TLDR (Too Long, Didn’t Read)

This is a comprehensive guide on spot trading in crypto markets, where you can learn how to purchase underlying assets and hold them until they rise in value. The guide takes an in-depth approach to spot trading and how it is better or worse than futures trading.

The guide also considers the benefits and drawbacks of using a centralized exchange (CEX) vs. a decentralized exchange (DEX) for the spot market.

In case you’re interested in spot trading crypto, here are the general steps to follow:

1. Step: Choose a crypto exchange to buy the underlying asset

2. Step: Decide which currency payment method to use for the purchase

3. Step: Place the buy or sell order/Buy the crypto at market price

4. Step: In case of a CEX, transfer the crypto to your non-custodial wallet. For a DEX, it should happen automatically.

What Does Spot Trading Crypto Mean?

The term spot trading refers to carrying out a transaction on the spot. This trading approach follows the infamous “buy low, sell high” philosophy, which prevails in traditional financial markets like forex, stocks, bonds, and commodities.

You’re genuinely the asset owner when you purchase crypto in a spot. Similarly, when you spot purchase crude oil, you’re the owner of the oil.

In the derivatives crypto market, however, you can only buy or sell contracts considering the underlying asset’s price.

The significant difference between crypto spot and margin trading is that you can only purchase using your funds without amplifying it with borrowed funds.

Spot trading differs from investing, commonly known as HODLing (holding on for dear life) among investors. The goal of crypto spot trading is to generate short-term profits consistently.

The success of your spot trade crypto approach depends on how well your entry and exit are. To identify perfect entries and exits, traders must use fundamental analysis (FA) followed by technical analysis (TA) to speculate the price fluctuations accurately.

Three basic concepts go into crypto spot trading:

- Spot Price

- Trade Date

- Settlement Date

If all the above confuses you, don’t worry. We have an explanation for everything with examples for you.

Spot Price

This is the current market price of the asset you’re looking at. For example, if BTC trades for $21,000, that’s your spot price. This is the actual market price of the assets involved, giving you exposure to the real-time market status.

Trade Date

This is the date when the trade is executed on the exchange. Whether you place a market order or a limit order, the definition of the date will remain the same.

Settlement Date

The date when you take delivery of the crypto assets. As you’re purchasing the asset and not a contract, the settlement date plays a major role for spot traders. In most cases, the trade and settlement dates are the same. Once you take delivery, there is no expiry on the purchase. You can hold on to it for as long as you want.

