TLDR

You can trade cryptocurrencies using both centralized and decentralized exchanges. This guide will provide the difference, pros and cons, and everything you need to know about the battle between centralized vs. decentralized crypto exchanges.

Centralized exchanges, run by a singular entity like traditional exchange platforms, remain the most prevalent choice for cryptocurrency trading. Centralized exchanges are typically more accessible and may be the safer option for the average user.

On the other hand, decentralized exchanges are not owned or operated by any single entity and allow users to trade directly with each other. This exchange provides the liquidity providers with a secure trading platform but does not offer the same protection or services as centralized exchanges.

Ultimately, both centralized and decentralized platforms can be useful depending on the situation, hence the importance of understanding the differences between the two before making a decision.

Introduction

Cryptocurrency exchanges are the platforms through which investors buy and sell cryptocurrencies with other digital assets or traditional fiat currencies such as the US dollar or euro.

On the face of it, the functionality of crypto exchanges is clear cut — buy, sell, and exchange cryptocurrency coins. Under this surface, however, these exchange platforms are further declassified, either centralized or decentralized.

Easy-to-use and beginner-friendly features like order books, price analysis, and charting tools make a centralized exchange appeal more to newbie crypto investors. Investors and crypto traders looking for more privacy and security and a more comprehensive array of investment opportunities(crypto assets) will find better value in decentralized exchanges.

In this article, we’ll discuss the benefits and drawbacks of each so you can determine which type of exchange is best for your needs. Read on to better understand crypto exchanges and how they can affect your crypto trading experience.

Centralized Exchanges

Regulated and licensed by governments, centralized exchanges are the most common online platform for cryptocurrency trading. They act as a third-party intermediary between buyers and sellers and typically charge a fee for each transaction.

A singular entity runs centralized exchanges — typically a company- responsible for maintaining the platform’s security, processing transactions, and keeping track of the exchange’s digital assets. For instance, Binance, Coinbase, and Crypto.com develop and manage well-known CEXes to make money.

Other prominent examples of centralized crypto exchanges include Bitfinex, Gemini, GDAX, Huobi Global, and Kraken. More often than not, these Bitcoin exchanges are visually appealing platforms that score for user-friendliness.

Users can deposit funds into their accounts using Bitcoin, which is then stored in a digital wallet. The user can then use the funds to make trades and purchase or sell digital currencies from the exchange. Users can transfer their funds to another wallet when they want to withdraw.

To get started, you must register for an account, prove your identification, and link a financing source, such as a debit card or bank account.

After setting up, you can purchase, sell, or exchange any supported cryptocurrencies via the exchange. Some platforms include additional features like the capacity to stake or lend your cryptocurrency in exchange for a small interest fee.

In summary, below are some benefits and drawbacks:

Pros of a Centralized Exchange

- Easy to use: A centralized crypto exchange is typically straightforward to use and offers a variety of trading tools and features. They also offer helpful customer support and tutorials for new or inexperienced traders.

- Access to multiple currencies: Centralized crypto exchanges are usually multi-currency platforms. They provide access to multiple crypto assets, currencies, and tokens. This makes it easy to diversify investments and trade in different digital assets.

- Regulation: Government regulation of most centralized crypto exchanges ensures compliance with industry standards and upholds ethical trading practices. This also helps to protect you and your assets from fraud or manipulation.

- High Liquidity: CEXes also provide high liquidity, meaning buyers and sellers can often find an order to match their desired price.

Trusted Partners

Cons of a Centralized Exchange

- Security: As with all centralized platforms/systems, a centralized crypto exchange is vulnerable to hacking and security breaches, which can lead to users losing their funds.

- Limited Accessibility: CEXes often only offer access to a limited number of tokens and coins, making them less attractive to users who want to trade various assets.

- High Fees: A centralized exchange typically charges higher fees for deposits and withdrawals than a decentralized exchange, which can deter some users.

- Lack of Transparency: The operational transparency of CEXes often falls short, making it challenging for users to comprehend the management of their funds.

- Loss of Control: As centralized exchanges hold users’ funds, users may find their control compromised and subject to the exchange’s terms and conditions.

Decentralized Exchanges

Decentralized exchanges (DEXes) are crypto exchanges that operate without a centralized server. Instead, they use distributed ledger technology (DLT) to connect users directly, allowing them to trade cryptocurrencies without trusting a third party, such as an exchange or a broker.

Examples of decentralized exchanges include 0x Protocol (Matcha), PancakeSwap, Uniswap, Sushiswap, Curve, and Venus. The designers of these exchanges aimed to create a trading environment that is secure, censorship-resistant, and permissionless.

DEXs are underscored by blockchain technology. They generally operate on smart contracts or contract-based platforms, meaning all trades are on the blockchain. This provides enhanced security and privacy, as users are not required to deposit their funds into a centralized account.

By eliminating the need for a middleman with self-executing smart contracts, DEXes reduce the risk of fraud and give their users more control over their funds.

Although DEXes often lack intuitive and user-friendly features such as fiat-to-crypto trading and customer support, they still serve as the only choice for those who seek full control over their cryptocurrencies and enjoy discovering new coin offerings.

To summarize, below are some benefits and drawbacks:

Pros of Decentralized Crypto Exchanges.

- Security: Decentralized cryptocurrency exchanges are not subject to government regulations or central servers, providing users with higher security. Since users control their funds, there is no risk of a central server being hacked or compromised.

