Coinbase Card Review: Is It The Best Crypto Card? (2024)

TLDR

In this Coinbase Card review, we will cover its functionality, the crypto rewards program, and all the pros and cons of using this debit card.

The Coinbase Card offers a simple way to earn crypto rewards of up to 4% without buying crypto. Its global backing by Visa and acceptance in 40M+ vendors make it appealing. It charges a 3% + 2.49% liquidation fee for foreign transactions, making it a deal-breaker for some.

Despite its availability in only the US and select EU countries, it’s still a viable option for crypto traders and supports 8+ cryptocurrencies. However, there are drawbacks, such as potential tax implications and limited rewards categories.

Let’s explore this further!

Coinbase card at a glance

| Feature | Details |

|---|---|

| Foreign Transaction Fees | 3% + 2.49% Liquidation Fee |

| Available Countries | US, UK, Selective EU Countries |

| Supported Cryptocurrencies | 8+ |

| Cashback Rewards | Up To 4% |

| Rewards Redeem Options | Transfer & Staking |

| Regulatory Compliance | GDPR & FinCEN |

Overview of Coinbase debit card

The Coinbase Card has been the key player in the crypto space since 2020, issued by Metabank and powered by Coinbase. You can spend your cryptos or USD anywhere Visa cards are accepted.

Interestingly, the card comes with extraordinary perks: no fees for crypto transactions, no annual fee, and a straightforward rewards system.

And here’s the best part – it’s not just for purchases. You can use the Coinbase Card at ATMs worldwide to cash out your cryptocurrencies. Like regular purchases, It converts your crypto to USD when you withdraw money from an ATM, with a daily limit of $1,000.

Who should get a Coinbase card?

- New investors: If you’ve been curious about crypto but are hesitant to spend your fiat currency, the Coinbase Card might be your perfect entry point—no need to purchase crypto to earn rewards, and no staking requirement.

- Coinbase exchange users: If you’re an active Coinbase user and hold cash or USDC in your account, the Coinbase card is worth using. While the reward rates might not match those of traditional cashback cards, the potential for a better return, given the volatility of cryptocurrencies, makes it an intriguing option to explore.

Eligibility criteria

To open the card in the U.S. and the EU., you’ll need:

- An active Coinbase account

- Completion of KYC verification requirements

- Being 18 years or older

The verification process involves uploading a photo of a government ID, such as a driver’s license or passport. It will also require your SSN, name, and date of birth to proceed.

Country Restrictions

The Coinbase Card is available in the US and selective European countries. Here are some:

- United States

- Austria

- Belgium

- Bulgaria

- Croatia

- Cyprus

- Denmark

- Estonia

- Finland

- France

- Germany

Benefits of using Coinbase card

Let’s explore some advantages of the Coinbase card:

No credit check and global acceptance

Coinbase Card operates as a debit card, eliminating the need for a minimum credit score and any credit check during the application process. With this card, you’ll spend directly from your Coinbase balance, avoiding using a line of credit altogether.

In addition to its perks, the card issuer’s global acceptance is powered by Visa. It lets you conveniently spend your crypto and cash at countless businesses worldwide.

Easy-to-use card

With Coinbase Caard, everything happens instantly, and funding is quick and hassle-free through crypto purchases via traditional bank accounts and cards. Soon, you’ll also be able to receive paychecks in fiat money or crypto directly debited to your card.

Another nifty feature is the flexibility to effortlessly choose and change your funding wallet. Besides that, switching between different wallets is effortless. For instance, as a US resident, you can easily opt for USD Coin to reduce tax obligations.

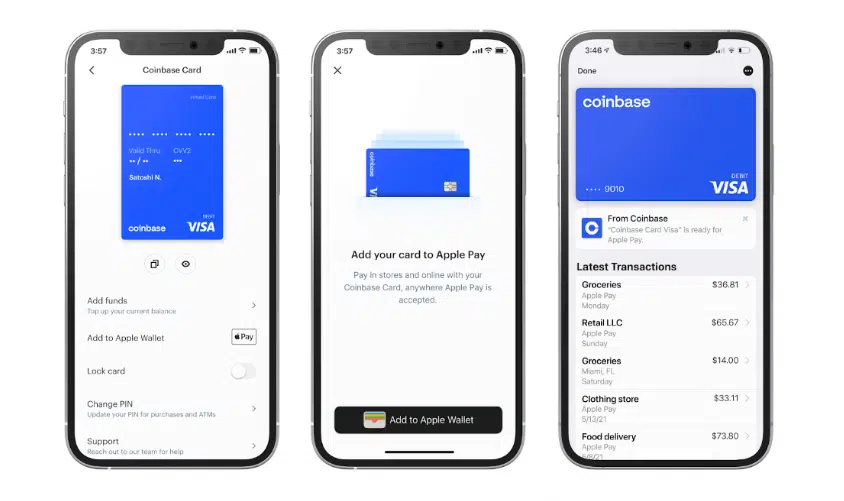

Pay on Apple and Google Pay

For seamless contactless payments with your Coinbase Card on Apple Pay and Google Pay, you can add the card as a payment method in the apps. Once approved, connect your card and start spending instantly. You can start using the virtual card before the physical card arrives.

