TLDR

As a beginner, leaping cryptocurrency investing can be intimidating. But fear not. We’ve got you covered. This guide will give an in-depth understanding of cryptocurrency, its creation, and the strategies winners use.

The goal is to give you the ins and outs of different crypto types and review some of the hottest beginner cryptos to invest in:

- Ethereum

- Bitcoin

- Solana

You will get information about the pros and cons of crypto investment, followed by simple steps to get started with crypto investments. Hop on board, and let’s join the crypto craze.

Crypto Investment: From Beginner to Pro!

Cryptocurrency is gaining traction in the market, and knowing how to purchase it is vital. Generally, these are the steps:

1. Choosing a platform

Deciding between a traditional broker or cryptocurrency exchange is the first step to beginning crypto trading. Traditional brokers offer lower costs but fewer digital and asset class-specific features than dedicated exchanges.

Crypto exchanges come with services like wallet storage and interest-bearing brokerage account options. You also have numerous cryptocurrency options here. However, such exchanges tend to charge by assets traded.

When selecting a platform for cryptocurrency trading, delve into the differences in cryptos offered, assess fee structures, past performance, and security, manage risk parameters, explore storage and transfer options available, and any resources provided to aid your understanding.

2. Funding your account

After settling on an exchange, the next step is to finance your account and start trading. Most crypto exchanges permit users to purchase cryptocurrency using government-issued currencies such as USD, GBP, or EUR with either debit or credit cards. But again, this depends on which crypto exchange platform you choose.

Cryptocurrency purchases with credit cards may appear enticing but can be highly volatile and risky. Many exchanges reject them due to the nature of their instability. At the same time, a select few card companies permit them, only after careful deliberation on potential debt or transaction fees.

Remember, cryptocurrency investing comes with certain costs, such as transaction and trading fees, which may depend on the payment method and platform chosen. Before deciding, evaluating all potential expenses related to the investment process is important.

3. Placing an order

Placing an order on a broker’s or exchange’s platform is straightforward. Select “buy” or “sell,” choose the desired order type, enter how many cryptos you wish to purchase/sell, and then confirm. The process couldn’t be simpler.

Investing in cryptocurrency is not only limited to the traditional ways. Alternative payment services such as PayPal, Cash App, and Venmo offer users numerous options – from buying and selling to holding these digital assets.

4. Storing the cryptocurrency in a crypto wallet

When you acquire cryptocurrency, it is stored in a virtual wallet. Your exchange will provide a digital repository to safeguard all crypto codes securely. You can protect your crypto investment with a software or hardware wallet. Use the former to store funds on an exchange you trust for frequent trading. To maximize security and peace of mind, opt for the latter. This is because they provide physical protection from cyber-attacks and enable secure storage offline.

A hardware wallet provides an ideal solution for those seeking maximum security for their cryptocurrency investments. Small in size, like USB drives, these physical devices are the most secure way to store large amounts of crypto assets.

Best Beginner Crypto to Invest In

As a newcomer to cryptocurrency, taking the plunge can be daunting. However, several entry-level coins offer an introduction into this new world without requiring expert knowledge of the markets. These options provide basic access and exposure to price changes for novice investors.

Ethereum (ETH)

Crypto newcomers should strongly consider investing in Ethereum, which is widely appreciated for its unique underlying technology. By supporting the DeFi and NFT industries, ETH is an ideal platform to develop dApps across numerous domains. Moreover, it offers unparalleled smart contract functionality, making networking easier.

Almost all trading platforms and brokers globally provide ETH as a purchase option since it remains one of the largest digital assets worldwide.

Ethereum is taking a decisive step forward with transitioning to a “Proof-of-Stake” consensus protocol, known as ‘The Merge.’ This upgrade has the potential to drastically increase scalability on the network and reduce GAS fees – allowing users greater access than ever before. If all goes according to plan, this could open massive possibilities regarding what can be achieved by Ethereum.