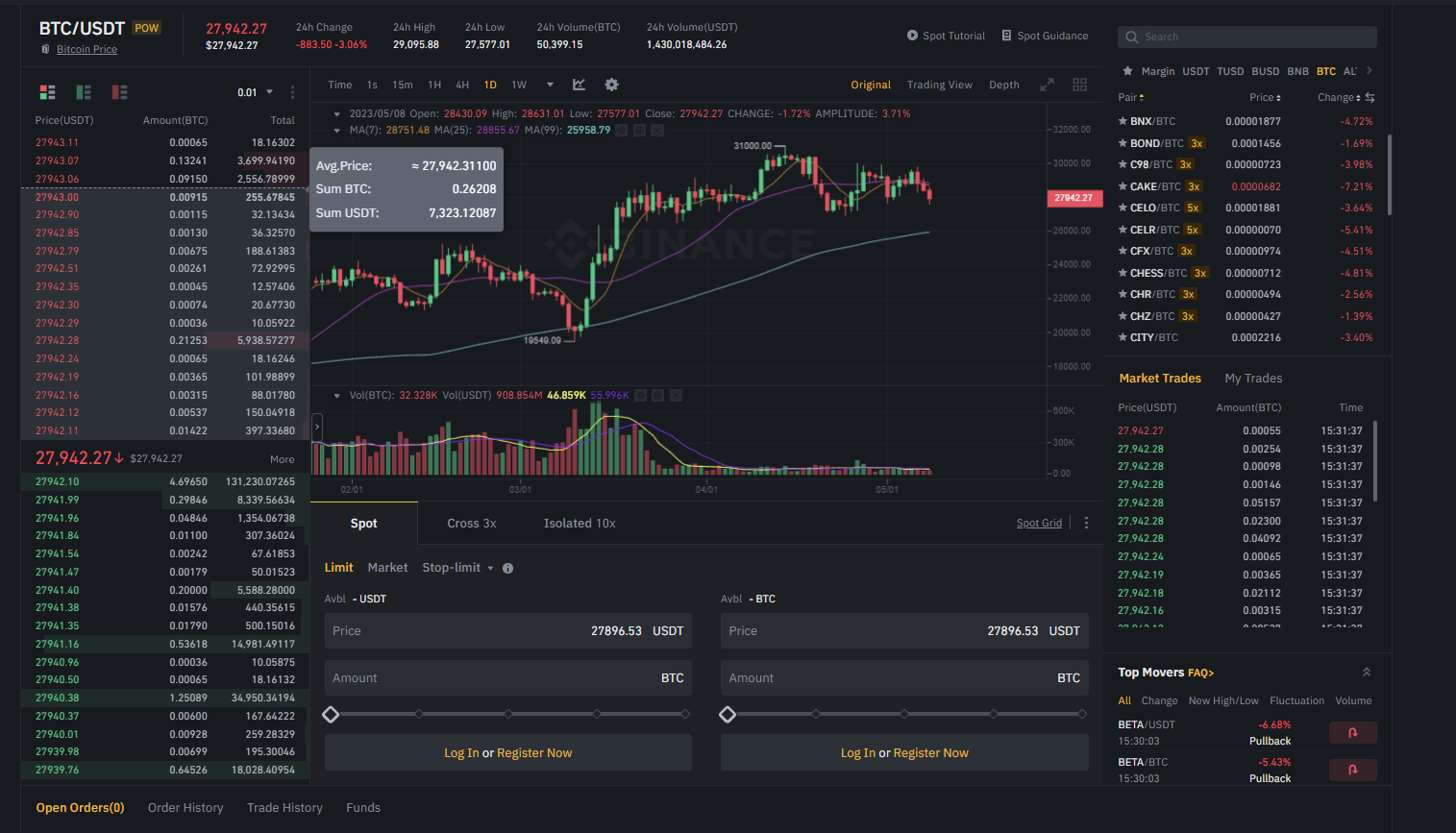

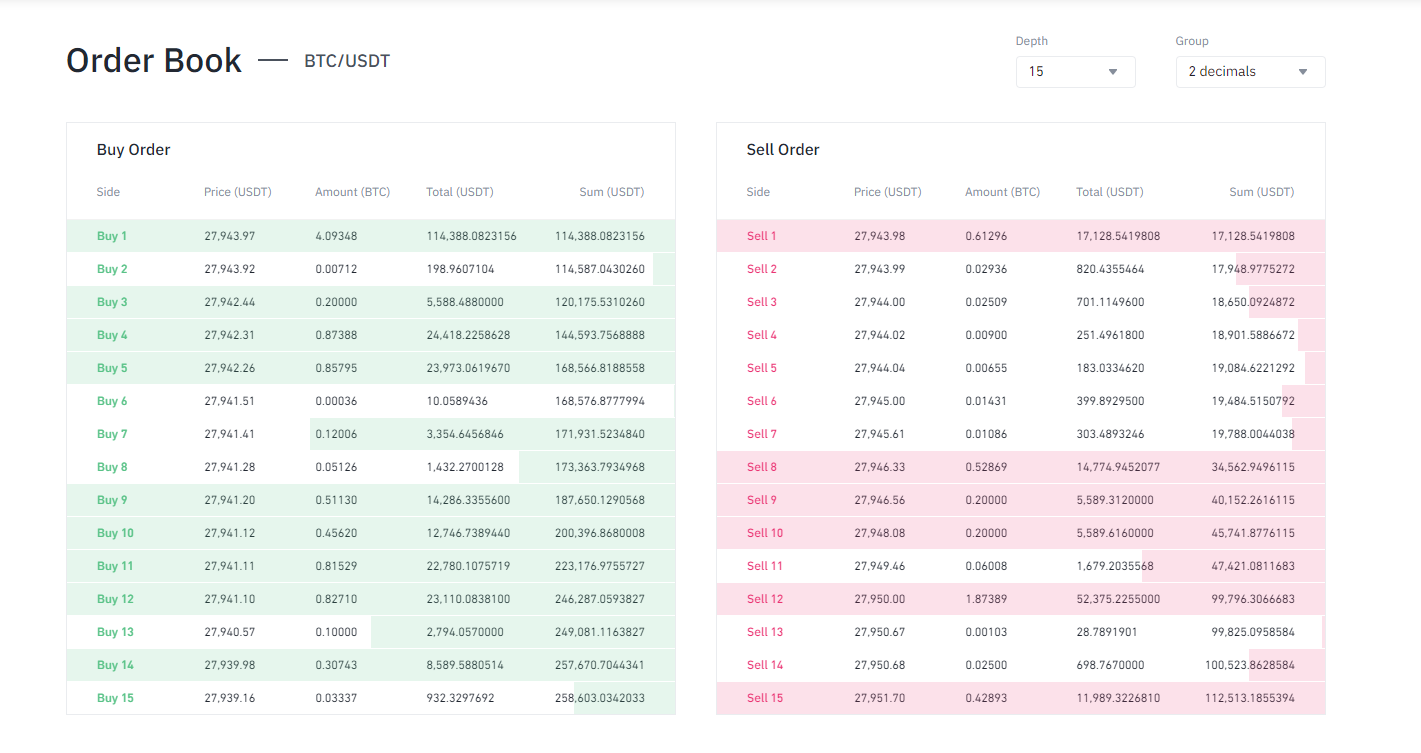

Spot Order Book

Now that we have reviewed the basics, let us look at the Spot Order Book.

Every order in a crypto exchange goes to the order book. An order book “represents the interests of buyers and sellers, offering a window into supply and demand for a particular asset.

There are two sides to every order book. The buy (bid) side and the sell (ask) side.

As the name suggests, the buy side contains all the orders where potential buyers bid on a certain amount of crypto.

On the other hand, the sell side contains all the sell assets orders where potential sellers are willing to release their holdings at the lowest price, usually for profit.

When a particular side of the order book overwhelms the other side at a specific price level, a “wall” is formed. A buy wall works as a support level on the current price chart, while a sell wall creates a resistance level, showing high pressure to sell assets.

Keep these two terms in mind, as they’ll be useful when we showcase the steps for crypto spot trading strategies.

Trusted Partners

Platforms for Crypto Spot Trading

You’ll need spot trading platforms to execute your desire to buy or sell coins. In general, there are three types of platforms traders use.

- Centralized exchanges (CEX)

- Decentralized Exchanges (DEX)

- Over-the-counter markets (OTC)

Centralized Exchanges

A centralized exchange is an exchange platform where a central authority executes all operations. Binance, Coinbase, Kraken, ByBit, etc., are all examples of CEX.

A centralized exchange is usually intuitive and beginner-friendly, with clearly defined fields on the interface. They also have very high liquidity, making different trading pairs easy to buy and sell.

