Welcome to our eToro Review.

eToro is a multi-asset investment platform that aims to simplify your trading experience. It offers a single hub for managing stocks, crypto, ETFs, and even commodities.

This convenience makes it a very popular choice for investors seeking to diversify their portfolios without managing multiple platforms.

But is it worth the switch?

In this eToro review, we’ll explain the platform’s pros and cons and share our hands-on experience of using it to trade in the markets.

It’s important to compare its features and limitations to other investment options before choosing the best crypto exchange.

Here at Coinweb, we have over a decade of experience in the industry and have witnessed countless crypto exchanges come and go.

Our take is that eToro’s convenience makes it a popular and standout choice for investors seeking to diversify their portfolio without managing multiple platforms.

In our experience, eToro is worth it, but you need to know about certain features and investment limitations before making a decision, which we shall explain below

eToro at a Glance

| Cryptocurrencies | ~30 |

| Stocks Available | ~3000 |

| Active eToro Users | ~33 million |

| Available Countries | 78 |

| Mobile App | Available on Android and iOS |

| Trading Pairs | 40 currency pairs |

| Headquartered In | Tel Aviv, Israel |

| Current CEO | Yoni Assia |

What is eToro and How Does it Work?

eToro is one of the most popular trading platforms on the planet, offering brokerage services and advanced trading features for people all around the world. Founded in 2007, eToro initially focused on foreign exchange markets and trading currency pairs.

Since then, the company has evolved into a giant financial instrument that offers crypto, bonds, different currencies, stocks, and ETFs.

Now, more than 90% of all eToro customers are trading cryptocurrency, which makes the eToro platform a great competitor for traditional cryptocurrency exchanges like Binance and Coinbase.

Who Created eToro?

eToro was created by Yoni Assia, Ronen Assia, and David Ring. The three started the company in 2006, but the main driving force behind it has always been Yoni Assia.

He was always passionate about investing, and after ending his military career, he started buying shares in different companies.

The young entrepreneur quickly realized how hard it is for people to buy shares, and decided to change that by opening an online trading platform named eToro.

eToro Benefits

eToro attracts more than 30 million investors annually for a reason – it has more benefits than other products. Let’s see why users chose this platform:

- Low Fees: eToro has some of the lowest fees in the traditional finance market, starting from $5 for withdrawals and zero fees for custody. The fintech doesn’t go for extra profitability, but rather for a larger customer base over a longer period.

- Long History: eToro has been around for a very long time, developing new products and winning trust.

- Multi-Asset Platform: eToro offers more than 5,000 different financial assets, including stocks, cryptocurrencies, ETFs, indices, currencies, and commodities in ONE application. You can also see your whole trading history presented on one page, which is an additional plus.

- Extensive Ecosystem: Over the years, eToro has become more than just an investment platform. Now, the company has its Visa debit cards, its crypto wallet, different courses, and much more.

- Buy Fractions: With the eToro app, even people who don’t have the liquidity to buy entire Apple or Amazon shares can invest in these companies. That’s because eToro was one of the first financial institutions to let customers purchase fractional shares.

Best eToro Features

eToro is constantly creating new features. Here are some of the most important ones you must know about.

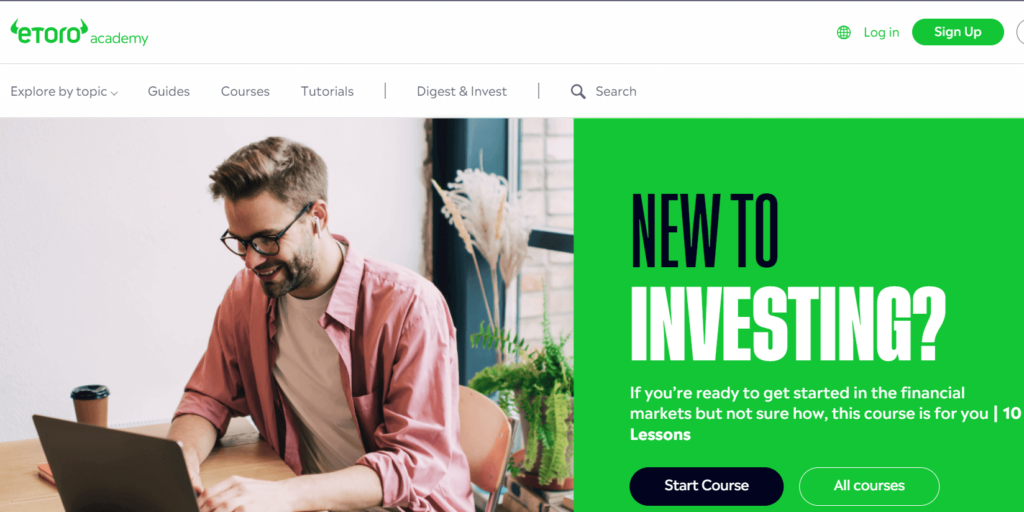

1. eToro Academy

If you have never heard of investing, eToro Academy is the best place to take your first step and get the information for your first market analysis.

eToro has gathered an immense amount of information that will help you navigate the world of crypto trading, long-term investments, portfolio management, and more. Based on this information, you can do market research and analysis.

