TLDR

Trade automatically using a dedicated crypto trading bot to improve productivity and efficiency. However, using a crypto trading bot will drastically reduce the need to depend on trading strategies which are sometimes confusing and cumbersome.

Crypto trading bots are a great way to create passive income with low risks. For newbie traders, these crypto bots are game changers.

Here are the basic steps for using a cryptocurrency trading bot.

- Step: Sign up

- Step: Verify your account.

- Step: Enable two-factor authentification.

- Step: Make a deposit.

- Step: Create the crypto bot and automate it.

What are Crypto trading bots?

Cryptocurrencies are notoriously known for volatility, which emphasizes how unstable the cost per unit of these currencies can be. This volatility makes manual trading a hard call for humans, especially with the number of factors that could affect humans and the currency’s price.

No matter the level of training a human has, trading psychology always ends up as the deciding factor.

Crypto trading bots, however, are essentially programs that execute trades. It sets repeated purchasing actions at specific trigger positions and sells at specific price calls or set percentiles.

Crypto trading bots are mostly set to finish trades with minimal markup margins as a risk management strategy to prevent huge losses. However, this does not imply that the bots always work perfectly, as they can still make errors or bad trade decisions due to wrong or faulty parameters.

List of the Best Crypto Trading Bots

Note that some platforms have free trial options, while others don’t. This guide will be taking Pionex (free for life). These are some of the best trading bots in the market today.

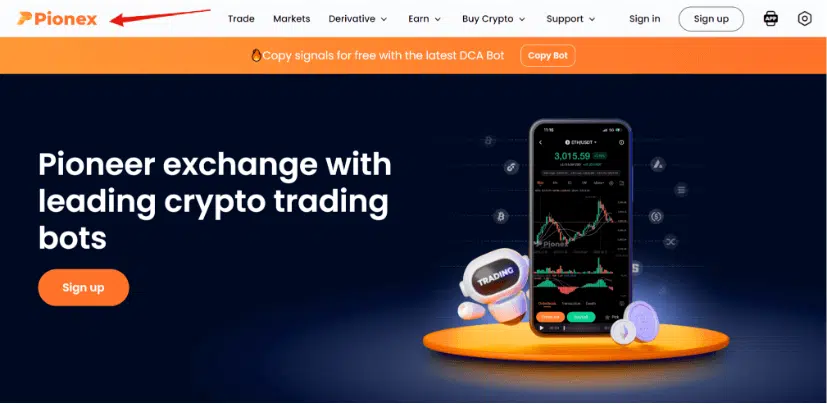

1. Pionex

Pionex is one of those free-to-use crypto exchanges that takes advantage of the many tools needed in some of the best crypto trading bots. Users can use Pionex not only as a trading bot but also as a regular exchange for buying, storing, and trading cryptocurrencies, among other things. They can also apply their trading strategies as trading tools on the platform.

It is one of the best crypto trading bots you’ll find out there, with all the tools crypto traders require. These tools include a leveraged grid bot, spot futures arbitrage bot, etc. For professional traders, dollar cost averaging is not something you can technically do on Pinox because it is crypto-centric.

Notable features

- A demo account is available; however, paper trading is not available.

- She advanced the grid bot.

- A rebalancing bot feature is available.

- Easy-to-use technical indicators

More details

Established in 2019, the crypto trading platform is the first to introduce built-in trading bots for investors and traders. The exchange is integrated with 16 automated trading bots for free! The user-friendly interface, innovative mobile app, and low trading fees have all contributed to the increasing popularity of the Pionex exchange.

-

16 built-in trading bots with detailed tutorials.

-

Aggregates liquidity from Binance and Huobi.

-

120 different cryptocurrencies.

-

Trading fee of 0.05% on each transaction.

-

Easy-to-use mobile app.

-

Limited flexibility to modify the built-in bots.

-

No demo account

-

No desktop app is available.

-

No withdrawals in fiat currency.

