TokenTax Review 2024: Can It Help You File Tax For Crypto?

Before we move on to our detailed TokenTax review, let’s look at the platform’s highlights. In short, it integrates directly with crypto exchanges, wallets, and other tax software. This helps import your transactions, calculate capital gains or losses automatically, and evaluate any tax liability.

TokenTax Overview

| Aspects | Details |

|---|---|

| Coinweb Rating | ⭐⭐⭐⭐ (4.4) |

| Founders | Alex Miles and Zac McClure |

| Launching Year | 2017 |

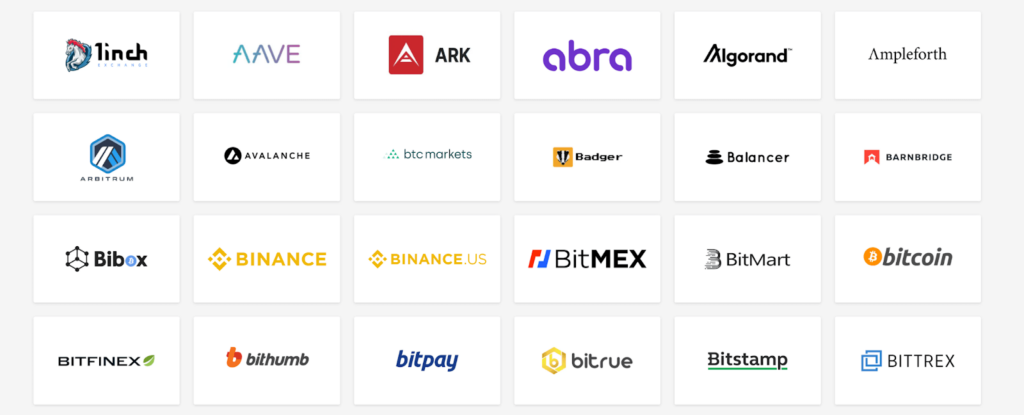

| Integrations | 120 integration, including wallets and exchanges such as Binance, Coinbase and KuCoin |

| Cost | $65 – $2,999 per. year. Customized enterprise plans are also available. |

| Features | One-click tax form generation, digital assets tax calculation, audit trail reports, and tax loss harvest. |

What Is TokenTax?

Co-founded in 2017 by Alex Miles, TokenTax is software designed to resolve all your crypto tax complexities.

Initially, TokenTax only imported data from Coinbase. It also won the Product Hunt Global Hackathon award in 2017. In 2019, it successfully acquired Crypto CPAs, an accounting tax firm, to broaden the scope of its services and increase supported exchanges like Binance and Bitcoin.

Today, it offers accounting and crypto tax services to crypto investors worldwide according to their tax laws and deadlines. The platform also has tax guides and consultants to answer any tax-related queries. TokenTax aims to make mainstream adoption of cryptocurrency as convenient as possible.

What Are the Advantages of TokenTax?

Here are some benefits of using this software for calculating your tax. These features are important to consider in any TokenTax review.

Convenient Tax Calculation

This tax filing software has a user-friendly design that allows you to understand it. Even if you are a non-technical user, you can easily generate all your tax forms, like Form 8949 and FBAR, in TokenTax. With a click of a button, export them to TurboTax or TaxAct. This allows you to easily file taxes according to the IRS audit assistance or any local agency, saving you time and effort every tax season.

Easy Integration with Exchanges

TokenTax tax software helps you integrate with most decentralized and centralized exchanges. These crypto exchange integrations pull all your transactions directly from the exchange to calculate your taxes.

In addition, you can also connect your NFT or digital assets wallet with TokenTax to import any trading data or missing data required for tax preparation. You can look at the complete list of TokenTax integrations here to pay taxes seamlessly.

Prevents Tax-related Violations

This tax software complies with all IRS tax authorities and regulations and generates important IRS forms required to file US tax liabilities. Since it follows all the rules, using TokenTax saves you from violating any tax-related law.

