TDLR

This step-by-step guide takes you through how to borrow money with your cryptocurrencies. We give you a step-by-step example of the crypto-backed loan application process.

It highlights the critical difference between using a centralized and decentralized lending platform. It guides you through the terminology and essential processes underlying applying for a crypto loan.

The basic steps of applying for a crypto loan:

- Step 1: Sign up on a crypto lending platform like Binance

- Step 2: Deposit additional collateral

- Step 3: Fill out a loan form

- Step 4: Confirm loan terms

- Step 5: Receive your crypto loan

What is a crypto loan?

A crypto loan is backed by your crypto holdings, not your credit score. Crypto loans allow individuals to borrow money using their crypto as collateral assets. Unlike traditional personal loans, though, applying for a crypto loan is short and not riddled with background credit checks and credit score assessments.

Crypto loans work in an automated fashion. The DeFi protocol performs the loan application process in a decentralized finance ecosystem. In the centralized finance (CeFi) ecosystem, the company’s crypto lending platform automates its application process.

However, the interest rates are preset in most crypto loans, and the loan application is approved once all terms and conditions are met. The borrowers receive their funds immediately after the deposit.

Compared to traditional banks, the crypto loan process is more transparent. The loan terms are the same for everyone, regardless of their history or background.

Choosing a lending platform

There are two types of lending platforms to use when borrowing money with crypto – decentralized finance (DeFi) and centralized finance (CeFi) lending platforms. They both offer the best crypto-backed loans. However, there are a few key differences between how the two types administer the loan process.

CeFi lending platforms

CeFi platforms are usually easy to use and often have lower interest rates than DeFi loans. Even though a company operates them, they do not charge origination fees. Borrowers can even take out fiat loans using their crypto as collateral. The loan process is automated, and the crypto loan is immediately disbursed into the borrower’s wallet.

Accessing custodial crypto loans is possible via CeFi platforms such as Binance, Coinbase, Blockchain.com, and Nexo. A CeFi lending platform takes possession of the collateralized assets and gives out custodial crypto loans.

The crypto assets are held with the company that owns the platform. This is risky for the borrower because “not your crypto, not your coins.” For users worried about protecting their digital assets, DeFi lending platforms are their best option.

DeFi lending platforms

DeFi platforms are solely run by smart contracts. The borrower enters a loan agreement with the lending protocol, not a crypto company. DeFi protocols can not issue fiat currency loans. They only deal with crypto assets.

DeFi protocol can be complicated to manage for non-technical people. However, the DeFi platform does not take possession of the borrower’s collateral assets. Instead, the crypto assets are held in the borrower’s DeFi wallet until the borrower pays back the loan amount or defaults on the bank loan payments entirely.

Borrowing crypto from Binance

Before borrowing a crypto loan from Binance, you must sign up for a crypto account. The easiest way to sign up on Binance is to click the [Get Started] button.

More details

Binance is a great combination of low fees, deep liquidity and multiple cryptocurrencies and trading pairs. We have tested every aspect of it and it STILL holds its reign as the top exchange in the world. In our view, it is the perfect crypto exchange for both newbies and advanced traders alike.

-

Biggest exchange in the world.

-

Industry's lowest trading fees.

-

Advance trading options like leverage trading.

-

600+ crypto options, 150+ for the US.

-

Lucrative on-site staking options.

-

Hiccups in account verification.

-

Less regulated than some competitors.

-

The corporate structure is not transparently.

To sign up for an account, you need the following:

- E-mail address

- Mobile number

- ID verification

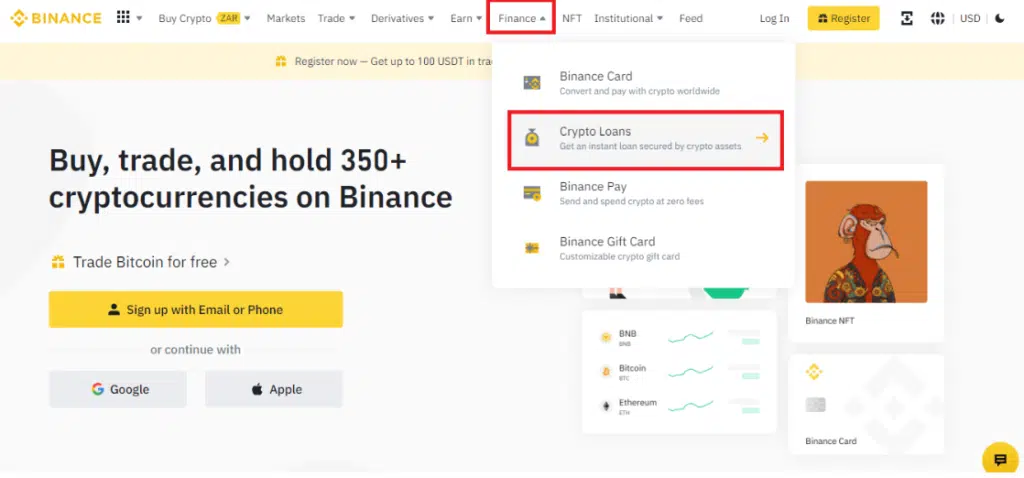

Step 1: Go to the Crypto Loans page

From the Binance homepage, click on the [Finance] tab at the top of the main navigation bar and select the [Crypto Loans] option from the drop-down menu.

