TLDR

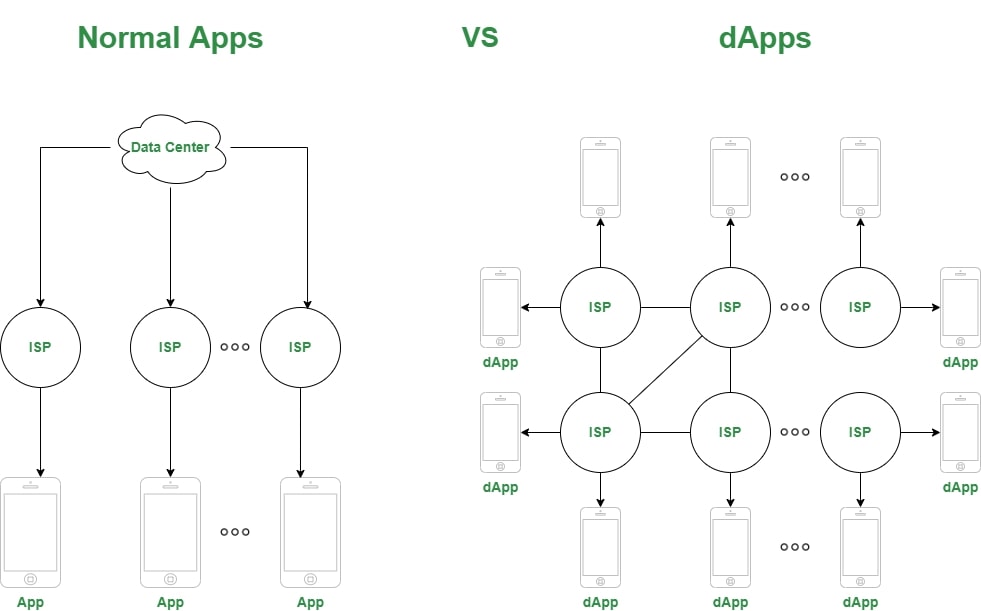

A decentralized application (dApp) is a software or web application on a blockchain network. A network of users controls dApps, making them decentralized, unlike traditional web applications controlled by a central authority.

A dApp consists of three components:

- A smart contract

- User interface

- Backend code running it

dApps use cases range from digital asset management to gaming, social media, and supply chain management. Famous dApp examples in the crypto industry include decentralized exchanges like PancakeSwap, marketplaces like OpenSea, and decentralized autonomous organizations (DAOs).

How do dApps work?

Let’s define how dApps work easily:

The smart contract sets the rules governing network interactions. The user interface is the face of the dApp and allows interaction with the smart contract. The backend code is the core infrastructure storing and retrieving data from the blockchain.

What are the benefits of a decentralized app?

Decentralization offers many advantages over a traditional centralized network. For one, it makes dApps more resistant to censorship and data tampering.

Individuals or interest groups struggle to shut down or manipulate dApps, as no single entity controls them. Furthermore, dApps are often more transparent and open because the blockchain records all transactions and data, making them visible to everyone.

Ever heard about DeFi?

One example of the most popular use cases for dApps is in the world of finance. Decentralized finance (DeFi) platforms, also known as open finance, design a new class of dApps that aim to provide financial services without central authority control.

These platforms allow users to borrow, lend, and digital trade assets without the need to pay for banks or other financial institutions to function as intermediaries. This can help to democratize access to financial services and make them more accessible to people around the world.

How do dApps work – use cases?

Let us go through some of the mentioned decentralized Apps above to answer this question.