The platform contains more than 7 courses and a little over 70 lessons on different aspects of investing. The best part about them? They are completely free!

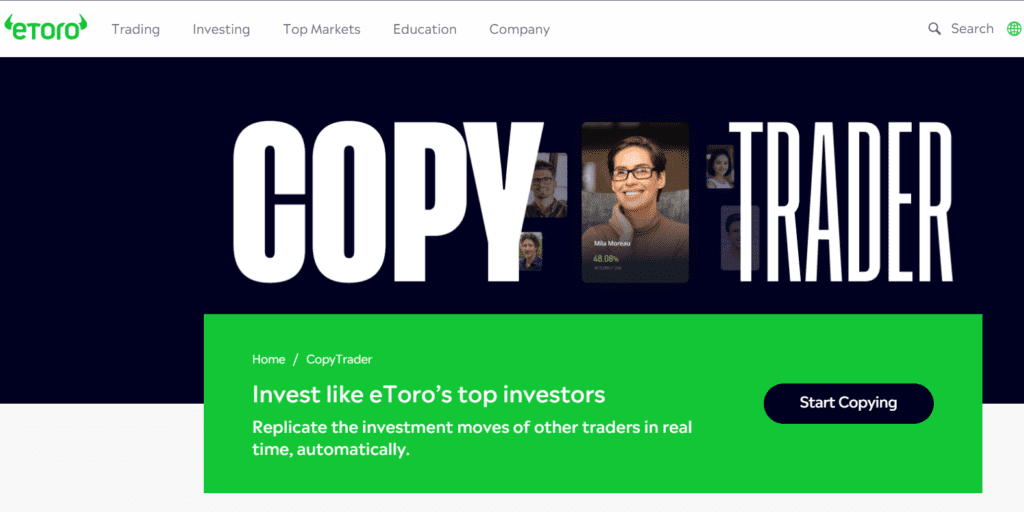

2. Copy Trading

Copy trading is a popular investor program used by millions of people online. You are copying the moves of experienced traders, making a profit using their knowledge and risk management.

eToro took this technique to a whole new level, developing a platform with hundreds of top-notch crypto traders you can copy. You can choose trading strategies with higher returns but take higher risks, or you can copy a trader with lower returns but close-to-zero risks.

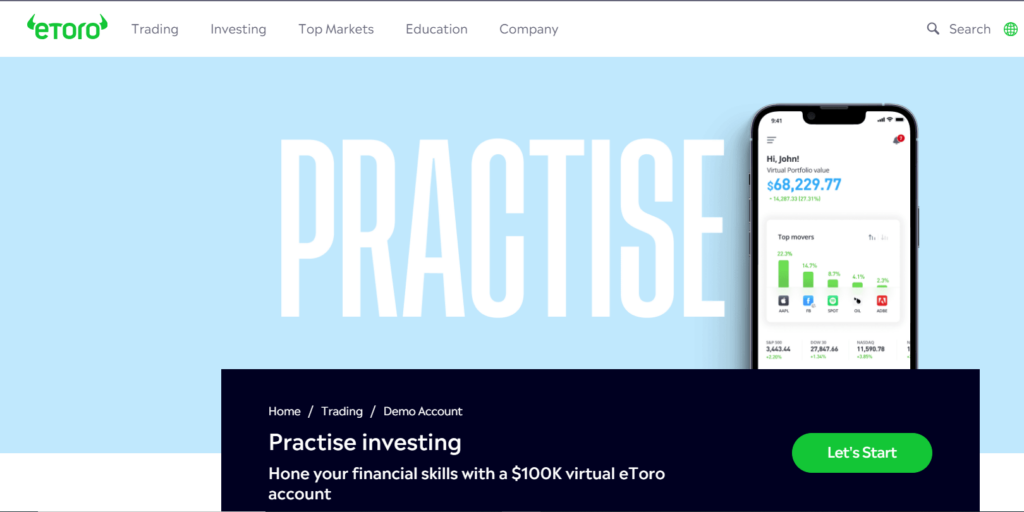

3. Demo Account

eToro gives every new trader $100k worth of virtual currency to trade different stocks inside a demo account. This way, you can familiarize yourself with the app, learn a few tricks directly from the game, and practice trading while not losing cash.

In my experience, learning through practice is a hundred times better than learning from some articles online, especially if you already know the basics from eToro Learn.

