TLDR

This guide will explore some of the best AI crypto trading software. Designed to enhance your trading, this software offers numerous advantages.

Some key features are automated trading, technical analysis, backtesting, risk management, and real-time market data access. Not only that, but you can effectively increase profitability by using advanced trading algorithms and data analysis.

However, users should be aware of potential disadvantages, including a learning curve for some platforms, additional fees for certain features, and the need for proper research before relying entirely on AI trading software.

What is AI Crypto trading?

AI Crypto trading software harnesses the power of artificial intelligence (AI) to bring automation and valuable insights to cryptocurrency trading. With the best crypto trading software, crypto investors can automate their trading activities by leveraging critical technical indicators, similar to AI stock trading.

AI Crypto trading software is designed to automate trading cryptocurrencies at optimal times. Their primary application is to enhance profits and minimize losses and risks.

Moreover, these applications provide the convenience of managing multiple crypto exchange accounts from a single platform. Numerous programs support trading for popular cryptocurrencies like Ethereum, Litecoin, and Bitcoin (BTC), simplifying the cryptocurrency trading experience.

However, trading cryptocurrencies comes with its own set of challenges. The crypto markets operate 24/7, demanding constant chart monitoring to seize trading opportunities. And this continuous vigilance has prompted the popularity of AI crypto trading bots over time.

AI trading bots excel in delivering superior performance. Additionally, they effectively alleviate the need for users to invest ample time in studying various strategies and parameters.

Besides that, they present an excellent option for beginner traders and individuals interested in entering the world of crypto trading, as they allow non-professional traders to use profitable strategies effectively.

How does AI Crypto trading software work?

An AI Crypto software analyzes vast quantities of data to uncover meaningful patterns. These patterns are derived from diverse sources such as news reports, social media platforms, and financial markets.

Once identified, these patterns serve as the foundation for predictions made by the crypto trading bot, offering insights into the future direction of the cryptocurrency market and potential profit opportunities for experienced traders.

The realm of AI crypto software encompasses a variety of algorithms for data analysis and advanced trading indicators and decisions. Each AI crypto software may adopt its unique approach, using algorithms tailored to its specific objectives.

These algorithms and techniques leverage the power of artificial intelligence to derive insights from complex datasets, enabling informed and potentially lucrative trading strategies.

Top AI trading software to look out for

Let’s explore some different trading software available on the market.

3Commas

For advanced users of trading bots seeking sophisticated bot trading, particularly in programmatic options strategies, 3Commas is an excellent choice. It provides a user-friendly and affordable package, making it suitable for independent traders who embrace more complex strategies.

It is a comprehensive crypto investment platform catering to manual and automated trading strategies for multiple crypto exchanges like eToro and Binance. Its advanced trading tools allow users to seamlessly manage their assets across 16 major crypto exchanges through a unified interface.

Furthermore, 3Commas equips traders and retail investors with strategies to capitalize on bear, bull, and sideways markets, facilitating profitable trading endeavors. An exemplary feature of 3Commas is its support for options trading, which can be challenging.

However, the platform simplifies the process with its intuitive and visually appealing user interface, empowering investors to program automated options strategies. Additionally, 3Commas offers a valuable resource through its blog, providing insights, analytics, and guides tailored for crypto traders.

Pros

- User-friendly interface and affordable pricing.

- Supports programmatic options strategies.

- Offers advanced trading tools.

- Accessible across major crypto exchanges.

Cons

- It may require some learning curve for beginners.

- Limited customer support options.

More details

3Commas is a trading bot platform that enables you to develop a bot with curing-edge trading capabilities from the ground up. It executes trades on your behalf on 20+ leading cryptocurrency exchanges. UI is easy, has a simple registration process, and all features are accessible on their mobile app.

-

Supports 16 cryptocurrency exchanges.

-

Worldwide service for crypto lovers.

-

Paper, automatic, margin, and social trading.

-

Fantastic hosting service.

-

All functions are available via mobile apps.

-

Stiff in price.

-

Can be complicated for beginners.

-

No desktop app is available.

Pionex

With Pionex AI crypto trading software, you can access a remarkable selection of crypto trading bots. It offers over 15 unique trading bots built into the platform. The best part? It’s free to register.

These advanced crypto bots empower you to automate your investing strategy, freeing you from the need to monitor the volatile crypto market constantly.

