3Commas 2024 Review: Unveiling the Power of Automation

What is 3Commas?

If you’re searching for a top-tier cryptocurrency management solution, go no further than the 3Commas platform. In this 3Commas review for 2024, we will discover the trading tool’s good, bad, and ugly aspects.

The driving force behind this project is the team’s mission to enhance investor autonomy by mitigating their financial exposure to loss and increasing their return on investment.

The 3Commas trading bot is the brains behind the operation and works across multiple principles and exchanges. Automated trading bots are complex software that constantly places trades based on all the trades and traders’ requirements.

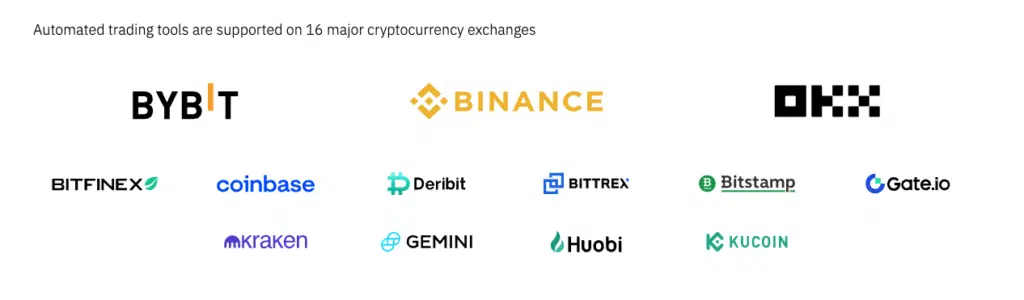

3Commas has over 220,000 active users and processes over $10 million daily trade activity across its network of 16+ supported exchanges, including Coinbase, Binance, Bitfinex, Huobi, and others.

| Feature | Detail |

|---|---|

| Founded | 2017, Canada |

| Interface | User-friendly, with advanced tools |

| Trading Modes | Supports both automated and manual crypto trading |

| Mobile App | Available |

| Supported Crypto Exchanges | Over 20+, including Binance, BitMEX, and Coinbase Pro |

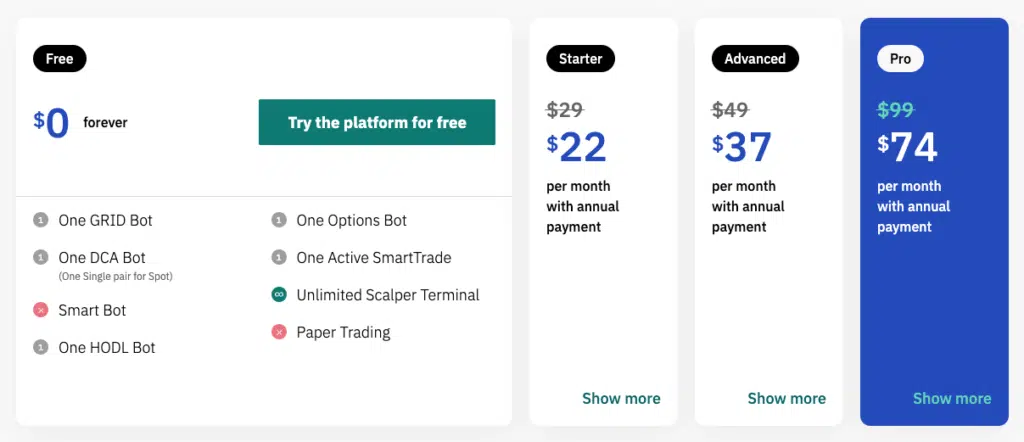

| Pricing Plans | Free, Starter ($29/m), Advanced ($49/m), Pro ($99/m) |

| Free Trial | 7 days |

| Automated Trading Bots | Available |

Characteristics that Set It Apart

Effectiveness

3Commas takes advantage of a web-based platform that is easy to use and rich in features and data. Trading methods, stop-loss levels, and even take-profit and stop-profit points can all be tailored to the individual user.

Innovation

API interface with bitcoin exchanges enables automated trading, and the bot functions continually on any device. Android and iOS mobile device apps round out the platform’s accessibility options.

Comprehensive Tools

The site offers a vast array of trading tools, including automated bots and performance statistics, and the opportunity to create, analyze, and backtest crypto portfolios and track the top-performing portfolios made by other customers.

In addition, users can participate in social trading by monitoring the activities of other traders and mimicking their successes.

