This Accointing review will examine all the positive and (very few) negative aspects of Accointing as crypto tax software.

Accointing supports over 300 integrations and works across multiple countries by selecting country-specific crypto tax options. The software automatically imports transaction data from exchanges using API keys. It ensures the complete security of transactions and protects the users’ privacy.

A strong plus is its desktop and mobile app versions. It generates tax reports from several cryptocurrency exchanges and wallets. The only drawback of Accointing is that it does not have unlimited transactions, even for the highest-paid plan.

This review shows that Accointing has four different plans, including the free version. The price range from $79 annually to $299, and you can get a maximum of 50,000 transactions per report.

Who Should Use Accointing?

Accointing is a one-stop shop for most of your crypto needs, especially regarding accounting and the analytical aspect of cryptocurrency.

If you’re a DeFi degen or HODLer, it becomes increasingly difficult to manually manage all crypto transactions, trades, and tax reports. Accointing provides a multi-solution to these challenges by providing an automated system to help you monitor your transactions and help in generating a tax report.

For New Users

The crypto tax software is easy for anyone, including new crypto enthusiasts looking to manage their portfolios and effectively file tax reports. However, the numerous tools available on Accointing can be somewhat overwhelming for new users.

Professional crypto traders widely use Accointing due to its sophisticated features and ease of use. There are different plans provided by the platform, including for starters. The starter plan is free and easy to navigate for first-time users.

What Countries Are Supported?

The tax software generally supports crypto taxes for countries like the USA, UK, Australia, France, Germany, and most EU countries.

Other countries supported by Accointing can use the software if they have similar tax laws and regulations. They plan to extend the services to support even more crypto users in other parts of the world.

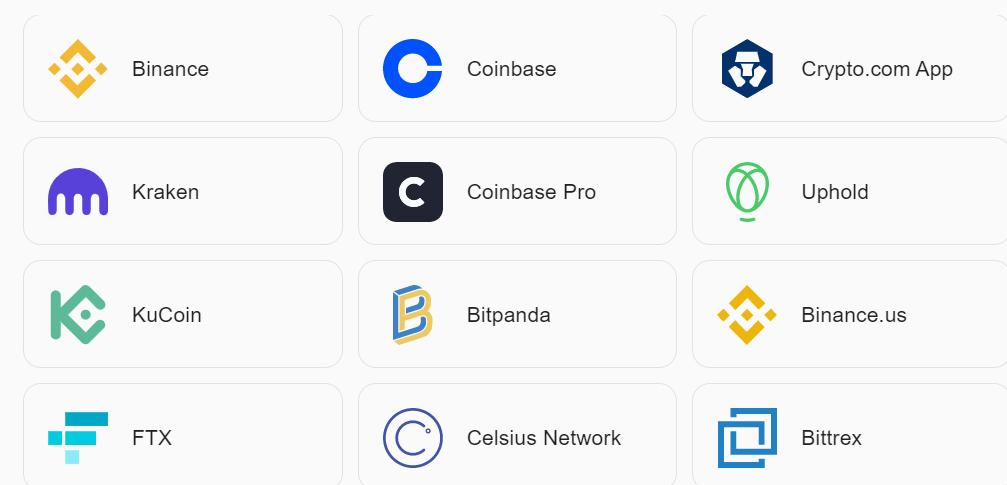

What Integrations Are Supported?

Although the crypto tax software is limited by its price and geographical availability, it has a wider reach with the number of integrations – exchanges, and wallets – it supports. It currently supports the integration of over 300 different wallets and exchanges and over 7,500 currencies.

The exchange data are imported automatically on Accointing using Application Programming Interface (API). For exchanges that cannot be automatically integrated on Accointing, you can download the transaction history in a CSV format file and upload it directly.

The platform also works as a portfolio tracking dashboard; you can import all your transactions using API, wallet address, and manual input and review and track the performance while analyzing for gains and losses.

What Makes Accointing a Good Choice?

Effective Tax Management

It adopts global techniques like the same-day rule to analyze trade profits and losses. The software also classifies transactions separately to identify assets and profits made off trade.

