Uphold Card 2024 Review: The Best Way to Spend Your Cryptocurrency

TLDR

The Uphold debit card is a convenient solution for crypto traders. Uphold platform account holders in the U.K. and the U.S. can actively obtain the card, enabling them to use it virtually or physically at any establishment that accepts MasterCard or Visa cards.

Uphold actively provides a wide selection of over 250 cryptocurrencies for users to choose from. Additionally, the card actively facilitates usage in more than 200 countries worldwide. The virtual card is free, and the physical card is available to U.K. residents for just £9.95.

With six tiers and low transaction fees for withdrawals, the Uphold card makes it easy to convert specific assets to fiat currency. However, its customer support needs improvement, and it has some of the highest spread fees in the market.

Despite its drawbacks, the Uphold debit card is a popular choice for cryptocurrency traders seeking convenience and security. If you want to learn more about what makes this card stand out, keep reading.

Who should use the Uphold card?

Uphold debit card overview

Uphold was founded as Bitreserve in 2013 but rebranded in 2015 as a multi-asset trading platform that allows users to buy, store, and convert multiple digital assets. The Uphold HQ is currently in New York, USA.

The platform serves over 10 million users in over 150 countries worldwide and supports the trade of more than 250 cryptocurrencies, 27 national currencies, and four precious metals.

The company recently launched the Uphold card, a virtual card allowing users to withdraw funds from their Uphold wallets. The new card functions similarly to regular debit cards, allowing active usage wherever MasterCard is accepted globally. In addition, a physical Uphold card is now available for users residing in the U.K.

For new users

If you are new to Uphold and looking for the easiest and fastest method to access your stored assets, you might want to obtain a Uphold card. You can also access your account and track your spending using the Uphold mobile app.

You can order a debit card from Uphold’s platform easily by choosing a card type, verifying your phone number, and connecting your uphold account with the card. This process is simplified for new users.

Geographical availability

Initially, the card was restricted to the U.K. but expanded globally. The card can be used in over 200 countries across the globe.

You can also get it as a US citizen, with certain exceptions in Colorado, Louisiana, Nebraska, New York, and Virginia.

What makes the Uphold card a good choice?

User interface and experience

Uphold is famous among people who trade cryptocurrency because of its easy-to-use interface. It has a solid app and website with great UX. As a result, people new to trading can quickly get on the platform, create their accounts, buy cryptocurrency, and start using the card.

The significant advantage of the card is that it allows users to access their funds almost anywhere in the world, a feature not standard on many other platforms.

Uphold also allows traders to buy and trade across asset classes. Cross-asset trading of digital assets is a scarce feature among other platforms. In addition, you can use these assets to pay with your Uphold card.

