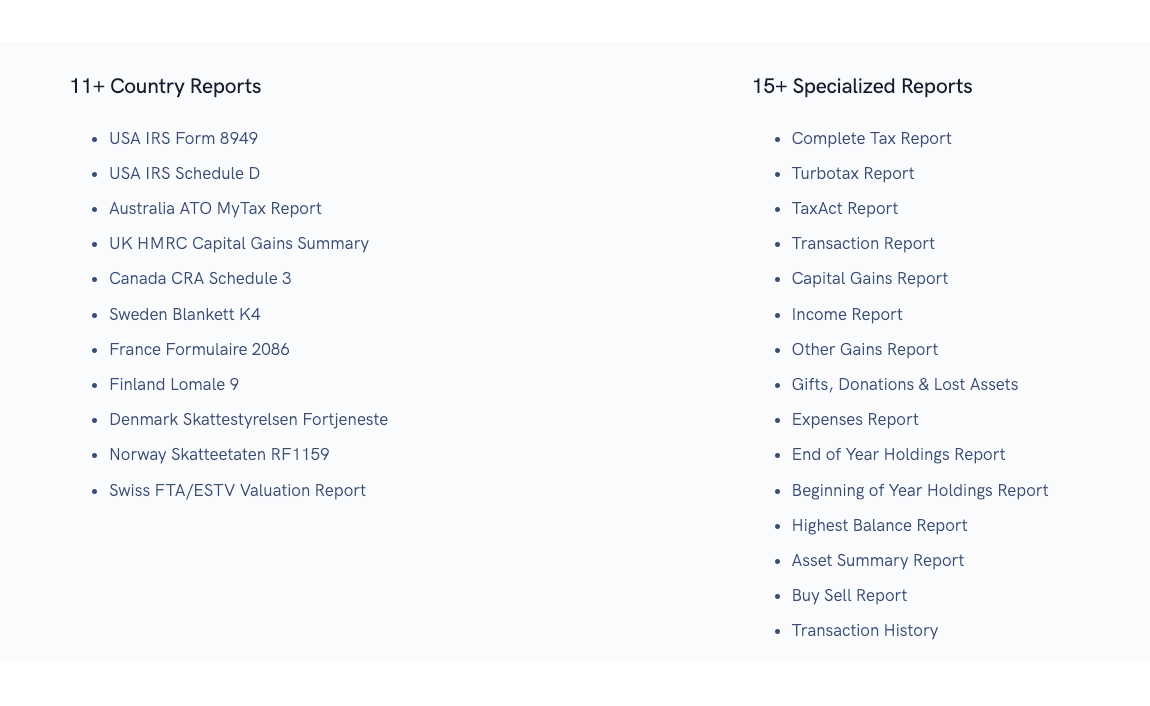

What Tax Reports can be generated with Koinly?

Koinly can generate several tax reports based on the country where it is used. It uses each country’s tax law to generate specific tax reports.

Here are some of the methods and tax reports supported by Koinly.

- Multiple Cost basis methods: The method used for calculating costs depends on the country’s regulations, and one can choose between a host of methods. The complete tax reports cover all your capital gains, end-of-year balances, income transactions, margin trades, etc.

- Form 8949, Schedule D: This tax report technique is more specific to US taxpayers. Koinly can generate all the needed tax forms to file taxes.

- Smart transfer matching: Koinly also adopts AI techniques to detect transfers between your crypto wallets and make any necessary reports.

- Capital gains tax and margin trades: You can also use the tax software to get a detailed report on your taxable gains and other income transactions.

In addition to all of these tax reports, Koinly also provides specialized local tax reports such as:

- Capital gains summary for the UK

- Swiss Valuation Report

- K4

- Rf1159

- Sheet 9A

What Makes Koinly a Good Choice?

