Binance Card Review 2024: Extensive Look at the Crypto Card

TLDR

This Binance card review will give you everything you need to know – the good, bad, and ugly – to help you pick the right card.

The Binance Visa card is available for new and existing Binance users in certain EEA regions and a few countries in South America. The major drawback of the card is its limited geographical coverage, especially for US users and continents outside of Europe.

The card comes in physical and virtual forms and is accepted at any payment point where you can use the Visa debit card.

There is no monthly fee on the Binance card. There is a low % transaction fee of 0.9% for payments, everyday purchases, and withdrawals. However, you get cashback on your purchases of up to 8%. The physical card has a daily spending limit of 8,700 EUR and a withdrawal limit of 290 EUR.

The steps of getting a Binance card include:

- Register a Binance account.

- Complete Identity Verification

- Order a Binance Visa debit on the Binance Page

Who should use the Binance Visa Debit Card?

The Binance Visa card is a cryptocurrency debit card used by anyone who wants to transfer money, pay for products or services online with their cryptocurrency, or convert their crypto into fiat currencies that can be spent at physical stores.

Despite these functionalities, it is important to consider the downside of the Binance card, like crypto conversion fees, transaction fees, ATM withdrawals, the number of converted coins, and other features before choosing the Binance card. There is up to a 0.9% withdrawal fee, and this card is not functional in countries like the United States.

For new users

The Binance Visa card is unsuitable for beginners, as you need to have a Binance account and hold some cryptocurrencies. However, opening an account on the exchange is simple, and so is the purchasing process of cryptocurrency from the exchange.

Binance requires you to have some cryptocurrency in your funding wallet before applying for a debit card. Also, the card only supports 14 types of cryptocurrencies; you must ensure you hold one of the supported cryptos.

Binance Card Review: Geographical availability

There are limitations to the geographical regions where you can use the physical Binance card. In choosing to use the card, you need to consider the locations where this card is made available.

It is only available in most European countries:

- Austria

- Belgium

- Finland

- France

- Germany

- Ireland

- Italy

- Netherlands

- Norway

- Poland

- Portugal

- Spain

- Sweden

- etc.

It is also available in South American countries like Argentina, Brazil, and Columbia.

What makes Binance Card a good choice?

HODL crypto

If you’re a HODLer, this is a good choice. Most cryptocurrency debit cards operate by selling your cryptocurrency and providing an equivalent amount in fiat currencies. However, the Binance card allows you to maintain ownership of your digital assets by only converting at the point of purchase or transactions using the card.

This means that your crypto assets remain yours, and only the amount needed to complete your transaction on the card will be converted to fiat. One benefit is that you will still have any gains from the crypto you hold. Remember to set off a percentage of your portfolio for spending.

User interface and experience

The Binance card is designed to run seamlessly with a designated app available to Binance users. The app is intuitive and allows you to access details about your card, including balance, cashback, and transaction details.

The user interface of the Binance card app is easy to use and navigate, even for the beginner trader. The app is available on both iOS and Android devices. This means you have full control over your card activity.

Security

Contis Financial Services Limited provides financial security for Binance Visa and debit cards. Your cash is kept in a regulated bank account, separate from the company’s funds, ensuring its safety. Additionally, these funds are insured, protecting them in case of any loss or liquidation, unlike other companies in the crypto industry.

The card itself is also provided with modern security features such as the 3D Secure Verification (3DS) process before transactions are approved online. This is an additional layer of security that aids the prevention of fraudulent transactions and illegal access to your assets. Binance also provides some security tips to help safeguard your funds.

Low Fees

New and existing Binance users enjoy the low-fee features of the Binance card. The fees are up to 0.9% on payments and withdrawals.

One major perk is no fees for issuing a physical or virtual card. No visa is accepted. Neither are any monthly fees or annual fees charged for holding the card. However, since the converted currency of the card is Euro, there is likely a conversion charge when making purchases outside of the Euro.

