Quick Look

| Exchange | eToro | Binance | Swiss Borg | Nexo | CEX.IO | OKX | Bybit | CoinW | Prime XBT |

| Ranking | 1st | 2nd | 3th | 4th | 5th | 6th | 7th | 8th | 9th |

| Best for | Beginner traders | Advanced traders | Long term investors | Crypto lenders | Casual traders | Day traders | Expert traders | Crypto collectors | Margin traders |

| Trading fees | 0.1-1% | 0.1% | 1.49% | 0.04-0.20% | 0.15-0.25% | 0.08-0.1% | 0.1% | 0.2% | 0.05% |

| Number of crypto | 90+ | 400+ | 60+ | 60+ | 100+ | 350+ | 100+ | 400+ | 40+ |

| Visit | eToro | Binance | SwissBorg | Nexo | CEX.io | OKX | Bybit | CoinW | Prime XBT |

1. eToro – The Best Crypto Exchange for Beginner Traders

eToro is a leading financial broker and crypto exchange with over 30 million registered users. Among the elements we enjoyed the most about eToro is its social copy trading suite.

Even though eToro does not offer as many crypto assets as other competitors, its simplicity, accessibility, education, and support are perfect for beginners.

ID Requirements

You must submit an ID document (e.g., an international passport), proof of residence (e.g., a recent utility bill), phone number, and e-mail address.

Trading Fees

eToro sets a 1% fee on every crypto transaction (both opening and closing), with a 2% transaction size fee for each token transfer. The exchange’s strong user-friendliness overcompensates for its average fees.

Supported Cryptocurrencies

In the US, you can trade 25 cryptocurrencies with eToro. The list includes BTC, ADA, ETH, LTC, XLM, and TRX, among others.

Supported Countries

It is possible to use eToro in America (US, Brazil, Mexico, etc.), Europe (Austria, Italy, France, etc.), Asia (Azerbaijan, Bahrain, etc.), and Oceania (Australia).

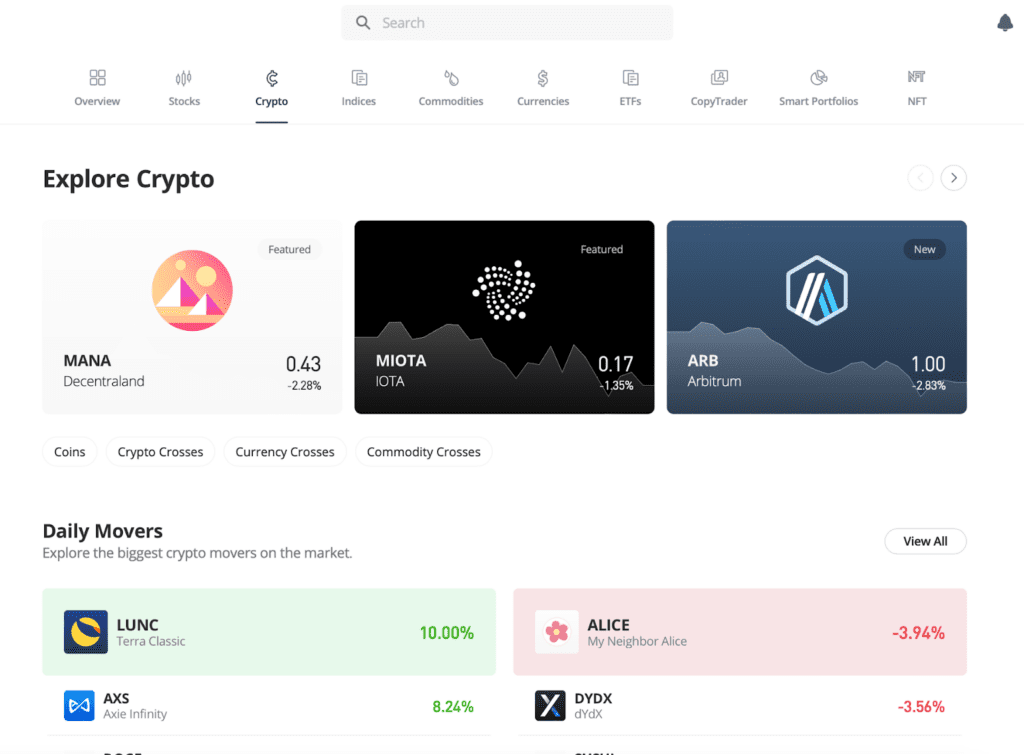

Our Experience Trading with eToro

We like how eToro has merged multiple markets in the user’s dashboard (screenshot below). As you see, you only need a click to switch from one market to another.

Once you click an asset, you will immediately see a real-time price chart on your screen.

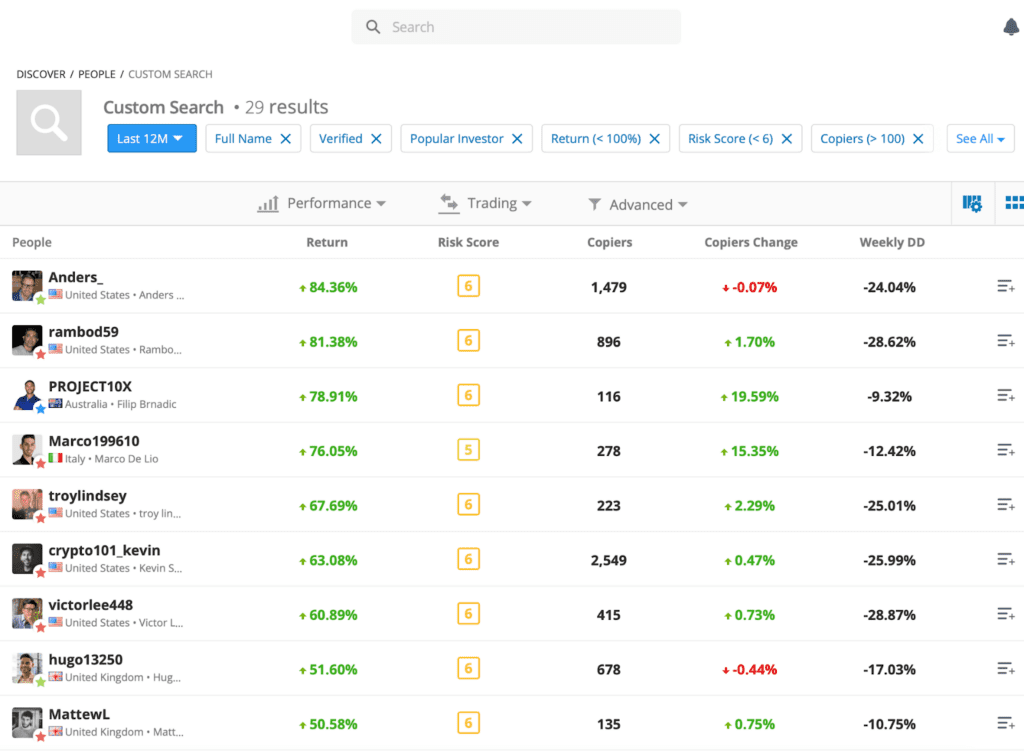

Most people know eToro because of its social trading platform. The website has a detailed list of successful traders that you can copy in just one click:

Overall, our impression is that the extremely high user-friendliness of the platform justifies the relatively high transaction costs.

Pros and Cons

| What We Like | What We Don’t Like |

| User-friendly interface | Relatively high fees |

| Social trading feature | Few tokens available |

| Educational material |

Who It’s Best For: Beginner Traders

eToro’s customer-oriented outlook, social trading features, an elaborate library of learning resources, and easy-to-grasp fees position it as one of the best beginner options. This is the right crypto exchange if you’re new in the cryptocurrency industry.

More details

eToro is a popular online trading platform for crypto assets, stocks, and ETFs, featuring low fees and a user-friendly interface. With a free eToro wallet and social features like messaging boards, users can copy experienced traders and access numerous assets. Take a look at what makes this platform perfect for starting your trading journey.

-

Provides an attractive, communal atmosphere.

-

Offers zero commission on ETFs.

-

Extensive selection of educational resources.

-

Mobile app with trading features.

-

Smooth account opening and bank transfer.

-

Limited number of cryptocurrencies.

-

Limited customer support.

-

No crypto-to-crypto trading pairs.

2. Binance – Best for Advanced Traders

Binance is the fastest-growing cryptocurrency exchange, with millions of users across the globe.

The centralized exchange is an outstanding alternative to advanced traders because of its broad cryptocurrency list, solid security features and protocols, crypto rewards, and quick customer service.

ID Requirements

You’ll need to provide identification (e.g., driver’s license or passport), proof of address (e.g., bank statement or utility bill), and contact details (phone number and email address).

Trading Fees

Binance has a standard trading commission equal to 0.1% on each transaction. A 0.5% charge is applied on instant, buy and sell actions. Considering the high amount of tokens you can find on Binance, these transaction fees are definitely more than reasonable.

Supported Cryptocurrencies

Binance supports over 400 cryptocurrencies for trading (150+ in the US through its separate entity, Binance.US). The list includes popular ones like BTC, BUSD, BNB, ETH, XRP, and more.

Supported Countries

Binance is accessible to buy and sell crypto in many countries, including Canada, the US, Mexico, the United Kingdom, Germany, Spain, Japan, South Korea, and Australia.