Accointing comes pre-loaded with tax reporting regulations available for the countries it supports. You only need to select the country you are reporting tax for, and you will get your country-specific tax report.

The generated report can be used to fill out tax forms or shared with a tax professional for further review.

Enhanced Privacy and Security

Accointing boasts of a highly secure platform that secures the privacy of users’ data used to generate tax reports. Such data are fully encrypted using the AWS Key Management System (KMS) per industry standards.

Although the tax software can access exchanges and wallets, it only requests read-only access to users’ exchanges. This means it cannot alter your trade or finance on the exchange or wallets.

If you delete your account from Accointing at any point, all the data obtained so far will also be deleted.

Weekly Reports

Aside from creating and generating tax reports alone, the system provides insightful details for its users. Some of these insights include the weekly market reports generated to inform users about current investments and how to maximize profit-making.

In addition to the weekly market reports, numerous other educational resources are available on the platform to enhance the understanding of tax regulations present in different countries.

Trusted Partners

How to set up an Accointing account?

Now that we know what the benefits are. Let’s show you how to set up an account.

Step 1: Create a Free Account

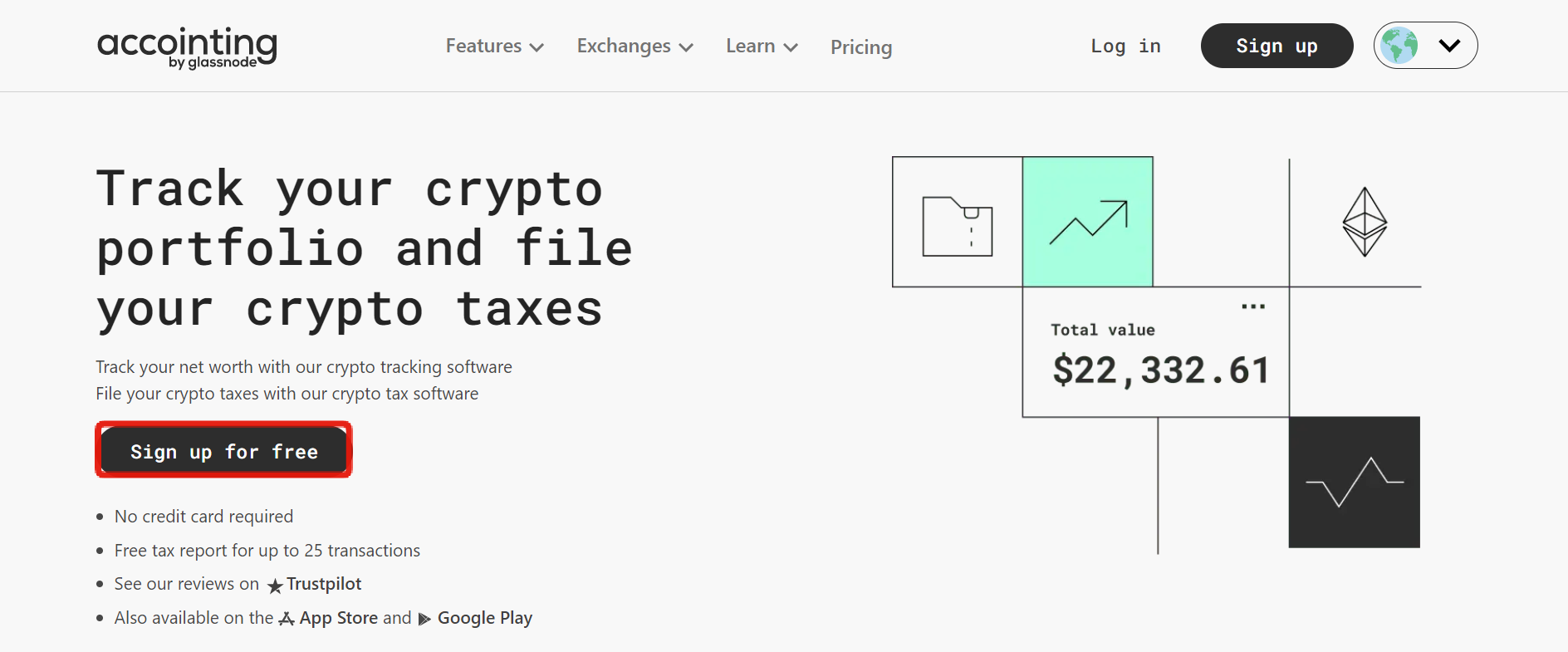

Visit Accointing website to create a free account. Click the [Sign up for free] button on the website homepage.