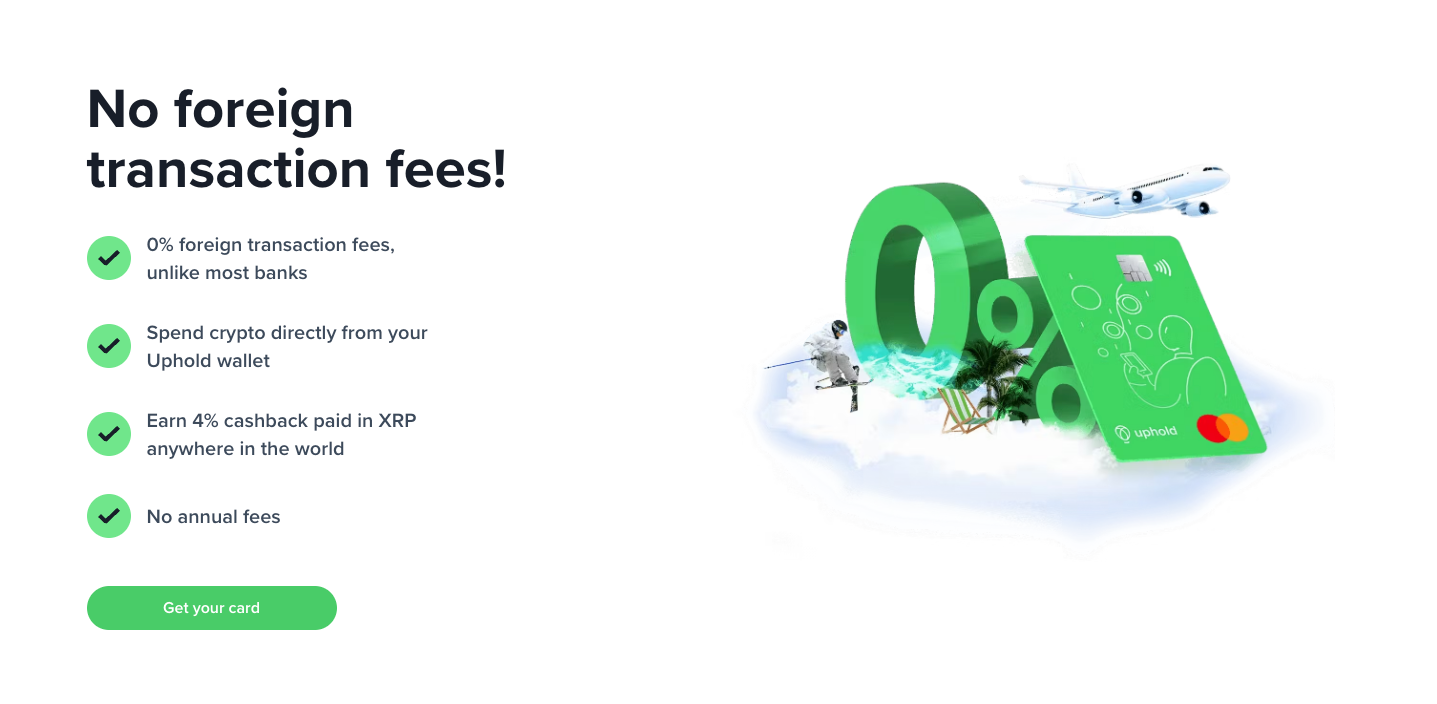

Cashback rewards

This Uphold review shows that cashback on this card is strong. Users earn rewards every time they transact on their Uphold debit card. If you buy an item in USD using the card, you will receive 1% cash back on the amount spent. However, for XRP, you get 4% cashback. The amount of cashback will be sent to your user account wallet.

This feature is unique to Uphold. Other platforms like Binance require users to Stake BNB tokens to be eligible for cashback rewards. This is not necessary on the Uphold platform.

Fee structure

The virtual card, available in the U.S. and U.K., is free to activate. On the other hand, getting a physical card available in the U.K. costs £9.95. This is, however, a one-time fee.

Sending money into the Uphold wallet will cost you a small fee, depending on how you choose to spend Bitcoin to top up your account.

| Deposit Method | Fee |

|---|---|

| Wire Transfer (<$5,000) | $30 fixed |

| Debit Card | 3.99% of the deposit amount |

| Bank Transfer (ACH, SEPA, SWIFT, etc.) | Free |

This table shows that wire transfers below $5,000 incur a $30 transaction fee, debit card deposits have a processing fee of 3.99%, and bank transfers, regardless of the specific method, are free.

Security

Uphold provides standard security such as KYC verification and two-factor authentication, provides cold storage for user funds, and performs extensive background checks for all staff members.

How to acquire an Uphold card

More details

Uphold partnership with Mastercard allows users to use the card for online and in-store purchases. Uphold offers a highly secured payment process, an excellent user interface and experience, and good cashback payment rewards. The significant drawbacks to this card are its geographical limitation to U.S. and U.K. and the poor customer support.

-

Supports over 250 assets.

-

They are accepted almost everywhere in the world.

-

Transparent fee structure.

-

Easy user interface and excellent user experience.

-

Cashback rewards on every payment.

-

High spread fees.

-

Relative new product.

-

Poor customer service.