Our Experience Trading with Binance

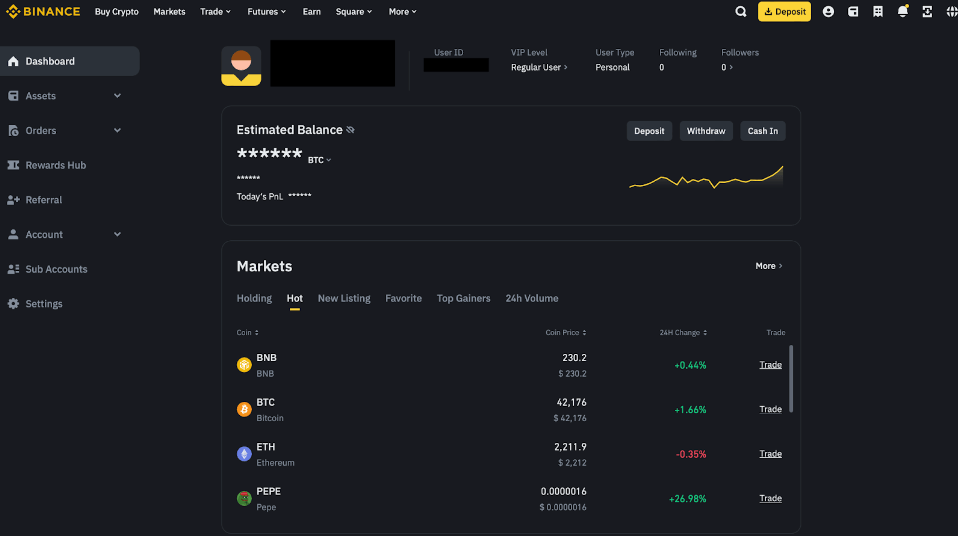

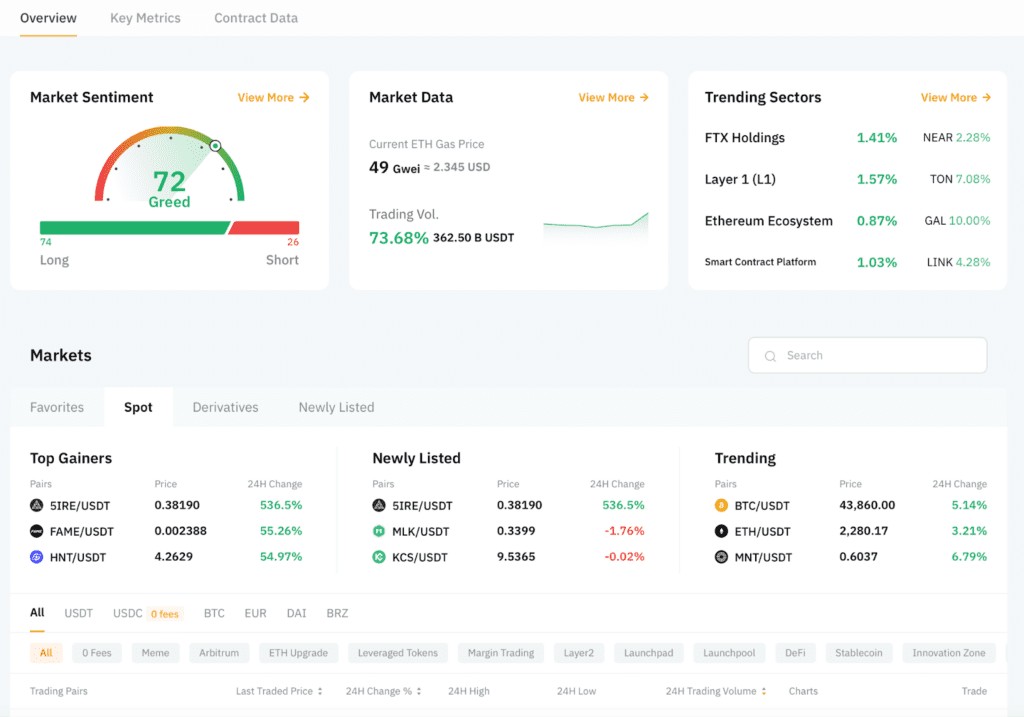

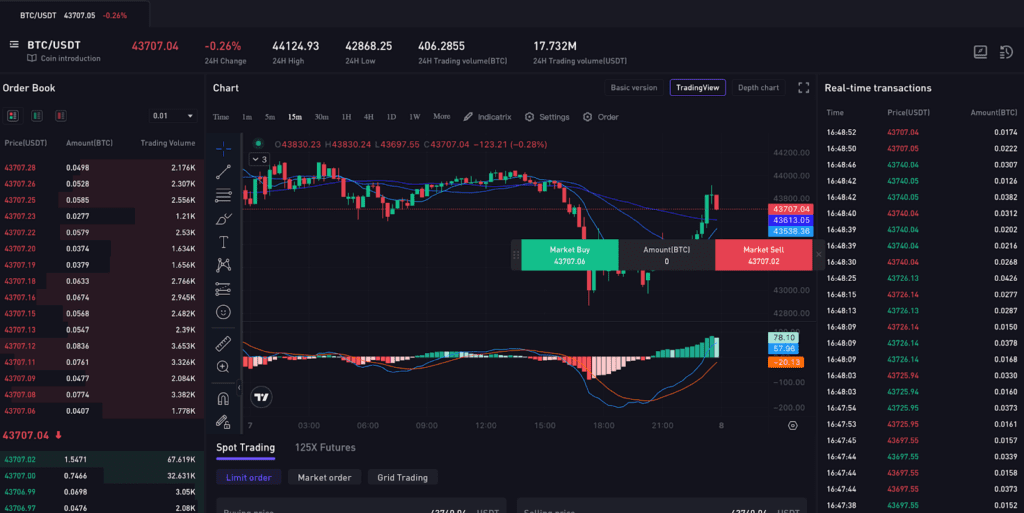

We think Binance is one of the most intuitive digital exchange platforms that display different cryptocurrency markets on a single dashboard (see the picture below).

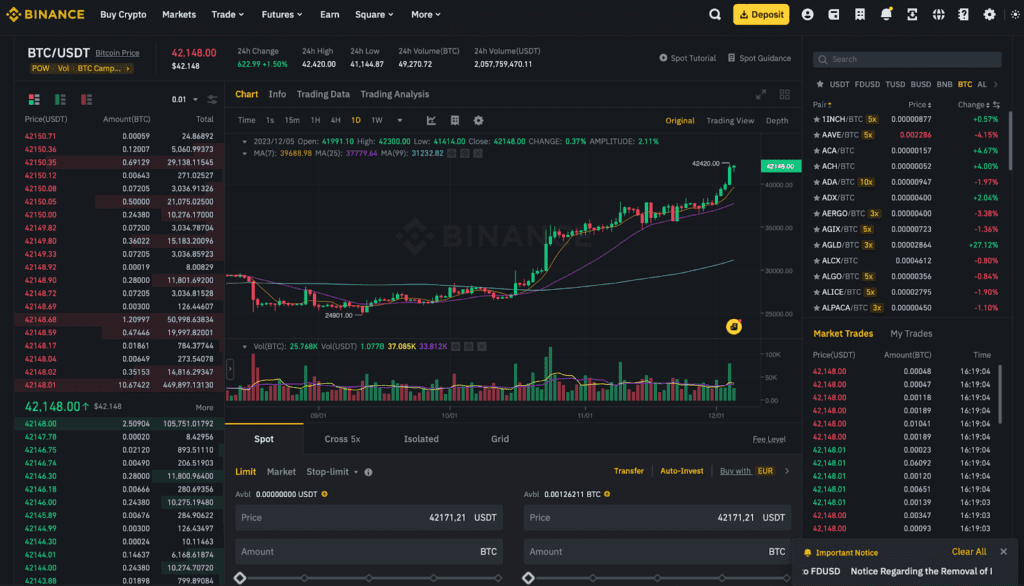

Binance makes it incredibly easy to monitor your preferred crypto prices with its advanced charts:

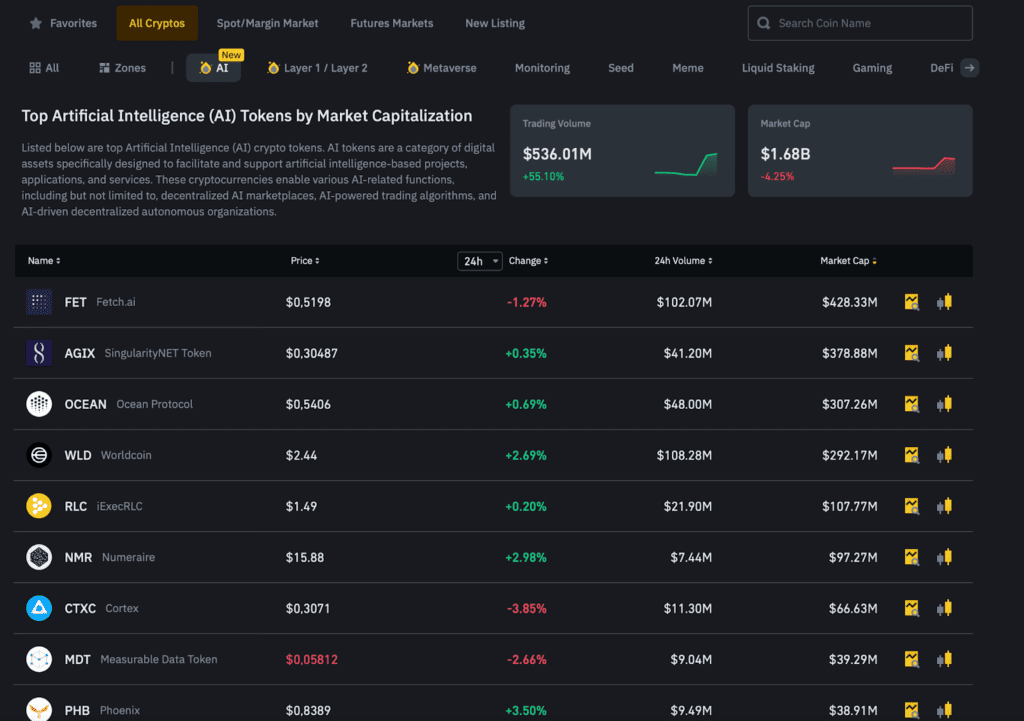

Trading tools have made Binance popular, and here is a quick look at how they can help you follow market trends:

We feel that Binance’s straightforward interface makes up for its trading fees. If you’re an advanced trader, Binance might be worth trying.

