TLDR

This article explains in detail how USDC staking works.

To earn rewards from staking USDC, take the following steps:

- Buy USDC from a reliable trading platform like the Binance Exchange.

- After buying USDC successfully, click the EARN button at the top of the screen.

- Select USDC, then click the subscribe button to select how much you want to stake and the lock duration. Agree to the stake-and-earn terms and conditions and proceed.

- Click the CONFIRM button. That’s it! You can start earning annual interest from staking USD coin.

What is USDC Staking?

USDC staking is holding or locking USD coins in a crypto wallet to earn rewards. The crypto wallet could be centralized or decentralized, depending on the user’s choice.

Staking allows holders to earn interest from the token.

The reward or interest rate varies and typically depends on the platform where the asset is locked.

8 Steps to Stake USD Coin (USDC)

To stake USD coin, follow the steps highlighted below:

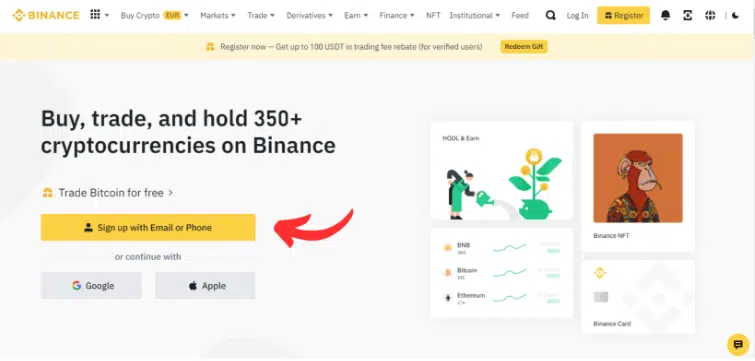

Step 1: Buy USDC from a Reliable Crypto Platform

Purchase USDC from a reputable crypto exchange. Binance is one of the best crypto exchanges to buy USDC. Click the [Get started] button to sign up.

More details

Binance is a great combination of low fees, deep liquidity and multiple cryptocurrencies and trading pairs. We have tested every aspect of it and it STILL holds its reign as the top exchange in the world. In our view, it is the perfect crypto exchange for both newbies and advanced traders alike.

-

Biggest exchange in the world.

-

Industry's lowest trading fees.

-

Advance trading options like leverage trading.

-

600+ crypto options, 150+ for the US.

-

Lucrative on-site staking options.

-

Hiccups in account verification.

-

Less regulated than some competitors.

-

The corporate structure is not transparently.

To purchase USDC from Binance, visit Binance.com and sign up.

If you already have a Binance account, skip to Step 5.

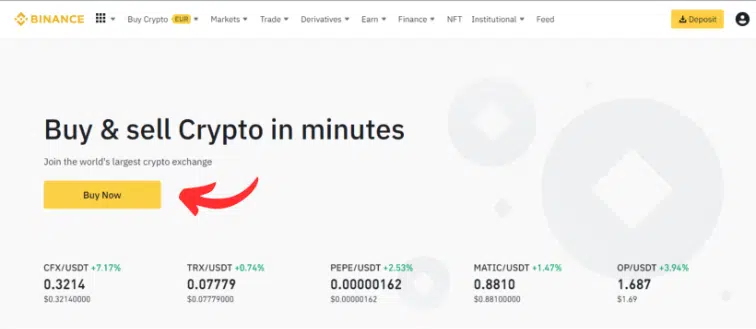

Step 2: Click the BUY NOW button

Click the [BUY NOW] button and select the currency you want to use.

You can use any fiat currency to purchase USDC on the centralized exchange.

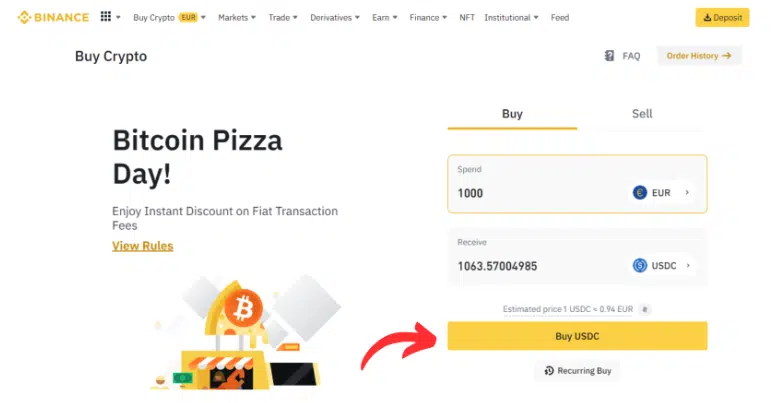

Step 3: Input the Amount of USDC you want to Buy

Input the amount of USDC you wish to buy. Then click the [BUY USDC] button.

