Crypto.com Card Review 2024: Spend Your Crypto with Style

TLDR

This crypto.com card review will examine all its benefits, disadvantages, and improvements to help you decide if this card is correct.

Crypto.com Visa cards are widely accepted across the world. This can be attributed to the solid network of Visa worldwide and the availability of over 200 cryptocurrencies on the crypto.com exchange. It operates like a prepaid debit card; once funded, it can be used to transact. The Crypto.com Visa Card allows crypto holders to spend their assets without converting to fiat currency.

One significant advantage of this prepaid card is the flexibility of funding, which could either be through PayPal’s fiat wallet or directly from a cryptocurrency wallet. This includes 5% cashback, subscription rebates, and complimentary airport lounge access.

A significant drawback is the amount of cryptocurrency to be staked over a period to access certain benefits the card provides.

Who should use the Crypto.com card?

The increasing cryptocurrency adoption has made crypto cards familiar in daily business. Crypto cards are now used and accepted for payment of goods and services by many offline and online vendors.

Crypto.com Visa card is a crypto-backed card. Many crypto investors and crypto enthusiasts patronize Crypto.com because of the excellent trading experience and low transaction fees it offers to its users. It is also a leading crypto site because of the availability of a wide range of cryptocurrencies. This card is for both new and veteran investors.

Crypto.com debit cards are based on the Visa card network. The user’s cryptocurrency wallet directly funds the card, which replicates a Visa prepaid debit card in the crypto world and can carry out transactions without needing to be connected to any active fiat bank account.

You can use the card to buy cryptocurrencies like Bitcoin or Ethereum and make payments at merchant stores or with other digital coins.

Crypto.com Card Review: Geographic availability

One of the strong points of the Crypto.com card is its broad geographic spread. The card was launched in 2016 for the Singapore market and has rapidly spread to the United States and the United Kingdom. The card is now available in 31 European countries, including all 27 EU member states.

Crypto.com card continues to expand its service region, encompassing more countries and territories, making it one of the most widely available crypto cards. Australia, Brazil, and Canada are among the latest countries to receive the card service in the planned rollout of the crypto company.

How does the Crypto.com Visa card work

Over 40 million merchant stores worldwide currently accept the Crypto.com Visa card, thanks to the comprehensive coverage of the Visa network. Additionally, it can be used for online payments at merchants that accept Visa cards.

The card allows flexibility in funding. The card can be funded directly using fiat or cryptocurrency. It can also be funded using the crypto.com App. This can be through the purchase of crypto from the app or withdrawal from a crypto wallet onto the card. You can immediately fund the card with the fiat equivalent of your chosen cryptocurrency and use it for transactions.

Another way to fund the Crypto.com visa card is to fund through fiat. Users in the United States can fund their crypto card directly from PayPal accounts. However, this process draws a transaction fee of 2.1% on every funding.

What makes the Crypto.com Visa card a good choice?

There are various reasons why a Crypto.com Visa Card is a good choice among crypto users.

The flexibility of using

Crypto.com Visa card grants crypto users flexibility on how to use their crypto assets. With the crypto.com visa card, it is possible to spend crypto assets for daily transactions like fiat currency. You can now use the card to transact with merchants, not directly accepting cryptocurrencies. That means that crypto.com visa card holders can make payments in crypto while the merchant receives fiat.

No monthly or annual fee

Unlike traditional card services, which charge a stipulated amount for card services monthly or annually, Crypto.com Visa cards have no extra monthly or even annual fee charges. There are no foreign exchange fees when spending in another country. This is one of the major advantages of using the crypto.com card compared to their competitors.