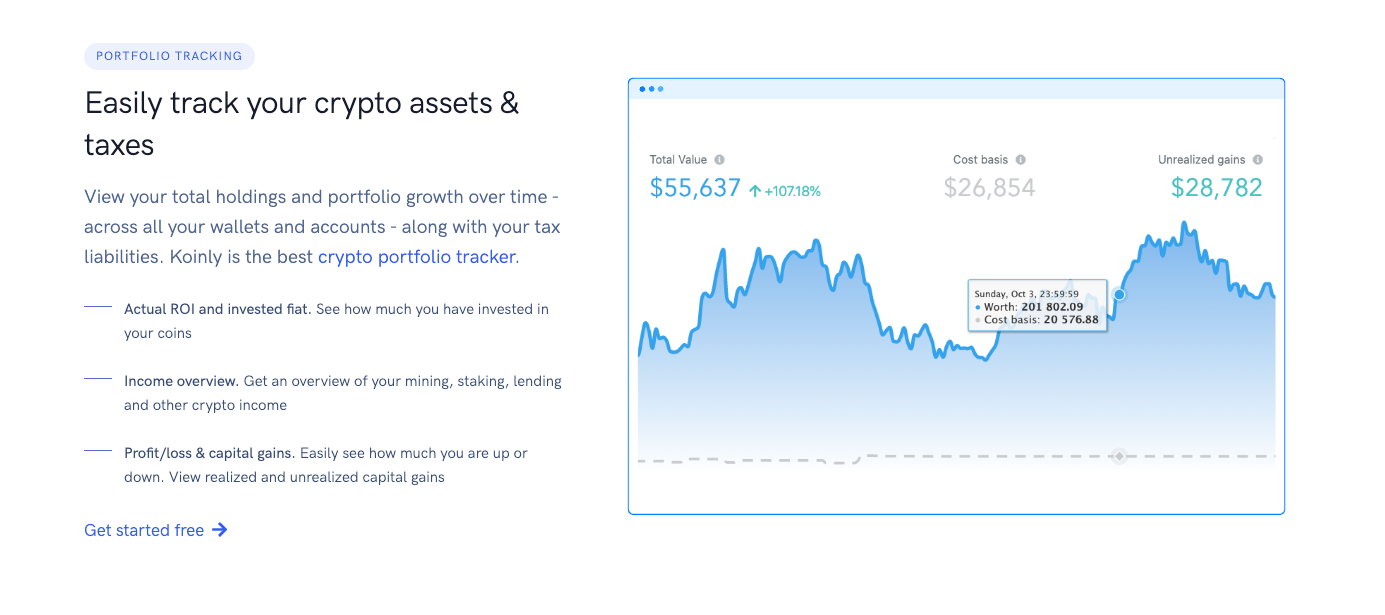

Portfolio Tracking

Do you have multiple crypto assets across multiple platforms – which is typical of most crypto investors? Tracking all of your crypto assets across various platforms might be difficult. Here again, Koinly comes to the rescue.

Users don’t just use Koinly as tax software; it also helps them track all of their asset performance in one place. It provides a specialized dashboard to see the performance of all your crypto assets linked to the platform.

The good part of the portfolio tracking tool is that it provides a visual depiction of all your transactions. While providing an overview of your crypto trading history, it also gives you information about how much you have invested alongside your profit and loss with the tax liabilities.

Easy Data Import

The real burden of calculating crypto taxes is going back and forth on different platforms and extracting transaction data. This is an even bigger burden for crypto companies that manage large portfolios for large investors. If you are in this situation, Koinly got you covered.

Koinly supports automation and import transactions from multiple exchanges, wallets, etc., integrated into its platform. This feature is even more convenient as Koinly supports the automatic syncing of many exchanges, wallets, and blockchain services.

Koinly can connect easily with these services through the use of API. The API feature helps users extract the needed information automatically in a short amount of time. It also supports CSV file imports, including xPub/yPub and zPub.

Multiple Tax Reports

Another advantage of using Koinly is the multiple tax reports it can generate. It provides international tax reports and localized tax reports depending on the country and needs of the users.

Koinly supports over 20 countries on about 4 different continents. The intuitive crypto tax software produces crypto tax reports based on the tax regulations of the region. It offers the user an easy way to pay taxes.

To deliver this output, the crypto tax calculator combines these regulations with popular accountancy methods. In addition to generating tax forms, it also supports exporting transactions to other tax tools and software.

Comprehensive Guide for Users

Koinly users are not kept in the dark when using its platform. The platform has a comprehensive guide for all categories of users. It provides valuable information that enables users to navigate the tax report tool easily.

It also provides information about how its crypto tax calculator works and the different tax guides available for each region. The crypto tax software maintains a blog offering relevant resources accessible to its users.

In addition, to the resources provided, Koinly has a robust customer support team that is handy in responding to customers’ inquiries.