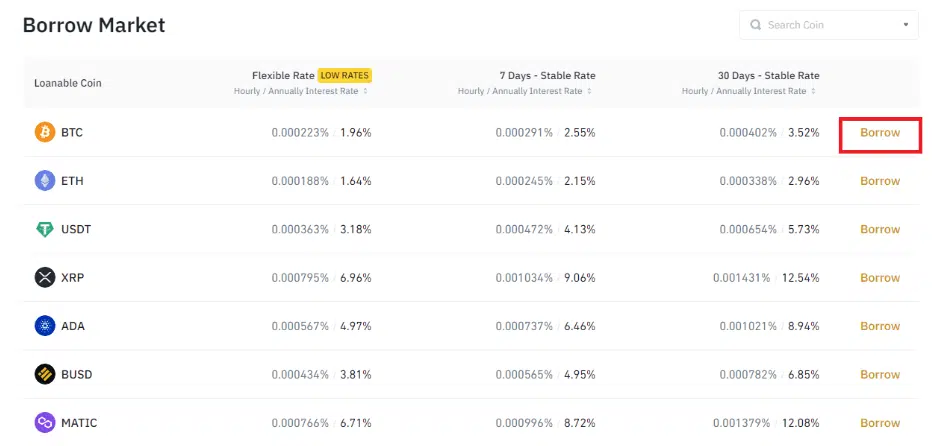

Step 2: Select the coin to borrow

Select the coin you want on the crypto loans page and click on [Borrow].

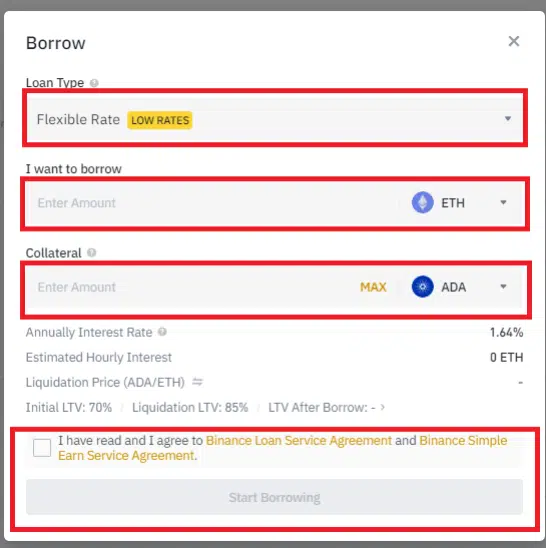

Step 3: Fill out the loan form

On the crypto loans page, Binance will prompt you to specify which asset you wish to borrow with crypto and how much of it you want to borrow together with the help you wish to use as collateral.

Confirm that all the loan details are correct and agree to the terms and borrowing rates. If you’re satisfied with the loan terms charged interest amount, click [Start Borrowing] to borrow the funds.

Binance will deposit the secured loan into your ‘Fiat and Spot’ wallet, from where you can use them as any other unborrowed assets, including trading, staking, lending, selling, or even withdrawing to an offline wallet.

How to repay your crypto loans on Binance

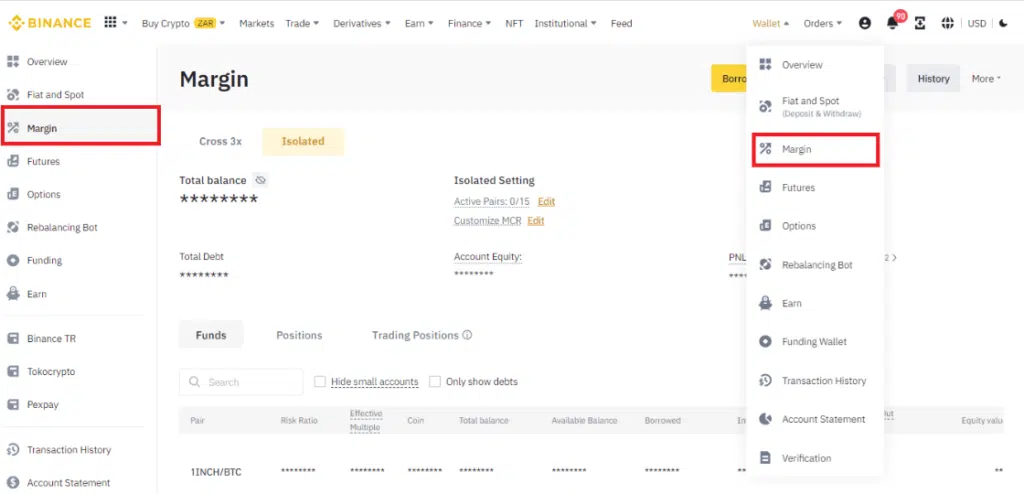

Step 1: Go to the Wallets page

Log in to your Binance account, click on [Wallet], and select [Margin] from the drop-down menu.