Pros and Cons

| What We Like | What We Don’t Like |

| Smooth Fiat-to-Crypto exchanges | Ongoing legal issues |

| Wide Cryptocurrency Selection | Withdrawal block issues |

| Advanced trading tools |

Who It’s Best For: Advanced Traders

Experienced traders favor this platform because of its advanced trading tools. With its relatively low trading fees and numerous digital assets, Binance has become the best platform for those looking to trade larger volumes.

More details

Binance is a great combination of low fees, deep liquidity and multiple cryptocurrencies and trading pairs. We have tested every aspect of it and it STILL holds its reign as the top exchange in the world. In our view, it is the perfect crypto exchange for both newbies and advanced traders alike.

-

Biggest exchange in the world.

-

Industry's lowest trading fees.

-

Advance trading options like leverage trading.

-

600+ crypto options, 150+ for the US.

-

Lucrative on-site staking options.

-

Hiccups in account verification.

-

Less regulated than some competitors.

-

The corporate structure is not transparently.

3. SwissBorg – Best for Long-Term Investors

SwissBorg is one of the best cryptocurrency exchanges and investing platforms in the globe utilized by many people.

SwissBorg has great wallet functionality, a good choice of fiat currencies, a high-security level, competitive withdrawal fees, and many benefits for long-term investors.

ID Requirements

To open a crypto exchange account, just give SwissBorg a copy of an ID document, proof of address, a phone number, and an email address.

Trading Fees

Standard users will pay fees of 1.49% on all purchases and sales. The fee policy also mentions a 0.10% execution rate on token transfers. These fees may look high, but we think that SwissBorg’s effective cryptocurrency trading mechanism makes up for it.

Supported Cryptocurrencies

You can trade over 60 cryptocurrencies with SwissBorg, from BTC to ETH, passing from altcoins such as VET and LDO.

Supported Countries

Swissborg services are available in numerous countries worldwide, which include Canada, Brazil, France, Belgium, Japan, Singapore, Australia, and New Zealand.

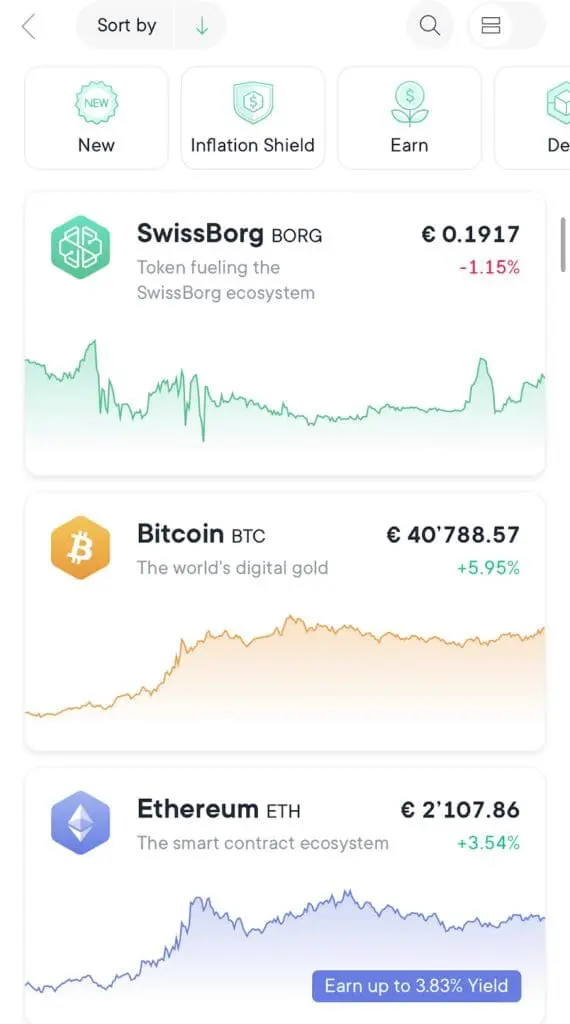

Our Experience Trading with Swissborg

We like the inclusion of various markets in the user’s dashboard: you just need to click once to move from market to market.

By clicking on an asset, a real-time price chart shows up immediately.

Another feature that identifies Swissborg is auto-invest. As illustrated below, the platform provides a comprehensive list of auto-invest plans based on the automated dollar cost averaging (DCA) strategy:

Our view is that the relatively ordinary transaction fees are compensated by user funds and the high user-friendliness offered by this platform, compared to most crypto exchanges.

Pros and Cons

| What We Like | What We Don’t Like |

| Passive income opportunities | It may be complex for beginners |

| Fast trade execution | Offered leverage might not suit all. |

| User-friendly interface |

Who It’s Best For: Long-Term Traders

Its long-term vision, transparent wealth management strategies, and easy-to-use interface make Swissborg a preferred option for serious traders.

In addition, its overly integrated product suite is easy to navigate for non-crypto experts.

More details

SwissBorg is a crypto-investing app that offers over 60 cryptocurrencies for buying, selling, and storing. With transparent fees ranging from 0.25% to 1%, they assure users of always providing the best price without deductions. SwissBorg Earn also allows you to earn interest on over 20 crypto assets, a valuable feature.

-

Easy to use and intuitive.

-

Attractive yields.

-

A robust SwissBorg community.

-

Innovative products and services.

-

Good customer support.

-

Not available to US customers.

-

Custodial service.

-

Higher tiers are unattainable for average users.

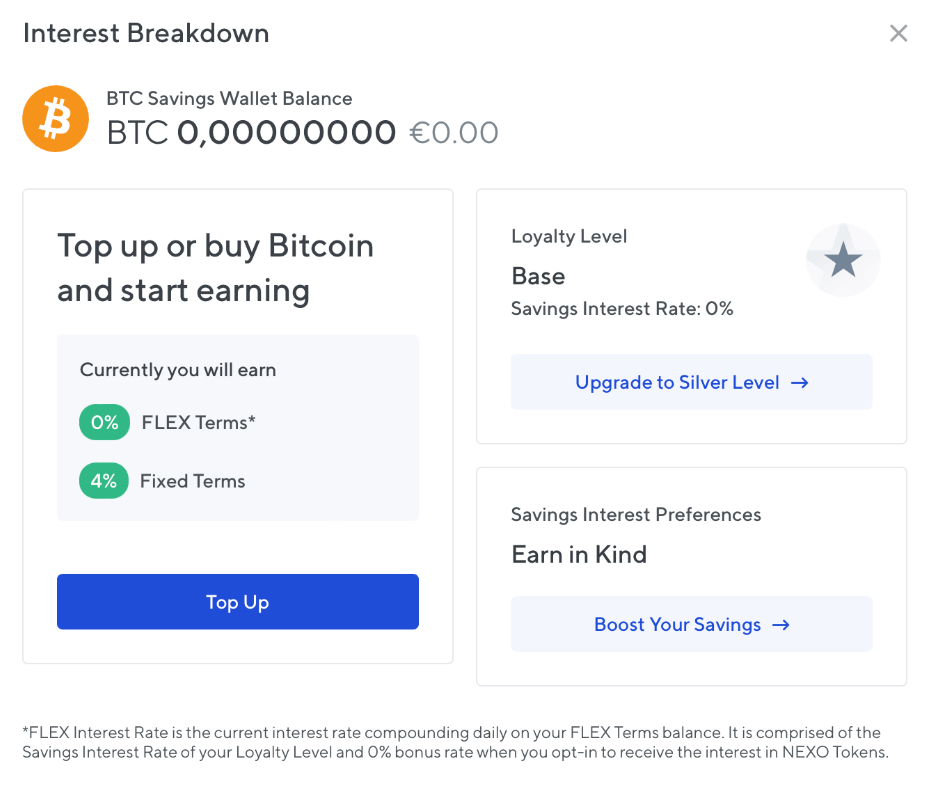

4. Nexo – Best for Crypto Lenders

Nexo is a leading financial platform that focuses on cryptocurrency lending and has a large worldwide following. One special feature first to be noticed in Nexo that we should point out is its crypto credit line.

Although it may not be as integrated in terms of services, Nexo offers an easy-to-use interface with greater learning resources compared to other cryptocurrency exchanges.

ID Requirements

If you want to register with Nexo, you must give an ID document, proof of address, a phone number, and an email address.

Trading Fees

Nexo Pro trading fees span from 0.04% all the way to a peak of 0.20%, which depends on the type of trade and your Pricing Tier at Nexo. The platform charges such fees in response to its robust feature set.

Supported Cryptocurrencies

Nexo’s platform supports more than 60 cryptocurrencies. These include popular tokens like BTC, ETH, DOT, and UNI.

Supported Countries

The Nexo platform is available to let you buy and sell cryptocurrencies in many countries across the world, such as Mexico, Argentina, France, Spain, India, Singapore, and Australia.