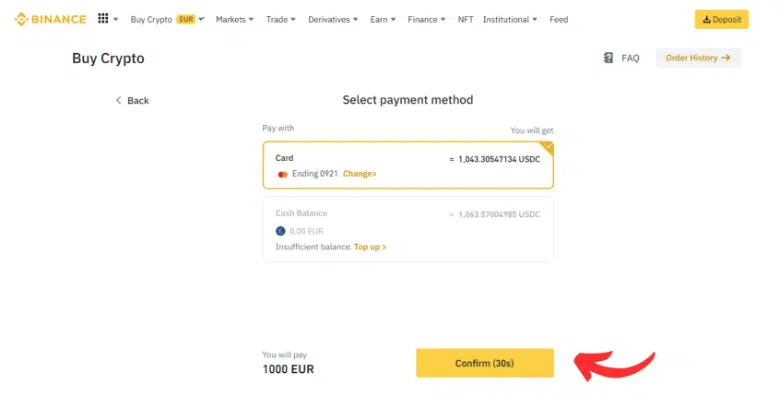

Step 4: Select a Payment Method

You can use a credit or debit card to buy USD coin.

Click the [CONFIRM] button and complete the purchase.

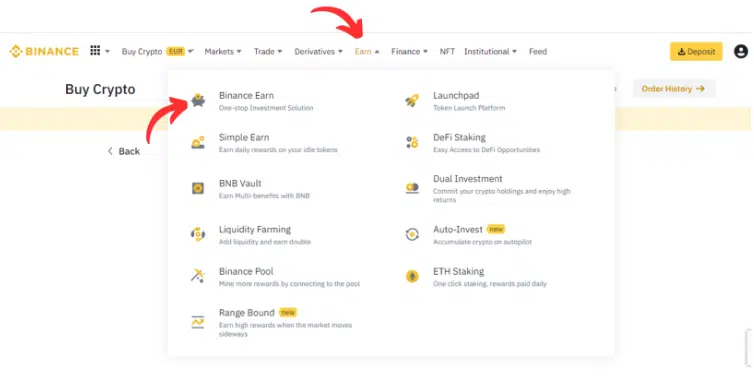

Step 5: Click the EARN button at the top of the screen

To stake your USD coin, select [EARN] and click on [BINANCE EARN].

You will be redirected to the earning page, where you can lock your USD coin to earn interest.

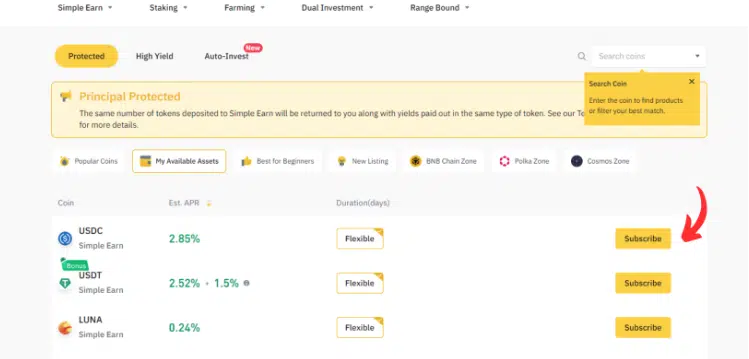

Step 6: Select USDC

Scroll down the page and select USDC.

Click the [SUBSCRIBE] button to select the amount you wish to stake and the earning duration.

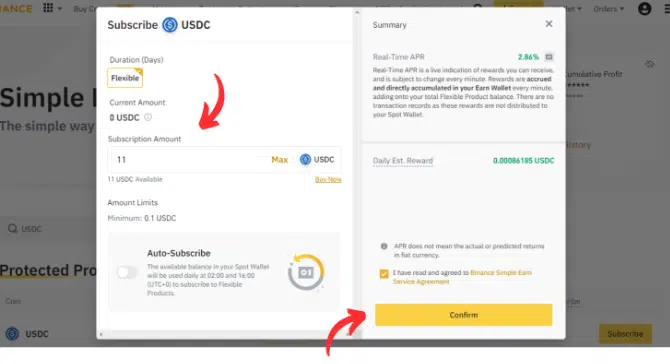

Step 7: Input the Amount of USDC

Manually input the amount of USDC you want to stake. Click on the “max” button if you want to stake everything in your wallet.

