TLDR

Many cryptocurrency traders and investors have fallen victim to the IRS because many don’t realize that crypto-related income is to be included in tax reporting. After all, the IRS regards crypto as property rather than virtual currency.

If you haven’t been doing so, it’s time to start tracking all your crypto transactions for proper documentation.

The best way to do this and avoid all the complex processes is to use Koinly as a third-party tracking software that you can sync directly to your tax forms.

The second alternative is to get a professional to help with proper documentation and reporting.

This guide will give you everything you need to pay crypto taxes and get the best insider tips & tricks to pay taxes on crypto too.

Introduction

Cryptocurrency has recently become a popular investment option, but many people are unsure how the United States government taxes it.

Generally, cryptocurrency is treated as property for tax purposes rather than as a virtual currency.

When you sell or exchange Bitcoin, Ethereum, or other cryptocurrencies, you may have to report the transaction as capital gains or loss on your income tax return.

The financial interest of the IRS in digital currency transactions is not new. According to IRS Notice 2014-21, cryptocurrency is considered taxable income because it is considered property rather than a digital currency.

How Do I Know My Crypto Income Tax?

The tax implications of cryptocurrency transactions can be complex, so it’s essential to understand when and how your crypto is taxed as income in fair market value.

To understand the crypto income tax, there are two main events worthy of note: taxable income and non-taxable income. It is important to understand the difference, so let us go through them.

Non-Taxable events

What are considered non-taxable events:

- When you buy and hold cryptocurrency: You do not have to report it as income if you buy it without any plans of selling or exchanging it. However, you must register capital gains or losses once you exchange virtual currency for profit.

- Donation: If you buy any digital currency intending to donate to a recognized charity cause, you can claim a charitable deduction and not carry any tax burden like a tax deduction.

- If someone gifts you valuable virtual currencies: you won’t have to pay any tax until you record gains and losses on any exchange you make.

- Gifting: You can give up to $15,000 worth of virtual currency to anyone and an even higher amount to your spouse without attracting any tax liability. If you gift an individual any virtual currencies exceeding $15,000, you can escape the tax bill by filing a gift tax return. You can also avoid paying taxes on the crypto if your exchange is not for a good or service.

- Self-Transfer: Crypto transactions between two wallets owned by the same individual are not taxable.

The Taxable Events

- Selling crypto with a profit is considered a taxable transaction in the U.S. If you incurred losses, deducting that loss from the cryptocurrency taxed is possible. Therefore, you owe crypto taxes if you sell your original asset for more than what you bought.

- You might also owe taxes on crypto exchange if you convert one crypto asset to another crypto asset because you technically have to sell the original asset to buy the new one.

- The tax authorities will consider short-term gains or losses on your cryptocurrency if you sell or exchange it within a year of holding it. They will then tax these gains or losses at your ordinary income tax rate, the same rate applied to any other income you earn.

- If you hold your cryptocurrency for more than one year before selling or exchanging it, any gains or losses will be considered long-term and taxed at the lower capital gains tax rate.

- If you use cryptocurrency to pay for goods or services, you must report the transaction as income and pay taxes on the value of the goods or services received. This is because the IRS believes that to convert your virtual currency into a medium of exchange, you must sell it first, and crypto trading attracts capital gain taxes.

- If you receive cryptocurrency as payment for goods or services, you will have to report the transaction as income and pay taxes on the value of the crypto received.

- If you earn cryptocurrency through mining or staking, you owe crypto taxes based on a fair market value, have to report it as income, and pay taxes on the value earned.

- If you hold certain digital assets such as USD and earn any returns, it is considered taxable income. The IRS treats these returns as income rather than interest.

- ETH2: If you staked ETH and have ETH2 accruing interest, these interests are not considered taxable income until they are released into your control.

- Airdrops and Other Incentives: If you receive a cryptocurrency airdrop or fork, you must report it as income and pay taxes on the value of the crypto received. The same goes for receiving any reward through referrals, sign-ups, or other types of reward. All of these attract crypto income taxes and are considered taxable.

