Yield App Review 2024: The Best Wealth App in Crypto?

Key Insights:

- Yield App is a centralized crypto earning platform that provides up to 11% APY on 15 tokens, including popular cryptocurrencies like Bitcoin & Ethereum.

- Yield App has a low-risk approach, avoiding practices like unsecured lending, leverage use, and swapping customer assets.

- Although the app has security features like 2FA and 256-bit encryption, it is not accessible in the US and Canada.

Yield App Overview

| Attribute | Information |

|---|---|

| Coinweb Rating | ⭐⭐⭐⭐ (4.5 stars) |

| Supported Token | 15 (BTC, ETH, BNB, USDT, USDC, AVAX, SOL, DOT, MATIC, ATOM, TUSD, DAI, YLD, LINK, XRP) |

| Yield rates | BTC (2.5% – 7%) ETH (1.5% – 7.5%) Stablecoins (up to 11%) |

| Launched In | 2020 |

| Founded By | Tim Frost and Justin Wright |

| Top Features | Earn, Yield Pro, Instant Swaps, Fiat Support |

What is Yield App?

Yield App is your go-to digital asset wealth management platform for safely earning daily compounding interest on your digital assets. You can earn up to 11% APY on popular cryptocurrencies like Bitcoin and Ethereum.

Designed for beginners, it makes passive crypto investing accessible to everyone. As both a savings account and an exchange with fee-free swaps, Yield App generates yield through DeFi pools and market strategies, providing higher Annual Percentage Yield (APY) than most competitors like Nexo and YouHodler.

With 100,000+ global users, Yield App rewards its community with a high yield. They are registered as a virtual asset service provider (VASP) with Italy’s Organismo Agenti e Mediatori (OAM), making them one of the industry’s few regulated digital wealth platforms.

Who are Yield App’s Founders?

Founded by Tim Frost and Justin Wright, the duo led the company to 75,000 users and $500 million in assets within the first year.

With a fintech startup background, Frost held executive positions at EQIBank and WireX since entering the blockchain industry in 2015.

This isn’t your typical crypto startup, as they’re seasoned professionals steering the ship, which is uncommon for Web3 startups.

The Yield app team has secured $61.3M in funding over 3 rounds and collaborates with external managers backed by reputable advisors and partners like BnkToTheFuture, TrustSwap, Yeoman’s Capital, PALcapital, Alphabit Fund, and Digital Strategies.

What are the Advantages of the Yield App?

Let’s explore the advantages:

High APY, up to 11%

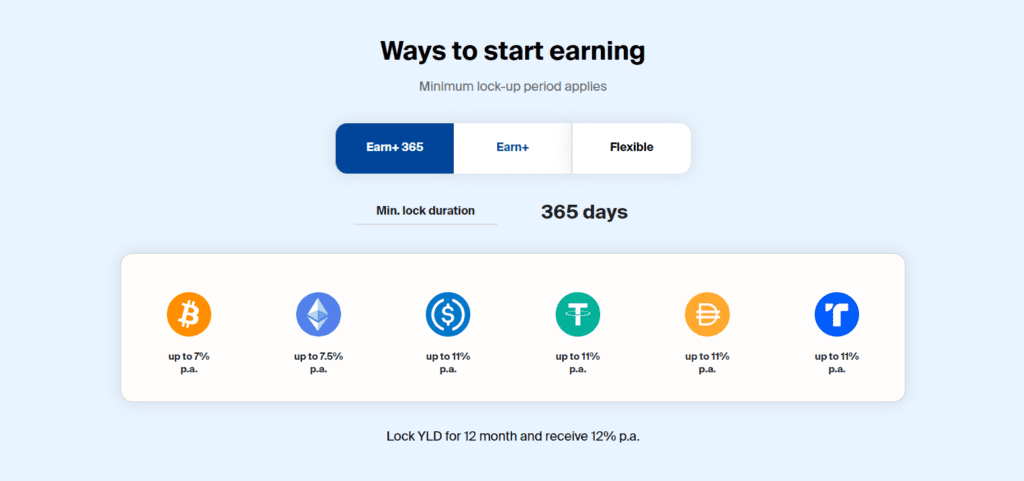

Yield App is all about turbocharging your digital assets’ earnings with daily rewards. They’ve got three earning programs for you:

- Flexible: The flexible lock-up is available for ETH, AVAX, BNB, and stablecoins.