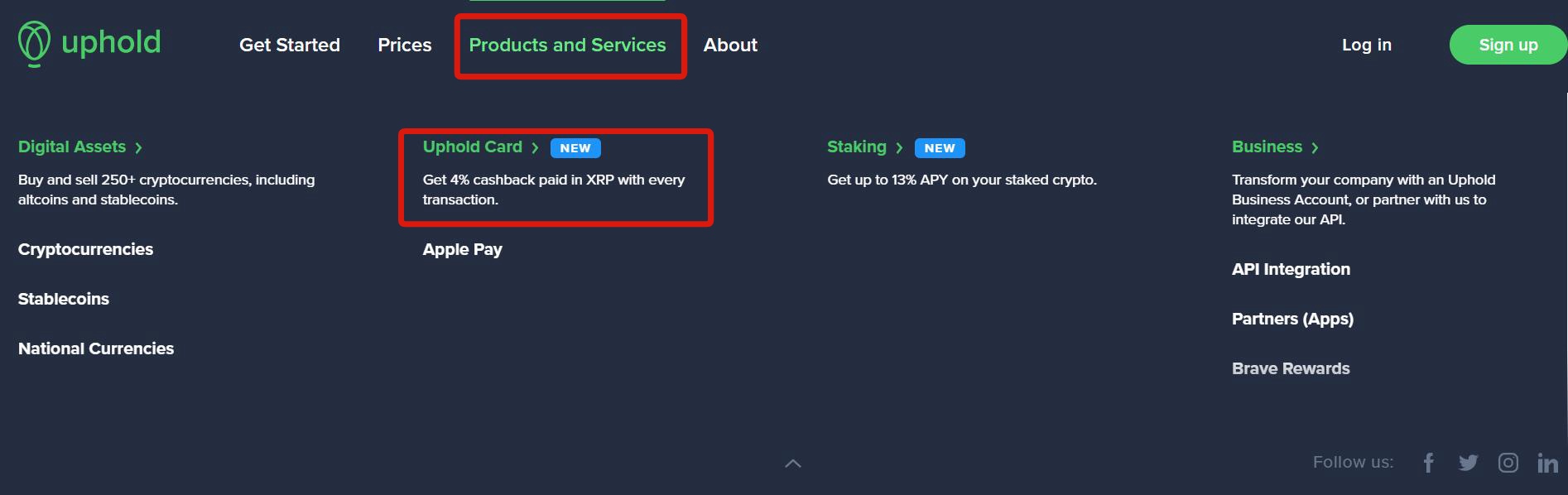

Step 1: Visit the Uphold website

First, visit the Uphold website to register for a crypto debit card.

Next, click the [Products and Services] tab and select the [Uphold card] button.