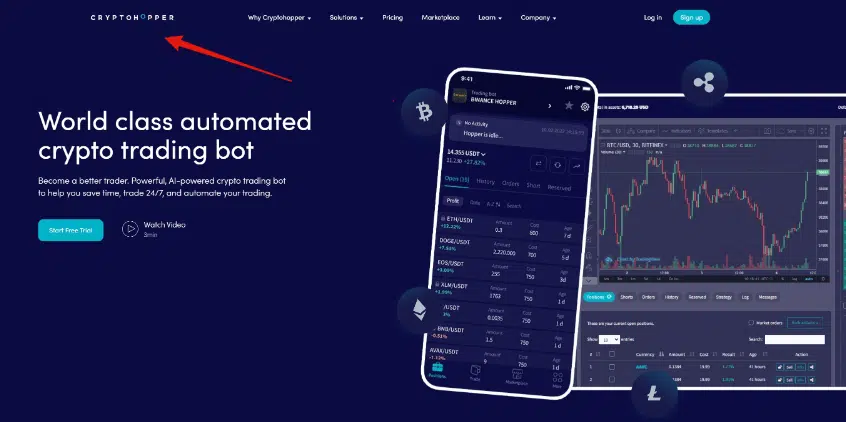

2. CryptoHopper

CryptoHopper is one of those cryptocurrency trading bots that has reached the top of the list because of its simplistic user experience. It has a 7-day free trial period where users can try out some premium features before making a valid purchase.

It is an easy-to-setup platform that requires no prior trading strategy expertise that helps retail investors access a smart trade terminal that functions efficiently. Unlike most trading platforms, it is not a subsidiary of any broker but only handles automated crypto trading.

CryptoHopper allows users to manage their accounts across various crypto exchanges through one single trading/ portfolio management system.

Notable features

- Trading charges are fixed based on the number of tools used; users are not charged a per-trade commission.

- Access to crypto trading strategy designer tools.

- Available spot futures arbitrage bot to help users benefit from the price differences across various exchanges.

More details

Cryptohopper is a great trading bots for their market trades. Due to cryptocurrency trading bots' sophisticated trading functionality and user-friendliness, Cryptohopper is the ultimate bot for new and advanced users. These competing trading bots can be outfitted with data-driven insights and individualized trading techniques to improve their performance.

-

Allows individuals to automate their transactions.

-

Create customized trading strategies.

-

Supports integration with multiple exchanges.

-

Advanced charting and technical analysis tools.

-

All functions acessable via mobile apps.

-

The platform can be difficult for beginners to navigate.

-

Monthly subscription for advanced features.

-

Challenging for non-technical users.

3. Shrimpy

Shrimpy is a cryptocurrency trading bot recognized and trusted to trade on major crypto exchanges like Binance, Kucoin, Coinbase, and Kraken. Moreover, it allows newbie traders a one-access platform to connect their wallets and exchanges through its simplistic portfolio management system, allowing them to monitor markets and trades in real time.

Shrimpy has a copy trading feature that allows users to trade without having their trading strategies. It houses trading communities of leading traders who other users can copy with just a few clicks. The system compensates these trading communities for their expertise; however, for the newbie user, his profit is far more important.

Shrimpy is the first out of the trading platforms to bring the portfolio rebalancing bot feature into the crypto space. This feature is theoretically engineered to increase the user’s chances of earning trickle profits consistently.

Notable features

- Links over 25 exchanges and wallets.

- Free package

- Premium access to a leveraged grid bot

- Excellent social trading and copy trading features

- Professional grid trading bot

More details

Shrimpy is a user-friendly crypto trading platform that can manage multiple crypto exchange accounts in a single interface. It provides many features, such as smart order routing, dollar cost averaging, smart portfolio allocation, portfolio rebalancing, etc. These features may benefit traders to manage multiple portfolios efficiently and earn more profits.

-

Beginner-friendly and easy to use.

-

There is a free version of it.

-

It supports multiple crypto exchanges.

-

No mobile version.

-

Limited customer support.

4. Coinigy

With over 5,012 supported cryptocurrencies, 20k+ markets, and 46 exchanges, Coinigy is easily one of the best of its kind. It is the perfect solution for crypto traders who want to consolidate all their trading accounts into one simple platform. It is so power-packed that even the free-trail version allows for unlimited trading transactions to several exchanges, all within 30 days.

