Salt Lending 2024 Review: Pros and Cons of Crypto Loans

TLDR

This Salt Lending review will thoroughly explore the platform enabling users to borrow cash or stablecoins using their crypto assets as collateral.

With a range of critical features, including crypto portfolio management, extensive insurance coverage, educational resources, and insights from industry experts, Salt Lending provides users with a holistic borrowing experience.

Also, the platform supports multiple cryptocurrencies as collateral and offers flexible loan options and terms. Salt Lending prioritizes security through its custody-agnostic approach and multi-party computation technology.

Introduction

Headquartered in Denver, Colorado, SALT lending started to provide a solution for crypto holders. It is perfect for those who want money to maintain long-term investments without selling their digital assets and holdings in the short term.

As a result, the company has established its brand by offering salt loans to big organizations and individuals worldwide. In contrast to lending platforms, SALT disrupts the traditional borrowing approach by introducing a new system in the cryptocurrency world that users prefer.

Initially, SALT lending emerged as an innovative digital asset platform, introducing the SALT native token in crypto finance. Operating on the Ethereum blockchain, SALT smart contracts exclusively benefit members. With the SALT token, a basic member can pay for memberships and enjoy perks on the SALT lending platform.

SALT smart contracts run on an ERC-20, which combines the loan agreement terms with cryptographic code to enforce and execute the agreement. ERC-20 is a standard for Ethereum token contracts, facilitating token exchange.

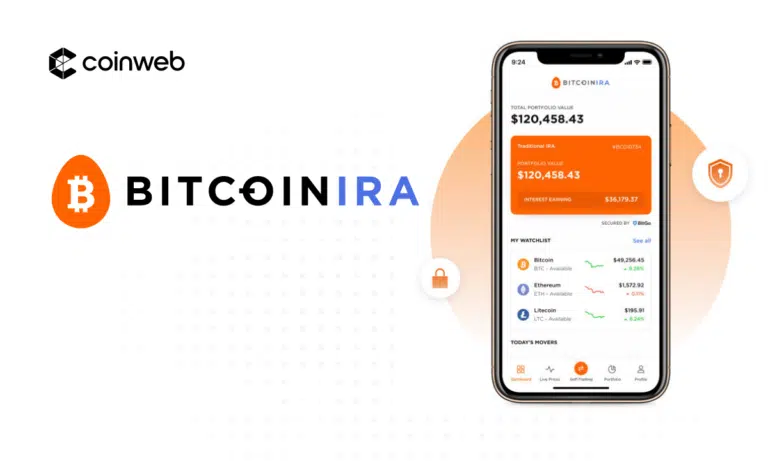

What is Salt Lending?

SALT Lending is a centralized crypto lending platform that enables users to borrow cash using their crypto holdings as collateral assets. When borrowers obtain a loan through SALT Lending, the platform holds their crypto assets until the loan is fully repaid.

It supports a wide range of tokens as collateral, including Bitcoin, Ether, Bitcoin Cash, Dogecoin, Ripple, SALT, USDC, PAX, TUSD, Litecoin, Dash, and PAX Gold. As one of the pioneering platforms in this field, SALT Lending has remained at the forefront of crypto-backed loans.

The minimum borrowing amount on the platform starts at $1,000, with slight variations based on the user’s location. SALT Lending offers two types of loans: personal and business loans.

Loan rates may differ but tend to be very low for many borrowers, and the platform does not impose any additional fees.

Borrowers are exempt from withdrawal fees, origination fees, custody fees, prepayment fees, and even bounced ACH fees. Consequently, the cost of borrowing on this platform remains exceptionally low.

Salt Lending Review: Who should use it?

SALT Lending is an ideal option for individuals based on their needs and circumstances. While many use crypto loans for margin trading, SALT Lending crypto loans serve various purposes. Here are the types of individuals who would benefit most from SALT Lending:

Crypto investors with low credit scores

SALT Lending does not require credit score checks and focuses on collateral. This means individuals with low credit scores can secure loans with rates comparable to traditional personal loans. Rather than facing high APRs due to insufficient or no-credit checks, users can enjoy more favorable rates despite their credit score or history.

