Get a comprehensive understanding of the Revolut card with this review covering both the pros and cons, helping you decide on the right card.

Revolut cards are one of the most trusted cards by travelers. It allows transactions in over 35 currency denominations. It does not have any associated monthly or annual charges.

Revolut cardholders enjoy fee-free ATM withdrawals, both domestically and internationally. The card is supported by a multi-currency Revolut bank account, which operates in over 30 countries. These accounts enable users to maintain their financial balance in supported currencies.

Revolut card comes with benefits such as free medical insurance, travel insurance, and delayed luggage insurance. Card users get free airport lounge access for airport delays exceeding an hour.

Who should use Revolut Cards?

Overview

Revolut was a startup initially based in a financial technology incubator hub in London. It became a superpower in the financial industry, starting as a travel card with no foreign exchange changes and gradually metamorphosing into a digital bank.

Revolut, the brainchild of Nik Storonsky and Vlad Yatsenko, who acts as the company CEO and CTO, used their separate wealth of experience to build one of the biggest financial unicorns in the world. It is regarded as a reliable financial technology company after raising over 800 million dollars in July 2021 and is presently valued at around 33 billion dollars.

Revolut Card Review: Geographical availability

Unlike traditional banks, Revolut is a digital bank that operates without a physical branch network. However, it has wide coverage in terms of countries and regions it covers.

Revolt has two banking licenses in Lithuania and Australia. Lithuania’s license serves entire European Union countries, which means you can access the Revoult card from any European country.

The service of the digital bank has also expanded to cover countries in North America, including the United States and Canada. It also has a presence in Australia and Singapore.

The financial app primarily offers services through GBP, EUR, and USD bank accounts, allowing users to convert them into local currencies.

Although it is obtaining a UK banking license, Revolut’s electronic money payment services regulations and Revoluts money transfer regulations are authorized by the Financial Conduct Authority under the Electronic Money Regulation 2011 of the UK. This means it is part of the UK financial services compensation scheme.

How does the Revolut Card work?

Revolut card operates like a traditional prepaid card. The cards are funded directly from a Revolut account. These cards do not need periodic funding like traditional prepaid cards. It can be used for online payments and transactions at walk-in merchant stores.

People fondly refer to the Revolut card as a travel card because it enables users to make payments worldwide and exchange currency between different denominations.

Revolut card also allows free international money transfers from anywhere worldwide. These international money transfers are done at the bank rate and without additional fees.

How secure is the Revolut card?

Revolut has taken extra steps to ensure the security of its card. Revolut anti-fraud program has successfully reduced the number of fraudulent transactions to a relatively insignificant number. This makes this digital card to be more secure than traditional cards.

Revolut allows users to freeze and defrost their cards via the app instantly. This is very useful if you lose your card or if a misplaced card is found later. This process takes only a few seconds and a single click.

With the Revolut app, it is possible to track the card location, limit spending, and block unauthorized online or swipe transactions. The user can also set a monthly spending limit as additional protection.

In case of card theft, users can easily order a new card through the app without visiting a physical bank. The replacement card is delivered within approximately three days, significantly faster than traditional banking systems.

What makes Revolut cards a good choice?

Revolut cards are useful for anyone who transacts in the digital space. Many international transactions can now be done easily. Here are a few good reasons to get a Revolut card today.

Easy to open

It takes less than 5 minutes to set up a functional Revolut account. All that is required to set up is an available phone number that can receive a text message, a mobile device, an active e-mail, and a government-issued photo ID for KYC verification.

After carrying out all the necessary KYC procedures and setting up bank details for the account, the account holder can order their preferred card with a preferred delivery destination.

Fast and easy top-up

Revolut app is operational in over 35 countries and supports up to multiple currencies and 30 currency denominations. The Revolut app allows easy funding through any of the denominations. This means local currencies can fund the account and be held in any other foreign currency.

The conversion from one currency to another occurs at a flat bank rate without additional charges. Users have the option to set instant payment notifications or specific exchange rates. You can instantly fund the card through the app using a variety of payment gateways, such as debit and credit cards, PayPal, Google Pay, and Apple Pay.

Free ATM withdrawals

Aside from the fast and easy top-up in any of the supported currencies. Revolut cardholders enjoy free ATM withdrawals in their home country or abroad. This allows the cardholder to spend like a local in any country.

Revolut partners with the two biggest card network providers, Visa and Mastercard. Hence, Revolut cards can be Visa or Mastercard, ensuring their wide acceptability worldwide in merchant stores or ATMs.