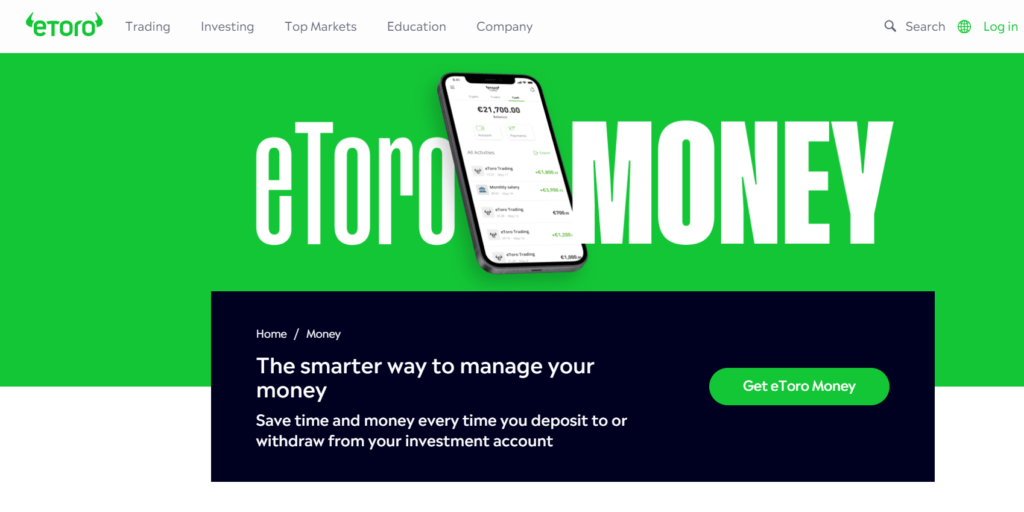

4. eToro Money

eToro Money is a separate application that complements the eToro trading platform. It provides an easier way of depositing, withdrawing, and managing money on eToro.

I use it for both deposits and withdrawals and save up to $15 for every $1000 deposited or withdrawn from the investment app.

Also, this service has a Visa debit card through which you can make day-to-day purchases directly from the account, without the need to withdraw fiat money to a bank.

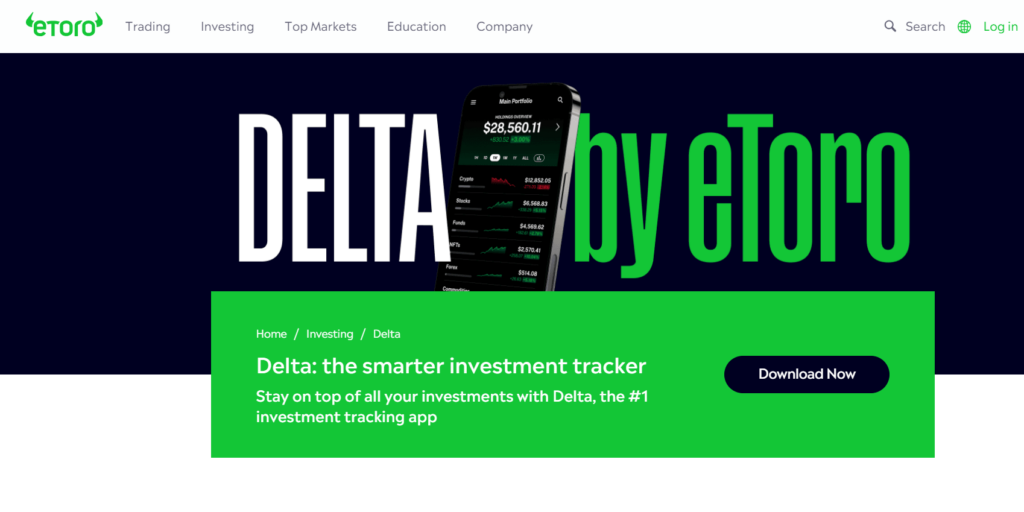

5. Delta

Track all your investments in one application with Delta, an investment market price tracker developed by eToro. Combine your NFTs, stocks, bonds, exchange-traded funds, and cryptocurrencies to track their performance in real-time.

I use it to understand the movement of my crypto portfolios. This helps me understand if I need more exposure to crypto, some new commodities, or a new NFT that will boost the performance of my portfolio. However, it is not automated, and you need to get your own investment ideas.