For Beginners

Those holding Bitcoin or Ethereum can use SALT Lending’s forgiving loan interest rates, fees, and loan-to-value (LTV) ratios. Additionally, the platform’s stabilization feature protects users’ cryptocurrency assets during bearish trends, allowing beginners to convert their collateral to fiat money and mitigate potential losses in value.

Investors with large unrealized gains

Suppose you have held coins like BTC or ETH for an extended period and experienced significant growth in their value. In that case, SALT loans offer investors a way to unlock that value without selling the tokens and incurring crypto taxes. By using BTC or ETH as collateral, individuals can obtain a cash loan against their cryptocurrency holdings, providing access to liquidity while preserving their investment.

Investors looking to purchase a home

In cases where traditional home mortgages are inaccessible, SALT lending offers Bitcoin enthusiasts an alternative in the form of a crypto mortgage. By borrowing cash against their crypto holdings, individuals can acquire a home or rental property, diversifying their portfolio without selling their cryptocurrencies.

How SALT Blockchain-Based Lending Works

Here is how SALT works:

Requirements for SALT Loan Approval

To get a SALT loan approved, several conditions must be met:

- Becoming a member of the SALT platform is necessary, which involves purchasing a SALT token and creating an account.

- You need blockchain assets such as Bitcoin, Ethereum, or Litecoin to serve as collateral.

- You must complete the identity verification process, which entails providing personal information, proof of address, and income verification.

- The conditions will depend on numerous factors like loan amount, interest rate, duration, and loan-to-value ratio.

SALT’s Loan-to-Value Ratios

SALT’s loan-to-value ratios (LTVs) determine the relationship between the loan amount and collateral value. A lower LTV indicates less risk for the lender and more favorable loan terms for the company and the borrower.

SALT offers loan-to-value ratios ranging from 20% to 70%, which vary based on the loan option and the value of the collateral type chosen. If you choose a 12-month loan with a 9.99% interest rate and use Bitcoin as collateral, you can get LTVs of 30%, 40%, or 50%.

Higher LTVs allow for a greater borrowing amount but require a larger collateral deposit, increasing the likelihood of a collateral maintenance call in case of downward or bearish trends.

Getting started with the Salt Lending platform

Follow these few steps to create an account with the SALT lending platform.

More details

SALT Lending is suitable for borrowing cash using a limited range of cryptocurrencies in your portfolio. It specializes in centralized finance lending and protects your collateral during market downturns. Its loan features are highly flexible with minimal fees, allowing users to customize their salt loans according to their preferences.

-

Does not check the borrower's credit history.

-

Provides real-time notifications.

-

Great customer support.

-

Comprehensive insurance coverage.

-

Cold wallets and multi-signature security provided.

-

Minimum loan amount is $5000.

-

Short repayment window.

-

Crypto collateral highly risky due to market fluctuations.

