TLDR

This guide has a proper showdown between USDC vs. USDT, the two most popular stablecoins in the crypto market. You don’t need to do the heavy lifting as we have already done that. So which one should you choose, you say? Read on.

USDT and USDC are the world’s most used stablecoins and the first and second-largest by market capitalization. They are cryptocurrencies designed to have their value pegged to the U.S. dollar.

Users choose one over the other for various reasons. Still, users who fancy liquidity and versatility tend to go for USDT, while users who prefer transparency and safety often choose USDC.

However, price stability is an essential factor that should be considered. USDT, the older of the two stablecoins, has lost its peg more than USDC, which has only traded significantly below $1 twice in almost five years.

Both provide a cheap, quick, and highly available means for people to send money worldwide without needing a bank account or relying on an intermediary such as a bank or payment processor.

A bit about stablecoins

Stablecoins are crypto assets with a value pegged to some external asset, usually fiat currencies like the U.S. dollar. Stablecoins primarily provide a means for crypto users to protect themselves from the market risk inherent in typical cryptocurrencies as their price remains fixed to their reference asset.

We can actively categorize stablecoins into three broad types. Those anchored to a fiat currency earn the title of fiat-backed stablecoins. In contrast, stablecoins upheld by crypto tokens bear the name of crypto-backed stablecoins. A third, distinct category, algorithmic stablecoins, doesn’t rely on fiat or crypto backing. Instead, they sustain their value through the active mechanism of arbitrage.

The decision of which stablecoin to use between USDT and USDC ultimately depends on an individual’s preferences, risk tolerance, and intended uses. While similar in form and function, a few key differences motivate crypto users to choose one. It is, however, up to each individual to research which suits them more.

Trusted Partners

USDT vs. USDC stablecoins comparison

Let’s go to the heart of the discussion and compare both stablecoins. USDT and USDC work similarly, but a few important differences drive users toward one another. We’ll compare the two crypto assets directly, highlighting each one’s strengths and weaknesses.

USDT vs. USDC: Liquidity

USDT and USDC are two of the most liquid cryptocurrencies on the market. You can actively acquire them through both centralized and decentralized exchanges. On most major platforms, you can trade them against other high-profile cryptocurrencies such as Bitcoin and Ethereum.

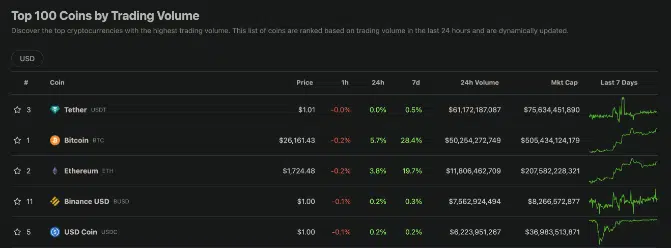

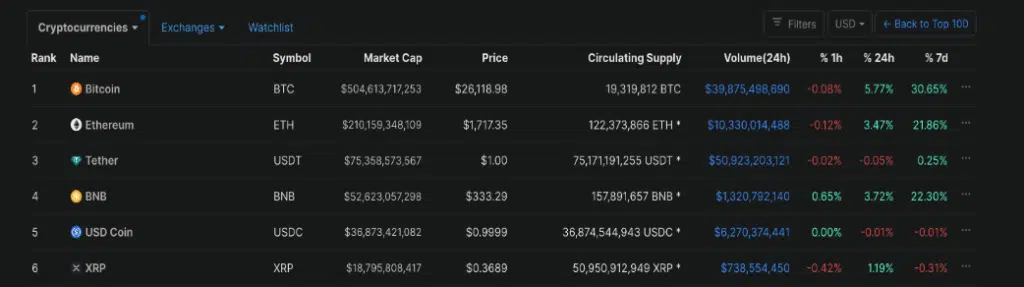

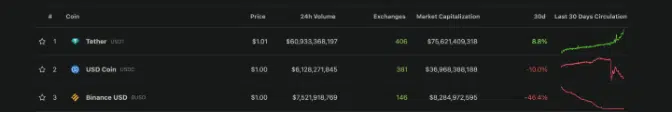

USDT has the edge over USDC regarding liquidity, as it is the most traded cryptocurrency in the world, compared to USDC, which is only fifth. The daily trading volume of USDT is usually about ten times the USDC volume.

This significant difference in trading volume means that USDT users might have an easier time buying and selling their USDT stablecoins, huge amounts, than USDC users.

USDT vs. USDC: Price Stability

During extreme market volatility or turmoil, stablecoins may sometimes lose their peg and be worth significantly more or less than their reference asset.