Pionex boasts low trading fees, ensuring you keep more hard-earned profits. And remember the fully fleshed-out mobile app, delivering seamless trading on the go. Whether you’re a high-volume trader or prefer the convenience of mobile investing, Pionex has got you covered.

While Pionex supports manual trading through crypto-to-crypto conversions, its true standout lies in its extraordinary selection of crypto trading bots.

These remarkable pieces of software are designed to execute buy and sell orders automatically, triggered by specific pre-defined market conditions. Imagine the power of having a tireless, automated assistant working tirelessly on your behalf.

Pros

- Powerful crypto platform with built-in trading software.

- Free registration and low trading commissions.

Cons

- Emphasis on trading bots, limited support for manual trading.

- Mobile apps could be more advanced.

- Limited availability of crypto-to-crypto conversions.

More details

Established in 2019, the crypto trading platform is the first to introduce built-in trading bots for investors and traders. The exchange is integrated with 16 automated trading bots for free! The user-friendly interface, innovative mobile app, and low trading fees have all contributed to the increasing popularity of the Pionex exchange.

-

16 built-in trading bots with detailed tutorials.

-

Aggregates liquidity from Binance and Huobi.

-

120 different cryptocurrencies.

-

Trading fee of 0.05% on each transaction.

-

Easy-to-use mobile app.

-

Limited flexibility to modify the built-in bots.

-

No demo account

-

No desktop app is available.

-

No withdrawals in fiat currency.

CryptoHopper

Ideal for those venturing into crypto trading bots, Cryptohopper is one of our ultimate picks for the best crypto trading bot overall. With support for over 100 tokens across 15 exchanges and a user base exceeding half a million, Cryptohopper caters to a wide range of traders.

Its subscription packages, ranging from $0 to $99 per month, offer options suitable for everyone. Beginners will appreciate the abundance of educational materials, templates, full-copy trading bots, and trading signals, empowering them to kick-start their trading journey. Moreover, the leverage trading bots make it perfect for savvy traders.

Meanwhile, seasoned traders can design and backtest their strategies using the platform. Thanks to its cloud-based infrastructure, Cryptohopper ensures quick deployment. Overall, its extensive tools and user-friendly interface solidify its position as our top choice for overall functionality.

Pros

- Free starter plan.

- Established a platform with a large user base.

Cons

- No phone support (ticketing only).

- Additional fees for signals.

More details

Cryptohopper is a great trading bots for their market trades. Due to cryptocurrency trading bots' sophisticated trading functionality and user-friendliness, Cryptohopper is the ultimate bot for new and advanced users. These competing trading bots can be outfitted with data-driven insights and individualized trading techniques to improve their performance.

-

Allows individuals to automate their transactions.

-

Create customized trading strategies.

-

Supports integration with multiple exchanges.

-

Advanced charting and technical analysis tools.

-

All functions acessable via mobile apps.

-

The platform can be difficult for beginners to navigate.

-

Monthly subscription for advanced features.

-

Challenging for non-technical users.

Bitsgap

Discover the remarkable capabilities of Bitsgap’s trading bot, providing seamless access to over 25 top crypto exchanges for automated trading.

Take a 14-day free trial and quickly sign up or log in using your Google or Facebook accounts. Before committing to advanced plans, explore the platform’s features through a demo exchange to familiarize yourself with its functionalities.

Bitsgap offers an array of powerful features designed to enhance your trading experience. Engage in arbitrage trading across multiple exchanges, leveraging market disparities to make profitable trades. Stay ahead of the curve with timely market signals, empowering you to make well-informed trading decisions.

Additionally, Bitsgap provides comprehensive portfolio management and tracking capabilities, enabling you to monitor and optimize your investments effectively.

Use backtesting to fine-tune pre-configured trading bots, optimizing their performance in bullish and bearish market conditions. With Bitsgap, you gain the tools and resources to elevate your trading bot strategies and maximize your potential.

Pros

- Access to 25+ crypto exchanges.

- 14-day free trial, easy sign-up.

Cons

- Web-based only.

- Limited manual trading support.

- The learning curve for optimizing bots.

More details

Bitsgap is a trading bot that offers a comprehensive platform for users to trade digital assets on multiple exchanges from a single account. The bot automates trading strategies, provides real-time market analysis, and helps users make informed decisions by offering advanced technical indicators, charting tools, and other features.

