TLDR

Uniswap is a decentralized exchange (DEX) that offers hundreds of tokens. It runs on the Ethereum blockchain and allows users to swap tokens without intermediaries. Interestingly, it uses unicorns to work (as shown by its logo).

There are several ways in which users can get started using the Uniswap DEX, such as the MetaMask wallet, the Trust Wallet, and the Coinbase wallet.

Traders can swap Ethereum tokens without being concerned about the safety of their funds on Uniswap. In the meantime, anyone can lend their crypto to liquidity pools, which are special reserves. Their fee is based on the money they provide to these pools. This tool enables cryptocurrency trades without dealing with middlemen or third parties.

Introduction

There are hundreds of tokens available on Uniswap. The protocol enables cryptocurrency trades without dealing with middlemen or third parties.

The Uniswap platform executes trades through smart contracts. The concept of smart contracts is that certain conditions must be met for the algorithm to execute. That is how third-party rent collectors are eliminated.

This guide provides an overview of what it is, how it works, and how users can get started using the Uniswap DEX.

How to use the Uniswap protocol

Uniswap is an excellent tool for finding gems not on centralized exchanges, staking, providing liquidity to earn yield, and trading trustless and permissionless.

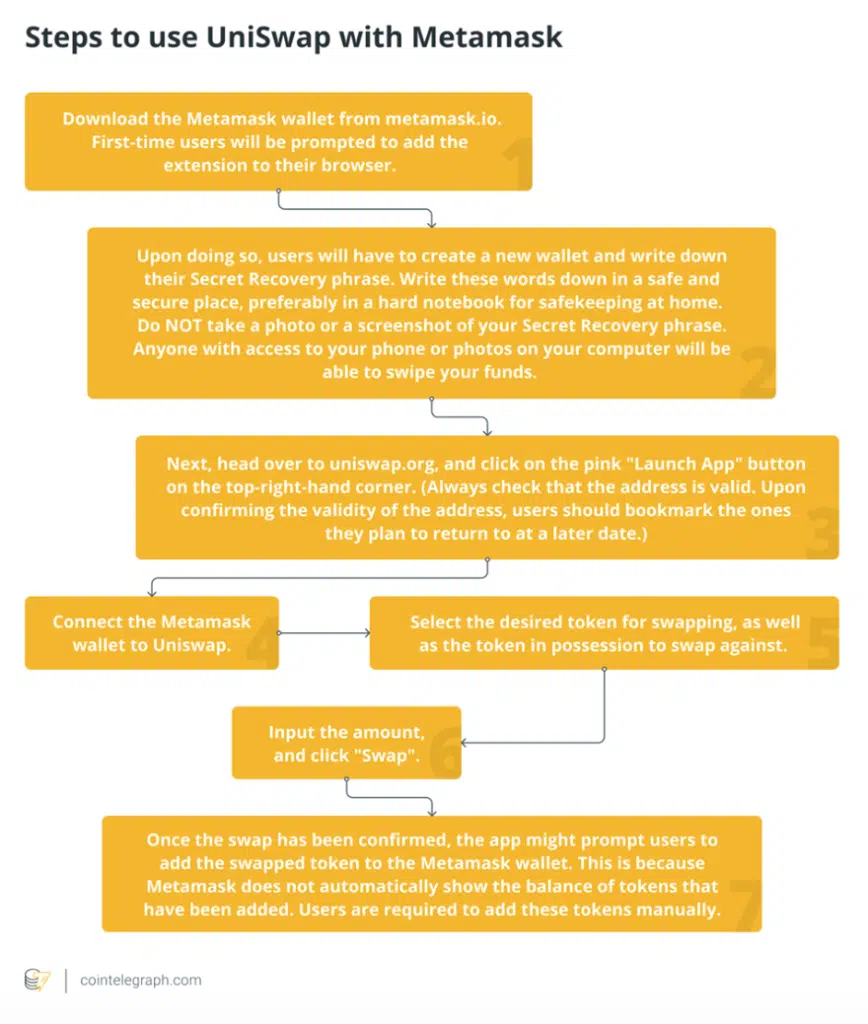

The process of trading on Uniswap is also very straightforward, requiring only a few steps:

You will need a compatible wallet, like Metamask or Trust Wallet, to use the Uniswap protocol. Since the Uniswap desktop version is impeccable compared to the Uniswap app mobile version, we will show you how to use Uniswap on the desktop.