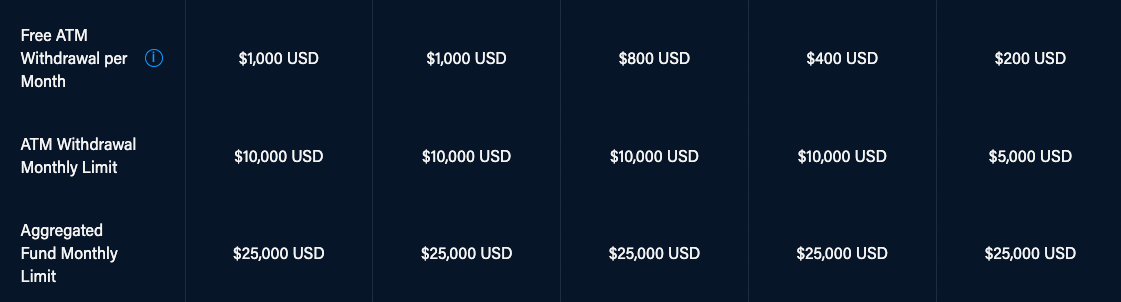

Free ATM withdrawals

It allows cash withdrawal from ATMs worldwide across the world for free. This is a convenient way for crypto enthusiasts to avoid foreign transaction fees, exchange charges, and typical prepaid debit cards and credit cards. This affords crypto holders to access funds easily as needed.

Cashback rewards

One major perk of this card is that it offers cashback bonus rewards on every transaction you make. Crypto.com debit cards give up to 5% cashback for every transaction with the card. This cashback is paid in Cronos (CRO), the native token of Crypto.com. This token can then be converted to fiat. The value of Cronos is typically between $0.16 – $ 0.50 and is subject to market volatility.

Fast for online payments

You can use Crypto.com Visa cards for online payments across various merchants, making it a versatile payment option. It eradicates the need to convert the crypto asset to fiat before purchase.

Rebates and other rewards

Crypto.com cards pay reimbursement on regular subscriptions such as Netflix, Spotify, and Amazon Prime. It also provides complimentary airport lounge access in over a thousand airports worldwide.

Virtual Card

The card comes as a digital twin. This allows the usage of the virtual card pending the arrival of the physical card. This is also important when carrying out online transactions when the physical card is not immediately accessible.

The virtual card is compatible with Apple Pay and Google Pay.

How to get a Crypto.com Visa card

The process of getting a crypto.com card is simple. Follow these few steps to get delivery of the crypto-backed Visa card.

Step 1: Visit the Crypto.com website

Visit the crypto.com website and click the [Sign Up] button in the upper right-hand corner.

More details

The Crypto.com Visa Card is a popular cryptocurrency-backed card, funded from a crypto wallet or via PayPal. It can be ordered and delivered without fees and is accepted at over 40 million merchant stores and 2.5 million Visa ATMs worldwide. Cardholders can earn 5% cashback on transactions by staking Cronos.

-

Cashback crypto rewards.

-

No monthly or annual fees.

-

Easy card management.

-

Flexibility in funding.

-

Free ATM withdrawals.

-

Varied card tier privileges.

-

Low Monthly cash back limits.