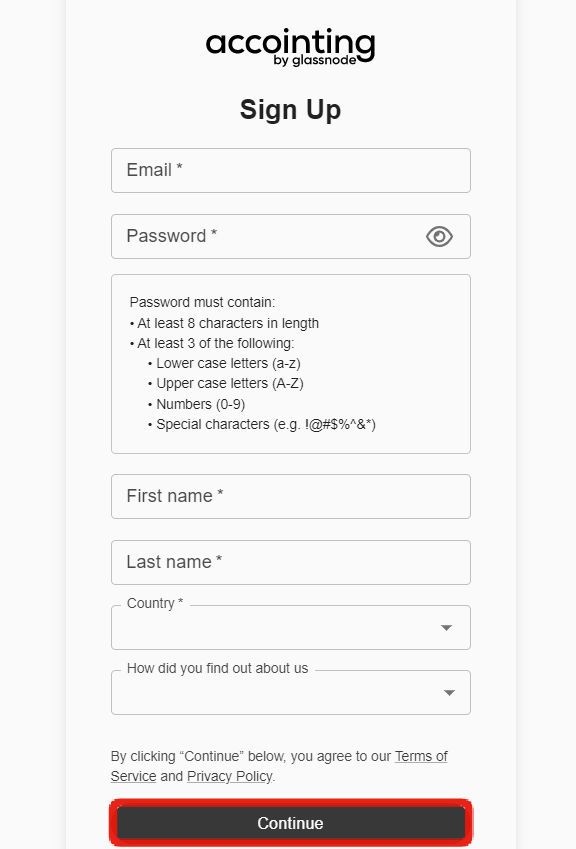

This leads to the signup page, where you must enter personal details such as name, country, e-mail address, and password.

Once this is done, select the [Continue] button.