Step 1: Connect your Metamas wallet

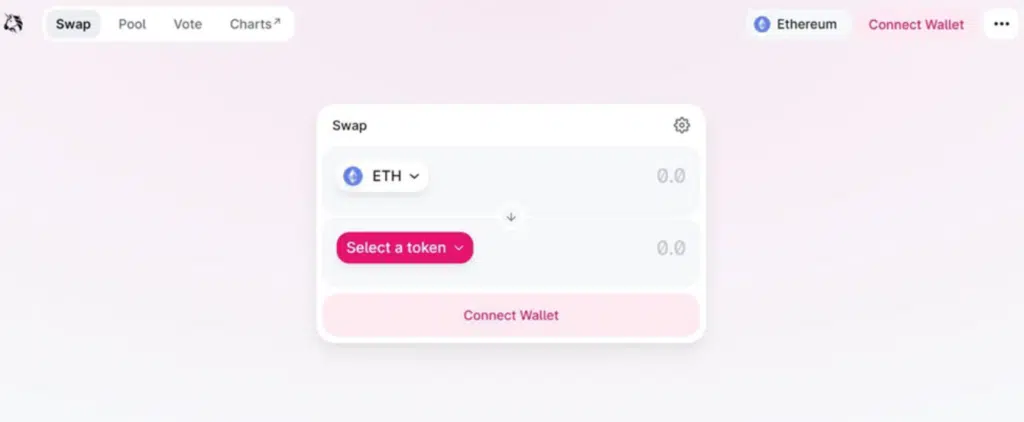

First, visit the official website and click [Launch App] in the menu bar. You can connect your Web 3 wallet by clicking [Connect Wallet] in the top right corner.

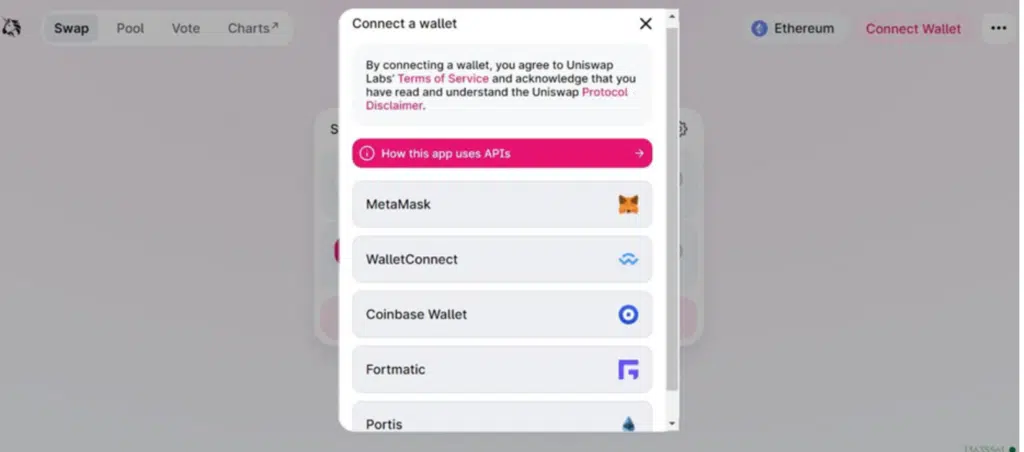

An overview of wallets supported will be provided.

One of the most popular Ethereum wallets is MetaMask. Other good alternatives are the Trust wallet and Coinbase wallet.

Mobile users can use WalletConnect’s mobile app by scanning the QR code, which comes with other wallets.

You’ll be asked to confirm the connection if you’re connecting via a third browser extension or the mobile app.