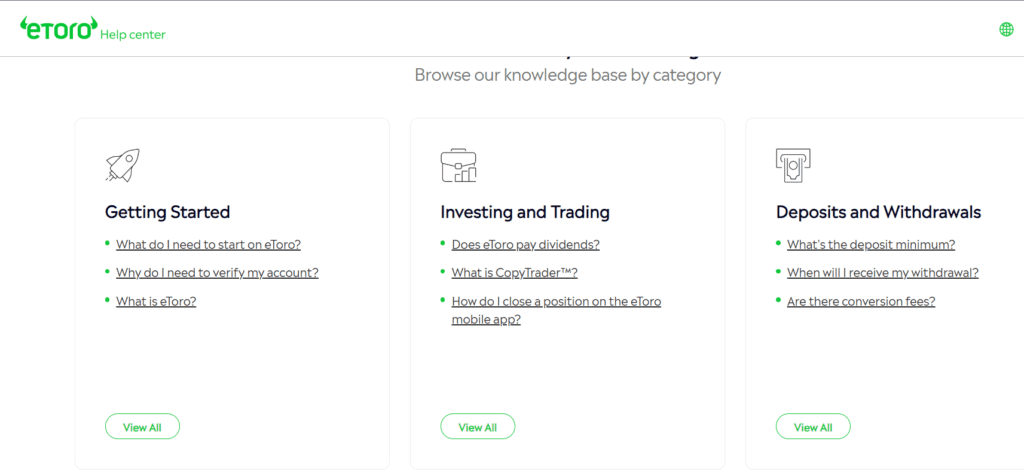

6. Customer Support on the eToro Platform

Just like any other financial instrument on the market should do, eToro has a top-notch help center and client support service. Before going into the work of physical agents, let’s take a moment and appreciate how detailed their help center is.

Any standard problem can find its solution here, without even contacting customer service. For me, this page is enough to clarify all the issues I encounter while using eToro.

The biggest downside I have encountered with eToro’s chat service is the fact that they don’t work 24/7. Other than that, they are extremely polite, fast, and quick on their feet.

I once had a problem with withdrawing crypto from eToro to Metamask, the wallet wasn’t responding.

I contacted customer support and they clarified that the company is doing some routine maintenance on their software and that’s why I couldn’t send the crypto.

Shortly after, they sent me an email to check on me and to tell me that the maintenance period was over and I could send the crypto.

7. Security for eToro Users

eToro, just like any financial institution out there, MUST be as secure as possible if they want to stay regulated. The company uses the biggest banks in the world to safeguard clients’ funds, which means that no financial or liquidity will affect your stocks or liquidity.

On top of that, eToro uses SSL encryption, the most powerful encryption to this date, to keep all personal information hidden from the public. To enter the platform, I had to create a 30-character-long password, and the company effectively took fake websites off the web.

I also enabled the two-factor authentication. It requires me to use a second-party-issued code (I linked Google Authenticator with eToro) to enter the website and complete withdrawals or deposits.

How to Get Started With an eToro Account

More details

eToro is a popular online trading platform for crypto assets, stocks, and ETFs, featuring low fees and a user-friendly interface. With a free eToro wallet and social features like messaging boards, users can copy experienced traders and access numerous assets. Take a look at what makes this platform perfect for starting your trading journey.

-

Provides an attractive, communal atmosphere.

-

Offers zero commission on ETFs.

-

Extensive selection of educational resources.

-

Mobile app with trading features.

-

Smooth account opening and bank transfer.

-

Limited number of cryptocurrencies.

-

Limited customer support.

-

No crypto-to-crypto trading pairs.