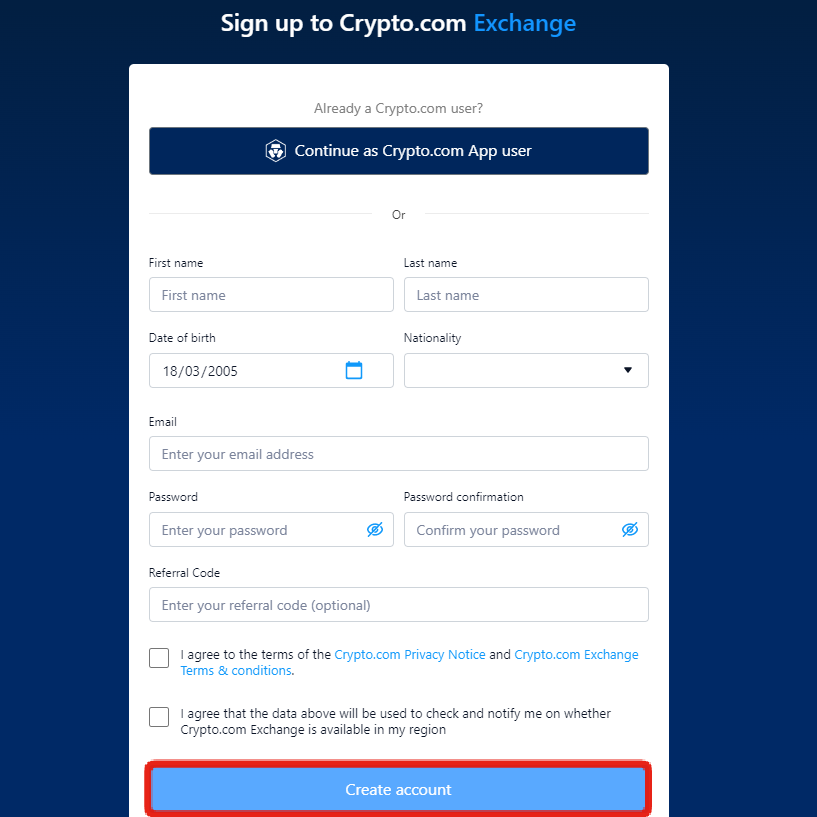

Step 2: Sign up

This account creation requires full name, date of birth, nationality, and e-mail address (for account confirmation).

Once you have completed all the required details, click [Create an account].

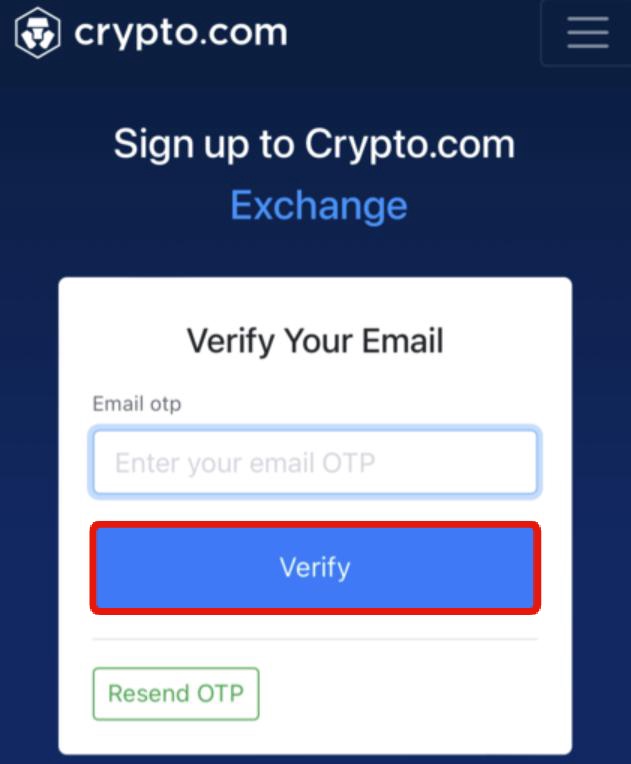

After registering, the system will send an e-mail containing a one-time password (OTP) to your registered email address for verification. Check your inbox to confirm your registration.