Confirm that your wallet is connected.

Step 2: Swap to your preferred crypto

On the Uniswap platform, you can start swapping tokens once your wallet has been connected.

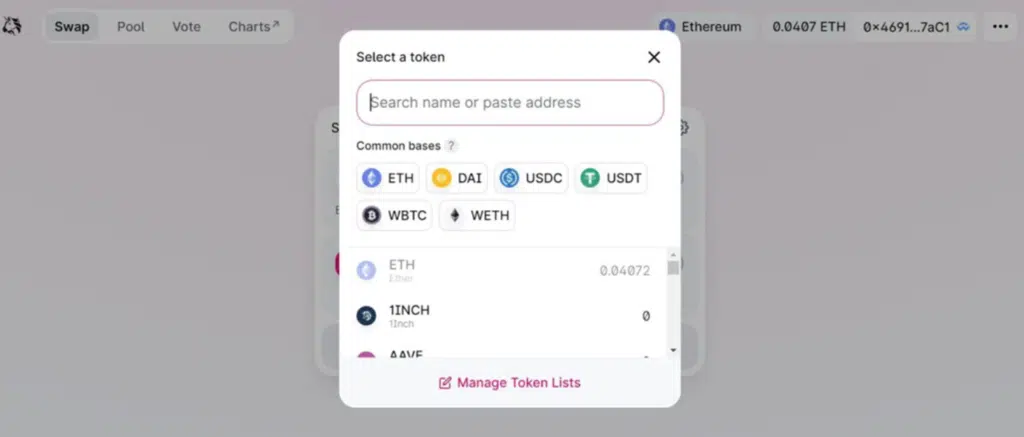

The first step is to choose the cryptocurrency you want to swap.

If you know the name or address of a token, you can search for it. We highly recommend getting the contract address if you don’t know the name. That can be found on Etherscan.

Since anyone can list a token on the Uniswap exchange, you may come across many fake coins trying to steal your money. It’s like being on the shores of Mogadishu, where there are Pirates. Watch out for pirates by confirming the wallet address on Etherscan.

Step 3: Enter the amount of crypto you would like to swap

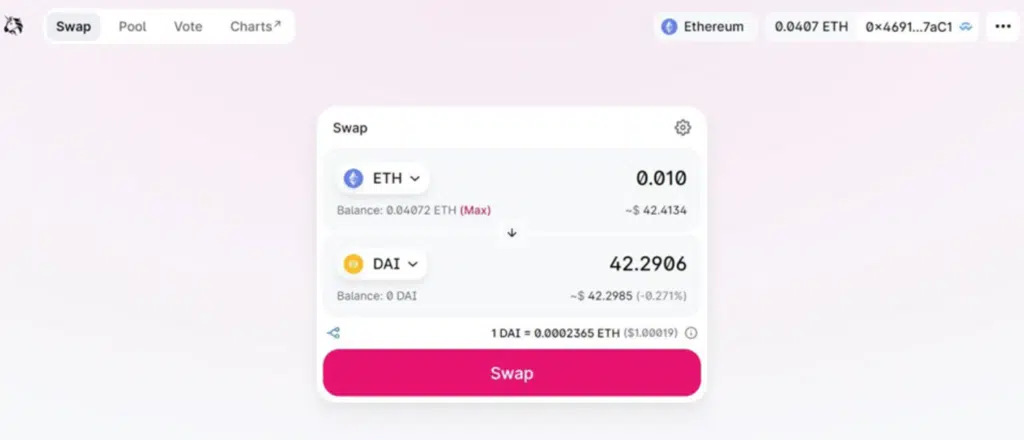

Uniswap will automatically determine how much you will receive for the other token.

Let’s say you want to exchange ETH for DAI.

Enter the amount of ETH you wish to sell cryptocurrency exchange in the ETH field if you wish to exchange a specific amount of ETH.

In the field of DAI amount, you can enter the amount you wish to receive.