Then, you’re all set to authorize payments with a fingerprint ID, wallet PIN, or facial recognition for ultimate ease. With Coinbase Card integrated with these payment solutions, you can enjoy contactless payments via Near Field Communication (NFC), eliminating the hassle of PINs or magnetic strips.

Diverse crypto support

Coinbase card currently supports more than eight different cryptocurrencies. Here are the crypto assets that it supports:

- Ethereum (ETH)

- Bitcoin (BTC)

- Litecoin (LTC)

- Bitcoin Cash (BCH)

- Stellar Lumens (XLM)

- Basic Attention Token (BAT)

- 0x (ZRX)

- Augur (REP)

Coinbase Card Review: Key features

Here are the key features of the Coinbase card:

Dedicated mobile app

The Coinbase Card app’s intuitive interface and availability on Android and iOS make it incredibly user-friendly.

In addition, activating the physical card through the app was a breeze. It’s a one-stop hub where you can set and change your card’s PIN, choose the funding Coinbase wallet, and effortlessly keep track of transactions. Also, it offers the ability to adjust card settings and direct purchases directly from the app.

But what’s practical is the peace of mind it offers. In case of any mishap, you can deactivate or temporarily lock your card within seconds, ensuring your funds are safe.

Earn cashback rewards

With a Coinbase card, all purchases earn you rotating monthly crypto rewards, with popular coins like Bitcoin and Ethereum always available.

Plus, buying crypto on Coinbase earns you bonus crypto rewards. Once your transaction is done, Coinbase sends you the rewards. Depending on the merchant, appearing usually takes 1 to 5 days.

The return you get depends on your chosen reward. Opting for popular, highly liquid coins like Bitcoin yields a lower return (1% to 2% at most). However, going for less popular coins like Algorand or Dogecoin can give you a higher return (up to 4%).

But there’s a catch – less popular coins are more volatile and can lose all their value. You’ll be exposed to this downside risk if you quickly convert your rewards to USD (which might have tax implications). So, weigh the options carefully.

Rewards redeeming options

Coinbase Card offers you three options to make the most of your crypto earnings. First, you can transfer your cryptocurrency rewards to a secure and reliable crypto wallet. Coinbase provides a free crypto wallet service where you can safely store your coins. Alternatively, you can use a third-party wallet if you prefer.

Another option is to trade your earned crypto rewards for other cryptocurrencies from Coinbase’s extensive list. With their platform, you can easily convert your coins into available options.

Lastly, cryptocurrencies like Ethereum can be staked with Coinbase, allowing you to earn staking rewards as a Coinbase Card member. It’s a great way to maximize the potential of your rewards and get even more out of your crypto journey.

Tax implications for US users

For US users, spending cryptos with the Coinbase Card has a tax implication. Selling cryptos is considered a taxable transaction, as digital assets are classified as property for capital gains tax by the Inland Revenue Service (IRS).

Using your Coinbase Card to transact from your crypto wallet involves selling your cryptos for fiat, making it a taxable event. As a result, you’ll need to report any realized gains or losses in your tax return.

However, there’s a way to avoid taxes. You won’t be subject to any tax implications if you connect your card to your USD Coinbase or USD coin crypto accounts.

Security and safety

At Coinbase, your protection starts with high-grade AES-256 encryption for passwords, OAuth tokens, and SSL encryption for data transmission. Plus, almost 98% of most user funds are kept in cold storage, adding an extra layer of safety. On the data front, Coinbase is entirely GDPR and Data Protection Act 2018 compliant.

As a centralized crypto exchange, Coinbase goes the extra mile with e-money compliance and strict adherence to money transmission regulations set by top financial authorities like the UK Financial Conduct Authority and FinCEN in the US. It also abides by various state money transmission laws, the USA Patriot Act, and the Bank Secrecy Act.

Regarding the Coinbase Card, they don’t skimp on security either. It’s protected with a PIN required for every transaction and a two-step online transaction verification. And in case of any mishap, the instant card freeze feature comes to the rescue – an immediate block if you lose the card or it’s compromised.

Fees and costs

With no card issuance or annual fees, it’s easy to make the most of your crypto card without worrying about yearly charges. Nevertheless, there are still some fees depending on your card usage.