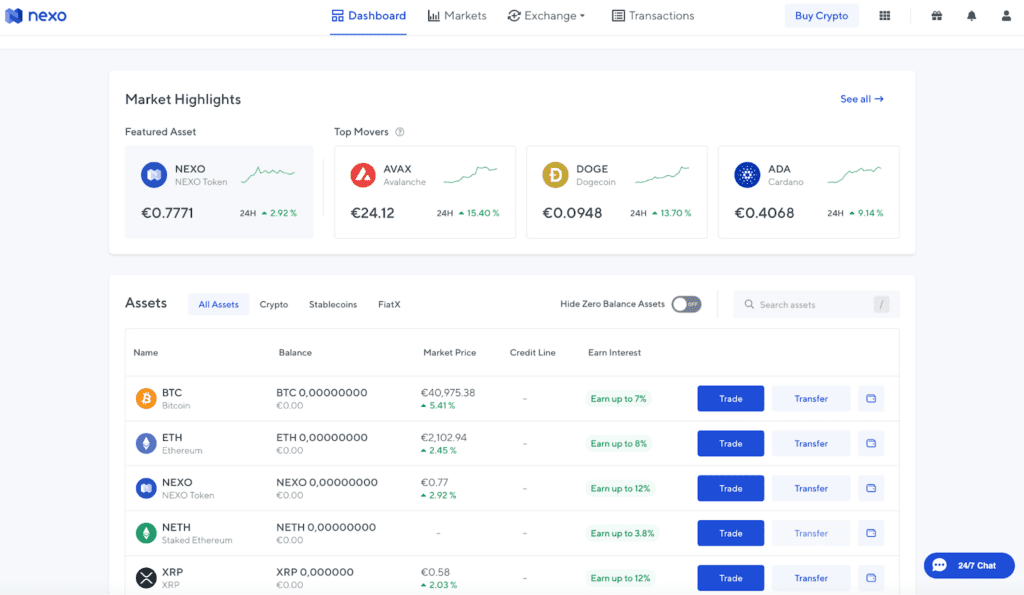

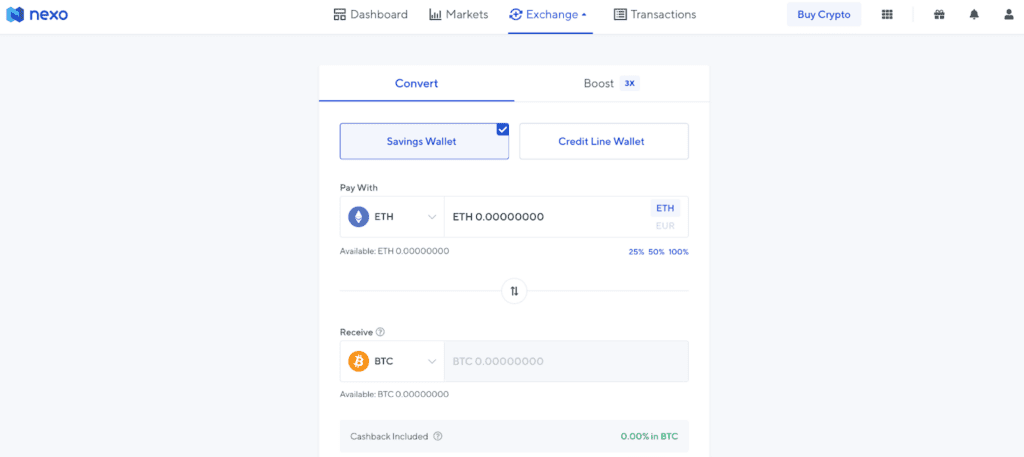

Our Experience Trading with Nexo

Trading with Nexo has been intuitive and flawless for us. It will only take you a few seconds to switch from one crypto to another.

When you select a specific cryptocurrency, you’ll see the typical swap interface popping up on your screen:

Nexo is predominantly known for its great crypto-lending options, compared to other cryptocurrency exchanges. Just click on a cryptocurrency, and you’ll see all you need to know on the matter:

Nexo is worth considering if you are looking to start investing in crypto assets or want to earn interest on your crypto holdings, too.

Pros and Cons

| What We Like | What We Don’t Like |

| Competitive lending rates | Not available in the US. |

| Low borrowing interest rates | Potential risks associated with instant loans. |

| High liquidity |

Who It’s Best For: Crypto Lenders

Nexo is a suitable choice for crypto lenders and new entrants compared to other cryptocurrency exchanges, given its comprehensive services.

The simplified cost of borrowing eliminates hidden charges, thereby making it easy to understand the lending costs involved.

More details

Nexo is an advanced and regulated crypto platform that offers a secure, fast way to own 40+ cryptocurrencies. Its users can access highly attractive earning rates on various crypto assets. Nexo also provides easy-to-use loans backed by cryptocurrency. This exchange offers a crypto-backed debit card to make everyday use of crypto a breeze.

-

Loyalty earning opportunities.

-

Up to 16% APY on digital assets.

-

Swap between 500+ market pairs.

-

Loan options for users.

-

Licensed and regulated.

-

No benefits without a native token.

-

No live chat support.

-

No anonymous option.

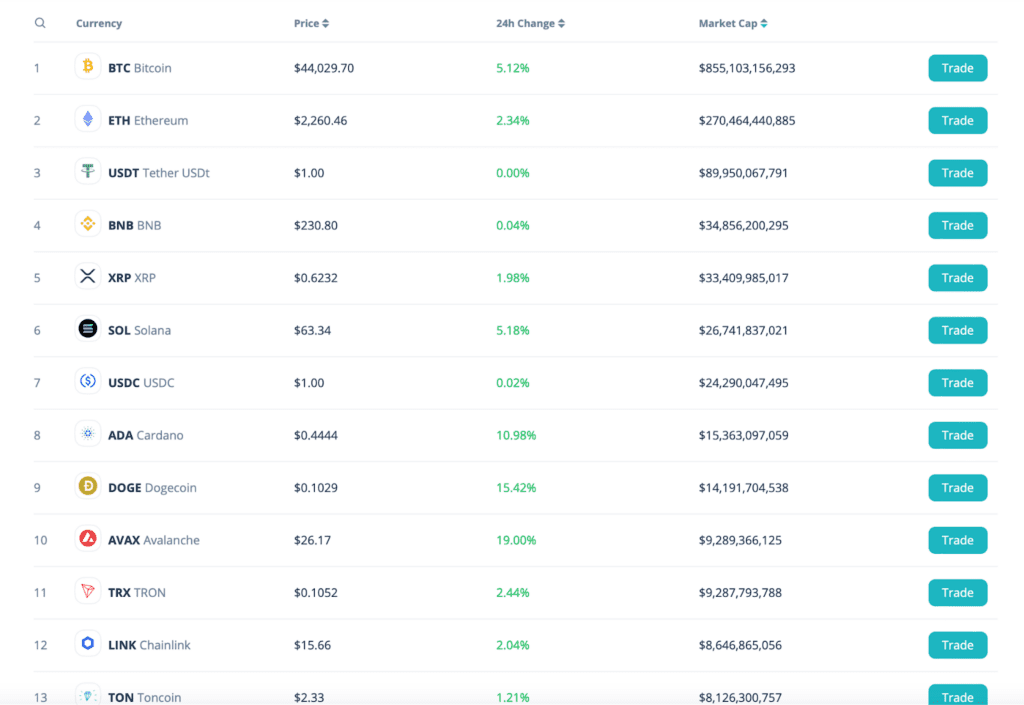

5. CEX.IO – Best for Casual Traders

CEX.IO is positioned as a leading cryptocurrency exchange, with millions of users worldwide. The intuitive trading interface sets CEX.IO apart as it is certainly not a platform-for-professionals type of project.

Casual traders normally opt for CEX.IO due to its simple, easily accessible platform, useful educational resources, and staking feature, compared to other cryptocurrency exchanges.

ID Requirements

You’ll need a valid ID (e.g., a passport), proof of residency (e.g., a utility bill), and a selfie for verification on CEX.IO.

Trading Fees

The trading fees that CEX.IO applies are trade volume-based rates, starting from 0.25% taker’s fee and 0.15% maker’s for volumes below $10,000 over a period of thirty days. The costs decline with increased trade volumes, encouraging more trading without discouraging occasional traders.

Supported Cryptocurrencies

CEX.IO offers more than 100 crypto-to-crypto and crypto-to-fiat markets, including BTC, ETH, and XRP.

Supported Countries

CEX.IO operates in various regions, such as the US, Canada, Portugal, the United Kingdom, India, and South Korea.

Our Experience Trading with CEX.IO

The CEX.IO exchange offers many products and features, as is evident from its dashboard.

With its simple navigation menu, it becomes easy for anyone to follow the prices and analyze charts on this platform.

We liked CEX.IO’s crypto staking feature. It enables intermediate to advanced-level crypto investors to earn up to 30% APY on their staked coins.

CEX.IO’s features make it perfect for traders who are only interested in crypto, as the platform offers a broad range of digital currencies and tokens.

Pros and Cons

| What We Like | What We Don’t Like |

| Wide range of features | It may overwhelm beginners with its product variety. |

| Multi-layer security | Poor customer service. |

| Low trading fees |

Who It’s Best For: The Best Platform for Casual Traders

CEX.IO is an ideal platform for the average trader compared to other cryptocurrency exchanges, as it has a user–friendly interface, different trading options available to traders, useful learning guides, and a clear fee program

More details

CEX.IO is one of the market's highly-regarded trading platforms. The exchange has earned consistent praise from customers who appreciate its simplicity and features. Funds are SAFU, customer service is quick, and users can rely on guided assistance. This exchange ensures a smooth trading experience, which makes it a good choice.

-

Simple, minimalistic, and user-friendly interface.

-

Competitive commissions for takers and makers.

-

High levels of security.

-

Mobile trading app for Android and iOS devices.

-

Data encrypts customers' information.

-

Beginners may feel overwhelmed by number products.

-

Lower liquidity compared to global exchanges.