Step 4: Execute the order

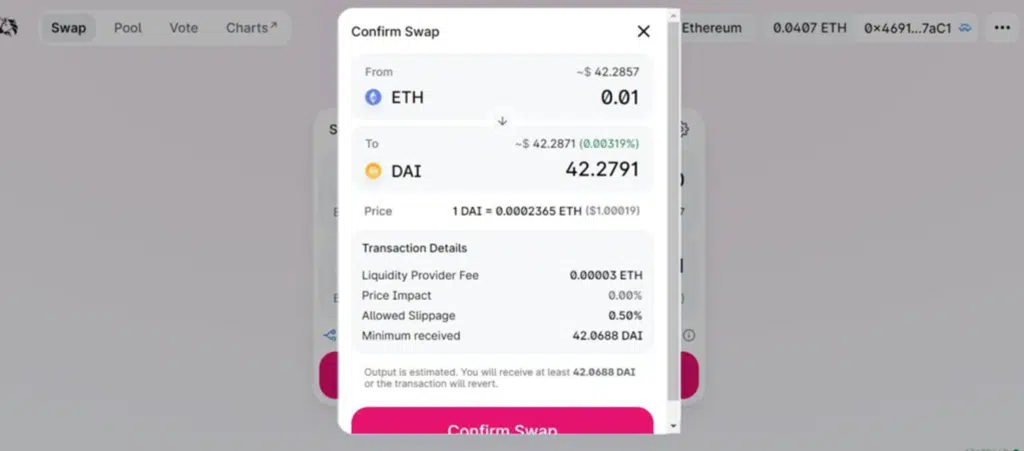

If you agree with the rate and amount, click Swap to confirm the transaction.

When you click the swap button, a new window will appear where you can review the details in Metamask. You would have to pay gas fees for the swap.

The Swap will be executed after you click [Confirm Swap].

After confirming the Swap, you will receive the token in your Metamask wallet.

This is a very straightforward process. Enjoy trading on Unisway!

More details

Uniswap is a user-friendly cryptocurrency exchange with competitive fees for all trading levels. It enables direct crypto trading from digital wallets, supports options and futures contracts for BTC and ETH, and offers advanced trading features for experienced traders and institutional clients.

-

Full transparency and open-source code.

-

No KYC process.

-

All ERC20 tokens are supported.

-

Earn passive rewards by providing liquidity.

-

Low fees for most transactions (~0.3%).

-

No option for fiat-to-crypto transactions.

-

Challenging for inexperienced crypto traders.

-

No insurance coverage for lost crypto incidents.

-

No mobile trading application available.

How to add liquidity on Uniswap

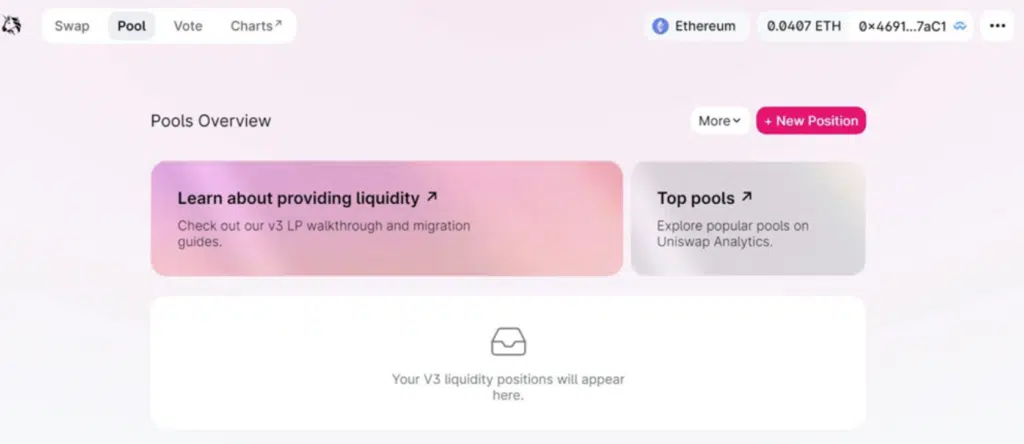

The Uniswap liquidity pool allows you to add liquidity to liquidity pools to generate income. It is comparable to leading money to someone and getting interested.

