Wirexapp Review 2024: A Single Solution To Manage Fiat & Crypto

TL;DR

This Wirexapp review will explore the versatile crypto bank offering borderless trading and advanced features. Plus, you can manage crypto via mobile and access a crypto debit card for payments and free ATM withdrawals globally.

Furthermore, its X-accounts allow users to earn up to 16% APY on popular digital assets. Moreover, it offers three premium account types, costing up to $29/month.

Although deposits and withdrawals are free, it charges account funding fees ranging from 1.99% to 3.24% when using local cards. However, some of its drawbacks are limited crypto support, lack of trading tools, regulatory compliance issues, and hectic KYC.

Wirexapp at glance

| Feature | Details |

|---|---|

| Coinweb Ranking | ★★★★ |

| Launched In | 2014 |

| Based In | United Kingdom |

| Native Token | WXT |

| Crypto Trading Pairs | 130+ Cryptocurrencies |

| Support Fiat | 13+ Fiat Currencies |

| Supported Countries | 100+ Countries |

| Customer Support | Live Chat, Email, Social Media Handles |

| Account Types | Standard, Premium, Elite |

| Minimum Deposit | No Limit |

Company Overview

Founded in 2014 by Dmitry Lazarichev and Pavel Matveev, Wirexapp is a German digital payment platform. Interestingly, the crypto-friendly bank aims to make banking services available to everyone regardless of geographical boundaries, with a 3.3 rating on Trustpilot.

Over the years, Wirex has developed its offerings, from launching its first-ever crypto debit card to its first-ever MasterCard Principal Membership in the US.

To add to its credibility, it holds an e-money license offered by FCA for releasing the world’s first-ever business-to-business (B2B) crypto-friendly accounts.

Who should use Wirexapp?

Let’s explore who should use Wirexapp:

For newcomers to the Crypto space

As a beginner, with WazirX, you can open an account in just minutes to access crypto and fiat currencies.

Moreover, given the scams in the crypto space, it is natural to worry about your assets’ safety. Wirexapp covers it with insurance coverage, so you can navigate this space worry-free and earn on your investments.

For seasoned crypto traders

Though Wirexapp might not be the best option for seasoned traders, it still has many advanced features.

With all exclusive benefits like earning interest and stablecoin support for B2B payments, it offers all this accessible at your palm. But what outranks this bank from competitors is its seamless deposit and instant transfer options on multiple blockchain networks.

Geographical availability

Wirexapp is not accessible in every country and only offers services in 130+ countries. And the availability varies by country due to differing financial regulations and restrictions. Here are some restricted countries:

- Afghanistan

- American Samoa

- Antarctica

- Belarus

- Bhutan

- British Indian Ocean Territory

- Burkina Faso

- Cambodia

- Central African Republic

- Chad

- China

What makes Wirexapp stand out?

Here are some key advantages of using Wirexapp:

Wirexapp educational resources

Though we found that Wirexapp has limited educational materials to help you start with its features, fret not, their help center is a suitable alternative and a go-to hub for swift and practical solutions to all your product-related questions.

If you face an issue, you can start by exploring their blog with the latest updates. You can also benefit from the vibrant Wirex community to find the answers to the most commonly asked questions. Besides, it helps you network with like-minded enthusiasts.

Mandatory KYC verification for safety

With the rise of a regulatory push against crypto-friendly banks, the Wirex platform mandates KYC verification at the registration level. Additionally, it ensures regulatory compliance and adds an extra layer of security to your data and funds.

dApps and borrow

Wirexapp offers an easy-to-explore Web3 ecosystem with diverse, decentralized applications (dApps) on blockchain networks. You can interact with popular dApps like Uniswap, Compound, Aave, MakerDAO, and more using your Wirex account.

Furthermore, the bank offers the convenience of instantly borrowing stablecoins using cryptocurrencies as collateral, starting at 0% APR. The process is a breeze, with no credit checks required to secure these crypto-backed stablecoin loans.

Wirexapp easy to use

Wirexapp’s web version provides a user-friendly dashboard, making managing digital assets easy and earning interest in X-Accounts.

On the other hand, the mobile version mirrors the same design for on-the-go payments. Plus, it is handy to review Wirex X-tras debit card rewards and spending. Still, we found that some users have highlighted rare verification issues and lags on the app.