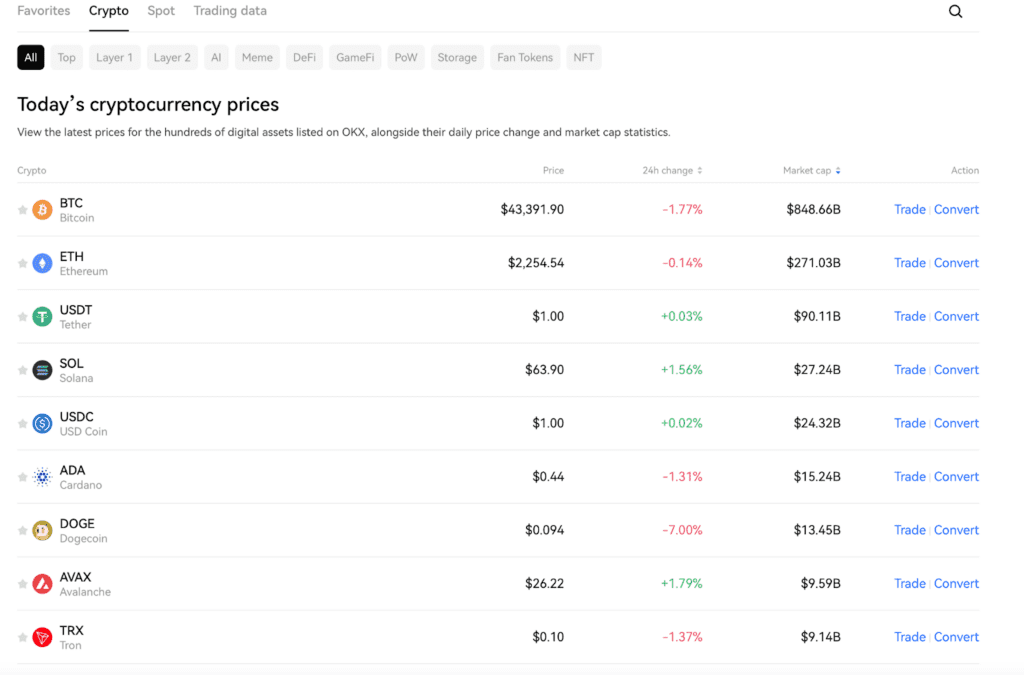

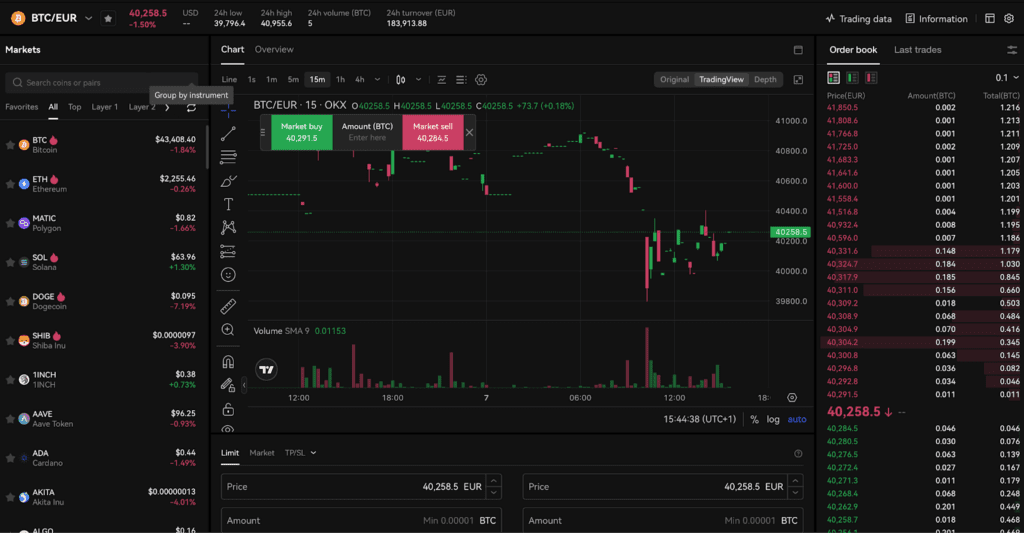

6. OKX – Best for Day Traders

OKX is also a high-quality crypto exchange with many users. The platform is developed with futures trading in mind, an aspect that sets OKX apart when it comes to day traders.

OKX offers a wide array of cryptocurrencies. It is highly convenient for day traders due to its simplicity and ease of operation.

ID Requirements

You’ll need an ID document, proof of address, your phone number, and an email address to operate on OKX.

Trading Fees

The trading and taker fees that you’ll find on OKX are based on the amount of the 30 trading days a user has traded (for instance, the basic level requires 0.1% taker fees). We believe that this structure cost makes perfect sense for a futures-based platform, compared to many crypto exchanges.

Supported Cryptocurrencies

OKX provides over 350 different crypto trading options, which include popular choices such as BTC, ADA, ETH, LTC, XLM, TRX, and many more.

Supported Countries

OKX is reachable from a variety of countries globally, such as Argentina, Brazil, Germany, France, Bahrain, Azerbaijan, and Australia.

Our Experience Trading with OKX

OKX has clearly been developed with the user in mind for simple navigation, especially for those who are new to crypto trading.

OKX gives live crypto prices and complete charts, making it easy to follow crypto market trends.

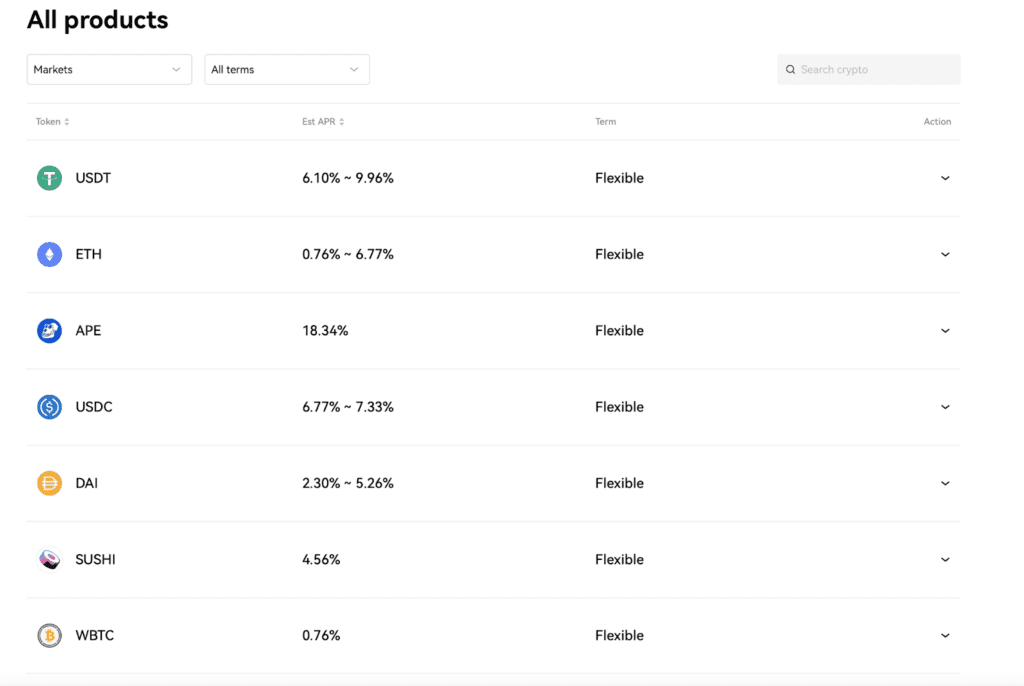

Another aspect we liked about OKX was the staking possibilities, letting users earn interest on their belongings.

OKX behaves like a powerful daily trading tool compared to many crypto exchanges. You may find whatever you are looking for on OKX, and the day traders on our team are certainly enjoying it.

Pros and Cons

| What We Like | What We Don’t Like |

| User-friendly interface | Not available to US users. |

| Low trading fees | Mixed reviews on customer service |

| Many available tokens |

Who It’s Best For: Day Traders

By focusing on the end users with real-time trading data and a minimalistic dashboard, OKX is the right crypto exchange of choice for day traders. The platform has hundreds of cryptocurrencies available, providing vast trading options.

More details

OKX crypto exchange supports over 300 digital assets and over 80 fiat currencies. It is accessible in over 100 countries and territories across the world. It has one of the highest trading volumes in the crypto world and is a fantastic mobile app that offers all services on the go. The trading fees are very low. Its major drawback is its unavailability in certain countries.

-

Supports numerous tokens.

-

Great Mobile app.

-

Extensive educational resources.

-

Provision of multi-lingual services.

-

Geographical limitation.

-

KYC limitations.

7. ByBit – Best for Expert Traders

It’s worth noting that ByBit is a trusted exchange for experienced crypto-currency traders. The good thing about ByBit is that it has a lot of tools for advanced trading.

Even with a limited token choice, ByBiy successfully gives experienced players what they need.

ID Requirements

To proceed, provide an ID (such as a passport), proof of your current address (like a recent bill), phone number, and email address.

Trading Fees

ByBit charges a 0.1% fee for makers and takers in spot trading. The taker fee is 0.055% for both margin trading, futures trading and perpetual trading, while the maker fee remains the same. ByBit has advanced features and an easy-to-use interface that justifies these fees.

Supported Cryptocurrencies

You can trade more than 100 different cryptocurrencies on ByBit. This includes popular options like BTC, ETH, SOL, and APE, among others.

Supported Countries

ByBit can be accessed to buy and sell crypto in many countries worldwide, including Canada, Mexico, Germany, France, Japan, India, Australia, and New Zealand.