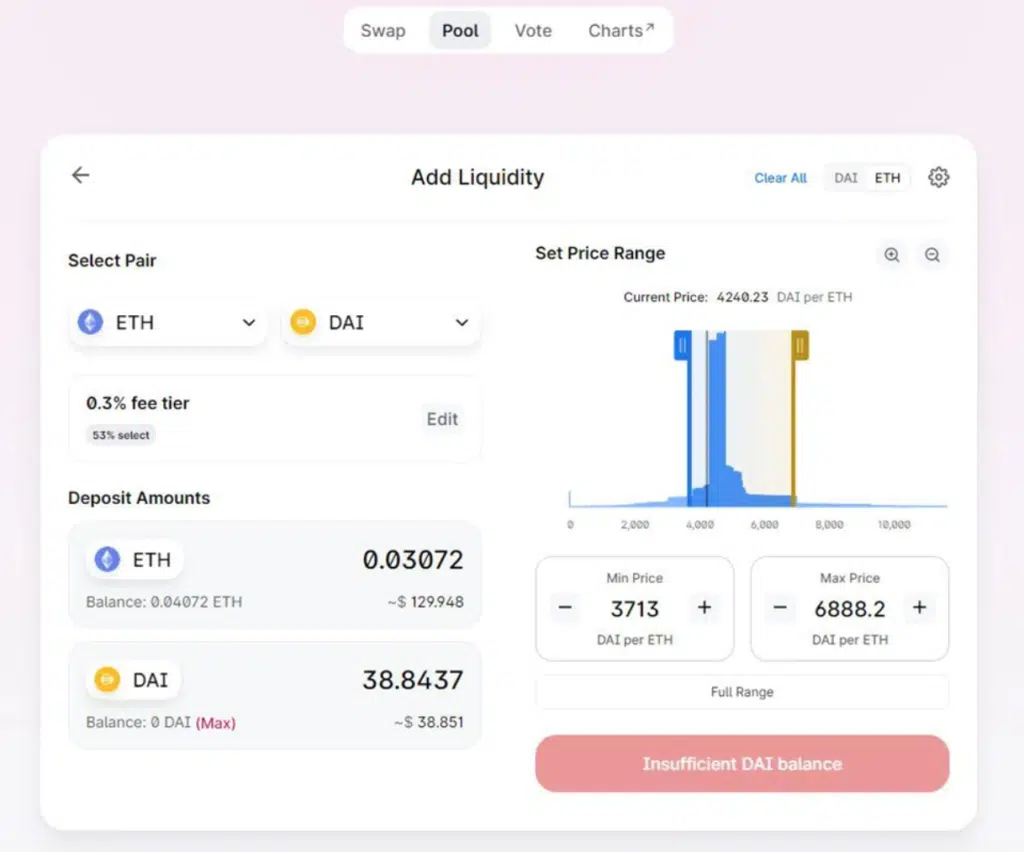

However, to provide liquidity – you must provide liquidity in pairs.

Examples would be ETH and USDC. There has to be a 50/50 balance of how much to add to each in the liquidity pool. We will explain the reasoning later.