It is important to note that the tax laws regarding cryptocurrency are still evolving and may change in the future. Therefore, it is always best to consult a financial advisor or tax attorney to stay abreast of the policies and regulations governing all crypto transactions.

How Much Crypto Income Tax Do I Owe?

Now that you have realized that some cryptocurrency transactions are taxable, what is the following line of action?

You can start independent tax reporting by calculating how much you will owe taxes through gains, losses, and every other crypto exchange over time.

How To Calculate Your Crypto Income Tax

If you live and work in the U.S., you usually see automatic federal and state tax deductions from your payments.

However, the crypto income tax rules require you to consider every income received in crypto as a taxable event. However, they do not automatically deduct ordinary income tax rates.

When you report your taxes, the IRS will calculate your tax liability based on the fair market value of your cryptocurrency as income.

Paying capital gains tax on significant profits earned from crypto can affect your tax bracket. You also might need to pay more on your capital gain tax.

You can check the IRS website for the latest information on tax forms and report income, capital gains, and losses.

Difference Between Long and Short Term Capital Gains

The period you hold your crypto assets significantly affects how much crypto tax you pay. Both long and short-term capital gains apply to cryptocurrency taxed at federal and state levels.

Essentially, the difference between what is regarded as lengthy and short-term capital gains is time.

The longer you hold it, the less you pay. The shorter you hold it, the more you pay.

Steps To Calculating Your Crypto Tax

Step 1: Know Your Cost Basis

Your cost basis is generally the number of crypto assets you begin with. The cost basis may differ according to various situations.

The cost basis for your first crypto purchase is the amount you paid.

Your cost basis would be the worth of the crypto according to the fair market value of the time if you started by mining or staking crypto.

If someone has gifted you your first crypto, your cost basis will depend on both the individual who gifted it to you and the fair market value of the crypto at the time of the gift.

Step 2: Determine Your Capital Gains and Losses

After determining your cost basis, subtract how much you made from your crypto sales.

If your sales exceed your cost basis, you have made capital gains; no capital loss; if it doesn’t, you have incurred capital losses.

This is a reasonably straightforward process if you have all the documentation and are good with numbers. If you’re not, a third-party tracking app is for you.

Third-Party Tracking Apps For Calculating Your Crypto Taxes

Several third-party software solutions are designed specifically to help individuals with the complex tax rates associated with cryptocurrency.

However, to choose the best software that suits you, there are things you must look out for before you make a choice.

Data Integration

Most Cryptocurrency trackers work through a system that connects third-party aggregator APIs. This way, it helps feed the single platform with all your numerous crypto data.

The tricky thing about these trackers is that most can only function in specific countries or work with particular platforms. This means that not every tracker will work for you.

This is why testing the tools you see and ensuring they work well in your specific environment and for your particular need is important.

High-Security

Since cryptocurrency operates on a decentralized system, low-level security could enable malicious users to steal other users’ information. This is a crucial factor to consider.

Finding a tracker that prioritizes security is easy to find.

Besides, check their websites for tools like data encryption, two-factor authentication, and extra points for trackers that don’t have direct access to users’ account information.

Automation and Ease of Use

Aside from tax information, one of the primary reasons people use trackers is the ease of seeing all your activities and assets on a single platform.

The ease of automation will also keep track of your transactions in real-time without having to input the individual details for each asset all the time.

We recommend Koinly as a tax-tracker

Getting a tracker that can offer you excellent services and still help keep all transaction documentation can be a significant task, as there are many things to consider when choosing.

This is why we recommend Koinly as your one-stop shop for taxes.

If keeping your records organized due to multiple trades or wallets is proving challenging or time-consuming, this app was designed specifically for you.

You can now import your coins directly from the ledger, sync all your exchange trading history in one click, and be ready for accurate and up-to-date tax return reporting in minutes!

With Koinly, you do not have to spend hours downloading data or miscalculating market prices to document capital gains and losses properly. Koinly automatically imports your transactions and generate tax return when required.

How To Use The Koinly App

Now that you know how essential the Koinly software is and how it can help you, the next step is to get started.