- Earn+: Gives you higher APY, but a 30-day lock-up is mandatory for all assets.

- Earn+ 365: This program gives you 11% APY for ETH, BTC, and stablecoins but requires a year lock-up and Diamond tier status (staking 20,000 YLD).

Yield App uses strategic approaches (no lending or leverage) to protect your investments, ensuring the opportunity to earn yields across diverse market conditions.

Although they keep the specifics confidential, they focus on risk-assessed decentralized finance (DeFi) and arbitrage trading.

Most competitive swap rates

One of the most advanced features of Yield App is its swaps. You can swap up to 70 different pairs with the most competitive rates. We found that, on average, with Yield App, you get 1-2% more for your EUR and GBP when converting to major crypto assets such as BTC and ETH.

Instant Fiat Deposits

Yield App’s ability to execute bank deposits and withdrawals is a key advantage for users who value seamless transactions.

I recommend you opt for platforms that allow bank deposits to save on fees associated with credit card transactions. Yield App provides users with a dedicated banking IBAN for fiat transfers.

This feature is especially valuable for those who’ve experienced crypto transaction censorship by banks. Yield App’s collaborations with top fiat service providers ensure swift Euro (EUR) and British Pound (GBP) deposits and withdrawals, enhancing user convenience.

Earn Interest from Day One

Yield App offers something traditional banks can’t match by tapping into DeFi protocols’ back end to generate yield seamlessly, with a user-friendly front-end interface for its users.

Interest starts accruing from day one, paid daily and the flexible products don’t come with lock-up periods or hidden fees.

The best part is that you can freely withdraw your funds anytime without penalties or delays. Other high-yield products, Earn+ and Earn+ 365, offer higher rates but require a lock-up duration of 30 or 365 days.

In addition to receiving higher rates, you must stake YLD, Yield App’s native token, which acts as a loyalty tier membership. The more you stake, the higher your rates on other assets.

Safe Access to DeFi

Yield App is all about keeping your investments safe in DeFi. They use a 135-point risk model to check market exposure and deal with smart contract risks. Plus, they go the extra mile with regular third-party smart contract audits.

Yield App is picky when picking platforms for your assets – they use a careful screening process.

What I really like is their policy against risky leveraged investments. They’re steering clear of potential losses, making the platform more stable.

They also spread their investments across different pools, making the system more resilient. As a user, their security focus and smart risk management make the Yield App stand out as a reliable option in the DeFi space.

Yield App Fees

Yield App features a clear rate sheet outlining withdrawal and refund fees as its only charges.

In contrast to other crypto swap products, there are no swap fees—users pay the exact price displayed on the swap page. Additionally, there are no transfer fees for fiat currencies.

Withdrawal fees differ for each cryptocurrency. Here they are outlined for each respective asset:

| Asset/Network | Withdrawal Fee | Minimum Amount |

|---|---|---|

| ATOM | 0.29 ATOM | 9 ATOM |

| AVAX (AVAXC) | 0.13 AVAX | 3 AVAX |

| BNB (BEP-20) | 0.02 BNB | 0.41 BNB |

| BTC | 0.0007 BTC | 0.0024 BTC |

| DAI (ERC-20) | $13.47 | $150 |

| DOT | 0.75 DOT | 13.5 DOT |

| ETH (ERC-20) | 0.011 ETH | 0.04 ETH |

| LINK | 0.6 LINK | 9 LINK |

| MATIC | 4 MATIC | 100 MATIC |

| SOL | 0.05 SOL | 1.5 SOL |

| TUSD (ERC-20) | $13.47 | $150 |

| USDC/USDT (ERC-20) | $13.47 | $150 |

| YLD (ERC-20) | 200 YLD | 1000 YLD |

| XRP | 4 XRP | 150 XRP |

Here are the fees for fiat withdrawals and refunds:

| Currency | Withdrawal Fee | Withdrawal Fee |

|---|---|---|

| EUR | 0.1% with a minimum of 15 EUR | 15 EUR |

| GBP | 0.1% with a minimum of 15 GBP | 15 GBP |

Getting Started with the Yield App

Follow these steps to get started with Yield App:

More details

Yield App is a crypto-earning platform with high APYs of up to 11% on popular coins like Bitcoin and Ethereum. The platform's website and app are simple and easy to navigate. However, Yield App is unavailable in the US, Canada, and some countries, making it less suitable for American users.