Exchange Connectivity

3Commas provides trading bots for 23 exchanges, including:

- Binance

- Binance US

- Coinbase

- Coinbase Pro

- Bybit

- Crypto.com

- Bitstamp

- KuCoin

- Poloniex

- Gemini

- Gate.io

- Bitfinex

- Bittrex

- Kraken

- OKX

- Deribit

- Huobi

Customer Care

The platform is available in English and Russian, and a support team is available around the clock to assist with any concerns. To get in touch with the team, users can use Twitter, a Telegram group, or Facebook, in addition to the Help Center.

The FAQ page in the Help Center addresses frequently asked questions and simple manuals describing how to use the platform.

How Does the 3Commas Platform Operate?

We have discovered some unique features in this 3Commas review. Short and long algorithms, paper trading, unique tactics, and a comprehensive dashboard for monitoring various exchanges are just some of the features of the trading bot.

Key advantages of the 3Commas trading platform include the following:

- The platform provides several tools for crypto traders to keep tabs on their portfolios, whether they are brand new or already connected. The user-friendly interface shows current stats and lets you view the best-performing portfolios in real-time.

- The 3Commas “Smart Trade” terminal facilitates the hassle-free management of various investments across multiple exchanges and the placement of non-standard orders. Limit your losses and optimize your gains using “Stop Loss and Trailing Stop” and “Take Profit, Trailing Take Profit and Multiple Take Profit Targets.

- Grid bots let traders purchase and sell cryptocurrency at predetermined prices by establishing only upper and lower bounds. The trading dashboard handles everything else.

- If an asset’s price declines, the DCA bots on the platform will automatically buy more of it, averting a potential trading disaster.

- Trading options has never been easier than with the help of the options bots on 3Commas, which employ a calculated algorithm to place trades on the Deribit exchange at your direction, allowing you to quickly and easily set profit targets and risk limits.

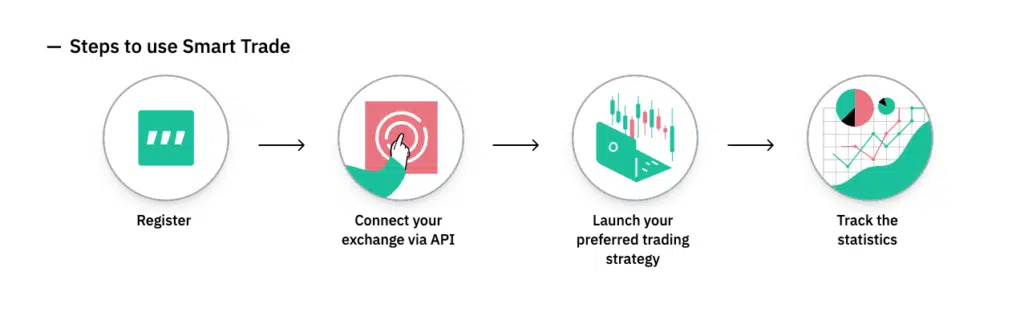

Traders can begin using 3Commas after creating an account and enabling two-factor authentication. Signing up can be done either manually by sending an e-mail or automatically by connecting with Facebook.

