CoinLedger Review of 2024: The Best Crypto Tax Software for Traders

TLDR

In this comprehensive review of Coinledger, you’ll learn everything you need to know about this magnificent tax software. Coinledger is an excellent tool to support crypto users by automating their taxes. It supports over 200 exchanges and 15 DeFi exchanges, and the platform also supports wallets and NFTs.

The tax system integrates with exchanges and wallets using APIs and public wallet addresses. Aside from exchanges, it also integrates with traditional tax filing software like TurboTax, TaxSlayer, TaxACT, and H&R Block.

There are four paid plans in addition to the free plan, which gives you access to large volumes of transactions. The price ranges from $49 to $299, and you also get a 2-week money guarantee period if you do not like the service.

The guide also considers the benefits and drawbacks of using tax accounting software. I’ll be honest; there are no drawbacks.

Who Should Use Coinledger

As we all know, creating income tax reports is tedious, even for ordinary things, and can be more painstaking for crypto transactions. This is where Coinledger comes in.

Coinledger is an automated tax filing software that leverages advanced technology to provide crypto tax services. This software takes away the laborious process of compiling your data manually to calculate your crypto and tax bills.

Is CoinLedger Good for Beginners?

Coinledger is a good fit for crypto enthusiasts new to generating tax reports for their crypto assets. The tax reporting software automatically imports data from connected exchanges and generates your tax reports in minutes.

Coinledger can help beginners navigate the murky waters of taxation – especially crypto taxes. It effectively calculates how to pay how much you owe in taxes to avoid underreporting or overpaying.

What Countries Are Supported?

Although the official website does not state countries it doesn’t support, we extract that the software works with countries that operate with First in, First Out (FIFO) and Last in, First Out (LIFO) calculation methods.

Currently, it only fully supports users from the United States, with plans to reach other jurisdictions in the coming years.