Trusted Partners

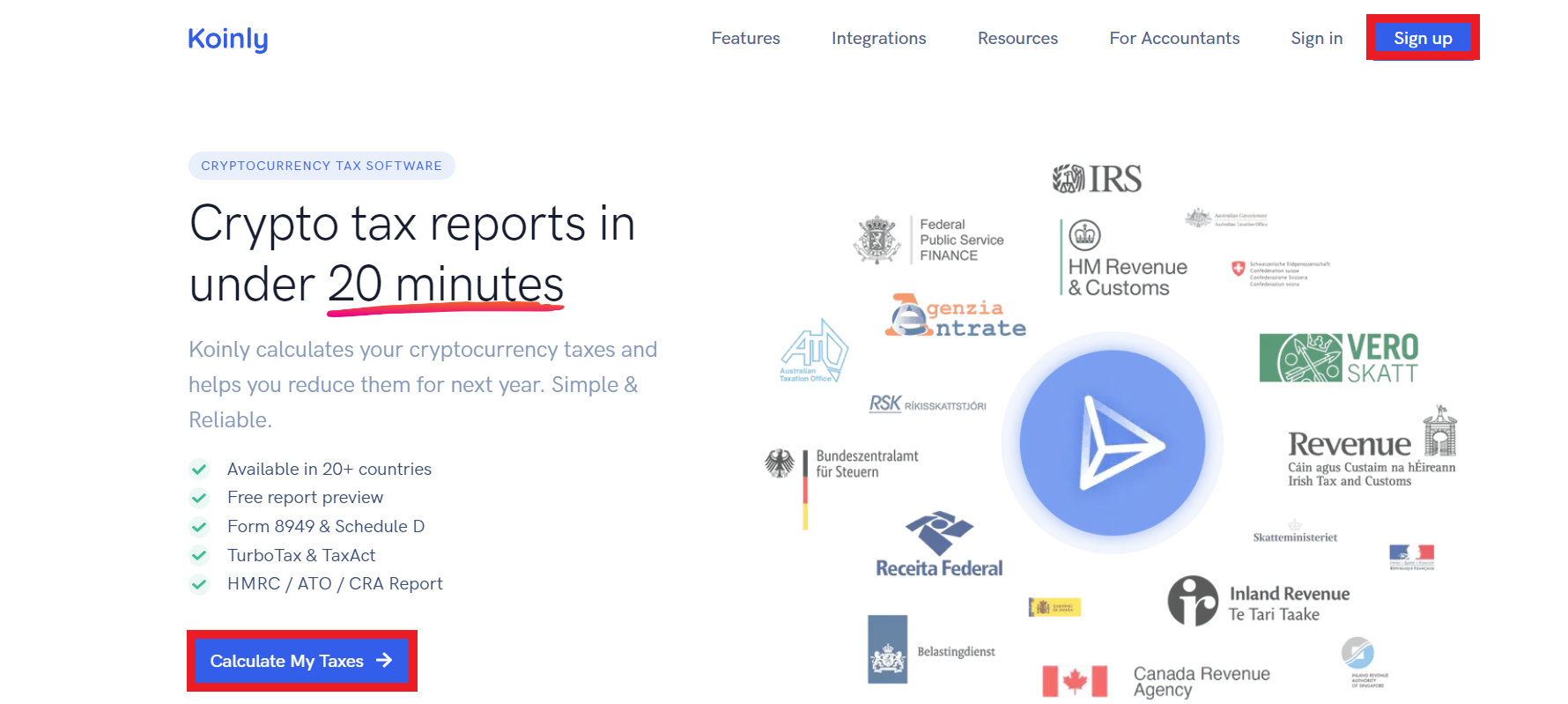

How to Set Up a Koinly Account?

Step 1: Visit Koinly to Create an account

To get started, visit the official website.

You can either select the [Calculate my taxes] button at the lower part of the homepage or the [Sign up] button at the top right corner.