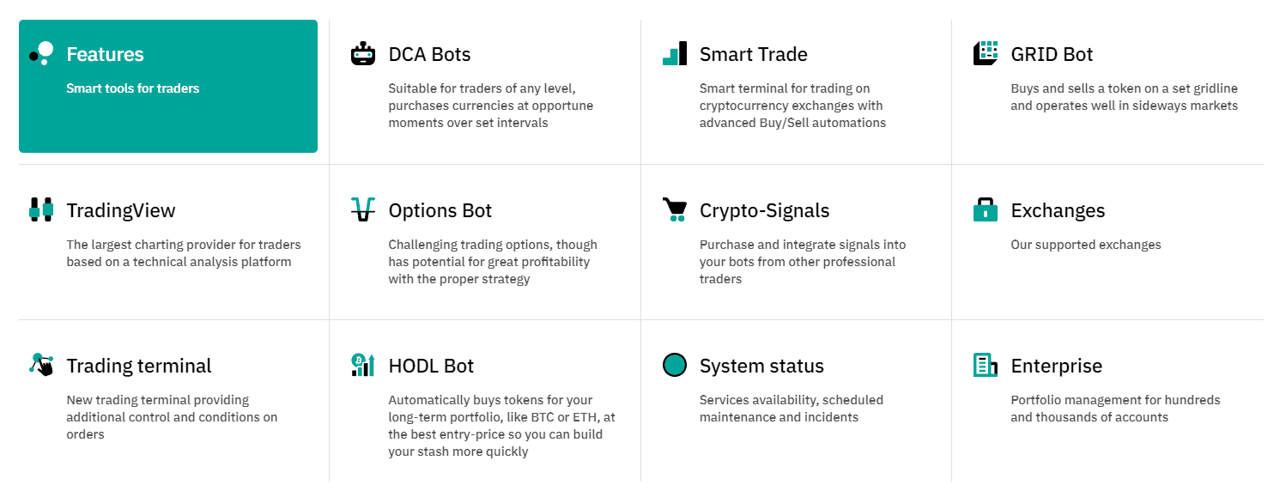

Features of 3Commas Automated Trading Bots

1. Smart Trade

A function called “Smart Trading” lets users purchase and sell cryptocurrencies on various exchanges simultaneously. 3Commas has revolutionized the crypto trading happenings by integrating the progressive Smart Trade function into TradingView.

Using the stop-loss and take-profit actions, as well as the option to sell by numerous targets, the users of the Smart Trade feature have multiple sell targets they can manually trade to optimize their earnings, take profit, and stop-loss risks.

When it comes to the trading dashboard, the fact that even the initial trade amount can be set with a few clicks speaks volumes about how well-thought-out and designed the interface is.

2. Dynamic Trading Terminal

3Commas integrates this techy trading feature, which empowers investors to supervise numerous forex accounts concurrently. The intrinsic blueprint of the site allows users to make the most of their cryptocurrency trading chances with the aid of all the potent characteristics at their fingertips.

Thanks to the enlightened terminal, crypto traders can now break away from the confines of multiple crypto exchanges. Trading in high-volume, low-volume, or anonymous marketplaces is a piece of cake for them.

The primary benefit of this action is the ability to use advanced order types such as native orders, order groups, conditional market orders, and conditional limit orders (OCO).

3. DCA Bots

DCA regularly invests a fixed amount of money in the market to spread out the impact of price fluctuations.

Two distinct DCA bot analytics can be purchased from 3Commas:

- DCA Long Bot: This aids traders in determining the average cost.

- DCA Short Bot: which examines the underlying cryptocurrency.

Suppose a trader has $5,000 and intends to put away $1,000 monthly. A trader who invests all of his money at once would pay 20% more if the price started at $100, dropped to $90, then $70, then $80, then $95.

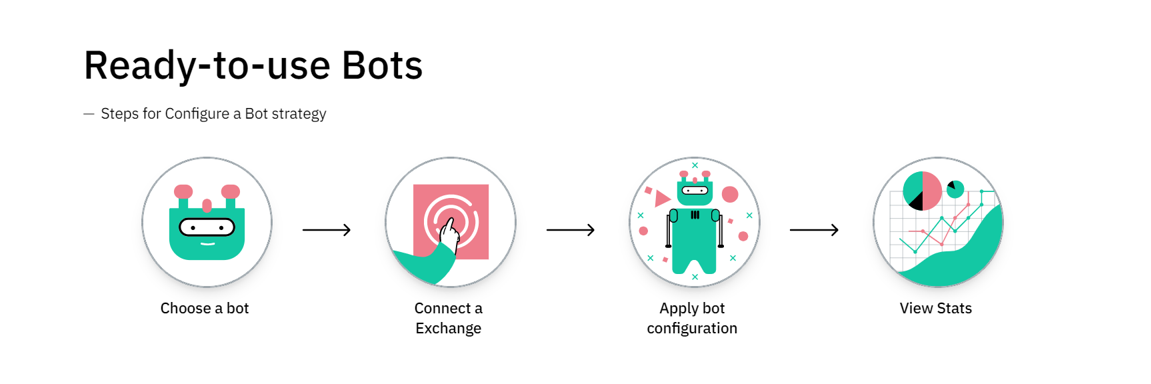

Nevertheless, this expense can be significantly reduced using the 3Commas DCA bots, which routinely make monthly investments. Simply choose a DCA bot, link it to an exchange, finish the setup, and monitor its stats to see how well it’s doing.

4. Grid Bot

They are a high-tech, user-friendly form of automated bitcoin trading bots that can help users quickly rake in earnings. The user can use them by picking a coin and an investment amount and letting the bots handle the rest.

Grid Bots will automatically buy more when the price of the selected cryptocurrency declines and sell when the price increases, maximizing profits.

There is little difficulty in beginning to use the Grid Bots. Users must register for the service before selecting an available exchange and bot mode (Manual or AI).

Traders can choose low-value coins to invest in and determine how much money they want to put into the venture before establishing buy-and-sell limits to ensure they make a certain amount.