-

Fully automated bots that work 24/7.

-

Backtested ready-to-go strategies.

-

No withdrawal fee.

-

User-friendly interface for easy navigation.

-

7-day free trial and a demo trading mode.

-

The monthly subscription fee for using the platform.

-

No mobile app to access Bitsgap through smartphones.

TradeSanta

Unlike other AI crypto software, TradeSanta is the ultimate destination for novice and professional traders. It is a one-stop shop for the world of automated crypto trading bots and trading platforms.

TradeSanta knows starting can be daunting, so they offer an affordable pricing structure, intuitive mobile and desktop interfaces, and a comprehensive set of risk management tools.

But what truly sets TradeSanta apart is its exceptional user support chat feature. Unlike many competitors, TradeSanta provides a team of dedicated “Santa’s Helpers” ready to assist you every step, ensuring you never feel alone in your trading endeavors.

With support from top exchanges, including Binance, Coinbase Pro, and Huobi, TradeSanta empowers you to navigate the crypto markets confidently. TradeSanta also offers many resources to help you succeed in social trading, from pre-built exchange account templates to customizable futures trading strategies.

Pros

- Simple bot creation process.

- Affordable plans.

- Exceptional support service.

Cons

- Not for advanced traders.

- The free trial is limited to three days.

HaasOnline

Unleash your best crypto trading bot expertise with HaasOnline’s TradeServer, the ultimate choice for technically skilled day traders looking to build and optimize their best crypto trading bot.

While HaasOnline has always been known for its robust TradeServer, it has recently taken things up a notch by introducing the TradeServer cloud. Now, traders can enjoy 24/7 access to HaasOnline’s powerful tools on any compatible device.

But that’s not all – what sets HaasOnline apart is its implementation of Edge Computing. By bringing its trading bots closer to the trade servers of exchanges, HaasOnline ensures lightning-fast execution with lower latency than its competitors.

With support from leading exchanges like Binance, Bitfinex, Coinbase Pro, and more, HaasOnline empowers traders to conquer the markets and seize every opportunity. Take advantage of this cutting-edge solution for your crypto trading endeavors.

Pros

- Edge computing for lower latency.

- Powerful backtesting and simulation engines.

- Pre-built trader bots are available.

Cons

- Not for beginners.

- There is no free trial option.

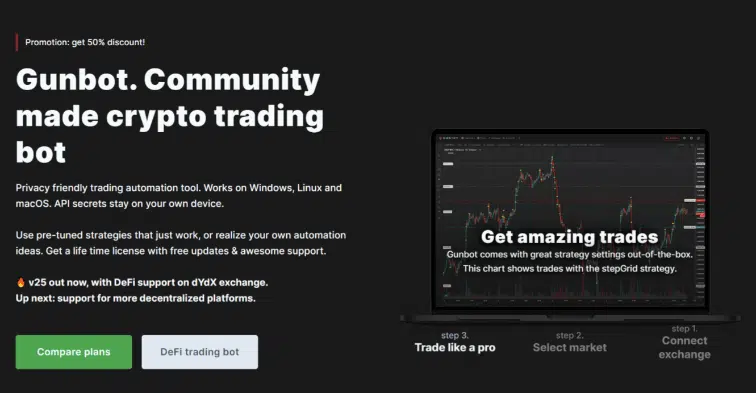

GunBot

Gunbot is specially designed for technically skilled traders seeking a robust crypto trading bot with extensive control capabilities. The best part is its support for multiple crypto trading platforms, including ByBit, Binance, and KuCoin.

Gunbot may not be the most user-friendly option, but it compensates with its rich features, provided you’re willing to overcome the learning curve.

The price of this tool reflects its suitability for advanced traders, particularly those comfortable with coding their scripts. Unlike most AI crypto software, Gunbot operates through a one-time software purchase.

It places the security responsibility on the user and allows for license resale if needed or desired. Gunbot benefits from an active community that offers support and pre-built scripts.

Pros

- Extensive control for technical users

- Well-established platform with a large userbase

Cons

- Steep learning curve

- Basic mobile app limited to activity checking

Things to look for in AI trading software

Choosing the right AI crypto software requires you to consider these factors.