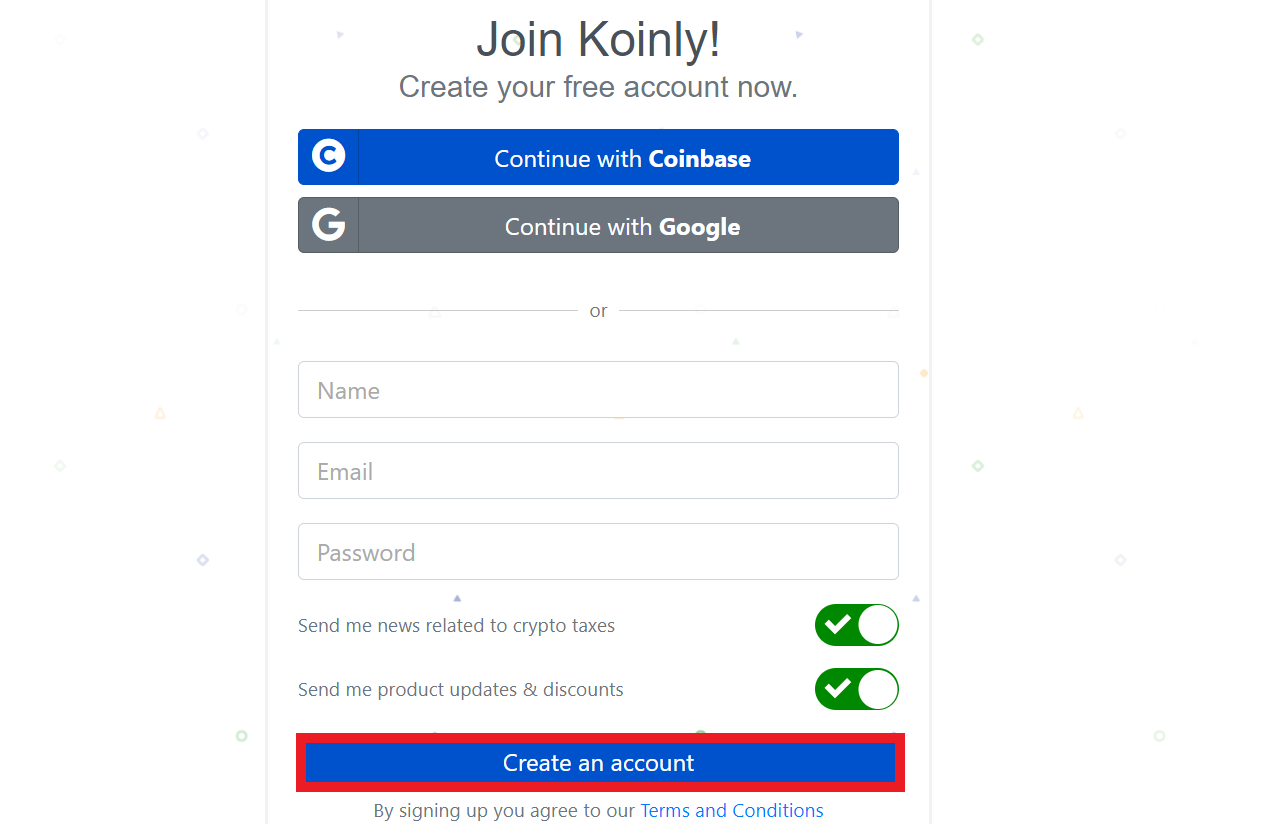

Step 2: Sign Up

You can enter your name, e-mail, and password from the sign-up page. Once done, select [Create an account].

Alternatively, you can create an account using your Coinbase or Google account.