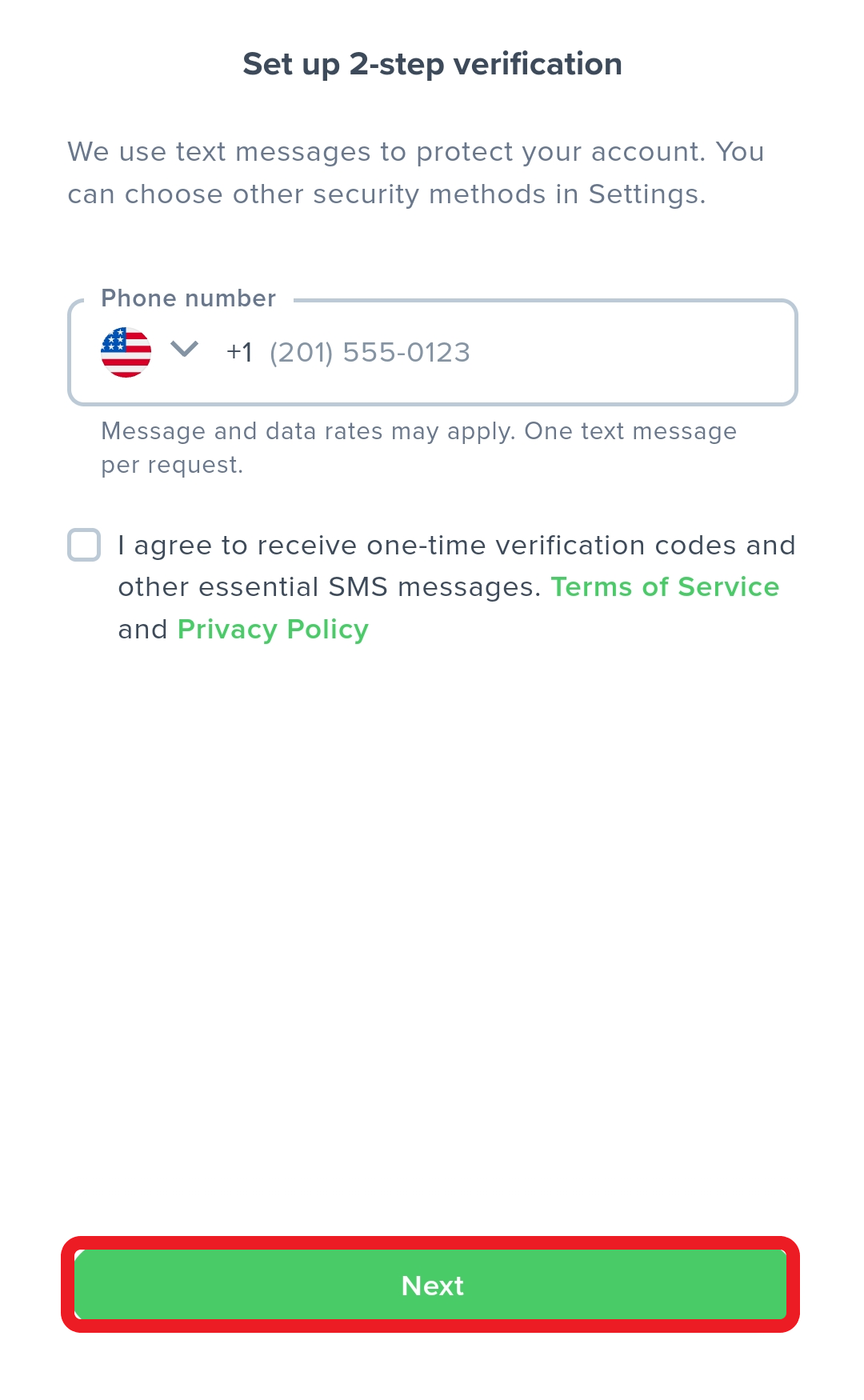

Step 2: Verify your phone number

Enter your phone number into the space provided and click the [Continue] button.

A verification code will be sent to your number.

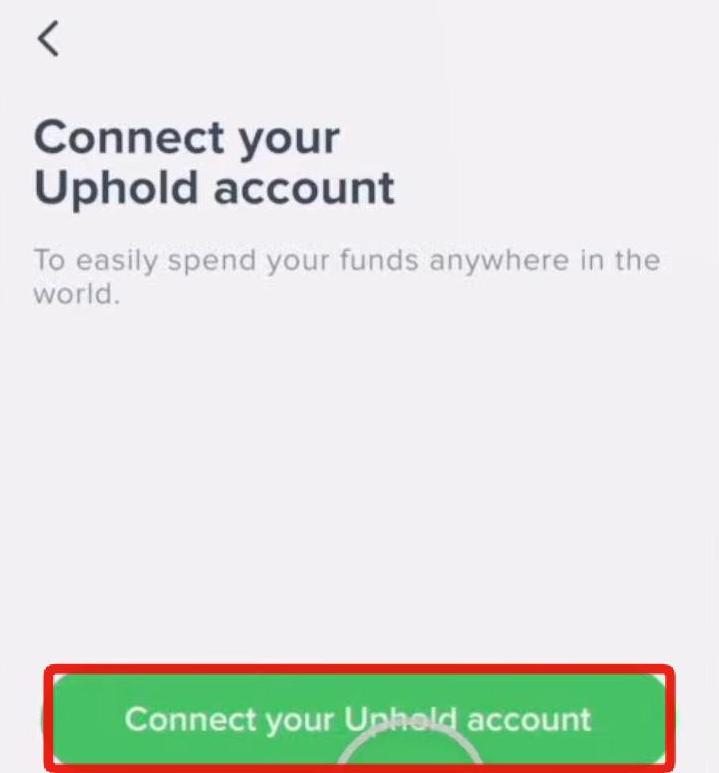

Step 3: Link your Uphold account

Once you have verified your phone number, you will be asked to connect your Uphold account. Select the [Connect your Uphold account] button.