Step 2: Sync Exchanges and Wallets

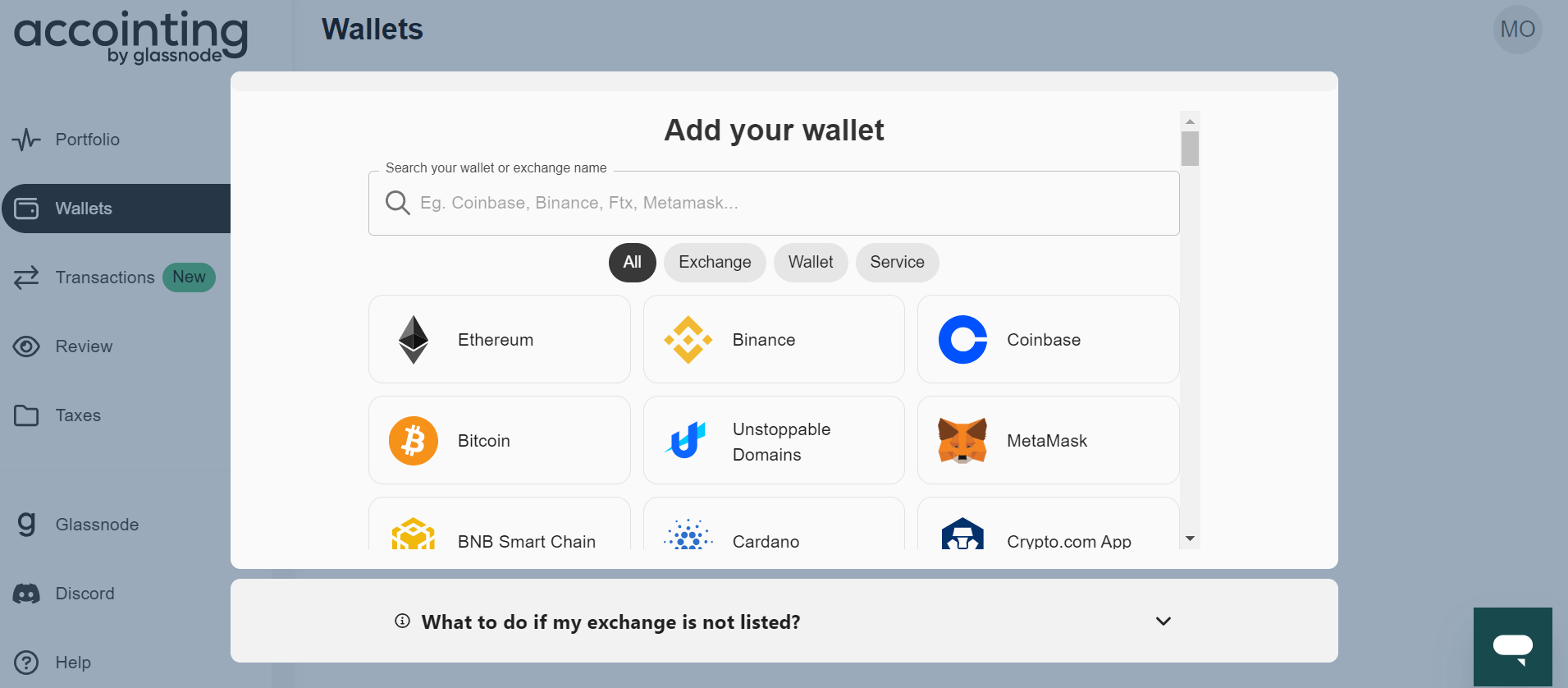

The next step requires integrating your wallets and exchanges with Accointing using APIs.

Select as many wallets or exchanges as you require. Once fully integrated, you can prepare to automatically import transactions from all of them.