Bitcoin (BTC)

Bitcoin is a revolutionary digital currency and indisputably the most successful Proof-of-Work cryptocurrency. Despite other crypto projects offering greater novelty, investors still flock to Bitcoin due to its pioneering status. It is validated by mass adoption from traditional financial markets.

For novice crypto investors, Bitcoin is a great option to consider. Individuals can opt for fractional investing (investors can buy fractions of a coin instead of purchasing an entire Bitcoin) and benefit from exposure to BTC’s price movements without needing large capital outlays.

Bitcoin is quickly establishing itself as a viable payment option, with global merchants recognizing it as an accepted method. This makes it particularly appealing for those just starting in crypto investing.

Solana (SOL)

Solana has surged in popularity this year, becoming one of the leading crypto tokens for newcomers. Driven by its superior scalability and cost-effectiveness compared to Ethereum’s fees and throughput issues, many developers have turned to building applications on the highly reliable Solana network.

Solana is a next-generation blockchain that offers rapid scalability with its innovative ‘Proof-of-History’ consensus algorithm. It can process an impressive 65,000 transactions per second at just $0.00025 each – without compromising decentralization.

What is Cryptocurrency?

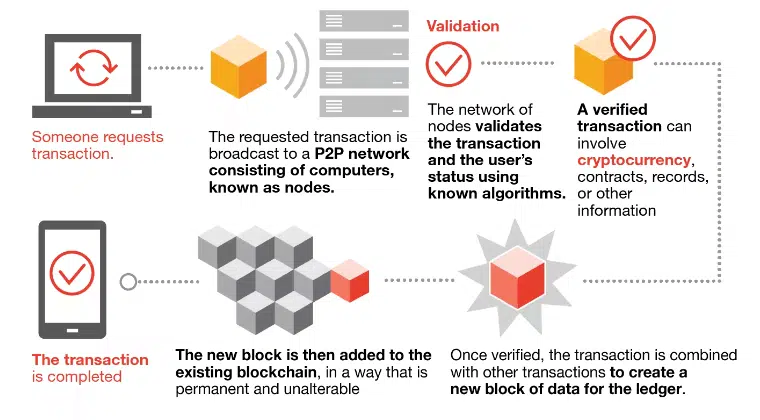

A cryptocurrency is a digital asset that secures and verifies transactions without a central authority. Blockchain technology is an innovative solution used in cryptocurrency; it functions as a digital ledger that securely records all transactions.

Since its invention in 2009 with Bitcoin at its helm, numerous other cryptocurrencies have become available on the stock market. These cryptocurrencies have generated exceptional investment opportunities and provide an alternative everyday spending option. This includes online shopping and paying for services.

More recently, crypto assets have surged in popularity, prompting interest from mainstream investors worldwide. Though there is still disagreement about the potential future value of these digital coins, their sudden boom has sparked intrigue and debate as to whether they are suitable investments for risk-takers or greener pastures for opportunity seekers.

However, investing in cryptocurrency carries significant risks due to price volatility. Potential investors must thoroughly understand the associated risks before investing their hard-earned funds.

How Does Cryptocurrency Work?

Cryptocurrency is a digital currency that operates without central banks and governments. It relies on a decentralized public ledger, a blockchain, which tracks and records all transactions securely held by users.

Cryptocurrency is created through a highly complex mining process requiring advanced computing power to solve intricate mathematical algorithms and generate coins. For those looking into how to invest in cryptocurrency now, it can be acquired from brokers before being stored securely in cryptographic wallets.

But what gives cryptocurrency its value?

Unlike more traditional investments such as stocks or real estate, cryptocurrency is not subject to traditional variables affecting investment, such as local economic trends or corporate profits. Rather, cryptocurrency differentials depend solely on market demand. If there’s high interest in crypto units, their value will increase accordingly. In contrast, prices will drop dramatically if investors lose enthusiasm for cryptocurrencies.

But cryptocurrency can be a lucrative investment, with healthy returns when markets trend upward.

What to Consider When Investing in Cryptocurrency?