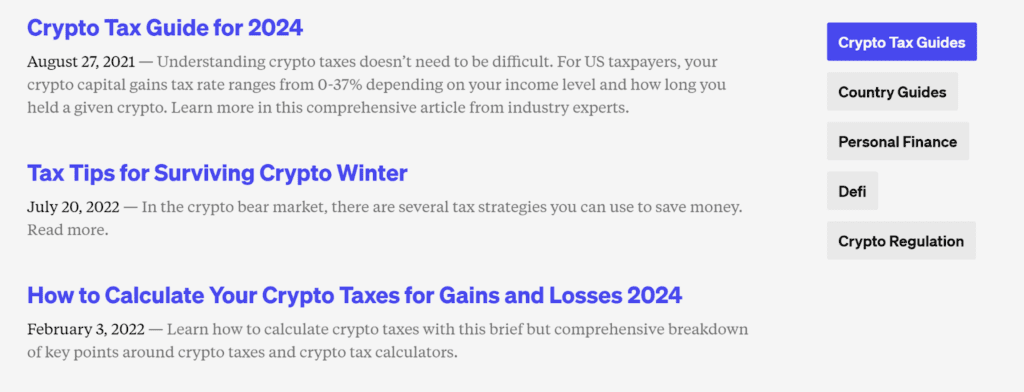

Increase Crypto Knowledge Through Guides

If you want to learn about crypto taxes, the Crypto Tax guide on TokenTax is a perfect way to start.

Similarly, the DeFi and NFT Tax guides give you an overview of the procedure to file taxes for these products. Increasing crypto knowledge through these sources helps you build confidence and trust in the entire tax calculation process.

Who is TokenTax For?

TokenTax’s software is great for the following.

- Beginner Investors: If you identify as a beginner trader, this crypto tax software offers its Basic Plan. It is enough for most investors to use Coinbase or Coinbase Pro to generate their gain/loss reports. However, you must jump into their Premium Plan if you use exchanges or wallets other than Coinbase.

- Advanced Investors: If you are an institutional or advanced investor, TokenTax offers VIP and Pro plans with various features like calculating margin trading taxes and direct consultations with tax experts. These plans are suitable for investors with a large number (over 1000) of transactions from various exchanges.

- Accountants: Accountants can use TokenTax to calculate their clients’ crypto taxes and help accountants fill out a relevant crypto tax form online. In addition, the guides available on TokenTax’s websites are great resources for brushing up on crypto tax intricacies.

TokenTax Pricing Plans: Which One is Right for You?

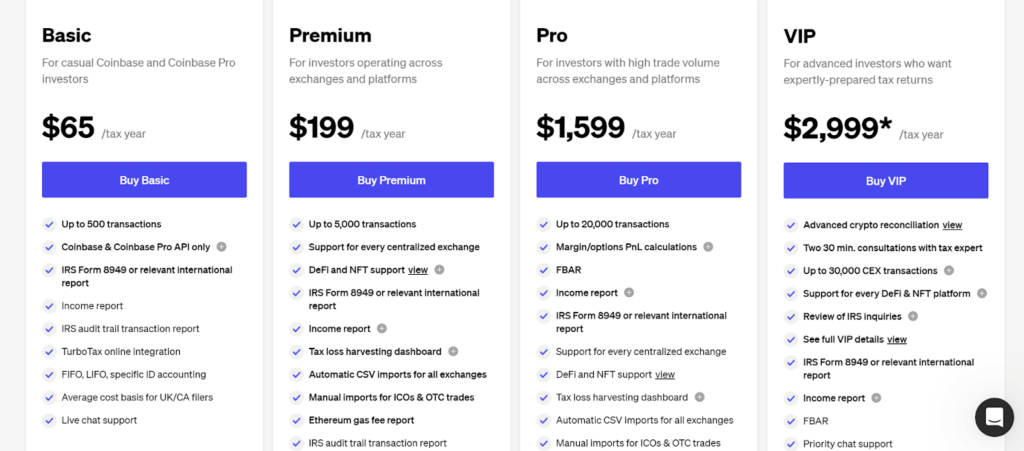

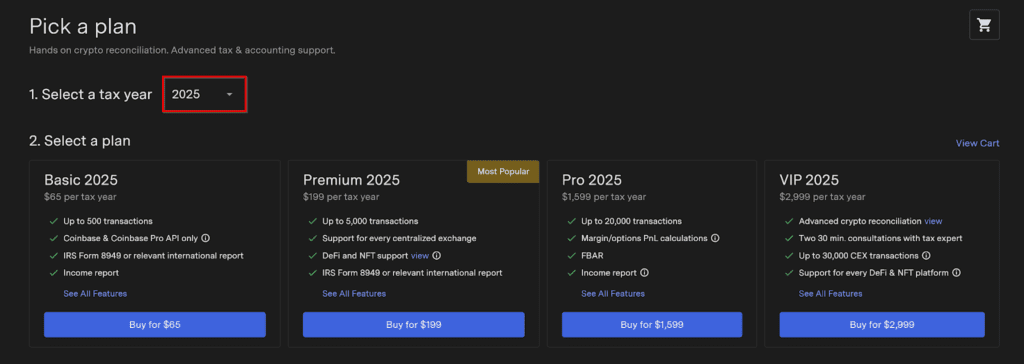

The platform offers five different membership plans with notable benefits.