Step 3: Import your Transactions and Generate Tax Report

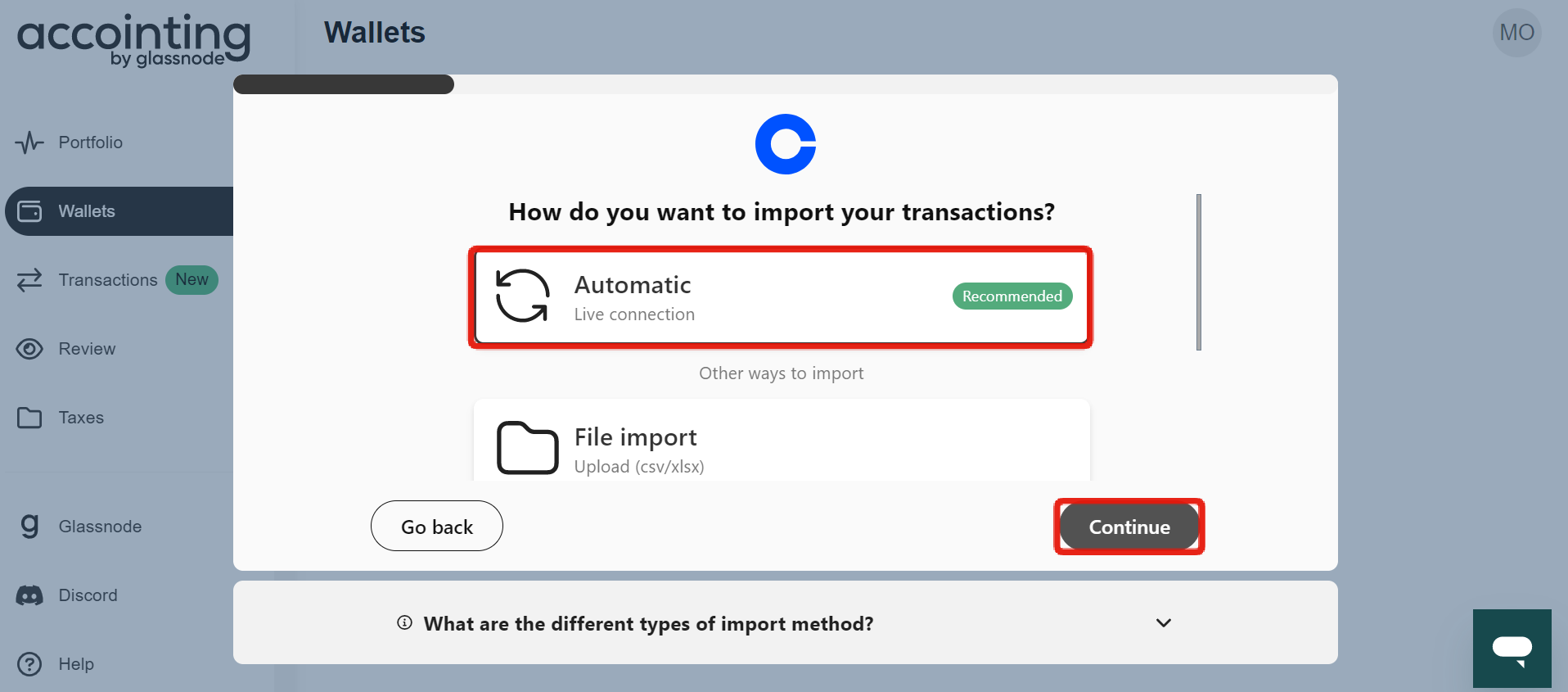

You should select the automatic option of importing your transaction from the connected crypto exchange or wallet. Select the [Continue] button to proceed.

Import your transaction and generate your tax report.

That is all you need. Congratulations!

Accointing Review – Pricing and Plans

There are four different plans available for Accointing, including the free plan. The crypto tax software has top reviews and an amazing 30-day money-back guarantee policy for any plan. The plans are also flexible, and you can upgrade at any point in time.

Free Tax Plan

Accointing comes with a free plan, especially for early crypto starters and those that want to try out its features before subscribing.

Despite being a free plan, it has several exciting features, including tax loss harvesting. However, the number of transactions that can be imported using the free plan is 25.

Hobbyist Plan – $79/year

This is a higher plan when compared with the free version. The paid hobbyist plan costs $79 annually, giving you access to up to 500 transactions for each tax report.

It has all the features available on a free tax plan and has the added advantage of e-mail support. Users of this plan can get easy and fast access to customer support.

Trader Plan – $179/year

A higher version of the paid plan is the trader plan. It costs $179 annually, and users can import 5000 transactions for each tax report. You will also have access to all the available features on the Accointing platform.

Pro Plan – $299/year

The pro plan is recommended for heavy Bitcoin and crypto traders. The plan costs $299 annually and can support up to 50,000 transactions for each tax report.

Accointing Review: Top Features

Desktop and Mobile App

The software has both a desktop and mobile app to accommodate the needs of its numerous users. Both desktop and mobile apps have a user-friendly interface and easy navigation.

It includes a portfolio tracking overview, crypto market intelligence, cryptocurrency tracking, and tax alerts.

Despite the mobile app’s usability, you still need the desktop version to import and generate your tax report.

