TL;DR

- As a U.S. taxpayer dealing with crypto, you must report your transactions to the IRS using Form 8949. Here, you report acquisition dates, sale dates, and capital gains from your digital assets.

- Filling out Tax Form 8949 can be daunting for first-time crypto taxpayers. We’ll guide you through the entire process and share crypto tax tools to file Form 8949 on the fly.

Feeling stuck with reporting your crypto earnings to the IRS? To help you in the process, we’ve expertly crafted this guide on filing Form 8949.

With over a decade of experience in crypto, we’ve completed hundreds of forms like this, and we’re eager to share our knowledge with fellow crypto enthusiasts.

Read on to learn how to accurately report gains and losses and discover software tools to help you. With this knowledge, you’ll be ready to fill out your next Form 8949 like a pro!

Do I Use Form 8949 To Report Cryptocurrency and NFTs?

As all U.S.-based investors and traders, you must report your crypto and NFT digital assets to the IRS. Here’s how reporting and taxation may vary:

- When selling and trading assets or using them as a payment, you file the IRS Form 8949 “Sales and Other Dispositions of Capital Assets” with your tax return;

- When earning crypto or NFTs as rewards, you complete Schedule 1.

How To File Form 8949?

To report your crypto asset dispositions, go through a 6-step process of filing the IRS Form 8949.

Step 1: Identify Your Crypto Disposals

First, recall all the cases when you disposed of your capital assets throughout the tax year.

Did you sell your crypto stocks? Did you trade your assets away? Or did you purchase something with crypto? All these cases will constitute crypto disposals.

Step 2: Gather Disposal Data

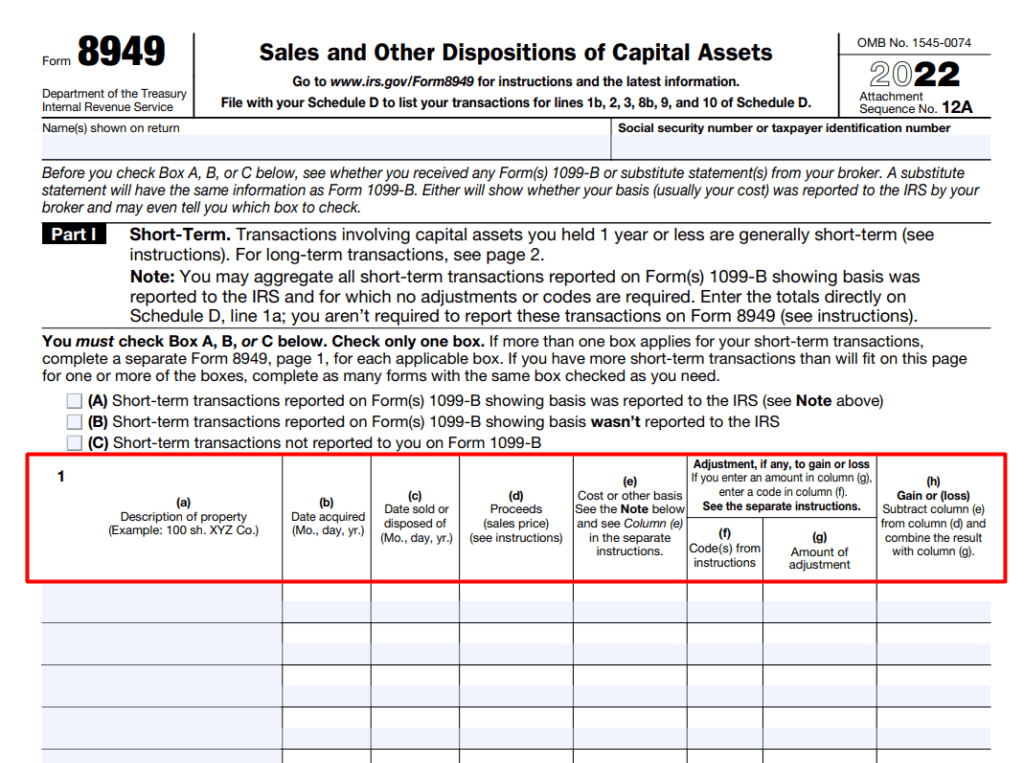

Next, collect the data about your crypto asset dispositions. On Tax Form 8949, you’ll need to specify the following:

- The asset you disposed of (say, an NFT or cryptocurrency in the amount of 0.7 ETH);

- The date you acquired your capital assets;

- The date you disposed of your assets;

- Proceeds from your crypto stock disposals (aka sales price);

- The cost basis of acquiring crypto or NFTs;

- The code for adjustments made (if applicable);

- The amount of adjustment (if applicable);

- Whether you incurred capital gains or losses.

