TLDR

Understanding what Chainlink is about differs from understanding what “Chainlink staking” is. Luckily, this guide will help explain everything you need to know about both.

The steps for Chainlink staking are as follows:

- Purchase LINK tokens.

- Select your staking provider.

- Create a staking account.

- Deposit LINK tokens.

- Begin staking.

There are many things to understand about Chainlink staking; one is that it offers a crypto-economic value advantage to community members with staking rewards. Staking also contributes to improving the overall security of decentralized Oracle networks.

Introduction

The core architecture of Chainlink is regarded as foundational infrastructure greatly assisting the smart contract economy. Chainlink has roughly a thousand Oracle networks’ core support infrastructure to safeguard billions of dollars across hundreds of projects.

It is crucial to increase Chainlink’s security to keep up with the rising Chainlink-powered applications. The heightened security is needed as the Chainlink ecosystem develops to integrate more Oracle services and on-chain transactions on other blockchains. The first step in the new Chainlink Economics 2.0 age of secure and sustainable growth is staking.

Staking seeks to give Chainlink a new level of crypto-economic security. It uses cryptocurrency rewards and penalties to further encourage the proper running of the network. Chainlink staking gives Chainlink ecosystem participants, including node operators and community members, the ability to increase the security guarantees and user assurances of Oracle services by backing them with staked $LINK.

The staking of LINK, in turn, enhances the ability for nodes to receive jobs and earn corresponding fees within the Chainlink Network.

How to Stake Chainlink

Staking LINK is a straightforward process. However, you do have to be careful to ensure you don’t do the wrong thing. Follow this step-by-step guide on how to stake Link:

Step 1: Purchase LINK Tokens

This first step is for you to purchase LINK. If it is not your first time dealing with cryptocurrency transactions, it’ll be nothing new. You can get LINK on cryptocurrency exchanges such as Binance, Kraken, or Coinbase.

Step 2: Select Your Staking Provider

Next, you must decide on a staking provider that supports LINK staking. This stage is important because it determines how smooth your staking will be. Examples of some popular providers include Binance and Nexo. Review the provider’s staking requirements, rewards, and fees to determine if the platform meets your preferences and needs.

More details

Binance is a great combination of low fees, deep liquidity and multiple cryptocurrencies and trading pairs. We have tested every aspect of it and it STILL holds its reign as the top exchange in the world. In our view, it is the perfect crypto exchange for both newbies and advanced traders alike.

-

Biggest exchange in the world.

-

Industry's lowest trading fees.

-

Advance trading options like leverage trading.

-

600+ crypto options, 150+ for the US.

-

Lucrative on-site staking options.

-

Hiccups in account verification.

-

Less regulated than some competitors.

-

The corporate structure is not transparently.

More details

Nexo is an advanced and regulated crypto platform that offers a secure, fast way to own 40+ cryptocurrencies. Its users can access highly attractive earning rates on various crypto assets. Nexo also provides easy-to-use loans backed by cryptocurrency. This exchange offers a crypto-backed debit card to make everyday use of crypto a breeze.

-

Loyalty earning opportunities.

-

Up to 16% APY on digital assets.

-

Swap between 500+ market pairs.

-

Loan options for users.

-

Licensed and regulated.

-

No benefits without a native token.

-

No live chat support.

-

No anonymous option.

Step 3: Create a Staking Account

Creating a staking account is the same as setting up a wallet. You must set up a wallet that supports staking Links. You can choose from several wallet options, including MetaMask, Ledger, and Trezor. Smart contract wallets are also supported. Ensure your wallet supports Ethereum and is compatible with the provider you choose to use.

More details

The Ledger Nano X is a must-have, secure hardware wallet for cryptocurrency. It features easy mobile pairing, a sleek design, Bluetooth support, and robust security features like a safe chip and two-factor authentication.

-

Supports 5500 various cryptocurrencies.

-

Private keys are encrypted.

-

Desktop and mobile devices are supported.

-

Bluetooth enabled.

-

Allow 100 apps storage.

-

Fairly overpriced against the competition.

-

Only 100 apps are allowed.

-

Bluetooth works solely with mobile.

More details

The Trezor Model T is a high-quality hardware wallet that offers top-notch security for cryptocurrency investors. Trezor is known for its transparency and trustworthiness. The ability to store 1500+ tokens and Non-Fungible Tokens (NFTs) justifies the premium price of $219. However, some users have reported issues with the MicroSD card slot. Trezor Model T is a solid pick to safeguard crypto despite minor concerns.