Cashback and Wirex rewards

Wirexapp incentivizes paying with its cards and offers up to 8% cashback in crypto for every in-store and online purchase. But it has a downside, as rewards vary depending on your pricing plans.

In addition, it offers an easy way to earn X-points and loyalty tokens by referring friends to Wirex or completing designated tasks. Moreover, traders can delight in receiving up to $10 in Bitcoin as a reward for each successful referral. And no hidden fees are lurking in the shadows.

Wirexapp review: Key features

Let’s explore some key features of Wirexapp:

Flexible withdrawal and deposit options

Wirexapp lets you pick what suits you best, including bank transfers, credit or debit cards, cryptocurrency wallets, or stablecoin bridges. With support for numerous traditional and digital currencies, including US dollars, euros, Bitcoin, Ethereum, and many more, your options are virtually limitless.

If you don’t have access to crypto, the bank gives you the option for live exchange for supported digital tokens. While most competitors charge high conversion fees, you can exchange crypto and fiat at the best OTC and interbank rates without additional costs.

But if you prefer easier solutions like PayPal, Apple Pay, Google Pay, and Samsung Pay, it is easy to link any of these methods to your Wirexapp account.

With Wirex, you don’t need to wait hours or days to fund your account. Regardless of your location, it supports integrated banking channels like Swift, SEPA, and other Faster Payments.

Supported cryptocurrencies

With Wirex, seamless cryptocurrency, and fiat exchanges await you. If Wirex users are based in the US, they’ll have access to a diverse range of over 130+ cryptocurrencies, including:

- Bitcoin

- Ethereum

- Cardano

- Ripple

- Solana

- Litecoin

Unlike fixed fees, Wirex uses a smart approach and collaborates with ten crypto exchanges and three over-the-counter (OTC) institutions to get you the best rates.

Think of it like brokerages such as Voyager, which scout multiple exchanges for competitive rates. While you incur varying spread fees, Wirex does not add additional transaction fees.

Wirex X-accounts

Wirex bank users can earn up to a 16% APY on various cryptocurrencies and fiat currencies like USD or Euros with Wirex X-accounts. Also, it supports popular tokens such as Aave, Bitcoin, Dai, Ethereum, Solana, TUSD, Uniswap, USDC, WTX, etc. Most of these assets pay a competitive 6% APY, while fiat currencies offer a generous 12% APY.

Whether you receive rewards in WXT (Wirex’s native token) instead of in-kind rewards can boost your APY by up to 4%, depending on your Wirex plan. Wirexapp distributes Interest compounds daily, while rewards are distributed weekly without additional fees.

X-accounts are a straightforward way to put your digital assets or idle cash to work effectively. And let’s not forget that earning up to 16% APY easily surpasses any high-yield savings account out there.

To make this work, it taps into DeFi liquidity pools, DeFi lending pools, and institutional lending liquidity, ensuring hassle-free DeFi yields for beginners without the complexities of direct market involvement.

Customer support on Wirexapp

For any concerns traders might encounter – adding funds, profile verification, Card payments, account-related issues, rewards, or fees – the Wirex support team is readily available 24/7, ensuring swift assistance.

Rest assured, our review found that your inquiries won’t go unanswered. But even if that rare event happens, you can create a support ticket or find instant solutions on the Wirex community forum.

Still, if you need further aid, the customer support representatives are accessible through social media pages like Facebook, Instagram, and Twitter.

Anonymity and security

Even though Wirexapp takes security seriously, it is not the most suitable option for those who prefer anonymous trading. That’s because it makes identity verification compulsory, resulting in minimal privacy.

On the other hand, the crypto bank holds the esteemed PCI DSS Level 1 certification. For rock-solid safety, the 3D enrolment features protect online and offline transactions.

Additionally, Wirexapp is fully licensed by the FCA as an e-money issuer, adding to its credibility and market reputation. To enhance security even more, it implements two-factor authentication, robust TLS, and 265-bit AES encryption to ensure that sensitive information remains secure. Moreover, with almost 11,000+ reviews, it has a 3.3 rating on Trustpilot.

Wirex token

Like other platforms, Wirexapp has its native governance token Wirex (WXT). It works as the utility token on the exchange and operates on the Stellar blockchain.

You can access higher cashback rates paid in WXT and upgrade your accounts. The amount of cashback a user can earn depends on their account type.

- Standard account holders can earn up to 1%.

- Premium account holders can receive up to 3%.

- Elite account holders can earn up to 8%.

