TLDR

The token swap involves migrating your native token to your desired token across different blockchain networks. The atomic swap process eliminates the need to change digital tokens via fiat money.

The type of token will determine the crypto-swapping method to use. You can either swap through an exchange or by manual means. The swap can be on a centralized or decentralized exchange. It can also be an atomic swap without the need for an intermediary.

Introduction

Cryptocurrency has always challenged the conventional means of carrying out financial transactions. The use of cryptocurrency has rapidly increased globally as it is becoming more effective in using traditional currencies for transactions.

Token often refers to a cryptocurrency token not built on its blockchain but on an existing one. They have various purposes after they have been created, including using them for fundraising through the initial coin offering (ICO) process.

One of the challenges previously identified in the crypto ecosystem is the difficulty of transferring crypto assets from one Blockchain network to another. However, introducing the token swap has helped reduce this rigorous process.

This article focuses on what token swap is all about and how to successfully carry out a swap in simple steps.

What is a Token swap?

A token swap is a simple way to exchange tokens between entities across blockchains. It refers to exchanging a crypto token for another without first converting to fiat currency. Users can conduct swapping through cryptocurrency exchanges or token swap platforms.

This reduces the need to obtain crypto via a fiat exchange, reducing crypto’s dependency on fiat currency. Over the years, it has evolved, transitioning from non-fiat crypto token transfers to playing a role in token migration processes.

Types of Token Swap

As highlighted below, two significant methods exist for performing a swap.

Regular token swaps

Token swaps occur within an exchange environment, which can be centralized or decentralized. The swap done on a centralized or decentralized exchange is the same. The only difference is the amount of control the owner had over their assets.

In a centralized exchange, the custodian has ultimate and complete control over the assets. On the other hand, in a decentralized exchange, the complete control of crypto tokens lies with the owner, which is the exact opposite.

Cross-chain token swaps

This type of swap is more common. It involves the moving of tokens from one Blockchain network to another. Token swaps occur by utilizing bridges that lock tokens on one blockchain network and mint-wrapped tokens on the other.

A good example is using the Binance bridge to lock ETH on the Ethereum network and receive wrapped Ethereum (wETH) on the Binance blockchain.

How to Carry out a Token Swap Using Bybit?

The following steps will guide you to swap two crypto tokens on Bybit.