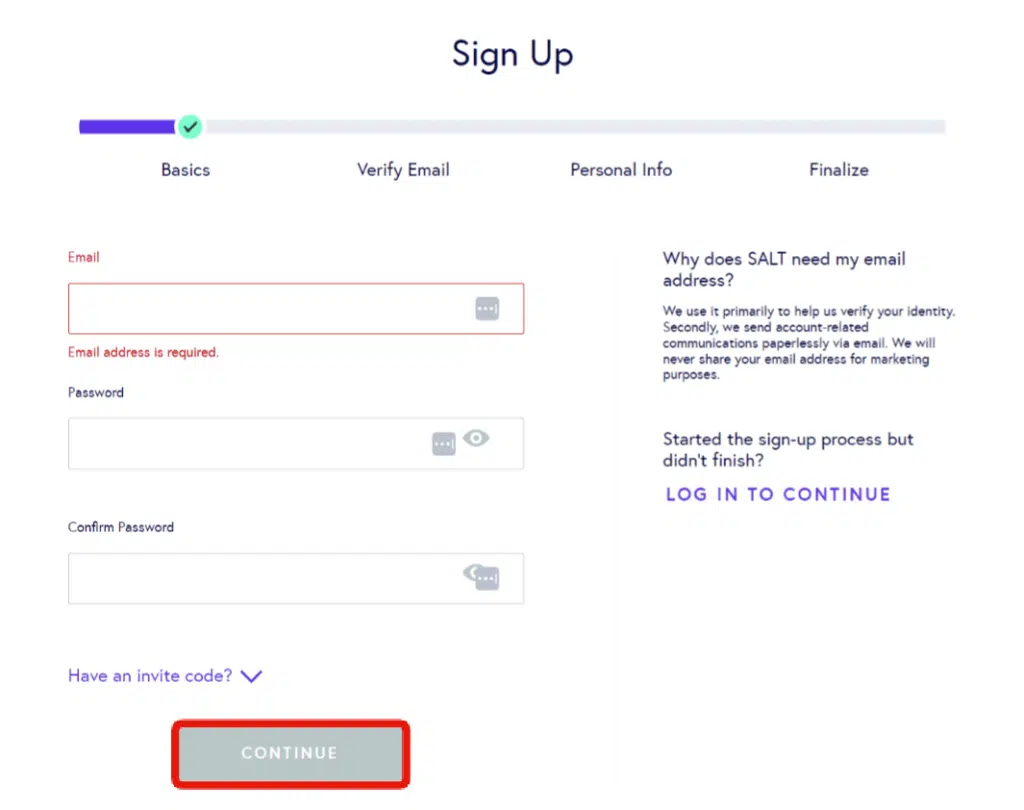

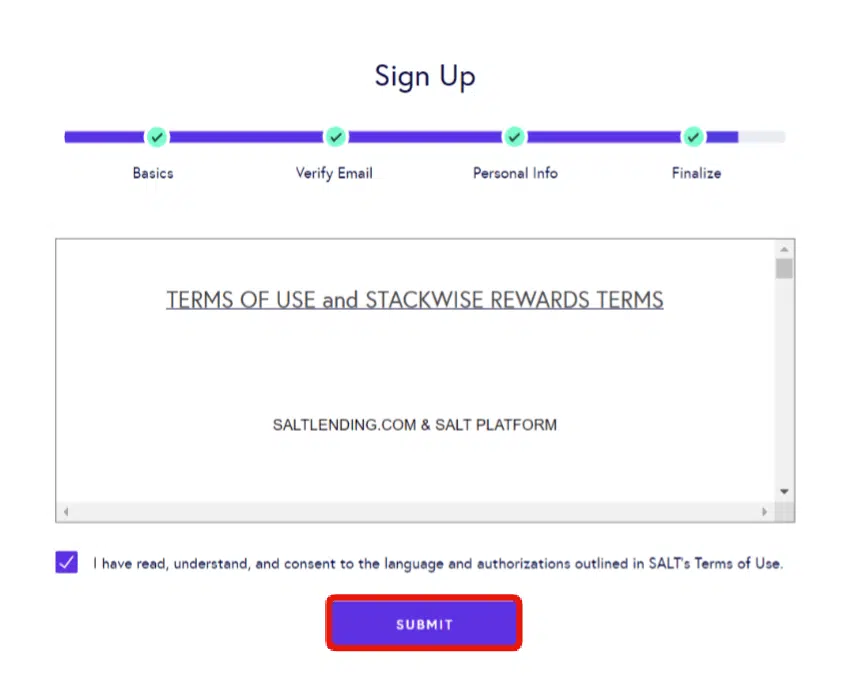

Step 1: Visit the website

Start by visiting the website. Click the [Sign Up] button on the site’s main landing page.

Step 2: Enter your e-mail and password

Next, fill in your e-mail address and choose a strong password. After that, click [Continue].