Coinigy offers security through data encryption, two-factor authentication, and other security measure observed by the platform. According to online reviews, it also hosts one of the best customer support units in the industry.

Notable features

- 24/7 live support

- Simplistic portfolio management UI

- Offers a referral program as an extra income source.

More details

Coinigy is a comprehensive multi-exchange cryptocurrency trading and portfolio tracking management platform. It provides many features, such as real-time API, portfolio tracking and management, insights, historical data, etc. These features help traders to place and execute trades much more efficiently and improve trading performance.

-

Provides real-time market data to traders.

-

Advanced trading tools for identifying opportunities.

-

Wide range of cryptocurrency exchanges.

-

Able to manage portfolio efficiently.

-

Beginner traders might find it overwhelming.

-

Subscription plan might be expensive for some.

5. CoinRule

CoinRule, like the other crypto bots mentioned, is simple to use, has an excellent user interface, and has a very accessible pricing plan that works for everyone. Also, it allows users to have a 30-day trial period to perform many functions, and it has an impressive customer service unit rated 8.5 out of 10. For a crypto bot, that’s a very high score.

Notable features

- Simplistic UI

- Responsive customer care unit

- Users get private keys to protect their accounts, just like on Trust Wallet.

More details

Coinrule is an excellent platform with more than 250 automated trading rules and advanced algorithms. One of the significant advantages of Coinrule is that its users don't require coding expertise; thus making it easy to use and highly customizable. However, the absence of a mobile app and the limited number of exchange APIs supported are disadvantages.

-

Minimal fee with no locked commissions.

-

Access to exchanges and marketplaces.

-

Auto trading rule implementation strategies.

-

Access to the 34 best crypto trading bots.

-

Simulated market for testing trading strategies.

-

Decentralized exchanges are not supported.

-

Only supports 40 cryptocurrencies.

-

API integration with only 15 exchanges is available.

-

No mobile app.

How to Use a Crypto trading bot – Pionex

Now that we have provided you with the top trading bots, let’s show you how to set up your own trading bot with Pionex.

Before using the Pionex crypto trading bot, you must sign up for a free account. Pionex is one of the few to be granted a regulatory license in the US. It is often called one of the most reliable free crypto trading bots.

You can also use any crypto tax software integrations from any of the popular crypto tax software companies like CoinTracking.

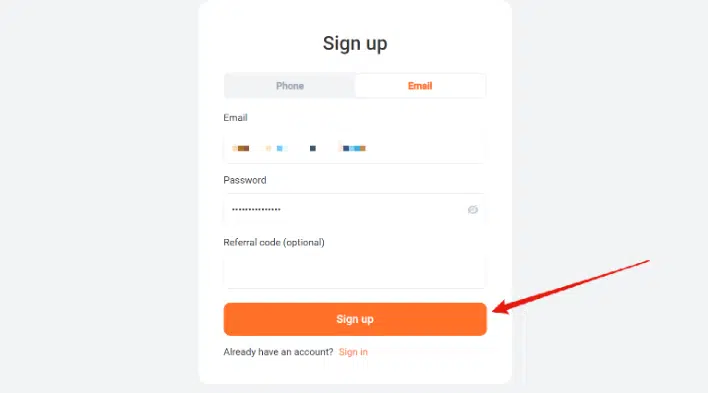

Step 1: Sign Up

First, visit the Poinex website. You can either create an individual account or an institutional account.

You’ll be required to enter your ‘Phone number‘ and ‘password,’ or your phone number and password. Hit the [Sign up] button when you’re satisfied with your input

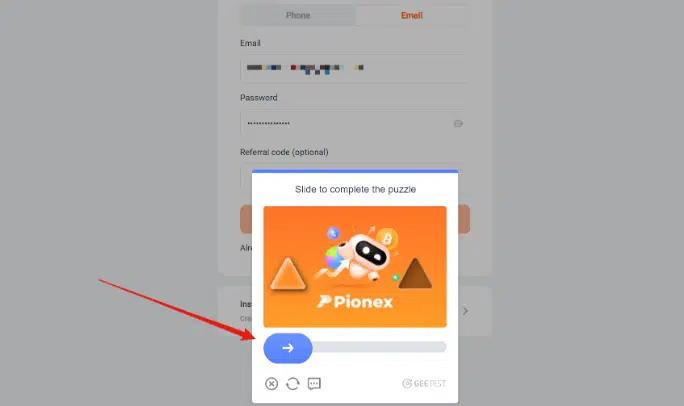

You’ll get a prompt to complete a puzzle.