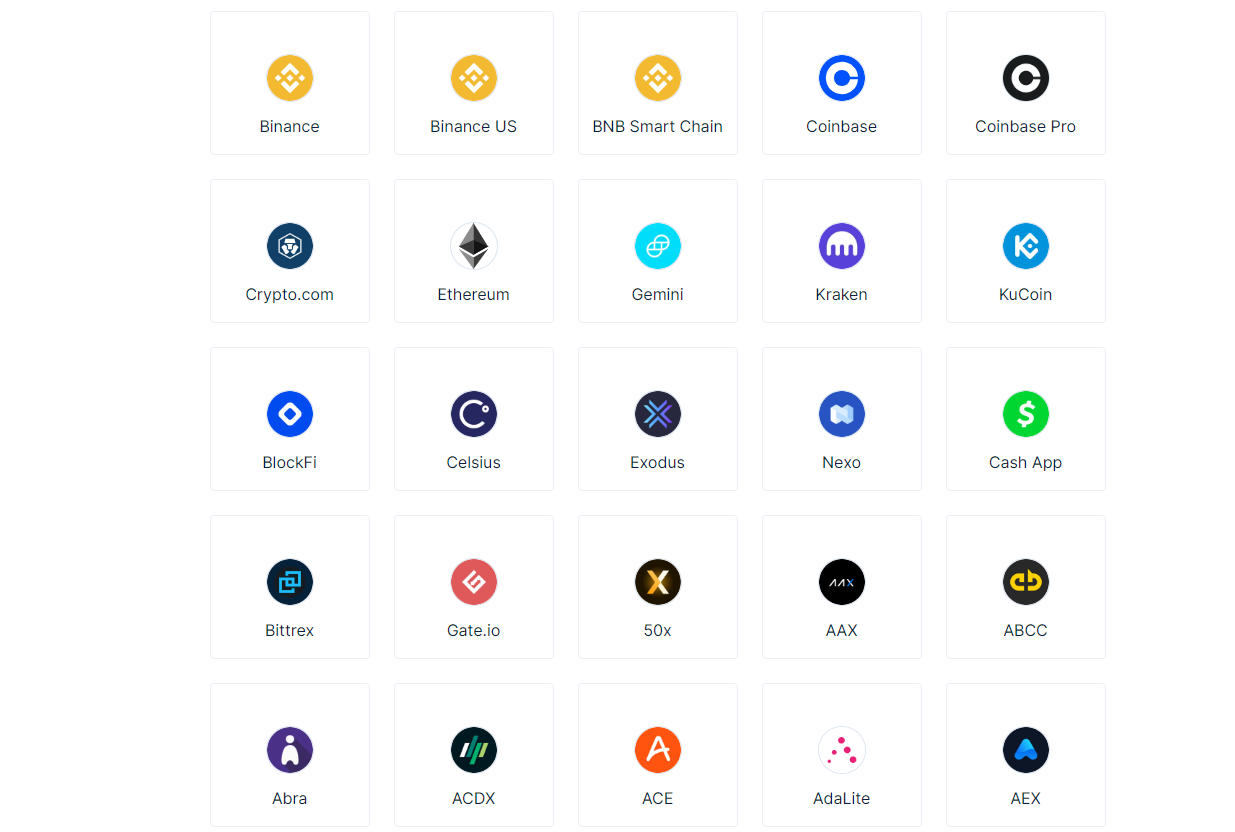

What Exchanges are Supported?

Some common exchanges that Coinledger supports include Binance, Coinbase, Bitstamp, KuCoin, Kraken, etc. You can still create your tax reports by importing your transaction history using a generic CSV template file, even for the few un-supported exchanges.

Coinledger supports an extensive array of cryptocurrency exchanges. This is one of the selling points of the tax reporting tool, as it allows users to connect their transaction history directly from their favorite exchange.

What Makes Coinledger a Good Choice?

Smooth Integration

Coinledger offers smooth integration with centralized and decentralized blockchains, exchanges, wallets, and other tax software. This integration is done through an Application Programming Interface (API), which allows you to import data from other platforms without doing manual tasks.

You can easily export the tax report to another tax filing software before submitting it to the appropriate company or government institution.

Easy Import and Export of Data

With over 300+ integrations (crypto, exchanges, and wallets) that can be connected to Coinledger, importing and exporting all your transactions becomes super easy. Aside from importing your trading history to the platform, you can export your tax filings in the correct format.

Effective Tax Management

It provides several tools that help you save money when paying your taxes. One such tool is tax loss harvesting which can help you minimize your tax rate by calculating your losses.

You can also collaborate with accountants and tax professionals to help you review your tax report before final submission. Coinledger allows you to grant access to authorized personnel through the tax pro account feature.