Multi-currency card for users

Wirexapp multi-currency card is designed for those who want to spend money and crypto worry-free globally. You can use it to pay crypto and fiat currencies seamlessly anywhere that accepts Visa cards.

So, whether online or in physical stores, use this card to earn cashback rewards for each purchase without worrying about foreign exchange fees. Not only that, but cardholders can earn up to 1.5% in Bitcoin for every in-store transaction.

To help you keep track of your spending habits, the Wirex app sends you instant receipts and live notifications for all transactions.

Lastly, like a normal debit card, you withdraw cash from ATMs worldwide with minimal fees to enjoy flexibility while on the go.

Wirex free wallet

The Wirex Wallet is a secure, keyless, non-custodial software cryptocurrency wallet on Android and iOS. In addition, it provides an easy way to explore the world of DeFi and NFT marketplaces on various blockchains. Moreover, you can earn up to 25% APY by staking Aave and Compound.

Plus, with biometric backup, recovering your wallet on a new device is hassle-free. Besides that, its compatibility with Bitcoin, Ethereum, and Solana makes it a versatile and free software wallet. So, it is a solid pick if you are looking for a reliable alternative to MetaMask and ZenGo.

Wirexapp Review: Cost and fees on Wirexapp

WireX has no commission on crypto exchanges but applies a 1.5% spread on currency conversions. Interestingly, you can enjoy fee-free exchanges for fiat currencies and fiat-backed stablecoins.

For deposits and withdrawals, Wirexapp offers zero fees for fiat currencies via bank transfers. However, withdrawing cryptocurrencies to external wallets incurs variable fees based on network congestion.

Furthermore, account funding fees for crypto deposits via local credit or debit card vary based on location and currency, with rates like 3.24% for buying crypto and 1.99% for fiat and stablecoins in the UK. In Australia, it’s 2.49% for crypto and 0.8% for fiat and stablecoins.

Additionally, setting up a Wirex account incurs zero fees, and obtaining a physical card is free. Plus, the loading fees are non-existent, and domestic transactions come at no extra cost. However, ATM withdrawals using the card charge are free up to a limit for each country, and after that, a 2% fee is charged.

| Feature | Standard Account | Premium Account | Elite Account |

|---|---|---|---|

| Monthly Fees | $0 | $9.99 | $29.99 |

| Cryptoback (Online) | Up To 1% | Up to 3% | Up To 8% |

| Cryptoback (In-Store) | Up To 1% | Up To 2% | Up To 4% |

| Savings Bonus Rates | Up To 1% | Up To 6% | Up To 16% |

| Live Exchange Rates | Unlimited | Unlimited | Unlimited |

| Currency Conversions | 1.5% Crypto – 0% Stablecoins/Fiat | 1.5% Crypto – 0% Stablecoins/Fiat | 1.5% Crypto – 0% Stablecoins/Fiat |

| Physical Card Fee | No Fee | No Fee | No Fee |

| OTC Crypto Exchange Rates | Unlimited | Unlimited | Unlimited |

| ATM Withdrawal Fees | 2% After A Limit | 2% After A Limit | 2% After A Limit |

| Card Top Up Fee | 1% | No Fee | No Fee |

Account types

In a recent update, Wirex has done away with the previous monthly account maintenance fee. Now, they only face a monthly account fee if they wish to enjoy the highest cashback or upgrade their account type.

- Standard (free)

- Premium ($9.99/month)

- Elite ($29.99/month)

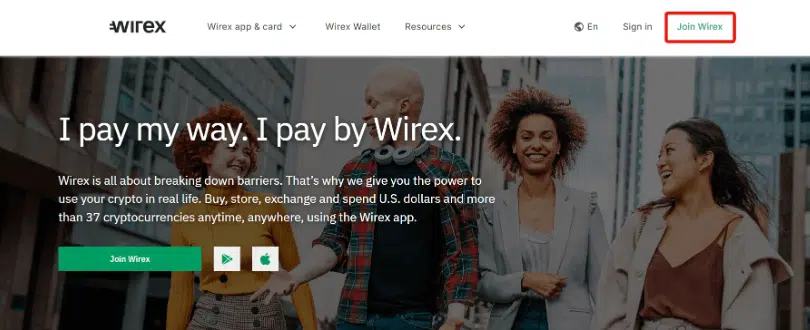

Getting started with Wirexapp

Follow these steps to create an account with the crypto bank in minutes:

More details

Our Wirexapp review found that the crypto bank is a single solution to manage your fiat money and cryptocurrencies. With its Cryptoback rewards card, you can spend your crypto as traditional money anywhere. Yet, the lack of DeFi and limited token support might be a dealbreaker for those with extensive portfolios.