More details

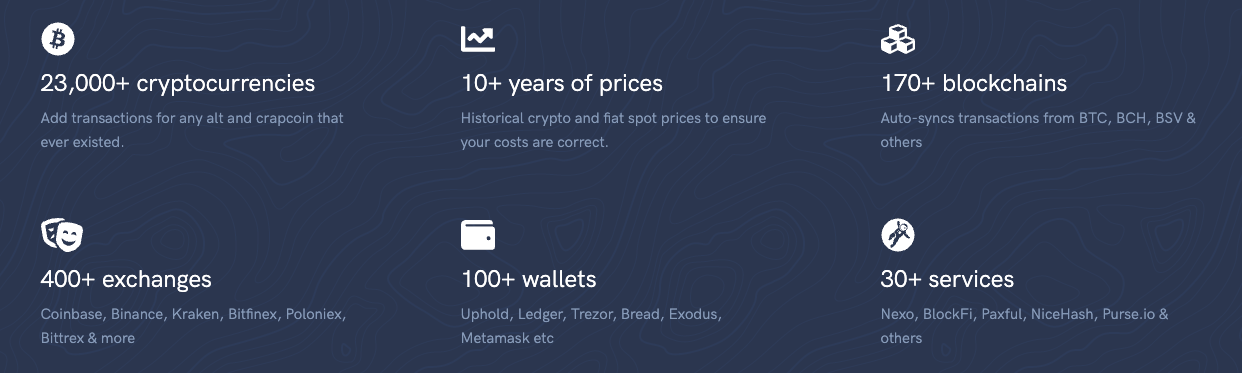

Koinly is one of the top leading crypto tax software. It leverages automation to directly import crypto transactions from supported integrations and calculate gains and losses to determine tax implications. Koinly supports more than 700 integrations and is available in over 20 countries and functions using the tax law of the supported countries. The use of Koinly is flexible and also functions as a portfolio tracker, giving an overview of all your assets in one place.

-

Multiple tax reports.

-

Numerous country support.

-

Easy to use.

-

Flexible plans.

-

Wide integration support.

-

Does not accept cryptocurrency payments.

-

Slightly expensive.

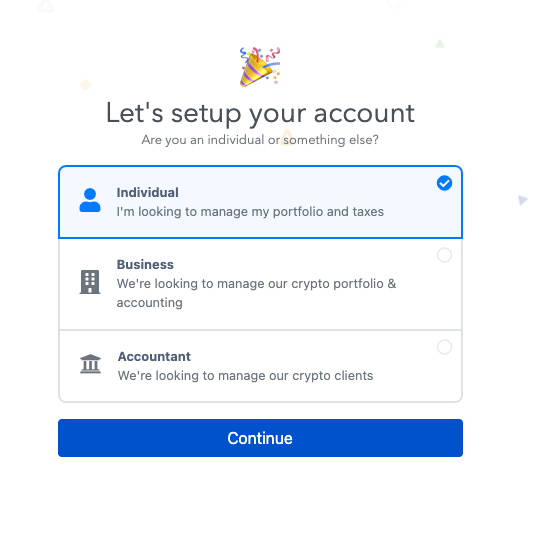

Step 1: Sign up

The first thing to do is to sign up on the website. You can choose to do this manually or use your Google account.

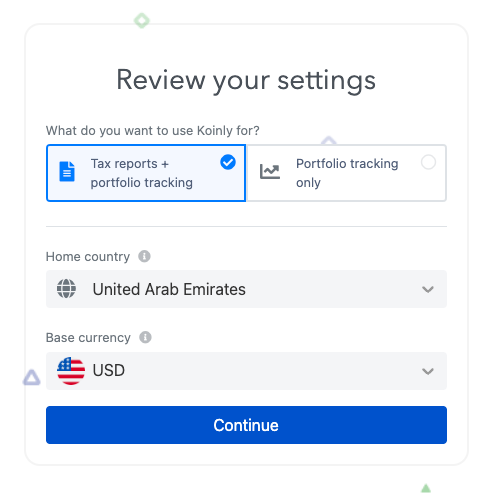

Step 2: Select your location

The next step is to select your location for accurate tax tracking and reporting.

You can go to your settings and customize it for correct tax reporting according to the policies of your location.