How to Use Coinledger

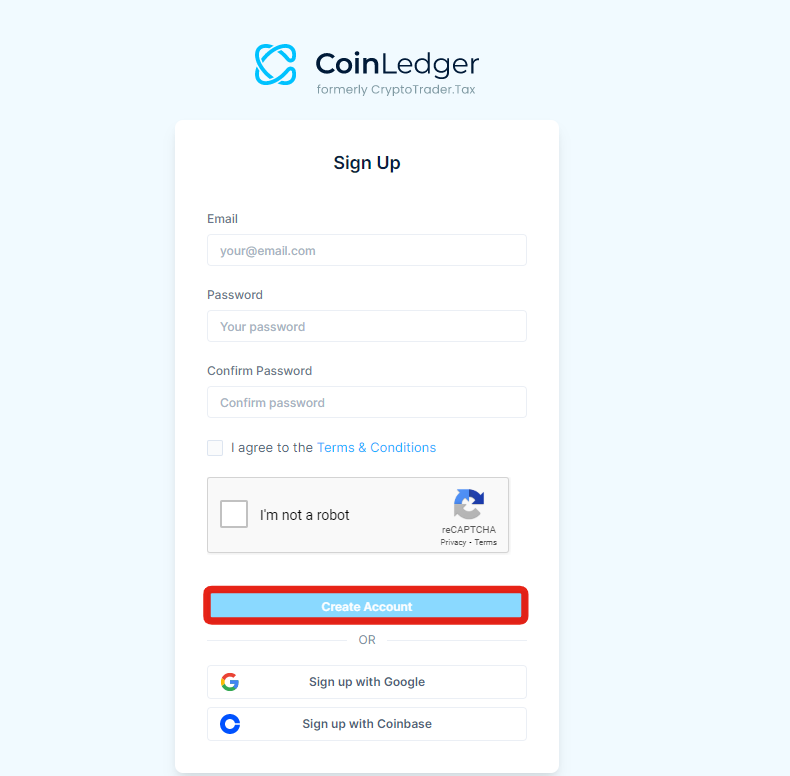

Step 1: Sign up on Coinledger

To start, visit the official website and select the [Sign up] button in the top right corner.

This leads you to the sign-up page, where you must enter your e-mail and create a password. You must also agree with the terms and conditions by ticking a little box.

Once done, click the [Create Account] button to use the crypto tax platform.