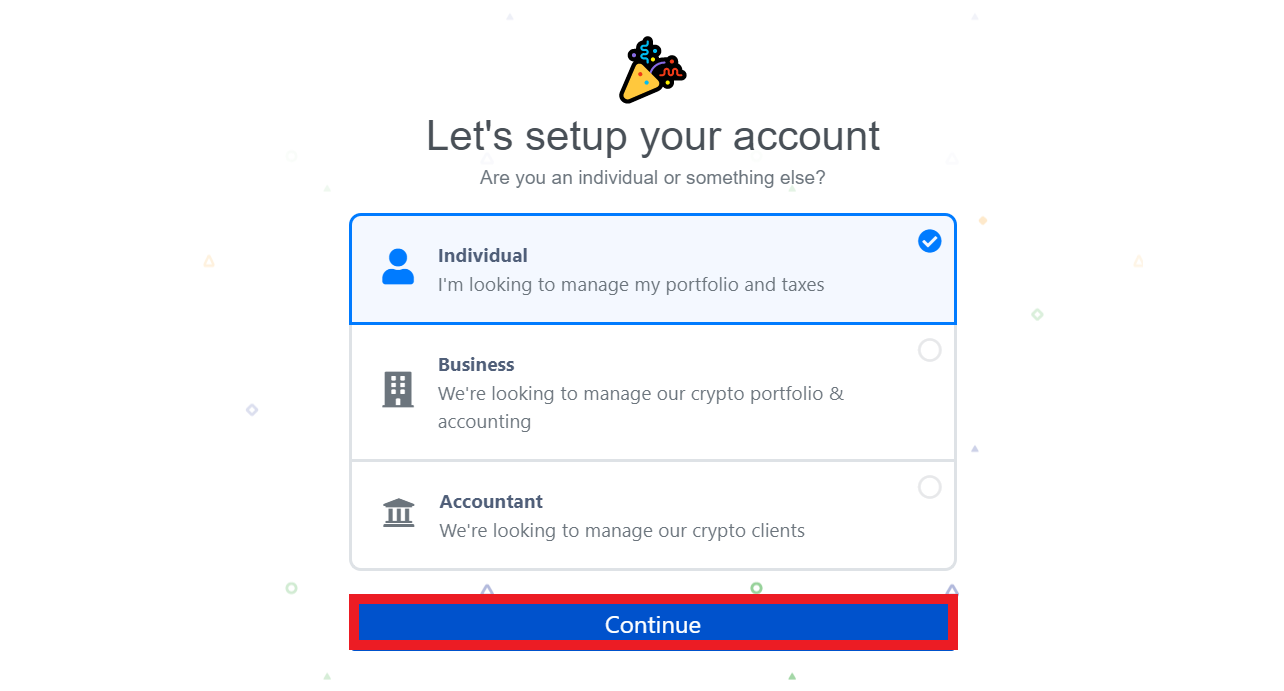

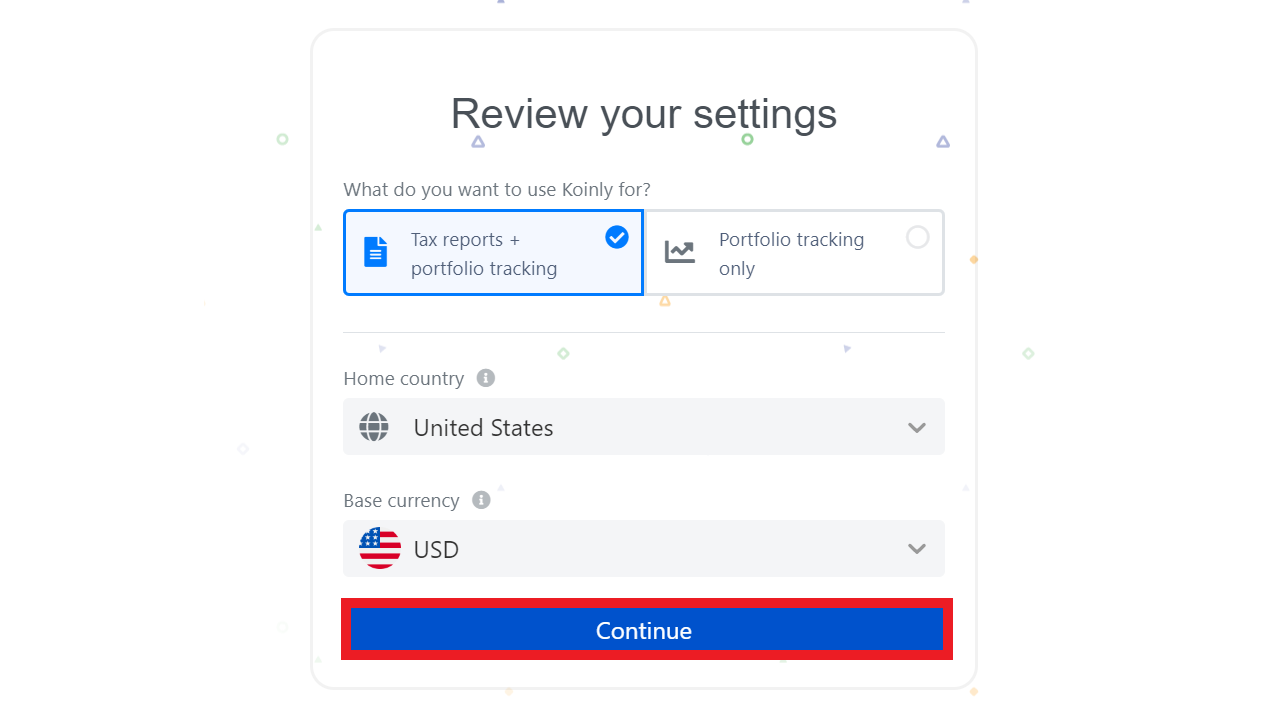

Step 3: Set up your Account

At this stage, you can customize your account to suit your needs.

Koinly provides three categories of users – Individual, Business, and Accountant. You can select the [Continue] button once you select the one that applies to you.

In addition, you can also review your settings and choose what you want to use Koinly for.

Select your home country and base currency, then click the [Continue] button.