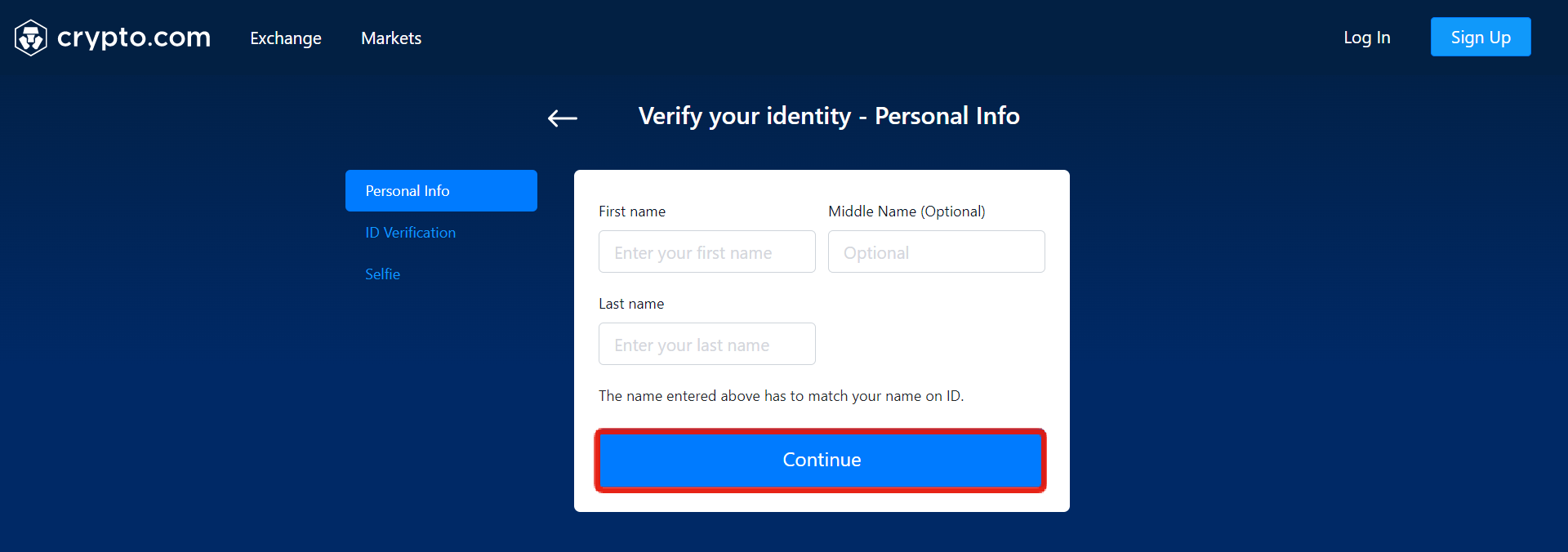

Step 3: Account verification

The next step is to register via the KYC procedure. This would involve uploading a picture of a valid government-issued ID.

This typically takes between a few hours to a maximum of 1 day to get verified.

Step 4: Download the app

We recommend downloading the Crypto.com mobile app via the website links, App Store, or Google Play after registration to ensure easy accessibility. To do so, click the [Download App] button.

Step 5: Purchase CRO

Once verified, the next thing is to purchase Cronos (CRO). The easiest way to do it is by buying through a debit or credit card in the Crypto.com App.

Click on the [Buy] button and follow the subsequent onscreen instructions.

After completing the purchase, you can request the card.

Various tiers of cards are available, and some require staking a certain amount of CRO. However, the first, midnight blue card tier, doesn’t require CRO staking.

Step 6: Card application

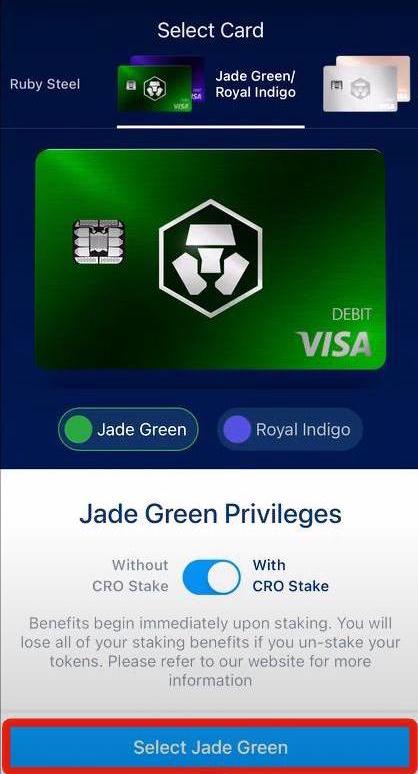

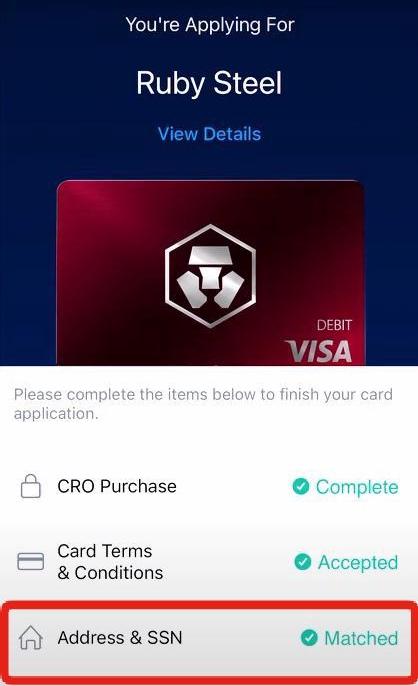

After completing the CRO purchase, click the [Card] button on the bottom right corner of the home page.

To select the appropriate card tier, you can navigate the list of available tiers and choose the one corresponding to the minimum staking amount of CRO required.