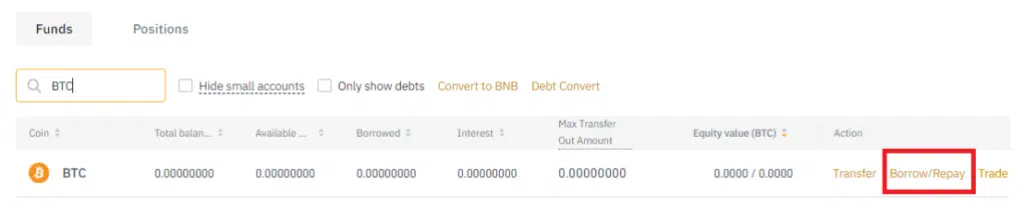

Step 2: Select the coin to repay

Select the coin you want to repay and click [Borrow/Repay].

The final stage is to enter the amount directly or click on the percentages you wish to repay. Regardless of the repayment amount, you need to repay the interest first.

Note:

Binance will calculate the interest rate of your loan in the next hour based on your borrowed amount. Currently, the Bitcoin annual interest rate sits at 1.98%.

You can repay the remaining loan amount at any time or over monthly payments. However, every time you make a repayment, you will need to repay the interest first.

Remember to repay in the same coin as what you borrowed. For example, if you borrowed ETH, your account must have ETH when you repay. Note that you cannot use other coins for repayment.

Popular crypto collateral coins

Some crypto lending sites only accept a few coins for collateral. Here are the leading most generally accepted currencies:

- Bitcoin: Bitcoin is the widely accepted cryptocurrency for collateral. It has the largest market cap and is a highly liquid cryptocurrency.

- Ethereum: Ethereum is the second most accepted cryptocurrency for collateral required. ETH has the second largest market cap after Bitcoin, and most lending platforms use its smart contract features.

- USD Tether: USDT is the third most accepted crypto collateral coin because it is a stable coin with the largest market cap.

- USD Coin: USDC is another popular crypto collateral coin most lenders accept. Circle, a US-based blockchain company, issues USDC, which is trusted and well-respected in the crypto industry.

Trusted partners

Not a Conventional Loan, but Crypto Assets Loan

Today, you can take out a crypto loan online from anywhere in the world. You do not have to be a citizen of a particular country to qualify. All you need is crypto to collateralize your loan application.

Taking out a crypto loan does not impact your credit score. No origination fees exist; the same interest rate applies to all loan applications. The whole process is unbiased because smart contracts manage it and not humans. Here are some of the ways why crypto loans are far superior to traditional bank loans:

- Applicants do not need to perform a credit check.

- Applicants do not have a bank account.

- Applicants receive same-day funding.

- Applicants take charge of their application process.

- Applicants can apply from any geographic location

- Loan applications are open 24/7

Why do people borrow money with crypto?

People borrow money with crypto for many reasons, but the most prominent one is that they cannot access a loan account from traditional banks. Taking out a conventional loan from a bank account requires a lot of paperwork. Applicants must be citizens of a specific country and present proof of residency as a home address to qualify for a traditional bank loan.

This presents a problem for immigrants, people who are digital nomads, and those who choose to lead unconventional lifestyles.

In addition, traditional banks do not charge customers the same interest rate and rates. The interest rates charged are based on the individual’s credit score. Again, this presents several problems for immigrants, young adults who do not have a credit score, or those whose credit scores are too low to qualify.

Using your crypto assets to secure a loan presents a much easier alternative to traditional loans. Most crypto lending platforms do not require paperwork at all. The interest rates are set and apply to all individuals who wish to take out a loan regardless of their credit score.

A crypto lending platform does not have to perform credit checks at all. All that is required is that the borrower has enough crypto collateral to finance monthly payments on the loan.

What Can I Use a Crypto Loan For?

Maybe you have no problem securing a traditional loan with a favorable interest rate from a bank. But it’s Friday night, and a new coin is pumping. You would like to get in on the action immediately. But, you do not have the capital and do not want to sell your bitcoins.

In that case, securing a bank loan in time would not work, as banks only operate on weekdays. By Monday morning, you will have lost the opportunity to buy this new coin at a low price.