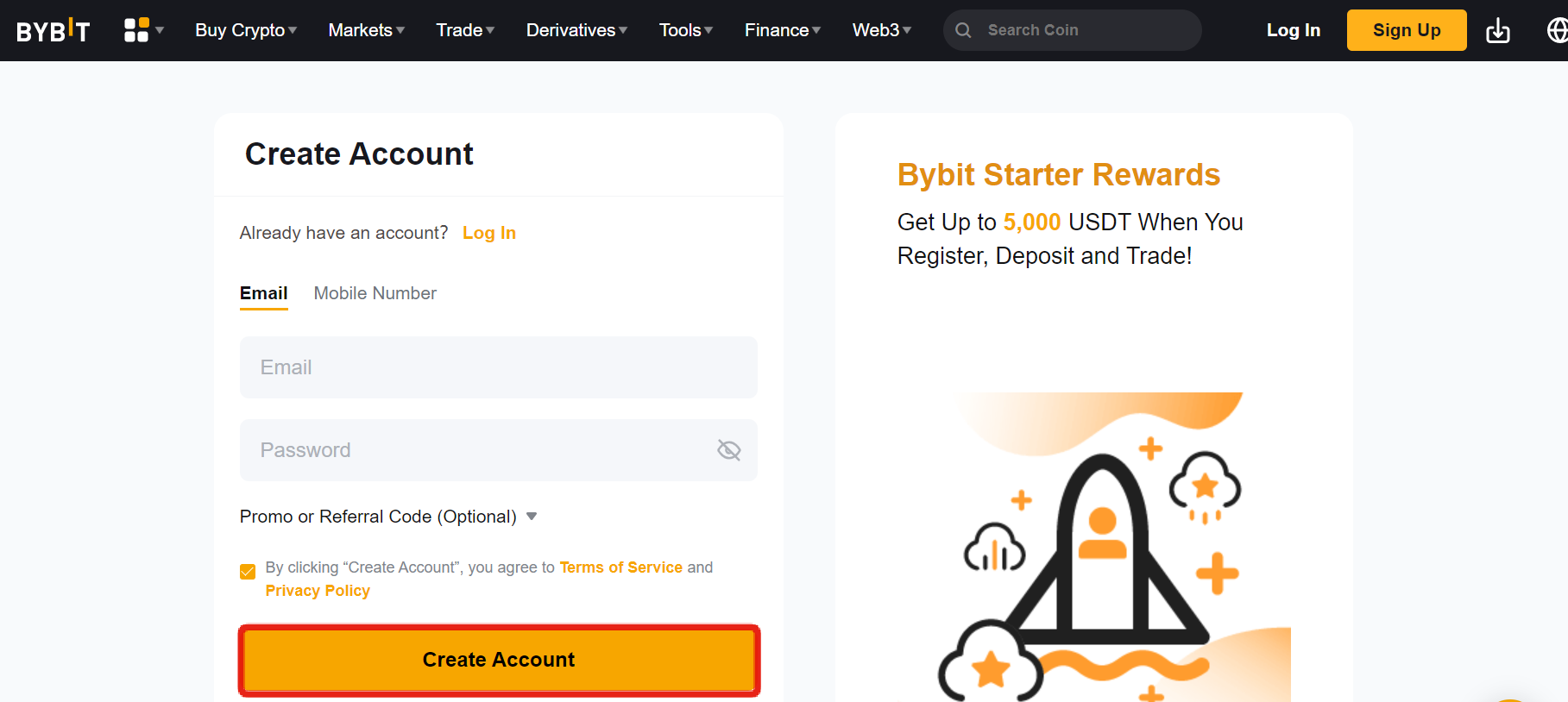

Step 1: Sign up on Bybit

To start swapping, you need to open an account on Bybit. The easiest way is to click the [Get Started] button.

More details

Bybit is a leading futures trading platform globally, offering up to 100x leverage and attracting users who prefer to remain anonymous. With a presence in 180+ countries, it is renowned for its efficiency and unique features in cryptocurrency derivatives trading.

-

The platform offers up to 100x leverage trading.

-

Strong educational resources.

-

Diverse markets for traders, spot, perp, and futures.

-

Risk-free demo accounts to explore all key features.

-

TradingView integration.

-

The platform is difficult for beginners to navigate.

-

It does not offer a quality spot trading feature.

-

The NFT marketplace is limited in terms of options.

-

Security is of the gold industry standard.

The sign-up process is straightforward. You only need an e-mail address and password to create the account.

Step 2: Create a wallet

Once you have verified your account on Bybit, you can go directly to creating a wallet by selecting the ‘Create Wallet‘ option at the lower part of the dialogue box.

