TLDR

NFT staking involves locking NFTs on blockchain protocols for rewards. Some protocols require holding, while others mandate validation. Research platforms like Binance NFT power station, MOBOX, and KIRA network for pros and cons. Benefits include passive income and easy learning; drawbacks are scam vulnerability and price sensitivity.

Introduction

Are you looking for an easy method of earning rewards from the trade of non-fungible tokens (NFTs)? Discover staking, a cutting-edge strategy holders employ to generate income on the blockchain. With NFT staking, you can earn passive income while supporting the growth of the NFT community.

Like other crypto and NFT trading strategies, understanding NFT staking can be intimidating. This article provides a comprehensive guide covering pre-staking knowledge, legitimate platforms, rewards, and more.

What is NFT staking?

NFTs are digital assets that may come in different forms of internet collectibles such as art, music, videos, items in blockchain games, and so on. They are smart contracts; as a result, they cannot be manipulated or forged in any way.

Furthermore, NFTs are unique cryptographic tokens, often based on the Ethereum network and recorded on the blockchain. These tokens prove the ownership of physical or digital assets. One of the popular uses of NFTs today is in play to earn games where players have verifiable ownership of the virtual items in the form of NFT collectibles.

NFTs are, as a result, ideal for wait-and-HODL strategies, although there remains some uncertainty about when, if at all, an NFT will appreciate over time.

With staking, however, NFT owners can monetize their collections. It refers to locking up NFTs on a blockchain protocol to earn rewards from the staking platform.

Many NFT holders also use it to grow their crypto portfolio and earn interest without selling their assets. It is also used to increase exposure to new NFT projects.

The rewards earned from the NFT staking pool are directly proportional to how much is staked. Most platforms using proof of stake (PoS) blockchains use staking to incentivize more users to participate and secure their networks.

Before staking NFTs, holders need to read the terms and conditions of the contract closely to maximize the rewards and minimize risks from staking. The following are some things to keep in mind when participating in NFT staking:

Eligibility of Tokenized Assets

As a potential NFT investor, it is important to ascertain the eligibility of their tokens for staking, as not all NFTs can be staked. Only NFTs that have been distributed by protocols supporting NFTs can be staked.

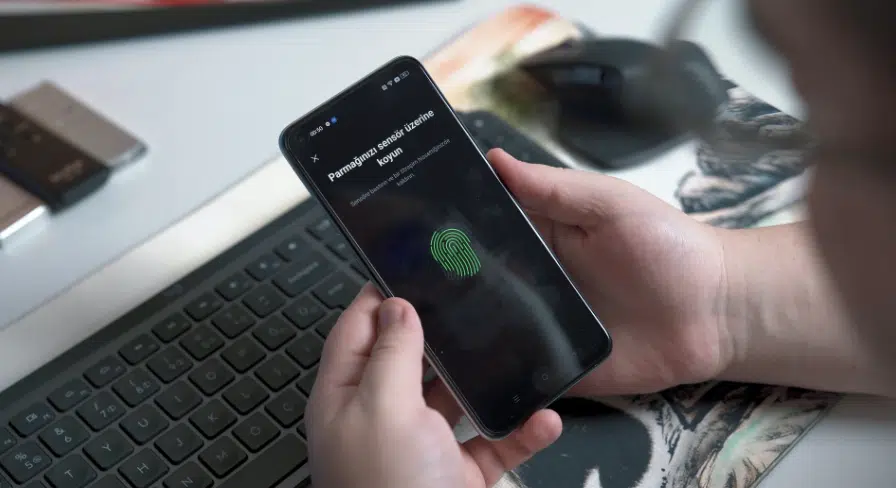

To verify your digital asset’s staking eligibility, ensure it fulfills the contract’s terms, such as signature ownership verification and maximum staking limits.

Compatibility of Digital Wallet

It is important to note that not every NFT wallet is compatible with staking. As a result, before investing in NFT staking opportunities, you will want first to send the NFTs to a compatible wallet. Using a non-compatible wallet may cause your staked NFTs to be confiscated by the contract at any point in the process.

Requirements of the Contract

As an NFT holder, you must thoroughly read the contract terms before staking NFTs. Within the contract, essential details such as fees, annual interest rate, and payout schedules will affect the amount paid as a staking reward.

In addition, details such as the staking cryptocurrency to ascertain if you will receive rewards in the same currency as the token.

Staked NFTs’ Verifications

Finally, check the contract for other verifications to be completed before presenting the tokens to be staked. One common verification often required by contracts is ownership verification.

Trusted Partners

How does NFT staking work?

Staking NFTs resemble proof of stake, a system where token holders actively stake their coins, enabling them to validate transactions and earn additional assets in their crypto wallet.

Alternatively, some protocols resemble the PoS system, requiring participants to engage in validation processes before receiving staking rewards. Often chosen randomly based on the number of staked NFTs, validators increase their selection chances by pledging more NFTs.