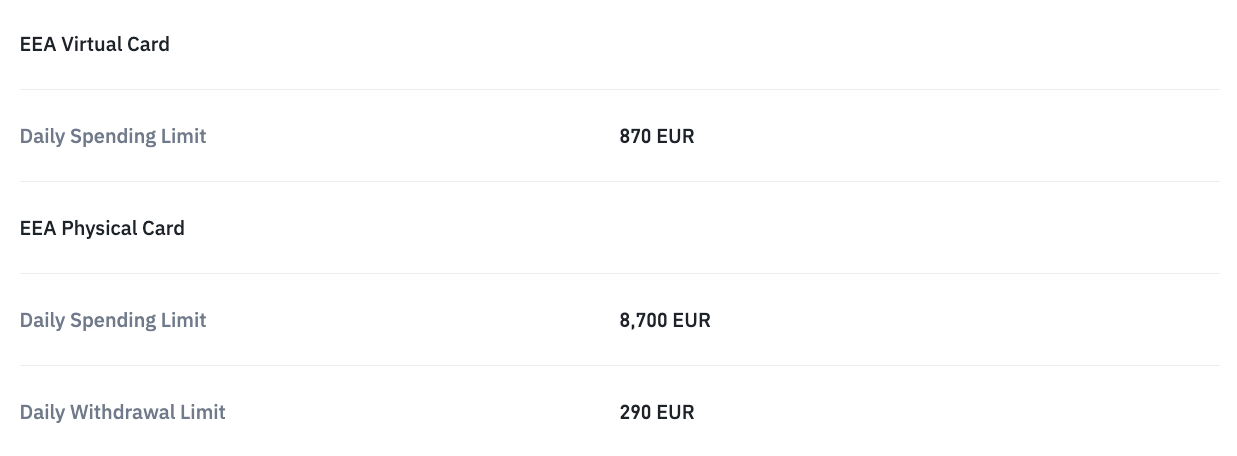

The card dashboard on the Binance card app holds information about the total spending and withdrawal allowed daily. Different daily spending limits are allowed on the card dashboard for different cards.

How to get a Binance Visa Card

You can follow this simple step-by-step guide to get the Visa Card. If you are an existing Binance user, you can skip the first step and go directly to order your card.