Cryptocurrency investment carries high-risk potential. While there are tales of inexperienced investors with extraordinary profits, it’s important to note that luck plays a major role; investing at the wrong moment could lead to significant losses in a very short period.

Although Bitcoin is considered a legitimate asset in some countries, such as the U.S., Canada, and El Salvador (where it was adopted as legal tender), others are implementing restrictive government regulations on cryptocurrencies due to their uncertain future. To make it worse, recent legislation has targeted crypto investments for taxation in the United States alone.

Simultaneously, cryptocurrencies have the potential to revolutionize global commerce, but current adoption is hindered by regulatory activism. Advocates of crypto recognize its promise as a unit of exchange. However, only a few businesses still accept it as payment.

In a nutshell, before you start investing in cryptocurrency, you have to brace yourself for the following:

- Investing in cryptocurrency can be extremely rewarding, but it also involves risk. Think carefully before entering the market and consider whether you can handle potential price volatility.

- The risk of total loss cannot be overlooked. It’s important to weigh this balance before committing any funds; only invest what you can afford to lose.

- Investing in crypto requires prudence and caution. Unfortunately, if your security is compromised (crypto exchange is hacked) or you transfer coins to an incorrect address, it could mean losing your cryptocurrency forever.

Different Types of Cryptocurrency Investing

Maximizing your investment portfolio with cryptocurrency is no longer a far-fetched idea. From owning one or more crypto coins to investing directly in entities that use this technology, there are various approaches for adding exposure to cryptos into your financial plans.

Crypto investments in cryptocurrency companies

Investing in companies that focus on or have indirect exposure to cryptocurrency has become increasingly popular. From mining companies and hardware makers like Robinhood Markets Inc., PayPal Holdings Inc., and MicroStrategy, there are plenty of options for investors seeking higher returns.

Directly buying cryptocurrency

With cryptocurrency, you have the option of investing in both established traditional assets and up-and-coming digital currencies. Coins like Ethereum and Bitcoin boast long histories, while ICOs provide an opportunity with newly released coins.

Investing in cryptocurrency-focused funds

Instead of selecting a single cryptocurrency venture, you may invest in an entire collection through cryptocurrency-focused funds. Exchange Traded Funds (ETFs) and index or futures funds are all viable options alongside crypto investment trusts for diversifying your portfolio.

Trusted Partners

How To Choose The Right Cryptocurrency To Invest In?

With thousands of cryptocurrencies on the market, making a sound investment decision can be daunting. Consider these aspects carefully to choose the right cryptocurrency to invest in.

Supply of coins

A key factor to consider when investing in cryptocurrencies is their supply. Knowing the maximum number of cryptocurrency coins available can help determine its future value – if demand exceeds this limit, prices may rise significantly over time. For example, Bitcoin has a limited quantity of 21 million, and as more people invest in it, increasing demand causes price levels to follow suit due to scarcity.

Market capitalization

When making your next crypto investment, consider the current market capitalization. This will give you an idea of which cryptocurrencies have a higher value and how that has changed over time. Furthermore, be mindful of global events as they can drastically impact prices. Evaluate the volatility associated with each currency to ensure your choice brings maximum benefit and minimal risk in light of these ever-changing conditions.

Utility

The utility of a cryptocurrency can significantly influence its value, so it is essential to consider use cases when investing. A coin’s white paper should be consulted for details on the cryptocurrency’s uses and any potential forthcoming applications.

Additionally, investors must consider if adequate cryptocurrencies are already performing similar functions in the crypto market and new regulations that could alter possible uses for certain coins. By carefully examining these key components, one will put themselves firmly along the path toward successful crypto-investment decisions.

White Papers

Investing in cryptocurrency requires due diligence. Before putting your money towards any crypto, review the associated white paper. It is a document providing detailed information about the coin and its underlying blockchain technology. This will equip you with important insights related to the whole asset class and guarantee it is legitimate. Be mindful of fraudulent coins and brokers operating within this market. Ensure to investigate before investing thoroughly.