Click and hold the blue button, and drag and drop the button at the empty space to complete the puzzle.

Step 3: Verification

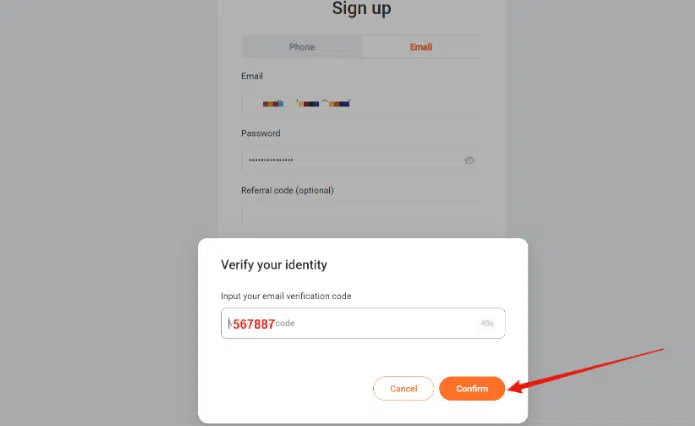

After completing the puzzle, the platform will prompt you to verify your e-mail address. You will receive a six-digit code via e-mail for the verification process.

Input the code in the space provided before the 60 seconds timer runs out. Now hit the [Confirm] button to go to the Next step.

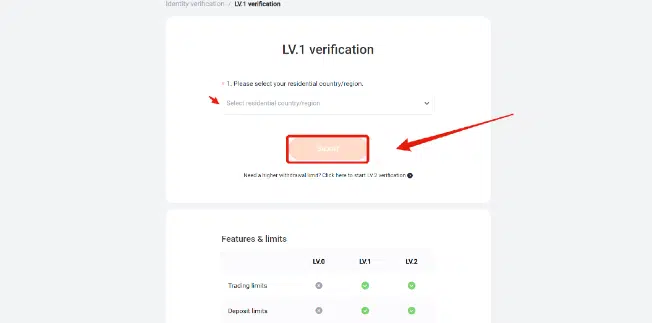

After verifying your e-mail, a pop-up menu will appear asking you for KYC verification. It promises to take between 1-2 minutes.

Note: KYC verification is compulsory on the Pionex trading bot platform.

Hit the [Verify] button to get the process started.