Proceed to confirm the delivery address where the card is to be shipped.

Step 7: Start using the Crypto.com card

The delivery time for most cards across the United States is 3-14 business days. You can easily track the card’s status by clicking on it in the mobile app.

Upon arrival, the card is activated on the app by clicking the [Activate My Card] button. This entails creating a pin and inputting the card CVV.

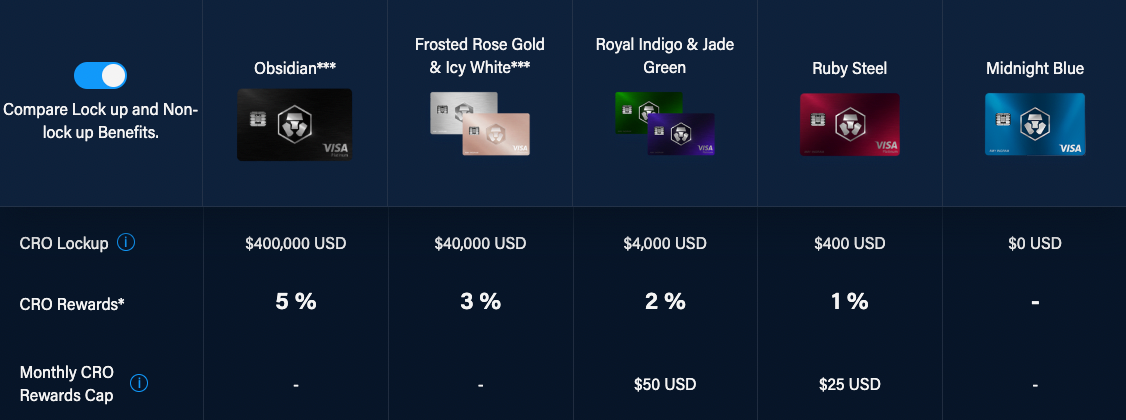

Crypto.com Card Review: Visa Card Tiers

The Crypto.com card comes in tiers. They have differences in spending limits and CRO rewards. They also need a certain amount of CRO to be staked over a stipulated time.

Here is the summary:

- Midnight blue card – no stake requirements, no cashback.

- Ruby Steel card – $400 CRO staked, 1% cashback.

- Royal Indigo/Jade Green card – $4000 CRO staked, 2% cashback.

- Frosted Rose Gold/Icy White card – $40,000 CRO staked, 3% cashback.

- Obsidian card – $400,000 CRO staked, 5% cashback.

Midnight Blue

This is the lowest card rewards program tier provided by Crypto.com and does not require CRO staking. It can earn rewards and spend fiat currency in a crypto wallet.

However, it does not even earn rewards that come alongside any reward; that means there is no reward regardless of the amount of card spending carried out. Unlike other tiers, the card is made of plastic and not metal.

Ruby Steel

This next tier requires staking of $400 worth of CRO for six months minimum. The issuer produces the card with a metal body and a thin plastic layer to enable contactless payments.

This tier offers a 1% cashback on every payment paid in CRO. Unfortunately, the maximum monthly reward is about $25, which means spending above $2500 would not receive a reward. Spotify access is for six months only.

Royal Indigo/ Jade Green

This tier comes in two different color varieties. To qualify for the card, you need to stake a minimum of $4000 worth of CRO rewards on eligible purchases and receive 2% cashback on overall spending, which will be deducted from the annual fee in the form of CRO. The maximum annual fee is $50, based on monthly expenditures. Once you meet these requirements, the card will be issued.

Although, your staked CRO comes with a 4% annual fee and interest. The holder also gets Spotify and Netflix for the first six months and free airport lounge access for up to 4 visits annually. The $50 monthly maximum means breaking even on the staked $4000 will take longer.

Frosted Rose Gold /Icy White

The Frosted Rose Gold/Icy White card has a $40,000 stake requirement and no monthly cashback limit. This debit card gets a whopping 3% cash back on every purchase. It comes alongside a subscription to Netflix, Amazon Prime, and Spotify.

Also, the card covers free airport lounge visits all year round alongside a guest and a discount of $50 on Expedia.