Liquidity mining with selected tokens

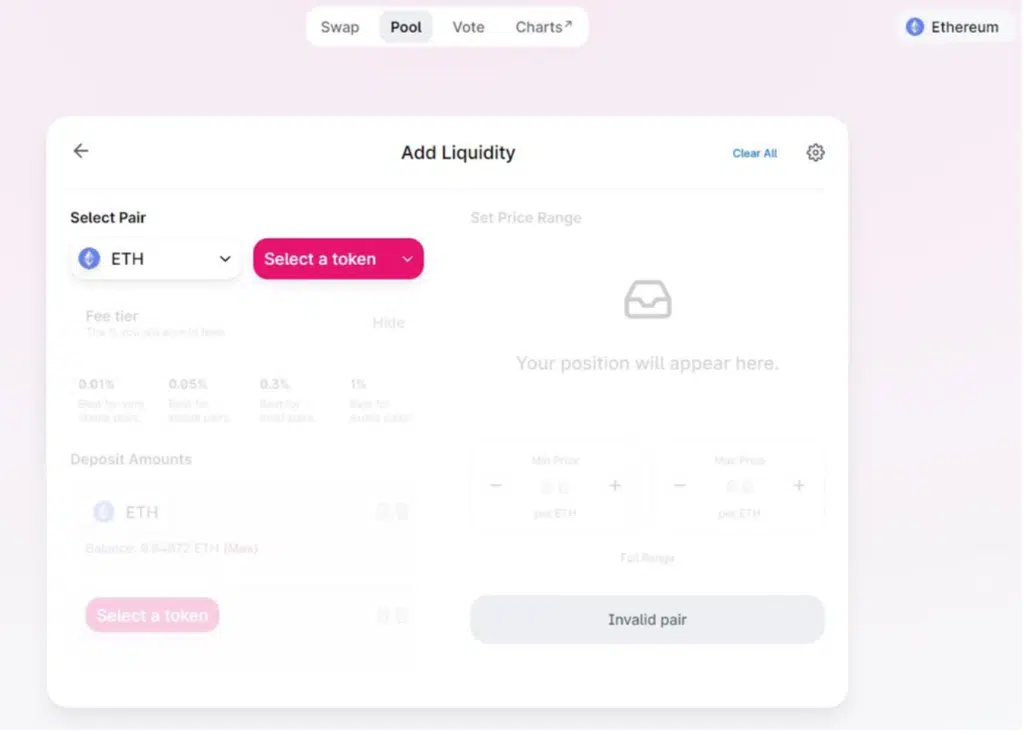

You can add liquidity by selecting the trading pair you wish to submit to the Pool and then clicking [+ New Position].

It is even possible to add a new token.

To mine liquidity, select an amount.

Your next step is to choose how much liquidity you want to provide to the liquidity pool. For each trading pair, you must include the corresponding ratio.

Ensure Supply is reviewed and confirmed.

The Ethereum transaction fees and gas fees will be paid after you enter the desired amount for both assets. When you click Supply, the LP tokens will be sent into your wallet, and you’ll see the share of the liquidity pool. The pool share is a proportion that indicates your share of the Pool.

Knowing how to use Uniswap now will help you decide whether it’s right. DEXs like Uniswap are popular and reliable. As a DEX, it offers various features and is more efficient than a centralized exchange.

What is Uniswap?

Uniswap is an entirely decentralized exchange that does not consist of one entity owning or operating it. Automated liquidity protocols are used, in this case, a relatively new crypto trading model.

The Uniswap platform was built on the Ethereum blockchain in 2018. This allows it to support all ERC-20 tokens and other infrastructure projects built on the Ethereum blockchain, like wallets like MetaMask and MyEtherWallet.

In addition to being completely open source, Uniswap also enables anyone to create their decentralized exchange based on Uniswap’s code. There is even a free token listing option on the exchange.

The traditional centralized exchanges are profit-driven and charge listing fees, so DEX’es are preferred over other exchanges for token listings.

Unlike centralized exchanges, decentralized exchanges such as Uniswap allow traders to keep control of their funds at all times. Instead of executing orders through a blockchain, which takes time and money, orders can be logged on an internal database at centralized exchanges.

Control over private keys eliminates the risk of losing assets during an exchange hack. Its protocol is home to over $3 billion worth of crypto assets and ranks as the fourth-largest decentralized finance platform.

Uniswap’s UNI tokens

The UNI token is Uniswap’s native token and has been described as a governance token. Holders can vote on new developments and platform changes by holding a token. Among the changes are the distributions of new tokens to the community and developers and any modifications to trading fees. In September 2020, UNI tokens were created to keep users away from rival DEX SushiSwap.