How is Cryptocurrency Created?

So, where does cryptocurrency come from?

Simply put, cryptocurrency is generated through a complex process of coding and mining. Transactions are confirmed by miners, thus creating new coins to enter circulation in the digital economy.

Smart contracts

Cryptocurrencies are programmable money, a concept made possible by the development of smart contracts. These pieces of code execute tasks defined by an author and cannot be altered once deployed onto a blockchain network. Smart contracts eliminate third-party interference for automated enforcement or execution purposes.

Cryptocurrencies allow users to transfer ownership of units, with such transactions recorded in a ledger. However, smart contracts take it one step further and offer more advanced options for transferring these units – from enabling time-sensitive transfers to triggering them upon certain events taking place.

ERC-20

ERC-20 may sound like a mysterious military codename, but it’s innocent. The acronym derives from Ethereum Request for Comments and the numerical value attached to the original proposal – “20”. It refers to nine essential functions all cryptocurrencies must abide by when operating within the Ethereum Network.

Ethereum’s versatile Blockchain platform has revolutionized the cryptocurrency industry by enabling users to easily create digital currency based on ERC-20 standards. As Ether remains the primary payment form, other cryptocurrencies thrive within this revolutionary network.

Consensus algorithms

Cryptocurrencies rely on complex systems known as Consensus Algorithms to reach an agreement. Choosing the right algorithm is essential, as it affects a cryptocurrency’s decentralization, transaction speed, and resistance to attack. All these are the key factors for successful use cases.

More information on how cryptocurrency is created:

- Cryptocurrency is an intricate software system that uses code to govern the recording and storing of transaction-related data.

- The blockchain database serves as a ‘ledger’ for these financial tokens, such as Bitcoin.

- Every token has a numerical value stored on its respective cryptocurrency’s blockchain.

- Creating new crypto coins and incentivizing users to participate in the blockchain process are determined by algorithms written into their codebases, such as maximum supply levels and mining rewards.

Is Crypto a Good Investment?

After a sudden price drop, the cryptocurrency markets appear to be regaining footing. Consequently, it inspired many investors back to consider investing in cryptocurrencies yet again.

But is it worth investing in?

Let’s look at the pros and cons of cryptocurrency to decide for yourself if it is a good investment.

Pros of investing in cryptocurrency

Cryptocurrency presents an exciting opportunity to capitalize on its projected growth. Early adopters who position themselves for a potentially hefty return will benefit the most as crypto sees widespread use and acceptance across various industries.

Cryptocurrency is the perfect option for those seeking financial independence. As a decentralized currency, it offers unparalleled convenience and flexibility regarding global payments. You can send money anywhere worldwide without going through tedious paperwork or relying on banks.

Cons of investing in cryptocurrency

The highly volatile crypto market

Cryptocurrencies have soared and plummeted in price, often unpredictably. Such rapid fluctuations make it a risky investment; only a fortunate few become “Bitcoin millionaires.” Contrary to popular belief, investing in crypto is often a risk. While media outlets may cover stories of success, the reality is that far more investors experience losses when participating in cryptocurrency exchanges.

You may lose your crypto assets forever.

Crypto investors are wise to store their assets in hardware wallets. However, any loss of the wallet or forgetting its password can make these digital coins inaccessible and unrecoverable – meaning you have lost your crypto investment forever.

So, should you invest in cryptocurrency?

Well, it depends. Cryptocurrencies such as Bitcoin and Ethereum provide the potential for an impressive return on investments over time, with success contingent upon reaching goals set out initially. Investors in cryptocurrency projects that achieve their investment objectives may not be guaranteed a successful outcome, but they can reap significant rewards. Nevertheless, cryptocurrencies need to achieve widespread adoption to become long-term successes.

How to Make Money with Cryptocurrency?

Trading

Investing for the long-term is a strategy of buying and holding assets, whereas trading profits from short-term opportunities. The cryptocurrency market can be volatile: prices may skyrocket or plummet instantly. To thrive as a trader, one must possess sound technical insights, risk management, and solid analytical acumen.