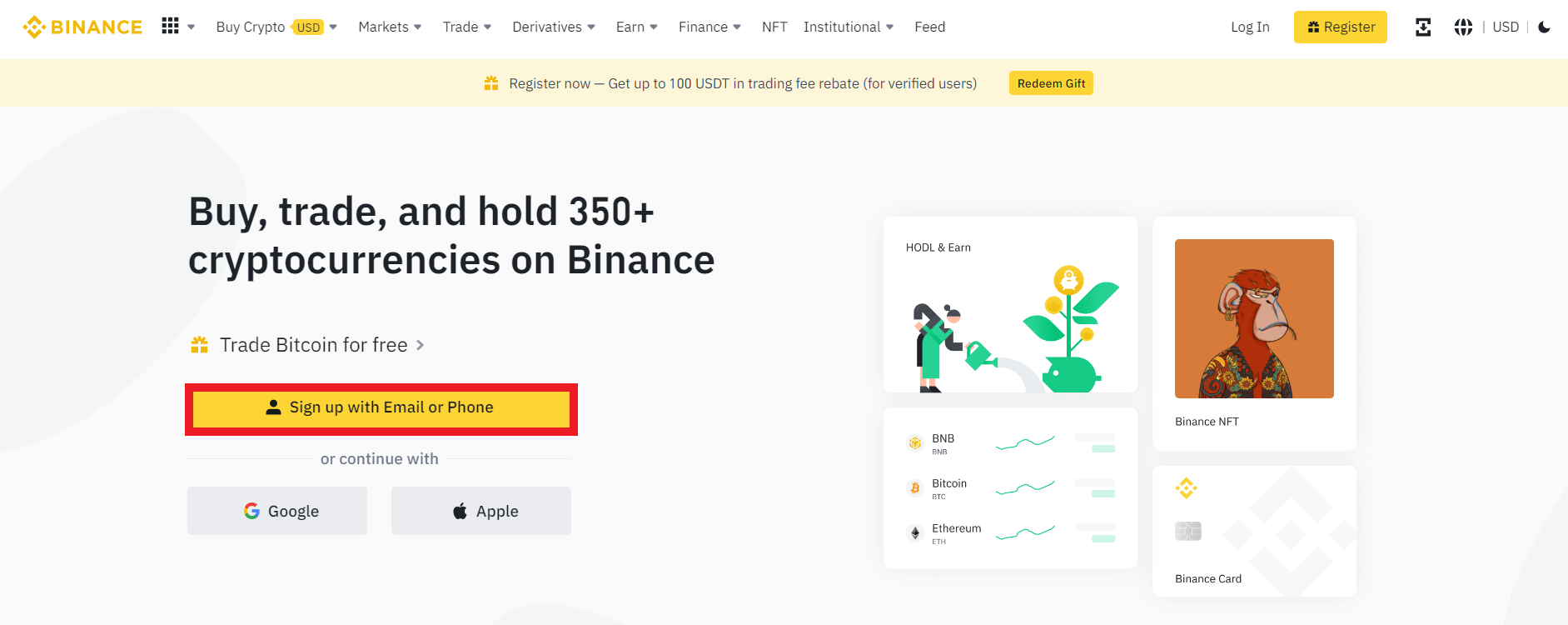

Step 1: Visit the Binance Website

The first step to getting a Binance card is to open an account.

Visit the Binance website and select the [Sign up] button. You can sign up with your e-mail or phone number. Alternatively, you can sign up with Google or Apple ID.

More details

The Binance Card is an excellent choice with up to 8% cashback. It is a Visa card for online payments, allowing you to make purchases and withdraw money or cash from ATMs. The Binance Card currently supports 14 cryptocurrencies for spending. No issuance or monthly cost and only a 0.9% crypto conversion charge for withdrawals or purchases!

-

It may be used all around the world.

-

Low processing fees.

-

High withdrawal limits.

-

Cheap transaction costs globally.

-

Cashback in BNB up to 8%.

-

Not available in the United States.

-

Supports only a limited number of cryptocurrencies.

-

Slow customer support.

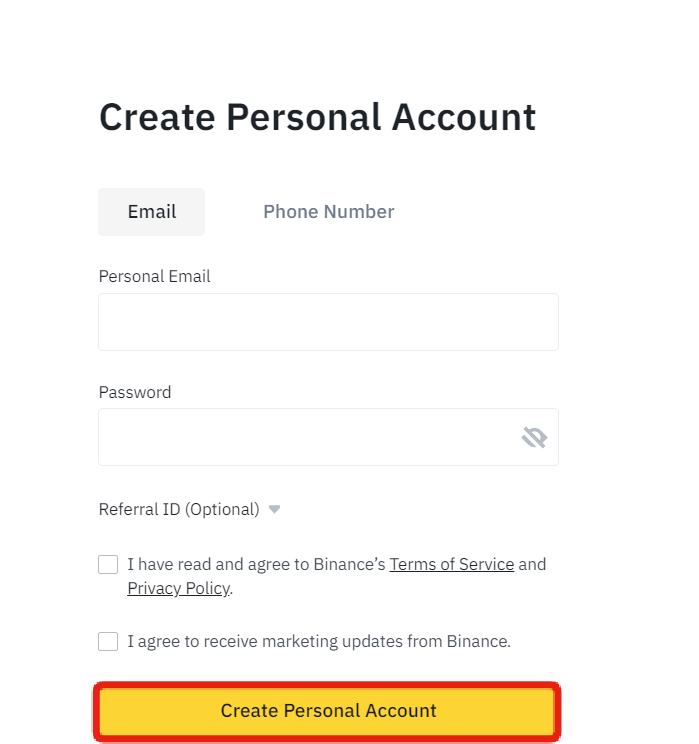

Step 2: Register a Binance account

Sign up for a Binance account by entering an e-mail and password. Once inputting this detail, click the [Create Personal Account] button.

You must also complete the identity verification process for your account (KYC) to receive the card.