Step 2: Integrate your Wallets and Exchange

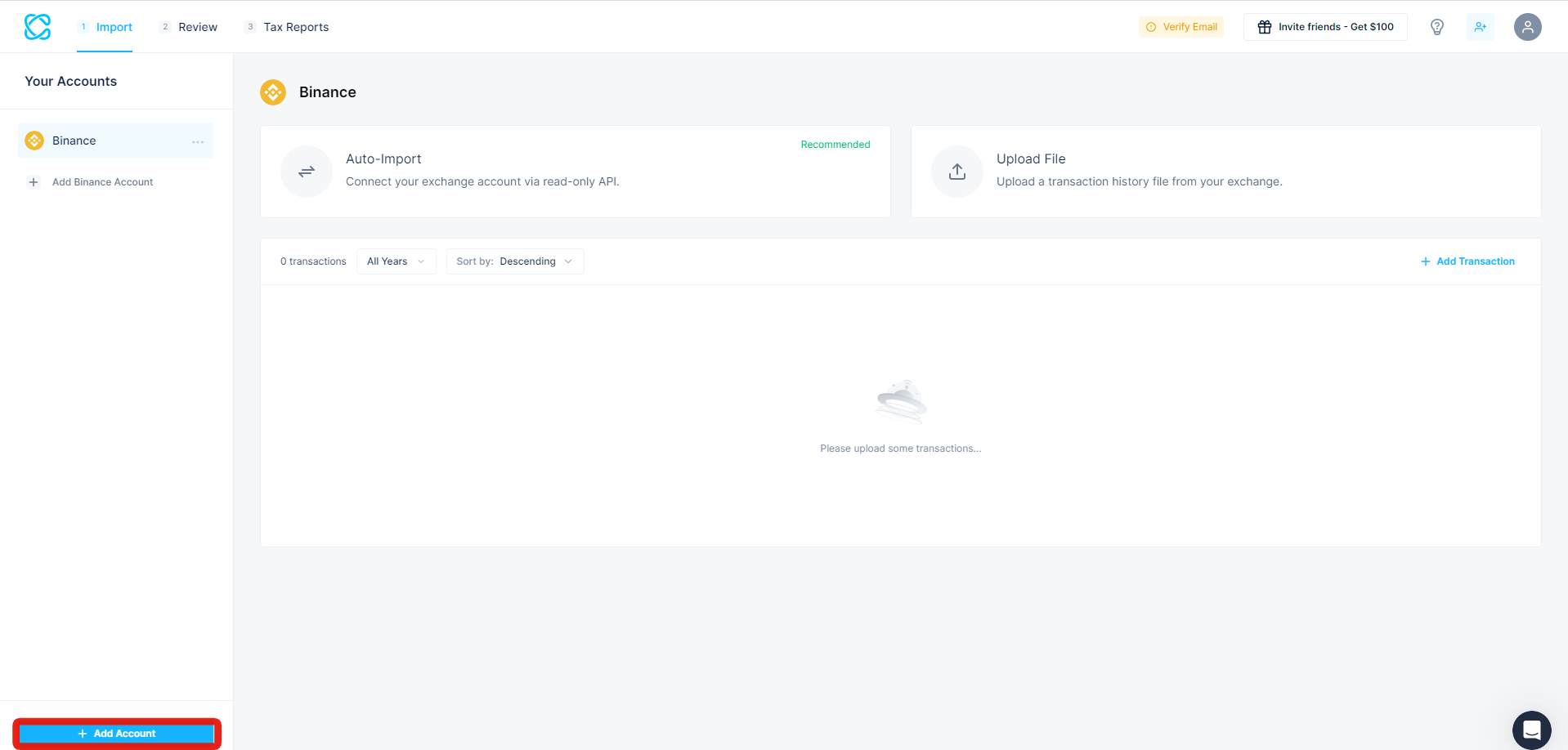

Once you have an account on Coinledger, you need to integrate an exchange or wallet where your transactions will be imported.

Click on the [Add Account] button to connect your exchange.

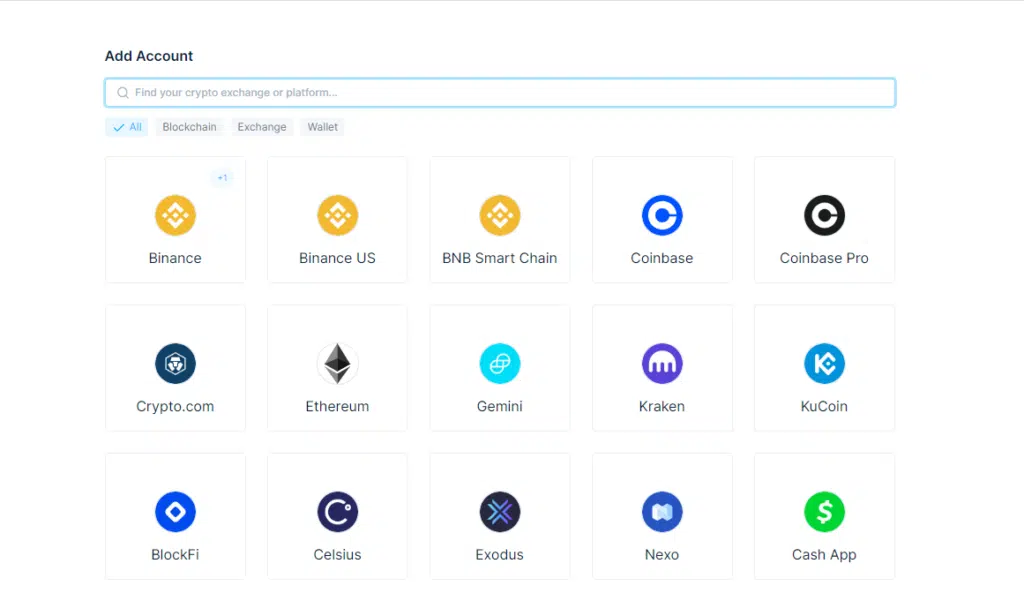

The page leads to over 200 exchanges and decentralized applications available on Coinledger. You can select all the exchanges that you need.