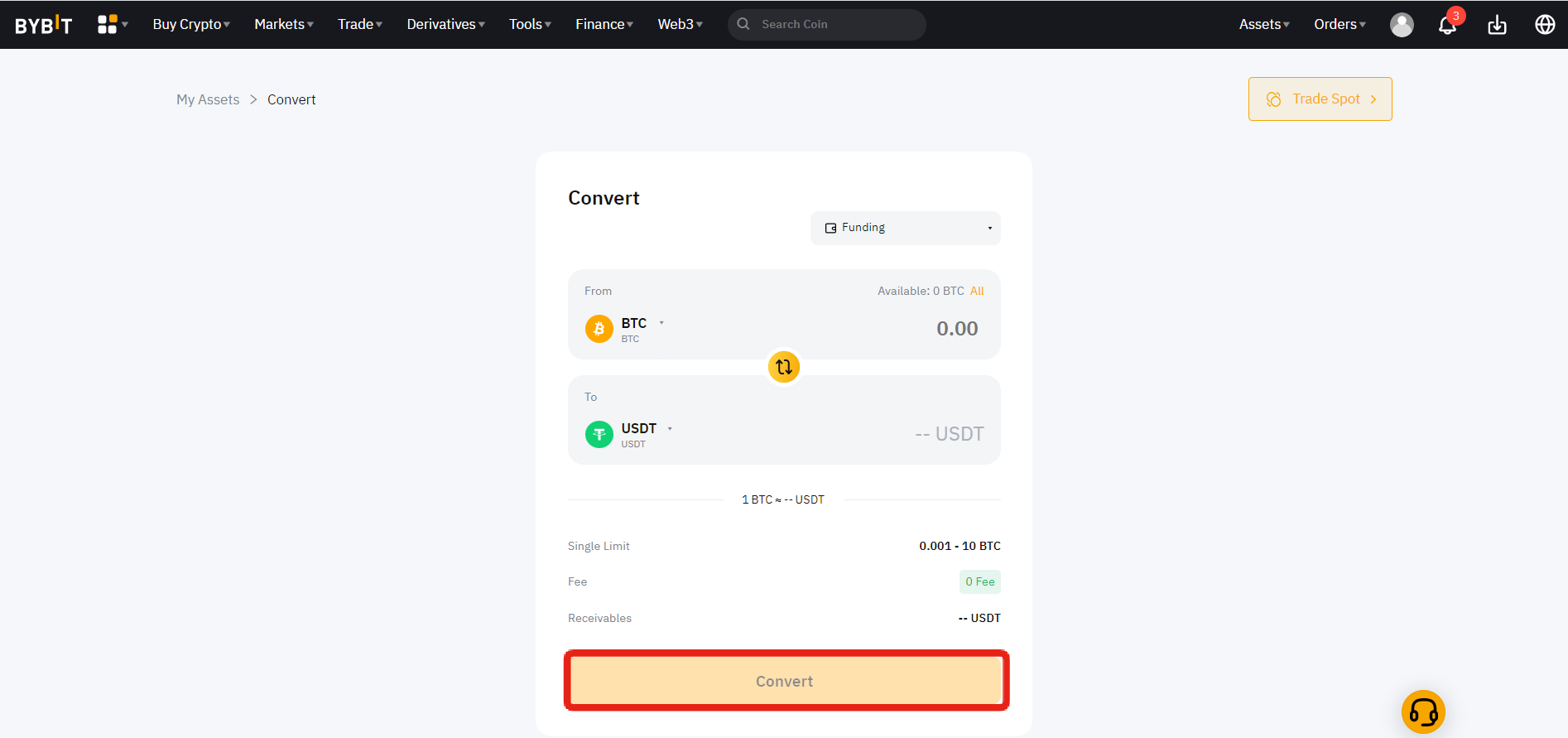

Step 3: Commence trading with the new token

If you don’t have any tokens in your wallet, you can buy them using our guide here.

To swap existing tokens in your wallet, you access the swapping option by selecting the ‘Convert‘ button from the top list of icons on the Bybit portal.

The exchange makes token swapping easier and more convenient. Token swapping on exchanges is completely transparent, with no hidden fees.

P2P Token Swaps

The DIY swap method is very similar to the exchange method.

- Identify the platform or person you will exchange tokens with

The platform-supported wallet or individual issuing the coin will provide users with a wallet to download or a website to register on. Users would receive two wallets, one for each currency, one for the old and one for the new.

- Swap tokens

Once you complete the token swap process, transfer the old and new tokens to the recipient’s wallet to credit the new coin or account. On the other hand, the manual approach to token swapping may pose some significant risks.

These wallets and sites designed for token swaps may present complications for newcomers. Furthermore, irregularities due to the poor User interface can cause inconsistencies between functionalities and their descriptions and designs. These irregularities can lead to minor errors, which may lead to irreversible consequences.

Therefore, manual token swaps are more suitable for individuals with a strong understanding of the crypto sphere. The manual token swapping process description provides a high-level overview of the manual token swap work process. Other factors, such as token trading pairs, would influence the process’s variations.

What is the Best Token Swap platform?

The token swap chosen for crypto swaps affects the user’s experience. This involves fees, transaction processes, pairing, and privacy. Here are some of the common token swaps available.

1. Uniswap

With Uniswap, it is easy to swap tokens in the Ethereum Blockchain without a need to Verify identity or create an account. Uniswap also boasts of high liquidity and high interest returns. Uniswap supports a wide range of wallets, such as:

- MetaMask

- Wallet connect

- Coinbase wallet

The platform supports a wide variety of popular ERC-20 cryptocurrency assets, such as:

- Ethereum

- USD coin

- Tether

- Chainlink

- Uniswap

- Wrapped Ether

- Wrapped BTC

More details

Uniswap is a user-friendly cryptocurrency exchange with competitive fees for all trading levels. It enables direct crypto trading from digital wallets, supports options and futures contracts for BTC and ETH, and offers advanced trading features for experienced traders and institutional clients.

-

Full transparency and open-source code.

-

No KYC process.

-

All ERC20 tokens are supported.

-

Earn passive rewards by providing liquidity.