Step 3: Divide Disposals into Short-Term and Long-Term

The IRS Form 8949 has two parts — long-term and short-term. Break down your crypto transactions into long-term and short-term ones. Here’s how you do it:

- Digital assets held for more than one year go to Part II (the long-term part);

- Property disposed of in less than a year months of holding goes to Part I (the short-term part).

Why does this categorization matter, you ask? Long-term capital gains are subject to a lower tax rate than short-term gains. The former is 0-20%, while the latter can reach up to 37%.

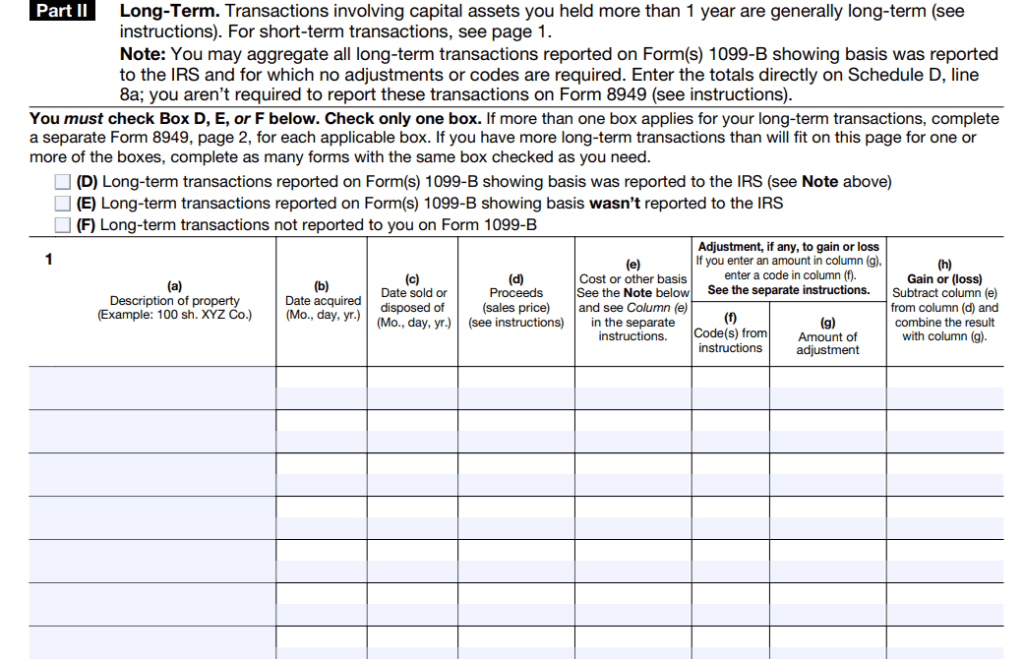

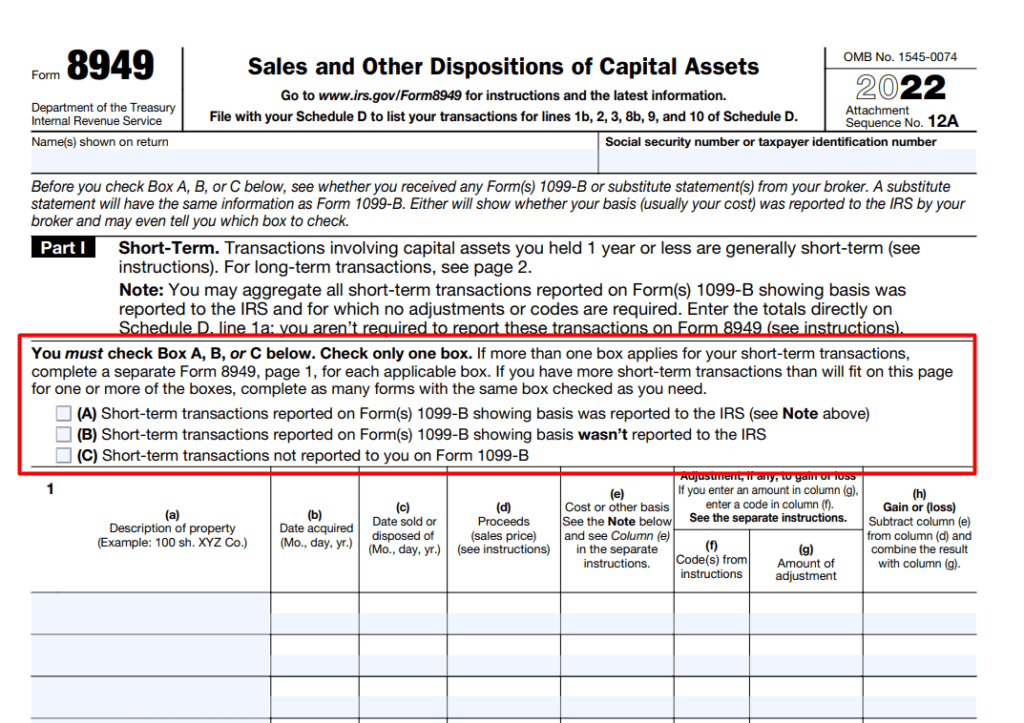

Step 4: Check the Appropriate Boxes

Let’s move on to the checkboxes in both long-term and short-term sections. Here, you need to tick the option that applies to you:

- Transactions reported on Form 1099-B and reported to the IRS

- Transactions reported on Form 1099-B and NOT reported to the IRS

- Transactions NOT reported on Form 1099-B

Most crypto taxpayers tick the “C” box since they don’t receive Form 1099-B from the exchanges. If you received one from a platform like Coinbase, tick the “A” or “B” box (whichever applies to you).

Step 5: Report Your Crypto Disposals

To declare your crypto disposals, enter the property description, date acquired, date sold, cost basis, and other information for each disposal on a separate line.

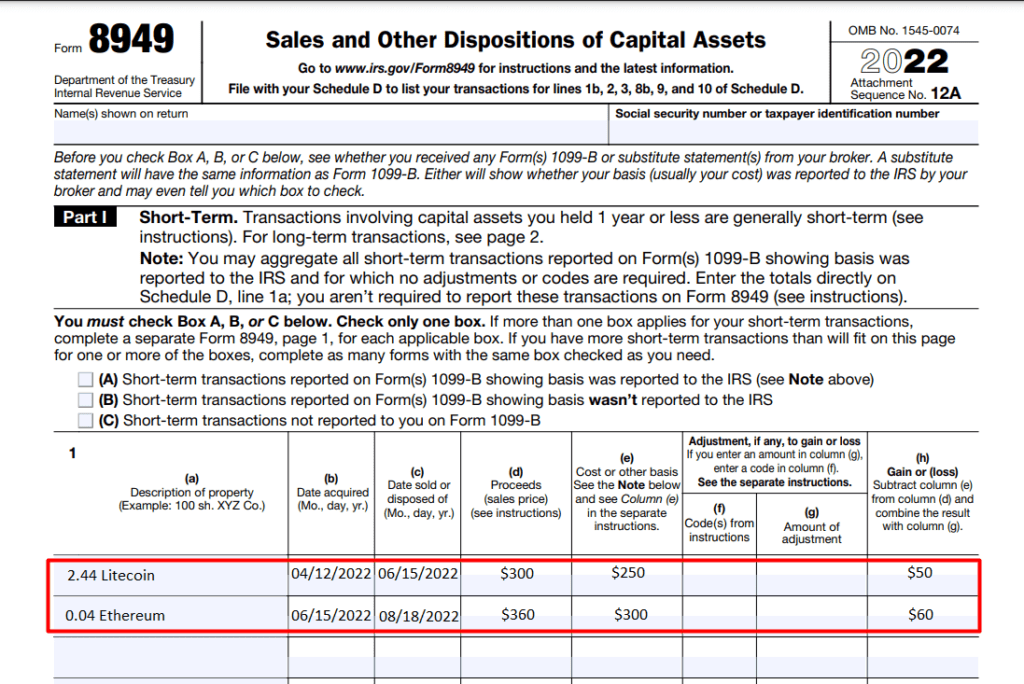

Let’s illustrate how to do it with an example:

Suppose you bought Litecoin (LTC) for $250 (the first cost basis) in April 2022. In June 2022, you traded it for Ethereum (ETH) for $300 (proceeds). In August 2022, you sold ETH for $360 (the second cost basis).