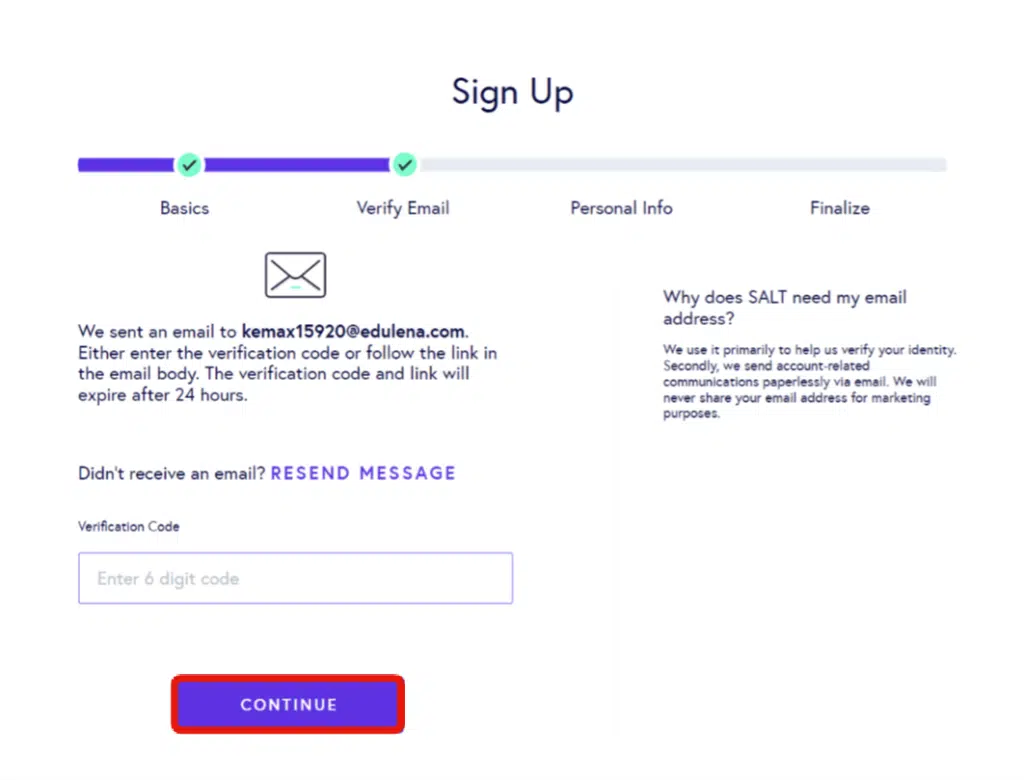

Step 3: Verify e-mail

Following that, you will receive a code on your registered e-mail address. Enter the six-digit code, and when done, click [Continue].

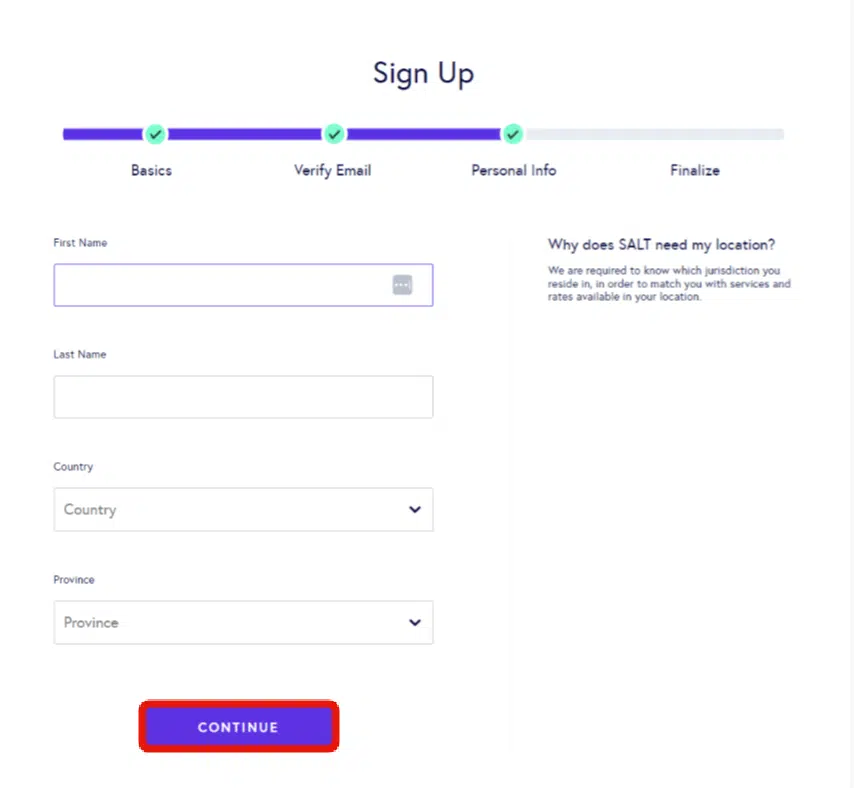

Step 4: Enter the correct details

You will be asked to enter your personal information, including name, country of residence, and province. Click [Continue] after filling in the information.