Our Experience Trading with ByBit

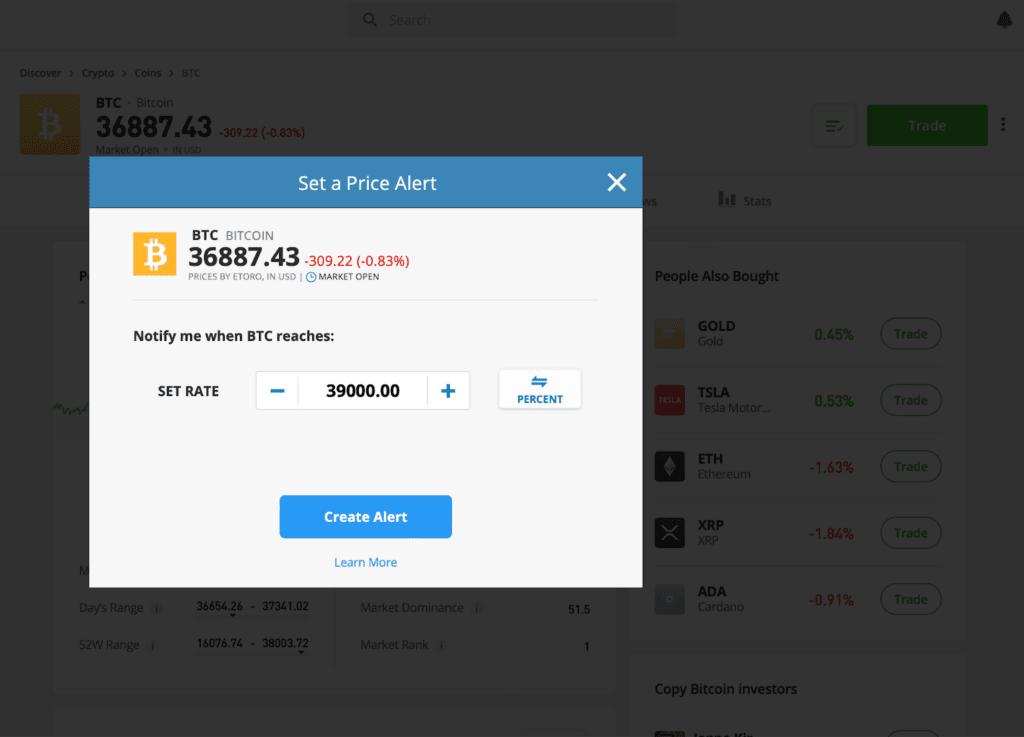

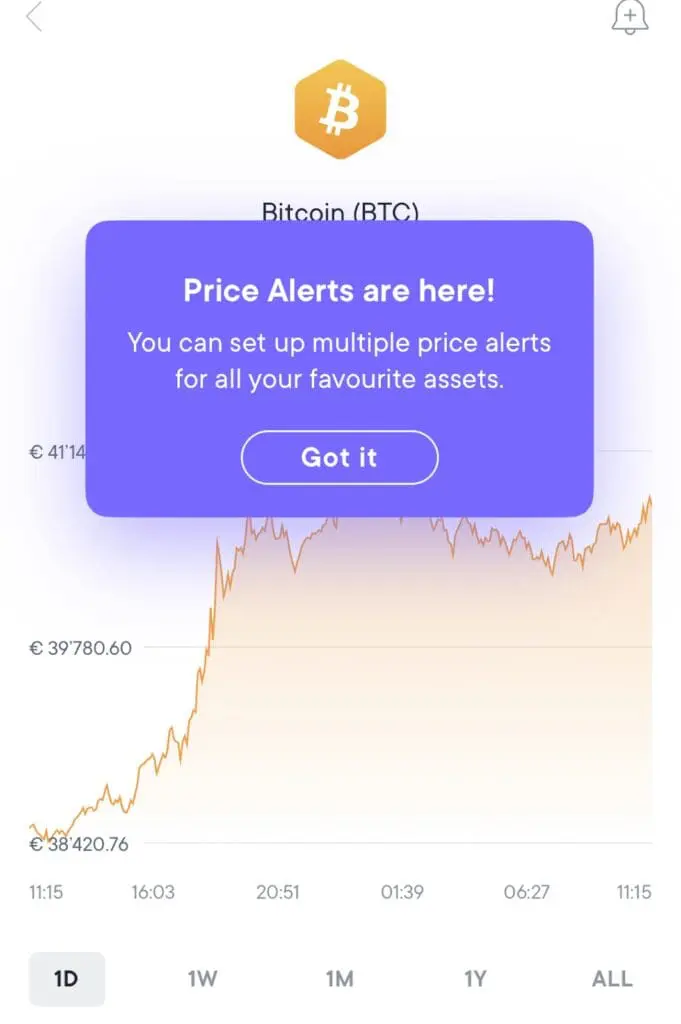

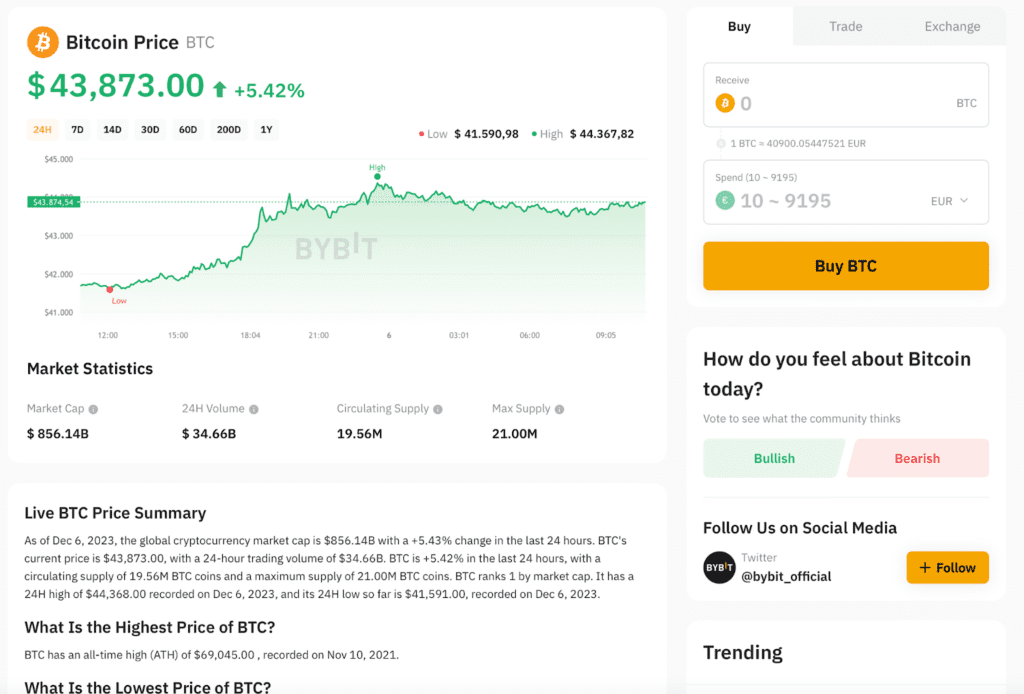

As you can see from the screenshot below, we like that various markets are featured in ByBit’s user interface. With a single click, you will have easy access to different markets.

As soon as you select a crypto asset, it displays its live price chart immediately. Additionally, you can track the price changes of your preferred supported crypto assets by using Bybit’s alert function.

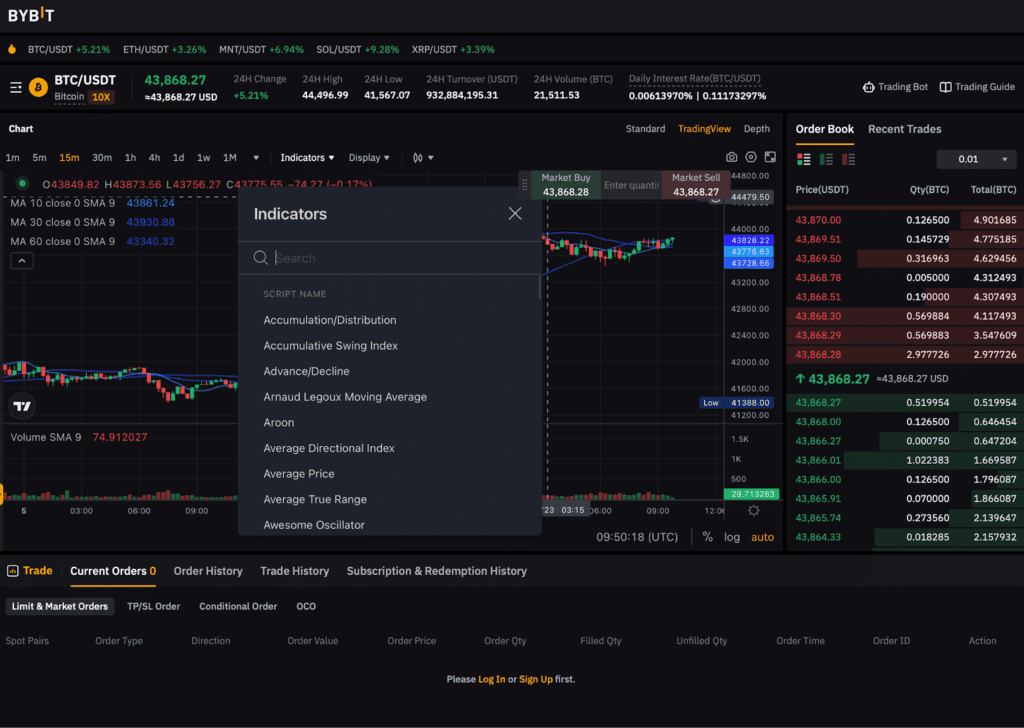

ByBit is also renowned for its sophisticated trading features, as you see below.

Overall, this is one of the best trading platforms with respectful trading charges, as it’s very simple to operate.

Pros and Cons

| What We Like | What We Don’t Like |

| 100x leverage on Bitcoin | Limited to cryptocurrency spot and derivatives trading |

| User-friendly platform | Fewer investment options |

| Low minimum entry requirement |

Who It’s Best For: Expert Traders

Experienced traders will find ByBit a good alternative. The platform provides many advanced trading features and functionalities, high leverage rates, a high volume of active traders, and an easy charge mechanism.