ATM withdrawals are free up to $200; after that, a small 1% fee for domestic and 2% for international withdrawals applies. Remember, there’s a foreign transaction fee of 3.00% and a 2.49% liquidation fee.

One thing to consider, though, is the inherent volatility of cryptocurrencies. Due to potential slippage, there might be differences between the reviewed transaction and the final one.

But don’t worry; Coinbase factors in the spread when converting your crypto to fiat for the settlement. And finally, the spread doesn’t affect spending from your USD Coinbase account or USDC wallet.

Card limits and responsive customer support

The Coinbase Card brings convenience with specific purchase limits tailored to different regions. For US clients, enjoy a daily purchase cap of $10,000, with a limit of $1,000 for ATM withdrawals.

On the other hand, EU and UK clients have a daily purchase limit of £500 / €500. Monthly purchases are capped at $20,000, and the yearly limit extends to $100,000.

If you need higher limits for your Visa debit card, Coinbase support is there to help, and they’ll assist you with increasing the limits.

Whenever you need assistance, they’ve got your back 24/7. You can drop them an e-mail or call them locally and internationally through their dedicated support line. It’s easy to contact Coinbase customer service – sign in to your app, go to [card settings], and select [Call Support].

How to get Coinbase Card

Follow these steps to order your physical Coinbase card.

More details

The Coinbase Card seamlessly integrates the crypto economy into our everyday transactions. Unlike typical Visa debit cards, it promotes zero transaction fees and an annual fee, providing the most cost-effective way to use your crypto. We recommend it as an ideal entry point for newcomers hesitant about volatile coins.

-

$0 annual fee.

-

Earn crypto back on every purchase.

-

Used everywhere Visa is accepted.

-

No ATM fees.

-

No credit check is required.

-

Monthly spending limits apply.

-

Tax implications.

-

Requires Coinbase account for eligibility.

-

No bonus spending categories.

Step 1: Open your app

First off, you need to download the app. Once done, open the app and select [Pay] from the bottom section.

Step 2: Tap on get started

Next, you will see a screen with a Coinbase Card option; tap [Get Started].

Step 3: Start the application

After that, a new pop-up will appear on your screen; tap [Get Started] to start the application.

Step 4: Confirm details

Then, review all the details, and click the [Looks Good!] button.

Congratulations! You have successfully ordered the card.

Drawbacks of Coinbase Card

While the Coinbase Card has numerous benefits, its downsides might be a deal-breaker for some users. So, consider these points before applying:

- Spending crypto has tax implications: Selling cryptocurrencies (excluding stablecoins like USDC) can trigger tax liabilities if the value increases from the time of purchase.

- Monthly spend allotment limits rewards potential: The Coinbase Card limits monthly spending, restricting potential rewards.

- Rewards value subject to crypto market fluctuations: Due to the highly volatile nature of cryptocurrencies, your Coinbase Card rewards can lose value or even become worthless.

- No bonus spending categories: While the Coinbase Card offers solid rewards of up to 4%, it lacks bonus spending categories, unlike many popular rewards credit cards that provide higher returns on specific spending types.

- Higher returns mean Higher Risk: Coinbase offers higher reward rates for lesser-known crypto coins like Stellar Lumens (XLM), which also means taking on more risk as your rewards may fluctuate significantly.

Coinbase Card Review: Our Verdict

The card offers a straightforward and accessible way for crypto enthusiasts to earn rewards without purchasing cryptocurrencies directly.

Its global acceptance through Visa provides flexibility for spending, and the option to transfer rewards to a secure crypto wallet or trade for other cryptocurrencies adds versatility. However, potential tax implications, limited rewards categories, and fees should be carefully considered.

For those willing to navigate its limitations, the Coinbase Card can be a valuable addition to their crypto journey. Nevertheless, exploring non-crypto alternatives before making a final decision is essential, as there might be better-suited options for individual spending habits.

The Coinbase Card can be worth it for crypto enthusiasts who want to earn rewards without buying crypto. However, it might have limitations and potential tax implications.

The Coinbase Card is a debit card that allows you to spend crypto, USDC, or USD anywhere Visa cards are accepted. You don't need a minimum credit score, and there are no transaction fees. It operates directly from your Coinbase balance.

Unlike a traditional debit card, the benefits of the Coinbase Card include earning crypto rewards without buying crypto, global acceptance through Visa, contactless payments, and the ability to transfer rewards to a secure crypto wallet or trade for other cryptocurrencies.

The card is free for Coinbase customers without card issuance or annual fees. However, there are some fees, such as a crypto conversion fee when spending crypto, foreign transaction fees, and ATM withdrawal fees beyond a specific limit.