Step 5: Check terms and conditions

To finalize the process, check the terms and conditions box, and click [Submit].

Congratulations! You have successfully registered an account with the platform.

Salt Lending Review: Key Features & Perks

Let’s explore several factors and features that make SALT a solid pick for every cryptocurrency enthusiast.

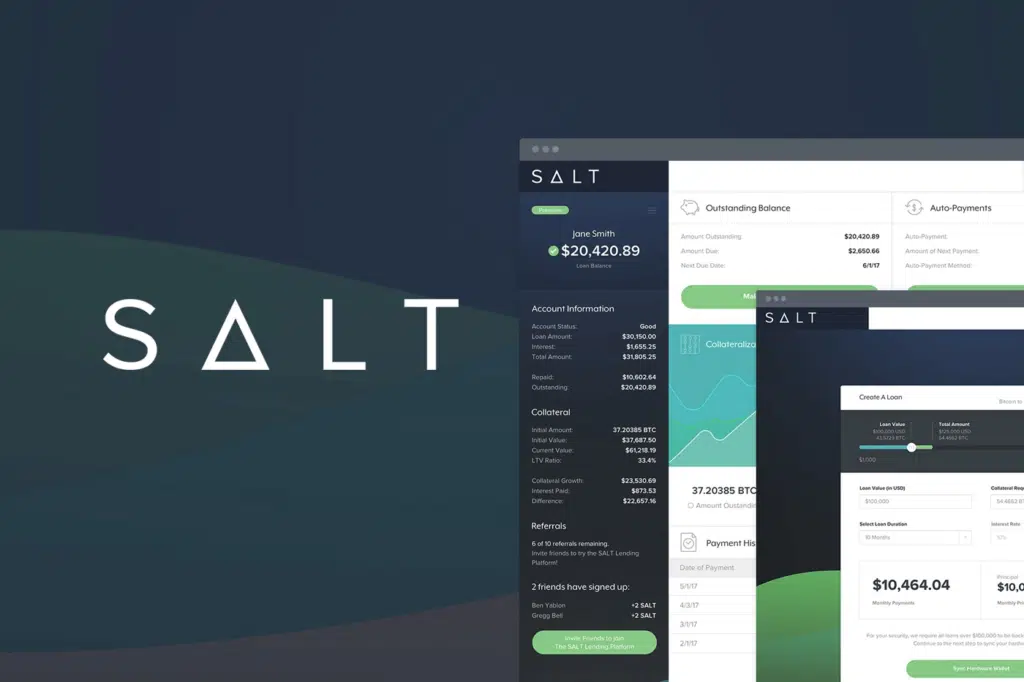

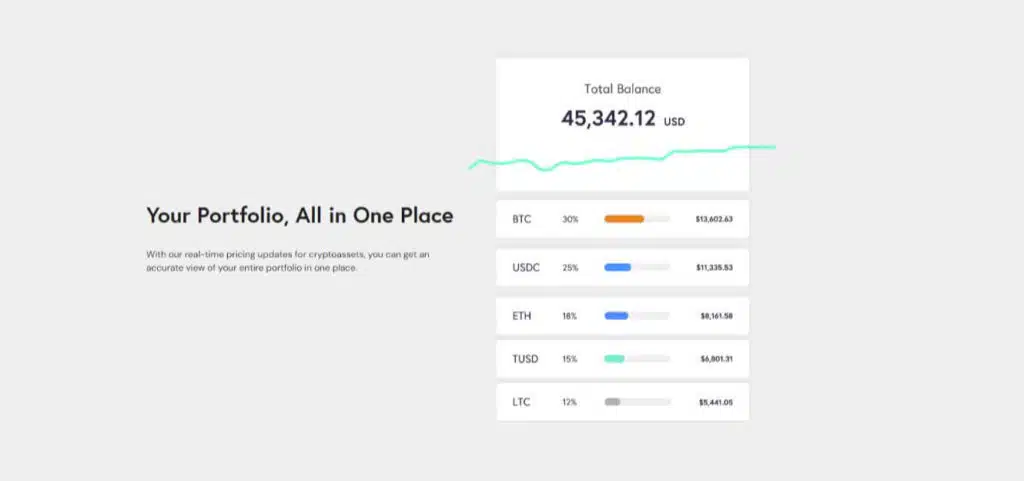

Crypto portfolio management

Salt Lending provides users with a comprehensive crypto portfolio management tool through its user-friendly dashboard. This dashboard lets users easily access and track important loan details, such as the loan amount, interest rates, and periodic payment schedules.

Moreover, they can also monitor their collateral balance, enabling them to stay informed about their borrowing status.

Additionally, users can adjust loan terms, manage their collateral, and make payments directly through the platform, streamlining the borrowing process.

Extensive insurance coverage

Salt Lending has partnered with Fireblocks, a renowned custody management platform, to offer extensive insurance coverage for users’ crypto assets as a testament to its commitment to security.

Besides that, this coverage protects against cyber threats and DeFi scams that may occur during the transit and storage of blockchain assets.

Using this robust insurance coverage, Salt Lending aims to instill confidence in users, assuring them that their valuable crypto assets are well-protected throughout the borrowing process.

Comprehensive educational resources

Salt Lending understands the importance of empowering its users with knowledge and information. To that end, the platform offers a wealth of educational resources to help users navigate the world of crypto lending, borrowing, and investing.

Users can access a dedicated blog, podcast, YouTube channel, and an informative FAQ section. These resources cover many topics, including loan management strategies, market trends, risk management, and industry insights.

By providing these educational materials, Salt Lending empowers users to make well-informed decisions and maximize the potential of their crypto assets.

Insights from Industry Experts