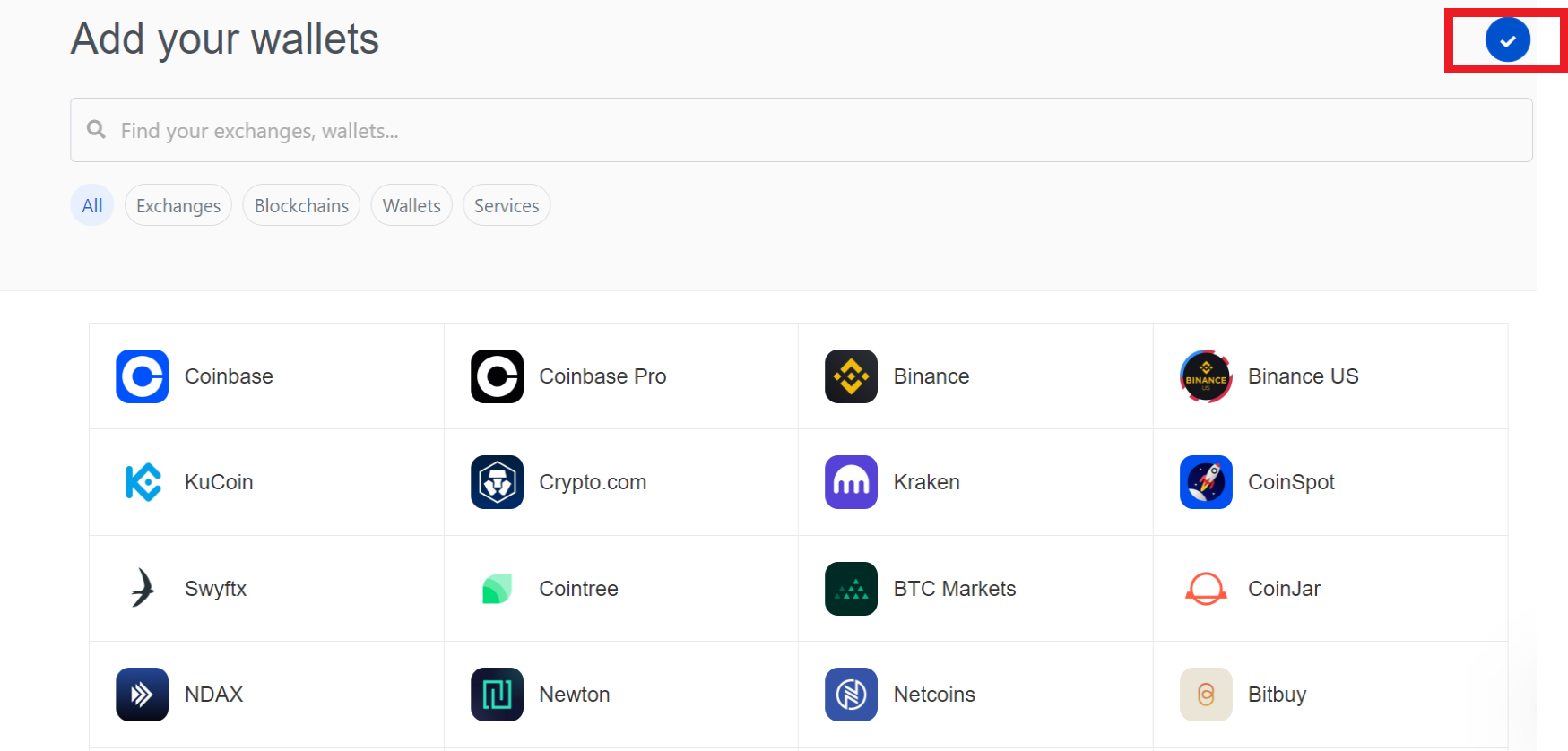

Step 4: Add your Wallets

The page is next to where you can add your exchanges, wallets, and blockchain.

You can select as many that apply to you. Select the [Done] icon once you have marked all that apply.

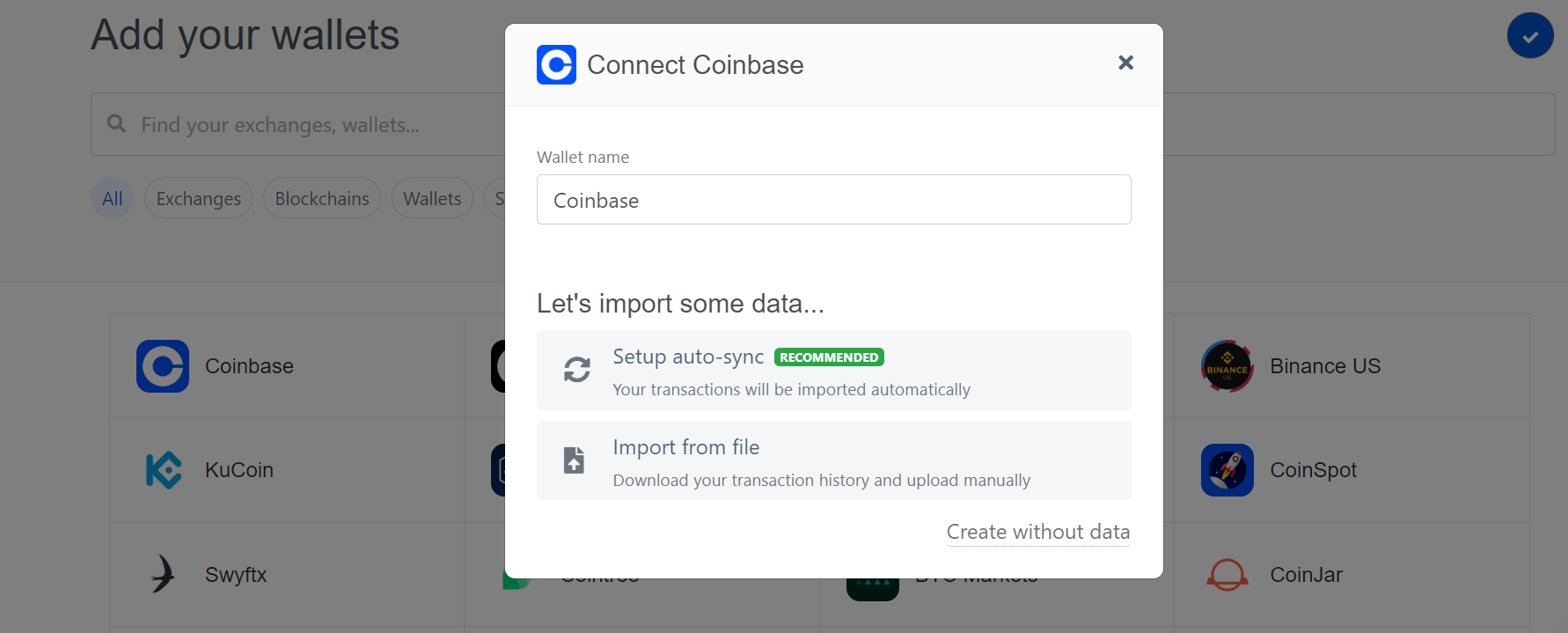

Step 5: Import your Transactions

After selecting any supported integrations, you can import your transaction from the connected platform.

You can select the auto-sync option that uses API features to import transactions automatically.

If the API feature is unavailable, you can import transactions using the CSV files option.