Decentralized Exchanges

A decentralized exchange or a DEX is the opposite of a CEX. Its whole operation of the spot trading platform is based on peer-to-peer trading, eliminating all central bodies.

Once the project is launched, all operations are executed autonomously, given that all assigned conditions are met.

A DEX spot market directly connects to your non-custodial wallet, allowing you complete control of your funds. DEXs are usually better at resisting manipulation and unexplained price action.

However, DEXs are not yet the norm, leading to a lack of liquidity, especially for large traders. This is why the slippage amount is higher in DEXs when compared to CEXs.

Over The Counter (OTC) Market

When a trader eliminates both centralized and decentralized exchanges for spot trades, it’s known as an over-the-counter (OTC) approach. The buy and sell of an asset happen directly between the buyer and the seller. This goes to show that spot markets exist even without an intermediary.

Depending on the participating parties’ wants, OTC transactions may be executed based on the spot or futures trading prices. Forex is the world’s largest OTC market, with over $5 trillion in volume! In the crypto industry, most institutions opt for the OTC cryptocurrency market.

How to Decide When to Buy an Asset in Spot Market?

Whether you’re crypto spot trading or futures trading, you can’t expect to jump in and buy. Your success as a spot trader depends on your entry’s accuracy and existence.

Successful traders combine fundamental analysis and technical analysis to find areas of value for their trading activities. You did the same to see potential gains.

