Unbanked BlockCard Review 2024: Is it the Best Card?

TLDR

In this Unbanked BlockCard review, I uncover its features tailored for US cryptocurrency enthusiasts.

The card lets you spend 15 cryptocurrencies, offers up to 6% cashback, and has an intuitive mobile app.

I appreciate the diverse funding options: Samsung Pay, Google Pay, and bank transfers. But, a word of caution: staking TERN for rewards requires a switch from other cryptos to TERN

While Unbanked BlockCard is primarily for US crypto users, weighing its token-related challenges is essential.

Dive in with me.

| Attribute | Information |

|---|---|

| Coinwebs rating | ⭐⭐⭐⭐ (4.4 stars) |

| Launched In | 2019 |

| Physical Card Fee | Up To $10 |

| Annual Fee | No Annual Fee |

| Supported Cryptocurrencies | 15+ Cryptocurrencies |

| Platform App | Mobile/Desktop |

| Staking Rewards | 1% To 6% |

| Type of Card | Visa Debit Card |

Overview of the BlockCard

BlockCard, launched in 2019 by Unbanked (formerly Ternio) and the Metropolitan Commercial Bank of New York, aims to promote cryptocurrency adoption.

With zero transaction, exchange, and deposit fees, it offers users the choice of virtual, plastic, or metal cards.

Plus, it is accepted at over 46 million VISA retailers worldwide; BlockCard is primarily in the United States, with European expansion plans ahead.

Who should use BlockCard?

TERN Investors

If you are a TERN investor, BlockCard will surely fit your needs. It lets you instantly convert and spend your crypto worldwide without high fees.

Plus, you can stake your cashback rewards for more profits and a passive income.

KYC requirements

To get started with your BlockCard account, a necessary KYC (know-your-customer) process is in place. Here’s how it goes:

- Begin by filling out your profile and sharing some essential personal details.

- Next, you must provide a government-issued ID like your passport or driver’s license.

- Take clear pictures of both sides of your ID and upload them to the platform.

- Once you’ve done that, click the [Verify] button.

After completing these steps, your bank account will be good to go, and you’ll be all set to dive into the world of BlockCard!

Availability

As of the time of writing, the card is only accessible to US-based users. However, the company has plans to expand its services to 26 European countries soon.

What are the Pros?

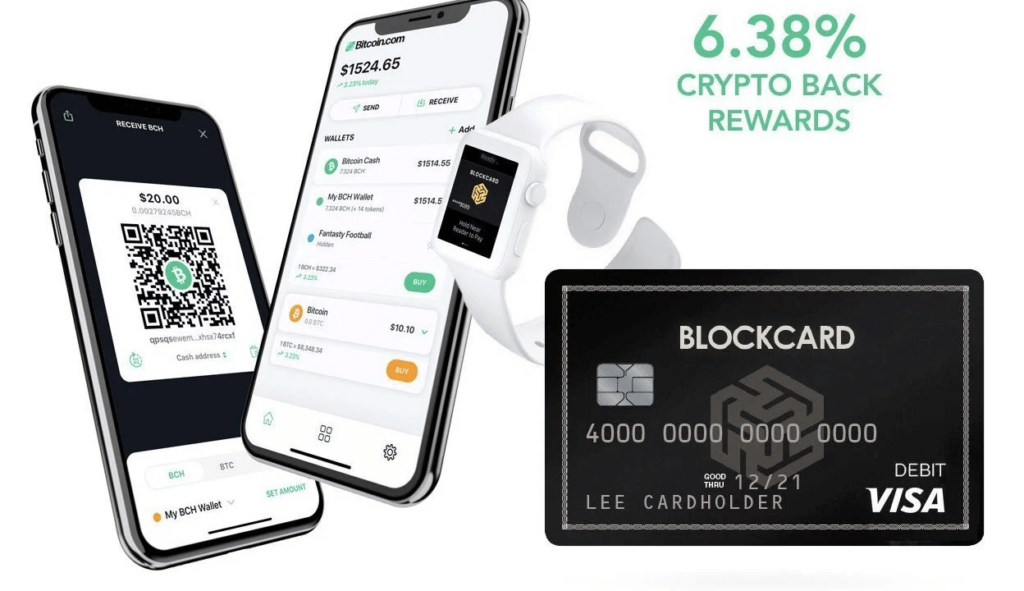

Impressive Cashback Rewards

Blockcard offers lucrative crypto cashback rewards of up to 6%. Unlike other debit cards with a cap on specific spending, it is unlimited.

So, how does this work? It lays out six different spending limits, from 30,000 TERN for 1% to 145,000 TERN for 6%, meaning that the more you spend, the more cash you get.

Mobile App

BlockCard gets it – we all want a straightforward way to handle our finances, and that’s where their mobile app shines.

We found it super handy as it makes checking your balance, depositing money, sending funds, and even referring friends easy.