ATM withdrawals are made without worrying about recurrent charges like regular bank transfers, debit, prepaid or credit cards.

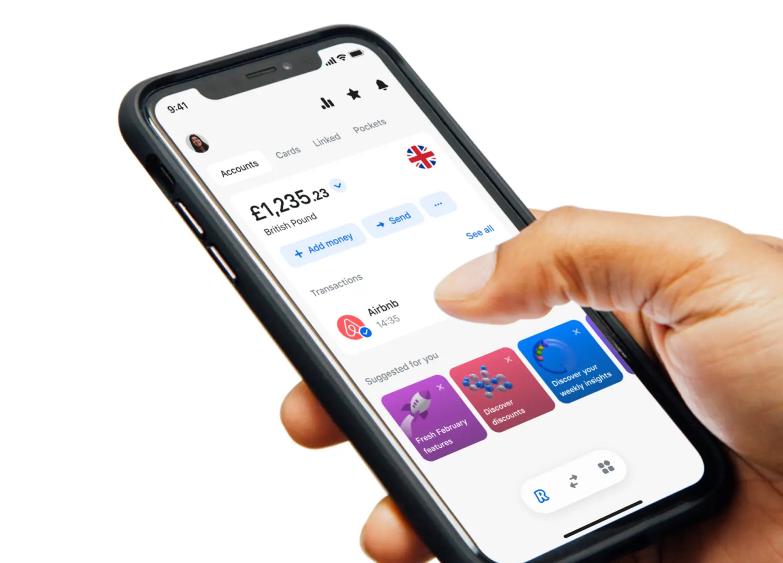

All in one App

With Revolut, you can conveniently manage all your finances in a single app. The app enables you to track your spending and allocate it accurately, regardless of where the transactions occur. It also includes a budgeting feature that alerts when spending is about to exceed the budget.

Also, all financial activities such as investing, fixed-term savings, cryptocurrency holdings, and foreign exchange services can be done in just one app.

The Revolut fixed savings, known as the Revolut vault, offers up to a 5% annual interest rate. It also introduced a safe joint vault where numerous other users can contribute towards a cause.

The digital banking app allows convenient card management services, including funding, deactivating, and placing orders. Additionally, users can use the virtual card on the app while awaiting the arrival of their physical bank card.

Reimbursement package

Another reason to choose the Revolut card is its reimbursement package, especially on retail purchases. It offers an extended 90-day return window for all retail purchases. This provides ample time to determine if the item meets users’ expectations.

When the retailer refusers collect the item, Revolut pays back reimbursement on all retail purchases between $50-$300. Furthermore, if a Revolut user cannot attend an event for which they have purchased a ticket, the cardholder is eligible to receive cashback for tickets worth up to $1000.

This reimbursement offer is relatively new and enjoyed by users in Europe.

Revolut Junior

Revout Junior comes with a junior account, card, and app controlled by the parents. The app allows parents to track their kid’s spending and probable location via the kid’s transactions. It also allows the parent to send money overseas to kids abroad who are Revolut users easily.

With Revout Junior, parents can add task-associated rewards to teach their kids the value of money. The kids also have access to goals that give them a fast way to achieve their saving goals. This encourages financial intelligence and cultivates saving habits among this age group.

Customized cards

Every day can be beautiful with customized Revolut cards. Revolut allows its users to apply for customized cards.

The user chooses the card’s background picture, color, and shade. The customized card service is available for all Revolut accounts, including Revolut Junior. This increases the card’s aesthetics and helps differentiate the card from multiple users in a household at a glance. This service costs about $5.99 per card.

Revolut airport lounge and insurance benefits

Revolut card holders enjoy insurance benefits, especially during their trips abroad. It covers all emergency medical bills that Revolut cardholders accrue during their traveling. These bills cover minor and major medical procedures.

Recently, Revolut signed an agreement with Allianz to provide insurance for all travel luggage of its cardholders worldwide. They would give financial reimbursement for any loss that might have occurred due to misplaced or delayed baggage.

Revolut cardholders enjoy free access to airport lounges with complementary dishes during flight delays that exceed an hour. These offers are without limits on the Revolut Premium and Metal cards.

How to apply for a Revolut card?

Now you have gotten all the benefits, here is how to get a Revoult card.

Step 1: Create a Revolut account

You need to have an active Revoult account before requesting a card. Visit the Revolut website to sign up.