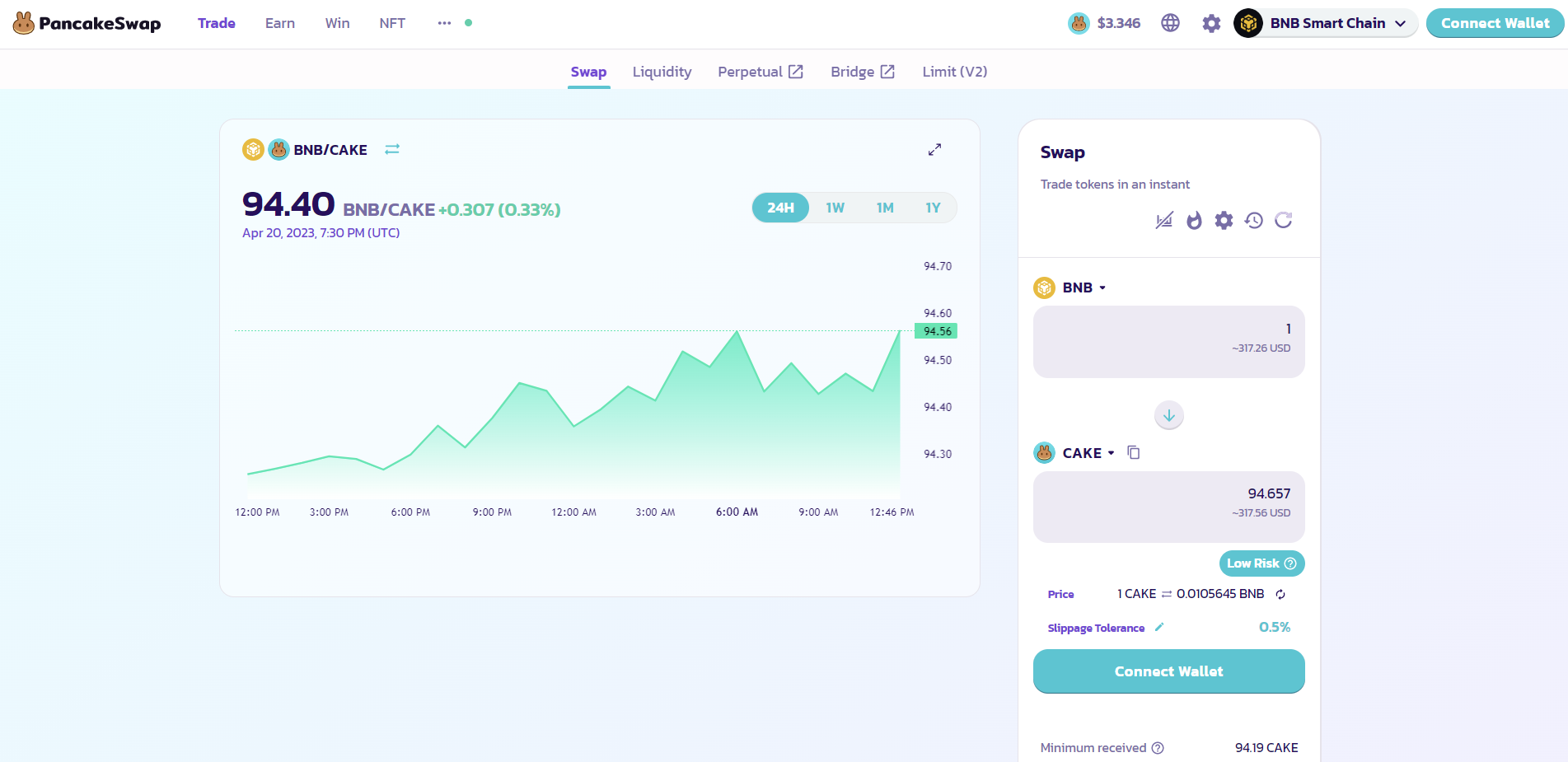

PancakeSwap

Pancakeswap is a decentralized exchange (DEX) that runs on the Binance Smart Chain (BSC) and allows users to trade cryptocurrencies in a trustless, decentralized manner. Instead of relying on a centralized intermediary, PancakeSwap uses smart contracts on the BSC blockchain to track and facilitate user trades.

DEX makes swapping easier by using one of its key features: a liquidity pool system. Users can supply liquidity to the exchange by depositing their assets into a pool, enabling trade execution with those funds.