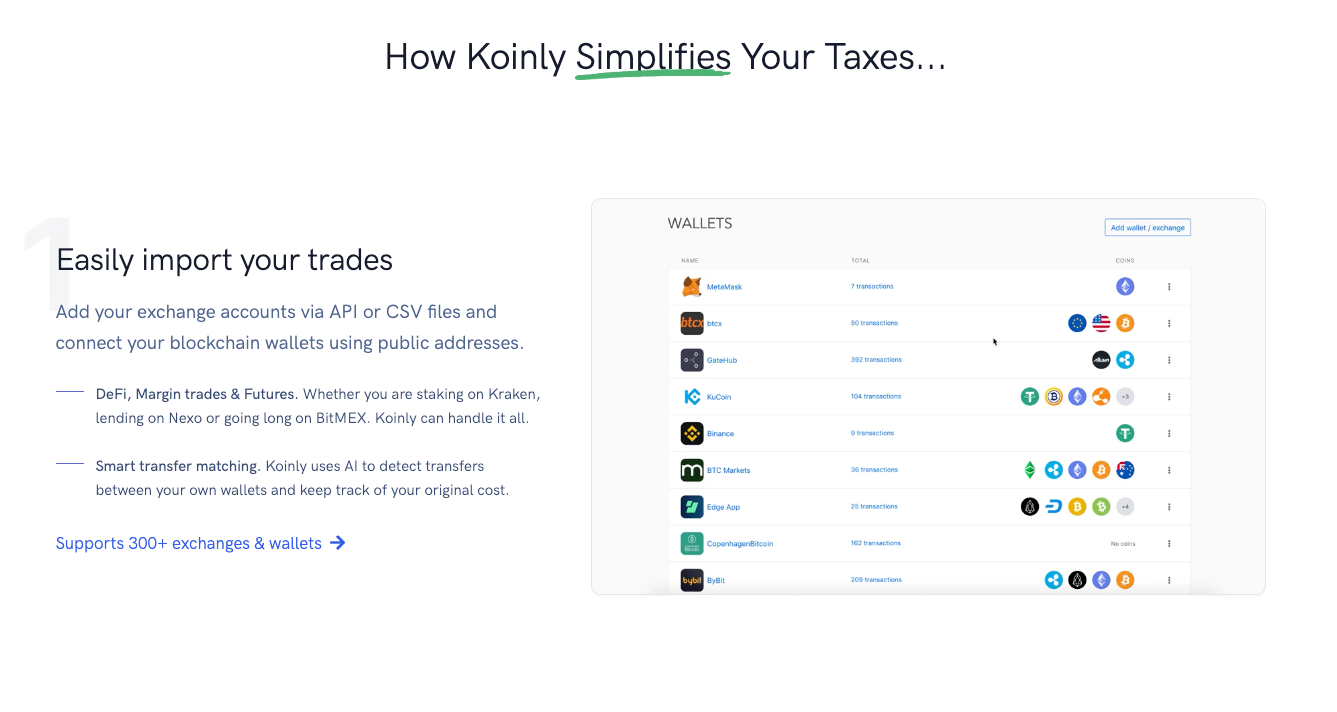

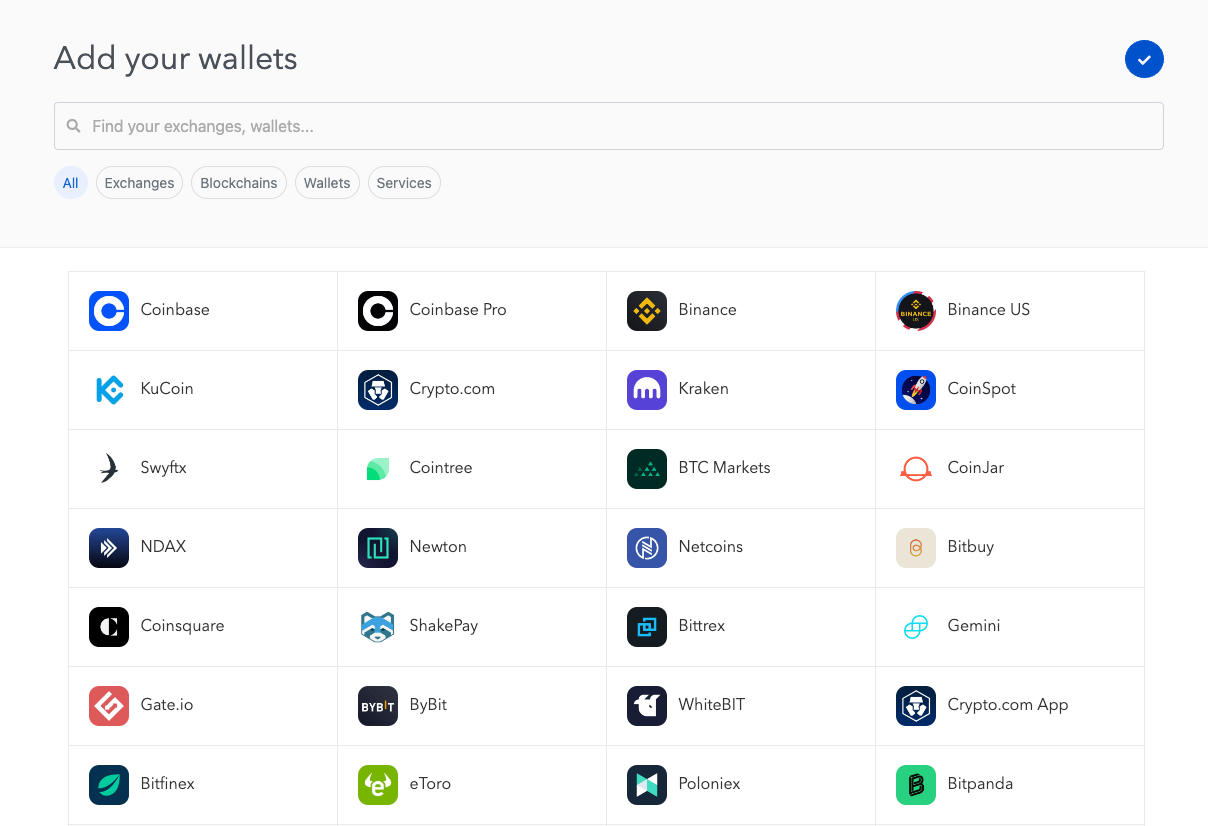

Step 3: Add wallets and exchange accounts

Once registered, proceed to the dashboard, enter your wallet, and exchange account information.

Koinly connects with a vast range of crypto services and helps track your activities across over 6,000 blockchains, 350 crypto exchanges, and 75 wallets.

As a result, Koinly supports many leading crypto service providers. It also connects with crypto lending platforms like Nexo, BlockFi, and Compound.