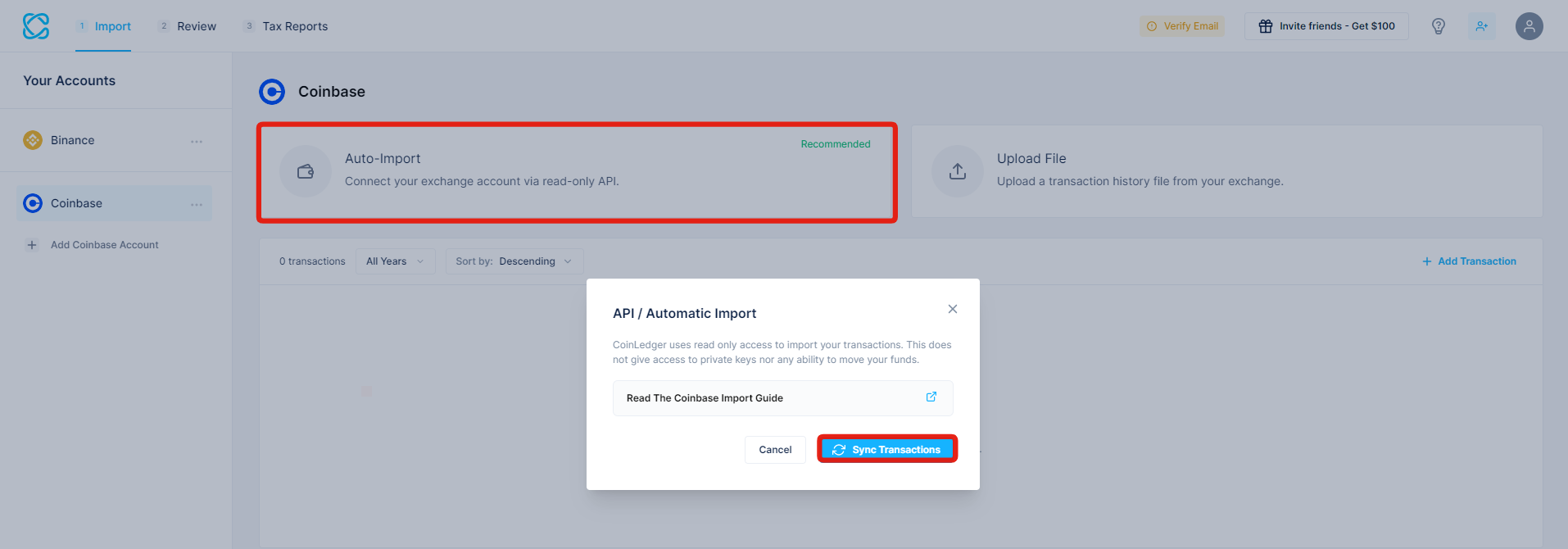

Step 3: Import Transactions

Select the exchange you want to import data from. Click the [Auto-Import] button and then [Sync Transactions] to import transactions from your chosen exchange.

Step 4: Preview your Report

Preview the report imported from your exchange to be sure it fully covers your trade history.

You can also invite an accountant at this stage to help you review your tax report before final submission to your tax administrator.

Step 5: Generate your Tax Report

Once you have reviewed the income tax report, you can upload it to your tax filing system – in most cases, TurboTax.

CoinLedger Pricing and Plans

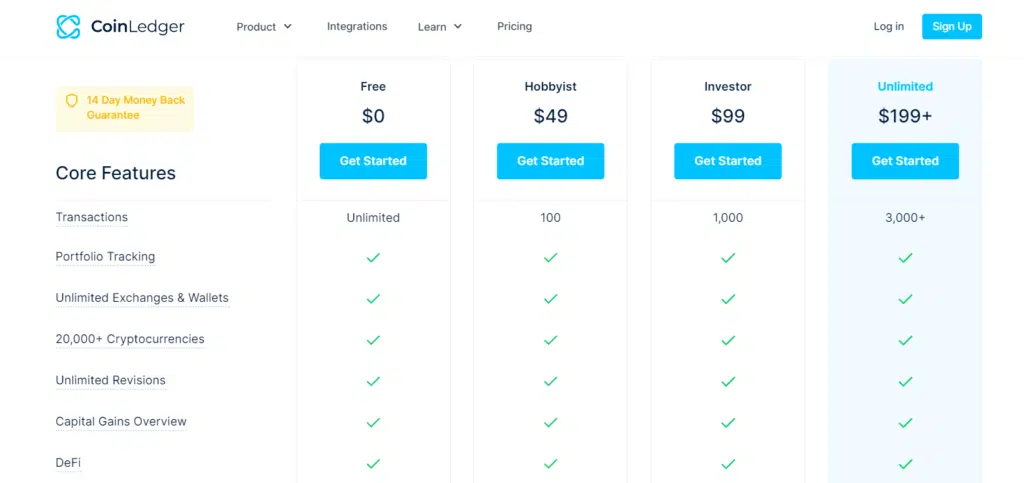

Coinlegder is made available to users through various plans and pricing, each supporting a unique feature.

