TLDR

Flash loans allow users to borrow assets and are a modern method of unsecured loans that traders can access on decentralized finance (DeFi) protocols based on Ethereum.

- Step 1: You first find a protocol that provides flash loans (dydx, Aave, Uniswap).

- Step 2. Once you have the preferred protocol, link your Web 3 wallet to the website.

- Step 3: Depending on the protocol, you may be required to put in collateral or a security deposit to obtain the flash loan.

- Step 4: Once the loan has been approved, you may use the borrowed funds to exploit market possibilities. Remember to pay back the loan as there are high interests to pay.

What is a Flash Loan in DeFi?

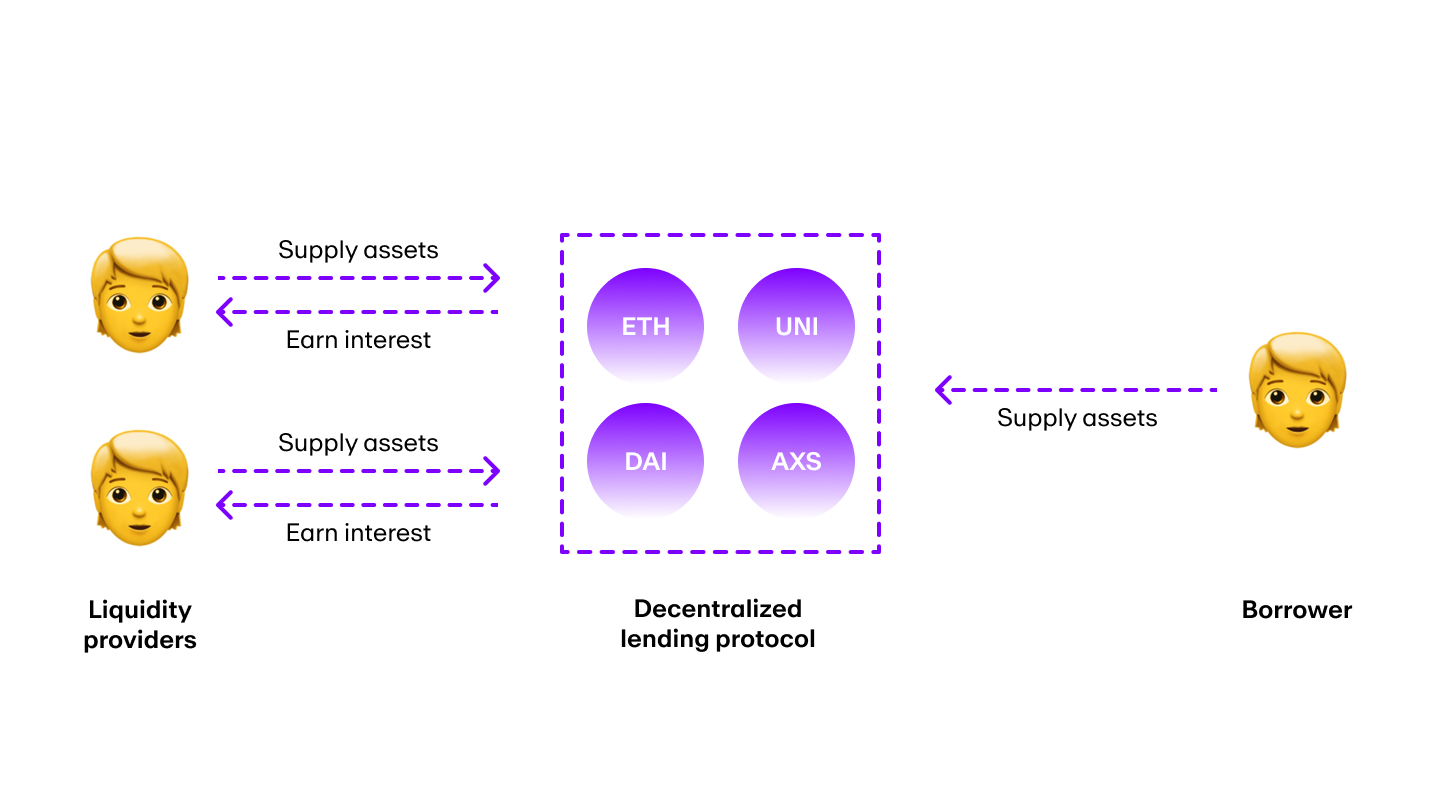

Flash loans are collateralized or uncollateralized loans without borrowing limits in which users borrow funds and return them in the same transaction.

It is a modern method of unsecured loans that traders can access on decentralized finance protocols based on Ethereum. They are usually used to solve an urgent financial need.