Basic Plan – $65/year

The Basic plan is designed for Coinbase Pro and Coinbase investors. Priced at $65 per year, it offers features like generating a staking income report and forms, integration with TurboTax, and live chat support. The plan supports up to 500 transactions.

Premium Plan – $199/year

If you are dealing with exchanges other than Coinbase, choose the Premium plan for $199 per year and get support for up to 5,000 transactions. It offers support for all centralized exchanges, a Tax Loss Harvesting feature, and relevant reports from a tax expert.

Pro Plan – $1,599/year

The Pro plan costs $1,599 per year. This is ideal for investors with high crypto trading volume. It supports 20,000 transactions with advanced features like Margin trading/Options profit and loss calculations.

VIP Plan – $2,999/year

The VIP plan may tick all the right boxes if you need expert-level calculation of your tax returns. With this program, you can import 30,000 transactions at a time for $2,999 per year. Additionally, you can take two 30-minute consultation sessions with a tax expert.

Enterprise Plan

Finally, you can opt for the Enterprise plan if you are a large crypto investor or a high-net company. This custom-made program will tackle your crypto tax problems via a dedicated team. This plan has no standard pricing, as the charges depend on your required assistance.

| Plan | Number of Transactions | Price/Tax Year | Integrations |

|---|---|---|---|

| Basic | 500 | $65 | Coinbase and Coinbase Pro |

| Premium | 5000 | $199 | NFT imports, DeFi, and all CeFi exchanges |

| Pro | 20,000 | $1,599 | NFT imports, DeFi, and all CeFi exchanges |

| VIP | 30,000 | $2,999 | Pro/Premium + every DeFi and NFT platform |

| Enterprise | Unlimited transactions | Custom pricing | Pro/Premium + every DeFi and NFT platform |

TokenTax Review: Top Features

Here are the most prominent features of this tax software.

Integration with Crypto Exchanges, Wallets, NFTs, and DeFi

TokenTax integrates with most Web3 wallets and centralized exchanges, including popular ones like Binance and Coinbase. You can also easily import transaction data from Web3 crypto wallets like Phantom or MetaMask.

Go to the crypto tax software API import page to find the list of wallets available for integration. You can also connect your NFT wallet with TokenTax to import all the relevant data. This makes it easy to calculate all the capital losses and gains on your NFT transactions.

This imports all crypto transactions to one page instead of tracking them manually one by one to prepare a tax bill.