Besides, the platform is also suitable for tracking your portfolios and investment accounts by linking them to your Koinly account.

Koinly also integrates and generates automatic import for 14 blockchains, including BTC, ETH, LTC, NEO, and EOS, with over 6000 cryptocurrencies you can import or record manually.

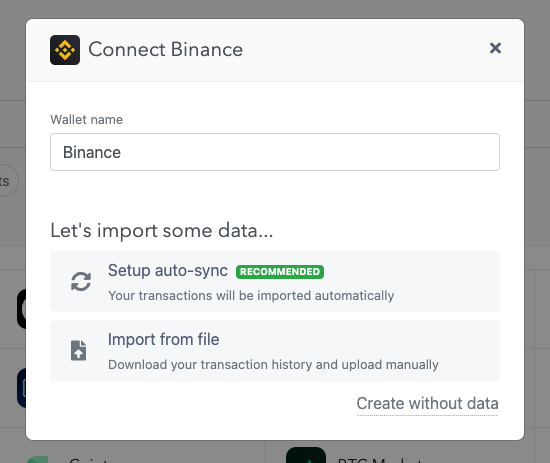

Step 4: Import all your transactions 📝

You have two options:

- Auto-sync the data

- Upload your transaction history manually by attaching it as a file

Click [Continue] once you select your wallet(s).

