eToro and Binance are two popular exchanges with advanced trading tools that have captured the attention of investors. But how do they work? And what unique features do they have? Which of these exchanges should you choose for crypto trading?

Our experts, with over a decade of experience trading on every exchange under the sun, explore features, security, fees, and user interface to give you the very best!

eToro vs Binance: Brief Comparison

| Features | eToro | Binance |

|---|---|---|

| Coinweb Rating | (4.9 ⭐⭐⭐⭐) | (5.0 ⭐⭐⭐⭐⭐) |

| Supported assets | 80 | Over 600 |

| Ease of use | Simple | Intermediate to complex |

| Security | 2FA | 2FA |

| Transaction types | Limit order, stop-limit order, buy, sell, and swap. | Vast trading options include limit orders, market orders, stop-limit orders, trailing stop orders, post-only orders, P2P, and margin trading. |

| Device compatibility | Web browser and Mobile app | Browser extension, Mobile app, and Desktop software. |

Overview of eToro

What are the main features? eToro is a multi-asset investment platform that is unique with its low trading fees, copy trading features for traders, demo account, social trading features, and support for over eighty (80) digital currencies.

What are the trading fees like? eToro does not charge its customers high fees. However, transactions involving digital assets attract 1% fees.

What digital assets does eToro support? eToro allows users to buy Bitcoin and 79 other altcoins, making the company well-positioned for its customers in Europe, Australia, and Asia. The exchange also accommodates thousands of other financial instruments.

Security of the platform: eToro has a reputable security system. The crypto exchange has several cold wallets where it stores users’ coins. To add an extra layer of security, this crypto exchange makes 2FA compulsory for its customers.

What transaction types does eToro support? eToro supports various types of transactions: limit orders, stop-limit orders, buy and sell, bank transfers, and swaps.

Maximum trading amount: The maximum trading amount varies depending on the asset sold or bought. However, the maximum amount for copy traders is $500,000.

Available locations: eToro’s crypto offerings are available to customers in Australia, Asia, and EU countries. The Australian Securities Commission regulates it.

More details

eToro is a popular online trading platform for crypto assets, stocks, and ETFs, featuring low fees and a user-friendly interface. With a free eToro wallet and social features like messaging boards, users can copy experienced traders and access numerous assets. Take a look at what makes this platform perfect for starting your trading journey.

-

Provides an attractive, communal atmosphere.

-

Offers zero commission on ETFs.

-

Extensive selection of educational resources.

-

Mobile app with trading features.

-

Smooth account opening and bank transfer.

-

Limited number of cryptocurrencies.

-

Limited customer support.

-

No crypto-to-crypto trading pairs.

Pros

- It supports 80 cryptocurrencies, including Bitcoin (BTC) and Ether (ETH).

- It has a built-in digital wallet – the eToro money crypto wallet.

- The copy-trading feature is available, making it an ideal platform for new investors.

- Trading crypto attracts relatively low fees.

- Withdrawal options could be via crypto, ACH, or wire transfer.

Cons

- The platform isn’t available to U.S. residents.

Overview of the Binance Exchange

What are the main features of the Binance Exchange? Binance is unique because it accommodates hundreds of digital assets and allows for the easy trading of these virtual currencies at low fees.

What are the trading fees like? Binance has one of the cheapest fees in the industry. The charges are pegged at 0.1% for crypto and 4.5% for debit or credit card transactions.

How many digital assets are listed on Binance? Binance supports over 600 digital assets.

Security infrastructure: Hot wallet, address white list, two-factor authentication, and FDIC-insured for fiat (US dollar).

Types of transactions: Spot trading, limit order, market order, stop-limit order, and others.

Maximum transaction amount: This varies depending on the cryptocurrency being traded.

More details

Binance is a great combination of low fees, deep liquidity and multiple cryptocurrencies and trading pairs. We have tested every aspect of it and it STILL holds its reign as the top exchange in the world. In our view, it is the perfect crypto exchange for both newbies and advanced traders alike.

-

Biggest exchange in the world.

-

Industry's lowest trading fees.

-

Advance trading options like leverage trading.

-

600+ crypto options, 150+ for the US.