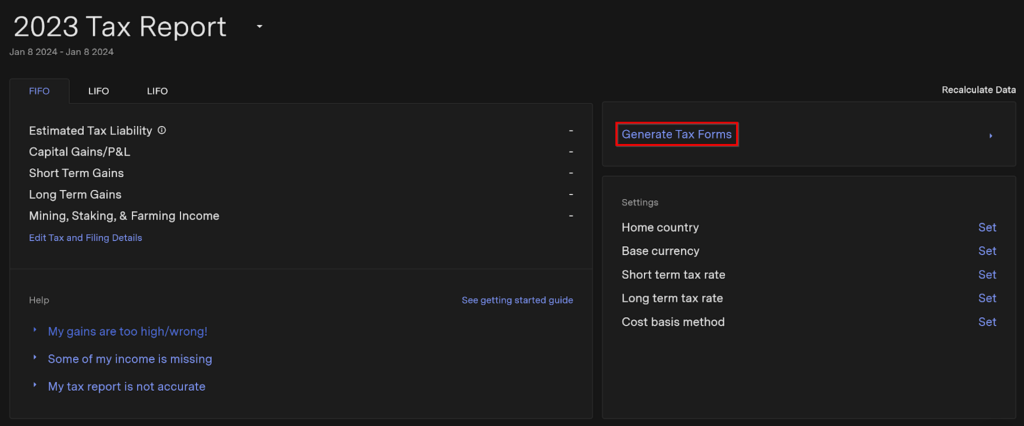

Tax Forms Generation for Capital Gains

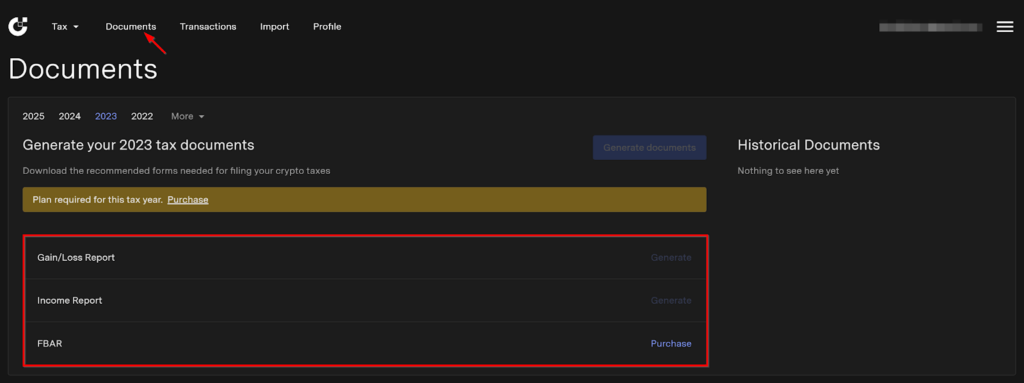

TokenTax generates all forms – capital gains and losses are reported on Form 8949. Additionally, you can generate forms like your Income Report and FBAR.

Once logged in, the tax dashboard has a [Generate Tax Forms] button in the top right. Click on the button and create forms to fill them later for tax filing. This form generator supports the FIFO ( First in, First out) and LIFO (Last in, First out) cost-basis asset valuation methods.

Another prominent feature of TokenTax is its ability to calculate capital losses and gains. It achieves this through the platform’s integration with TurboTax.

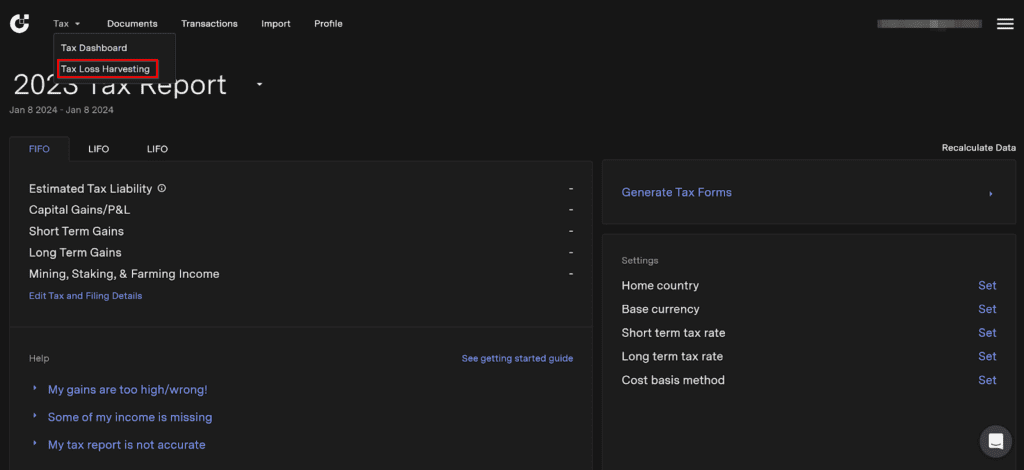

Harvesting of Tax Loss

Harvesting of tax loss reduces the amount of liable capital gains taxes. As a result, you can get a reduction in your tax.

This crypto tax software has a tool, the Tax Loss Harvesting Dashboard, to analyze your transaction history, find unrealized losses, and look for profitable tax loss harvesting opportunities.

You can access this tax dashboard by clicking [Tax] in the top left corner and choosing [Tax Loss Harvesting].