Check how these crypto disposals would look on the IRS Form 8949:

Step 6: Report Capital Gains Or Losses (Schedule D)

Done with Tax Form 8949? There’s still one more IRS form left to file — Form 1040 Schedule D, [Capital Gains and Losses]. You file Schedule D together with the completed IRS Form 8949.

Schedule D summarizes your capital gains and losses. Here, you divide your capital gains and losses into short-term and long-term (Part I and Part II, respectively).

By declaring the losses on Schedule D, you can lower your taxes and save some money. Carrying capital losses forward from previous tax years? Planning to carry losses from this tax year to future years? Specify these details on the IRS Schedule D.

Who Should Fill Out Form 8949?

Still not sure if you should file the IRS Form 8949? Let’s shed some light on this matter.

Taxable Gains

Did you buy and sell capital assets for profit during the tax year? Did you use these assets to buy something worth more than you paid? Answering “yes” to these questions means realizing a taxable gain. Thus, you have to declare it on the IRS Form 8949.

There’s still an exception for taxpayers, though. Should this gain occur in a tax-advantaged account such as an IRA, you wouldn’t have to report it. But, crypto investments are not that common in IRAs.

Losses Incurred

Incurred losses upon having disposed of your digital funds? You should still fill out a declaration form. Report your capital losses on Form 8949 and total capital losses on Form 1040 Schedule D.

Do I Have to Fill Out Form 8949 Manually?

Gathering data for the IRS Form 8949 and reporting your transactions may seem overwhelming. But fret not — you don’t have to do everything manually!

Specialized software tools can complete Form 8949 for you by pulling your transaction data from your exchange accounts. You can further import the generated IRS Form 8949 to your tax platform.

Too Many Transactions of Form 8949?

What if you had too many long and short-term transactions in the past tax year? How do you handle the limited maximum number of transactions in most tax filing tools?

Fortunately, the IRS accepts a consolidated summary of your crypto transactions and stock investment income. For quick and easy generation of detailed capital gains and losses reports, consider tools like CoinLedger or CoinPanda.

These tools will craft a report containing all the essential details – date acquired, date sold, proceeds, cost or other basis, and more. Once ready, import it to your preferred software for taxpayers.

What Other Forms Do I Need to Report Crypto?

Schedule 1

Under certain circumstances, the IRS can treat your crypto transactions as ordinary income. These instances may include hard forks, airdrops, staking rewards, and crypto lending interest.

To report your crypto income, you file Form 1040 Schedule 1, [Additional Income and Adjustments to Income]. Go to line 8 and enter the amount for your crypto gain.

