TLDR

KYC in cryptocurrency has become a serious concern regarding secure transactions. This article will inform you about KYC crypto and its importance to crypto investors.

KYC (Know Your Customer) in crypto is an AML (Anti-Money Laundering) regulation enforced on Virtual Asset Service Providers (VASPs).

Every customer willing to trade at crypto exchanges must provide personal information for verification. KYC standards enable account and transaction monitoring for crypto businesses for suspicious activities.

Although most VASPs are now implementing the KYC process, there are several ways to avoid it. However, non-KYC services have certain risks associated with cryptocurrency transactions.

What is KYC in Crypto?

KYC refers to a financial institution’s obligation to verify a customer before providing services. It’s an integral part of AML regulatory compliance. KYC crypto indicates the crypto company and exchange compliance with the KYC measures.

VASPs cover all financial institutions, including centralized crypto exchanges. However, the crypto market’s anonymity and decentralization directly contradict KYC’s adoption. Still, tight govt regulations keep increasing the number of KYC-compliant VASPs.

KYC Processes for Crypto

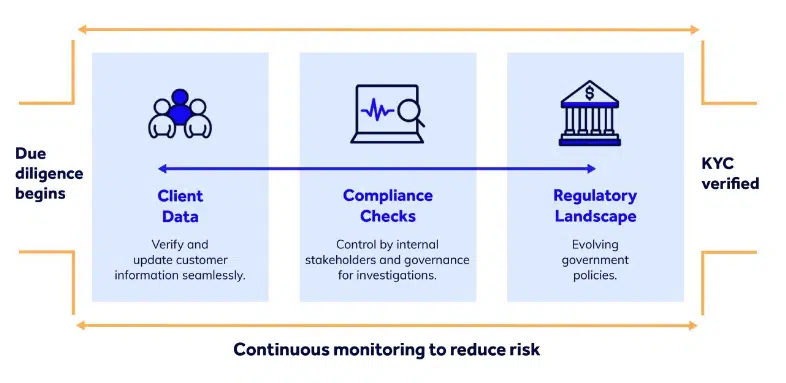

Many countries have mandatory AML regulations for crypto platforms, businesses, and exchanges. It applies the Customer Due Diligence (CDD) system, consisting of KYC checks, among other factors. The minimum KYC requirements for the identity verification process are:

- Full Legal Name

- Residential Address

- Date of Birth

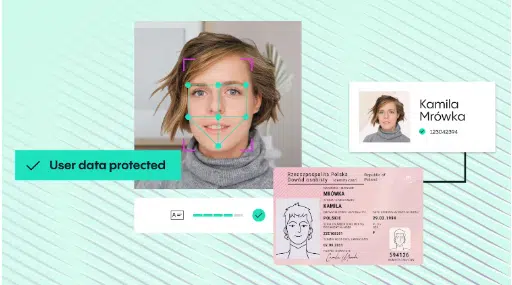

Crypto regulations vary drastically from country to country. You may have to submit additional information like nationality, gender, place of birth, occupation, tax number, etc. All the submitted information is cross-checked with the govt-provided ID uploaded by the client.

The crypto onboarding process through KYC programs usually features the following steps:

- Identification: This step acquires the customer’s personal yet necessary information.

- Liveliness: Determines whether the customer is a real/fake person or an identity theft.

- Verification: This segment compares the data with govt-issued documents or IDs.

- Address: Determines whether the client lives in a high-risk zone/region/country.

- Risk Score: This stage puts the client in a risk category based on the above steps.

Most crypto services delegate these tasks to a specialized third party to ensure a fast and proper verification process.

KYC Crypto on Anonymity and Decentralization

The decentralized economy has a severe problem with the KYC process due to its structure’s complete anonymity. Some crypto businesses don’t even know their customers. Government regulators have always pointed to this problem as a potent source of crimes, terrorism, and other illegal activities. That’s why every centralized exchange is bound to implement some KYC security measures.

However, KYC procedures don’t directly apply to DEX and other crypto companies to make trades using smart contracts. They are yet to become financial intermediaries or counterparties by overcoming regulatory risks. So, the effect on anonymity and decentralization is low.

Benefits of KYC in Crypto

The KYC process ensures safe and steady trading in modern financial contexts. There are several benefits of implementing KYC from a commercial/business perspective –

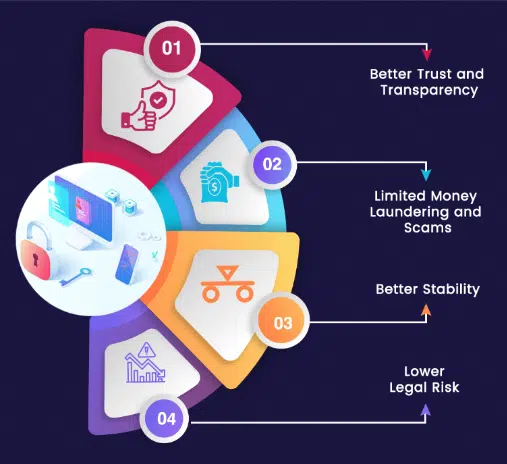

Trust and Transparency

Safeguarding the account means all your digital assets remain hidden from prying eyes. Investors and traders will turn to services that take proactive and precautionary measures against scams and frauds.