What is a DEX (Decentralized Exchange)?

Unlike centralized exchanges, decentralized exchanges (DEXs) allow tokens to be traded directly between peers via the blockchain. In contrast to centralized exchanges like Coinbase and eToro, Uniswap operates without the oversight of a major company. Unlike conventional exchanges, decentralized exchanges do not have to comply with know-your-customer laws. Cryptocurrencies can be traded on DEXs without a third party.

Explanation of Automated Market Makers

Uniswap allows users to easily trade any of the hundreds of supported tokens through its liquidity pools. Crowdsourced liquidity pools assist in trading assets through the pooling of funds. Traders execute trades using liquidity from these liquidity pools when ordering.

A similar process occurs in the stock market when market makers operate. A market maker is a company that constantly trades a particular stock by placing large orders.

Liquidity pools: users can place funds in liquidity pools and trade their orders to provide liquidity continuously. There are a few variations of liquidity pools, but market makers are a centralized version.

As a result, liquidity pools decentralize capital efficiency and automate the process of facilitating trading by eliminating the need for firms to support trading volumes. As well as earning fees, liquidity pools allow users to stake their funds.

What does Uniswap do?

There are many DEXs on the market with the suffix “swap” since Uniswap is an open-source protocol. The source code for these protocols is essentially a copy of Uniswap’s original. Their main differences are in their graphical user interfaces (GUIs) and their positioning and differentiation of offers.

Sushiswap

Among these copycats is Sushiswap, which is both famous and controversial. Once it obtained the source code of Uniswap, it launched a vampire attack.

DeFi protocols offer various incentives to liquidity providers as part of a vampire attack. In a vampire attack, the liquidity provider is drained from a protocol intended to be attacked.

What is Sushiswap’s method of attacking vampires?

Marketing campaigns were launched aggressively by the platform. In addition, they made switching over to their platform easy for Uniswap users and liquidity providers. The last step was to offer insanely lucrative rewards so that the participants were motivated to participate.

Uniswap vs SushiSwap

Among the differences between the two DEXs are the fees that liquidity providers are charged. There is a 0.3% offer from Uniswap, a 0.25% offer from SushiSwap, and an additional 0.05% dividend paid to holders of SUSHI tokens. In addition to nonfungible tokens, Uniswap has unveiled concentrated liquidity positions. Despite a few slight differences, both platforms are very similar.

Pancakeswap is another less controversial example. A DEX like this is a part of the Binance Smart Chain. A significant advantage of Pancakeswap is that it offers nonfungible tokens (NFTs) and yield farming opportunities, which are unique to Uniswap.

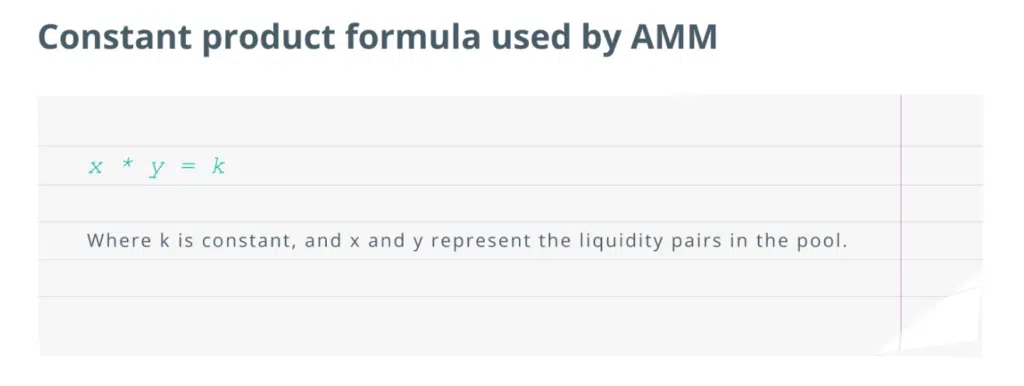

In contrast to the traditional open book model, UniSwap relies on the automated market maker (AMM) model. Several factors make the open book model less DEX-friendly, including liquidity concerns.