-

It supports 1400+ crypto assets.

-

Touch screen for a user-friendly operation.

-

It supports NFTs storage.

-

Too expensive when compared to its competitors.

-

It has limited mobile compatibility.

-

A bulky design that is quite hard to carry around.

Step 4: Deposit LINK Tokens

Once you have chosen the staking provider, you can deposit a minimum of 1 LINK token into your staking account/wallet. Ensure to follow the deposit instructions carefully.

Step 5: Begin Staking

After depositing your LINK, you can start your staking journey. Please choose the best staking option, whether it is a flexible staking option or a fixed-term staking option. Your reward will depend on your staking option and the amount of LINK you stake.

You can monitor the rewards you get in real-time through your staking platform. Stay updated on your accumulated rewards and change your staking delegation reward strategy if necessary.

Step-by-step on How to Stake Chainlink on Binance

You can easily buy LINK with the lowest fees and be sure of a secured transaction when you use Binance. Follow these steps on how to stake Chainlink using Binance as an exchange.

Step 1: Create an account

If it is your first time using Binance, click on [create account]. After that, you can sign in.

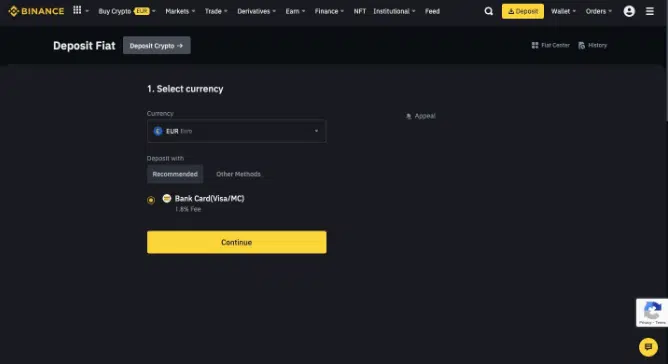

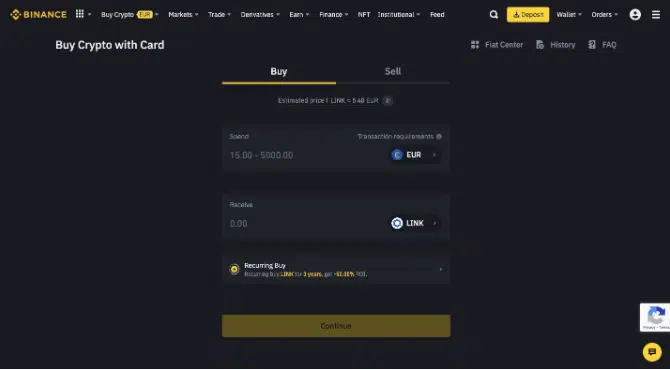

Step 2: Purchase Link Tokens

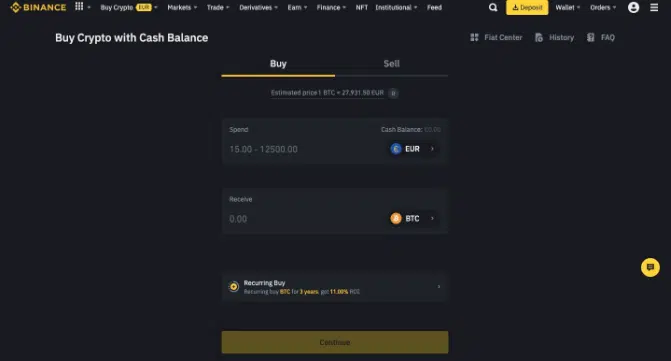

Purchase some LINK tokens. There are various ways you can purchase LINK on Binance, including:

Bank Deposit

Transfer fiat currency to your Binance wallet from your bank, then use the amount to buy Chainlink (Link). Your bank must support such a transfer for it to work.

Credit/Debit Card

This is the easiest way to buy Chainlink and the most recommended for new users. You can use either Visa or MasterCard.

Cash Balance

You can purchase Chainlink (LINK) by using your cash balance. Check the conversion rate on Binance and buy the amount you wish to.