In return, liquidity providers receive a portion of the trading fees generated on the platform. The platform also has a unique way of governance with its token CAKE, which allows holders to vote on platform proposals and earn rewards through staking.

More details

PancakeSwap is a top-tier crypto DEX on the Binance Smart Chain (BSC), providing secure and efficient token exchanges. It offers many features, including liquidity pools, staking, trading competitions, and an NFT marketplace. With its fast transactions, low costs, and support for over 500 trading pairs, PancakeSwap is a popular choice.

-

High daily transaction volume.

-

Transaction costs are relatively low.

-

Decentralized liquidity.

-

Perpetual trading contracts with leverage.

-

No dedicated customer support available.

-

Fiat deposits are not accepted.

-

Potential pricing delays.

OpenSea

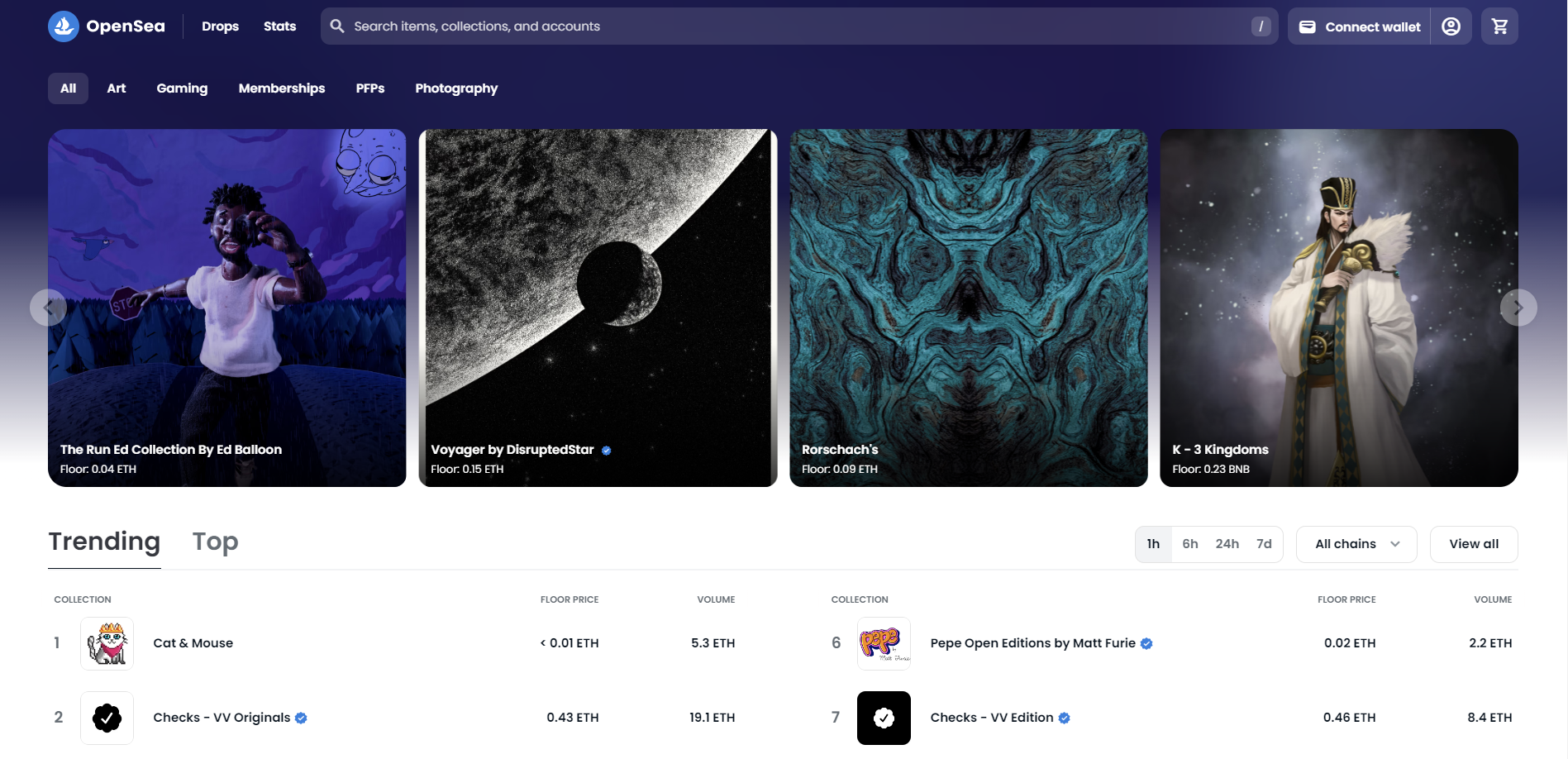

Opensea is a decentralized marketplace for buying, selling, and discovering non-fungible tokens (NFTs). It allows users to list, bid on, and purchase unique digital items such as collectible art, game items, and other virtual assets.

OpenSea is an application built on the Ethereum blockchain that allows buyers to have actual ownership and control of NFTs. It also has the feature of creating and managing your marketplace. It has become one of the most popular and widely used platforms for buying and selling NFTs.