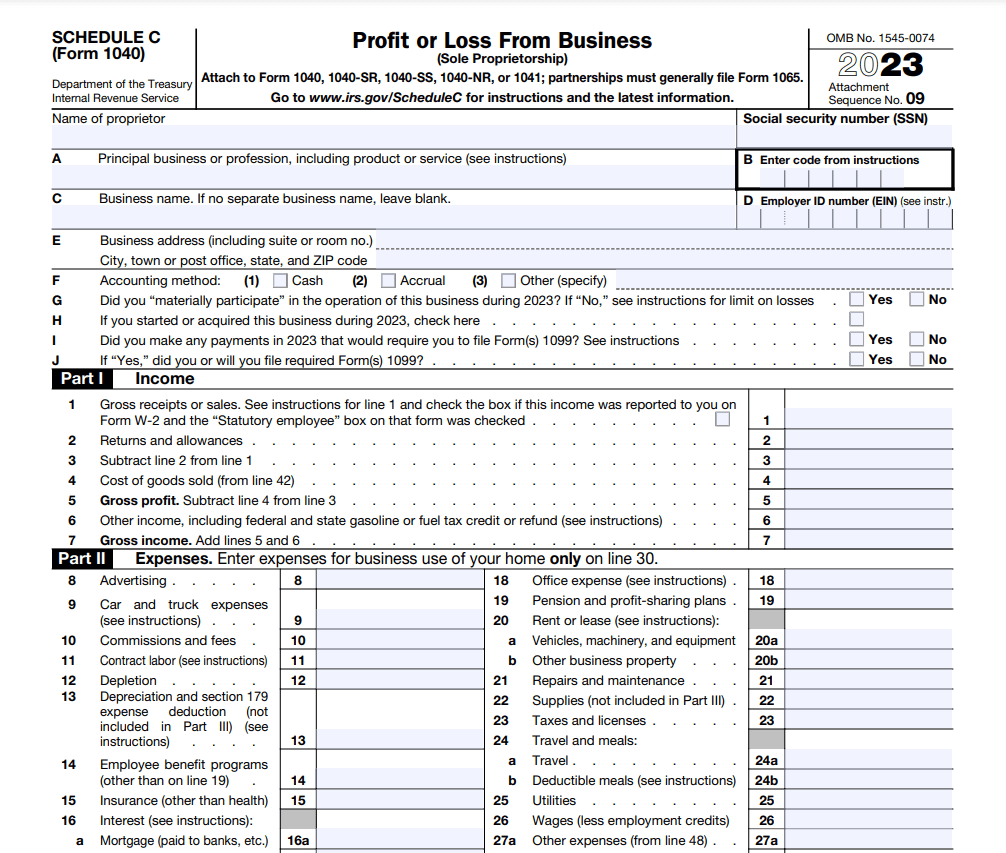

Schedule C

If you’re a sole proprietor, you’re responsible for reporting your self-employment revenue. To declare it, file Form 1040 Schedule C, [Profit or Loss from Business].

Note that you can deduct your expenses and lower the tax owed. If you’re a taxpayer in a crypto mining business, report your electricity bills or equipment purchased.

What Is the Best Tax Software To Fill Out Form 8949?

With tax reporting software tools, you no longer have to gather transaction data and input it manually. These tools can import all the necessary data from exchanges and calculate gains and losses for you.

With so many tax reporting solutions out there, how do you pick the best one? We recommend comparing the alternatives by the following criteria:

- Functionality;

- Supported integrations;

- Cross-platform compatibility;

- Security features;

- Usability and interface;

- Pricing.

Check out our curated list of the best crypto tax software solutions in 2024.

Some of our top picks include Koinly, Accointing, and CoinLedger.

More details

Koinly is one of the top leading crypto tax software. It leverages automation to directly import crypto transactions from supported integrations and calculate gains and losses to determine tax implications. Koinly supports more than 700 integrations and is available in over 20 countries and functions using the tax law of the supported countries. The use of Koinly is flexible and also functions as a portfolio tracker, giving an overview of all your assets in one place.

-

Multiple tax reports.

-

Numerous country support.

-

Easy to use.

-

Flexible plans.

-

Wide integration support.

-

Does not accept cryptocurrency payments.

-

Slightly expensive.

More details

Accointing serves dual purposes as a crypto tax software and a portfolio manager. The software allows users to link their exchanges and wallets and import transaction data from the connected exchange and wallet. The process is fully automated and secured. You can enjoy Accointing with any of the four plans and a full refund based on the 30-day money-back guarantee policy.

-

Effective tax management.

-

Privacy and security.

-

Supports multiple exchanges and wallets.

-

Desktop and mobile apps.

-

Limited transactions allowed.

According to the IRS rules, both individual taxpayers and corporations must fill out the IRS Form 8949. Any gain from crypto transactions is subject to taxes. Such transactions include buying or selling crypto as an investment and using it to purchase items.

You can find Form 8949 on the official IRS website. The website also provides instructions on how to declare your gains and losses from crypto transactions, stock trading, and broker activities.

You must complete Form 8949 regardless of whether you receive Form 1099-B (or substitute statement). Not all exchanges provide the Form 1099-B with calculated capital gains and losses to clients. Even if you have one, the data on it may be insufficient for the IRS.

You have to report any amount of crypto you dispose of. Crypto disposals are taxable events; failure to report them can constitute tax evasion.

The amount of your taxes will depend on the holding period and your income bracket. Short-term capital gains involve a 10%-37% tax rate. The tax rate can be 0%, 15%, or 20% for long-term crypto disposals as well as stock and broker investment income.