Step 5: Calculate capital gains

Next, click [Calculate capital gains] on the top menu to generate your crypto tax report.

Step 6: Download your Tax report

You can download your tax report now (for your records).

However, if you’re unhappy that your crypto tax report numbers are correct, you can change your data and generate a new report. If you are happy with the numbers, click [Yes].

And you’re done! Fill in your profile details while your assigned accountant prepares your tax return. woohoo!

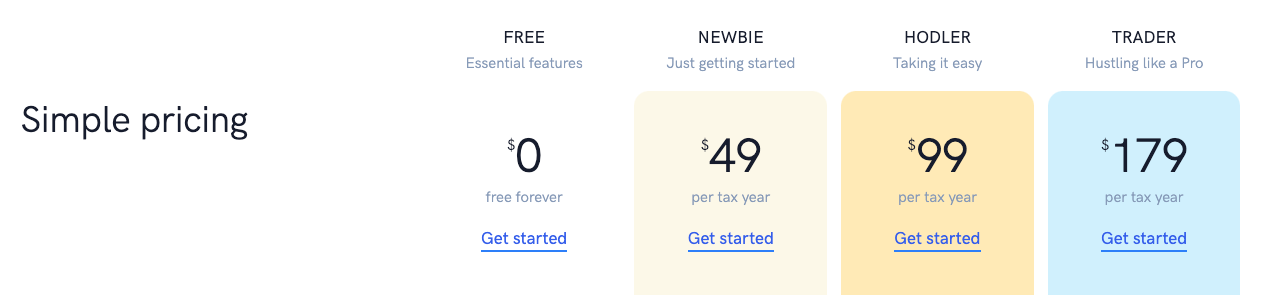

Price Plans for Koinly

The Koinly Platform has a good range of price plans catering to crypto users and investors.

Free Price Plan

This basic plan allows users to track their exchanges, trades, accounts, and wallet activities; you can also generate a capital gains tax preview on this plan. The Free plan also gives users access to FIFO and LIFO tax reports to connect and import data from various sources.

The Holder Plan

This plan costs $49 per tax year. It helps generate FIFO and LIFO tax reports alongside international tax reports, accessible audit reports, and Form 8949 and Schedule D reports. With this plan, you can also export to TurboTax and TaxACT. The only limitation to this plan is that you are only allowed up to 100 transactions.

The Trader Plan

Additionally, this plan costs $99 per tax year and has the same services as the Holder plan, with a limit of 1000 transactions and access to priority support.

The Oracle Plan

This plan costs $179 per tax year with access to 3,000 transactions and $279 for 10,000 transactions. The Oracle plan gives you access to the complete features and tools available on Koinly. You can also get free bulk actions and processes on this plan.

Key Features Of The Koinly Software

More details

Koinly is one of the top leading crypto tax software. It leverages automation to directly import crypto transactions from supported integrations and calculate gains and losses to determine tax implications. Koinly supports more than 700 integrations and is available in over 20 countries and functions using the tax law of the supported countries. The use of Koinly is flexible and also functions as a portfolio tracker, giving an overview of all your assets in one place.

-

Multiple tax reports.

-

Numerous country support.

-

Easy to use.

-

Flexible plans.

-

Wide integration support.

-

Does not accept cryptocurrency payments.

-

Slightly expensive.

1. It Supports over 20 Countries

This is one of the most outstanding features of the Koinly software. It works in over 20 countries across Asia, Europe, Oceania, and the Americas. With Koinly, you can generate several forms, schedules, and sheets that ease tracking your crypto income taxed.

2. Extensive Integration

Koinly works with over 6,000 blockchains and supports automated imports for BTC, ETH, LTC, and NEO.

It also effortlessly merges with 350 exchange platforms, including Binance, Coinbase, and other portfolio apps such as Blockfolio and Delta.

You can also track your mining, trading, staking, and other DeFi activities of over 70 wallets on Koinly.

3. Importation of Data

On the Koinly software, you can easily connect with many services through their seamless API and import key data.

4. Free Account

If you are unsure how Koinly works and would love to test it, the free account option allows tracking up to 10,000 transactions and generating capital gains taxes.