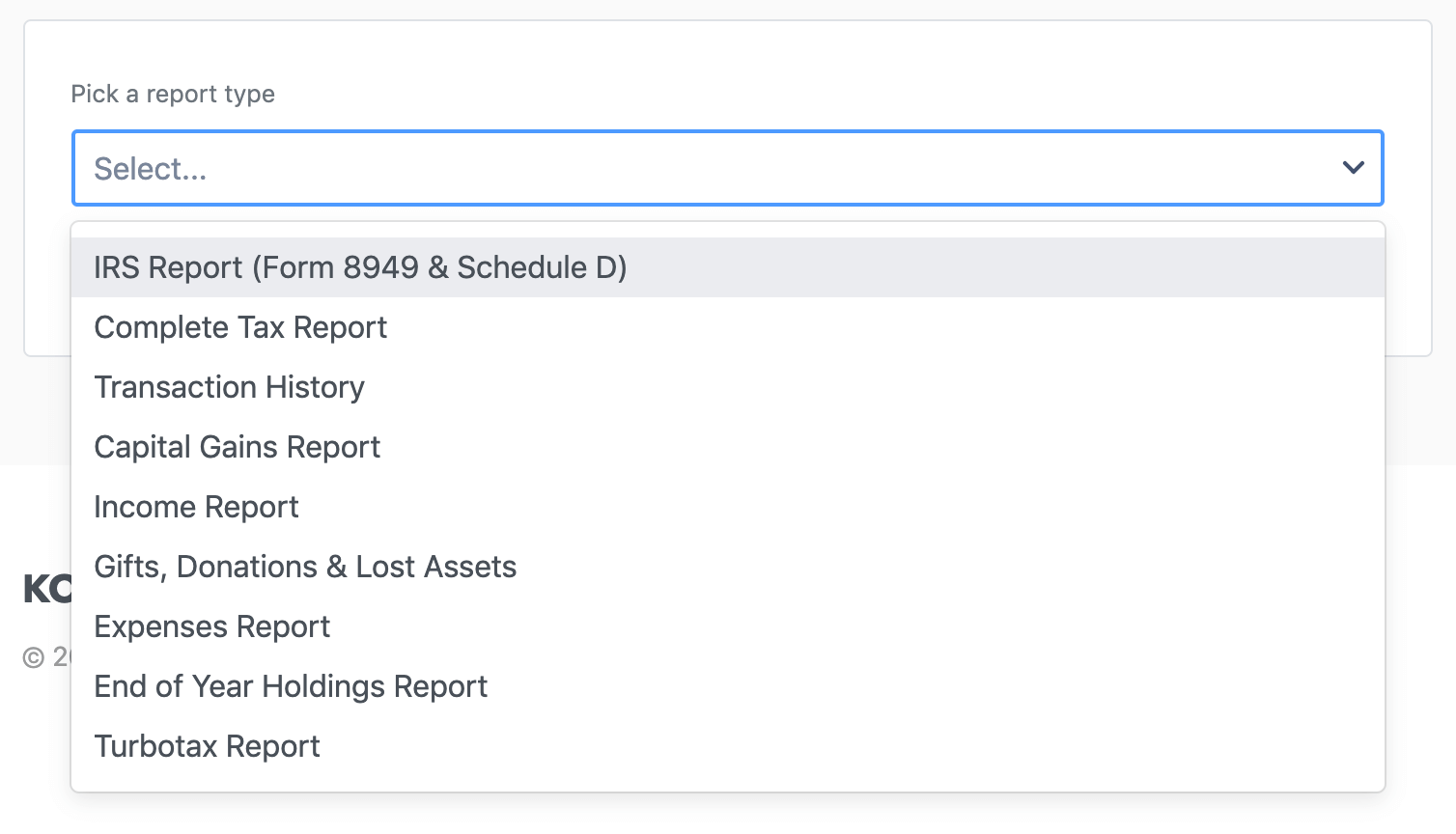

Step 6: Download the Report

Once your transactions have been imported, Koinly calculates your tax based on the information provided.

You can select what report type you want to download. Although you need to have one of the paid subscriptions before downloading it.

Koinly Review: Top Features

Multiple Integration Service

You can say goodbye to the manual computation of tax information. Koinly can speedily complete tax reports from multiple connected integrations. Through its high-end technology, it can support over 700 integrations on its platform. This limits the worry of not having your exchange accounts or wallet supported by Koinly.

The tax software supports the integration of exchanges, wallets, NFTs, and DeFi protocol. It links these integrations using API and connects with them using secured links. It does not request you read access to the account, thereby ensuring the integrity of the user’s accounts.

The integration with other blockchain services like NFT and DeFi protocols helps you have an overview of all your crypto activities in one place. This makes it easy for Koinly to calculate your crypto taxes based on all the transaction data provided.

Various Account Plans

Another beauty of Koinly is the multiple account options it provides to users. It has a total of four accounts, including its free account. The various account plans meet the needs of different categories of users.

The highest plan has a transaction limit of up to 10,000 transactions. This high volume of transaction limit works especially for corporate agencies managing multiple crypto accounts.

The less expensive and free account plans are also well suited for less active traders, including those who trade as a hobby. You get the needed transaction limit to process all your transaction data on Koinly.