Regardless of how long it might take to break even on the staked CRO, the holder of the CRO token continues to earn crypto rewards. You get a 2% increase in non-CRO crypto rewards on deposits of CRO tokens and discounted rates when trading CRO tokens on the crypto.com exchange.

Obsidian

This is the king of the Crypto.com Visa card. The holder enjoys all the rewards and benefits of a crypto.com card. This holder gets a maximum of 5% cashback with no monthly cap on the cashback.

It provides a continued subscription to Netflix, Amazon Prime, and Spotify. The holder also enjoys an exclusive merchandise welcome pack. This includes access to exclusive discounts to crypto rewards from partner merchants worldwide. The holder also has access to the private jet partner fleet of Crypto.com.

Outside the need of staking a direct deposit of a whopping sum of $400,000 worth of crypto funds with CRO, the holder enjoys a bonus interest of over 3% on non-CRO deposits.

Upgrading or downgrading Crypto.com Visa Card

Upgrading the crypto debit card

It is possible to carry out upgrades from one tier to another. The first thing to do is to stake the required amount for the new tier. A good example is staking $400 for the ruby steel tier.

You can quickly upgrade by clicking the [Upgrade] button in the CRO wallet on the Crypto.com app. Previously, there was a $50 upgrade fee, which was worth it as it could be earned back quickly from cashback. However, since June 2022, this upgrade fee has been waived.

This upgrade would deactivate the currently held physical card. Meanwhile, Crypto.com would issue a virtual card that can be used for online transactions pending the arrival of the new card, which takes only a few days.

Downgrading the crypto debit card

Withdrawing the staked CRO amount after the initial six-month lock-in is straightforward. In doing so, there would be an automatic reduction in the cashback and other benefits enjoyed.

The holder of the preferred card tier gets to keep the physical card until it expires but would enjoy access to some benefits of the tier. The excluded assets include airport lounge access, rewards cards, reduced free ATM withdrawals, and interbank limits bank account transfers and balance transfers.

Crypto.com Card Review: Drawbacks

There are a few things to consider before subscribing to a crypto.com visa debit card.

Varied card tier privileges

The debit cards are of different cadres. These cadres determine the benefits the holder of the card can enjoy. Benefits like free ATM withdrawal, hotel lounge, etc., are limited to lower-tier cards.

Crypto staking

Staking is the process of locking crypto assets for a set period to aid in the operation of a blockchain. This, in turn, leads to an increase in cryptocurrency, which is given as a reward. To subscribe to certain tier cards, there would be a need to stake a certain amount of CRO in the Crypto.com native blockchain.

This stake can be likened to a fixed deposit that must be made. A major disadvantage is that the user can no longer access the accruing benefit once the staked value drops.

Cashback limits

All card tiers do not enjoy the same level of cashback. Also, the cashback is capped at certain amounts per month. This can be attributed to the amount of staking that each card level requires.

Crypto.com Card Review: Our Verdict

The Crypto.com Debit Visa Card is a popular prepaid card that stands out among other crypto-backed cards. Unlike traditional prepaid cards funded with fiat, this card is funded with cryptocurrency. When using the card, the spending is converted to fiat at the point of purchase based on the current crypto market rates.

This innovative cooperation between Crypto.com and Visa has made it easier for crypto holders to spend their cryptocurrency with merchants who don’t accept crypto traditionally. The card also offers exciting rewards and a cashback of up to 5% on purchases.

This makes the Crypto.com Visa card an excellent choice for those looking to spend their crypto in the real world.

The Crypto.com Debit Visa Card is a prepaid card that can be loaded with cryptocurrency. It works like a traditional prepaid card, and spending is converted to fiat at the point of purchase based on current market rates. This makes it easy for crypto holders to spend their digital assets with merchants who don't accept cryptocurrency.

The Crypto.com Visa card offers various rewards and cashback on purchases of up to 5%. This makes it an appealing option for users looking to spend their crypto in the real world. Additionally, cardholders can access exclusive benefits, such as airport lounge access and discounts at various merchants.

To get the Crypto.com Debit Visa Card, you must register a Crypto.com account and apply for the card. Currently, the card has no annual fee or other hidden fees. But you might be charged on ATM withdrawals or if you don't use the card for some time.