-

Low fees for most transactions (~0.3%).

-

No option for fiat-to-crypto transactions.

-

Challenging for inexperienced crypto traders.

-

No insurance coverage for lost crypto incidents.

-

No mobile trading application available.

2. Bybit

Bybit is a centralized exchange with derivatives offering a good set of advanced trading tools. It has excellent security and a zero-downtime commitment, but it is unavailable in the United States.

It ranks high as one of the safest token swaps on the internet, with a low gas fee for its transactions. Fees are typically around 0.3% of the transaction, and unlike centralized exchanges, these fees go to liquidity providers as incentives, similar to Uniswap.

Bybit has a good resource that can be very helpful to newbies in the crypto space. These resources are in the form of articles and videos. They help provide a hitch-free experience. Also, a major perk of Bybit is its Testnet environment, which allows test run their strategies before final execution in the real world.

More details

Bybit is a leading futures trading platform globally, offering up to 100x leverage and attracting users who prefer to remain anonymous. With a presence in 180+ countries, it is renowned for its efficiency and unique features in cryptocurrency derivatives trading.

-

The platform offers up to 100x leverage trading.

-

Strong educational resources.

-

Diverse markets for traders, spot, perp, and futures.

-

Risk-free demo accounts to explore all key features.

-

TradingView integration.

-

The platform is difficult for beginners to navigate.

-

It does not offer a quality spot trading feature.

-

The NFT marketplace is limited in terms of options.

-

Security is of the gold industry standard.

3. Pancakeswap

PancakeSwap, like Uniswap, uses liquidity pools. This means that transactions are completed based on liquidity, which may result in slippage. Contributing funds to liquidity pools, on the other hand, allows investors to earn a portion of trading fees.

PancakeSwap is a decentralized platform; thus, all transactions are completed through your linked wallet. PancakeSwap charges a fee of 0.25% on both sides of a swap transaction. A portion of this fee is paid as a reward to liquidity providers.

More details

PancakeSwap is a top-tier crypto DEX on the Binance Smart Chain (BSC), providing secure and efficient token exchanges. It offers many features, including liquidity pools, staking, trading competitions, and an NFT marketplace. With its fast transactions, low costs, and support for over 500 trading pairs, PancakeSwap is a popular choice.

-

High daily transaction volume.

-

Transaction costs are relatively low.

-

Decentralized liquidity.

-

Perpetual trading contracts with leverage.

-

No dedicated customer support available.

-

Fiat deposits are not accepted.

-

Potential pricing delays.

