TLDR

Curve Finance is a decentralized exchange (DEX) protocol built with an automated market maker (AMM) system that optimizes the exchange of digital assets with identical tokens.

It is also great for exchanging tokenized versions of coins. It is governed by the Curve Decentralized Autonomous Organizations (DOAs).

Curve Finance creates a balance in the liquidity pools by selling excess tokens at a slightly lower rate and offering liquidity providers low fees, low slippage, and security against flash loans.

What Is Curve Finance

Curve Finance is a decentralized finance (DeFi) protocol built on the Ethereum blockchain.

It is an Automated Market Maker (AMM) that aims to provide a more efficient and stable way to trade and invest in stable cryptocurrencies using a unique liquidity pool model.

The Curve Finance system is a liquidity aggregator that allows you to add any asset while maintaining low fees and slippage while earning good money.

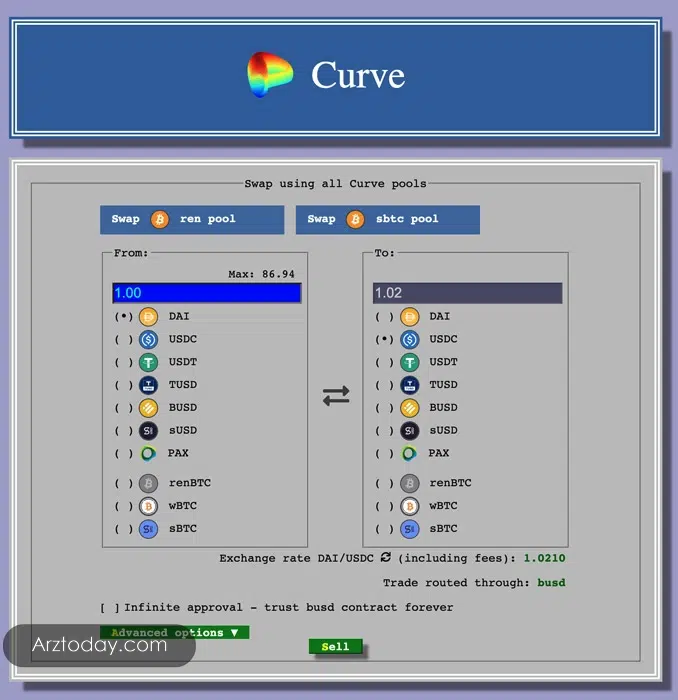

While Curve Finance has a functionality similar to Uniswap or Balancer, its unique system only allows for similarly behaving assets like stable coins or tokenized versions of these coins.

What is an Automated Market Maker

Automated Market Markers (AMM) are one of the most popular platforms where trading tokens is automated without permission.

Instead of using the standard order book like how exchanges used them, AMM functions with pricing algorithms. The coded base calculates the buy/sell aspect of an order book.

This is why it functions well with tokens within the same price range.

Among AMM’s most dynamically thriving tokens are wrapped BTC varieties such as WBTC, renBTC, and sBTC. These have a 1:1 value of the original BTC.

Liquidity Pools

The liquidity pools in the Curve DEX platform are more efficient and ensure low slippage on the Curve platform.

ERC-20 token holders can become liquidity providers and earn interest fees by supplying tokens to the pool. By supplying tokens, whose prices are dictated by a specific mathematical system, you actively contribute to a user-friendly liquidity pool. Modifying elements within this mathematical framework allows you to dynamically optimize the pool for various purposes.

When users deposit their cryptocurrency into liquidity pools, they receive CRV tokens. The value of the CRV token is directly tied to the value of the assets in the pool. Users can trade and invest in other cryptocurrencies using the CRV token, earning trading and liquidity curve rewards.

More than 17 curve pools are available for swapping and diverse types of assets. However, this is constantly changing because of the curve finance market demand volatility.

Trusted Partners

How Does Curve Finance Work?

We use a mathematical formula to calculate asset prices rather than relying on the order book system.

This formula was particularly for tokens belonging to the same price bracket. The formula would be useless if the tokens weren’t in the same price bracket.

The curve finance system has no control over the moves in the market outside of its scope and, therefore, cannot control any transaction done off the platform.

For example, 1 USDT equals 1 BUSD, which in turn equals 1 USDC, and it goes on. If you’re converting 50 million USDT to BUSD and then to USDC, brace yourself for some slippage in the respective smart contracts. As a result, you won’t receive an exact 50 million on the receiving end.

The Curve finance system guarantees low slippage on all transactions and keeps fees minimal.

Stability In Curve Finance

Unlike other AMMs, the Curve model works particularly well for long-term sustainability over the volatility risks in stablecoin trading. This is because it’s in a constant cycle of balancing the curve pool.