More details

Bybit is a leading futures trading platform globally, offering up to 100x leverage and attracting users who prefer to remain anonymous. With a presence in 180+ countries, it is renowned for its efficiency and unique features in cryptocurrency derivatives trading.

-

The platform offers up to 100x leverage trading.

-

Strong educational resources.

-

Diverse markets for traders, spot, perp, and futures.

-

Risk-free demo accounts to explore all key features.

-

TradingView integration.

-

The platform is difficult for beginners to navigate.

-

It does not offer a quality spot trading feature.

-

The NFT marketplace is limited in terms of options.

-

Security is of the gold industry standard.

8. CoinW – Best for Crypto Collectors

CoinW is a popular cryptocurrency exchange platform with an impressive lineup of crypto assets compared to its average competitor. This is an attractive feature for crypto collectors to diversify crypto assets in their portfolios.

Additionally, CoinW offers lower trading fees than other crypto exchanges, which can be very good for beginners and seasoned traders.

ID Requirements

Join CoinW by providing an identification document, proof of address, and a working phone number/email.

Trading Fees

CoinW charges a flat trading fee of 0.2%, which makes it more affordable than the average in the best cryptocurrency exchange and trading industry. CoinW is of great value to its users, as the platform offers low fees and a rich features environment.

Supported Cryptocurrencies

With CoinW, you can trade over 400 cryptocurrencies that range from the well-known BTC or ETH to less-known coins like OP, CFX, and APT.

Supported Countries

CoinW is accessible in various regions worldwide, including Mexico, Brazil, Germany, France, Singapore, Japan, and Australia.

Our Experience Trading with CoinW

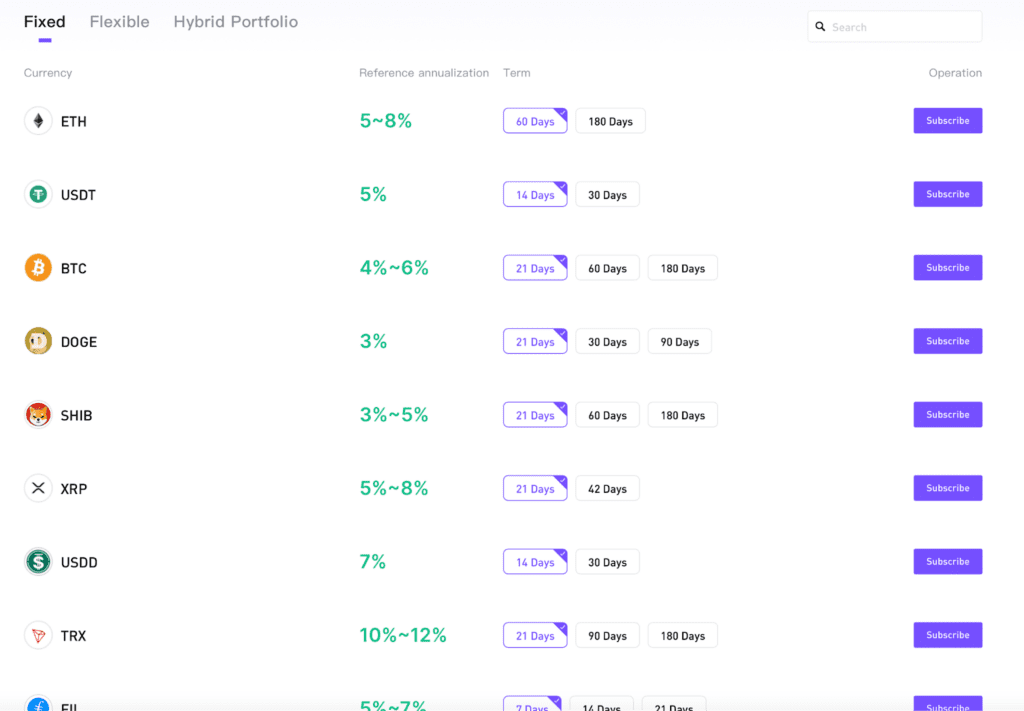

CoinW’s all-inclusive staking programs motivated us to include the best crypto exchange and account in our listing. Most of the staking programs are lifelong with adjustable terms.

The user interface is friendly and easy to use, thus improving the trading process.

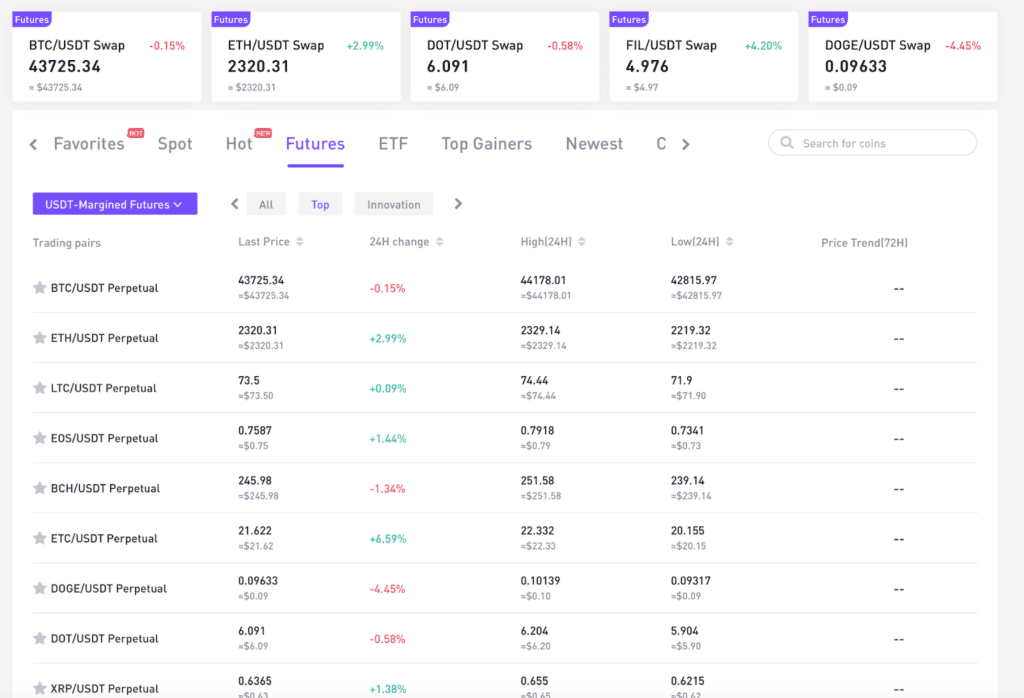

The platform also impresses with its spot and futures sections, giving the community new ways to invest in crypto.

CoinW caters to crypto collectors as it has an incredibly broad token catalog. For many traders, this makes it the best cryptocurrency exchange due to its cost-effectiveness coupled with a range of comprehensive offerings.

Pros and Cons

| What We Like | What We Don’t Like |

| 400+ cryptocurrencies | Reported issues with transaction execution. |

| Low trading fees | Copy trading needs improvement |

| Fast transactions |

Who It’s Best For: Crypto Collectors

New traders normally find CoinW an excellent platform because of its easy user interface, competitive trading fees, and the vast range of available cryptocurrencies. Its simplicity and inexpensive nature offer a less overwhelming platform for crypto collectors.

More details

CoinW is fast becoming a popular crypto exchange platform among traders. The exchange is available in over 3 continents and 120 countries. It also supports more than 100 cryptocurrencies and fiat currency. It has zero fees for spot trading and charges 0.02% as a maker and taker fee for futures trading.

-

Zero spot trading fees.

-

Futures trading & ETF.

-

Huge global presence.

-

High security.

-

Low trading pairs.

-

Poor customer service.

9. Prime XBT – Best for Margin Traders

Prime XBT is a leading trading platform and cryptocurrency exchange that has a large community. Its margin trading is one of the stand-out features we liked.

Additionally, Prime XBT has competitive rates in the crypto trades compared to other crypto exchanges, which may benefit regular traders.

ID Requirements

To begin trading on Prime XBT, provide your ID document (e.g., driver’s license), indirect confirmation of your residential address (e.g., bank statement), phone number, and email.

Trading Fees

Prime XBT has a trading fee of 0.05% for cryptocurrency transactions. In general, Prime XBT appears to have a good foothold with its friendly user interface and low fees.

Supported Cryptocurrencies

Prime XBT allows trading over 30 cryptocurrencies, such as BTC, ETH, LTC, XRP, EOS, SOL, ADA, DOT, DOGE, and stablecoins (USDC & USDT).

Supported Countries

You can buy and sell crypto with Prime XBT from various countries worldwide, including the US, Canada, Germany, Italy, India, Japan, Australia, and New Zealand.