The basic requirements for opening an account are to be 18 years, be resident in countries where Revoult operates, and have a valid government ID for verification purposes.

Click the [Sign up] button, which will take you to the download page of the Revolut App

More details

Revolut, a virtual bank with millions of users, issues cards supporting over 35 currencies. The card allows fee-free global withdrawals and provides free medical and travel insurance. There are three digital card types: Revolut Standard, Premium, and Metal, each offering distinct advantages. A notable downside is that customer support is only accessible via chat.

-

Free ATM withdrawals.

-

Fast and easy top up.

-

Travel and medical insurance.

-

Easy in-app crypto conversion.

-

Premium subscription options.

-

Poor customer support.

-

Rigid monthly limits.

-

Customer accounts can be frozen.

Step 2: Get a Revolut App

You can download the Revolut app from the Google Play Store or Apple Store. Read the associated terms and conditions alongside the privacy policy.

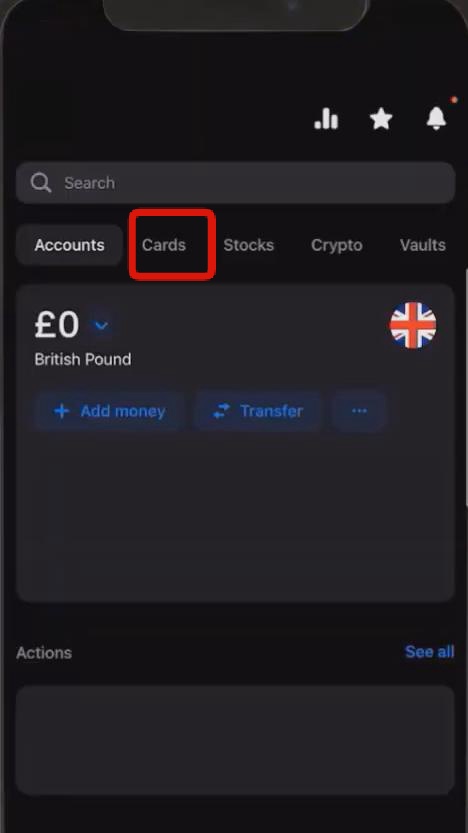

Step 3: Launch the Revolut App

Open your Revolut app and select the [Card] button at the upper part of the Apps dashboard. This will open the option to get a card, and you can choose the type you want.

The card comes either as a physical or virtual debit card.

The virtual card is released immediately, while the physical card takes a few days before delivery.

Step 4: Customize your card

The next step is to customize your card to your preference. The cards come in standard, metal black, premium grey, etc.

These cards correspond to different card levels with specific benefits, and these levels might require extra costs compared to the standard (free) model.

In addition to choosing a card level, you can change your card’s color and other aesthetical functions.

Step 5: Set a PIN

Set a PIN to validate your transactions on the card. Choose a simple-to-remember yet well-secured PIN that will not be easily compromised.

Step 6: Phone number verification

Revolut would send a text verification code to the phone number registered. Input this code and expect a ‘Success’ notification.

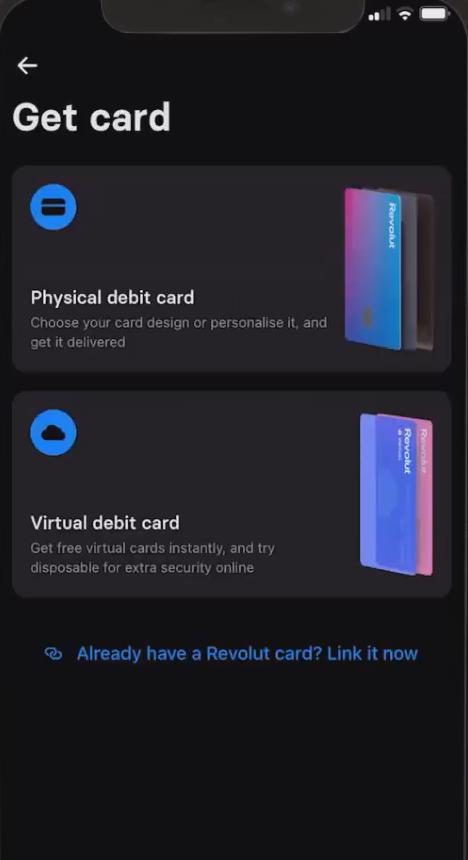

That interface should show a personal information page in which the delivery address to receive the card is inputted.