If the user can’t repay the loan before completing the transaction, a separate smart contract cancels the transaction and returns the money to the lender.

Why do flash loans exist?

This technology came into use when Marble Protocol first termed the concept in 2018.

Later, in 2020, the crypto platform ‘Aave‘ introduced the idea of providing Aave flash loans to traders operating through smart contracts. Though they were initially unusual, it has become a promising trend in the crypto world.

Barely six months after its official launch, Aave, an Ethereum lending platform, had already issued over $4 Billion in loans.

Fast-forward to today, there are already several lending platforms that execute them.

How Does Flash Loans Work

This method of borrowing digital assets is one of the beauties of blockchain technology. Flash loans attack the enormous flaws of traditional finance or regular loans by allowing near-instantaneous access to borrowed assets.

Thus, it executes at an eye-blazing speed with fewer requirements. These loans are so fast that borrowing and repayment of the digital assets co-occur in the same transaction. Also, the system makes use of a smart contract structure.

When a lender loans assets, these lenders require borrowers to repay the borrowed capital quickly. This is how it differs from normal loans.

So, suppose a borrower fails to repay the capital within a short time. In that case, the smart contract will terminate the loan and refresh all details, thereby reversing the initial transaction. This way, the complete loaned capital goes back to the lender.

How To Get Flash Loans In DeFi

The steps involved in getting flash loans in DeFi Protocols are easy.

Step 1: Choose a DeFi Protocol

Choosing the right DeFi lender is one of the significant steps in getting a flash loan. Due to the various options available in the crypto space, this can be a daunting task, especially for newer traders.

We have researched for you and recommend major platforms like dYdX, Aave, Uniswap, Compound Finance, and Maker DAO in the defi space.

Step 2: Create and Fund A Crypto Wallet

We recommend you have a crypto wallet to connect to DeFi Protocols to use a flash loan provider. A MetaMask wallet is one of the ideal options if you use a platform like Aave. View our step-by-step guide on creating a Metamask wallet.

There are several top-class platforms where you can create a wallet. With this wallet, you will gain access to activities in DeFi Protocols.

All DeFi systems operate on numerous networks with their native tokens. As a result, you may have to pay for all your activities on the blockchain networks. To do this, you will need a funded crypto wallet with some ETH or the native token on that blockchain.

Step 3: Calculate the Loan Amount

The next step is to calculate your loan upon finding the right DeFi platform and Flash loan lender.

This process involves carefully analyzing the amount you want to borrow from a lender. You can use a calculator online if you do not want to go through the process.

Step 4: Connect Wallet and Request the Loan

Once you have calculated the amount you need as a loan, you can connect your wallet to the chosen provider.

You can contact the provider or fill out their form, which is provided online.

The flash loan provider transfers requested assets to borrowers.

The borrower receives the borrowed token amount in a few seconds, and the transaction ends.

Step 5: Repay the loan

Once the operations are complete, the user will return the assets to the flash loan providers with or without the borrowed assets. This is a great loaning mechanism for uncollateralized lending.

Trusted Partners

Factors to consider to select the right platform.

Reliability

When using a flash loan, reliability is one of the crucial factors to consider when choosing a DeFi loan platform. In this context, reliability engulfs user safety, site reputation, and overall stability.

They involve several monetary transactions. Thus, extra caution is needed to find a well-known, trusted, and verified platform.

Site Optimization

A platform’s user interface and site optimization can determine the overall user experience.

A DeFi lending platform should be accessible on all mobile, tablet, and desktop platforms. Also, the interface should be fast and easy to use, as it will significantly improve the overall loan and trading processes.

Interest Rates

The interest rate significantly determines your potential ROI when securing a flash loan. The smaller the interest rate, the better your chances.

Overall, most DeFi lending platforms charge between 0 and 0.10%. Though there are barely any significant differences in most of their rates, going for a platform with a lower rate is always advantageous.

Advantages Of Flash Loans In DeFi Protocols

Flash loans are popular due to the numerous benefits they offer players over traditional loans.

Reduced Transaction Fee

In most cases, their transactions operate collectively, thus reducing the overall service fee. With this setting, the system charges the borrower the initial loan amount, lowering costs. However, the loan cost is 0.09% if the loan yields a profit on Aave.

Unsecured Loan

Traditional institutions adopt the secure loan system to borrow funds. This system requires that a borrower provide standard collateral to the lender to serve as the user’s loan and security. In this case, the lender takes hold of the collateral if the borrower defaults.

Flash loans, on the other hand, use unsecured loan systems. With this method, a borrower does not need to issue collateral to receive funds. Everything is regulated by smart contracts that are initiated through a single transaction.

Lenders can still get back their funds if a borrower defaults. However, it occurs differently with instant trades.