At last, they can fine-tune the effectiveness of their investigation and trading methods. The user interface of the 3Commas platform is very straightforward, which makes the process of launching the Grid Bots very simple.

5. Options Trading Bot

While options trading may seem complicated, the potential rewards more than makeup for the learning curve. 3Commas has added the options bot to simplify the procedure and lessen the potential for error. This bot employs cutting-edge AI algorithms to assess market conditions and make trading decisions.

Key advantages of utilizing an options bot include quick and accurate price calculation in response to changing market conditions, simple monitoring of gains and losses, the opportunity to assess the viability of various max safety trades, and a straightforward interface.

6. Crypto-Signal

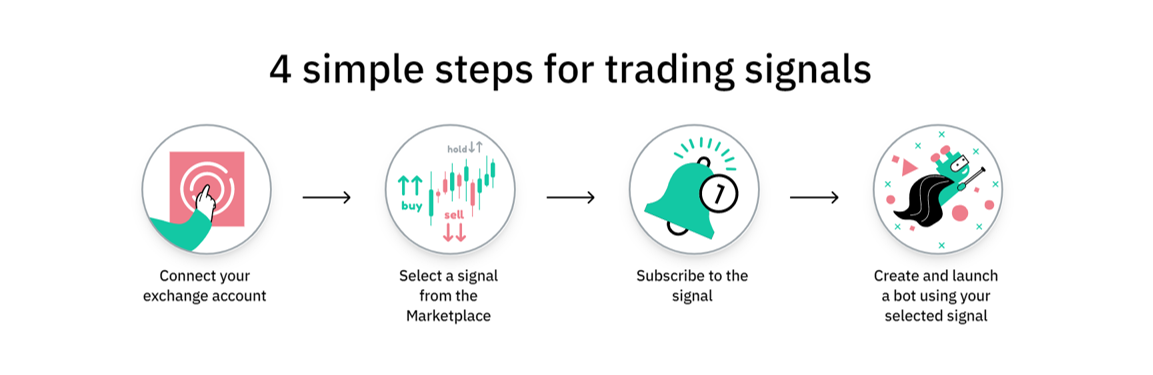

One of the simplest ways for novice traders to make profitable trades is to imitate the indications of more experienced traders. 3Commas provides the Signal Marketplace service, which allows users to track these signals easily.

The first steps are linking a crypto trading bot to your preferred currency exchange account, looking for a reliable signal supplier, and creating a new one. After that, you can relax and let the cryptocurrency trading bot handle everything else.

When the trading bot receives a trade signal from the signal source, it instantly goes to work to complete the deal at the time provided by the supplier. Utilizing this function does not require much effort on the user’s part.

You can automate your cryptocurrency trading by linking your exchange account to the platform, selecting a signal from the marketplace, subscribing to it, and then developing a bot to execute the signal’s trades.

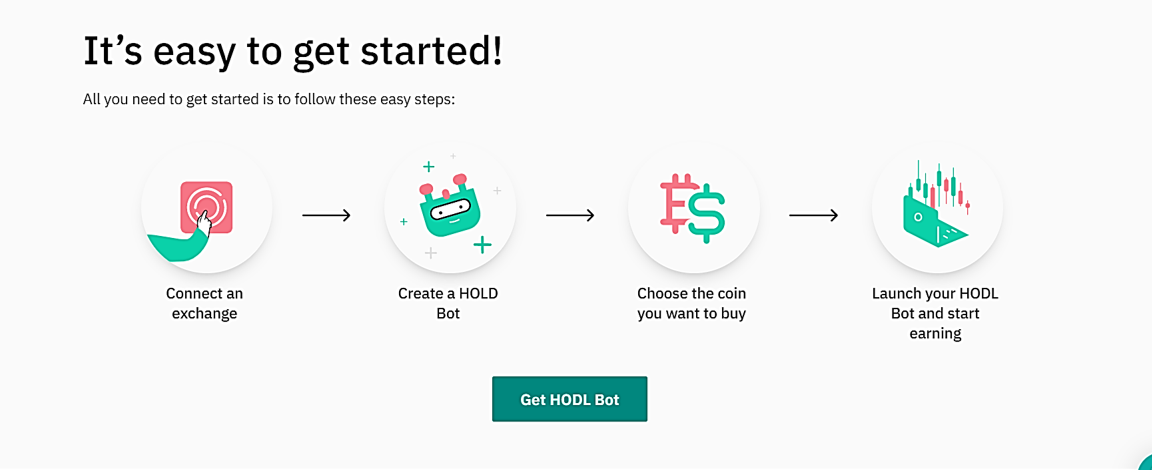

7. HODL Trading Bot

Another excellent trading bot from 3Commas that helps consumers navigate the complicated world of cryptocurrency trading. The HODL bot provides a low-cost way to construct portfolios and avoid potential hiccups in implementing a trading strategy.