There is a total of five plans available:

Free Plan

You can sign up on Coinledger for free. This gives you access to basic features like importing your transaction history, viewing your capital gains and losses, and tracking your portfolio.

A preview of your tax forms will also be available. However, you must pay for a plan to download your tax report. There is also a significant limitation on the number of trades permissible on the free plan.

Coinledger offers users a 2-week money-back guarantee feature that lets them try out the service before committing fully to be a paying user. If you do not enjoy the services offered, you can get a full refund within two weeks, which is longer than other tax filing software offers to customers.

Hobbyist – $49/year

The hobbyist is the first of the paid plans. The hobbyist plan costs $49 annually and supports up to 100 transactions.

Daytrader/Pro Trader – $99/year

The pro trader version is suitable for more active crypto investors. It costs $99 annually and supports up to 1500 transactions.

High Volume – $199/year

If you have crypto transactions higher than 1500, you might want to subscribe to the high-volume package. This plan costs $199 annually and supports up to 5000 transactions.

Unlimited – $299/year

This is the juiciest Coinledger paid plan. This is often recommended for entities not wanting to be restricted on the number of transactions they can upload.

The plan costs $299 annually and has an unlimited transaction limit.

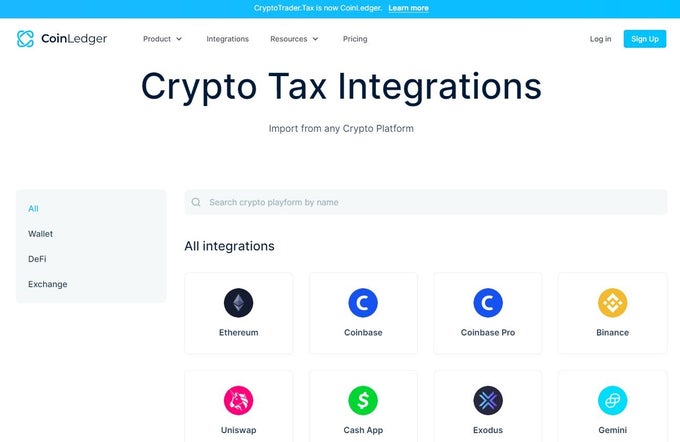

Coinledger Integration

Coinledger extensively integrates with several software and other relevant apps for your tax filing. The integrations are divided into the following categories.

Tax filing software

Four leading tax filing software integrated with Coinledger:

- TurboTax

- TaxSlayer

- TaxACT

- H&R Block

These integrations provide a seamless way of exchanging information with your Coinledger account.

TurboTax is a traditional tax software used by many to file taxes. Since Coinledger is a partner of TurboTax, you can add your crypto tax data to the rest of your reports. Coinledger matches the format required on any of the four tax filing software.

Exchanges

Another category of integration is centralized and decentralized exchanges. Coinledger can plug in with major exchanges and currently supports over 200 different exchanges.

From the Coinledger dashboard, you can select which exchange you want to connect to obtain trade history. Even if your exchange is unavailable on Coinledger, you can generate your transaction history into a CSV format and upload it for automatic extraction.

Wallets

In addition to exchanges, Coinledger also helps compile crypto taxes from DeFi and hardware wallets, such as MetaMask, Trezor, and Ledger.

The transactions from the wallets must be downloaded in CSV format before uploading them on Coinledger. Another alternative to getting transaction data from wallets is by providing your public wallet address. Coinledger will fetch the needed data since transaction history is publicly available on the decentralized blockchain.

NFTs

Coinledger can also serve as an NFT tax software. The minting and trading of NFTs result in gains and losses, making them taxable.