And if you’re into crypto, you’ll love how the app keeps you updated with real-time price data on your account balance in USD from the dashboard.

FDIC-Insurance

BlockCard is one of the few crypto debit cards that offer Federal Deposit Insurance Corporation (FDIC) insurance. This gives you extra security when using your card.

You can deposit and withdraw USD from your BlockCard account without worrying about your bank flagging your transactions. The FDIC protects Your USD deposits up to $250,000 like the big banks.

BlockCard Review: Tiers and Prices

Let’s dive into the three different types of Blockcards together:

Virtual Card – FREE

As the name suggests, this card isn’t physical. When you get it, it’s included for free, along with the plastic card. It comes with a new set of numbers, including card numbers, CVV, and expiration dates. Since it’s virtual, it’s designed for online use only and has a daily spending limit of $5000.

Plastic Card – $10

This card is available for just $10 and is a physical card. You can use it to withdraw money from ATMs. Like the virtual card, it comes with a daily spending limit of $ 5,000 and a daily ATM withdrawal limit of $500. This spending limit applies to Venmo transactions and PayPal cash withdrawals as well.

Metal Card – $50

The metal card costs $50 and has the same limits and fees as the plastic card. The critical difference between the two is the durability of the metal card, and it also comes with replacement protection. To get your hands on the metal card, you’ll need to pay $50. If you currently use the plastic card, you can upgrade to the metal card once it becomes available.

Fees and Costs

Here’s what we discovered about Blockcard fees, and let us tell you, it’s pretty user-friendly:

- Monthly Fee: It’s based on how much you spend. Spend over $750 in a month? No monthly fee for you! Spend less, and it’s just a reasonable $5.00.

- Issuance Fee: When you first get your Blockcard, a one-time issuance fee of $10.00. That’s lower than the industry average of around $15.00 for crypto debit card issuance.

- ATM Usage: Need cash? It’s a flat $3.00 fee if you withdraw in the US. Venture outside the US, and it’s a slightly higher $3.50. Remember that the maximum you can withdraw in a day is $500, which might be a bit low in some countries with tiny ATM limits.

- Spending Commission: The best part? Blockcard doesn’t charge any commission when you use it for spending. Yep, you read that right – zero commission. All the benefits are rare find in the world of cards.

- Deposit: As far as we know, there’s no maximum or minimum deposit. So, it’s pretty flexible.

- Maximum Spending: The daily spending limit is $10,000, which should cover most of us comfortably.

So, overall, Blockcard’s fees are competitive and won’t break the bank. It’s all about how you use it.

BlockCard Review: Top Key Features

Diverse cryptocurrency support

With BlockCard prepaid Visa cards, US residents can quickly deposit their cryptocurrency in a secure wallet, convert it into USD, and start spending while earning interest.

But here’s the catch – you’ve got access to just 15 crypto assets on BlockCard. These are the cryptocurrencies that cut:

- Bitcoin

- Ethereum

- Basic Attention Token

- Bitcoin Cash

- Ternio

- Dai

- Litecoin

- Stellar

- Pax Dollar

- Tether

- USD Coin

- TrueUSD

- Cronos

- Uniswap

- Solana

Accepts a variety of payment methods

BlockCard is your go-to solution for all your crypto needs. It supports all popular cryptocurrencies, including big players like BCH, BTC, and ETH.

Here’s the magic: when you deposit funds, they smoothly transform into Ternio’s digital currency (TERN), BlockCard’s reliable spendable asset.

Now, when you swipe it at any of the over 40 million global merchants, the TERN in your account converts to USD, making it easy to spend anywhere.

But here’s the kicker: if you’re running low on crypto funds or prefer traditional methods, you can top up your BlockCard with Apple Pay, Samsung Pay, Google Pay, and bank account transfers.

Customer Support

BlockCard claims to be there for you 24/7, but for us, there were some mixed experiences. They offer a [Contact Us] option where you can submit a ticket and an FAQ section for those who prefer self-help.

However, no live chat or phone number is provided that can instantly address your concerns. We did our research, and when we checked out third-party reviews on Trustpilot, things got interesting.

BlockCard had an above-average rating of below 3 stars out of 5. Some customers had positive experiences, praising the quick customer responses and the hassle-free sign-up process.

But some not-so-happy campers also complained about slow customer responses and accounts mysteriously closing with refunds in limbo.

So, the customer service journey with BlockCard seems like a mixed bag. It might work like a breeze for some, while others might find themselves waiting longer than they’d like.

How to get your BlockCard?

More details

Unbanked's Blockcard is a game-changer. No spending fee and it supports 15+ cryptos worldwide with a 6% cashback bonus. Just note the $2 international fees and $3 ATM charges. Plus, the app's perfect for US users to keep tabs on their finances.

-

Up to 6.38% cashback potential.

-

Visa card available.

-

Refer friends for bonus TERN.

-

Virtual/Physical card.