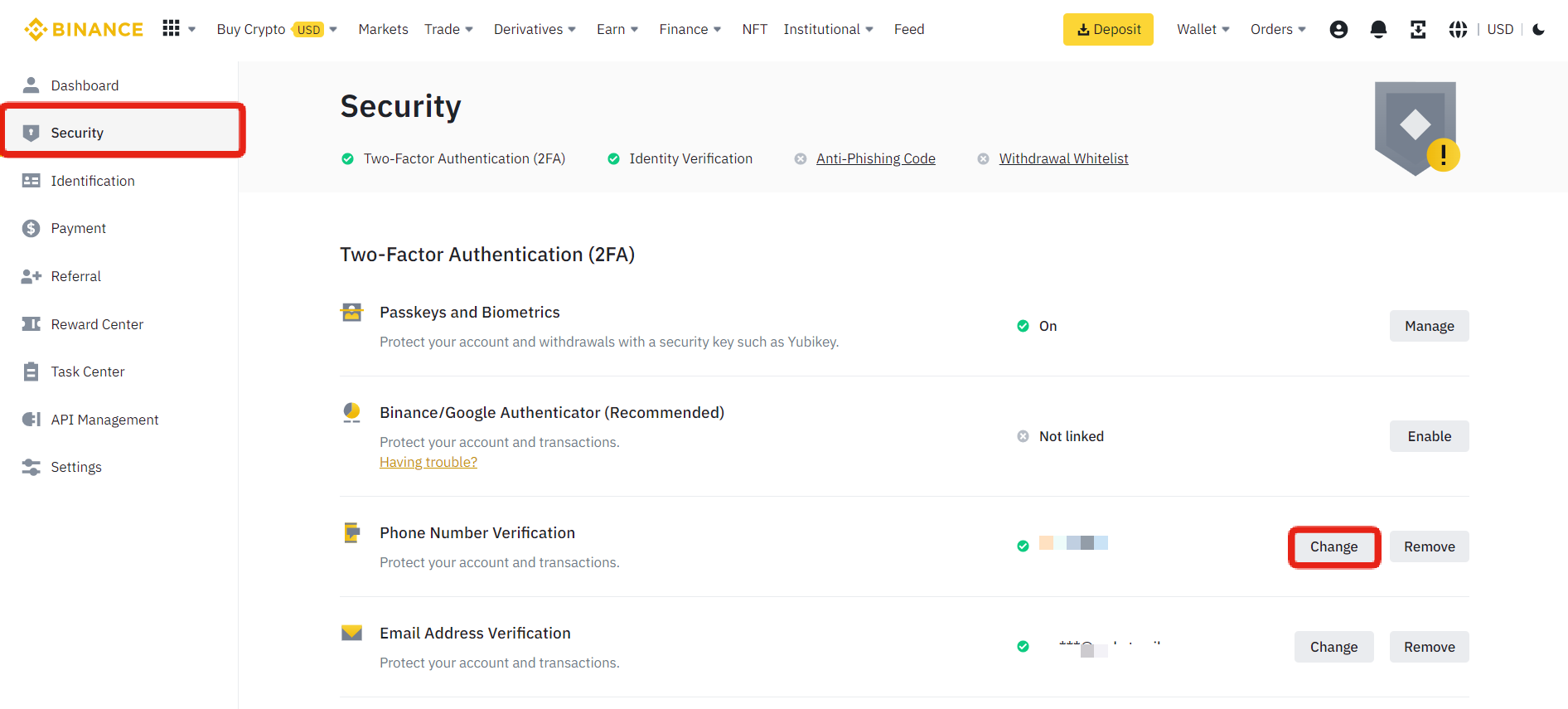

Step 3: Include a phone number

Once your account is set up, you must include an eligible phone number.

From your Binance dashboard, select the [Security] button, go to the phone number verification option, and enter an eligible number.

An eligible number is typically a phone number from the regions that support Binance cards.