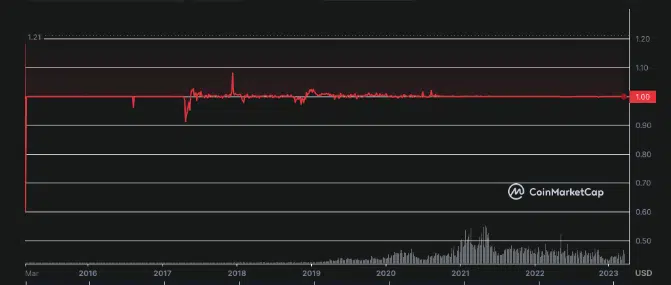

Depegging of USDT

USDT has lost its price peg several times over the years, usually quickly returning to its original price of $1. Some of the more notable depegs include one in May 2022 amid the Terra-Luna crash, where USDT traded for as low as $0.95.

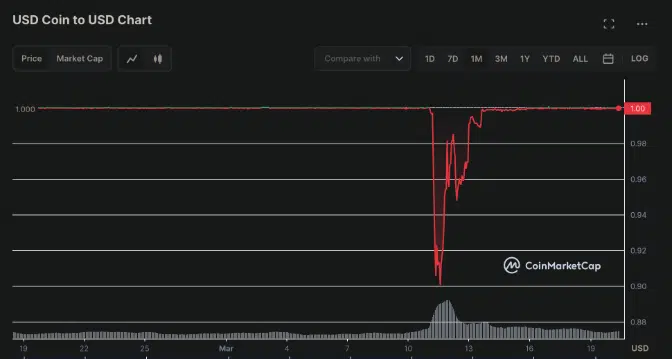

Depegging of USDC

USDC suffered its worst price depend recently following California regulators’ seizure of U.S. Silicon Valley Bank (SVB). The regulators stepped in as the bank was at risk of facing a bank run after suffering a loss of $1.8 billion from the premature sale of some bonds it was holding. This rendered it unable to meet up with customer deposit requests.

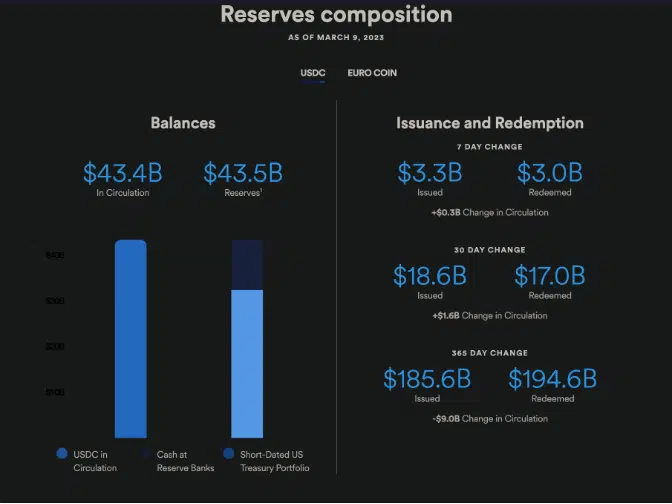

Circle kept $3.3 billion of the cash held in its cash reserves with SVB. The bank’s collapse sparked fears that the USDC issuer might lose access to those funds. With the loss of access, it would no longer be able to honor user redemptions. As a consequence sending, the price of USDC plunged to as low as $0.88.

The decline in the price of USDC caused users to flee to other stablecoins, such as USDT, whose price ballooned well past $1. The decline in USDC’s price actively influenced some crypto-backed stablecoins, such as DAI, which holds substantial USDC backing.

However, Circle took a proactive stance, announcing that it was still likely to retrieve the money as it had initiated a withdrawal before the bank’s seizure. They further assured they would compensate for any deficit using corporate resources if they lost access to the funds.

Upon this announcement, USDC’s price jumped and started trading close to its original price of $1. USDC eventually fully regained its price peg after U.S. government officials announced that no depositors in SVB would lose any of their deposits.

USDT, the older one, has lost its peg more than USDC, which has only traded significantly below $1 twice in almost five years.

USDT vs. USDC: Supported blockchain networks

The choice between USDT and USDC for some users is actively swayed by the blockchain networks that support the stablecoin. They often prefer to remain with blockchains they already know well.

USDT can currently be used on nine blockchain networks: Bitcoin, Ethereum, Tron, EOS, Liquid, Algorand, Bitcoin Cash, Solana, and Kusama.

Likewise, USDC boasts support for nine blockchains – Ethereum, Algorand, Solana, Stellar, Tron, Hedera, Avalanche, Flow, and Polygon. They both have plans to expand to other blockchains in the future.