With AMM, a liquidity pool and a constant product market maker model are used instead of a liquidity pool, and the Constant Product Formula is utilized.

V1 or V2 version of Uniswap protocol

Notably, most liquidity pool providers could permanently lose in version v1 of Uniswap. Therefore, v1 is best viewed as the minimum viable product’s beta or alpha test version.

Uniswap provided users with significant improvements with each iteration. In v2, UNI tokens were airdropped, and oracles were introduced. Users who used the platform before September 2020 received UNI tokens as Uniswap DEX’s official governance token.

Uniswap v3

One of the most noticeable improvements in v3 was the concentration of liquidity. This allows liquidity providers to decide how and when to receive their fees.w

Additionally, Uniswap v3 is now available on the Optimistic Ethereum network. Layer two scaling solutions are vastly superior to layer one scaling solutions. Optimism offers this superiority. In addition to reducing slippage and high gas fees, near-instant transactions are among its significant benefits.

To understand how Uniswap works, it’s essential to answer the following question:

- What are the risks associated with using Uniswap?

- What are the security implications of smart contracts, blockchain technology, and Decentralized Finance (DeFi)?

There is a high level of security on the Ethereum blockchain unless flaws can be exploited. An example is that Uniswap, in the past, was exploited through a reentry attack, but the bug has now been fixed (thereby making Uniswap more secure). Consequently, liquidity and trading volume have skyrocketed over the past few years.

Looking at the platform’s features, let’s explore how people can use it.

What to Look For on Uniswap When You’re Dealing with Fake Tokens

The Uniswap exchange requires you to be able to identify fake tokens. The more you know about these fake coins, the better off you will be in protecting your money. When using the Uniswap exchange, anyone can add any coin, resulting in your money being lost if you aren’t careful.

It is impossible to revert cryptocurrency transactions, so you will not be refunded if you purchase any fake coins by mistake. The logos of fake coins are almost always identical to those of real coins, so you must be extremely careful when handling them.

With Etherscan, you can check the validity of a coin. You need to match the contract number from Etherscan with the number in your Uniswap browser when trading tokens on Etherscan.

Rather than searching directly in Etherscan for a token or its address, use Coingecko to link Etherscan. It’s possible to search for all tokens and transactions with Etherscan, no matter how fake they may be.

Uniswap Liquidity Pool: Tips for Avoiding Failed Transactions

Uniswap can occasionally fail to process a transaction. When the price of the input currency falls beyond what you consider acceptable, it is called an input currency price drop. Uniswap will revert the Ethereum you sent when a transaction fails, but it won’t refund the gas fees.

Pay attention to people trying to carry out the same transaction as you to avoid failed transactions. You can find your intended trading pair by visiting the “Analysis” section of your Uniswap browser.

The Swap will be contended with by other people as well. You should increase your gas fees whenever the token value you wish to swap increases. As a result, your transaction will move more quickly, and you can beat your competitors.

Final Verdict

This guide showed you how to use the Uniswap Protocol with Metamask. Security and not being scammed are essential when operating on a DEX.

To avoid spending money on fake tokens, be careful how you trade crypto tokens on the Uniswap exchange. It is becoming easier and more accessible for people to make money from supplying tokens on Uniswap. All you need to do is make the right and knowledgeable decision before making any move about investing in crypto coins.

Discover the full range of features available on Uniswap. Easily swap, buy, and sell cryptocurrencies, securely send them to your MetaMask wallet, participate in liquidity pools for trading fee rewards, and conveniently store NFTs.

Trade seamlessly across Ethereum, Polygon, Arbitrum, and Optimism with Uniswap's open-source mobile wallet app. As the largest decentralized exchange by volume, Uniswap offers unparalleled trading opportunities.

To utilize Uniswap, ensure you have an Ethereum wallet such as MetaMask or TrustWallet. Follow these steps: 1. Connect your wallet to the Uniswap website. 2. Choose the tokens you wish to trade.