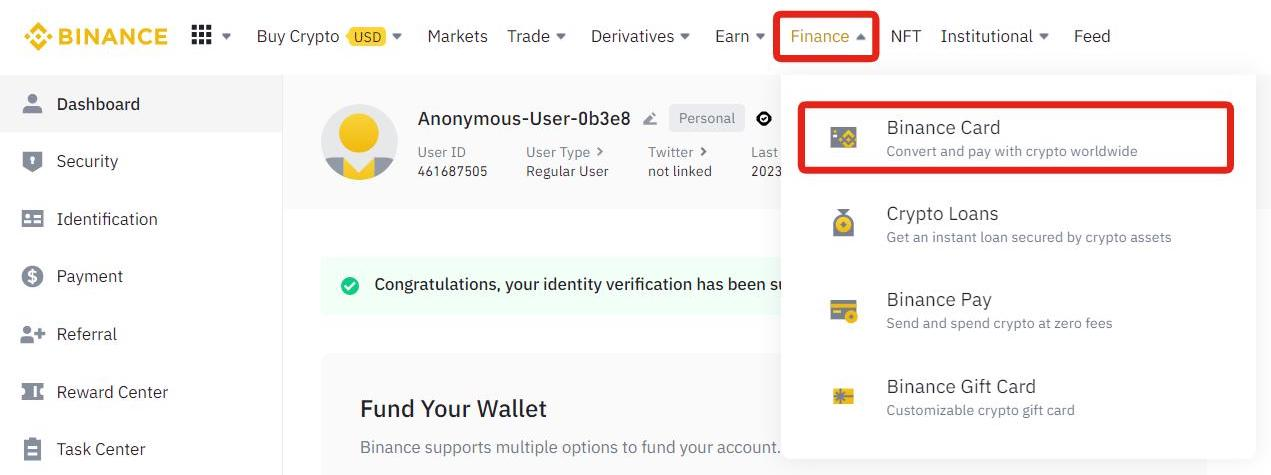

Step 4: Order a Binance Visa debit card

After your phone number is verified.

Go to your Binance account, click the [Finance] button, and then the [Binance Card], which appears in the navigation bar.