-

Lucrative on-site staking options.

-

Hiccups in account verification.

-

Less regulated than some competitors.

-

The corporate structure is not transparently.

Pros

- Supports over 600 cryptocurrencies which favours traders with diversified portfolios.

- It accommodates different transaction types, allowing users to choose their preferences.

- Just like eToro, Binance supports low trading fees.

Cons

- It lacks a built-in digital wallet.

- Customers in the U.S. can’t access the platform as regulation is a major concern.

eToro vs Binance: Company Overview

eToro was founded by two brothers, Ronen Assia and Yoni Assia, and a third founder, David Ring, in 2007 as a visual FX trading platform. The company expanded into stock and crypto trading in 2013 and 2017, gathering over 30 million users across three continents. Its uniqueness comes from its support of vast crypto assets and its copy-trading strategy, which traders find useful.

Binance, on the other hand, was founded in 2017 by Chanpeng Zhao, and it is the world’s largest cryptocurrency exchange, with a trading volume of $76 billion daily. Regulatory compliance concerns and legal battles with the SEC and CFTC have trailed the exchange.

eToro vs Binance: Features

eToro and Binance have dynamic features. They both have similar transaction patterns and low trading fees. However, they have some intrinsic differences.

eToro presents the following:

- A copy-trading feature and a $100,000 demo account.

- An array of pro-trading tools, including price alerts.

- A secure built-in hot wallet.

- The Popular Investor Program to earn passively.

In comparison, the Binance platform presents vast features such as:

- A comprehensive charting feature with several indicators.

- Seven order types – limit order, stop-loss, stop-limit order, and more.

- An option to use Trust Wallet – a third-party digital wallet integrated into the platform.

- Public API keys for integrating other software applications.

- Promotional emails.

Binance vs eToro: Supported Digital Assets

Both platforms support an extensive range of cryptocurrencies. While Binance supports over 500 digital assets, eToro supports just 80.

Binance and eToro support fiat currencies such as the U.S. dollar, British pounds (GBP), and euros (EUR).

The common crypto assets supported by both platforms include:

- Bitcoin (BTC)

- Ethereum (ETH)

- Tether USD (USDT)

- Dogecoin (DOGE)

- Litecoin (LTE)

- Polkadot (DOT)

- Solana (SOL)

- Polygon (MATIC) and other assets.

eToro vs Binance: Security

Both platforms provide a secure trading environment. However, eToro has maintained an overall reputation for security since its inception in 2007. There has been no formal report of a security breach or hack on the platform, as it stays dedicated to providing optimal service to its customers.

On the other hand, Binance is not consistent with regulation in certain jurisdictions worldwide. Recently, it was fined $2.7 billion by the U.S. Securities and Exchange Commission. Binance has also suffered several security breaches. An instance is the $570 million hack on its blockchain in October 2022.

Both platforms use passwords and two-factor authentication, giving their customers an extra layer of security via the Google Authenticator or short message service. Additionally, eToro stores customers’ coins in cold wallets to safeguard them from security breaches.

eToro vs Binance: Fees

Both eToro and Binance offer some of the lowest fees in the industry, making them even more attractive to traders.

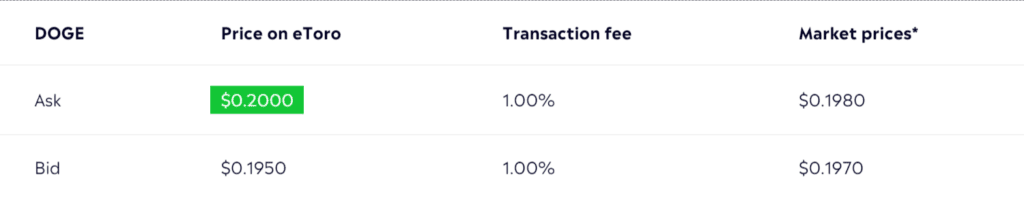

eToro charges a 1% fee for cryptocurrency trading, usually added to the bid-ask spread. It also has a $5 and $30 minimum withdrawal fee for non-Platinum, Platinum+, and Diamond Club members. On top of this, it charges a $10 inactivity fee per month should an account be dormant for up to a year.

