TDLR

In essence, Bitcoin leverage trading allows you to borrow funds using your deposited capital as collateral. However, using high leverage can quickly lead to losing funds, making it crucial to consider low leverage to minimize liquidation risk.

Fortunately, the registration process for most leverage trading platforms is straightforward, and there are dedicated exchanges that offer leverage trading with reputable brokers.

But to make the most of this trading strategy, effective risk management is crucial. By implementing strategies to manage the risks, you can minimize your losses and maximize your gains.

So, suppose you’re considering bitcoin leverage trading. In that case, it is essential to educate yourself on the risks and benefits and approach them with a sound strategy to make the most of this exciting opportunity.

Introduction

Over the last few years, Bitcoin and the crypto ecosystem have grabbed much attention globally. This buzz can be linked to the incredible strides recorded in the market. Not only have people considered buying and holding cryptocurrencies, but they have also looked in the trading direction. Because of this, leverage trading has become one of the most popular types of trading despite the current market price of Bitcoin.

Leverage trading in crypto may have been widely adopted as one of the most popular trading strategies. However, this kind of trading may be complex for beginners or complete newbies to the crypto market.

Leverage trading may not be complicated for those with experience in conventional markets. But this article will not only focus on crypto leverage trading. Instead, it would touch on how to start with Bitcoin leveraged trading, creating a risk management strategy, and managing capital in 2023. But before all that, let’s define what leverage trading in crypto entails.

What Is Leveraged Trading?

In general, leverage trading means using borrowed funds to make potential profits while paying interest on the borrowed capital. Leverage trading also required the services of a broker and a crypto exchange. This is because a trader needs to borrow through a broker if the initial capital is not enough.

But you need to understand specific terms as someone who wants to borrow money. The most important term one needs to understand is the leverage ratio. So, what does this mean?

By definition, the leverage ratio describes the number of times your initial capital gets multiplied. So, let’s assume that you get a ratio of 1:20. This means that you would only require $100 to trade Bitcoin with $2000. It’s the same case with a 1:30 ratio, which offers an extra $5800 more capital to a trader with a $200 initial capital.

How Leverage Trading Works In the Crypto Markets

Leveraging trading crypto like Bitcoin is unlike the method of trading cryptocurrencies that beginners know. This requires a lot of learning and patience as it comes with increased risk. So, how do traders leverage trade Bitcoin?

The first step to getting ahead is to find a crypto exchange that offers access to crypto derivatives. After this, register, verify, and fund your trading account. The exciting part is that you may intend to leverage trade Bitcoin, but you don’t necessarily need to buy Bitcoin with your initial capital.

The next step is to provide your trading capital to borrow more funds. However, it would help if you decided how much leverage you intend to use to get extra funds. So, for example, you want a 1:10 leverage from the $200 you deposited. All you need to do is use your funds as collateral so you can make leverage trades with $2000.

But if you are entirely new to trading cryptocurrency, it would be best not to exceed the 1:10 margin threshold. This is because of the crypto market volatility and unpredictable conditions. So, exercise extreme caution not to record significant losses when trading.

How to not get liquidated

That said, how do you avoid being liquidated? First, you must manage risks. This is the most crucial rule in any trading. Other things to keep in mind include the following:

- Familiarise yourself with the trading platforms.

- Learn different trading methods.

- Equip yourself with a risk management tool.

- Begin with a lower initial investment.

- Use lower leverage than high leverage.

- Set a maintenance margin.

So, if you follow these rules, you have a low chance of getting liquidated by the market. But if the market does not swing in your favor, you must add more money for negative balance protection.

How you can begin to leverage trading crypto in 2024

Step 1: Choose a Crypto Leverage Trading Broker

The first step is to familiarise yourself with trading on crypto exchanges. However, not every account can work as a platform for Bitcoin leverage trading.

So, first thing first, do your research about platforms that offer crypto leverage trading. The good thing is that we have already done that for you.