-

High yields of 11% APY.

-

15 popular tokens are supported.

-

In-app swaps with over 70 pairs

-

Direct fiat on- and-off ramp.

-

YLD native token with loyalty tiers.

-

Limited crypto support.

-

Not available in the US.

-

Only EUR and GBP for fiat currencies.

Step 1: Visit the Yield App Website.

Visit the Yield.app and tap the [Get Started] button in the middle of the home screen.

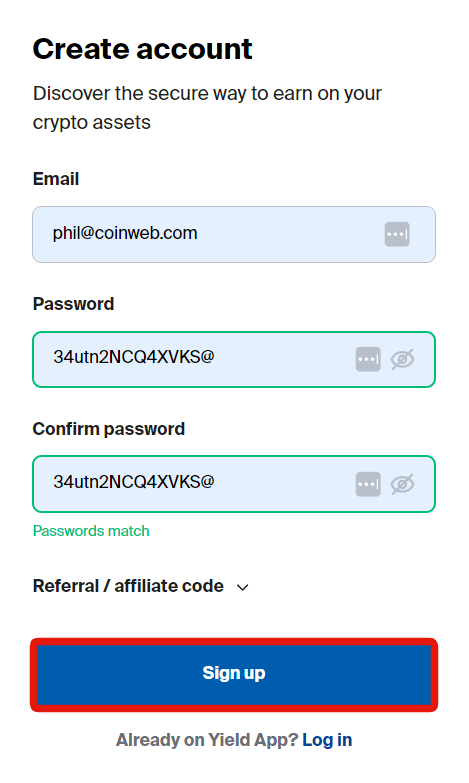

Step 2: Enter details.

Enter your email and pick a strong password to create a Yield App account. When done, tap [Sign Up].

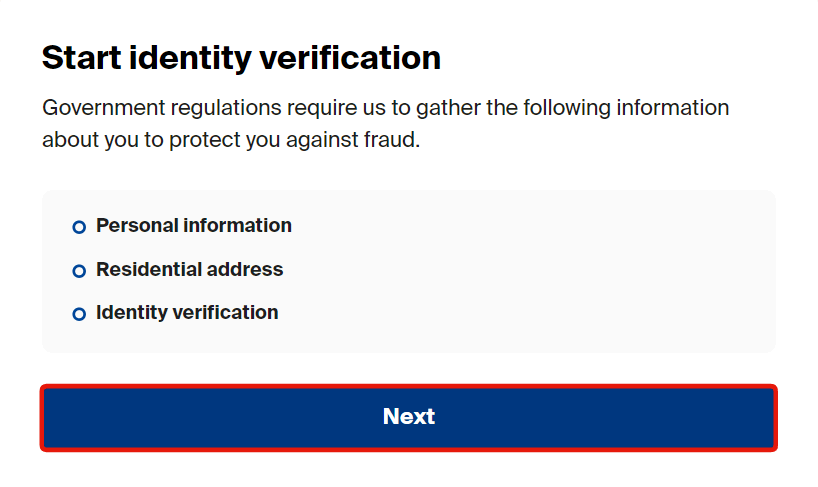

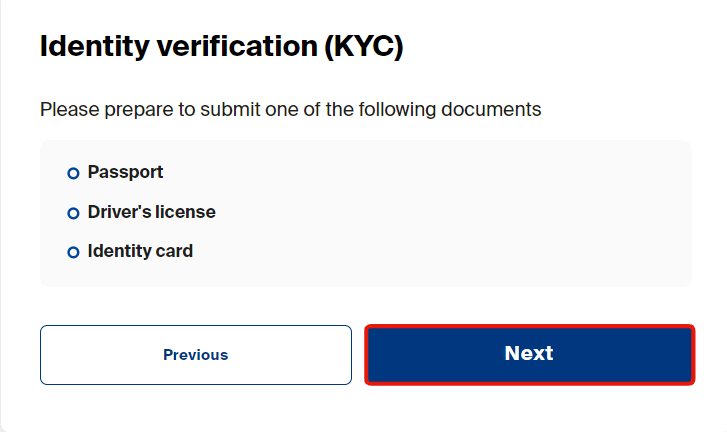

Step 3: Verify your Identity.