USDT vs. USDC: Availability

USDC and USDT can be traded on most of the world’s largest crypto exchanges, making them easy to obtain with fiat currency or cryptocurrency, store, and trade.

USDC was recently delisted by Binance – the world’s largest cryptocurrency exchange. The centralized exchange automatically converted its user’s USDC holdings to BUSD (a stablecoin that Binance issues) at a 1:1 exchange rate.

While USDC and USDT actively trade on the top centralized and decentralized exchanges, USDT might enjoy a slight advantage. Unlike USDC, it continues to trade on the world’s largest cryptocurrency exchange.

USDC vs. USDT: Transparency & Safety

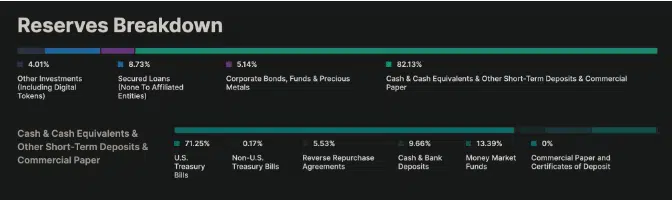

Tether Limited and Circle have their reserve assets regularly audited by independent, reputable accounting firms. This is done to assure users and regulators that they genuinely possess the reserve assets they claim.

Tether publishes daily updates on its reserves and has engaged independent auditing firm BDO Italia to perform assurance opinions on its reserves every quarter. Tether is, however, yet to perform a full audit of its reserves.

Important information regarding USDC reserves is also published daily, and the reserves are attested monthly by the accounting firm Grant Thornton, LLP. Its reserves have been shown to contain only cash and short-dated U.S. Treasury bills, both held with reputable custodians.

Moreover, Circle operates under U.S. state law as a regulated money transmitter, similar to Paypal and Stripe. They proactively undergo annual audits and have their financial statements scrutinized by the SEC.

Tether’s track record reveals shortcomings in meeting anticipated transparency and safety standards. In contrast, USDC consistently pursues and maintains high transparency and regulatory compliance. It is earning wide recognition as one of the safest and most transparent stablecoins.

Conversely, USDC often receives commendation as one of the market’s most transparent and trustworthy stablecoins. This is a stark contrast to USDT. Despite its substantial efforts to build trust within the crypto community, some still view USDT with a lens of skepticism.

About USDT

USDT, or Tether, is the world’s biggest stablecoin by market capitalization and has several users. Its market cap of over $73 billion makes it the third largest cryptocurrency in the world, behind only Bitcoin and Ethereum.

USDT launched in July 2014 as one of the world’s first stablecoins. It initially launched as RealCoin and ran exclusively on the Omni platform, a second-layer network designed to extend the capabilities of the Bitcoin blockchain. USDT now runs on eight other blockchain protocols, including Ethereum, Tron, Polygon, and Solana, and will expand to several others.

Upon launch, USDT gained widespread adoption, allowing crypto community participants to essentially store value and transact on the blockchain using a currency they were already familiar with – the U.S. dollar.

Beginning in 2019, Tether became the most traded crypto asset in the world, surpassing Bitcoin in daily trading volume, and it remains so to this day. Tether provided an easy way for people to send crypto dollars quickly and cheaply anywhere in the world, making it very popular.

USDT Tokenomics

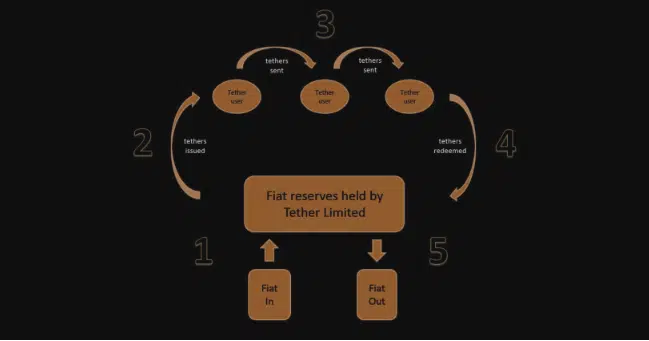

USDT is minted and issued by Hong Kong-based Tether Limited and maintains a 1-to-1 fiat currency backing. This means that for each USDT token in existence, an equivalent amount of U.S. dollars in cash and cash-equivalent assets, such as U.S. Treasury bills, is held in reserve by Tether.

USDT tokens, at any moment, can be exchanged for an equal value of U.S. dollars. Cryptocurrency exchanges and eligible corporate clients typically do it. Swapping a USDT token for U.S. dollars results in its destruction, effectively removing it from circulation. There’s no fixed limit to the quantity of USDT tokens that can be created.