Step 7: Place an order for a Revolut card

Revolut Premium and Metal card orders utilize express shipping, ensuring delivery within three business days. On the other hand, the standard card is shipped using standard shipping, which typically takes nine business days for delivery.

Some referral packages allow the cardholder to have premium accounts for a free plan of up to 3 months free, which normally costs $9.99 per month.

Step 8: Activate the Card

The card can be activated by paying at any store, restaurant, or hotel. It can also be activated on any ATM. Card activation is not needed for virtual cards as they are already active.

Congratulations!

Revolut Card Review: Top Offers and Features

Without a doubt, Revolut has transformed international cash transactions with its card and account services via its mobile app alone.

Revolut cards are now a vital component of the luggage of a modern traveler, especially across Europe and the United States. Its associated account can carry out transactions like a local in over 30 countries.

When traveling across various countries, all that is needed is to convert the currency to the respective home currency. This conversion is carried out at the current bank exchange rate with no Revolut fees. The subsequent withdrawal fees paid after exceeding the free limit are meager compared to other banks. The card services are very friendly to the pocket.

Here are some of the features and offers from Revoult

Revolut Standard – Free

Revolut Standard card is the most basic card type. This card is 100% free of usage, besides $5 for delivering the physical card in the US. Also, the card does not require any minimum amount of money in the account.

With the standard card, the holder can send money abroad and carry out international transactions without charges. The card allows a maximum monthly currency exchange of up to $1000. Also, it provides free international payments, money transfers, and ATM withdrawals of up to $1,200 per month.

Aside from this, it allows one international transfer across countries per month free of charge.

Revolut Plus – $2.99 per month

The Revolut Plus is a step higher than the standard card with additional perks and benefits. The card costs $2.99 per month, which is a small price for the fun that comes with a Plus card.

Revolut Plus cardholders can withdraw $200 monthly from any ATM that accepts Mastercard for free. When the free withdrawal limit has been exceeded, a fee of 2% is charged for subsequent free withdrawals only. You will also get one-year insurance on purchases up to $1000.

Another benefit of the Plus card is that you can get reimbursed for events you cannot attend after purchasing a ticket using the Plus card. Revolt refunds you up to $1000 for such occasions based on certain terms and conditions.

Revolut Premium – $9.99 per month

Getting the Revolut premium card costs a recurrent monthly fee of $9.99.

With the premium card, you have no limit for currency exchanges via the app. Aside from this, they enjoy three international transfers across different countries each month without any associated fees.

Another big benefit of this card is medical insurance. This allows Revolut to cover payments for all medical emergencies experienced while outside their home country. The holder of this Revolut card also has two free lounge access for flight delays exceeding an hour.

Additionally, the holder of the card enjoys priority customer support. In the case of any failed payment or other rare service anomalies, the holder can contact Revolut and be assured of prompt response regardless of where they are.

Revolut Metal – $16.99 per month

Revolut Metal is considered the king of the Revolut card clan. With this card, you get all the accruing benefits with standard and premium, in addition to many more.

It is the best card any traveler can have, for $16.99 per month, compared to other digital cards.

Upon issuance, the Revolut card is placed on express delivery. This means the card is delivered within three days.

Also, Revolut Metal comes with comprehensive medical insurance, which covers every emergency medical bill that can occur while traveling. The holder has a daily withdrawal limit of $1,200 from ATMs without any added charge.

A metal card holder gets four free lounge passes for flight delays worldwide for flight delays that exceed an hour. Revolut Metal also includes flight delay insurance and luggage protection.

Metal card holders also give a 1% cashback on transactions paid in any currency, including crypto. How great is that!

Revolut Card Review: Major Drawbacks

Revolut is an excellent financial service provider, especially with its App and card services, but it has drawbacks. Here are some areas Revolut is bound to improve on to continue to enjoy its growing customer acceptance

No credit line

Unlike most competitors that offer credit and debit cards, the Revoult card is only a debit card and gives users no credit line. This implies that you only get to spend the amount in your account without the option of getting an additional credit card from Revolut.

The downside is that you might be hindered from making payments at stores and establishments that accept only credit cards, such as a car dealer’s store or hotels. This challenge is a dealer common for individuals who reside in the US.

No physical presence

Revolut is a full-fledged digital bank with no physical location, which has drawbacks. It does not own any ATMs, so there is no possibility for cash deposits. Revolut cards don’t have to rely on bank transfer, PayPal transfer, Apple Pay, Google Pay, or Card payment to fund their Revolut app.