User identities allow trading with verified clients within a crypto exchange. And secure crypto transactions create and maintain transparency among the involved parties.

Lower Risk of Financial Crimes

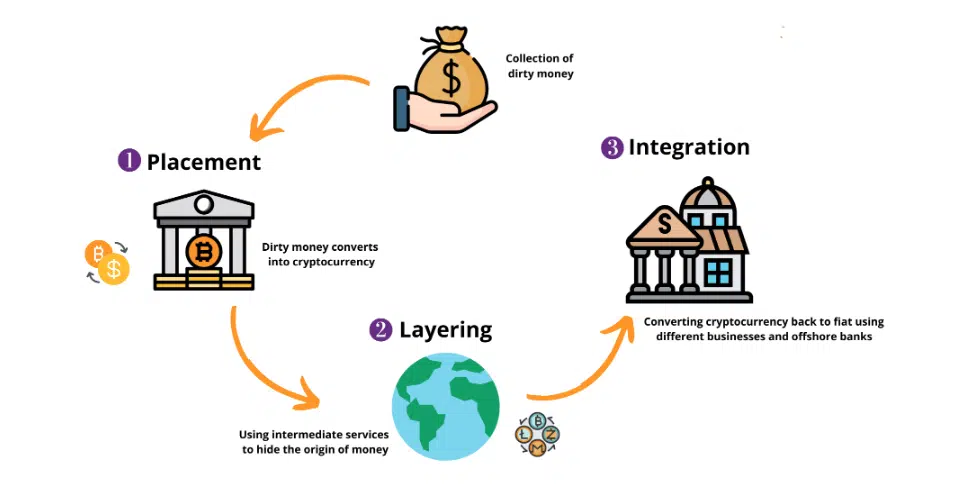

As mentioned, KYC is a vital part of AML set by global regulators. Criminals managed to launder crypto assets worth $8.6B in 2021 alone. Nobody wants to see a cryptocurrency exchange as a financial system of cryptocurrency fraud or criminal activities.

KYC lowers this risk of terrorist financing through sufficient monitoring of crypto trades. Thus, the process allows the authority to stay alert against money laundering risks.

Increased Market Stability

The crypto market is highly volatile and sensitive to media news and information. Pseudonymous trades by users with harmful intentions can cause havoc in the cryptocurrency market.

That’s where KYC can play a significant role in a customer’s identity with illicit cryptocurrency transactions, news, or information. And it effectively leads to the crypto market’s overall stability while building further confidence among investors and buyers.

Trusted Partners

Reduction of Legal Risks

Implementing KYC can help many crypto firms avoid legal disputes and regulatory penalties. Robust KYC policies also put the crypto exchanges ahead of competitors over KYC requirements by the law.

KYC lets VASPs prevent and limit fake identities almost instantly. And they don’t have to deal with money laundering accusations or customer risk issues more frequently, like non-KYC exchanges.

Future Crypto Compliance

Instead of confronting legal disputes, crypto exchanges can focus on reforming trading fees and rules. Crypto-related regulations keep changing with the evolving international guidelines.

These can directly affect conversion rates, financial transactions, and proper compliance. KYC crypto enables businesses to make necessary changes without trying hard to comply with newer legislation.

Reputational Damage Control

Damage control is integral to keeping the crypto business alive following criminal incidents. In a hack, breach, or scam, KYC-compliant companies can take preventive measures more quickly.

Also, they remain in a better position to regain their trust and boost their market reputation. Fast freezing or closing suspicious/accused/reported accounts can prevent further issues.

Can You Trade Crypto without KYC?

There are several ways to avoid KYC while trading at crypto exchanges. You can use non-KYC DEX platforms, which require almost no verification measures. You can opt for Bitcoin ATMs to purchase digital assets with fiat currency. These ATMs are like regular ATMs, catered to cryptocurrency transactions.

Some P2P or peer-to-peer exchanges like Paxful or LocalBitcoins also allow KYC-free purchases. Also, services like Changelly or ShapeShift let you buy crypto without KYC. Changelly features a combination of non-KYC and KYC, limiting the amount for non-KYC customers.

Non-KYC Crypto Service Problems

You can opt for non-KYC services to maintain anonymous transactions. But choosing a non-KYC crypto service involves the following risks –

- Weak protective measurements for assets.

- Increased vulnerability to financial crimes/hacks/scams.

- High transaction fees

- Non-compliance with federal regulations.

- Mistrust and misunderstanding among the partners.

Check out our list of the leading non-KYC exchanges.

No, KYC is yet to become mandatory for everyone involved in the market. There are several ways to avoid KYC for cryptos. However, cryptocurrency exchanges are under fierce govt pressure to implement full-scale KYC regulations.

Crypto wallets are either custodial or self-hosted (non-custodial). Custodial wallets hold private keys to an account, requiring KYC measures. But most wallets are non-custodial, needing no compliance with the KYC process.