Complete the security information. Tap [Next] to get started.

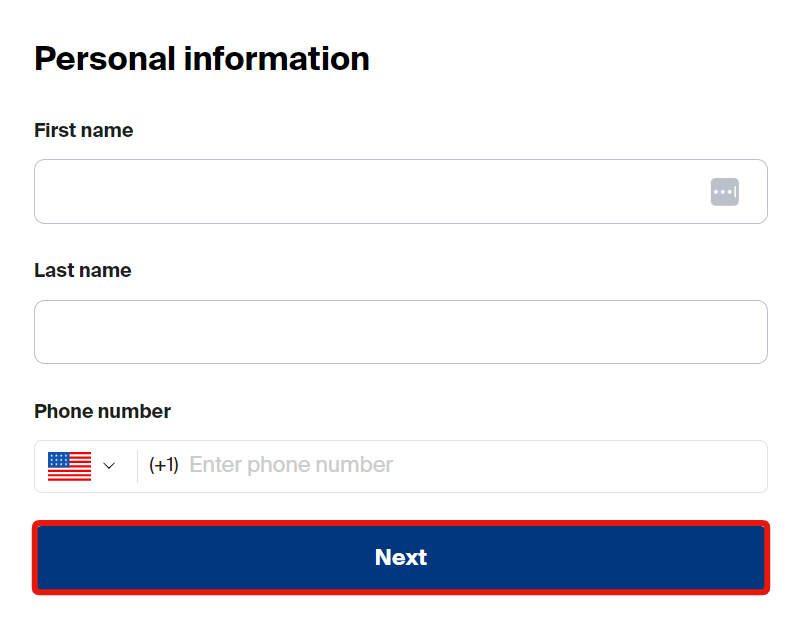

Step 4: Fill in personal details.

Now, you will be asked to enter your name and number. Double-check the details and hit [Next].

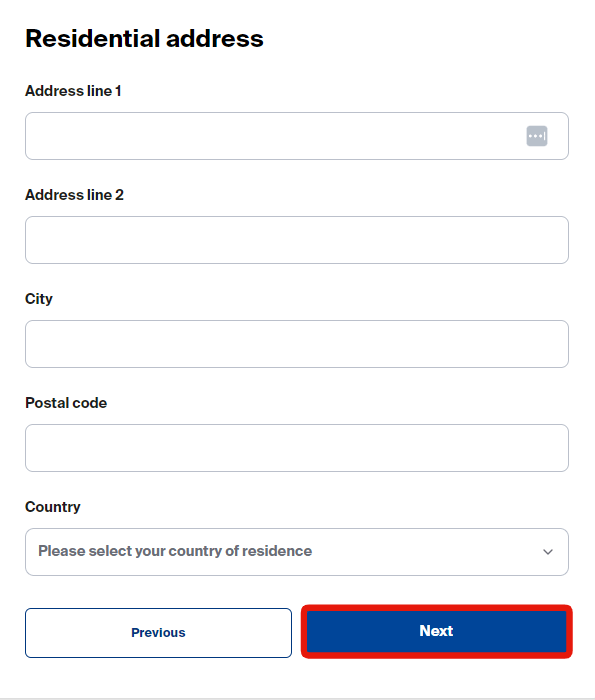

Step 5: Confirm the Residential Address.

Enter your address, postal code, and country of residence; when done, tap [Next].

Step 6: Complete KYC.

Submit your identity verification using a passport, driver’s license, or identity card. You can pick any option that suits you.

Step 7: Scan the QR.

To complete the KYC, scan the QR or copy the link on your phone and upload the image of the required doc.

Once you receive the confirmation email of your Yield App account, you can start earning interest immediately.