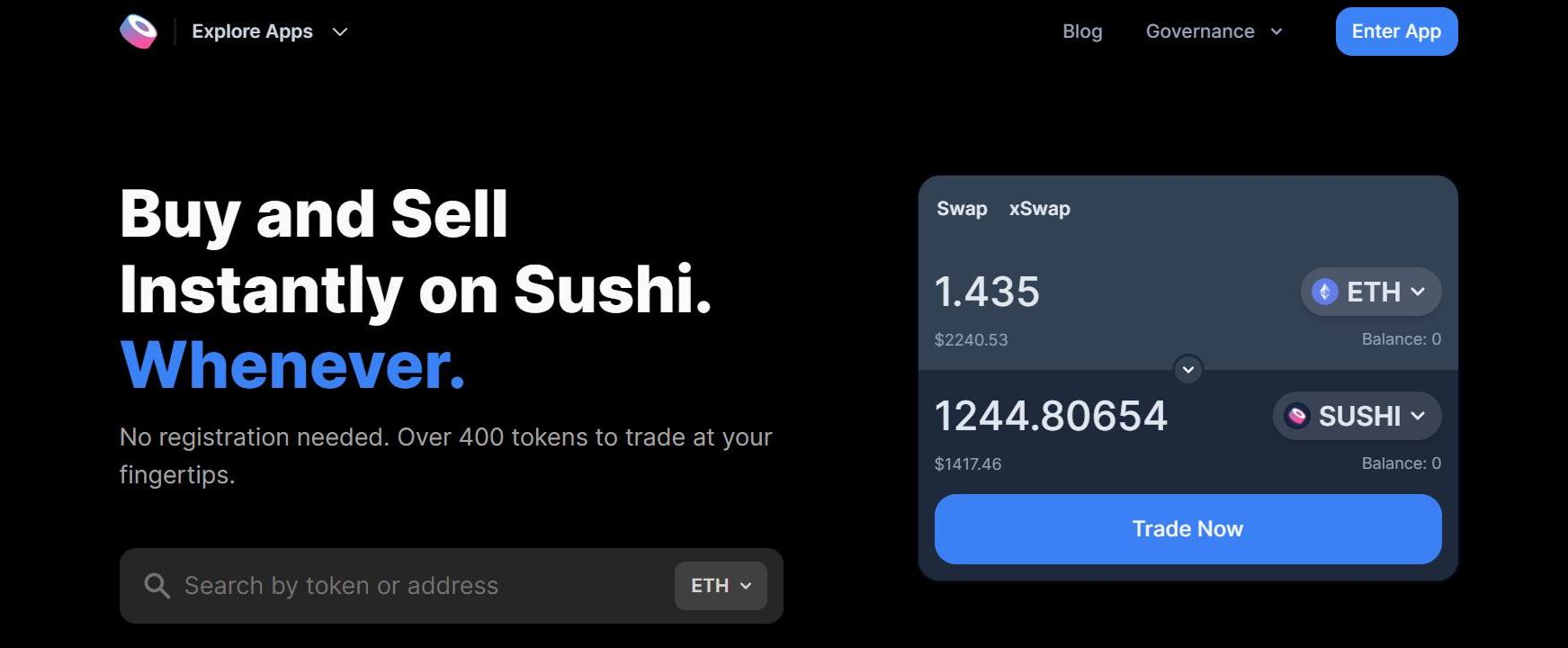

4. Sushiswap

SushiSwap is a robust token-swapping platform modeled after Uniswap that supports over 11,000 pairs. Rather than storing their tokens on the platform, users can connect their wallets to SushiSwap.

To stake tokens via SushiSwap, investors must first lend a minimum amount to the lending pool. This amount is refundable through other contributions. SushiSwap charges a flat 0.3% fee for all transactions and distributes 0.25% of pool trading fees to the liquidity pool.

Token Migration

Token migration is said to take place when a blockchain project is moved from one blockchain network to another and is used to either raise funds or improve the functionality of the network.

This term often overlaps with that of token-swapping services. However, in this case, the developer offers placeholder tokens on a Blockchain like Ethereum and requests token holders to exchange their placeholder tokens for native tokens of the new Blockchain.

For instance, an example is the token migration that Binance Coin did in 2019 by moving its taking from Ethereum Blockchain to its new native Blockchain, Binance Chain (BSC).

Decentralized Exchange Swaps

Decentralized Exchange Swaps (DEXs) don’t require users to deposit crypto assets into the exchange to perform token swaps. This ensures that the crypto holder has total control over the assets.

They rely on liquidity pools, user-supplied funds locked in smart contracts for users to carry out token swaps.

Centralized Exchange Swaps

Centralized Exchanges (CEX) are very similar to conventional stock exchanges by using an order-book model to make swaps. Order books are electronic ledgers that track buy and sell orders, order volumes, and prices, which users are willing to buy and sell assets.

Immediately, a sell order is placed, and the order book searches for a matching counter trade, a buy order. Once the direct trade order is matched, the token swap is completed.

Atomic/Cross-chain token swap

This form of token swap allows two users to directly exchange their crypto tokens without needing any intermediary platform like a token swapping site.

They are carried out using a Hashed Time lock smart contract only. This type of hashed time lock smart contract ensures that if one party does not deposit their asset alongside a cryptographic proof of transaction within a time frame, the swap does not occur.

Things You Should Know Before Doing Token Swap

Token swaps can be very straightforward and profitable. Before carrying out a token swap, here are a few things to verify because they will affect your swapping experience.

- Use the Right Wallet

To carry out a token swap, there would be a need to convert from fiat, which is held in a digital wallet. There is a need for the fiat wallet to be compatible with the token swap platform. Changing the wallet address to a compatible one might be needed.

- Understand exchange fees

Many exchange platforms charge varied gas fees for different token swaps. Various platforms may execute the blockchain token exchange process differently, influencing the exchange fee and gas fees you may be charged. It is important to pay attention to the fees and the corresponding reward.

Benefits of Token Swap

With a large number of crypto assets present in the cryptocurrency market, token swap comes with benefits, especially for crypto traders and investors. Here are some of the benefits.