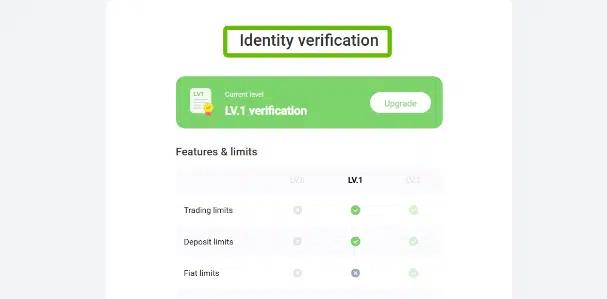

There are two levels of KYC verification

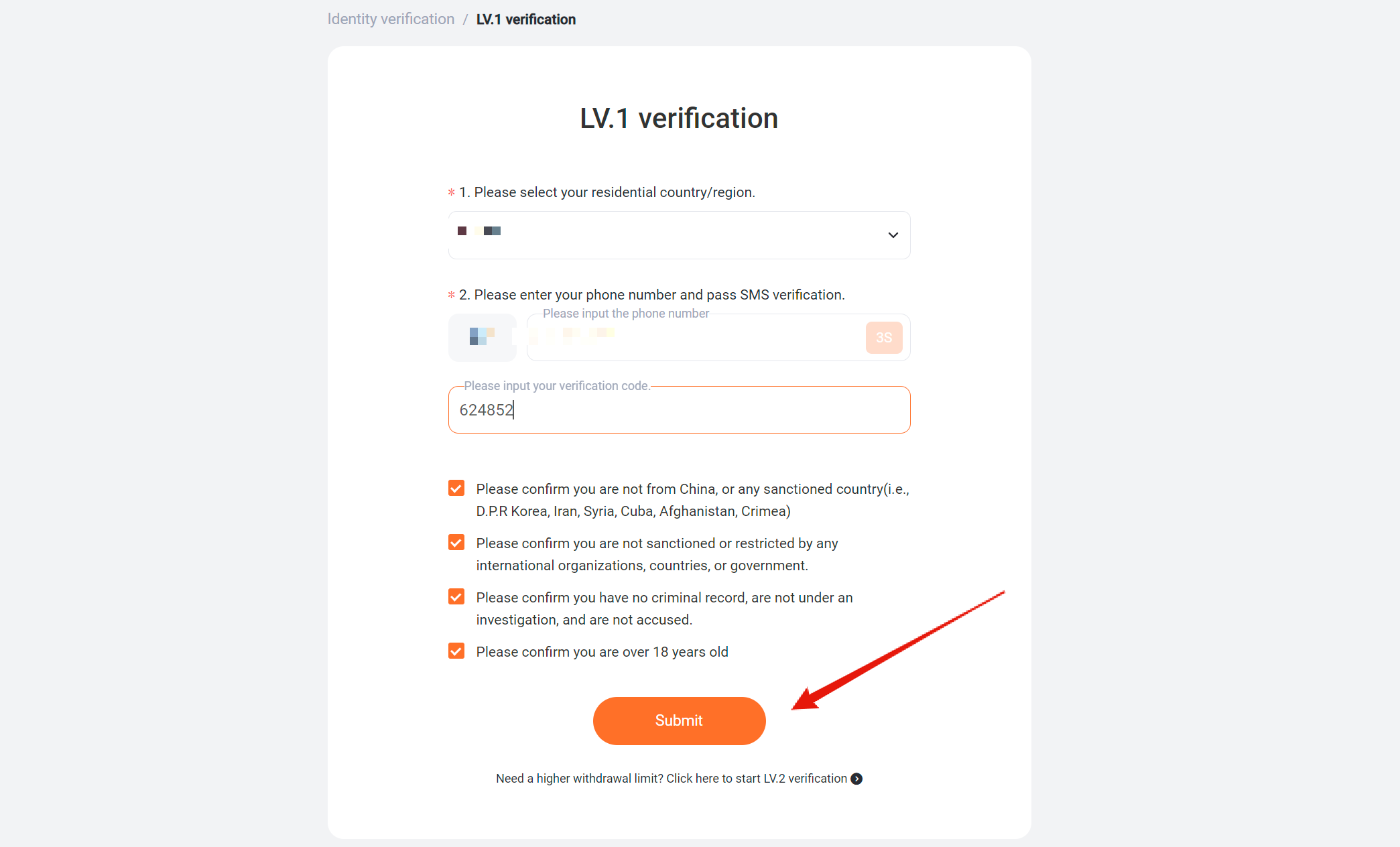

LV 1: Requires;

- Country or region

- SMS verification

LV 2: Requires

- Government-issued ID

- Facial recognition

Note: Level 2 KYC allows you to withdraw up to $1 million.

After entering your details, tick all the boxes and hit the [submit] button

Congratulations, you have completed your level one verification. You can go to level two verification or skip to the next step.

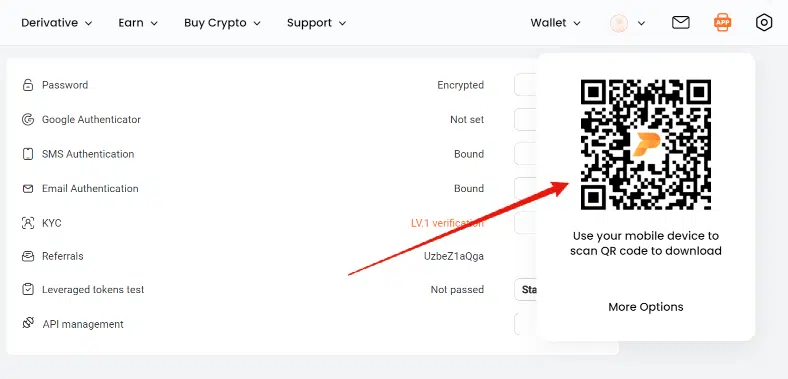

Step 3: Enable two-factor Authentification

Hover your mouse over your ‘avatar’ at the top right of your screen.