Binance uses the maker-taker approach for crypto trades, making the fees the same for both makers and takers. While it charges a standard 0.1% trading fee and 4.5% for debit or credit card transactions, bank transfers are free. Customers with high trading volume can qualify for discounts when they pay the fees with Binance coin (BNB).

The table below is a detailed comparison of the fee structure of eToro and Binance.

| Fees | eToro | Binance |

|---|---|---|

| Wallet | Free | N/A |

| Debit/credit cards | Free with the eToro debit card | 4.5% |

| Automated clearing house (ACH) transaction | Free | Free |

| Wire transfer or bank transfer | Free | Free |

| Cryptocurrency conversion | 1% | Free |

| Staking fees | 0.1% | 20% to 35% |

| Trades | Variable, usually 1% for cryptocurrency | 0% to 0.6% |

eToro vs Binance: Ease of Use

Both crypto exchanges have a significant level of user-friendliness. The account opening process on eToro and Binance takes just a few minutes. The requirements for account setup are a username, email address, and password. Identity verification is mandatory on both exchanges.

Besides having a user-friendly interface, both trading platforms offer unique customer support via a help center, live chat, ticketing system, and frequently asked questions page.

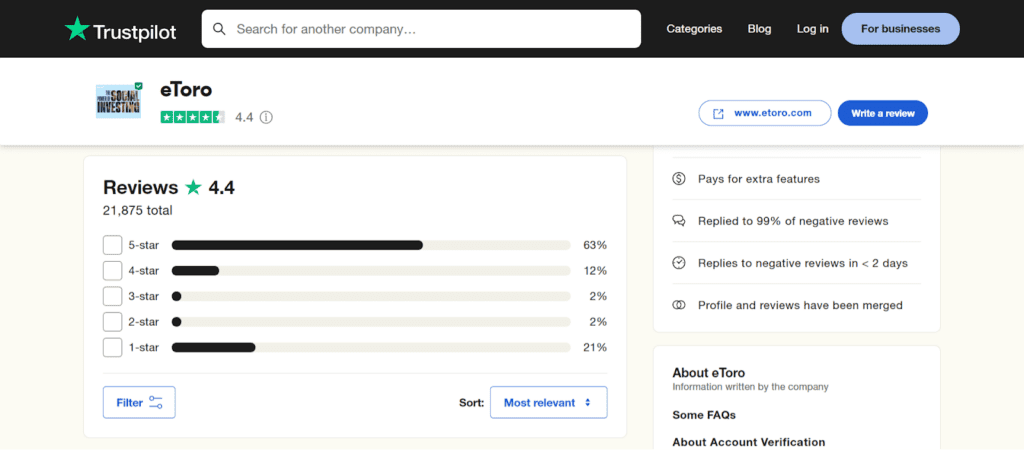

With both companies being global leaders that support millions of crypto investors, they receive positive reviews online from customers on multiple sites. However, some eToro customers have complained about their withdrawal options and hidden fees on Trustpilot.

While Binance promotes trading experience through the Binance Academy, eToro (being a social trading platform) makes its copy-trading feature available to customers.

Final Verdict

While Binance supports vast coins, offers elaborate educational resources, advanced trading tools, and lower fees, eToro leads overall. The platform offers copy trading and demo trading features that make the exchange easy, even for new cryptocurrency traders without significant trading experience.

Winner: Coinweb chose eToro because it has maintained a significant security reputation and complies with regulatory laws across several jurisdictions.

Both trading platforms are secure and form the largest cryptocurrency exchanges by trading volume. However, eToro is slightly safer since digital assets on the platform are held in cold storage.

eToro’s platform has a free digital wallet. You can access it when you create an account and verify your identity.

eToro stores its customers’ coins in cold wallets that do not require an internet connection to work. This reduces susceptibility to hacking.

Binance still faces regulatory issues. In November 2023, the exchange was fined $2.7 billion for violating financial acts such as the Bank Secrecy Act, which it and its founder have since agreed to.

eToro is a secure platform that is safe to use. It has maintained a reputation for securing customers’ funds and complying with regulatory requirements. Binance is secure but faces regulatory compliance issues.