The free account also allows you to track all crypto activities indefinitely.

5. Excellent Customer Service

The Koinly software prioritizes customer communication through its support page and comprehensible FAQ page for answering questions and providing solutions on crypto taxes and capital assets.

You can connect with its social media pages like Facebook, Twitter, and e-mails.

Tax Reports On Koinly

Koinly generates many local and standard capital gains tax reports for many countries.

Local Capital Gain Tax Reports

- K4

- Capital gains tax summary for the UK

- Swiss Valuation report

- Form 8949 and Schedule D

- Rf1159

- Sheet 9A

There are few of the local capital tax forms self-employment income produces.

Standard Capital Gain Tax Report

- Complete Transaction Report: This is the full documentation of all exchanges across your crypto wallets.

- Income Reports: This document will contain all your taxable events, like rewards from interests, airdrops, forking, and staking.

- Capital Gain Reports: You can record all your disposals in one document.

- Non-Taxable Income Report: This would include everything recorded as gifts, donations, and lost assets to ensure you don’t pay tax on them.

- Expense Reports: This document would contain everything recorded as cost. However, it would not include trading fees documented in your capital gain reports.

- TurboTax Reports: This would contain all the necessary information on your capital gain or loss in a corresponding format with the Turbotax tax software.

Complete Tax Report: This is the document of your short and long-term capital gains, transactions, and annual summary. This document is accessible and can be downloaded as a PDF file.