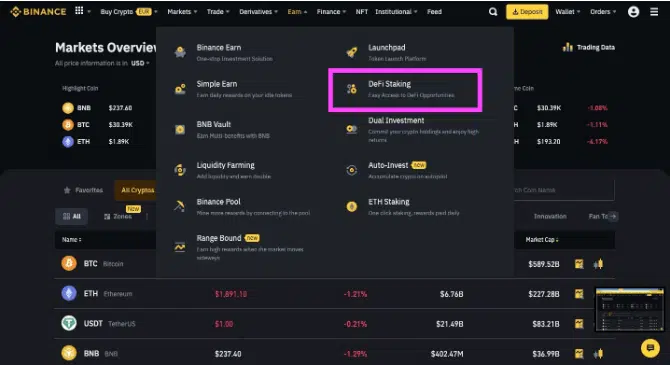

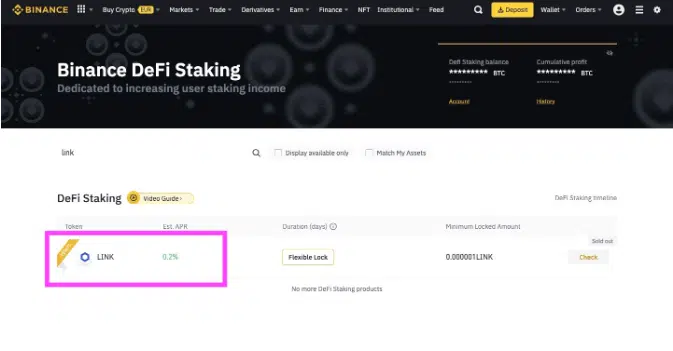

Step 3: Start Earning

Go to the Binance Earn section and select [DeFi Staking] or [Flexible Savings]. These options are under the [Earn] tab.

Step 4: Transfer Link

Select transfer from the options and fill in the necessary details. Once you complete all the required details, click [Lockup] to confirm your transfer

Why Should You Stake Chainlink?

Chainlink Staking is a major initiative supporting Chainlink Economics 2.0. It enables LINK+ token holders, owners, and actively staking node operators to profit from their contributions to the crypto-economic security of Oracle services. Over 6.9 trillion dollars‘ worth of transactions has already been made possible through the Chainlink Network.

Therefore, Chainlink-powered apps must provide vital protection for the network’s security as it scales with the increasing value. With the launch of Chainlink Staking online, v0.1, a crucial turning point in Chainlink’s new era of rapid and sustainable growth has come to pass.

Now that Chainlink Staking v0.1 is open for General Access, community members can stake up to 7,000 LINK in the limited-size v0.1 Staking pool. With General Access comes a larger scope of LINK token holders the chance to stake in chainlink staking v0.1, subject to the initial 25M Link staking cap and other participation requirements that cause restrictions.

First-come, first-served allocation of 22.5M LINK for Community Stakers and 2.5M LINK for Node Operator Stakers are available in the initial v0.1 pool, respectively. Up to the launch of Staking v0.1.2, staked LINK and prizes will be inaccessible.

You should also know that Staking v0.1 uses a non-custodial smart contract on the Ethereum blockchain; hence, only the staker can move the Staked tokens and LINK once unlocks are active.

Before starting your Chainlink Staking journey, you must understand and be comfortable with staking pool security parameters, such as the decentralized consensus mechanism, alerting system, the lockup period, staking rewards, and other key mechanisms.

Brief History of Chainlink Staking

Chainlink’s first staking launch was on 3rd October 2022. Allowing community members to check if they were eligible to stake. Those who qualified for early access on-chain transactions were the first to stake LINK tokens with the early access that started on 6th December 2022.

The early access phase made it possible for eligible community members to stake LINK (Chainlink tokens) before the public launch of the Staking Pool. It was on 8th December 2022 that the staking pool was open to the public, giving others a chance to stake Link until the pool filled up.

Important Things to Know Before Staking Chainlink

Before you start your journey as a Chainlink staker, there are some essential things to know that can guide you into ensuring you are making the right choices and guarantee a smooth experience.

Reputation and Security of Staking Provider

The provider you choose can determine your whole experience. Choose a reputable staking provider with a reliable track record and tight security. You should confirm that the provider is transparent with their security measures and has a good name in the crypto community.

Staking Period

Different providers have different staking periods. While some may offer shorter staking periods of armistice 40 days, others offer longer periods. You have to decide on which staking period is best for you.