Automated trading strategies

AI trading software should offer a range of automated trading strategies to cater to different trading preferences. It should provide options for predefined strategies, which are pre-configured and ready to use, and customizable strategies that allow traders to tailor the parameters to their specific needs.

Additionally, copy trading functionality can be beneficial, allowing users to mimic the stock trades made by successful traders.

The flexibility to adjust or change the chosen trading strategy at any time is essential to adapt to market conditions and personal preferences. By automating trades based on selected plans, the software saves traders time and effort while executing trades consistently.

Technical analysis

Effective AI trading software incorporates advanced technical analysis tools. These tools help traders analyze market data and identify trends, patterns, indicators, and crypto signals that can inform their trading decisions.

Historical and real-time data generate predictions and recommendations, empowering traders with valuable insights. The software should provide an intuitive interface that allows users to use these tools efficiently, even without extensive technical knowledge.

Effective backtesting

Backtesting is a crucial feature that allows traders to evaluate the performance and profitability of market trades and their trading strategies using historical data.

AI trading software should provide comprehensive backtesting capabilities, enabling users to assess the effectiveness of their custom trading strategies. Moreover, it should allow users to compare their plans with alternative approaches or benchmarks.

Through backtesting, traders can gain valuable insights into market volatility, optimize their strategies, and refine their trading approach based on past performance.

Risk management

Robust risk management features are essential in AI trading software. Traders should be able to set risk parameters, such as risk-reward ratios, stop-loss and take-profit levels, position sizes, leverage, and margin requirements.

Real-time risk exposure and performance monitoring are crucial to ensure prudent risk management practices. The software should offer alerts and notifications to inform traders about potential risks or bearish and bullish market trends.

By integrating risk management tools, AI trading software helps protect institutional traders’ capital and minimize potential losses.

Customization of software

Flexibility and customization options are valuable aspects of AI trading software. Traders should be able to personalize the software according to their preferences, such as choosing the interface layout, design elements, colors, fonts, and sounds.

The software of built-in trading bots should allow adding or removing features, functions, indicators, and widgets based on individual needs. Furthermore, seamless integration with other platforms, tools, or services can enhance profits and the trading bot experience.

Order management

Efficient order management is crucial for smooth and effective trading. AI trading software should offer intuitive order placement, modification, cancellation, and closure functionalities.

Traders should be able to access their order history, monitor order status, view order details, and retrieve execution reports conveniently. The software should use order management tools to optimize order execution, ensuring trades are executed at the best available prices and conditions.

Availability of real-time market data

AI trading software should provide users access to real-time market data from diverse sources and platforms. Traders should be able to access and analyze up-to-date information on prices, trading volumes, spreads, liquidity pools, news, events, and market sentiments.

The software should offer filtering, sorting, searching, and analysis capabilities to empower traders to make well-informed decisions based on real-time data.

Regular updates and integration with reliable data sources ensure accurate market analysis, predictions, and recommendations.

How has AI changed the crypto markets?

AI has revolutionized crypto trading, bringing market intelligence, automation, and convenience. It has transformed exchanges, enhancing security, efficiency, and customer service through fraud detection, transaction analysis, and hacking and money laundering prevention.

By leveraging advanced algorithms and data analysis, AI optimizes order matching, liquidity provision, and price discovery. It elevates the customer experience by offering chatbots, personalized recommendations, and automated support.

Moreover, AI empowers decentralized finance (DeFi) platforms to deliver innovative and user-friendly trading services. It enables automated strategies, portfolio management, market analysis, and price prediction for various DeFi protocols and tokens. Through smart contracts, oracles, and data feeds, AI helps users discover optimal DeFi opportunities and maximize returns.

Why should you use AI trading software?

AI trading software is a type of software that uses artificial intelligence and advanced algorithms to buy and sell assets automatically.

Automated investing options

AI trading software can offer you various options for investing, such as predefined strategies, customized strategies, or copies of your trading strategy. You can choose the option that suits your goals, preferences, and risk tolerance. You can also adjust or change your choices at any time. AI trading software can execute your trades automatically based on your chosen option, saving you time and effort.

Faster speeds

AI trading software can process large amounts of data and make complex trading strategies and decisions in seconds or milliseconds. It can give you an edge over other traders who rely on manual analysis or slower tools. AI trading software can also react quickly to market changes and opportunities, helping you to capture profits or avoid losses.