Investing in digital assets

Cryptocurrency can be an incredibly rewarding investment, offering potential profits when done strategically. Consider buying individual coins like Bitcoin and Ethereum or accessing a cryptocurrency index fund to diversify your portfolio to reduce the associated risk. Before investing, you must research the risks of investing in crypto assets.

Lending

Cryptocurrency lending is becoming an increasingly popular way to turn a profit. Lenders provide cryptocurrency and receive interest in return depending on the type of coin lent and the amount borrowed. Platforms for such transactions include Decentralized, Centralized, or peer-to-peer-based options with different features catering to specific requirements.

Staking

Crypto staking is an investment strategy that allows you to unlock the potential of generating passive income with your crypto assets. By committing a pre-defined quantity and holding onto it for a designated time, holders of crypto holdings can benefit from attractive returns based on the cryptocurrency and their stake size.

Mining

Cryptocurrency mining offers a lucrative way to generate revenue and is the primary means of creating new coins. Mining is integral in validating blockchain transactions by confirming them on the ledger and adding data blocks for future records. Miners who contribute their resources are rewarded with cryptocurrency as recognition for their services.

Affiliate programs

Cryptocurrency exchange affiliate programs present a unique opportunity to generate profits without actively trading or investing in the market. To gain an advantage, one must be prepared. However, competition can often be fierce and cutthroat.

What Can You Buy with Cryptocurrency?

The first cryptocurrency, Bitcoin, had the original purpose of being used as a currency for daily transactions, allowing consumers to purchase anything from necessities through larger investments.

Although the use of cryptocurrency is steadily increasing among institutions and businesses alike, it has yet failed to reach its expected potential regarding everyday purchases. However, merchants are still offering crypto-friendly services on many e-commerce sites.

Here are some examples of what you can buy with cryptocurrency:

Luxury goods

Some luxury retail outlets now offer the option to purchase items with cryptocurrency. Bitdials allows customers to own exclusive pieces, such as prestigious Rolex or Patek Philippe watches, by paying through Bitcoin.

Technology sites

You can find tech giants among the ever-growing list of companies brokerage services that accept cryptocurrency, such as Microsoft and AT&T. This includes e-commerce staples like Overstock and Shopify. Even brick-and-mortar retailer Home Depot is on board with crypto payments.

Insurance

In 2021, Swiss insurer AXA took progressive steps by allowing its customers to pay for insurance in Bitcoin, except for life coverage, due to existing regulations. In a similar move, US-based home and auto insurer Premier Shield Insurance also permits premium payments via cryptocurrencies.

Cars

Cryptocurrency is becoming a more viable option for car purchases, with some dealers across all market levels now accepting it as payment.

Summary

Cryptocurrency is quickly becoming a future investment for many. As a beginner investor, educating yourself on crypto and how it works and discovering the pros and cons of investing in cryptocurrency is essential for an informed decision. Putting in the right amount of research can help new investors determine which coin will be most beneficial for them.

By staying up-to-date with current market trends and carefully implementing strategies, any investor who has just entered the crypto space can turn a small investment into making millions.

Concentrate on the total amount you wish to invest, rather than the quantity of coins you want to purchase. Keep in mind not to invest beyond your financial capacity.

Cryptocurrency exchanges are the primary platforms for buying digital currencies. Numerous options are available, including popular choices like Coinbase, Binance, and Etoro. These exchanges enable the acquisition of cryptocurrencies such as Bitcoin and Ethereum using a debit card.

As with any investment, it's crucial to comprehend what you're investing in. If you're hesitant to risk a significant sum, consider starting small to familiarize yourself with the process. Numerous crypto exchanges offer minimum purchases of $10 or less, making it accessible to begin cautiously.

Bitcoin is often recommended for beginners due to its wide recognition and large market cap. Other options like Ethereum and Litecoin can also be suitable. Always research before investing.