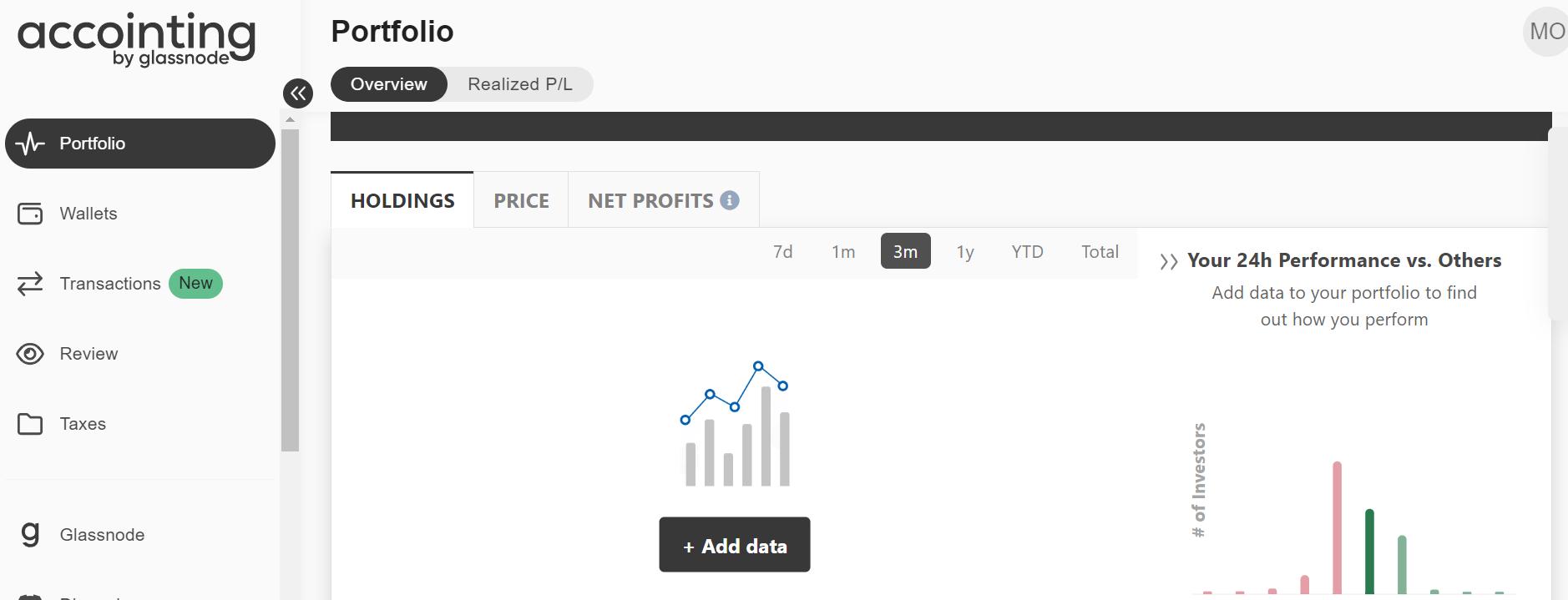

Portfolio Analytics

Accointing offers comprehensive analytics of your cryptocurrency portfolio once you integrate your exchange or wallet. With crypto portfolio analytics, you can quickly review your crypto investments.

Another useful feature of this crypto portfolio analytics is that you can analyze your financial positions and make valuable investment strategies based on the values and the information obtained from the analytics.

Crypto Tax Calculator

An added feature of Accointing is its crypto tax calculator. The calculator monitors trading activities and calculates the taxable amount based on gains and losses.

It also helps in making guided decisions since you can know the tax implications of your trade even before you finalize the trade. At the end of the year, the final transaction history with taxes is provided to track your trading and performance.

Accointing Review: Drawbacks

Lack of Unlimited Transactions

Accointing might be unfit for active traders or corporate crypto organizations since the maximum number of transactions permissible is 50,000. This might limit those with a higher volume of trades and need more time computing their crypto taxes.

Final Thought

This Accointing review has presented the core features and value of the tax reporting software and how important it is for smart investors.

The crypto tax app manages a cryptocurrency portfolio and provides a comprehensive tax report in a few clicks. The process of generating a report is free from complexity and also secure. Accointing users can monitor the trade transaction history from the mobile app and file tax reports by integrating exchanges and wallets.

The software can integrate with exchanges using API keys while maintaining compliance with high-level security encryption.

Accointing is legal and operates in various countries, including the US, UK, Germany, Australia, and the EU generally. Accointing supports the tax report system of these countries and plans to expand to cover more geographical regions.

Glassnode acquired Accointing in October 2022. The company was originally founded in 2018 in Switzerland.

Yes, it is safe to use. It encrypts users' data using user-specific keys generated by the AWS Key Management System (KMS). It also only requests read-only access when using API keys.