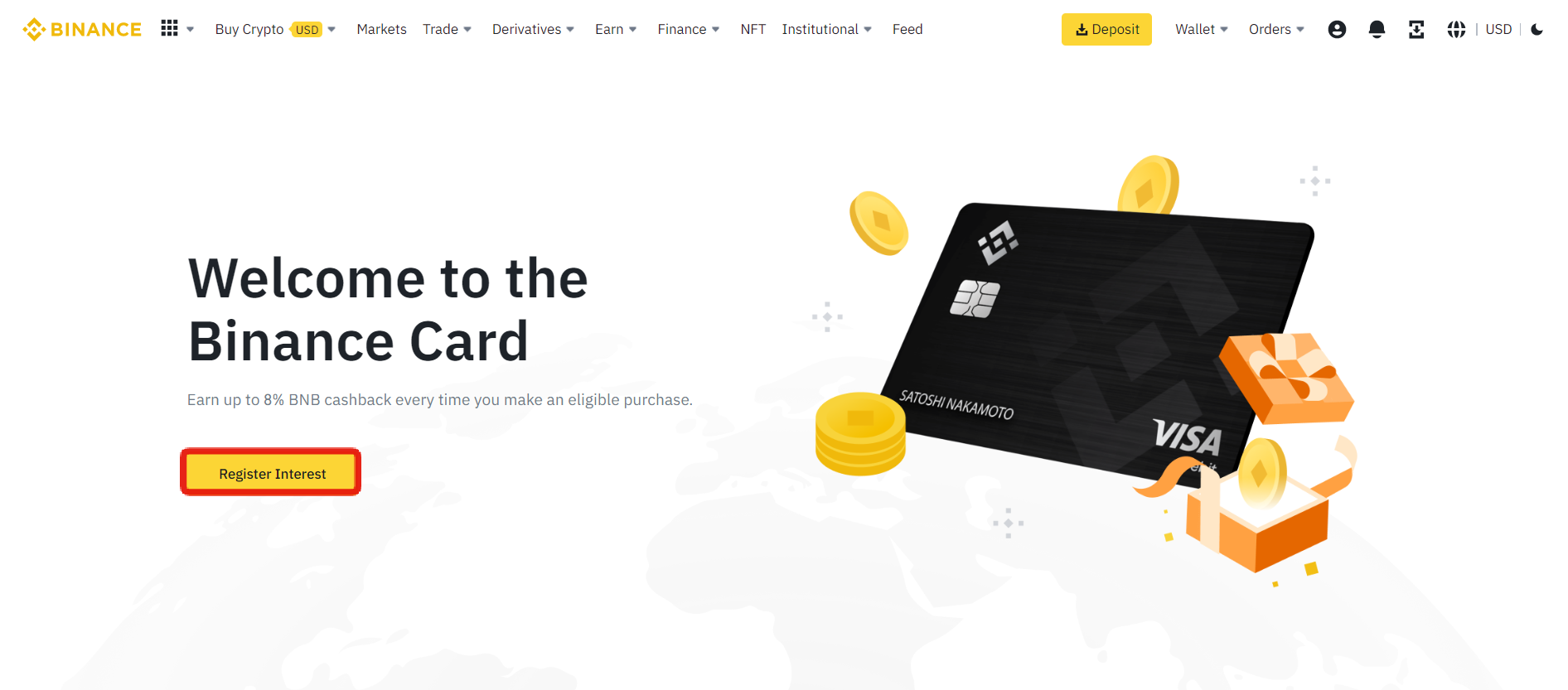

This leads to the ‘Order Binance Card‘ page, where you can order your card. Click the [Register Interest] button.

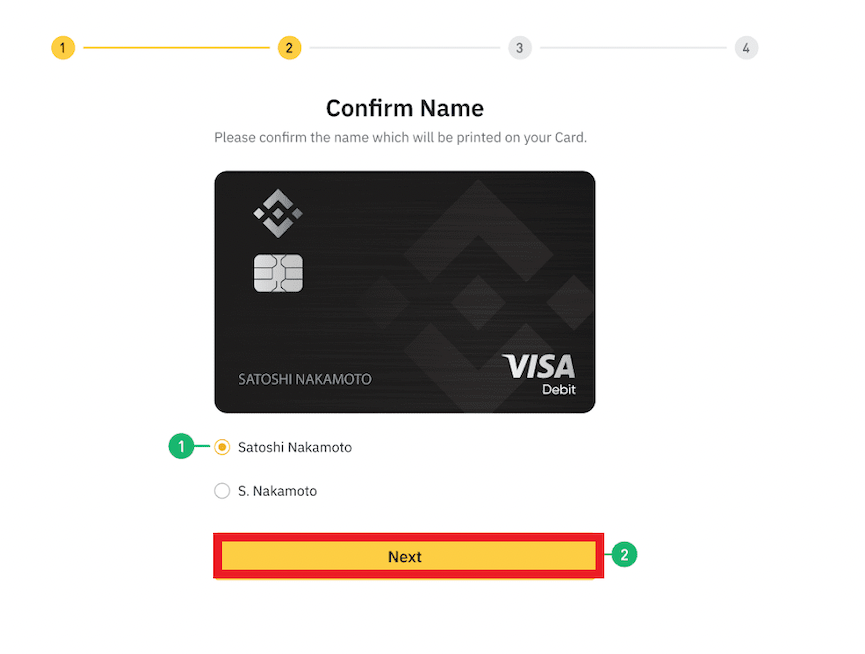

Step 5: Customize your card

You will be directed to the next stage to customize your card. Here, you may pick how your name appears on the card. When you are sure, click [Next].

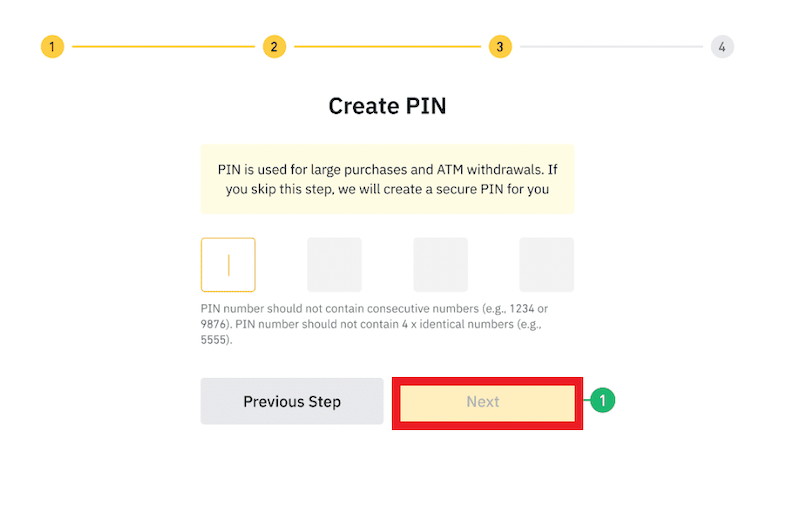

Step 6: Create a PIN

Next, create a PIN for your card. This usually involves a four-digit PIN.