Our Experience Trading with Prime XBT

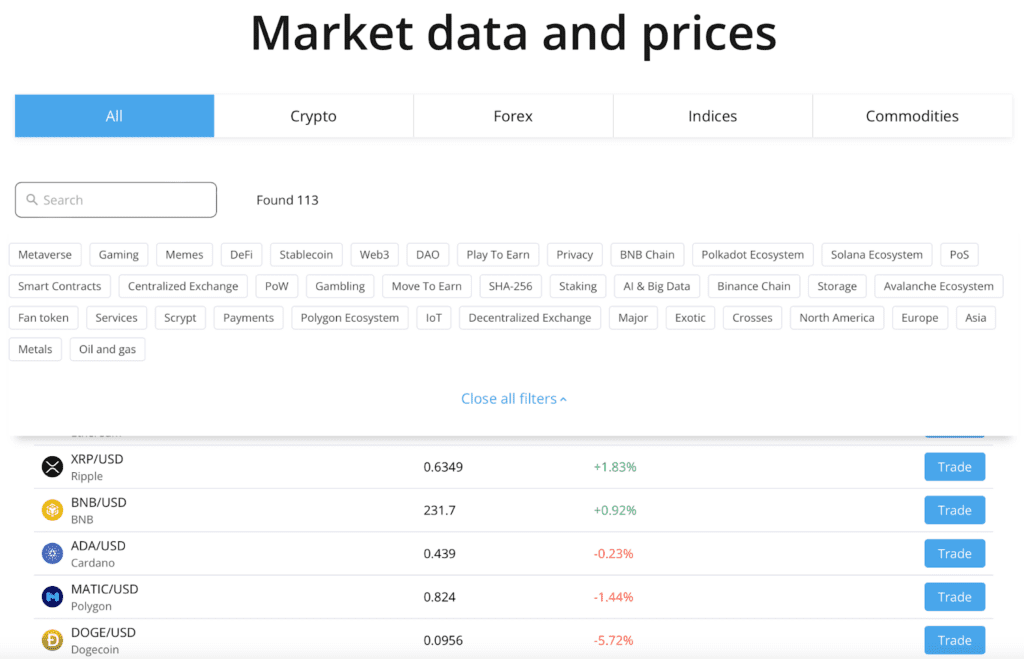

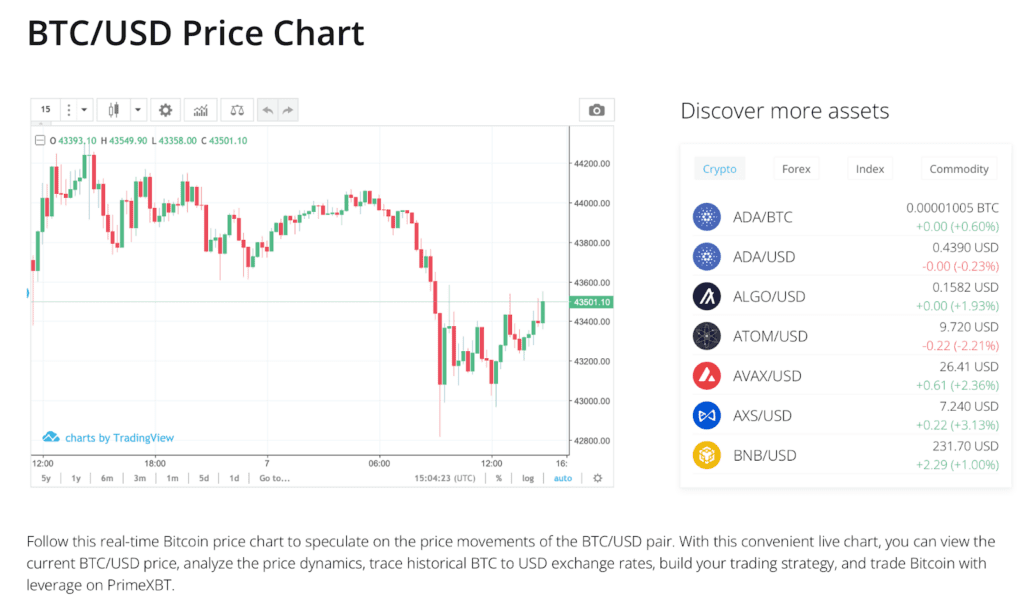

Prime XBT’s platform is intuitive and very responsive, providing users with a user-friendly interface.

The exchange offers real-time market data and powerful charting functionalities, enabling easy monitoring of market movements for informed decision-making.

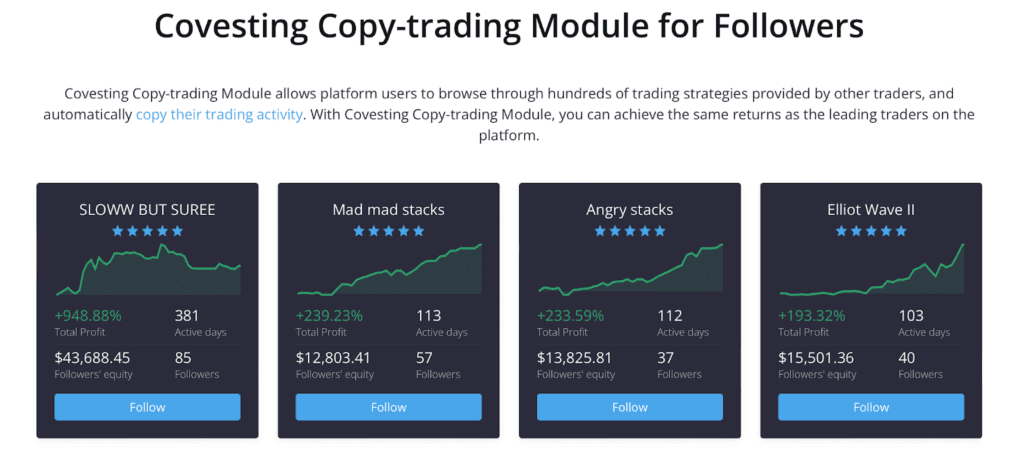

One more trait we have learned to value is the copy trading function, enabling inexperienced traders to mimic the strategies of successful colleagues.

We would say that Prime XBT is perfect for investors using margin. It is flexible and provides the best tools for fast, short-term trades involving leverage in various asset classes.

Pros and Cons

| What We Like | What We Don’t Like |

| User-friendly interface | Limited cryptocurrency pairs |

| Copy and Margin trading | Lack of regulation in some countries |

| Advanced charting tools |

Who It’s Best For: Margin Traders

Prime XBT has a strong trading option and an easy-to-use interface, making it a great choice for margin traders. With features like copy-trading and high leverage ratios, this category of investors will love the platform.

More details

PrimeXBT is a comprehensive cryptocurrency exchange providing up to 100x leverage in margin trading! It also features unique trading tools, such as the "covering" feature, enhancing the security of trades and "turbo" trading option for its users. Despite these advantages, it's worth noting that PrimeXBT's unavailability in 14 countries that affects its overall market position.

-

Simple Sign Up.

-

Lower trading fees than competitors.

-

Effective analysis tools and charts for trading.

-

Supports 15 languages for diverse audience.

-

Does not operate in the U.S. and Canada.

-

No spot trading.

-

No demo accounts to its new customers.

Our Methodology for Selecting the Best Crypto Exchanges

Experience taught us that there are different dimensions to consider when evaluating a crypto exchange. Each website proposes a different recipe, and we have chosen to combine the strategies designed by the best crypto exchange reviewers as follows:

- Services (20% importance): when we analyzed this aspect, we asked ourselves, “How many platforms does a user need to perform different actions?” For instance, we normally want the safest crypto exchange to offer transfers, swaps, staking, rewards, and other popular features in this market.

- UX/Design (15% importance): The combination of effectiveness and user-friendliness is essential for a highly-reputed exchange.

- Feature development (15% importance): The number of services a crypto exchange offers is certainly important, but each reviewer must consider how well-designed a feature is. It is not sufficient to merely give a swap interface to the community.

- Customer service (20% importance): Anyone, from beginner to seasoned traders, will need to contact a crypto exchange sooner or later. The client support must be excellent, always available, and quick to locate solutions.

- Supported cryptocurrencies (15% importance): Here, we intend to evaluate the number of available cryptocurrencies on a crypto exchange and the vetting process designed by a platform before listing a token.

- Data protection (15% importance): Finally, we evaluated how a crypto exchange handles your data before recommending it. If a platform clearly specifies how data exchange security was preserved, we evaluated the project positively.

What Factors Should I Consider When Choosing an Exchange?

When selecting a crypto exchange, take into account security, competitive fees, the number of currencies supported, and liquidity. Consider its public perception and KYC and AML procedures. Check if it provides insurance funds and your preferred trading options, and ask yourself: do these crypto exchanges fit my trading style?

What Security Measures should I look for in a Crypto Exchange?

When picking a crypto exchange, prefer the crypto exchanges that feature various security features and provisions such as data encryption, two-factor authentication, and insurance funds. Verify that the platform has full regulatory compliance, a good track record, and strong KYC/AML policies.

Important Things To Know About Crypto Exchanges

How do Crypto Exchange Fees Work?

Typically, fees of crypto exchange hover between 0% and 1.5% per trade, differing from the maker or taker role. These are normally linked to the trade value. Other trading platforms also levy charges on actions such as transferring cryptocurrency.

How Do I Submit My ID Requirements to a Crypto Exchange?

To submit your ID requirements to a crypto exchange, simply give your name, nationality, date of birth, email, and mobile. Upload government-issued ID documents such as a passport or driver’s license.

What Type of ID Requirements Are Accepted?

The most commonly accepted ID types are government-issued documents such as driver’s licenses or real ID-compliant cards. Ensure these are valid and not expired.

Why Are Certain Cryptocurrencies Not Supported by All Exchanges?

Even the best cryptocurrency exchanges may not support certain cryptocurrencies with regulatory limitations, licensing necessities, or simply because they choose to. For instance, if the exchange believes that a crypto price is too volatile and linked to a project with poor security, the token may not be listed.

Why Are Certain Crypto Exchanges Not Supported in My Country?

Some global crypto exchanges are not supported everywhere for different reasons. Barriers for a lot of them include getting licensed in the US. For example, Nexo chose to gradually exit this market. In addition, the listing of certain cryptocurrencies can be affected by their compliance with laws or operational difficulties.

Should I Choose a Centralized or Decentralized Exchange?

The choice between centralized exchanges and decentralized exchanges depends on what you want to achieve. Decentralized exchanges are ideal if you prioritize the low transaction fees and retain full control of your assets. Nonetheless, centralized exchanges might be appropriate to ensure a more user-friendly experience, especially for novices, even though such exchanges would have higher costs.