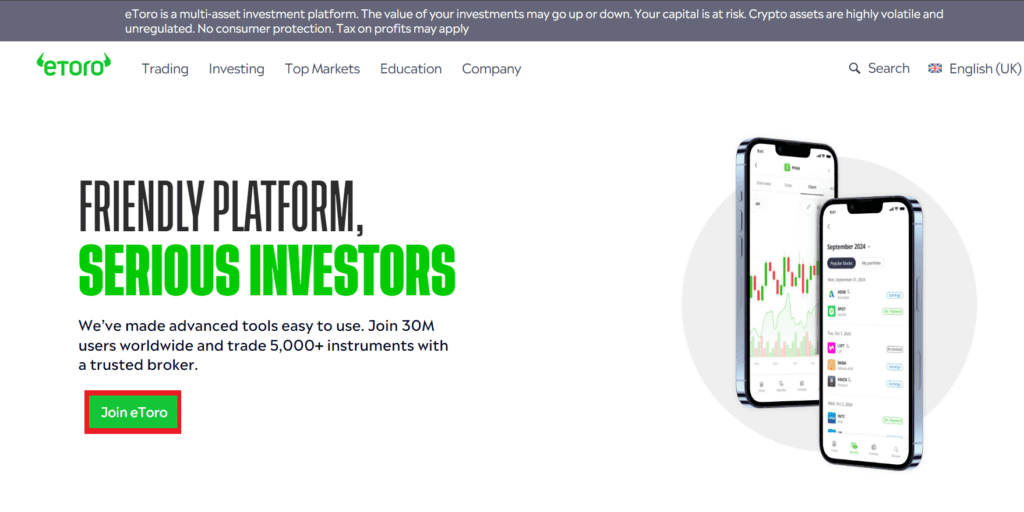

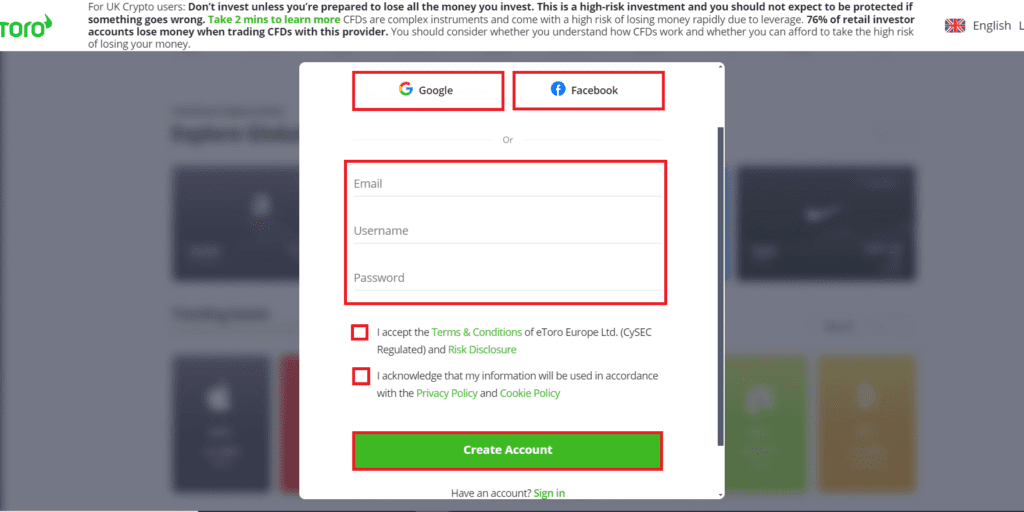

Creating an eToro account is easy. Let me show you how to do it.

Visit the eToro home page, find the green button that says “Join eToro” and click on it.

After that, you’ll be sent to this page. Enter all the details the site needs and create your account. You can also create an eToro account using your Google or your Facebook. Don’t forget to check those boxes below.

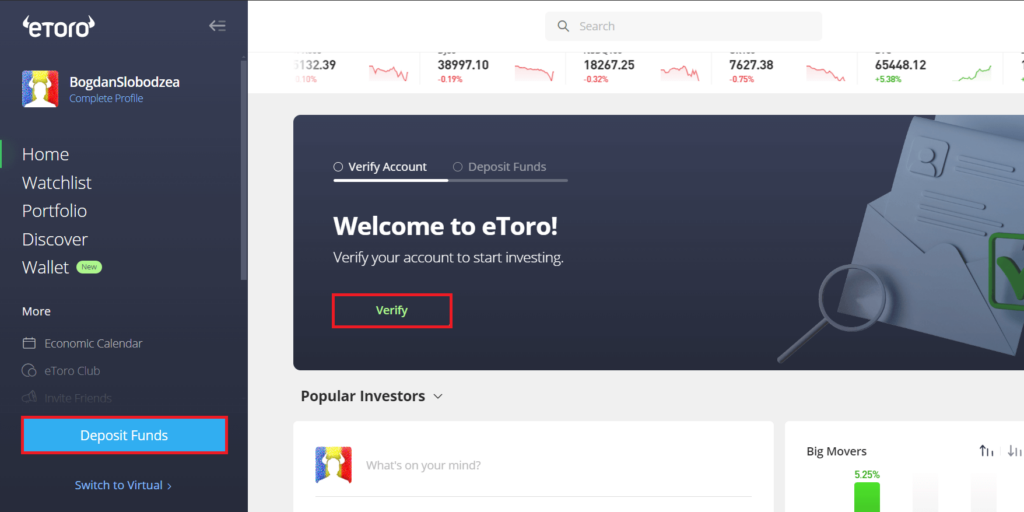

After you create your account, you’ll have to complete eToro’s KYC to start trading. You will have to provide personal information and documents (any form of identification and proof of residence.)

After the verification process, you can fund your account. Deposit cash using the blue button in the left corner. You can use Apple Pay, Google Pay, or by simply writing your card details. There are no deposit fees on eToro.