- Speed: Decentralized exchanges are typically faster than centralized exchanges because they do not require the user to wait for the exchange to process their order. Executing the user’s order directly on the blockchain enables the network to complete transactions swiftly.

- Privacy: Decentralized exchanges provide users with greater privacy than their centralized counterparts. Since transactions are not stored on a central server, users’ data is not accessible by third parties. This helps to protect users’ privacy and financial information.

- Lower fees: DEXes typically have lower fees than centralized exchanges due to the lack of a middleman. Since the exchange does not take a cut of the user’s profits, fees can be significantly lower.

- Anonymity: Users don’t need to register or verify their identities on DEXes, which makes trading anonymous and secure.

Cons of Decentralized Crypto Exchanges

- Lack of regulation: Decentralized crypto exchanges lack central authority regulation, leaving traders unprotected in case of hacks or technical issues leading to fund loss.

- Potential for fraud: Due to the lack of regulation, there is a higher risk of fraud or manipulation on decentralized exchanges.

- Poor liquidity: DEXes are still relatively new and, therefore, may not have the same level of liquidity as CEXes. Due to this, buying and selling your cryptocurrencies can be an uphill task.

- User Interface challenges: DEX might be more difficult to navigate, especially for newbie crypto traders.

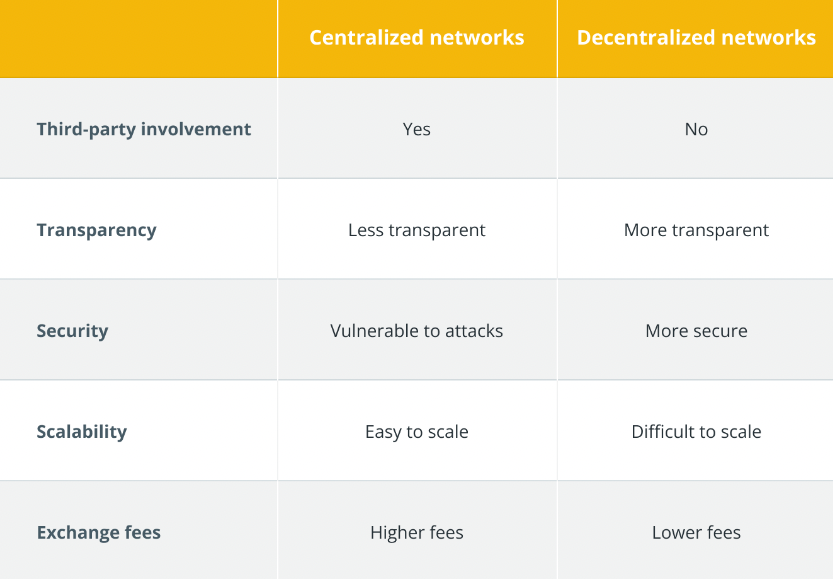

Key Differences Between Centralized and Decentralized Exchanges

Now that we know better about the two types of exchanges, let’s examine the distinctions between centralized and not centralized vs. decentralized crypto exchanges.

Custody

A centralized crypto exchange holds user funds in its wallets, while a decentralized crypto exchange does not hold custody of user funds. When you use a DEX, you effectively become your custodian of crypto assets. It enables you to be flexible when managing your cryptocurrency portfolio.

Security

Centralized crypto exchanges are prone to hacks and malicious activities, whereas DEXes are more secure as they’re not centralized in a single location.

Transparency

Centralized exchanges are less transparent, whereas decentralized ones are more transparent due to their distributed nature. You can easily find details regarding your DEX’s activities on its blockchain.

Regulation and Compliance

Centralized crypto exchanges are more heavily regulated, while DEXes are more centralized vs. lightly regulated.

Fees

A centralized token exchange typically charges high transaction fees, while a decentralized token exchange often charges lower transaction fees.

Liquidity

A centralized exchange usually has higher, above-normal liquidity than a decentralized exchange due to its larger user base. The controlling entity of the CEX also serves as a liquidity provider if need be. The implication is that on a CEX, you’ll be able to sell your crypto assets more easily than on a DEX.

Censorship

Governments or other centralized authorities can censor a centralized exchange, while a decentralized exchange is not subject to full control or censorship.

Crypto Asset Diversity

There are currently over 4,000 cryptocurrencies in the crypto market space. Not all of these tokens qualify to be listed on a CEX. The conditions are more strict and binding than DEXes’ arguably non-existent restrictions.

DEXes are home to newer, more-in-class cryptocurrencies you’d otherwise find in CEXes. This also means you’d have more money to take on more risks. Therefore, it is more important that you do your due diligence and understand your risk tolerance before committing your funds to any cryptocurrency.

Final Verdict

Centralized and decentralized crypto exchanges both have their advantages and disadvantages.

Centralized exchanges are more popular due to their convenience and security, while decentralized exchanges are more suitable for those who value privacy and autonomy.

Ultimately, the type of exchange you choose will depend on your needs, preferences, and risk tolerance. As the crypto space continues to evolve, we can expect both types of exchanges to become more accessible and secure.

The choice between centralized and decentralized crypto depends on personal preferences. Both offer advantages and disadvantages in security and user-friendliness.

Coinbase is a widely-used centralized exchange in the US and is often regarded as one of the best. It's notable that the exchange is a publicly-traded company with its stocks listed for trading.