Traders using the HODL bot have more leeway than they would with a strictly mechanical implementation of a standard Dollar Cost Averaging (DCA) approach.

To use the 3Commas HODL bot, choose the asset you wish to invest in and enter the appropriate purchases. Therefore, whether the asset’s price goes up or down, the bot will buy it in just a few minutes, evening out the portfolio’s performance.

3Commas Review: Automated Trading Pricing

There are four preliminary plans available through 3Commas:

- Junior: Free

- Starter: $22 per month

- Advanced: $37 per month

- Pro: $74 per month

If you upgrade from a free to a paid plan, you can use PayPal or Bitcoin. The payment process can be automated as a monthly payment through Paypal, while Bitcoin payments must be done manually every month. You can cancel your monthly trade automation membership anytime.

Junior Plan – Free

The free Plan from 3Commas includes access to their highly regarded SmartTrade and Market Place functions, among many others. But it doesn’t have the TradingView price indications, so you can’t use the automated bots.

This functionality is only available to paid subscribers. Also, the free Plan is only good for people who plan to trade cryptocurrencies with a total value of no more than $750 at any time.

Starter Plan – $22 per month

The 3Commas Starter Plan includes error and cancellation notifications and the capabilities included in the free Plan.

This Plan is available to users who have already upgraded from the Free Plan. Although it does not yet support automated bots, it alerts traders in case of any mistakes or cancellations, keeping them in the loop at all times.

Advanced Plan – $37 per month

The 3Commas Advanced Package is the most cost-effective choice for individuals looking to automate parts of their trading strategy.

Streamline your trading process and open up new avenues for profit with TradingView’s highly sought-after pricing signal tool for just $37 per month.

Pro Plan – $74 per month

The premium bundle from 3Commas offers the entire trading experience at a reasonable $74 per month. This special bundle combines the advantages of the superior package and additional features.

Traders on BitMEX have the luxury of using both Simple and Composite bots. Those who select this Plan also gain access to the comprehensive portfolio management suite, which is not available with any other option.

How to Open a 3Commas Account

More details

3Commas is a trading bot platform that enables you to develop a bot with curing-edge trading capabilities from the ground up. It executes trades on your behalf on 20+ leading cryptocurrency exchanges. UI is easy, has a simple registration process, and all features are accessible on their mobile app.

-

Supports 16 cryptocurrency exchanges.

-

Worldwide service for crypto lovers.

-

Paper, automatic, margin, and social trading.

-

Fantastic hosting service.

-

All functions are available via mobile apps.

-

Stiff in price.

-

Can be complicated for beginners.

-

No desktop app is available.

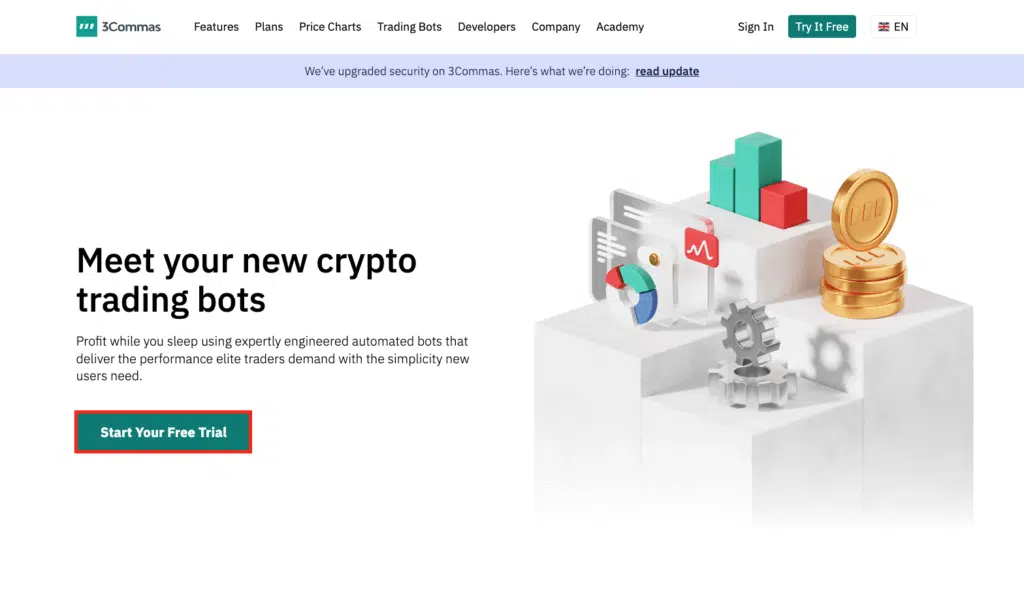

Step 1: Visit the 3Commas website

Visit the 3Commas website to sign up.