After adding a new block to the chain, validators confirm transaction blocks and newly minted tokens are distributed as staking rewards. NFT staking rewards depend on the number of staked NFTs and the staking duration.

NFT holders allow idle assets to generate passive income by staking and validating the blockchain.

What are various NFT Staking Platforms?

Several NFT staking platforms are out there, and it is important to do thorough research before picking one, as various blockchain platforms have pros and cons.

Some platforms reward users simply for staking assets and completing verification, while others require users to validate blockchain transactions before receiving rewards. Furthermore, choose your staking platform based on the desired cryptocurrency for payment.

Binance NFT Power Station

This platform allows you to stake your NFTs for BnBs, one of the most commonly used utility tokens with a wide range of applications. You can also charge NFTs supported by the token platform and earn even more rewards.

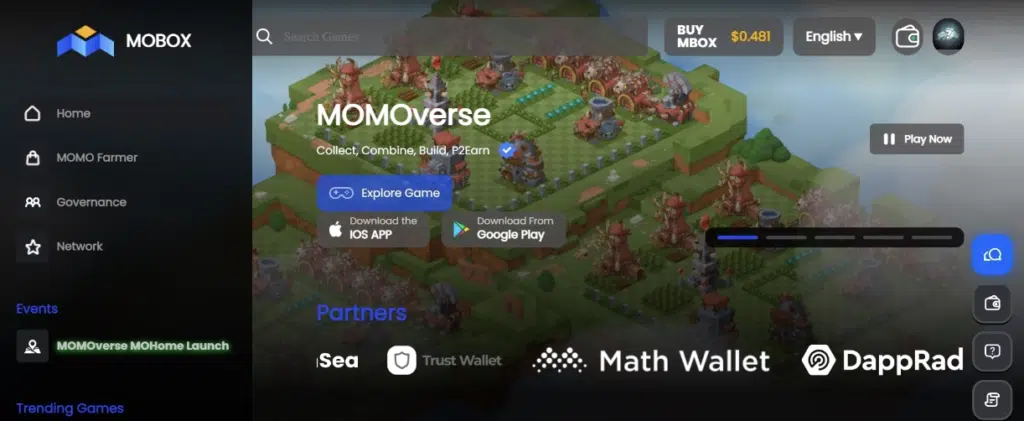

MOBOX

MOBOX is one of the most popular community-driven platforms on the NFT market; it offers NFT investors a platform for playing around with their favorite NFTs while earning rewards.

The platform allows the staking of MOMO NFTs designed to have different characters. Each character has its own ‘hash power,’ determining the rewards given to its owner.

In addition, MOBOX allows owners to stake their NFTs to earn rewards. Rewards on MOBOX are disbursed in MBOX tokens, which can easily be converted to Ethereum or other coins on the crypto market.

KIRA Network

The KIRA Network is a very volatile platform. This is because it allows for cross-chain staking, the only platform currently providing NFT holders with this feature.

KIRA allows for staking on other networks or blockchains such as EOS or Ethereum, and you still have the option to liquidity them whenever you need access to your funds.

DeFi applications are hosted on the KIRA Network with real-time value of the different assets being staked. This means that the platform allows for identifying the importance of virtual assets. In addition, KIRA is one of the most popular trading platforms, allowing holders to partake in trades using blockchain technology.

As a result, Kira Network is unique in its ability to be flexible enough to give users full control over their funds while being an information hub and allowing them to benefit from staking.

Benefits and Risks of Staking NFTs

NFT staking offers numerous opportunities for enthusiasts to earn passive income, but it also carries several risks.

Some of the benefits of staking NFTs include the following:

- NFT staking provides holders with the opportunity to make passive income. The process allows holders to make up to 5% to 20% of the value of their staked NFTs. As a result, the greater the value of NFTs staked, the greater the reward.

- NFT staking, unlike mining, is simple and equipment-free; often, just locking up an NFT yields rewards, although some platforms may require blockchain validation participation.

- Another benefit of staking is the opportunity to contribute to future projects within the NFT community.

On the other hand, a couple of risks are associated with staking NFTs. Some of these include:

- Because the NFT market is still relatively new, it is challenging to tell who is trustworthy. As a result, many holders become victims of scams that steal staked NFTs.

- Staking NFTs is also risky because of price sensitivity. The value of NFTs can increase or decrease significantly.

Conclusion

NFTs are digital assets in the form of internet collectibles such as art, music, videos, items in blockchain games, and so on. They are unique and cannot be duplicated. NFTs operate on the Ethereum network and are recorded on the blockchain. These tokens prove the ownership of physical or digital assets.

NFT staking allows NFT owners to monetize their NFT collections by locking the NFTs on a blockchain protocol via a staking platform. Many NFT holders also use it to grow their crypto portfolio and earn interest without selling their assets. It is also used to increase exposure to new NFT projects.

The rewards earned from the NFT staking pool are directly proportional to how much is staked. There are also benefits and drawbacks to staking NFTs.