-

Low international ATM fees.

-

Staking TERN for top rewards.

-

Monthly fee under $750 spending.

-

Numerous associated fees.

- Step 1: Register on BlockCard’s website to start the process.

- Step 2: Then, deposit funds via crypto transfer, ACH transfer, or at retail stores.

- Step 3: Next, complete KYC verification with legal documents.

- Step 4: When done registering, receive both virtual and physical cards to start spending.

Drawbacks of BlockCard

Lack of exit from staking

You need to consider the staking process for TERN and the Blockcard, which operates on a 30-day basis. If you opt out of the system, you won’t be able to exit the TERN market immediately.

Risk of TERN token’s value

Another potential dealbreaker with the Ternio Blockcard is its heavy reliance on the TERN token. To unlock the highest cashback rewards, users are required to stake TERN tokens. However, the future value of TERN is highly speculative, and these small-cap crypto tokens like TERN have a history of plummeting by 90%.

Limited support and use of cryptocurrencies

Unlike its other major credit cards, BlockCard only supports a small number of cryptocurrencies. You can’t directly store the cryptocurrencies Ternio supports in your account balance. Instead, you must convert all of your crypto tokens into TERN before you can use them.

Best Alternatives

Binance Card

Unlike Blockcard, Binance’s crypto debit card stands out for its 8% cashback rewards on BNB. Plus, it charges low foreign ATM withdrawal fees of up to 0.9 percent. Plus, you are charged no spending or annual fees on spending crypto. Lastly, the Binance Card has advanced security features, including 3D secure and real-time transaction alerts.

More details

The Binance Card is an excellent choice with up to 8% cashback. It is a Visa card for online payments, allowing you to make purchases and withdraw money or cash from ATMs. The Binance Card currently supports 14 cryptocurrencies for spending. No issuance or monthly cost and only a 0.9% crypto conversion charge for withdrawals or purchases!

-

It may be used all around the world.

-

Low processing fees.

-

High withdrawal limits.

-

Cheap transaction costs globally.

-

Cashback in BNB up to 8%.

-

Not available in the United States.

-

Supports only a limited number of cryptocurrencies.

-

Slow customer support.

Coinbase Card

Coinbase, a leading cryptocurrency platform, offers this card to US, UK, and EU users. US users can choose between 4% cashback in XLM or 1% in BTC for transactions. Note that there are fees, including a 2.49% liquidation fee for crypto transactions using non-USDC coins.

More details

The Coinbase Card seamlessly integrates the crypto economy into our everyday transactions. Unlike typical Visa debit cards, it promotes zero transaction fees and an annual fee, providing the most cost-effective way to use your crypto. We recommend it as an ideal entry point for newcomers hesitant about volatile coins.

-

$0 annual fee.

-

Earn crypto back on every purchase.

-

Used everywhere Visa is accepted.

-

No ATM fees.

-

No credit check is required.

-

Monthly spending limits apply.

-

Tax implications.

-

Requires Coinbase account for eligibility.

-

No bonus spending categories.

Uphold Card

In partnership with Mastercard, the Uphold card enables crypto, fiat currency, and precious metal transactions, similar to Blockcard. However, it’s exclusively available in the US. Uphold’s fees are lower than Blockcard, providing up to 2% cashback on crypto purchases, albeit slightly less than Blockcard’s cashback rate.

More details

Uphold partnership with Mastercard allows users to use the card for online and in-store purchases. Uphold offers a highly secured payment process, an excellent user interface and experience, and good cashback payment rewards. The significant drawbacks to this card are its geographical limitation to U.S. and U.K. and the poor customer support.

-

Supports over 250 assets.

-

They are accepted almost everywhere in the world.

-

Transparent fee structure.

-

Easy user interface and excellent user experience.

-

Cashback rewards on every payment.

-

High spread fees.

-

Relative new product.

-

Poor customer service.

Final Verdict

BlockCard’s crypto debit cards are gaining popularity among US investors for user-friendliness and spending rewards.

These cards offer different tiers with competitive fees and the convenience of converting crypto to dollars for spending worldwide via Visa. Users also enjoy perks like cashback and staking rewards.

However, the downside lies in accumulating fees for international PIN transactions and ATM withdrawals.

Furthermore, the card supports only 15 cryptocurrencies, potentially limiting its appeal to those with diverse crypto portfolios.

The spending limit on BlockCard crypto debit card varies depending on the card type, with daily limits typically set at $5,000.

The ownership of BlockCard is associated Unbanked and Ternio.

A BlockCard is a cryptocurrency debit card/Virtual card that allows users to spend their crypto assets at merchants that accept Visa, effectively turning cryptocurrencies into spendable funds. Your can be connected with Unbanked account.

Blockcard is suitable for crypto enthusiasts looking for an easy way to spend money, send money, or buying crypto. It can also be used on withdraw money from any international ATM and used for day-to-day transactions.