Buy Crypto on eToro

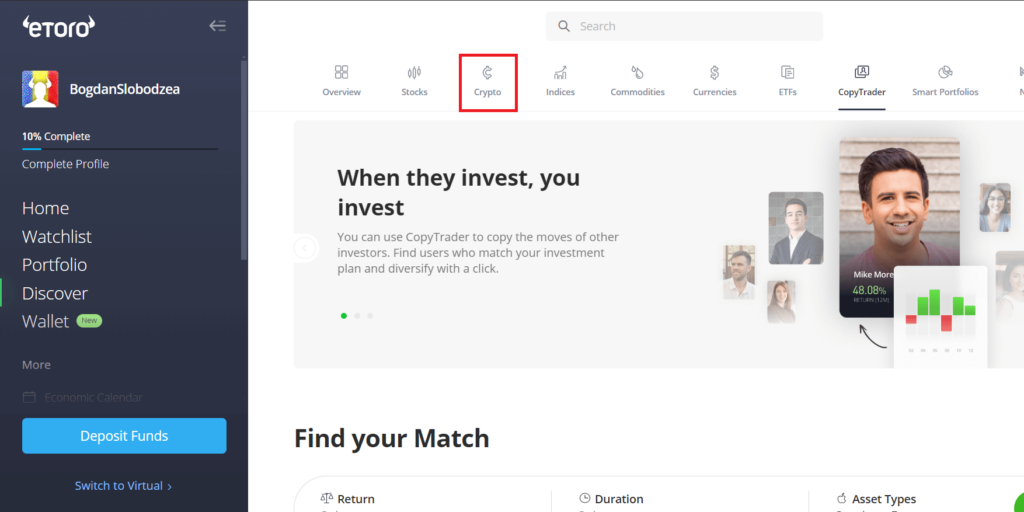

To buy crypto on eToro, you should first enter your main dashboard and find the “Crypto” tab on the menu.

When you enter the crypto side of the platform, you’ll find a lot of cryptocurrencies you can choose from.

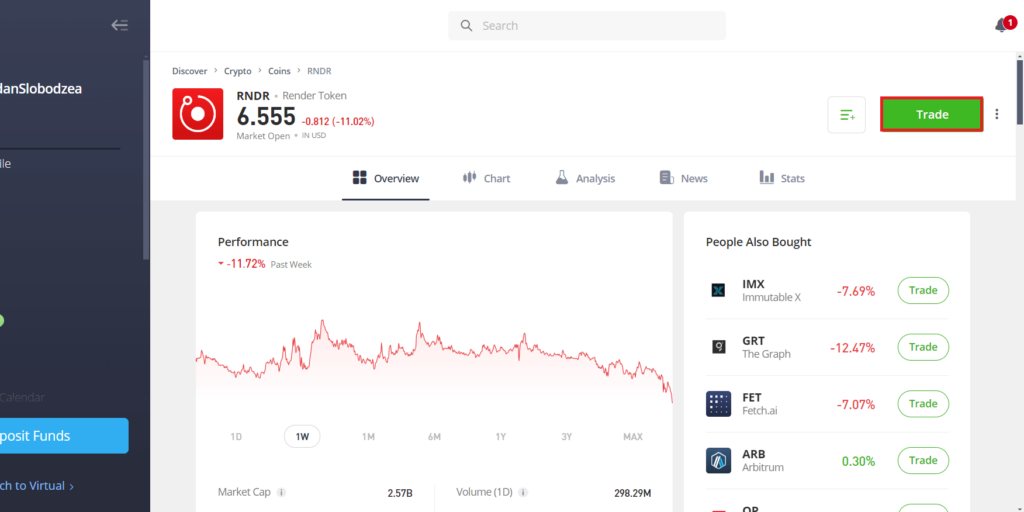

After you choose a coin, for example, RNDR here, you need to find the “Trade” button and buy the Render Token with the cash you deposited earlier.

Withdrawals

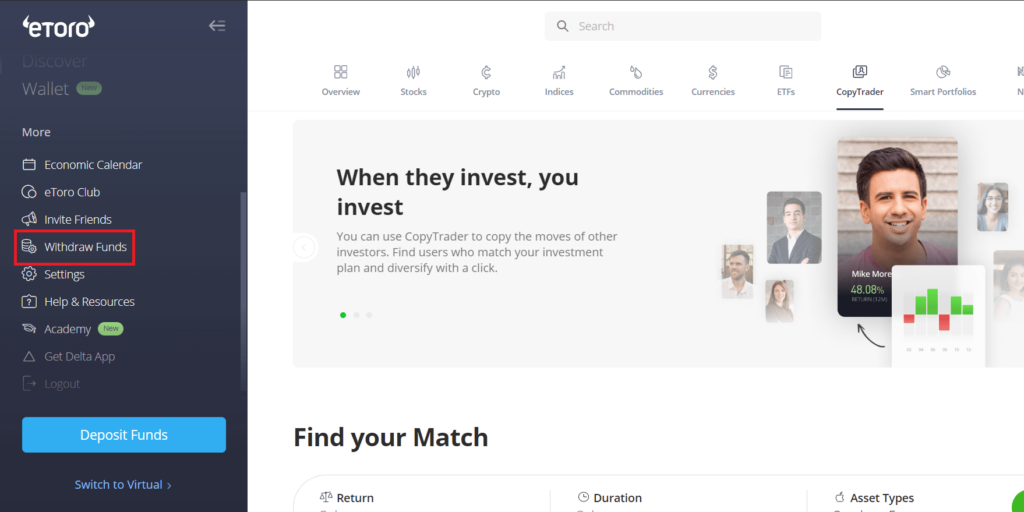

Withdrawals on eToro are as easy as they come. Find the “Withdraw Funds” on the left menu and click on it.