More details

OpenSea, celebrated as the largest NFT marketplace, stands out with diverse collections for various enthusiasts and a gas-free operation on Polygon. Noted for its fair fees and easy accessibility, it serves as an attractive hub for creators and collectors alike.

-

Competitive service fees.

-

No gas fees for most transactions.

-

The most extensive collection of NFTs.

-

Easy artist account creation.

-

10% royalty cap.

-

Limited customer service.

-

Vulnerable to scams.

-

History of insider trading.

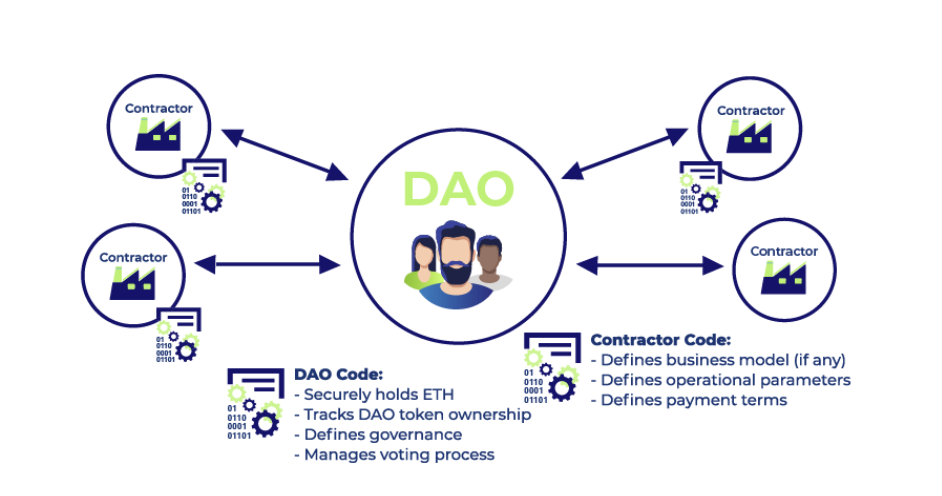

DAO’s

A DAO, or Decentralized Autonomous Organization, is a digital organization that operates on a blockchain network such as BSC. MetFi is an example of DAO, meaning any single authority or centralized entity does not control it. Its members run it through a set of rules encoded in smart contracts.

It operates on a blockchain-based platform and uses MFI tokens representing ownership and voting power. One can use them for various purposes, such as decentralized fundraising, community governance, and purchasing MetFi NFTs to access high yields (100-1000% APY) and staking benefits.

DAOs have the potential to provide a transparent, secure, and efficient way for communities to organize, govern and make decisions.

What are the risks when I use decentralized apps?