In short, a crypto loan is best applicable when used to finance the purchase of other digital assets. Users can use these loan instruments to buy more crypto to increase their holdings and boost their portfolios.

What do I need to get started with a crypto loan?

You will need a few things to get started with securing a loan from a crypto lender. Below is a general list of items you will need when securing any crypto loan:

- Collateral: Most crypto lenders offer collateralized loans and require you to deposit crypto as collateral for securing a loan.

- Crypto wallet: You must use a compatible digital wallet to deposit your collateral and withdraw the loan amount you would like to receive.

- ID verification: If you choose to use a centralized lending platform, you will need some form of identity verification document to sign up. Governments have scrutinized the crypto industry for anti-money laundering (AML) and know-your-customer (KYC) law compliance.

Self-repaying crypto loans

Self-replaying crypto loans are a new DeFi innovation popularized by Alchemix, a crypto lending protocol. The idea is that by using Alchemix, you will never suffer a liquidation event when borrowing money with crypto.

How it works is that the borrower deposits their digital assets as collateral on the platform and can borrow cash for up to 50% of deposited collateral. Since the platform gives out an interest rate on the collateral assets – the secured loan will automatically pay itself off over time.

Self-repaying loans are still a new phenomenon within the DeFi crypto industry. They have not been tested under severe market conditions. Users should do their research before applying for such loan payment schemes.

What is Loan-to-Value (LTV), and How Does it Affect Loan Rates?

The loan to value (LTV) is the value of a user’s loan amount compared to the value of the crypto assets they put up for collateral. Typically, for CeFi, most lenders set their loan-to-value ratio and liquidation thresholds based on risk management policies. For DeFi, the lending protocol will determine the LTV ratio and liquidation threshold.

LTV = Loan Amount / Collateral Amount x 100%

(Loan Amount = Principal + Interest)

If a user borrows from a lender with a 50% loan-to-value (LTV) ratio and a 75% liquidation threshold, that means that for a $50 loan amount, the collateral required is $100. For example, if a user wants to borrow $50 in fiat against their bitcoin, they have put up $100 worth of bitcoin as collateral.

If the bitcoin price rises by 50%, the borrower’s LTV decreases to 25%. But if the bitcoin price decreases by 50%, the borrower’s LTV increases to 100.% In the latter event, the lender would send out margin calls.

Margin calls and forced liquidations

Margin calls exist to alert borrowers to return the borrowed funds before the liquidation threshold is reached. If borrowers’ LTVs breach the liquidation, the lender seizes and sells their collateral. That is one of the big risks when borrowing money with crypto.

Some lenders initiate loan terms with partial automatic repayments by doing credit checks or pulling some of the collateral from the borrower’s crypto wallet. Loan payment

To avoid liquidation, borrowers must make the entire loan payment or add more collateral by depositing more crypto assets to the lender’s platform.

When taking out a crypto-backed loan, borrowers must always manage their TVLs to avoid a margin call or losing some of their crypto portfolios.

What are the other risks of crypto loans?

Like a traditional loan, all crypto loans are collateralized, usually by other digital assets like Bitcoin. All crypto loans charge interest rates. Borrowers must make interest payments to service the loans. Otherwise, they risk losing their collateral and decreasing their crypto portfolio. Here are the main risks:

Market volatility

The crypto industry is prone to extreme market conditions. In 2022, we saw the price of Terra Luna plunge from over $100 to less than $0.01 in a matter of weeks. Over $60 billion was wiped out from the industry.

Unfortunately, crypto is full of black swan events. Price stability is not guaranteed, and the value of your collateralized assets, and thus interest payments and rates, may fluctuate based on market conditions.

When borrowing money from a crypto end, it is advisable to use a stable coin like USD Coin (USDC) as collateral. USD Coin is a stablecoin that is backed 1 to 1 by the USD dollar; its value does not change

CeFi bankruptcy

In 2022, a lot of crypto lending companies declared Chapter 11 bankruptcy. On the list were big names like Celsius, BlockFi, and Voyager. Unexpected margin calls caught many investors off guard, and their crypto assets on the platforms had their crypto holdings frozen from withdrawals.

DeFi security

While using a DeFi wallet is one of the best ways to safeguard your crypto holdings, DeFi platforms are not immune from other risks. Since smart contracts solely run their operations, DeFi lending platforms are a honey pot for hackers and phishing attacks. In 2022, a lot of people fell prey to cyber-attacks.

Summary

- Crypto loans provide a solution for people who need better alternatives to the traditional loan system run by banks.

- There are two types of crypto lending platforms – centralized platforms run by a private company and decentralized platforms run by DeFi lending protocols.

- When borrowing from a crypto lending platform, users need to be aware of the loan terms and conditions to void the liquidation of their crypto assets.