Salt Lending takes pride in bringing valuable insights from industry experts and influencers to its users. Through interviews, articles, and opinion pieces, users gain access to the knowledge and perspectives of experienced professionals for a better trading strategy.

This exclusive content covers diverse topics, from market analysis and investment strategies to emerging trends and regulatory developments. By offering insights from industry experts, Salt Lending helps users stay updated and informed about the latest happenings in the dynamic world of cryptocurrencies.

Crypto-backed loan

One of the standout features of the Salt platform is its ability to provide loans using crypto assets as collateral. Users can secure loans in USD or stablecoins by leveraging their crypto holdings, such as TUSD or USDC.

This unique offering allows users to unlock the value of their cryptocurrency without needing to sell it, preserving their investment positions and potential future growth. Salt Lending offers a variety of loan options and terms, ensuring flexibility to cater to different financial goals and requirements.

Multiple cryptocurrencies supported

Salt Lending supports various cryptocurrencies as collateral, allowing users to choose from multiple digital assets. Supported cryptocurrencies include popular options like Bitcoin, Ethereum, Litecoin, Dogecoin, and Dash, and stablecoins such as Paxos Standard, TrueUSD, USD Coin, and Wrapped Bitcoin.

Moreover, this extensive support for multiple tokens allows users to use various cryptocurrency assets as collateral. It gives them more collateral options and opportunities when borrowing against their crypto holdings.

Enhanced security features

Security is a top priority for Salt Lending, and it employs advanced measures to protect users’ assets. The platform adopts a custody-agnostic approach, distributing risk and enhancing security.

By not relying on a single custodian, Salt Lending minimizes the concentration of risk and ensures the safety of users’ collateral.

Additionally, Salt Lending leverages multi-party computation (MPC) and blockchain technology, enabling secure and confidential transfer and storage of crypto assets. Through these enhanced security features, Salt Lending aims to provide users with peace of mind and a trusted environment for their borrowing needs.