Hacking

One of the biggest risks is the potential for hacking. Because dApps run on decentralized network platforms, they are more vulnerable to hacking attacks. Additionally, dApps are often open-source, so identifying and fixing vulnerabilities in open-source code can be more difficult. Unlike centralized apps, once you are hacked, there is no way to recover.

Scam and regulation

The absence of regulation by any central authority can make it more challenging to identify and shut fraudulent projects in dApps. Moreover, investing in dApps can be more difficult to understand the risks involved due to using new and untested technologies.

Liquidity and volatility

A further important aspect that should be considered when it comes to dApp is the issue of liquidity. Many dApps, especially those not widely adopted, might have a shallow trading volume, making it difficult for users to buy or sell their app assets.

Too much of unknown territory or a great chance?

Overall, dApps have a lot of potential to revolutionize various industries, from finance to gaming. Offering a level of decentralization and transparency that traditional centralized systems cannot deliver. However, knowing the risks and research before investing in any dApp is essential.

A dApp represents a new class of software applications built on decentralized networks rather than centralized servers. Additionally, it’s essential to stay informed about the regulatory landscape and laws and regulations surrounding how dApps operate, as they are still evolving. Still, they have the potential to revolutionize various industries and create new revenue streams for game developers and democratize access to financial services.

Why are dApps not used as traditional applications?

An important aspect to consider when it comes to dApps is the issue of scalability. Because dApps run on decentralized networks, they often need help with scalability issues that can slow down transactions. They also make it difficult for dApp to handle many users. This is a common issue faced by many blockchain-based dApps and is an area that is currently being researched and developed by many teams in the blockchain space. Many dApps need more user-friendly user interfaces written, which is another issue.

How bright is the future of a dApp?

Despite these challenges, dApps have a lot of potential for the future. As the technology and infrastructure improve, dApps will likely become more user-friendly. Also, as more people become familiar with blockchain technology and its potential uses, more dApps will probably be developed and adopted.

Do smart contracts secure them?

First of all, what is a smart contract?

Smart contracts are digital contracts that are stored on a blockchain network. They contain the rules and logic governing a decentralized application’s behavior (dApp). A smart contract self-executes, automatically performing the actions specified in the contract when meeting certain conditions. It maintains transparency and immutability, as the blockchain records all transactions and data, making them visible to everyone.

Is dApps backboned by these?

Yes! It’s pretty important to consider the issue of smart contract security risks. Smart contracts are the backbone of dApps. They contain the rules and logic that govern the behavior of the dApp. If a smart contract is not written correctly or audited, it can have vulnerabilities that hackers can exploit.

Who is in charge of the rules and regulations in this decentralized environment?

A decentralized network of users runs DApps, and it’s essential to have a system for making decisions and resolving disputes. This can be challenging as there is no central authority to make decisions, and it can be difficult to reach a consensus among the users, which creates an issue of governance.

Conclusion

In conclusion, dApp is a new and exciting technology with much potential for the future. Thanks to smart contracts, they offer a level of decentralization and transparency that traditional centralized systems can’t match.

However, it’s essential to be aware of the risks and challenges that dApps face, such as scalability, user-friendliness, liquidity, smart contract security, and governance. It’s essential to stay informed about the latest developments in the dApp space, the regulatory environment, and the laws surrounding them as they are still evolving and to do your due diligence before investing in any dApp.

Despite these challenges, dApps have the potential to revolutionize various industries and create new opportunities for developers, investors, and users alike. With the right approach, dApps can become more scalable, user-friendly, and secure, making them more accessible and adopted by the mainstream. It’s essential to know the risks and possibilities and make informed decisions regarding dApps.

DApps are decentralized apps that work on blockchain networks, controlled by groups of users instead of one central authority.

Examples of dApps include decentralized exchanges like PancakeSwap and marketplaces like OpenSea.

Bitcoin is a cryptocurrency, not a dApp, but it does operate on a decentralized blockchain network. MetaMask is also not a dApp. It is a browser extension and wallet for managing digital currencies, and it helps people use dApps.