No Paperwork

Traditional banks may require many documents from a borrower to secure a loan. These documents range from formal IDs to Bank Statements, Proof of Income, and more.

With flash loans, however, you only need a crypto wallet and a lending platform operating with other smart contracts, and you are good to go.

Avenue For Profit through arbitrage opportunities

You can use cryptocurrency loans to profit on arbitrage by utilizing the differences in the rates of various exchanges.

For instance, if an exchanger prices a token at $20, another exchange prices the same token on different exchanges at $30. You can use arbitrage to make a profit from the difference.

To do this, you must secure a flash loan and buy any amount of tokens you want from the lower exchange.

Suppose you purchased 100 tokens from the lower exchanger; the total money spent would be $2,000. At this point, you can sell all these tokens on the second exchange priced at $30. It will generate $3,000, allowing you to keep up to $1,000 in profit after repaying your $2,000 flash loan.

Instant Transactions

Unlike traditional loans with long processes and repayment durations, flash loans are instantaneous transactions.

Once you secure one, you must trade with the available funds and pay back within the same transaction process. In this case, your profit is the addition gained from the trading process.

Interest Rate/Collateral Swaps

Collateral and interest rate swapping are current trends in the blockchain community. It not only guarantees but adds profit to flash loan repayments. A collateral swap involves switching your existing debt for a different crypto with a lower interest rate.

Some platforms offer better loan terms than others. Thus, you can use this loophole to secure flash loans on these platforms. This way, you can clear off your current loan, so you only have to deal with the better loan offer.

Risks Involved In Flash Loan Transactions

Flash loans come with a massive pile of benefits to users. However, there are also some risks involved in using these transactions. Also, they can be complex and daunting for newbies to understand. Thus, only experienced traders and crypto investors should use the system.

Market Volatility

The fluctuations in the price of cryptos can affect the market volatility of flash loans. Though these fluctuations can sometimes lead to profit, a downward trajectory will have you losing more money than you borrowed.

This situation is one of the significant reasons you need to have sufficient experience to secure a flash loan. That way, you can carefully analyze and weigh your potential risks.

Potential Cyber Attacks

The Ethereum network and DeFi protocols are not immune to cyber-attacks. Thus, hackers often look for new methods to access loan funds illegally.

Also, smart contracts often have flaws, creating loopholes for cyber attackers. Sometimes, the data transmission can leave the borrower and smart contract vulnerable, allowing hackers to siphon loan capital.

Flash Loan Attacks In DeFi: Why They Occur

Flash loans in DeFi protocols are still new. Thus, the innovation is still developing, leaving some room for vulnerabilities. So far, the assets stolen from DeFi platforms are already worth over $500 Million. Research shows that most of these cyber attacks occurred via DeFi flash loans.

Multiple flash loan transactions take place within seconds. As a result, an attack can occur in a swift and undetectable manner.

In a bid to prevent flash loan attacks, expert developers are already doing research on the possibility of sealing all loopholes. Most hackers exploit flaws in smart contract codes to manipulate prices in the database that updates them.

What are Smart Contracts In Flash Loans?

Flash loans are automated, making it possible for funds to be available to the lender within the specified time frame. All these automated processes are only possible with smart contracts.

Smart contracts are codes that a flash loan system stores and executes on a blockchain. These codes are advantageous to borrowers and lenders, as they carry out all complex calculations associated with a loan.

In addition, they ensure fund protection and automatically set the contract term of a flash loan.

A smart contract prevents funds from moving from one wallet to another unless a borrower fulfills the loan’s obligations.

Conclusion

Future protocols that provide flash loans are likely to increase in number as DeFi gains more and more traction. Anyone may use this new technology and realize its full potential with the proper knowledge and direction.

Recommended reads:

In a flash loan, a user can borrow assets without providing any collateral upfront and must return the borrowed assets within the same blockchain transaction.

A flash loan transaction is considered complete only when the borrower returns the funds. Otherwise, the smart contract will reverse the funds to the lender, as if the transaction never occurred. This means that flash loans provide uncollateralized debts while maintaining the security of safe loans.

Flash loans are not secured by collateral, and therefore, anyone can borrow funds to generate profits.

Flash loans are risk-free, so lenders do not have any reason to worry. The smart contract automatically terminates the flash loan if a borrower fails to go by loan terms. The system returns the initial loan amount to the lender in this case.

No. Flash loans are not hacks. Securing a flash loan is an official process in the crypto world. However, some hackers exploit the system's vulnerabilities to manipulate processes and steal loan capital.

Since the official launch of flash loans in 2020, there have been quite several DeFi lending platforms available online. So far, Aave remains the primary platform for flash loan transactions. However, competitors like dYdX, UniSwap, and DEX also exist.