You’ll see a page where you can simply input your bank details and get the fiat directly on your debit card or bank account.

Be aware that eToro charges a $5 fee to withdraw money. Also, trade your assets to fiat before trying to withdraw. Otherwise, eToro will tell you you have an insufficient balance.

Withdraw Crypto on mobile

To withdraw crypto from eToro, you should download the eToro Money wallet. Open the app on your mobile device and sign in.

If you see the “Crypto” icon at the bottom of the screen, tap it to view your wallets. Tap the type of crypto asset you wish to send and write the address. Confirm the transactions with the code you got through an SMS and that’s it.

eToro Pricing and Fees

Compared to other trading platforms, eToro doesn’t have that many fees. Here’s the structure of the fees you should know about:

Investment Account Fees

| Account Opening Fee | Free |

| Management Fees | Free |

| Withdrawal Fee | $5 |

| Inactivity Fee | $10/month |

| Conversion Fee | Depends |

*The conversion fee depends on the payment method a customer uses.

Stocks and ETF Trading Fees

| Commission | Free |

| Market Spread | Depends |

| Overnight Fee | Free |

| Custody Fee | Free |

| Stamp Duty Reserve Tax | 0.5% |

*A market spread is the difference between the buy and sell prices. It is not a separate charge by eToro but a reflection of current market conditions.

Fees for Crypto Trading

| Buy/Sell Fee | 1% |

| Market Spread | Depends |

| Overnight Fee | Free |

| Custody Fee | Free |

| Crypto Transfer Fee | 2% |

Also, eToro club members are eligible for discounts and fee reductions. Here are the equity requirements you must meet to use eToro’s trading platform with lower fees:

| Tier | Equity |

| Silver | $5.000 |

| Gold | $10.000 |

| Platinum | $25.000 |

| Platinum+ | $50.000 |

| Diamond | $250.000 |

I currently complete crypto trades on eToro with a gold tier, making it much more comfortable and less expensive.

eToro Pros and Cons

Every platform has its advantages and disadvantages. Let’s start with the pros!

eToro Pros

- A Combination of Stocks and Crypto

- Great for Advanced Crypto Traders

- Offers Social Trading

- Provides Smart Portfolios for Beginners

- Regulated in Tens of Jurisdictions

For me, eToro is the perfect combination of traditional finance and cryptocurrency. The platform offers a wide array of financial instruments to grow and maintain your investment portfolio.

With a strong emphasis on security and regulatory compliance, eToro makes your crypto journey more secure and stable. That being said, eToro has become my go-to choice for combined stock, bond, and crypto investments.

eToro is a great brokerage firm with many advantages. Among the most important ones are the tools for advanced retail traders (I use and enjoy them) and their social trading feature. With eToro’s social trading, you can get the communal trading experience of other traders inside the eToro network.

However, with its advantages, eToro is not perfect. Let’s see what are the platform’s biggest disadvantages:

eToro Cons

- Focused on Traditional Assets

- No Cryptocurrency Pairs

- No Additional Services

While eToro is a great trading tool, it lacks important aspects we can find in other crypto exchanges. With no derivatives, margin trading, or staking, eToro only allows you to buy and hold.

On top of that, the platform only has around 30 crypto assets and no crypto pairs. This can make the transition from one cryptocurrency to another pretty annoying for those who have been trading their whole life on traditional CEXs or DEXs.

Our Experience with eToro: Great for Combining Stocks and Crypto

I used eToro for trading CFDS and investing in stocks even before finding out about the world of crypto. When they added the support for Bitcoin and Ethereum, eToro became my go-to platform for long-term investments.

With more than 3000 available stocks and over 30 cryptocurrencies, eToro is not just another overhyped financial tool, it is a digital behemoth that competes with institutional-sized hedge funds and asset managers.

It offers learning tools, demo virtual trading accounts, copy trading, and many more features that can help a person pursue their investment goal.

In my opinion, eToro is the perfect platform to start your trading journey, just like I did. Let me show you how one platform can change the way a person (me) goes about their finances.

Personal Experience with eToro

I started using eToro long before learning what crypto and Bitcoin were. Back in 2012, when they first launched a mobile app, I was instantly hooked. They didn’t even have stocks back then, only forex trading and other minor financial instruments.