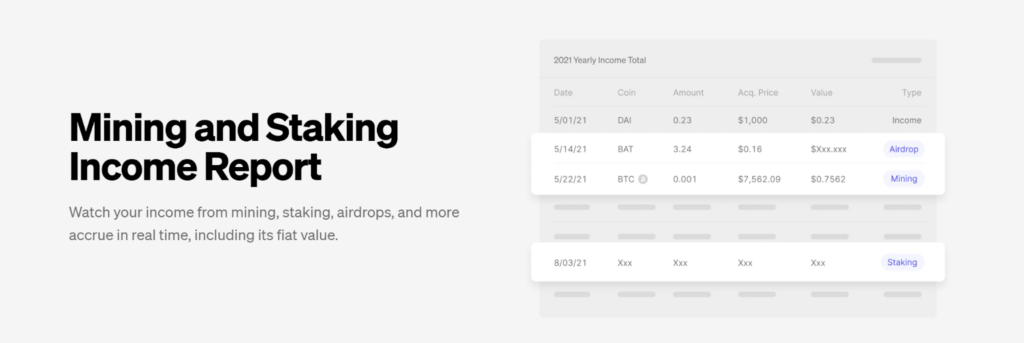

Staking and Mining of Income Reports

Do you earn crypto from staking or mining activities? If yes, this crypto is taxable and must be reported in Form 1040 while filing taxes.

Courtesy of this feature, the software automatically separates transactions related to staking and mining as you import your data. This saves you the hassle of monitoring transactions and putting them in the right form for staking income reports.

Generate ETH Gas Fee Report

You pay a gas fee whenever you make a transaction on the Ethereum Blockchain. You can deduct this fee as an expense to reduce your tax burden.

TokenTax helps you identify the deduction automatically by generating ETH Gas reports after importing data. This saves you the time you would have spent calculating the fee manually or checking other ETH gas tools. Remember that this feature is only available in the Premium plans and above.

Audit Trail Report

TokenTax allows you to generate your Audit Trail Report. These reports mentioned when a crypto token was bought, along with its price and quantity. Using these reports, you can easily calculate gains and losses manually. This is especially helpful if you are filing taxes on your own without the help of a professional.

Support from Tax Professionals

TokenTax allows you to hire one of their crypto tax experts or Certified Public Accountants (CPAs) to resolve complicated tax problems.

You can ask them about crypto data importing, account billing, and taxes. The professionals can even manually file your tax if requested.

How to Get Started with TokenTax?

Follow these steps to get started with this crypto tax software.

More details

TokenTax is a robust software that calculates your crypto tax by integrating with over 120 crypto exchanges and wallets. It comes with many features like one-click tax form generationm tax loss harvesting and reduces your tax liability. We recommend this software to crypto investors seeking a hassle-free tax filing experience.

-

Quick integration with TaxAct and TurboTax.

-

Certified CPAs offer consultations.

-

Easy-to-use tax filing software.

-

All tax services comply with IRS regulations.

-

Effortlessly Integrates with many exchanges.

-

No free plans are available.

-

Relatively more expensive than competing software.

-

Fewer integrations with third-party software.

Step 1: Visit the TokenTax Website.

Visit the TokenTax.co website and tap the [Get Started] button on the home page.

Step 2: Enter Your Details

Enter your email address and set a strong password. Click on [Sign up] to make an account.

Step 3: Pick a Plan

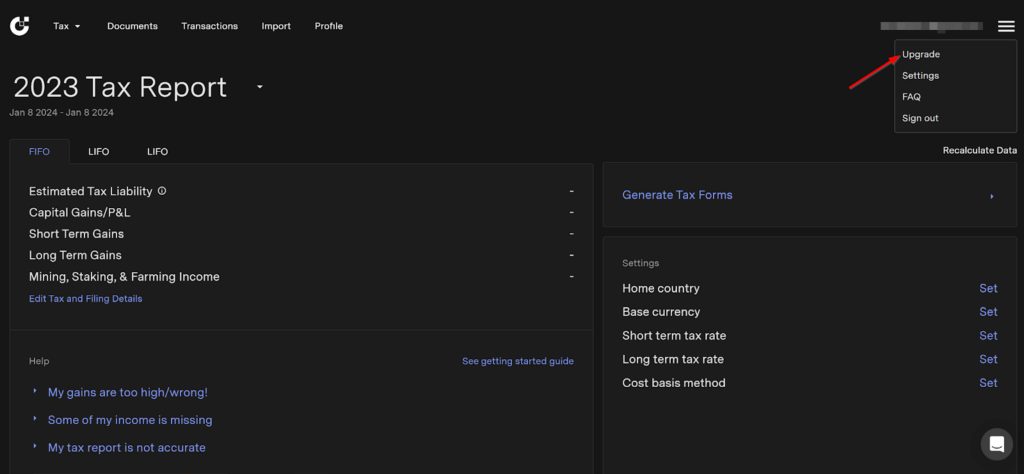

Once you have logged in, click on the menu button in the top right corner and click [Upgrade].