USDT controversies

Over the years, USDT has been the subject of much controversy, mostly stemming from its reluctance to audit its reserves fully. In 2018, it even engaged Friedman LLP to audit its reserves fully. Yet, midway through the agreement, they reversed their decision, citing the “excruciatingly detailed procedures” of the auditor and arguing that completing the audit within a “reasonable timeframe” was impractical.

After facing intense pressure from regulators, Tether began publishing a breakdown of its reserves, which anyone on its website can view. According to the most recent breakdown, Tether’s reserves include various assets, such as digital assets/tokens, secured loans, corporate bonds, funds, precious metals, cash, and cash equivalents.

USDT lawsuits

Tether has faced several lawsuits alleging various forms of financial misconduct. In 2017, the U.S. Commodity Futures Trading Commission (CFTC) issued subpoenas to Tether Limited and Bitfinex concerning USDT’s backing. Tether had previously asserted that fiat currencies, particularly USD, fully backed each USDT token. However, as the CFTC alleged in its lawsuit, this was not the actual scenario.

Tether ultimately faced a $41.6 million penalty and had to amend its claims actively. It stated that USDT’s backing doesn’t solely come from fiat USD but includes other assets like commercial papers, secured loans, and treasury bills.

In April 2019, the New York attorney general filed a lawsuit against Tether, accusing it of using funds held in its reserve to help closely associated crypto exchange Bitfinex cover an $850 million loss. Tether denied any wrongdoing but eventually paid $18.5 million to settle the case.

About USDC (USD Coin)

USDC, or USD coin, is the second-largest stablecoin and the fifth-largest cryptocurrency by market capitalization. The stablecoin was created by Centre Consortium, founded by payments technology company Circle and crypto exchange Coinbase.

USDC launched in September 2018 and, despite being a relatively late entrant to the crypto market, increased to become one of the most popular stablecoins in the world. The USD-backed token saw rapid adoption due to the Centre consortium’s meticulous approach to transparency, which gave it a reputation for being trustworthy.

USD coin initially launched solely on the Ethereum blockchain – which heavily uses smart contracts. However, over time, it has been updated to work on several other blockchains, such as Polygon, Solana, and Avalanche.

USDC Tokenomics

USDT and USDC stablecoins work in a very similar manner. Each USDC token maintains backing by one U.S. dollar, preserved as cash or cash equivalents in Circle’s reserves. Mimicking USDT, you can exchange USDC tokens for an equal value of U.S. dollars whenever desired.

Circle also takes care of the minting and issuance of USDC tokens. It is responsible for honoring USDC redemptions and destroying, or “burning,” redeemed USDC, taking them out of the USDC supply. Likewise, USDC does not have a limit on its maximum supply.

So, who wins?

USDT and USDC are the two main stablecoins helping bridge the gap between fiat and crypto. While they have much in common, they have unique strengths and weaknesses that users must consider carefully before choosing which to hold or use.

USDT is one of the oldest stablecoins and has stood the test of time, proving itself to be a reliable store of value and a quick and cheap means of transfer over the years. This has made USDT so profoundly entrenched in the crypto ecosystem that many consider its potential failure to be ‘systemically risky.’

On the other hand, the USD coin is the new kid on the block that grew rapidly to see its usage surpass many established stablecoins that came before it on the backs of unparalleled transparency and regulatory compliance.

Only time will tell whether there will ever be a winner in the battle between the two stablecoin giants. Still, one thing is certain: As these companies strive for a larger share of the stablecoin market, the competition will benefit users the most.

USD is a fiat currency, whereas USDT is a form of cryptocurrency. USDT can only be utilized on cryptocurrency exchanges, while USD has universal usage. Additionally, traders must have a USDT wallet to withdraw USDT from their exchange account.

At present, 1 USDT equals 1.00 USDC. Over the past 24 hours, the value of 1 Tether remains unchanged against USDC. The exchange rate between Tether and USDC has remained stable at 0.00% over the past month. To instantly convert USDT to USDC, consider creating a free account on Kraken.

Considering purchasing USD Coin? Given its function as a stablecoin, investors who buy USD Coin may not profit from their investment. The utility of this cryptocurrency lies more in its practical use rather than the potential appreciation in value.

Top Stablecoins to Invest in 2023:

1. Tether (USDT): Among the most prevalent stablecoins.

2. Binance USD (BUSD).

3. TrueUSD (TUSD).

4. USD Coin (USDC).

5. DAI.

6. Gemini Dollar (GUSD).

7. BitUSD.

8. USD Digital (USDD).