Bind the SMS and E-mail by using the [Bind] button.

Complete the three-step process, and you are good to go.

You can now download the Pionex bot trading app by turning on your scanner. This works for both Android and iOS devices.

Step 4: Make a Deposit

Hover over the main menu, go to [Wallet], and click [Deposit].

You can send cryptocurrencies from your crypto exchange account or any preferred wallet service you currently use.

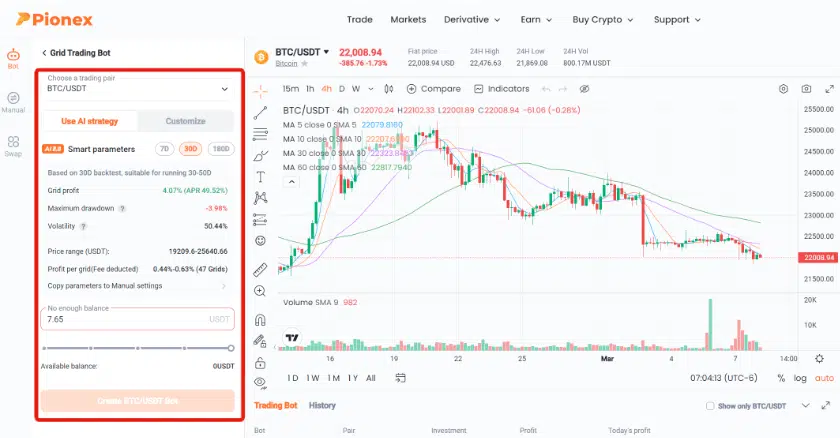

Step 5: Create A bot

After confirming your deposit, it’s time to create your first bot.

Hover your mouse around the [Main menu] and click on [Trade]. It’s time to use a trading terminal, depending on your preferred automated trading strategies.

You will be greeted with a feature-packed interface with many tools around you. Feel free to explore these tools or visit the Pionex official YouTube channel for a tutorial on every function on the Pionex trading bot.

Now select the bot you’d like to create and hit the [Create] button

Select a trading pair, and select the amount of crypto you have.

The bot will have automated trading parameters set by default. You can use those or set your preferred parameters.

Select a trading pair through the drop-down menu at the top left

Depending on the amount of time you set, your trading bot will continue working non-stop, making you residual income.

Note:

The Grid profit can be speculated from 3 – 5 % within 30 days and below 0.5% for seven days.

To get the complete estimated profits (in theory), you need to have deposited the minimum price range as shown when creating your trading bot.

Stick to the AI trading strategies until you know what you’re doing with the manual parameters.

How do I pick the best crypto trading bot?

Before picking a crypto trading bot that works for you, there are specific features you need to watch out for.

Reliability

To find out the reliability of a trading bot, you’d need to check its rating on Trust Pilot and ensure that several people aren’t complaining about the bot. Also, look out for fake reviews that might be displayed. The more satisfied clients they have, the more reliable they are likely to be.

To determine their reliability, check for how long the trading bot has been on the market and every news you can find. Finally, ensure these have been featured on trust worth platforms like Forbes, Business Insider, Yahoo Finance, Bloomberg, Coindesk, Coinweb, and other trusted authority sites.

Cost

Several crypto trading bots are paid. Some of these have free trials, demo accounts for practice, and other methods of helping you ensure that you’ll be getting your money’s worth. It is usually advisable to utilize the trial or demo accounts to get acquainted with the trading bots before depositing any crypto assets.

Also, note that the cost of getting a premium account has nothing to do with the deposit amount. You’ll have to deposit purchasing a premium account from these trading bots.

Note: most of the best trading bots don’t come cheap.