Now, set your tax year, choose a plan, and proceed to pay for tax filing.

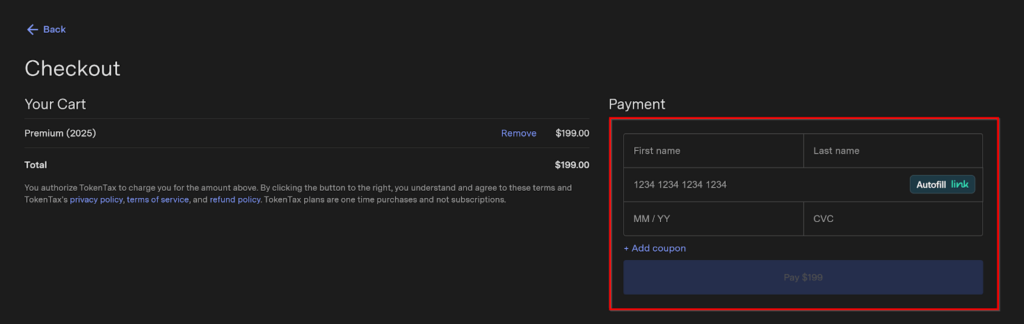

Step 4: Make the Payment

Add your payment details and click on [Pay].

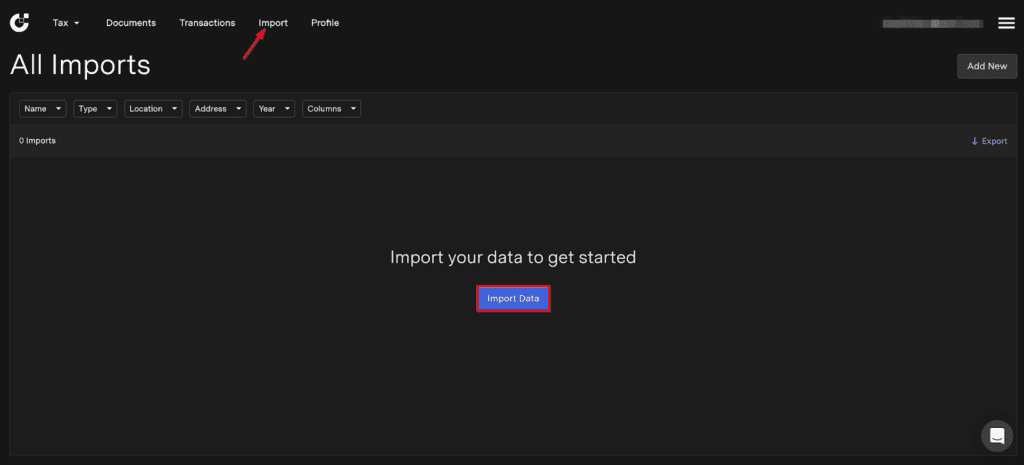

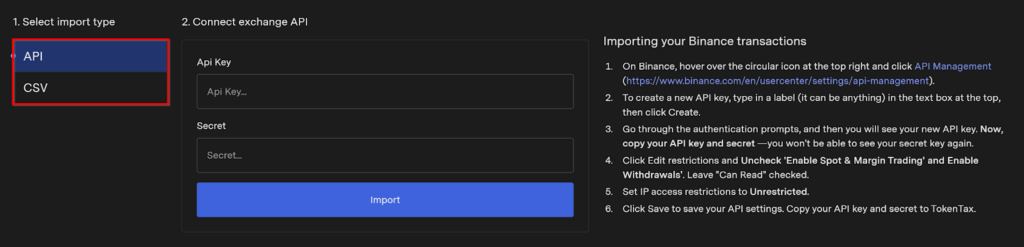

Step 5: Import Your Crypto Transaction Data

Go to [Import] in the top menu bar and select [Import Data].

From here, you can import your transaction data from any supported exchange or wallet. For example, TokenTax allows you to import data from Binance via API or CSV.