Salt Lending Fees and Customer Support

Salt Lending applies fees based on the loan amount, term, interest rate, and collateral type. The prices include the following:

- Origination Fee: A one-time fee deducted from the loan amount during funding. The percentage ranges from 0% to 5%, depending on the chosen loan option.

- Servicing Fee: A monthly fee covering loan servicing costs. The percentage ranges from 0% to 2%, depending on the chosen loan option.

- Interest Rate: An annual percentage rate (APR) applied to the loan balance. The interest rate ranges from 0.52% to 24.95%, depending on the chosen loan option.

Besides that, the lending platform does not charge any origination fee. Salt Lending offers customer support through multiple phones, e-mail, chat, and social media channels. Users can contact the support team to assist with loans or account-related inquiries.

Salt Lending Review: Advantages of using Salt Lending

SALT Lending offers several notable advantages in the realm of crypto borrowing. Here are the key some key things that help you gain benefits:

Easy access and quick approval process

Unlike traditional loans, SALT Lending provides a streamlined approval process. Borrowers can handle long waiting periods for loan approval.

As long as they have tokens to offer as collateral, accessing a loan on the platform is highly likely. SALT Lending does not require a borrower’s credit card debt history, making the process smoother.

Borrowers must follow a few steps, pledge their tokens as collateral, and receive the borrowed funds. This eliminates the cumbersome paperwork typically associated with traditional banks or credit unions, resulting in a significantly faster borrowing process.

Low Annual Percentage Rates (APRs) and no fees

SALT Lending stands out by charging $0 fees for various borrowing aspects. Withdrawals, custody, prepayment fees, origination fees, and even bounced ACH transfers incur no additional costs.

It keeps borrowing costs on the platform low. Moreover, the APRs for borrowing are generally lower than average. For instance, borrowers with loan-to-value ratios (LTVs) below 20% were paying interest rates well below 1%, while those with higher LTVs were paying slightly over 5% as of late August.

Borrower rewards

An exceptional feature of SALT Lending is that borrowers can earn rewards on their loans. When users make payments, SALT Lending rewards them with ETH, BTC, XRP, or USDC, which can be used at their discretion. Borrowers can use these rewards to make interest payments, top-up collateral, or other purposes.

Salt Lending Review: Major Drawbacks

While SALT Lending has several advantages, there are also potential downsides. Here are the possible cons of using the platform:

Crypto collateral is tied up temporarily

SALT Lending requires borrowers to have cryptocurrency assets and holdings to provide collateral as crypto assets for their loans. While this facilitates easier borrowing, it also means that more money and the total value of your crypto holdings will be locked until the loan is repaid or additional collateral is deposited.

At this time, it may not be possible for you to access your cryptocurrency. This could be a problem if you require it immediately. It’s important to know that market fluctuations during this period could result in potential risks and losses.

Personal information required

As a centralized platform, SALT Lending necessitates borrowers to provide specific personal data to comply with Know Your Customer (KYC) requirements.

The verification process can take a lot of time and may require sharing personal information like identification documents, Social Security numbers, and other sensitive details.

Besides that, this requirement eliminates the option of anonymity for crypto users seeking to borrow from the platform, which can be a significant drawback for some borrowers.

Salt Lending Review: Our Verdict

Salt Lending revolutionizes the lending landscape by allowing users to leverage their crypto assets for cash or stablecoin loans. They provide a secure and comprehensive solution for crypto-backed borrowing with a user-friendly interface and extensive insurance coverage.

The platform offers features like portfolio management and insights from industry experts, empowering users to make informed financial decisions.

By supporting multiple cryptocurrencies and employing advanced security measures, such as a custody-agnostic approach and multi-party computation technology, Salt Lending ensures a seamless and secure borrowing experience.

SALT Lending is an innovative platform that allows users to borrow cash or stablecoins using their crypto assets as collateral. It offers features like portfolio management, educational resources, and insights from industry experts.

SALT Lending prioritizes safety by partnering with Fireblocks for extensive insurance coverage of crypto assets. Collaterals are held in cold storage and protected against theft and crimes.

The CEO of SALT Lending is Bill Sinclair.