TLDR

Ready to take your trading game to the next level? Leverage trading may be the answer you’re looking for. With the potential for high returns on a smaller investment, it’s an attractive option for traders.

But, as with any trading strategy, leverage trading comes with significant risks. To mitigate these risks and improve your chances of success, it’s essential to implement effective risk management tactics. These are stop-loss and take-profit orders, careful position sizing, and avoiding excessive risk.

If you’re ready to dive into leverage trading and learn strategies, keep reading to discover the tips and tricks needed.

What is leverage trading?

Leverage trading is a popular practice used by investors to enhance their exposure. This is done without putting up the entire amount of capital required for the trade.

Traders can boost their purchasing power and trade with more capital than they could by borrowing money from an exchange.

By using their funds in a margin trading account, traders can enhance their trading leverage, which might result in bigger profits. This is particularly true in a down market when prices are declining, and conventional buy-and-hold methods might not be as successful.

Leveraged trading, however, carries a higher risk and should only be employed by seasoned traders aware of the dangers associated with crypto derivatives.

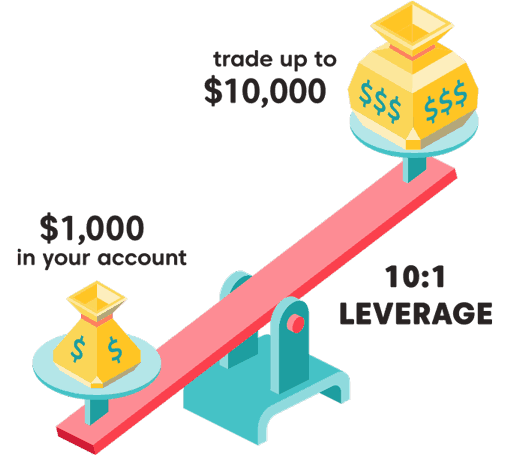

Trading with leverage varies slightly from trading on margin in that it enables traders to increase their potential gains and losses. A ratio, such as 1:100, expresses the leverage a trader can utilize, unlike regular trading. This ratio shows how many times the initial capital is multiplied.

At a leverage ratio of 1:100, for instance, a trader may manage a position worth $100,000 using just $1,000 of their own money.

Leverage trading enables traders to make more money with a lower initial investment. Still, it also has market volatility and raises the possibility of losing more money than you initially put up.

Which platform is the best for leverage trading?

For leveraged trading, ByBit is the go-to choice for our experts. This platform is simple for traders of all skill levels and has a user-friendly interface. It offers up to 100x leverage on different cryptocurrency pairs.

ByBit is a trusted and reputable choice for people interested in leveraged trading due to its high liquidity, variety of order types, and minimal trading costs.

Check out our comparison list of the best leverage trading platforms here.

More details

Bybit is a leading futures trading platform globally, offering up to 100x leverage and attracting users who prefer to remain anonymous. With a presence in 180+ countries, it is renowned for its efficiency and unique features in cryptocurrency derivatives trading.

-

The platform offers up to 100x leverage trading.

-

Strong educational resources.

-

Diverse markets for traders, spot, perp, and futures.

-

Risk-free demo accounts to explore all key features.

-

TradingView integration.

-

The platform is difficult for beginners to navigate.

-

It does not offer a quality spot trading feature.

-

The NFT marketplace is limited in terms of options.

-

Security is of the gold industry standard.

More details

BitForex provides an extensive selection of cryptocurrencies with high trading volumes at low fees. It offers a user-friendly trading terminal, a mobile application for trading, and the option to trade through MT5. The platform caters to beginners with a demo account and experienced traders with leverage trading and tradable perpetual contracts.

-

Low fees and high liquidity options for users.

-

User-friendly mobile app.

-

300 trading pairs and diverse digital assets.

-

Offers leverage up to 100x.

-

High-security, including 2FA and cold wallets.

-

Slow customer support than other platforms.

-

Lacks transparency.

-

Some outdated features.

More details

StormGain is an all-in-one online crypto trading platform. It allows traders to trade and mine cryptocurrencies simultaneously. Other than that, it offers high-leverage trading, a demo account, trading signals, integrated crypto exchange, wallets, and many more. Also, it has zero commissions. These features from StormGain will benefit traders to earn a higher income efficiently.

-

Mine cryptocurrency without needing equipment.

-

50k USDT demo account for practice.

-

Low trading fees.

-

Provides high leverage for traders.

-

Faces high leverage risk.

-

Limited support of trading pairs.

More details

eToro is a popular online trading platform for crypto assets, stocks, and ETFs, featuring low fees and a user-friendly interface. With a free eToro wallet and social features like messaging boards, users can copy experienced traders and access numerous assets. Take a look at what makes this platform perfect for starting your trading journey.

-

Provides an attractive, communal atmosphere.

-

Offers zero commission on ETFs.

-

Extensive selection of educational resources.

-

Mobile app with trading features.

-

Smooth account opening and bank transfer.

-

Limited number of cryptocurrencies.

-

Limited customer support.

-

No crypto-to-crypto trading pairs.

How does leverage trading work in crypto?

To use leverage when trading crypto, you must deposit a sum of money (collateral) into your trading or exchange account first.

Collateral requirements change based on the margin (the difference between the value of the position you want to open and its entire value) and the leverage (how much you want to use the leverage).

You must fund your trading account before you can engage in leveraged trading. Using a leverage ratio of 5:1, the minimum margin necessary to make a $5,000 investment in Ethereum (ETH) would be $1,000. Because of this, the minimum collateral required to open the position is $1,000.