The more I traded, the more I started learning about finance and economics. Interestingly enough, eToro was evolving together with me, and in 2013 when they first introduced commodity and stock trading, I was ready to rock this world.

Using eToro’s learning platform, I started understanding more about companies, different financial terms, and investing in general. After some years of gradually building my portfolio, I stumbled upon a new article on eToro: What is Bitcoin?

Then I realized that Bitcoin had been trading on eToro since 2013, I was just not paying attention. Back then the BTC you were buying was just a derivative of the underlying asset, but now eToro gives you the real asset which can be withdrawn to a hardware wallet like Ledger.

Not long after that, in 2017, eToro expanded its digital asset offering, enabling retail clients to trade and invest in ETH, XRP, Bitcoin Cash, and other popular cryptocurrencies.

I started to trade crypto, mainly ETH, XRP, and Litecoin, growing my portfolio each month. The market was booming until early 2018 when the bear market hit.

Shortly after that, eToro added some more altcoins, and I started accumulating BNB, ADA, and MKR. I liquidated my eToro positions at the peak of the 2021 bull market when Bitcoin was trading near its peak, at around $63k.

The Verdict: Should You Use eToro?

eToro is a great platform for those cryptocurrency investors who want to have a diversified portfolio but don’t want to use tens of different platforms to achieve that. With eToro, people can invest in crypto, ETFs, stocks, bonds, commodities, and much more from one single application.

That is why eToro is one of the most prominent players in the game. It was the first player to combine all these assets into one place, giving its users the whole financial system at their fingertips.

So, if you want to have one application for your entire investment activity, eToro might be the best option for you. Also, if you liked this eToro review, don’t hesitate to share it with one of your friends!

eToro Top 3 Alternatives

If you don’t want to use eToro, here are the best three alternatives you can find:

Bybit

Bybit is great for those passionate about derivatives. I use them for my longs and shorts, as well as for their debit card.

More details

Bybit is a leading futures trading platform globally, offering up to 100x leverage and attracting users who prefer to remain anonymous. With a presence in 180+ countries, it is renowned for its efficiency and unique features in cryptocurrency derivatives trading.

-

The platform offers up to 100x leverage trading.

-

Strong educational resources.

-

Diverse markets for traders, spot, perp, and futures.

-

Risk-free demo accounts to explore all key features.

-

TradingView integration.

-

The platform is difficult for beginners to navigate.

-

It does not offer a quality spot trading feature.

-

The NFT marketplace is limited in terms of options.

-

Security is of the gold industry standard.

Coinbase

Don’t want any shares in your portfolio? Start trading, staking, and hodling cryptocurrency with Coinbase, the biggest crypto exchange in the United States. Coinbase has become my go-to place for OTC trades, and their crypto debit card just rocks!

More details

Coinbase is one of the largest crypto exchanges in the world and a widely-used platform for buying, selling, and trading over 200 cryptocurrencies. It offers trading solutions for beginner, advanced, and institutional traders alike. Take a look at what makes it an excellent option for individual traders looking to trade in cryptocurrencies and beyond.

-

A wide-selection of coin offerings.

-

Most secure online crypto platforms.

-

Top-rated mobile app.

-

Easy interface and user-friendly.

-

Expensive and complex fee structure for beginners

-

Higher fees as compared to other cryptocurrency exchanges.

-

Slow customer support.

Binance

Binance remains the GOAT of crypto trading and my personal favorite. If you want deep liquidity, lots of trading pairs, and many order types and trading options, the exchange created by CZ should be your primary choice.

More details

Binance is a great combination of low fees, deep liquidity and multiple cryptocurrencies and trading pairs. We have tested every aspect of it and it STILL holds its reign as the top exchange in the world. In our view, it is the perfect crypto exchange for both newbies and advanced traders alike.

-

Biggest exchange in the world.

-

Industry's lowest trading fees.

-

Advance trading options like leverage trading.

-

600+ crypto options, 150+ for the US.

-

Lucrative on-site staking options.

-

Hiccups in account verification.

-

Less regulated than some competitors.

-

The corporate structure is not transparently.

Yes, eToro is one of the most secure and trustworthy trading platforms in the world. Millions of people from all around the world are trading billions of dollars using eToro.

If that’s not an argument you should trust, I don’t know what is.

When you purchase a cryptocurrency on eToro, the company buys the tokens on your behalf and registers them in a segregated account under your name.

Yes, eToro is regulated in Europe. The company was registered in Cyprus and is one of the few licensed online brokers in the European Union and other countries outside the EU.

eToro Europe is regulated by the Cyprus Securities and Exchange Commission, while their American entity, eToro USA LLC, is regulated by the SEC.

Yes, eToro is great for day trading. With the vast amount of stocks, bonds, and other assets, as well as great charting tools, eToro can be used for day trading.