Select the [Start your free trial] button to register.

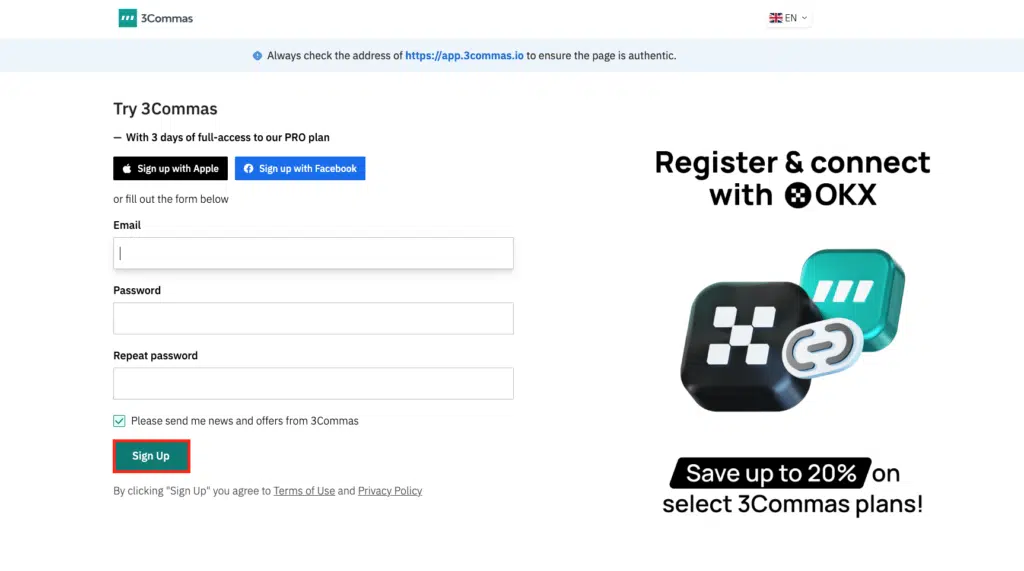

Step 2: Sign up on the Website

The button leads you to the signup page.

Enter a valid e-mail address and create a password. Once you are done, click the [Sign Up] button.

Step 3: Choose a Trading Bot or Strategy

Once you have signed up, you can choose a trading bot or manual trading strategy on the platform.

There are also instructions and tutorials available for new users.