How Do You File Your Crypto Taxes

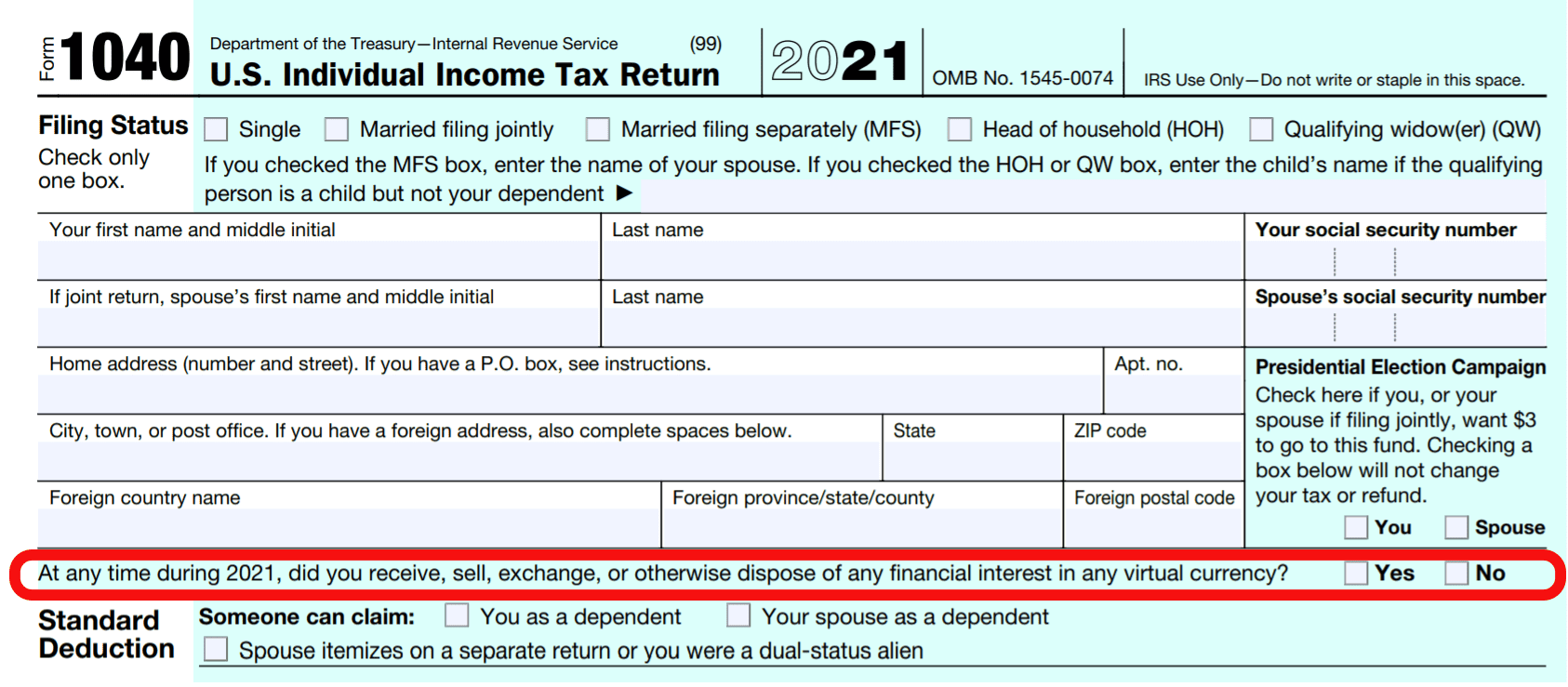

There is never a wrong time to start organizing your crypto tax reporting. The standard form has been updated to include whether you engage in crypto brokerage services during the year.

The IRS has also changed to Form 1040 and now includes this question: “At any time during 2022, did you receive, sell, send, exchange, or otherwise acquire any financial interest in any virtual currency?”

While simply buying and holding cryptocurrency alone isn’t taxable, selling a cryptocurrency attracts cryptocurrency taxes.

Here are some of the things to do when gathering your information:

- Keep Track Of Your Transactions: Ensure you keep all the information on your transactions to date. Record your cost basis, how long you held your crypto, your profit, and every receipt you can get. Your report with the IRS will not involve offline transactions; you can get the best third-party crypto tax software for tracking online and offline transactions.

- Fill Your Forms: After you have all your transaction information up to date, you must fill all required tax forms correctly.

- File Your Taxes: If you use a third-party app to track your transactions, you can connect this to your tax software and sync all the information.

Hire a Financial Advisor/ Tax Professional: Tracking and preparing all your tax information on your own may require a lot of work and a complex process. Alternatively, you can use tax preparation software to help you file your taxes accurately and on time. However, remember that not all tax software is created equal, and you should research to find one that fits your needs.

What Happens if You Don’t Pay Your Taxes

If you have found yourself in this situation, panic is unnecessary.

You are one of many investors who didn’t know to include your crypto-related gains and losses with your other capital assets.

The best way to manage this situation is to update your previous year’s tax information with your crypto-related information. It is better to do this before the IRS starts investigating and chasing you for cryptocurrency taxes.

The IRS treats tax evaders seriously, and by reporting yourself, you may avoid further investigation and more error discoveries.

The Best Way To Keep Your Cryptocurrency Taxes on The Low

- Don’t Sell Right Away: Some people are ready to sell their crypto when the market fluctuates. This will get your taxes on the high side. Hold your assets for at least one year before selling them off. This way, you can qualify for a long-term capital gains tax rate.

- Keep Track Of Your Losses: This way, you can write off as much as $3000 in tax loss harvesting when you claim all the losses made during the year.

- Donate: If you can, donate some of your crypto assets, as this will attract a reduction in your tax rate according to the value you donated.

Conclusion

Cryptocurrency is a property for tax purposes; hence, when you sell or exchange crypto, you may have to report the transaction as a capital gain or loss on your income tax return.

Consulting a tax professional before making any crypto transactions is essential as the tax implications of crypto transactions can be complex, and it is important to understand when and how your crypto is taxed as income.

Koinly is the best tax tracker we can recommend for everything tax-related.

Happy taxing!

When you receive cryptocurrency as payment for goods or services or through an airdrop, the received amount will be subject to taxation at ordinary income tax rates. On the other hand, if you dispose of your crypto, the net gain or loss amount will be taxed as capital gains.

If you dispose of your cryptocurrency within a year of acquiring it, you will be subject to short-term capital gains tax. This type of tax is considered as ordinary income for taxation purposes, and the percentage of tax can vary between 10% – 37%, depending on your income level.

All taxable transactions involving virtual currency must be reported on your Federal income tax return for the taxable year of the transaction, regardless of the amount or whether you receive a payee statement or information return. This includes reporting income, gain, or loss from such transactions.