Risks Involved

You’ll have to weigh your options before deciding on the trading bot with trading strategies that suit your needs. The strategies are always expressly stated on the bot’s platform or in a set of guides.

Also, understand that there is always a possibility that you could lose your funds due to bad technical indicators sent by its programmers. Also, note that there can be cases where malfunctions could happen.

Don’t forget to find one with a free trial when in doubt.

Reviews

Ensure you go through honest reviews written by credible sources like CoinWeb. This will give you all you need to understand the crypto bot’s pros, cons, and features.

Support & Tutorial Availability

Before using a crypto trading bot, ensure they have a working customer support unit that can attend to issues whenever they arise. Also, ensure you find tutorial videos made by the community or the team (essential).

Types of Crypto Trading Bots

There are five commonly used crypto trading bots. They are structurally different and follow different sets of trading strategies.

1. Arbitrage Crypto trading bots

It is widespread to see different prices of the same cryptocurrency on other exchanges. These discrepancies are often negligible, but the slightest price change can be utilized to earn a few extra bucks in a strategist’s hands. The concept of arbitrage trading emanates from this common situation.

Arbitrage refers to buying assets and securities from one market or platform and selling to another. Performing this process to make a profit yourself is almost impossible because of the volatility mentioned in this article. Professional traders use arbitrage trading bots to perform these actions.

A great example is CoinRule. It has a free trial version and is recognized by Forbes, Business Insider, Yahoo Finance, and several other reputable organizations.

Pros

- Speed and Efficiency

- Always on, 24/7 trading

- Lower Risks

Cons

- Often high cost

- Small profit margins and potential

- Requires capital to make any difference

2. Coin lending bots

Lending is one of the most effective crypto trading strategies for traders with crypto assets in their wallets without an urgent need to use them for anything. Without them, you can lend your coins to traders; however, finding who to lend to and an interest rate that works for you can be time-consuming.

Coin lending bots speed up lending out your coins and, in turn, offer better interest rates (ROI). These kinds of bots are mainly featured on exchanges; however, there are a few standalone lending bots like YouHolder, Nexo, etc.

YouHodler is an excellent example of a coin-lending bot. It has a 4-star rating on trust pilot, supports hundreds of cryptocurrencies, and has been featured by Bloomberg, CoinDesk, and other trusted companies.

More details

YouHodler, a crypto exchange and lending platform, offers high interest on crypto deposits and provides clear information about its risks, rates, and fees. Users can collateralize digital assets for short-term loans, which can be used for advanced trading. However, its unavailability in the US and high loan APR might dissuade some investors.

-

Earn interest in your digital assets.

-

Borrow against your crypto.

-

Access advanced trading tools.

-

Effective customer service.

-

High APR on loans.

-

Regional restrictions in some countries.

-

Lacks transparency in the interest rate rates.

Pros

- Appealing interest rates

- Saves time

- diversified portfolio

Cons

- Higher default rate

- Uncertain tax implications

- No insurance

3. Margin Trading or Leverage Bots

Margin trading bots use more complex trading strategies and borrow from an exchange platform to execute a trade requiring more capital. In simple terms, it is a trading strategy involving leveraging on equity provided by the abovementioned exchange.

These are strongly advised against, especially for newbie crypto traders; however, they can be powerful tools for Experienced traders.

Pros

- Increased flexibility

- The credit improves the investor’s ability to purchase

- Better opportunities

Cons

- High investment cost

- High risk of getting liquidated

4. Market Maker Bots

Market-making on its own is a strategy used by exchanges to fill buy and sell orders, allowing actual traders to fulfill their placed orders. It is why you can place a buy or sell order on the most popular exchanges and almost immediately complete it.

Market-making trading bots use varying algorithms to fill up order books and provide liquidity for traders. It also falls in the strongly unrecommended category, as they are used mostly in exchanges

Pros

- High-performance ratings

- It creates fluidity

- Highly scalable

Cons

- Latency

- Susceptible to periodic losses

- Only practical for exchanges

5. Technical Trading bots

They are the most used trading bots deployed in the market. It combines social and signal trading to forecast movements in price. These are primarily programmed to monitor price movements at take advantage of market trends to buy low and sell high.