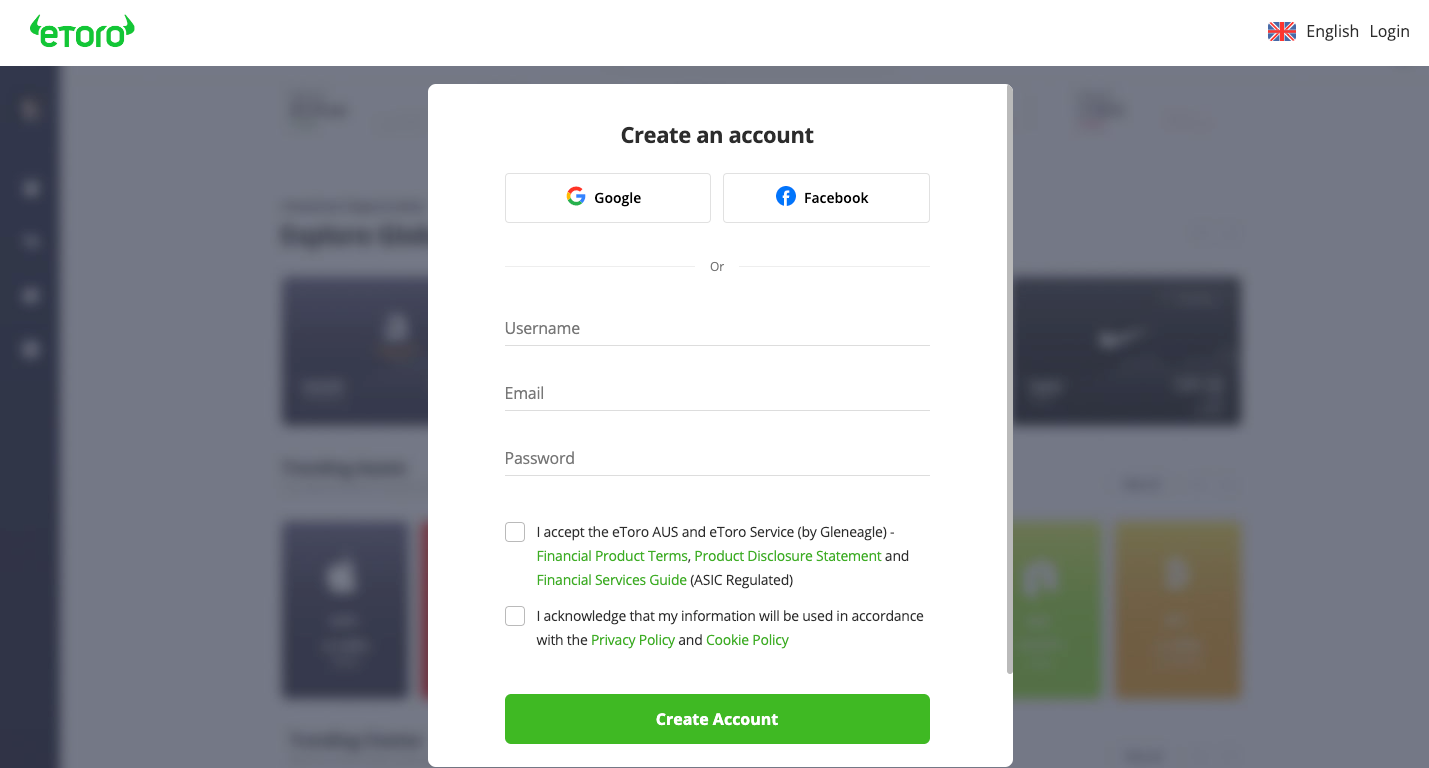

An excellent example of such a platform is eToro. The eToro platform is a broker that allows the leverage trading of Bitcoin and other digital assets. Interestingly, it is suitable for both beginners and experienced traders.

So, all you need to do is register and verify your account to get started. If you don’t have an eToro account, check out this easy step-by-step guide.

More details

eToro is a popular online trading platform for crypto assets, stocks, and ETFs, featuring low fees and a user-friendly interface. With a free eToro wallet and social features like messaging boards, users can copy experienced traders and access numerous assets. Take a look at what makes this platform perfect for starting your trading journey.

-

Provides an attractive, communal atmosphere.

-

Offers zero commission on ETFs.

-

Extensive selection of educational resources.

-

Mobile app with trading features.

-

Smooth account opening and bank transfer.

-

Limited number of cryptocurrencies.

-

Limited customer support.

-

No crypto-to-crypto trading pairs.

You can also consider others like ByBit.

More details

Bybit is a leading futures trading platform globally, offering up to 100x leverage and attracting users who prefer to remain anonymous. With a presence in 180+ countries, it is renowned for its efficiency and unique features in cryptocurrency derivatives trading.

-

The platform offers up to 100x leverage trading.

-

Strong educational resources.

-

Diverse markets for traders, spot, perp, and futures.

-

Risk-free demo accounts to explore all key features.

-

TradingView integration.

-

The platform is difficult for beginners to navigate.

-

It does not offer a quality spot trading feature.

-

The NFT marketplace is limited in terms of options.

-

Security is of the gold industry standard.

NB! Leverage trading is not legal in all regions. So, ensure that you familiarise yourself with the regulations in your region before signing up or committing your funds to a prohibited platform.