Staking Rewards and Fees

Staking is a significant component of Economic 2.0 and is a form of community participation. Therefore, Chainlink will provide rewards to fairly incentivize the early birds for their contribution to the evolving crypto-economic security of Chainlink oracle networks.

Your reward and fees vary depending on your staking provider, how many tokens you stake, and other factors. So, consider the rewards and fees a provider offers when choosing the one to register with.

Risks and Potential Rewards

There is always a risk that comes with staking on blockchain networks, and it is essential to understand the potential rewards and risk that comes with staking. A key strategy to staking is only to stake what you are okay with liaising because you never know.

However, considering and understanding the market condition and the overall health of the Chainlink network can help increase your chances.

Some of the risks associated with Chainlink staking are:

- Network Security: Staking means trusting your LINK to a third-party provider, which comes with risks. Although you have higher security chances when working with a reputable staking provider, there is always a chance of hacks or other security breaches.

- Risks Associated with Staking Provider: A significant criterion when choosing a staking provider is choosing one that is reputable and has strong security. However, there is still a chance of unforeseen issues or fraud.

- Unexpected Technical Problems: The Chainlink network has only been operating for five years, and there is always a risk of unforeseen technical issues arising. Some of these issues can affect the security or stability of the network and likely affect your rewards.

- Volatile Market: Just like the volatility in the cryptocurrency market has its advantages and disadvantages, so does Chainlink’s volatility. Your token’s value can fluctuate, leading to losses or gains.

- Uncertainty of Regulations: Staking and LINK are still subject to regulatory uncertainties, as with all cryptocurrencies. Changes in the law could make it harder for stakers to receive rewards or even cause them to lose the tokens they have staked.

Requirements for Staking on Chainlink

Some staking providers may require a minimum quantity of LINK, while others may have varying stake requirements. Before selecting a provider, be sure you comprehend the specifications.

Understanding the prerequisite of Chainlink staking is very important to begin your journey. The prerequisites help you confirm whether you are eligible for staking on Chainlink. Having your LINK tokens in a personal crypto wallet is vital for staking Chainlink.

The second most vital requirement indicates the number of LINK tokens and gas fees in ETH. In detail, Let us explain each of these requirements for staking on Chainlink.

Minimum Requirements and Gas Fees

With the future release of the new staking mechanism, the most asked question is, “How do you make money on Chainlink?” Participants, however, must make financial investments before seeing profits. A minimum of 1 LINK must be in your self-custodial crypto wallet to stake on Chainlink.

You would also need the required ETH quantity in your crypto wallet to cover the transaction gas fees. Due to the on-chain nature of staking, gas fees are a necessity. As a result of the volatile nature of gas prices, you must first confirm the transaction fee before issuing an Ethereum staking request.

Self-Custody

Chainlink Staking v0.1 pool works with and is compatible with numerous well-known web3-based wallets. Some popular web3 wallets include Coinbase Wallet, Metamask, and WalletConnect-compatible.

The chainlink staking web page pools support smart contracts with contract wallets like Agnosis and Gnosis Safe. In addition, hardware wallets like Trevor and Ledger help with the self-custody requirements of staking on the Chainlink staking v0.1 side.

Conclusion

The various staking strategies on Chainlink offer their unique means of advancing the platform’s goal of achieving crypto-economic security. Better performance guarantees the decentralization and security of Oracle networks through staking on a decentralized Oracle network.

This guide provides the information you need to confidently stake your LINK tokens while knowing your decision’s risks and rewards.

Remember that choosing a good and reputable staking provider is the first step to ensuring an enjoyable experience. Understand the staking requirements and rewards, and take the measures to secure your tokens.

Before staking your tokens, as with any cryptocurrency investment, you should thoroughly weigh the risks and make an educated choice. By doing this, you can take advantage of the benefits of Chainlink staking while also contributing to the development of a blockchain environment that is more safe and decentralized.

The baseline rate for the community stake portion of the pool is set to be 5% a year in LINK against their committed stake for helping secure the security of the Chainlink Network.

How much Chainlink Node pays or how much a person earns from it varies. Some of the top Chainlink nodes make about $8000 per day. However, this does not happen overnight.

Yes, it is. As a Chainlink node operator, you get your reward in LINK tokens and can convert it to any currency you want.

By running a Chainlink node, you get to be a part of the Chainlink network, allowing you to help developers create hybrid smart contracts and give them access to real-world services and data.