Two options are available to get your transaction data from NFT marketplaces; API or wallet address. Similar to the process for wallet integration, you can provide your wallet address, and Coinledger will do the rest by fetching all NFT-related transactions.

The API integration option is only available for OpenSea.

DeFi

Coinledger supports over 15 DeFi exchanges and integrates with them using the API method to obtain the necessary transaction data. If an API is unavailable for your DeFi exchange, you can still obtain the data by downloading the transaction history as CSV files before uploading it on Coinledger.

Coinledger Features

Track Financial Status

It is easy to lose sight of your crypto assets and trading, especially if you are a high-volume trader. Coinledger is an effective portfolio tracking tool that keeps all your crypto assets within a glance.

You can have all your transactions from different exchanges presented in a single dashboard by simply supplying your API key or public wallet addresses.

Another added feature of the portfolio tracking on Coinledger is that it helps you classify your transactions to avoid confusion. It distinguishes between taxable incomes and non-taxable transactions, which is helpful when it comes to calculating your capital gains taxes and losses.

Save Money on Taxes

Coinledger is vital for crypto investors who want to save money on taxes they pay through tax loss harvesting. This technique allows selling investments at a loss to offset the gains made on other investments, thereby reducing the tax payable.

The crypto tax software helps to identify unrealized losses based on the current market price. With this information, you can choose which investment and how much to sell to tap into the tax loss harvesting.