Let’s use the USDC and BUSD pool as an example. The process goes like this:

- If users start selling BUSD on Curve, they will upset the Curve pool.

- The pool now has more USDC than BUSD.

- The pool then slightly discounts the price of USDC as an incentive to gain market stability.

- The USDC is sold, and the balance is restored to the pool.

The goal of the curve pool is to maintain low fees, a balanced pool, and minimum risks that come with volatility.

Features Of Curve Finance

One of the Curve’s great attributes is its output’s consistency due to its standard formula; this means that the volatility of the digital market system is minimal.

In addition, this helps to prevent the dangers of market manipulation that happens on most Decentralized Exchanges (DEXs) like flash loan attacks and others.

Another great attribute of Curve Finance is its ability to allow users to deposit more than one token or asset on the same platform. A serial token holder can deposit BTC, ETH, USDC, USDT, etc., on a single platform.

We then measure the pools to determine the achievable level of supply and demand, helping to balance the prices.

Users also have the opportunity to borrow tokens from the pool easily and without the need for collateral.

The Curve is also great in helping users earn passively by actively engaging provisions of liquidity pools. Depositors can profit from a share of the fees on any trades the liquidity pool generates.

CRV Tokens

When the curve pool launched a Decentralized Autonomous Organization (DAO) to manage the protocols on the platform, it was a step toward decentralized governance.

In general, governance tokens regulate DAOs, granting token holders voting power. Specifically, CRV tokens regulate the Curve DAO.

You can buy or earn the CRV token through yield farming when you provide liquidity and earn yield farming rewards. The best place to buy CRV tokens is Binance.

More details

Binance is a great combination of low fees, deep liquidity and multiple cryptocurrencies and trading pairs. We have tested every aspect of it and it STILL holds its reign as the top exchange in the world. In our view, it is the perfect crypto exchange for both newbies and advanced traders alike.

-

Biggest exchange in the world.

-

Industry's lowest trading fees.

-

Advance trading options like leverage trading.

-

600+ crypto options, 150+ for the US.

-

Lucrative on-site staking options.

-

Hiccups in account verification.

-

Less regulated than some competitors.

-

The corporate structure is not transparently.

Yield farming also gives CRV tokens as incentives to users who want to become liquidity providers. This way, they get both money and become fractional owners of a DeFi protocol.

Holders use CRV tokens to vote or reject proposals, with their voting power proportional to their number of locked CRV tokens. The more they lock, the stronger their voting power becomes.

Every year, liquidity providers receive a distribution of CRV at a rate that decreases annually.

Security Risk In Curve Finance

Curve Finance is a community reserve protocol that profits the users greatly. Trail of Bits has also audited it, but none absolved it of legal risks.

When participating in smart contracts, one primary security rule is to invest only what you are willing to lose.

Another risk is the impermanent loss, which is the number of dollars you can potentially lose as liquidity providers to any AMM.

Another risk on the curve platform is the risks that come with users of other smart contracts on the same platform. A failure in one protocol can result in a chain reaction that can spread across the whole system.

Who Is Behind The Curve Finance System

There is scanty information about the team behind the Curve Finance system. However, one important name to note is Michael Egorov. Michael is the CEO of Curve Finance.

He is a former scientist and physics Olympic medalist who co-founded NuCypher with infrastructure experience at Linkedin.

He developed the foundation algorithm for Curve Finance while researching liquid staking and creating algorithms for deep markets.

Conclusion

In summary, Curve is a decentralized finance protocol that uses liquidity pools to provide a more efficient and stable way to trade and invest in cryptocurrencies.

Furthermore, it’s a system that runs with Ethereum-based tokens while ensuring that users providing liquidity in the pools enjoy low slippage effects and earn rewards.

While Curve Finance is an excellent part of the DeFi space, it’s not without risks, mainly because other blockchains rely on it.

Additionally, the protocol uses a constant product formula that helps to prevent flash loan attacks and other types of market manipulation.

Curve Finance stands as a decentralized finance (DeFi) protocol, offering a decentralized exchange (DEX) for stablecoins within the Ethereum ecosystem. Ethereum was purposefully crafted to promote efficient exchanges between cryptocurrencies of equivalent value.

Like all DeFi protocols, Curve comes with its set of risks. However, since its inception in 2019, it has operated seamlessly, earning a reputation as one of the most reliable and secure platforms in the DeFi space. For investors eyeing the lucrative opportunities of DeFi yield farming, Curve represents an excellent prospect.

The platform extends its services across multiple EVM-compatible networks. Liquidity providers (LPs) stand to earn yield via trading fees, interest from associated lending protocols, and incentives through CRV tokens. Despite inherent risks associated with DeFi, Curve upholds its position as one of the most trusted and secure platforms.