Our Expert Review of the Yield App Features

Here are the key features of the Yield App with our expert opinion:

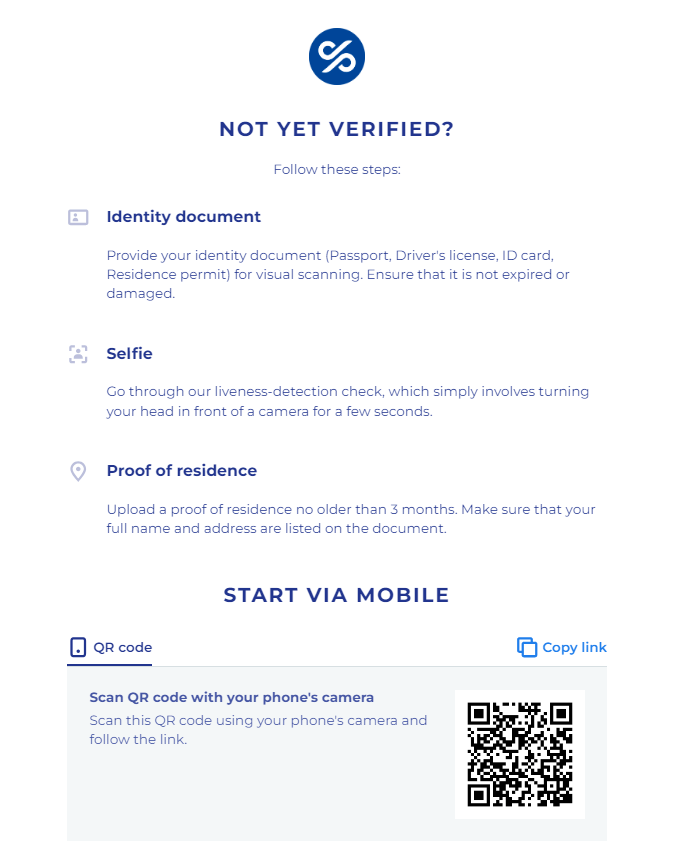

Instant Swaps on Crypto and Fiat

Yield App has a built-in crypto on-ramp that allows you to buy digital assets using EUR or GBP, with a $100K purchasing limit. All swaps are instant and come with no fees, so only the price you see on the screen is what you get.

The process is seamless overall, thanks to its partnership with Fintech giants like Volt, which bridges 1,800+ banks and the Yield app. Even if you don’t want to use your traditional bank, Yield App, in partnership with Fiat Republic (fiat as a service), Yield App gives you virtual International Bank Account Numbers (IBANs).

Yield Token (YLD)

The Yield token (YLD) is like your special pass for getting great crypto returns on the Yield App, as you need to stake the tokens to unlock higher APYs.

These digital assets are easily available on platforms like KuCoin and Yield App. The amount of staked YLD defines your tier, and each tier comes with its perks.

For example, stake over 1,000 YLD tokens, and you get extra rewards and increase your YLD returns to 12% if you keep them locked up for a year.

If you’re in the top tier, you get VIP support access to a chat group where you will be the first to know about the new Yield App card program.

| Membership | YLD Staked | Free Withdrawals | VIP Customer Support | Rates | YLD Lock* |

|---|---|---|---|---|---|

| Bronze | 0-999 YLD | No | No | up to 5% p.a. | 0% p.a. |

| Silver | 1,000-9,999 YLD | No | No | up to 6% p.a. | 12% p.a. |

| Gold | 10,000-19,999 YLD | No | No | up to 7% p.a. | 12% p.a. |

| Diamond | 20,000 YLD + | 3 crypto & 1 EURGBP per month | Yes | up to 11% p.a. | 12% p.a. |

Secure On-Chain Finance

Yield App has expanded beyond yield generation with the Layer 1 blockchain it’s incubating, Haven1. This is designed to tackle security issues in traditional blockchain and DeFi, aiming to make on-chain finance mainstream.

Yield App aims for safe transactions on the network, and can be used for on-chain lending using real-world credit scores.

Haven1 is all about turning real-world assets like property and stocks into tokens, and it plays nicely with Ethereum as a Sidechain rather than trying to outshine it.

Since its inception, the Haven1 ecosystem has grown with applications like HavenSwap, HavenLend, and HavenPerps.