Also, read the service agreement, and agree to it before proceeding. The service agreement outlines the risks associated with staking USDC on the platform.

Finally, click the [CONFIRM] button.

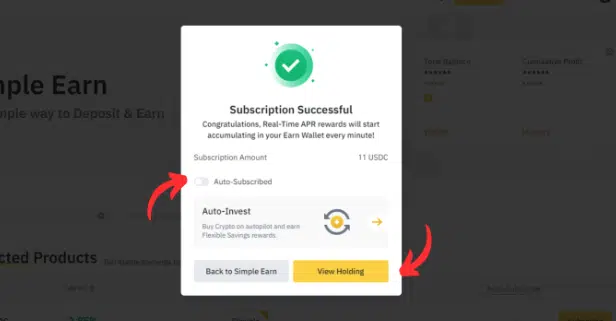

Step 8: Staking Successful!

After confirming the parameters, you will receive a message stating that you have successfully subscribed to the stake-and-earn service on the Binance exchange.

You may also decide to turn on the auto-staking feature. You can view your holdings by clicking the [VIEW HOLDING] button.

What are the returns in Staking USD Coin on platforms?

Now let us look at the potential interest in some well-known centralized and decentralized crypto trading platforms.

| Platform | APY (%) | Notes |

|---|---|---|

| Nexo | Up to 12% | One of the largest staking platforms with over 5 million users. |

| Crypto.com | 6.5% | Flexible staking duration options. |

| Coinbase | Up to 2% | APY can change as Coinbase reviews rates periodically. |

| Compound | 1.97% | A DeFi lending platform that supports staking. |

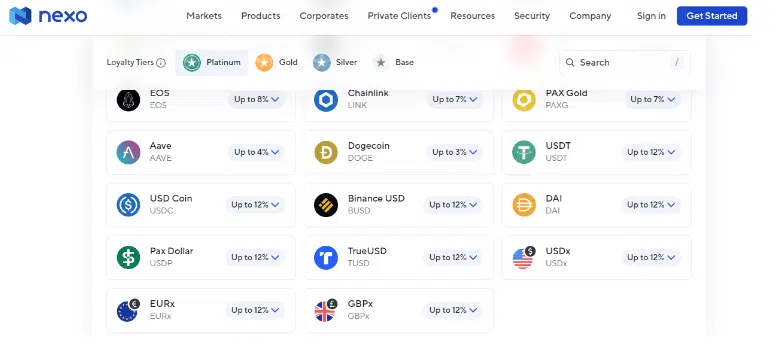

Nexo

Nexo is one of the largest staking platforms globally.

The platform has over 5 million users.

Nexo has one of the best APRs for staking USD coins. Stakers can earn up to 12% interest annually.

More details

Nexo is an advanced and regulated crypto platform that offers a secure, fast way to own 40+ cryptocurrencies. Its users can access highly attractive earning rates on various crypto assets. Nexo also provides easy-to-use loans backed by cryptocurrency. This exchange offers a crypto-backed debit card to make everyday use of crypto a breeze.

-

Loyalty earning opportunities.

-

Up to 16% APY on digital assets.

-

Swap between 500+ market pairs.

-

Loan options for users.

-

Licensed and regulated.

-

No benefits without a native token.

-

No live chat support.

-

No anonymous option.

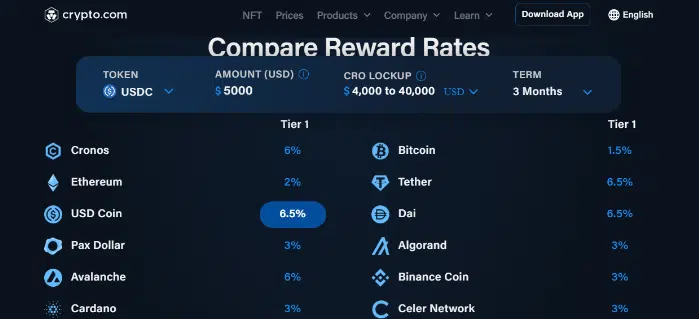

Crypto.com

You can earn up to 6.5% APY for staking USD coins on Crypto.com.