While using leverage, the margin needs to drop. To open the same $5,000 position with a margin call leverage ratio of 10:1, you only need to deposit $500 as security.

You’ll need to determine a maintenance margin threshold in addition to the initial margin deposit. Your position will not be liquidated if the market goes against you and your margin falls below the threshold. Putting extra money into your margin account may be necessary if this occurs.

It’s crucial to remember that leverage trading always carries the potential for substantial risk and can result in losses that far outweigh the initial investment made. You should only engage in leverage trading if you are prepared for the potential downsides and thoroughly understand the risks involved.

Crypto leverage trading in long and short positions

Leverage trading can be utilized for both long and short positions in crypto trading. A long position leverage in crypto trading is taken when you expect the asset’s price to rise, while a short position is when you anticipate the asset’s price to decrease.

Long positions

Crypto leverage trading allows traders to take long positions with borrowed funds. A long position is when a trader anticipates the price of an asset to increase. To illustrate, suppose you want to invest $5,000 in Ripple (XRP) with 5x leverage. This means you only need to deposit $1,000 as collateral.

If the current market price of XRP rises by 10%, you could earn a profit of $500 (10% of $5,000) plus any fees or interest charges associated with the leverage. This is a much higher profit than you would have made with your initial investment of $1,000 without leverage.

However, leverage trading can magnify losses as well. For example, if XRP drops by 10%, your position could incur a loss of $500 plus any fees or interest charges associated with the leveraged trade. If your collateral falls below the required margin threshold, your position will be liquidated, and you will lose your entire investment.

Short positions

Trading with cryptocurrency leverage is also possible for short positions, in which investors expect an asset’s price to fall. Imagine you want to open a $5,000 short position with a 5x leverage on Ethereum (ETH). This implies that you will borrow ETH from someone and then sell it for the going rate.

With a $1,000 deposit as collateral and a 5x leverage, you can sell $25,000 worth of ETH. You can buy back the same amount of ETH at a lower price, return it to the lender, and retain the difference as profit if the price of ETH lowers by 10%.

But, you would have to buy back the same amount of ETH at a greater price than you paid for it if the price of ETH rose by 10%.

Your position will be liquidated, and you will suffer a loss if the price rises further and your collateral drops below the necessary margin barrier.

What are the advantages of leverage trading?

Trading with leverage has several benefits for investors who want to increase their assets and potential profits. Some of the main benefits of leveraged trading are listed below:

- Higher Profits: One of the key advantages of leverage trading is that it allows traders to make considerably bigger earnings with a smaller starting investment. Because they only have to cover a small fraction of the entire cost of an asset when using leverage, traders may be able to generate higher returns.

- More Assets: Leveraged trading lets investors diversify and make more money by buying more assets with less money. These benefit traders who trust their investment ideas and aim to maximize profits.

- More Flexibility: Leverage trading helps traders close more deals and profit from abrupt price changes. This may assist momentum traders in capitalizing on the market’s quick price changes.

What are the disadvantages of leverage trading?

While leverage trading offers several advantages, it’s important to know the potential disadvantages before getting involved. Below are some of the key disadvantages of leverage trading:

- Higher Losses: Leverage trading has several disadvantages, including the potential for greater losses than conventional trading. In this trading style, high leverage ratios can magnify losses and cause a significant decline in your trading account balance if the market swings against you.

- Difficult for New Traders: Leverage trading presents a significantly high risk, making it challenging for novice traders to understand. Inexperienced traders could make costly errors and incur losses since they don’t completely comprehend the hazards.

- Psychological Traps: Psychological traps that affect traders’ decision-making ability can also be present in leverage trading. For instance, traders can try to compensate for losses by enlarging their position, which could lead to even bigger losses. Keeping your cool and trading with reason is critical to avoid these pitfalls.

Leverage trading strategies to manage the risks

Leverage trading can be a lucrative way to maximize your profits and investment portfolio. It also comes with significant risks. Here are some strategies to help you manage the risks of leverage trading and ensure a profitable trading strategy:

Stop-loss orders

The employment of stop-loss orders is a useful risk management strategy. A stop-loss order helps you limit losses if the whole market moves and goes against you by automatically closing your position at a specific price. Due to the potential for increased losses in leveraged trading, this is very crucial.

Take-profit orders

Using take-profit orders is an additional tactic to think about. A take-profit order helps you lock in profits before the crypto market or conditions change by closing your position when your specified profit level is reached. This can be useful for a proper risk management strategy in erratic cryptocurrency markets.

Position sizing

Properly sizing your positions is another key strategy for managing risk in leverage trading. By carefully planning out your position sizing, you can avoid situations where you could lose a significant percentage of your trading capital in one unsuccessful leveraged trade.

Never risk more than you can afford to lose

It’s also important to remember that leverage trading in crypto markets carries significant risk. You should never invest more funds in the crypto market than you can afford to lose.

Limiting your risk to no more than 5% of your crypto portfolio when trading on a crypto exchange is a good idea.

Crypto leverage trading is a trading method that enables traders to amplify their market exposure without having to commit the full amount of capital required. This approach involves borrowing funds from a broker, enabling traders to trade more substantial positions and potentially earn higher profits.

While leverage trading may result in higher profits, it's important to note that future price movements are unpredictable. Crypto leverage trading is particularly risky due to the high volatility of digital assets compared to stocks or precious metals.

Undoubtedly, leveraging cryptocurrencies can be a lucrative trading approach. However, traders should evaluate their risk tolerance and devise a well-thought-out strategy before undertaking leverage trading. Moreover, they should exercise caution while trading with borrowed funds.