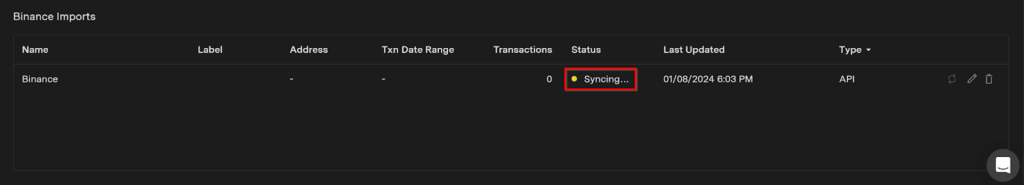

Once you’ve connected your exchange, it will show on your imports page as “Syncing…”

Step 6: Generate Tax Documents

Once you have imported your transaction history, you can head to the top menu and select [Documents]. You can generate your Gain/Loss Report, Income Report, and FBAR from here.

Drawbacks of TokenTax

Here are some downsides of Token Tax.

- No Free Plan: Although you can sign up to the platform for free, you must pay for a plan to avail of TokenTax’s offerings. A freemium version would have been great.

- Expensive: All plans are expensive compared to similar software. TokenTax’s plans range between $65 and $2,999 per year, higher than competitor platforms. Compared to CoinLedger, their paid plans start at $49/tax year.

- Fewer Integrations With Third-party Software: Unlike competitors, TokenTax has integrations with only two third-party software. For example, CoinLedger partners with multiple software such as TurboTax, H&R Block, Tax Slayer, and TaxAct.

How Does TokenTax Compare With Its Alternatives?

Koinly

Koinly offers custom reports, advanced analytics, and multiple wallet and exchange integrations. Koinly’s paid plans start from $49, while TokenTax’s cheapest plan starts at $65. However, TokenTax has a better dashboard and responsive support from experts.

More details

Koinly is one of the top leading crypto tax software. It leverages automation to directly import crypto transactions from supported integrations and calculate gains and losses to determine tax implications. Koinly supports more than 700 integrations and is available in over 20 countries and functions using the tax law of the supported countries. The use of Koinly is flexible and also functions as a portfolio tracker, giving an overview of all your assets in one place.

-

Multiple tax reports.

-

Numerous country support.

-

Easy to use.

-

Flexible plans.

-

Wide integration support.

-

Does not accept cryptocurrency payments.

-

Slightly expensive.

CoinLedger

With its paid plans starting at $49, CoinLedger is cheaper than TokenTax. However, it offers comparatively similar services. You can use CoinLedger to track your crypto data automatically and generate reports as required. However, it integrates with fewer exchanges than TokenTax.

More details

Coinledger is a cost-effective way of filing crypto taxes without manually inputting transactions into your tax forms. The software integrates with major exchanges and wallets using APIs or public wallet addresses, automatically importing transaction data. It also identifies investments to sell at a loss to reduce your tax bill.

-

Smooth integration of exchanges.

-

Easy import and export of data.

-

Effective tax management.

-

Save money on tax.

-

Limited international country support.

ZenLedger

ZenLedger tracks your crypto trade transactions and calculates your profits and losses automatically. Like Koinly and CoinLedger, its paid plans start from $49, which is cheaper than TokenTax. Zenlegder also offers premium support all days of the week.

| Platform | Free Plan | Starting Price (per year) |

|---|---|---|

| TokenTax | Not available | $65 |

| Koinly | Available | $49 |

| CoinLedger | Available | $49 |

| ZenLedger | Available | $49 |

TokenTax Review: Our Verdict

Overall, TokenTax is a helpful tax software for filing crypto taxes and generating reports to evaluate capital gains and losses. As a user-friendly platform, it calculates taxes and manages their reporting.

Moreover, the available support from their tax experts saves you time and stress.

However, it is an expensive platform with no free plans available. But, if you can afford it, the software’s incredible features and offerings often offset these issues.

Yes, it is. The platform is only provided with read-only trade data through APIs. This means it can’t steal your tokens or access your keys. There haven’t been any negative reviews regarding this.

However, since it doesn’t require any two-factor authentication and just a password and email address to log in, your account can be vulnerable to hackers.

All new and expert crypto traders and investors can use this software. Additionally, tax accountants can use TokenTax as a full-service accounting firm to calculate crypto taxes for their clients. TokenTax supports every user through its incredible interface.

Although you can sign up for free, you must pay for a plan and priority support.

The TokenTax platform was founded by Alex Miles and Zac McClure.

TokenTax tax software integrates with TurboTax, a tax preparation software, to transfer your reports related to crypto tax reporting. When integrated with TokenTax, TurboTax allows you to conveniently generate your tax or IRS form and file your tax returns on this user-friendly software.