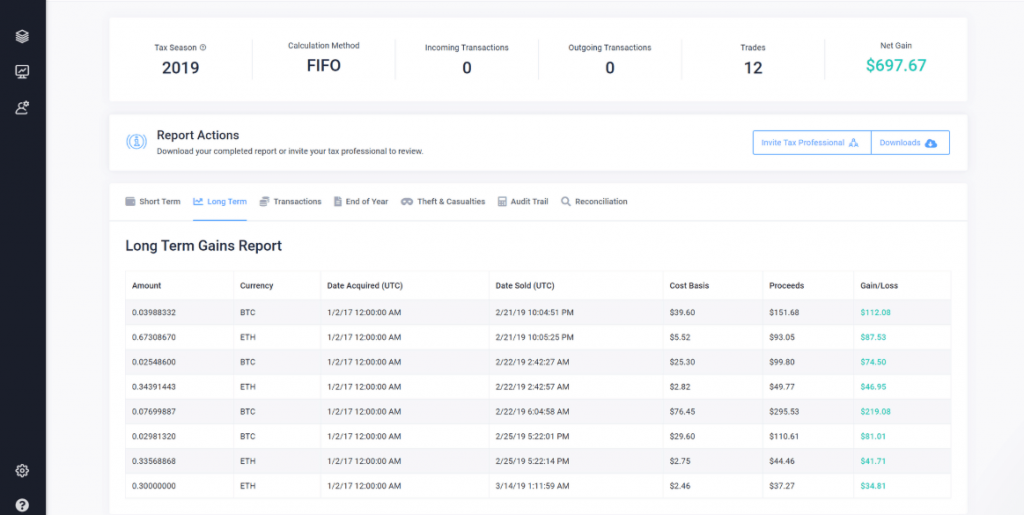

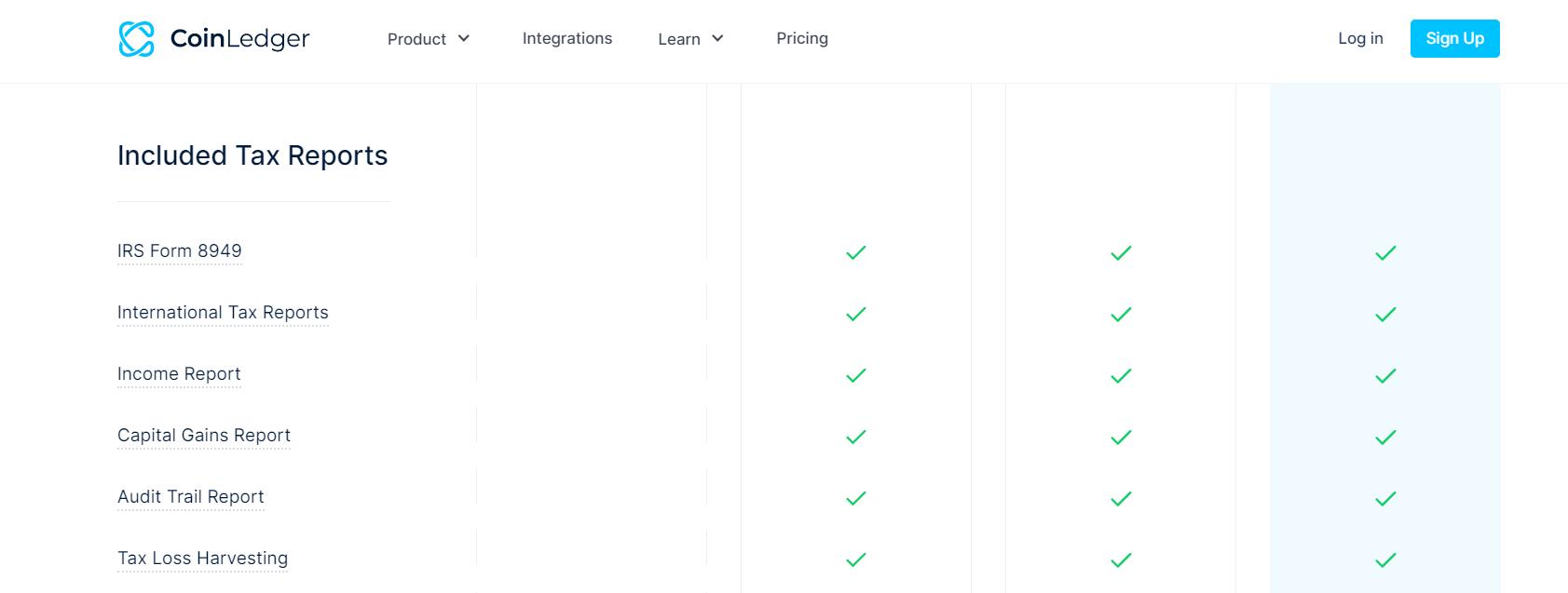

Multiple Crypto Tax Reports

There are different types of tax reports, even for crypto taxes. Gathering these different reports can become tedious if you do it manually. Coinledger can classify different transactions into their respective tax reporting forms.

Here are some of the lists of tax reports that Coinledger can generate:

- Audit Trail Reports

- IRS Form 8949

- Cryptocurrency Income Report

- Short-and Long-Term Gains Report

- Tax Loss Harvesting

Coinledger Drawbacks

Poor International Support

One of the drawbacks of Coinledger is that it is not fully optimized to serve the tax system of other international countries. Unlike other Coinledger alternatives, the software is more suitable for only the US tax system and other countries with similar systems.

The lack of integration with other countries’ tax systems makes computing the tax directly harder, and there might be a need to input data manually.

Conclusion

Coinledger is one of the leading crypto tax software that supports using automation to file taxes. It saves cryptocurrency users time and effort in computing how much tax they owe.

It is cost-effective when compared with other filing and accounting software available, and it comes with sophisticated features such as tax loss harvesting and integration with numerous exchanges. Coinledger is a good tax software choice for beginners and advanced crypto traders.

Coinledger offers a free tax reporting feature to import transaction data and preview reports. However, before downloading your report, subscribe to one of the four paid plans (Hobbyist, Pro Trader, High Volume, and Unlimited).

Coinledger was formerly known as CryptoTrader.Tax. The name was changed in 2022.

The tax software is safe to use. It only requests read-only access to exchanges and wallets when importing data. The imported data is also not stored on the database and deleted once an account is deleted from the platform.

The headquarters of Coinledger is located in Kansas City, Missouri, in the United States.