Once done, select the [Next] button to move to the order page.

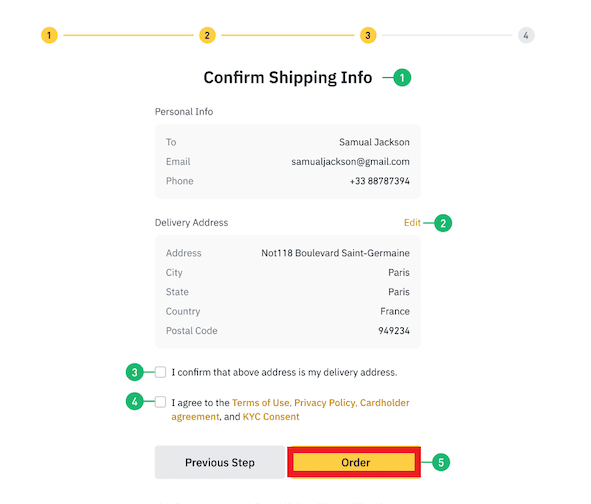

Step 7: Confirm the Order Address

Confirm your card’s delivery, shipping address, and other required information.

Once verified, click the [Order] button to complete the procedure.

After completing the registration process, your virtual Binance Card will be issued instantaneously and active until the physical card is delivered.

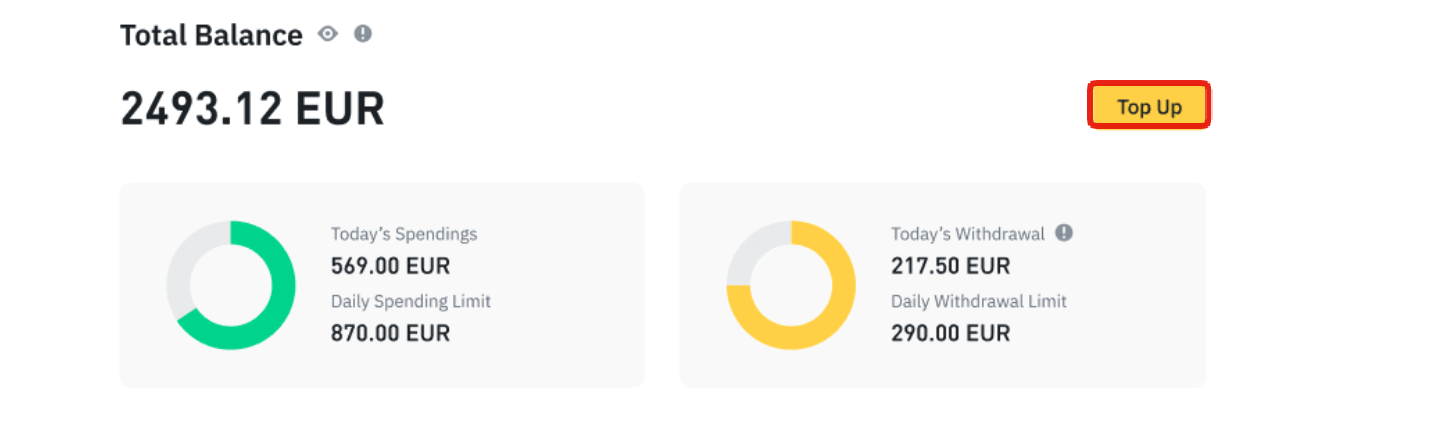

How to Top Up the Card?

To fund your Binance card, you must transfer from a spot wallet to the funding wallet. The card is loaded in Euro currency.

The [Top up] button is visible above on the dashboard, and you can select the amount you wish to transfer.

No fee is linked to this transfer, and once you confirm the transfer, your wallet will be credited immediately. You can view your card’s balance and other details on the dashboard.

The Binance debit card will automatically follow this sequence whenever you pay by prioritizing the cryptocurrencies you want to spend. This ensures that your preferred currencies are used first, giving you more control over your spending.

Binance Card Review: Top Features & Perks

Cashback rewards

Binance Card provides cashback on any purchases made using the card. Your account’s cashback rate is determined by the amount of Binance Coins (BNB) you have staked. You can receive up to a whopping 8% Cashback on eligible purchases.