Tax Loss Harvesting

It is common for investors to reduce capital gains tax by selling other investments at a loss. This technique assists investors in offsetting the high tax amount by selling profitable assets at a loss.

Crypto investors can also use this tax loss harvesting technique, and Koinly calculates tax, considering this feature. This technique is completely legal and subjected to the tax law of different countries and regions.

You can use the Koinly dashboard to identify your unrealized gains and losses. From here, you can see the opportunities available for tax loss harvesting.

Wide Geographical Availability

One feature limiting tax software’s effectiveness is geographical availability—most other tax reporting software support only a limited number of countries. However, Koinly has a wider geographical presence and can be used in most countries.

Asides from the primary countries it supports, which is about 20 in number, it also supports other geographical regions that use similar accountancy methods for calculating tax returns.

Koinly generates customized and localized tax reports for supported countries, allowing users to complete tax forms for submission to tax authorities directly.

Access to Professionals

Koinly provides services to tax professionals and accounting firms on its platforms as an add-on feature. Users who require these professionals’ services can easily connect on Koinly.

Running them through a tax expert is sometimes advisable, even after collating your tax reports. This makes Koinly a one-stop shop for all your tax-related concerns.

On the other hand, Koinly provides a platform for accountants and tax professionals to operate and calculate crypto taxes for their clients. It provides all the tools for professionals to track heavy transactions, including managing multiple clients with one account.

Koinly has fully onboarded 10 CPAs – two from the USA and eight from Ireland. Listing tax professionals is a continuous process, and more professionals are expected to be listed as time passes.

Koinly Review: Pricing and Plan

Koinly comes in four different packages, including the free plan.

1. Free plan

As the name implies, you do not have to pay any recurring subscription fee to use the service. The free plan provides all available features, including portfolio tracking and tax report generation.

You can also contact the customer support team through live chat and e-mail.

2. Newbie – $49/year

The newbie plan is the next upgraded level after the free plan, costing $49 per year. This upgraded plan lets you generate all the needed tax reports, including the FIFO, LIFO, and other international tax reports. It also allows export to integrations like TurboTax and TaxACT.

However, this plan limits you to only 100 transactions, which can be somewhat restrictive for high-volume traders.

3. Holder Account – $99/year

The holder account costs $99 annually and features similar to other paid plans. The main difference for this plan is the increased number of transaction limits to 1000. Users of this plan also have higher priority regarding customer support services.

4. Trader Account – $179/year

The trader account comes in two tiers. First is the plan that costs $179 per year and allows only 3000 transactions. The second tier comes with a cost of $279 and is available for up to 10,000 transactions.

This highest-paid subscription plan gives users premium access to all the features available on Koinly, including priority support from the customer care team. You also can generate custom crypto tax reports.

Koinly Security

Another area where Koinly excels is the area of security. The tax software provides security for users and data processed on its platform. This is especially important since there is sensitive financial information being processed.

Data are imported from integrated platforms using API. The data are also encrypted while in transit to keep the information secure. The API and application endpoints also score an A+ on the SSL lab tests.

When demanding access to connected exchanges or wallets, Koinly does not require private keys. It solely demands read-only access. The API keys also use the aes-256-gcm encryption before storing it, while all data shared on Koinly uses the 256-bit encryption.

In addition to the industry security protocols put in place by Koinly, it also uses Amazon Web Services (AWS) for data storage and hosting. It uses Heroku, a highly secured cloud application that helps isolate and secure customer data.

Koinly Drawbacks

Does not Accept Crypto Payment

It might be shocking to hear that the well-respected crypto tax tracking and reporting software does not accept cryptocurrency as payment.

It is unclear why the company only accepts payment with fiat currency and might be a bit unrepresentative of the company as it works with crypto assets yet does not accept this payment method.

Slightly Expensive

While Koinly is not the most expensive crypto tax software, it still costs a lot. The software is even more expensive for traders with high trade volumes.

You still have to pay for more transaction limits up to a maximum of 100,000 transactions after using up the transaction limit of 10,000 on the trader account.

This runs into a high cost for high-volume traders and can be a delimiting option for users.

Final Thought

This Koinly review has provided insight into how the crypto tax software works and the set of users it is suitable for. It meets the need of almost all crypto users who require filing their crypto taxes.

The software is a one-stop shop for all the needs of a crypto investor. It also provides portfolio tracking, where you can see the performance of all your crypto assets in one single place.

Koinly supports quite several integrations and is available in major countries. Although it is considered slightly expensive, you will get value for money.

Koinly prioritizes the security of its users and uses industry-standard security procedures. It does not require private keys and encrypts data while in transit. Koinly is a reliable and secure option for international users.

Yes, Koinly has a free account option for users. The free option can access all the features of Koinly, although it has a bit of a limitation.

No, Koinly does not directly submit to IRS, but it provides a prefilled form 8949 and Schedule D, which can be submitted to IRS.

The founder and CEO of Koinly is Robin Singh. He has a background in finance and accounting and worked for a Fortune 100 company before establishing Koinly.