These money transfers often experience delays, which may be as long as 2-3 days before the money transfer reflects on the Revolut balance.

Account freezing

Revolut customers have experienced locked accounts, potentially leaving cardholders stranded during crucial financial transactions. While these security measures are in place to address concerns, it is important to be aware of the possibility of being unable to access funds when using the Revolut card.

Frequent freezing of customers’ financial and business accounts can discourage the processes for many people. The problem of poor customer service compounds the challenge of account freezing.

Chat-only customer service

Revolut customer support is only available via chat. Although the customer care agents are available 24/7, their availability via chats limits the ability of Revolut users to express themselves or their complaints.

Revolut users have reported significant delays in accessing customer support services. This becomes particularly burdensome for users whose accounts are temporarily frozen, as they may be unable to access the chat feature on the app for assistance.

Unavailability in many countries

Revolut is not yet operational around the globe. Although Revolut users can access the app anywhere worldwide, it does not yet accept all nationalities.

Revolut App can only be downloaded by people living in these areas:

- European Economic Area (EEA)

- Australia

- Singapore

- Switzerland

- Japan

- The United States

The lack of spread to other countries and regions limits the number of users it has and the number of merchants that can accept the card.

What is a Revolut Card spending limits?

Spending limits on a Revolut card refer to the maximum transaction volume allowed. These limits are expressed as currency exchange limits and ATM withdrawal limits.

Currency exchange limit

This is the maximum currency exchange that can be carried out by the Revolut card anywhere in the world. Every other exchange carried out after this limit attracts a transaction fee. For example, Revolut standard cards have a preset currency exchange limit of $1000.

ATM withdrawal limit

The Revolut card allows users to withdraw cash from any ATM worldwide up to a maximum limit. ATM withdrawals using the card are free of charge until this limit is surpassed. The withdrawal limit varies based on the type of card chosen, and it increases accordingly. For instance, the Revolut Metal card has an ATM withdrawal limit of an equivalent of $1200 in any currency.

How to change Revolut card spending limits

Revolut cards come with different spending limits preset on them. Revolut Standard Free cards have a preset currency exchange limit of $1000, while the premium and metal cards have an unlimited currency exchange.

Metal cards enjoy the best ATM withdrawal limit of $1200, while premium and standard card access are lesser. The various spending limits placed on a card are part of Revolut’s effort to minimize fraud and loss Revolut’s to users. Also, the spending limit is an excellent tool for parents who track their kid’s Revolut junior account.

However, spending limits can be a bottleneck for specific customers, especially those carrying out large transactions. The solution is to increase the spending limits imposed by Revolut manually. You can increase your spending limit from the app itself.

It is important to note that users cannot increase the spending limits of the Revolut Standard account. This can be done only by transferring money or upgrading the Revolut account to Premium and Metal accounts.

Revolut Card Review: Summary

Revolut has continued to break heights with its all-inclusive financial services. It has grown from a digital wallet to an all-inclusive financial super-app. Revolut accounts provide many benefits, such as multi-currency accounts, fast and cheap foreign exchange, free ATM withdrawals, and versatile travel cards.

Revolut cards are very versatile debit cards. Unlike typical cards, Revolut cardholders can carry out transactions in various currencies worldwide with no ATM charges or transaction fees. The cards come in multiple types.

- The Revolut Standard card is free.

- The Revolut Plus card with a monthly fee of $2.99

- The Revolut Premium card with a monthly cost of $9.99.

- The Revolut Metal card with a monthly fee of $16.99.

A good reason to own one of these cards is the ease of currency exchange. The holder can convert their finances into over 30 currencies via the Revolut app. The card includes unique benefits such as comprehensive travel and medical insurance, complimentary airport lounge passes for flight delays, and delayed luggage insurance protection.

Revolut operates under the regulation of the FCA, and client funds are securely held in segregated accounts at reputable banks like Lloyd's or Barclays. As an authorized institution by the FCA, Revolut ensures the protection of funds in accordance with the requirements set by the FCA, the Electronic Money Regulations 2011, and the Payment Services Regulations 2017.

At present, Revolut facilitates card payments and ATM withdrawals in over 140 currencies worldwide, wherever Mastercard and Visa are accepted.

For the standard version, Revolut exclusively provides Visa cards. Users have the option to order a new card, whether it's a virtual or physical one, which will be a Visa card.