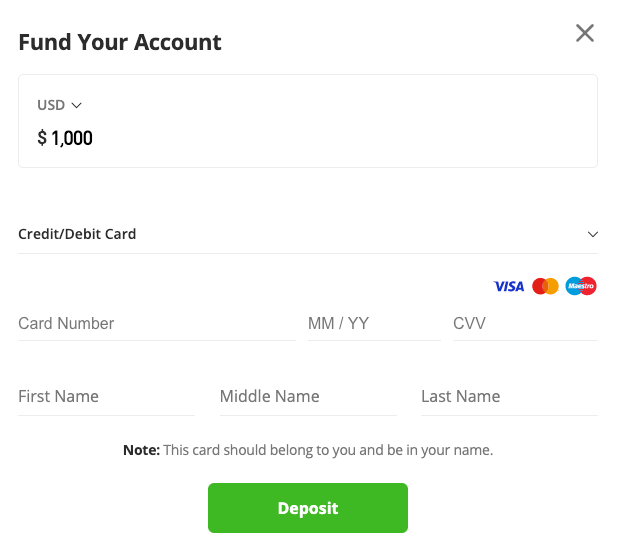

Step 2: Deposit Your Funds

The second step after verification is to deposit your desired capital. Some platforms have a minimum deposit requirement. So, do well to confirm this information before making your final decision.

Simultaneously, you need to confirm that the available deposit options are the ones you can access. If not, you would have wasted time going through the registration process.

Step 3: Start Trading

Lastly, you can start trading once your deposit is reflected in your trading account.

However, you must move some of your funds to your margin account. This step is necessary so you can borrow funds.

Since you borrowed funds from a broker, the gains you make are now both your profits. So, ensure you do not skip the steps to take profit orders.

Crypto Leverage Types On Your Trading Account

There are two ways traders can leverage trade Bitcoin.

- The first is to open a long position.

- The second is to open a short position.

In this section, you will learn about the difference between both.

Crypto Leverage Trading: A Long Position

Leverage trading Bitcoin into a long position expects the asset price to increase. For instance, let’s assume you bet on the Bitcoin price, so you open a long position for $1,000 with 10x leverage. In this case, your collateral is $100. But you have the potential to make $300 in profits in the Bitcoin price increases by 30%.

However, if you lose the trade, your account will be down by $300. And since your collateral is only $100, you could get a margin call or be liquidated quickly.

Opening a Short Position

Unlike a long position size, opening a short position for a Bitcoin leverage trade is anticipating that the asset’s price will fall. So, imagine you open a short position size for $1,000 with 10x leverage. Like the first example, your leverage collateral is $100.

So, when the Bitcoin price decreases, you make profits. But you will be liquidated if the Bitcoin price increases far above the required margin. All in all, you need to consider your buying power and how the market moves so you can efficiently manage risk.

How Does Leverage Trading Differ From Margin Trading?

You may have thought that leveraged and margin trading are the same, but that’s not factual.

In this section, we will quickly explain the difference between both concepts.

While leverage trading in crypto allows you to access credit facilities provided by the trading platform, margin trading involves using your initial capital from the crypto exchange. So, consider this when you go into the crypto derivatives market to leverage trading Bitcoin.

Pros and Cons of Leverage In Crypto Trading

For many traders, leveraged trade is one of the fastest ways to make money with Bitcoin. Nonetheless, it may also be one of the fastest to lose funds, including borrowed money. So, what are the advantages and disadvantages of trading cryptocurrencies using leverage?

Pros

- Access to borrowed capital with little to no hassle

- Opportunity to increase your investment portfolio within a short period

- Ability to make gains irrespective of asset’s price and market moves.

Cons

- Massive losses without proper risk management

- It can be challenging for beginners to understand.

How to Manage Risks With Leveraged Trades

You might get carried away with the excitement of making profits when you trade crypto. So, in this part of the article, we will highlight a few ways you can avoid situations where the margin falls below the maintenance threshold.

- Set a take-profit order.

- Use the stop-loss feature.

- Only trade with money you can afford to lose.

- Plan your trading objectives by considering your position size.

Final Words

In conclusion, leverage trading Bitcoin or any other cryptocurrency can be exciting and risky at the same time. However, you must understand that you need a lot of education and practice to excel in the venture. So, we implore you not to depend on this article alone as you can also further your research.

Regardless, let’s refer to a few pointers. Leverage trading allows you to borrow funds while using your deposited capital as collateral. You can either choose to open a long Bitcoin position or a short position. Opening a short means you expect the Bitcoin price to decrease, while a long means you are betting on a price increase.

Irrespective of how excited you might be, remember that you can get liquidated, and using high leverage can drive you faster that route. Carry out due diligence.

The leverage available for crypto trading is typically expressed as a ratio. For instance, by applying 1:10 leverage to a crypto trade, the trader can increase their position size by ten times. Notably, some crypto exchanges provide leverage positions exceeding 1:100!

By using 10x leverage, we can purchase $1,000 worth of stock while putting in only $100 of our own money. For instance, a $100 investment with 10x leverage yields $1,000 in purchasing power for stocks.

Expert traders commonly advise not to risk more than 3-5% of trading capital per trade, regardless of how promising the trade appears. This is because no trade can guarantee a positive outcome, and overextending oneself with leverage can expose their wallet balance to significant risk if the trade goes against their prediction.