Your wallet receives BNB tokens as cashback for cleared purchases, eligible for daily cashback transactions per purchase. Receiving the eligible cashback can sometimes take a few days after the purchase.

Binance has 7 Cashback levels, which are used to calculate the monthly average balance and cashback rewards.

| Level 1: | No minimum monthly BNB stake balance, 0.1% cashback. |

| Level 2: | 1 BNB monthly stake balance, 2% cashback. |

| Level 3: | 10 BNB monthly stake balance, 3% cashback. |

| Level 4 | 40 BNB monthly stake balance, 4% cashback. |

| Level 5: | 100 BNB monthly stake balance, 5% cashback. |

| Level 6: | 250 BNB monthly stake balance, 6% cashback. |

| Level 7: | 600 BNB monthly stake balance, 8% cashback. |

The cashback reward increases across levels corresponding to the minimum BNB balance required. Additionally, the cashback is capped at a certain amount for each level.

Mobile App and Push Notifications

With your mobile app, you can instantly monitor your daily transfers and any transactions made with the card. It is compatible with iOS and Android. An added feature to the app is the push notification that pops up after any transaction is made on the card.

The Binance app is intuitive and helps well with the card. The app is user-friendly; you can have all the card details you need at the tip of your fingers.

You can easily safeguard your Binance card by temporarily freezing it through the app if you suspect fraudulent activity or unauthorized transactions. The app also provides comprehensive information about the card’s usage and status, ensuring you have full control over your finances at all times.

Supported Currencies

The Binance Visa card is not only limited to Binance coin; it also supports many other cryptocurrencies. Currently, the crypto card supports 14 cryptocurrencies, including BTC, ETH, XRP, USDT, SHIB, etc.

You can fund your virtual cryptocurrency debit cards or physical cards using any supported cryptos. In addition to cryptocurrency funding, the card supports the Euro as a fiat currency.

Binance card limits

Since the Binance card is funded to withdraw cash from the funding wallet, there are no pro fees charged. However, the card has certain spending and withdrawal limits, which depend on whether it is a physical or virtual card.

The virtual card comes with a daily spending limit of 870 EUR, while its counterpart, the physical Binance card, has a daily spending limit of 8,700 EUR. There is a cap on daily ATM withdrawals, which is 290 EUR.

There are no fees for card issuance, card inactivity, cardholder agreement, or management. Although, if you are replacing your card, you must pay a monthly fee of 25 EUR.

Disadvantages of Binance card

Unreliable customer support

Binance customer support is really slow, and this is a pain point for many users. Contacting their support team may be a hassle if you encounter an issue using your Binance Card. The lack of adequate customer support concerns many users who require technical support when using the card.

Restricted Geographical Access

The Binance Card is only available in the supported European countries and selected South American countries like Argentina, Brazil, and Colombia.

Given that the United States has the highest cryptocurrency use, it’s disappointing that the Binance Visa Card is not available in the United States.

Binance Card Review: Our Verdict

It is common to have many users wondering if the Binance Visa card is worth it. The card offers numerous benefits, mainly because it allows you to hold on to your crypto assets and only converts them to fiat currencies at the point of purchase.

The card also offers low fees for ATM withdrawals and transactions. You can get up to 8% cashback when using the card. Also, because the card supports up to 14 cryptocurrencies, it is a choice card for many individuals planning to get a crypto card.

Although the card offers physical and virtual card options at no cost, it has geographical limitations. The card service is only limited to users present in certain European countries and has recently allowed some countries in South America to be part of the program. The geographical coverage of Binance cards is expected to expand in the coming years.

Enjoy zero ATM withdrawal fees and foreign transaction fees within Europe, as well as no sign-up or annual fees with the Binance Card. Hold your cryptocurrency in your Binance Funding Wallet and only exchange when making payments, eliminating the need for pre-conversion. Plus, rest assured that all your Binance Card funds and transactions are protected by Binance's world-class security measures.

The Binance Visa Card does not impose any issuance or monthly fees and only incurs a transaction fee of up to 0.9% for both transactions and ATM withdrawals.

To initiate a withdrawal from Binance to your bank account, you need to log in to your account and navigate to the Wallet section. Under Fiat and Spot, you will find the options for deposit, withdraw, and send. Choose Withdraw to proceed.