Yield Pro

Yield Pro brings in some advanced structured products thanks to Yield App teaming up with Trofi Group. These are a bit riskier and more tailored towards savvy investors, but they also have products with protection for your principal, along with the chance for some gains.

These structured products enable niche crypto trading strategies, with Dual Currency now live and the rest launching soon:

- Buy-Low and Sell-High Dual Currency: Allows you to take advantage of the relative differences between two cryptocurrencies.

- Range: Allowing investors to bet on a cryptocurrency within a predetermined price range.

- Sharkfin: Racking up substantial profit when a cryptocurrency appreciates within a specific range without going beyond.

- Target: Ensuring profit when the price of a cryptocurrency remains above a set target for an extended period.

Yield App Security Features

In short, based on their security features and licensing, you can rest assured that your assets are safe. As a regulated entity, it builds trust while users get added security, strict measures, and transparency.

On top of that, it has implemented strong security measures, like 2FA, activity logging, session monitoring, alert emails, and address listing. To protect access to personal data, they also have 256-bit encryption.

A sophisticated 135-point model evaluates contract security, past performance, liquidity, and governance. Less than 10% of protocols meet their strict criteria.

The app cares for its investors and uses various strategies, focusing on crypto arbitrage to benefit from price differences across all top exchanges.

This includes techniques like liquidation arbitrage, volatility arbitrage, and triangulation arbitrage, ensuring a diversified approach and minimizing the risk of setbacks during market fluctuations.

Yield App Wallet

Yield App has introduced an in-house custodial wallet as part of the V2 platform upgrade, serving as a versatile multi-asset, cross-chain solution integrated within the Yield App ecosystem.

For security, Yield App has partnered with Fireblocks, a leading wallet service provider offering insurance coverage for all assets in custody and during transit.

The wallet benefits from the same institutional-grade security measures as the rest of the app, as detailed in a later section.

Its architecture is safeguarded within a ring-fenced data infrastructure, encompassing data centers, dedicated nodes, hardware security modules, user databases, portfolio engines, and a regulatory risk management suite.

Functionally, the Yield Wallet displays held assets and serves as the hub for asset management, including deposits and withdrawals.

Yield App Membership

Yield App offers four membership tiers—Bronze, Silver, Gold, and Diamond—based on your number of YLD tokens. Each tier has perks like higher interest rates, exclusive products, and extra rewards.

There’s an extra perk for those at the Diamond Tier—a special Discord community to connect with the team and fellow Diamond Tier members.

You can also enter the exclusive world of top-tier service through Yield App’s unique Relationship Manager Program. By depositing $100,000 (USD equivalent), you can join the VIP tier and enjoy the benefits of a dedicated Relationship Manager.

With this personalized point of contact, clients receive prompt assistance, rapid resolution of inquiries, and exclusive access to upcoming products and services.

Supported Crypto Assets

Yield App currently supports a range of cryptocurrencies, including BTC, ETH, USDT, USDC, DAI, BNB, AVAX, MATIC, SOL, DOT, ATOM, XRP, LINK and YLD (Yield App token).

A Mobile App

Yield App’s mobile has a 3.6-star rating on the Google Play Store and is designed to manage digital wealth on the fly easily. It’s a user-friendly tool for financial activities with features like buying, swapping, earning, and staking.

The app has modern security features like fingerprint/face ID for added protection.

Who should use it?

Here is who we think should use it:

- Institutional clients: Yield App doesn’t just cater to individuals; it’s designed for enterprise clients too. With specialized onboarding and relationship management teams, businesses can swiftly kick start their journey to earning yield on digital assets in just a few days.

- Advanced traders: Yield App is an excellent option for crypto holders seeking to earn asset yields. With APYs up to 11% on stablecoins, the platform is a solid choice for crypto businesses. Remember to stake YLD tokens to maximize your potential yields on the platform.

- New traders: Yield App is ideal for new users due to its user-friendly interface, offering up to 11% APY on stablecoins. The platform’s flexibility, transparency, and security measures, including two-factor authentication, appeal to those entering the crypto space.

Drawbacks of the Yield App

Here are some of the drawbacks of the Yield App platform.