Minimum transaction fees

Cryptocurrency exchanges charge multiple transaction fees on a token swap deal because it converts to a fiat currency before converting to the destination token. The separate transaction fees impact the profitability of the process. While a token swap charges just a transaction fee because it is just a single transaction, which increases the investors’ gain.

Instant Conversion

The crypto market is very volatile. This volatile nature affects the price of tokens when going through multiple steps. The fluctuations in price can cause heavy losses for the investor due to the time consumed on crypto exchanges to convert from one token to another. This means that conversion can not be carried out at the market price.

Conversion on token swaps is instant, which allows traders to leverage on market timing for increased profitability.

Privacy and Security

Swap tokens are carried out on blockchain networks; most platforms are secure, and most tokens have private keys. Most tokens are at par with the best Crypto exchanges and maintain the topmost data integrity.

Simple Process

Token swap eliminates the complicated and sophisticated process the crypto exchange employs, which engages multiple steps to fo a token conversion. This has been known to deter several new investors from entering the crypto world. Token Swap uses a simple platform with a one-step process to convert crypto.

Access to dApps across Blockchain

Many cross-chain token swap bridges give access to decentralized applications available on various blockchains. This token migration means a Bitcoin holder can use dApps on the Ethereum Blockchain using wrapped Bitcoin (wBTC).

It also implements multi-chain protocols, reaching various audiences on multiple chains. This means a developer can leverage a large audience base on blockchains like Ethereum, home to about 250 developer communities.

Drawbacks of Token Swap

As great and advantageous token swaps are, they still have some drawbacks. Here are some challenges you should consider before using a swap.

Targeted by Hackers

Cross bridges are high on the priority list of many hackers. They are easy targets because they are a concentrated source of liquidity. Sadly, bridge hacks caused about 70% of stolen crypto in 2022.

Slippage

Slippage describes a token’s value change between the time of the transaction’s request submission and its execution. Although price fluctuations mostly favor the trader, they can also be disastrous. Slow processing speed caused by the large volume of transactions can lead to increased slippage. Many swaps have introduced fixed exchange rates to eliminate the negative effect of slippage.

Rigidity

Users can only perform token swaps among the available token pairs. Transactions have multiple time deadlines, and if they are not met, it can lead to swapped tokens being returned or frozen. Using smart contracts on token swap platforms isn’t universal, so traders must research their options to avoid this risk.

What is the Future of Token Swaps?

Although Bitcoin remains the most popular crypto, many investors are trying to diversify into the world of altcoins. The world of altcoins provides a new level of leverage that allows the investor to maximize the volatility. This increase in altcoins would lead to an increased deployment of swaps. The next few years would see a release of new crypto-swapping exchanges and services.

The obligation would be on these services to provide solutions to the existing loopholes in the various platforms currently offering the services. A major concern would be the trading fees, which can be expensive compared to other tradings, especially within the same blockchain.

This expectation, however, places additional pressure on service providers to improve their offerings. It is up to them to improve security, increase swap speed, and provide more user-friendly features.

Is Token Swap Worth Trying?

Without a doubt, swaps come alongside exposure to risks such as slippage and security breaches. In some cases, privacy can be a concern. Regardless, users who add to the liquidity pool profit financially by reviewing rewards.

As the need for token swaps has increased, platforms are increasingly upgrading their functionalities and security protocols to militate against these threats. Hence, token swap is worth a try when the platform is right.

Conclusion

Token swap represents a significant innovation in the cryptocurrency ecosystem, enabling the exchange of specific tokens for new ones. The token swap further strengthens blockchain technology and removes the barrier existing in the blockchain ecosystem.

There are different ways available for cross-token swapping. You can make use of an exchange platform or do it manually. If you choose to swap tokens through an exchange, a recommended approach is that you can trade on a centralized or decentralized exchange.

Token swaps streamline the process for crypto enthusiasts to investigate the vast landscape of the blockchain and participate in diverse projects they want to support. Occasionally, swaps are required to handle transaction fees payable exclusively in a particular blockchain's native coin.

Swap enables users to effortlessly trade one cryptocurrency for another within their Blockchain.com ecosystem. With Swap, you can exchange crypto using your DeFi Wallet or your Blockchain.com Account. Opting for swaps from your DeFi Wallet offers the advantages of non-custodial, on-chain trade settlement.

Trades are more intricate than swaps, providing a broader range of choices. Swaps cater to instant transactions, while trades can be tailored to specific times, prices, and market circumstances.