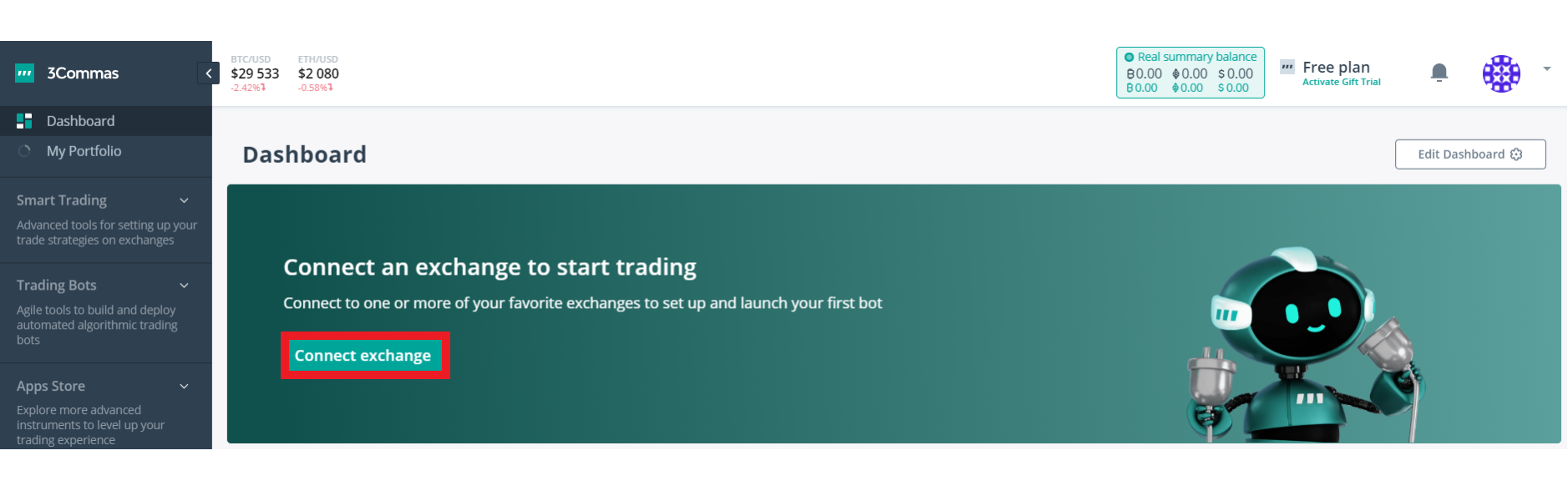

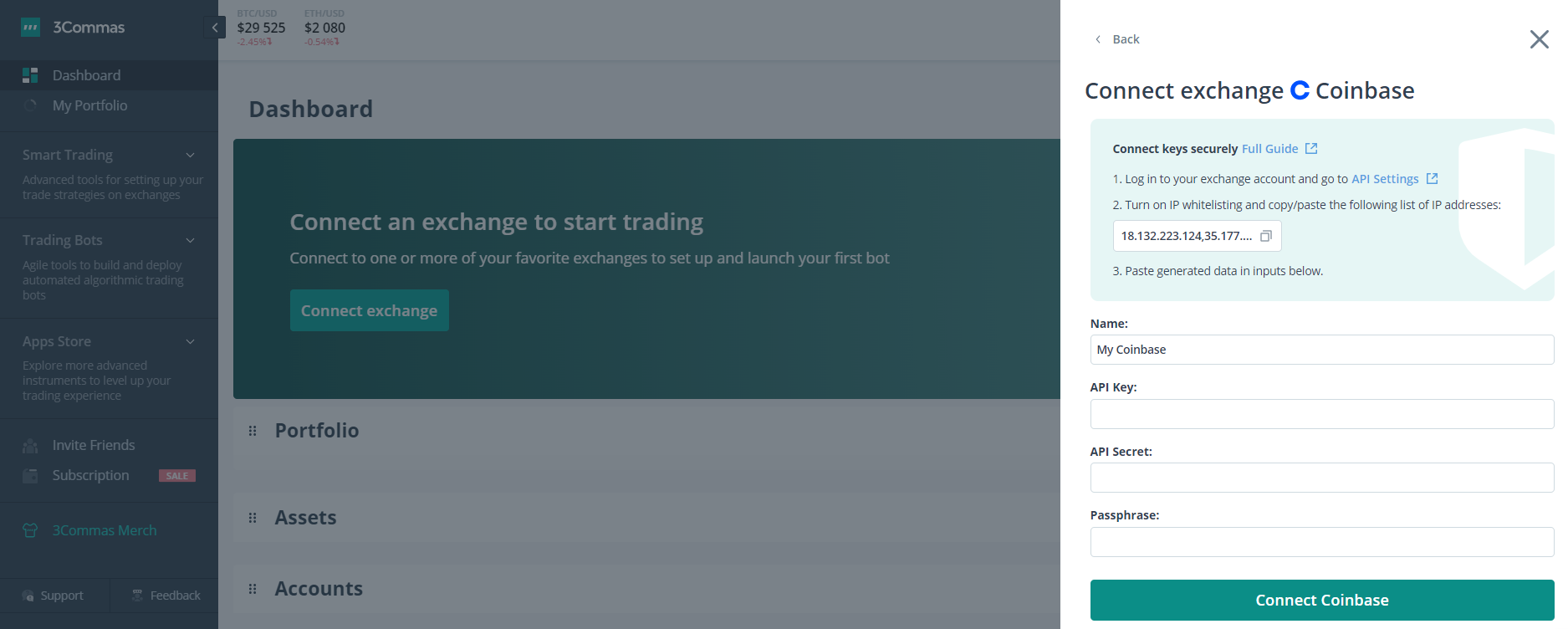

Step 4: Connect an Exchange and Start Trading.

Link your exchange to 3Commas to start trading.

Select the [Connect Exchange]. This will display a list of exchanges to select from.

Connect your preferred exchange by following the API steps, and start trading with the 3commas trading bot.

Once the exchange is connected, sit back and let the trading bot do the trading for you!

3Commas Trading Strategy: A Holistic Evaluation

3Commas offers many automatic trading bot strategies, from pre-set, manual trading, and easily customizable options to more intricate plans. While we will delve into the major strategies, it’s essential to note that this is not a complete compilation.