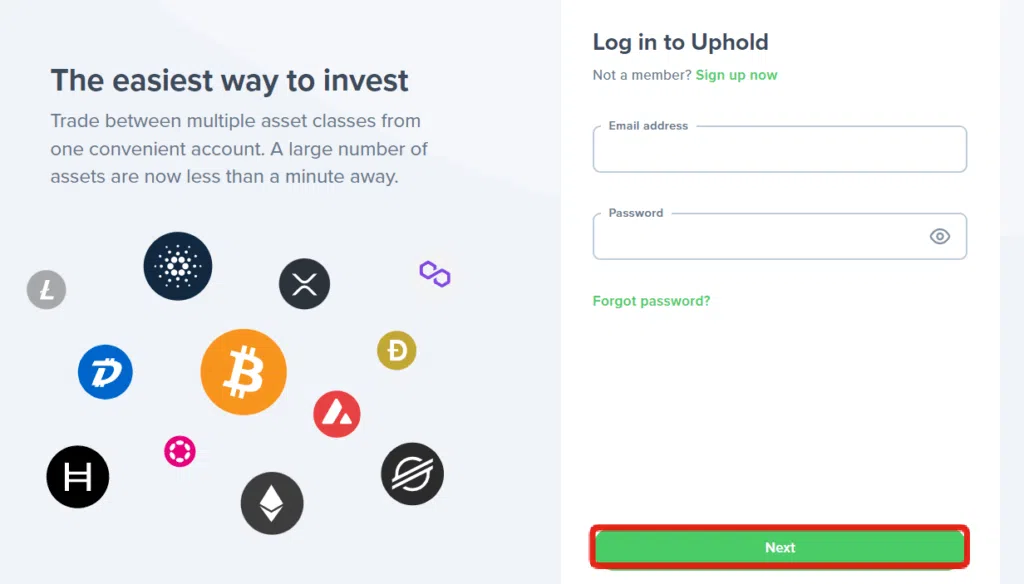

This takes you to the login page for Uphold. Here, you fill in your e-mail address and password.

Once you fill this, click [Next]. You can use the sign-up option if you do not have an existing account with Uphold.

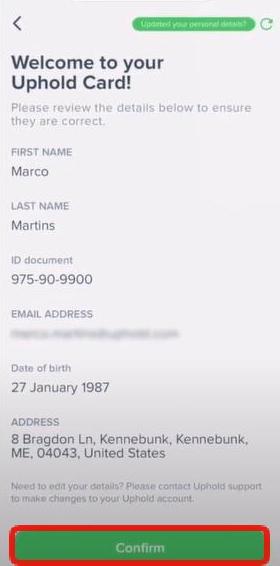

Step 4: Order your Uphold card

Once your account has been linked, you can order your Uphold debit card. Do that by selecting the [Confirm] button below your details.

Once this is confirmed, click [Order Card].

Congratulations! You have successfully ordered your card.

Uphold Card Review: Top Features

Types and tiers of the Uphold card

Uphold supports two types of cards, these include MasterCard and Visa.

In addition, the Uphold debit card comes in six different tiers. Each tier determines the type of asset that can be held on the card.

| Tier | Asset Type | Capabilities |

|---|---|---|

| 1 | Currencies (for bank transfers) | Can be transferred through banks. |

| 2 | Currencies | Can be exchanged globally. |

| 3 | Cryptos and Tokens | Can be stored, traded, and withdrawn. |

| 4 | Crypto Assets | Can be stored and traded, but not withdrawn. |

| 5 | U.S. Equities | Can be stored and traded. |

| 6 | Tokens and High Liquidity Assets (Universal Protocols) | Can be stored, traded, and possibly have other capabilities. |

The table organizes the asset types by tiers. Each tier outlines the associated asset types and their specific capabilities, from bank transfer currencies to high liquidity assets issued by Universal Protocols.