Fundamental Analysis

Simply put, you look into the “fundamentals” of a project before buying the asset. Information on the developers, total market supply, asset allocation among investors, real-world utility, and plenty of other facts determine the health of a project.

The healthier your choices are, the more likely crypto traders can succeed. Also, following up on current events regarding the project can help make trading decisions more accurate and help you execute trades more precisely.

Technical Analysis

Typically, technical analysis is conducted after fundamental analysis, after the decision to invest in a cryptocurrency trading pair has been made. Technical analysis aims to provide traders with up-to-date and price-action-focused insights to determine entry and exit points.

Remember the buy wall (support) and sell wall (resistance) we discussed in previous sections? Well, it’s a “wall” because that particular price level is very hard to break, and the price often bounces from those levels, creating an area of value for crypto assets.

A support level should be on your radar if you’re looking to buy assets for immediate delivery. But do you place a buy order right at the level? Of course not!

There is no “guarantee” in a trading market. So, you must set conditions through technical analysis to add “confluence” to your trades. The confluences can be price actions like breakout patterns or candlestick patterns. Or, it can be the smart money concept (SMC), an approach widely used by forex and stock spot traders.

Develop a Strategy

Unlike margin trading, you don’t need a rigorous strategy because you follow the “buy low, sell high” method. However, you need a solid risk management plan and position size to see a trading gain. Trading strategies that don’t follow a particular structure are usually never profitable.

Here are some fundamental concepts for developing your strategy before placing buy or sell orders.

- Entry Conditions: Once the price reaches the area of value where both the buyer and seller groups are interested, you need confirmation that the price will increase. Traditional spot markets usually follow bullish candlestick patterns for confirmation.

- Risk-to-Reward Ratio: Part of the management plan for a spot trade is setting a risk-to-reward ratio, also known as RR. It depicts how much your initial investment is and how much you’re looking to make. An RR of 1:3 means you’re risking 1 unit of your portfolio to make a 3-unit gain. Spot traders have the advantage over margin traders because a move in the wrong direction will not liquidate their positions.

- Exit Conditions: Protecting profits is very important. You must have a set target where you want to exit. It’s usually a resistance level tested multiple times on the price chart. The market can continue rising, but the opposite can also happen. It’s always better to be safe than sorry.

Spot Trading vs. Margin Trading vs. Futures Trading

When learning spot trading in crypto, you will also come across terms like margin trading and futures contracts. While the sentiment for all these approaches is the same, the execution is very different.

Margin Trading

Spot and margin are different because margin trading allows a trader to borrow funds from a 3rd party, usually the platform, to enter larger positions than their portfolio allows.

Essentially, you’re taking out a loan and using the loan amount to pay for the trade. You pay interest on the margin loan. On extremely leveraged trades, you risk getting margin calls and a forceful account liquidation.

Futures Contract Trading

Futures are when you purchase a contract based on the speculative future price movements of the underlying asset instead of owning the crypto assets. Unlike a spot trade, there is no spot date or actual asset transfer in futures trading. Margin calls can also happen in this market.

You also don’t pay any interest on the leverage position but fixed trading and funding fees. The CME Group is an example of a traditional market where you can trade futures contracts with borrowed funds.

Summary

Spot markets are undoubtedly the safest place to start for new investors. Traders can only use their money, eliminating the need to pay for interest or collateral. Spot markets exist for long-term holders and short-term traders who properly exercise risk management.

Before putting your hard-earned money into any crypto asset, research the project (DYOR) and understand the market dynamics. Consider this what is spot trading in crypto guide as your gateway into the future of finance.

Spot trading enables users to purchase and sell cryptocurrency simultaneously, making it a convenient method for investors to capitalize on price fluctuations in the crypto market. By quickly executing trades, traders can earn profits in a timely manner, and spot trading provides immediate access to buying and selling coins.

For beginners in the crypto trading world, spot trading may be a preferable choice due to its lower risk compared to futures trading. Nevertheless, if one possesses a solid comprehension of market operations and is willing to assume more risk, futures contracts may present more advantageous prospects.

Spot trading involves purchasing and selling assets at the current market rate, known as the spot price, with the aim of immediately acquiring the underlying asset. Day traders often favor spot market trading due to the ability to establish short-term positions with minimal spreads and no expiration date.