Moreover, these bots are programmed to recognize support and resistance points in a trend region and utilize this trade data to execute a simple automated trading strategy. Some Technical trading bots use technical indicators transmitted by the bot’s programmer to execute.

Pros

- Easy to use

- supports 24/7 trading

- low risk/capital involvement

- They are programmed with auto stop-loss features by default.

Cons

- Need periodic algorithm updates in other to stay relevant

- Low-profit margins

- It still requires the human factor on the backend.

Advantages of Using Crypto Trading Bots

These are some reasons to use automated trading bots as trading tools.

Excellent for Newbies

The learning process for those who want to trade crypto is quite tedious. You must master a trading strategy or learn to use trading signals(as a trading tool). With the invention of many crypto trading bots, newbies can earn some residual earnings while training.

The crypto bot trading technique cannot replace fundamental and technical analysis, but it can help newbies to focus more on crypto portfolio management.

Users can also get a free Bitcoin trading bot or a free trial. It is also important to state categorically that several countries have, by extension, laws around cryptocurrencies, making them legal.

Easy to Use

Cryptocurrency trading is easy when using trading bots. Users only need to fund their wallets and set the parameters needed. The trading bot does the rest. It is common knowledge that no one can trade crypto 24/7; However, crypto trading bots can.

Transparency

Unlike many web applications that utilize API, most crypto trading bots are open-source codes. This means that anyone from around the world can quickly inspect the code. Also, people will likely raise alarms if the code has malicious elements. You can request an audit from an interested blockchain developer for unpopular crypto trading bots.

Risk Management

Automated crypto trading bots help you manage your risk more efficiently. Furthermore, the crypto bot has set markers for every trade, instructing it not to go below a certain point unless there is a problem with the software. This feature assists in minimizing losses that may occur during trades.

Speed

Speed is one of those traits that make crypto trading bots profitable. Crypto trading bots can execute several trades within a short period. This is impossible, even for advanced traders with advanced trading indicators. This speed means more transactions per day, resulting in more profits.

Disadvantages of Using Crypto Trading Bots

Using a crypto trading bot might sound like the best thing since ice cream, but there are several downsides.

Instability

A crypto trading bot is a set of codes. They may sometimes fail due to a high inflow of users, mismanagement from owners, or bugs. In fairness, they have improved over the years, making them more reliable, but it doesn’t stop the periodic unstable execution of those codes on the trading bot.

Users can experience instability even on some of the best ones in the market. It is not limited to free trial bots alone.

Possibility for Fraudulent Bot

Since the space is unregulated, anyone can create a trading bot, launch it, and have unsuspecting users sign up and pay for it. These bots can have special access to certain files in your phone or device, placing your entire online details at risk.

It Cannot Make Emergency Decisions

A crypto trading bot cannot make on-the-spot decisions for you, so the code might keep running even when the entire market is going sour, e.g., When LUNA crashed suddenly. If you have a trade order in progress and that sudden drop happens, the trading bot won’t know what to do or what measure to take the way an advanced trader is.

It Doesn’t Support Every Cryptocurrency

There is always the issue of blockchain support, making it almost impossible for trading bots to support all cryptocurrencies. There are multichain solutions to this; however, a few restrictions still apply.

Summary

Every crypto trading bot is an automated trading software used by retail investors or crypto traders to make residual income. They are becoming quite popular in the crypto space; however, there are several cases where these bots failed to be profitable.

If you’re getting your cryptocurrency trading journey, find a crypto trading bot that works for you. When in doubt, go for one with a free trial to avoid spending money on one that doesn’t work for you.

Yes, but not all. Crafting crypto bots with prediction, automation, and order placement or execution technologies allows them to make profits in trading crypto. As a result, professional crypto bot trading can be successful as long as these elements are incorporated into the bot's design.

Using trading bots is legal, and there are no regulations or laws that prohibit retail traders from using automated trading in the markets, despite some objections from certain individuals about its impact.

At the top of our list for the best AI stock trading bots is Trade Ideas. This stock trading software boasts an impressive team of financial technology entrepreneurs and developers, who have contributed to its success.