Consistency in investments

AI trading software can help you maintain consistency in your investments by following your chosen option or strategy without deviation. It can effectively reduce human errors and emotions affecting your trading performance. AI trading software can also help you stick to your plan and discipline, avoiding overtrading.

Diversification of assets

AI trading software can help you diversify your holdings by allowing you to trade multiple markets, instruments, and time frames. It helps reduce your exposure to specific risks and increase your potential returns. AI trading software can also help you balance your portfolio and allocate capital optimally according to your risk-reward ratio.

More time on the market

AI trading software can help you trade 24/7, regardless of location or schedule. It is an excellent investment if you want to increase your exposure to the market and allow you to take advantage of more opportunities. AI trading software can also monitor your needs and alert you when there are important events or signals.

What are the drawbacks of AI trading software?

Here are some drawbacks of using AI crypto software:

Knowledge requirement

Although AI crypto software comes with preconfigured settings and templates, understanding how to customize and time these settings is crucial. Without prior knowledge, modifying settings as a first-time cryptocurrency trader can result in swift losses.

Monitoring necessity

AI Crypto trading bot software should not be considered a “set-it-and-forget-it” solution. Due to the cryptocurrency market’s volatility, relying solely on a trading bot can lead to losses, particularly during high volatility. If you need to gain the skills or knowledge to monitor market conditions actively, there may be better choices than a crypto trading bot alone.

Profitability uncertainty

While crypto software often comes at a cost, they do not guarantee profitability. Evaluating the trading indicators utilized by most grid crypto trading bots, tools, or bots is essential to determine their potential profitability. The bot or tool can then automate trades based on your decisions, but success is not guaranteed.

Lack of human judgment

Trading or portfolio management software operates based on predefined programs, lacking the capacity for critical thinking or contextual analysis. This limitation can occasionally result in suboptimal decision-making when reviewing trades in hindsight.

Complexity

Setting up AI software’s best crypto trading bots can be complex and overwhelming. This complexity may be a barrier for some traders unfamiliar with the technical aspects.

Creating software from scratch can also be exceptionally challenging, requiring coding skills to develop smart contracts. However, the mentioned crypto software simplifies the process by handling these complexities for you, allowing you to define the desired actions of the crypto bot.

Is investing in AI software for crypto worth it?

Investing in AI crypto software or trading tools can be worthwhile with informed decision-making, understanding the pros and cons, and exercising discretion. It can effectively improve your trading experiences and performance.

But before committing to such an investment, there are crucial factors to consider. Firstly, the accuracy offered by AI software relies on the quality and quantity of data, the reliability of algorithms, and market volatility and uncertainty. That’s why you unthinkingly trust the software and conduct independent research for verification. So, ensure that you are spending your money on the right tool.

Besides that, you must be cautious about software malfunctions, data security, compliance with regulations, and potential misuse of AI for fraud.

Lastly, a cost-benefit analysis is essential, as AI software can be costly. Traders should assess the expenses versus the benefits, comparing alternative options and aligning their goals, preferences, skills, and risk appetite.

Final verdict

AI has revolutionized the world of crypto trading, bringing significant advancements and opportunities. AI trading software offers many benefits, including intelligent automation, enhanced security, improved efficiency, and personalized customer experiences.

This software empowers traders with automated strategies, technical analysis tools, backtesting capabilities, risk management features, and real-time market data access. While there are potential drawbacks, such as a learning curve and additional fees, the advantages outweigh the disadvantages for many traders.

Considering cost, reliability, security, and regulatory compliance is crucial when selecting the best crypto trading software. With careful evaluation and utilization, AI trading crypto software can unlock new possibilities and drive success in the dynamic world of crypto trading.

The best software to trade crypto varies depending on individual preferences and needs. Some popular options include Cryptohopper, Gunbot, and HaasOnline's TradeServer.

Yes, there are many crypto trading bots and simulators available. Some platforms like Bitsgap offer demo exchanges where users can practice trading with virtual funds before risking real money.

Automating Bitcoin trading using AI cryptocurrency trading bots and software is possible. Platforms like Pionex, Bitsgap, and Cryptohopper offer automated crypto trading bots with features and trading bots that can execute trades on your behalf.

Crypto traders use a variety of apps depending on their requirements. Some popular apps include Binance, Coinbase, and Kraken, which provide trading platforms, portfolio tracking, and real-time market data to assist in crypto trading.