-

Regulated by FCA and MAS.

-

All-in-one currency management.

-

Use crypto anywhere.

-

No maintenance fee.

-

High interest.

-

Identity verification is required.

-

Regulatory impact on cards.

-

Custodial operations.

Step 1: Visit the website

First, visit the Wirexapp website and click [Join Wirex].

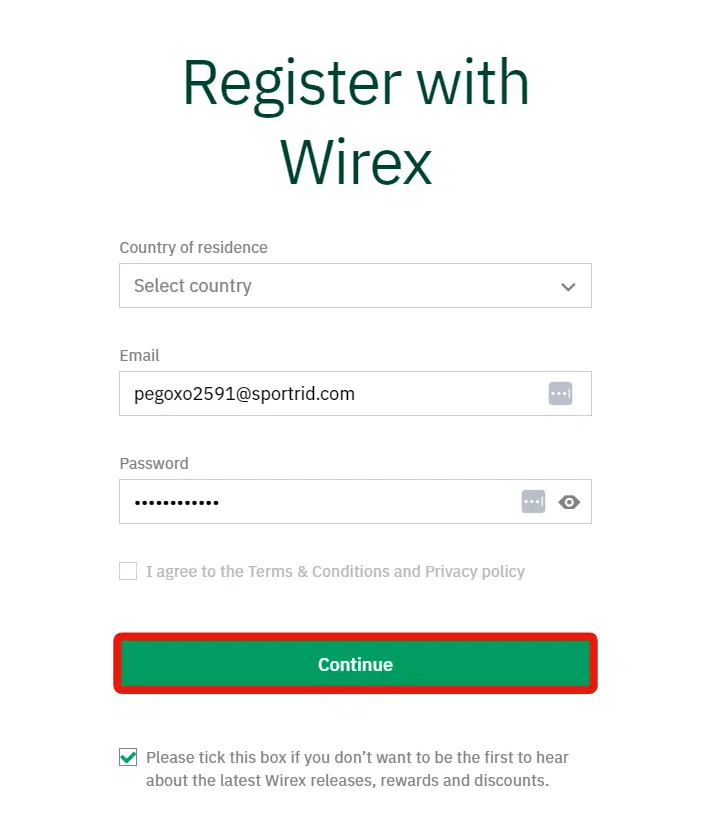

Step 2: Fill in the details

Next, you will be asked to select your country, e-mail, and a strong password. When done, click [Continue].

Step 3: Confirm e-mail

After that, a verification e-mail will be sent to your registered mail. Open your e-mail and click [Confirm Email].

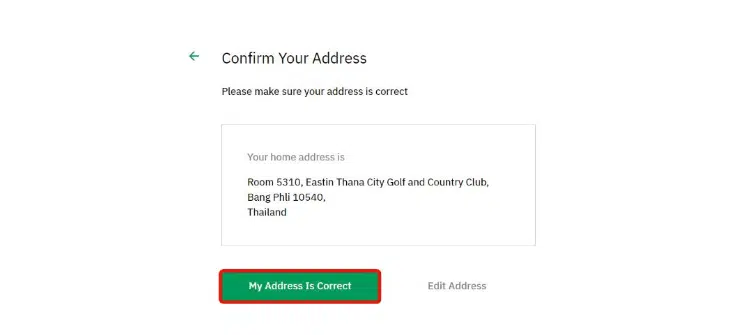

Step 4: Confirm your address

Then, confirm your address and other details after filling out your name and other details. Once done, click [My Address Is Correct].

Step 5: Start verification

Next up, click the [Verify Identity] to complete the registration.

Step 6: Scan QR on your mobile

Then, scan the QR on your screen to start the verification on your mobile.

Step 7: Select the document

Once on your phone, select [Choose Document] and pick any of the three ID options.

Step 8: Scan the ID card

Wirex can ask for further information, like scanning the ID card and a selfie using your camera. So, complete that if it gives you a pop-up.

Congratulations! You are all set. Now, fund your account and start spending.