Payment methods and withdrawal fees

Fees for withdrawing cash from the wallet vary depending on the means.

| Transaction Type | Fee |

|---|---|

| Withdrawal to Bank Account (National Currencies) | Free |

| Local ATM Withdrawal | $2.50 |

| International ATM Withdrawal | $3.50 |

| Local/International Purchase with Uphold | Free |

This table summarizes the fees associated with different types of transactions on Uphold.

The Uphold debit card also has withdrawals and spending limits:

U.S. residents’ card limit for a single retail transaction is $5,000, while the daily spending limit is $10,000.

However, U.K. residents can process up to $10,000 in one retail transaction, with a daily card limit of $10,000 with the virtual card.

Only two daily transactions are permitted for the physical card, with a single withdrawal limit of $500 and a maximum daily amount of $1,000.

Supported cryptocurrencies and national currencies

Depending on your location, the card supports more tokens and major currencies, including crypto, fiat, and precious metals.

Some cryptos-supported cryptocurrency exchanges in the United States and the U.K. include Bitcoin BTC, Bitcoin BTCO, ETH, SUSHI, SAND, XRP, etc.

Furthermore, the platform and card support several fiat currencies, including AED, AUD, JPY, CAD, CHF, USD, INR, GBP, and EUR.

Disadvantages of the Uphold card

Limited accessibility

The major disadvantage of the card is its limited access to users primarily residing in the U.S. and U.K. Thus, users outside these countries must acquire and validate an address in the accepted countries before accessing the card.

Customer service and satisfaction

Users accessing the Uphold app can chat with a customer service representative for technical support. Uphold customers can also contact customer service by filling out a form on the Uphold Website or connecting with the company on its Twitter account.

Despite these various methods of reaching out to the company, Uphold is famous for being poor at communicating effectively with its customers. The company has an average of 3.2/5 star rating on Trustpilot.

Other reasons for general poor customer satisfaction mentioned on Trustpilot include unexpected account lockouts, prolonged verification of deposits, delays in the authentication of profiles users’ accounts, etc.

Spread fees

In this context, spread fees refer to the difference in the price of an asset published on a crypto exchange to the actual price of the asset. The spread fee is often the profit made by the exchange for providing a platform for trade.

Uphold is known to have significantly higher spread fees when compared to those of competitors. Usually, the spread fee may vary from about 0.8% to 1.2%, subject to the volatility of the asset, with high fees set on low-liquidity cryptos and low fees for high-liquidity cryptos.

Conclusion

The Uphold card allows users to access their funds from almost anywhere in the world and earn cashback rewards as they spend. The platform uniquely allows the multi-asset trading of over 250 cryptocurrencies, stocks, precious metals, and fiat currencies.

Acquiring a card is easy and requires opening an account with Uphold and requesting a virtual or physical card. The physical card is only available to residents of the U.K. for £9.95. Uphold card supports multiple asset classes and has different tiers to keep these assets.

Uphold has a poor customer service rating and charges both trading commissions and a higher spread fee depending on the asset class and its volatility.

The Uphold Card offers no annual fees or activation fees. Even for users limited to the virtual card, it can be added to Apple or Google Pay wallets for in-person spending. With the Uphold Card, you have the flexibility to spend any asset held in your Uphold wallet, including cryptocurrencies, precious metals, commodities, or fiat currencies.

With the Uphold Card, you can conveniently spend cryptocurrencies, national currencies, and precious metals at over 50 million merchants and virtually all ATMs worldwide. It is accepted anywhere that Mastercard is accepted, making it a 'true' debit card rather than a pre-loadable card. Its wide acceptance sets it apart from many of its competitors.

You have the option to withdraw funds directly to your bank account or to private wallets on fourteen different crypto networks.