The site has a great interface, and the staking duration is flexible. You can lock your digital cash or assets for a month, three months, or even a year.

More details

Crypto.com offers a straightforward approach to cryptocurrency trading. Opening an account with crypto.com is quick and easy. It includes state-of-the-art safety measures that make it safe for users to buy and sell crypto quickly. This crypto exchange is highly recommended for anyone looking to securely trade large amounts of cryptocurrency!

-

250+ cryptocurrencies to choose from.

-

Firm and unparalleled security to users.

-

Earn interest in crypto.

-

Top-rated mobile app.

-

Low fees on trading and trading fee discounts.

-

Slow identity verification.

-

Customer service could respond faster.

-

Lack of educational resources for new users.

Coinbase

Coinbase users can earn up to 2% interest per annum.

Notably, Coinbase regularly reviews the reward rate, and the APY could increase or decrease occasionally.

More details

Coinbase is one of the largest crypto exchanges in the world and a widely-used platform for buying, selling, and trading over 200 cryptocurrencies. It offers trading solutions for beginner, advanced, and institutional traders alike. Take a look at what makes it an excellent option for individual traders looking to trade in cryptocurrencies and beyond.

-

A wide-selection of coin offerings.

-

Most secure online crypto platforms.

-

Top-rated mobile app.

-

Easy interface and user-friendly.

-

Expensive and complex fee structure for beginners

-

Higher fees as compared to other cryptocurrency exchanges.

-

Slow customer support.

Compound

Compound is a DeFi lending platform that supports staking.

The average APR for USDC on Compound is 1.97% per annum.

How does USDC staking work?

Staking USDC involves locking your USD coin for a fixed period. Many crypto exchanges attach penalties when a user unlocks an asset before the proposed date.

The longer the date a user locks an asset, the greater the yield derived from the lock.

Crypto exchanges may run a staking pool directly on public blockchains while offering users a percentage of the incentive generated from the pool.

Alternatively, a crypto exchange may generate investor yields through borrowing and lending.

Stakers loan their USD coin to the exchange, while the exchange loans out the asset to earn interest. When borrowers return the loan with interest, the exchange keeps the balance as a fee and rewards stakers for lending their funds to the platform.

The Benefits of USDC Staking

Reduced Volatility

The USD coin is a stablecoin pegged to the dollar. Hence, unlike other cryptocurrencies, like Bitcoin, which could plummet in value, USDC is a more stable investment.

Earning Passive Income

USD coin investors earn interest without actively lending or working for profit. Additionally, the average interest earned from lending and staking USDC is higher than that from borrowing and lending money to traditional financial and lending institutions.

Security

USD coins stored on a decentralized wallet are fully secure. The wallet owners cannot have their assets restricted or frozen.

The Risks of USDC Staking

Market Risk

Although the USD coin is pegged to the US dollar, the digital currency could still lose value in extreme market conditions. For example, in March 2023, USDC’s price crashed by about 12%. The price instability resulted from the Silicon Valley Bank crash and the bank’s affiliation with Circle, USDC’s issuer.

Smart Contract Risk

Smart contracts can be susceptible to hacks and bugs that could make stakers lose their digital assets. Further, when funds are lost on a smart contract, they can hardly ever be recovered.

Platform Risk

When you stake USD coin on a centralized exchange, you trust your funds with the platform. Many traders lost their funds in the FTX collapse that happened in late 2022.

Summary

Staking USD coins involves locking your coins to earn interest or passive income for a fixed period.

You can earn more juicy cash rewards from staking USDC coin than you’ll likely earn from traditional financial institutions like banks.

Although locking USD coin for a long time to earn interest has benefits, this strategy also has some risks.

The minimum amount required to stake USD coin depends on the lending platform. You can operate a staking account on some platforms with a deposit of 1 USDC. Other platforms may require more.

It is legal to stake USD coin in most parts of the world. However, note that the legality of using the USD coin varies from jurisdiction to jurisdiction. The staking service may not also be available to individuals in some countries.

The US government controls the dollar and most CBDCs. However, USDC is not controlled by the private sector or the government. It operates on a blockchain network and is not issued by the Federal Reserve Board.