Wirexapp Review: Drawbacks

Here are some drawbacks of the Wirexapp:

Inadequate regulatory compliance

Wirexapp complies with country-specific regulations but lacks licensing from NYDFS and Hawaii DFI, restricting services to residents in these states. Also, it doesn’t adhere to the GDPR of the European Union.

Challenging KYC verification

Some users have reported that the Know Your Customer (KYC) verification process is time-consuming, complex, and error-prone. Moreover, others have experienced account freezes without explanation even after completing the ID verification.

Lack of efficient Crypto trading

Another drawback of Wirex is that it needs more sophisticated trading pairs and charting tools for advanced traders. While ideal for spot trading, those needing advanced trading tools may consider other exchanges like Kraken.

Limited currency support

While Wirexapp supports 130+ cryptocurrencies and 13+ fiat currencies, it needs to catch up with some competitors in variety. For example, Coinbase supports 350+ cryptocurrencies.

Alternatives to Wirexapp

Let’s explore the best alternatives to Wirexapp.

Binance

Binance is a popular all-in-one money app that lets you send and accept payments in 350+ currencies and from over 100+ countries. Like Wirex, it provides live exchange rates, and you don’t get dinged with withdrawal fees.

And like Wirex, Binance has its own rewards card that lets you earn up to 8% cashback.

More details

Binance is a great combination of low fees, deep liquidity and multiple cryptocurrencies and trading pairs. We have tested every aspect of it and it STILL holds its reign as the top exchange in the world. In our view, it is the perfect crypto exchange for both newbies and advanced traders alike.

-

Biggest exchange in the world.

-

Industry's lowest trading fees.

-

Advance trading options like leverage trading.

-

600+ crypto options, 150+ for the US.

-

Lucrative on-site staking options.

-

Hiccups in account verification.

-

Less regulated than some competitors.

-

The corporate structure is not transparently.

Uphold

Uphold is another alternative to Wirexapp as it offers 250+ cryptocurrencies for trading. Additionally, it provides investments in U.S. equities, precious metals, and 35+ currencies across 180+ countries.

More details

Uphold is a secure, transparent digital asset exchange, ideal for no-hassle transactions. With no-fee transactions for assets over $100, it sets itself apart. Furthermore, its debit card facilitates instant cryptocurrency conversions, adding user convenience. However, it's important to note that equity trading isn't available on Uphold in the US and Europe.

-

Cross-asset trading in one platform.

-

Good educational content.

-

Transparent fee structure.

-

Easy user interface.

-

No advanced trading features.

-

Weak security as it has been hacked.

-

A less appealing mobile app.

Coinbase

For US crypto enthusiasts, Coinbase is an alternative crypto bank to Wirex. With support for 250+ cryptocurrencies, it offers a diverse trading landscape.

More details

Coinbase is one of the largest crypto exchanges in the world and a widely-used platform for buying, selling, and trading over 200 cryptocurrencies. It offers trading solutions for beginner, advanced, and institutional traders alike. Take a look at what makes it an excellent option for individual traders looking to trade in cryptocurrencies and beyond.

-

A wide-selection of coin offerings.

-

Most secure online crypto platforms.

-

Top-rated mobile app.

-

Easy interface and user-friendly.

-

Expensive and complex fee structure for beginners

-

Higher fees as compared to other cryptocurrency exchanges.

-

Slow customer support.

Wirexapp Review: Our Verdict

To sum it up, Wirexapp is your all-in-one money management crypto bank and puts the power of managing assets at your fingertips.

For those seeking to use their crypto for everyday payments, the Wirex debit card is a game-changer. However, investors looking for a broader range of crypto assets and advanced investment options might find Wirex’s offerings limited.

Primarily because the platform caters to beginners with its user-friendly services and focused selection of crypto assets, notably, the Wirex app operates with a custodial wallet, requiring users to entrust Wirex with their wallets’ private keys and funds.

Yes, Wirex Bank ensures a secure and convenient crypto experience. However, some concerns about regulatory compliance and KYC verification have been noted.

Absolutely! Wirexapp allows users to withdraw and deposit funds through various options. Currently, it supports bank accounts, credit/debit cards, cryptocurrency wallets, and stablecoin bridges.

Wirexapp serves as a versatile currency and crypto exchange platform. Also, it enables users to buy, store, exchange, and spend over 150+ cryptocurrencies and fiat currencies.

The Wirex crypto bank is available in 130+ countries but may not fully comply with certain regions' regulations. For instance, Hawaii, New York, Texas, and Vermont residents cannot access the platform.