1. Stop Loss

Stop Loss is one of the most fundamental techniques in the trading game. Successful traders use this strategy by establishing a maximum loss percentage. The trading robot will immediately place a sell order if the price hits the initial trade price.

Take the hypothetical case of a bot placing a $10,000 buy order for Bitcoin. The stop loss for a particular trade is set at a 10% drop from the initial price. The bot places a sell order if the price of Bitcoin falls below $9,000.

This method acts as a hedge, protecting investors from unexpected market moves. To limit losses and safeguard investments, traders use stop-loss orders frequently.

2. Trailing Stop Loss

While the stop-loss method is tried and true, the Trailing Stop-Loss strategy takes things to the next level. A trailing profit and stop loss move is a stop loss order triggered whenever the current price drops below a certain level or a certain percentage of the previous price.

Consider a scenario where the BTC price is $10,000 and the trailing stop is $1,000. The sell order will be activated at $9,500 if Bitcoin’s price rises to $10,500.

Bitcoin’s price must fall below $9,500 to execute the sell order. Compared to the static Stop-Loss method, this strategy is more adaptable, responsive, and smart, allowing for safer trade size against unexpected price swings.

3. Take Profit

Logical and easy to understand, Take Profit is a simple and effective trading method. To operate, it monitors your account’s performance and makes a smart trade call ASAP when a certain threshold is reached for target profit after deducting the trading fees.

If you buy Bitcoin (BTC) at $10,000 and programmatically set a 20% Take Profit, the bot will automatically sell the position when the price of BTC reaches $12,000.

4. Trailing Take Profit

The Trailing Take Profit is a novel approach because it automatically factors profits. By selecting this box, the bot will automatically cash out after it reaches a 10% gain.

In other words, if Bitcoin keeps rising after reaching $10,500, as in the prior scenario, the position will remain open until the trend reverses.

These illustrations show the wide range of particular trades available in 3Commas. Pairs, trading volume, minimum deal size, and many other parameters can be adjusted on the fly.

It is a very flexible and powerful trading platform that can be tailored to your preferences in minutes.

3Commas Security: An In-Depth Analysis

Few specifics are available on 3Commas’s security procedures. Remember, though, that the platform doesn’t keep your money. Furthermore, the trading crypto bot cannot withdraw funds from the associated exchange accounts.

The trading bots communicate with the user’s exchange accounts using API keys supplied by the exchanges. These keys enable the bots access to the user’s account to automate trades; they do not grant the bots the ability to remove funds from the account.

The company’s trading data terms of service leave room for interpretation. It seems that 3Commas keeps track of users’ own trading strategies and all the safety trades, though it’s unclear how much of this data is individualized. There is no indication on the site whether or not the corporation aggregates or anonymizes this information.

3Commas Performance: A Comprehensive Review

Its integration with APIs from different markets must be considered. These APIs grant restricted access to automated crypto trading bots, so their reactions to market shifts and orders are typically the same as those of human traders.

The absence of data on latency tests for 3Commas makes it hard to draw any firm conclusions.

Nonetheless, it’s important to remember that institutional investors with access to sophisticated technology and fast networks would have a distinct advantage. However, there don’t seem to be any major drawbacks of 3Commas compared to other competitors in the market, especially for individual investors.

3Commas Review: Final Thoughts

Unlike its competitors, 3Commas’ trading bot excels in two key areas: usability and consistency.

Traders of all skill levels may utilize the market’s 24-hour availability and lack of time zone restrictions thanks to the platform’s intuitive UI and tight connection with major exchanges like Binance, Coinbase, and Huobi.

The 3Commas Dashboard is user-friendly and gives traders a wealth of settings to customize their bots. The platform also provides learning tools and in-depth data so customers can easily track their bots’ performance.

3Commas provides a full-service platform for automated cryptocurrency trading, including portfolio management, analytics, and social trading.

Yes, 3Commas has implemented various security measures to protect its systems and user accounts, including using Cloudflare as a security provider and offering 2FA to users for added account security. There have not been any significant security incidents reported since its launch.

Since 3Commas is just a trading site, there is no direct withdrawal option. Log in to your connected exchange account to access and withdraw your earnings. For security reasons, the API keys you provide to 3Commas can only be used to read and write data and not withdraw.

Beast Mode is a smart trading feature in 3Commas that allows users to open multiple active safety trades using the same futures contract. It is a way to maximize profits from market conditions by using trading tools such as bots, grid bot, bots, and smart trades.