- Limited support for crypto assets: Yield App’s drawback lies in its limited crypto asset selection, supporting only 15 assets. While popular choices like BTC, ETH, BNB, and SOL are available, they may not be ideal for users with highly diversified portfolios seeking to generate yield on a wide variety of altcoins.

- No information on DeFi protocols: Yield App has yet to reveal the DeFi protocols they use for yield generation, and their asset support has room for improvement. However, there’s positive progress, as they’ve recently expanded their offerings to include AVAX and BNB.

- Limited geographical availability: Yield App’s drawback for users in the US is its limited availability due to stringent financial regulations. This is a common challenge in the crypto space, as many platforms need help understanding the US market. US residents seeking yield products may need to explore alternative options beyond the Yield App.

- Lacks advanced features: While Yield App offers yield-generating services and a fiat/crypto on-ramp, it doesn’t provide extensive features. If you’re seeking exchange services, borrowing options, DeFi wallets, or other functionalities, you won’t find them within the offerings of Yield App.

Alternatives of the Yield App

eToro vs. Yield App

eToro allows you to earn rewards on 4 cryptocurrencies, including Bitcoin, Ethereum, Cardano, and Tron. While you can only stake Ethereum using the eToro Money wallet, Cardano and Tron can be staked directly on the platform, earning up to 7% APY.

More details

eToro is a popular online trading platform for crypto assets, stocks, and ETFs, featuring low fees and a user-friendly interface. With a free eToro wallet and social features like messaging boards, users can copy experienced traders and access numerous assets. Take a look at what makes this platform perfect for starting your trading journey.

-

Provides an attractive, communal atmosphere.

-

Offers zero commission on ETFs.

-

Extensive selection of educational resources.

-

Mobile app with trading features.

-

Smooth account opening and bank transfer.

-

Limited number of cryptocurrencies.

-

Limited customer support.

-

No crypto-to-crypto trading pairs.

YouHodler vs. Yield App

Yield App offers an 11% yield, and YouHodler provides up to 15%. Both platforms offer similar services, including earning yield and fiat-to-crypto swaps. However, YouHodler distinguishes itself by offering crypto loans.

More details

YouHodler, a crypto exchange and lending platform, offers high interest on crypto deposits and provides clear information about its risks, rates, and fees. Users can collateralize digital assets for short-term loans, which can be used for advanced trading. However, its unavailability in the US and high loan APR might dissuade some investors.

-

Earn interest in your digital assets.

-

Borrow against your crypto.

-

Access advanced trading tools.

-

Effective customer service.

-

High APR on loans.

-

Regional restrictions in some countries.

-

Lacks transparency in the interest rate rates.

Nexo vs. Yield App

Yield App offers competitive yields of 11%, while Nexo provides a slightly higher 16%. Nexo’s services include earning yield, trading crypto, and borrowing funds. Yield App features services like Earn, Swap, Yield Pro, and Instant Fiat Deposits, catering to diverse needs.

More details

Nexo is an advanced and regulated crypto platform that offers a secure, fast way to own 40+ cryptocurrencies. Its users can access highly attractive earning rates on various crypto assets. Nexo also provides easy-to-use loans backed by cryptocurrency. This exchange offers a crypto-backed debit card to make everyday use of crypto a breeze.

-

Loyalty earning opportunities.

-

Up to 16% APY on digital assets.

-

Swap between 500+ market pairs.

-

Loan options for users.

-

Licensed and regulated.

-

No benefits without a native token.

-

No live chat support.

-

No anonymous option.

| Platform | Annual Percentage Yield (APY) | Tokens | Features |

|---|---|---|---|

| Yield App | 11% | 8 | Earn, Swap Assets, Yield Pro, Instant Fiat Deposits |

| Nexo | 16% | 5 | Earn Yield, Trade Crypto, Borrow Funds |

| YouHodler | 15% | 5 | Earn Yield, Fiat to Crypto Swaps, Crypto Loans |

| eToro | 7% | 4 | Low Fees, Crypto Staking |

Yield App Review: Our Verdict

Our comprehensive Yield App review establishes that the crypto platform is suitable for both seasoned stakers and newcomers, simplifying the DeFi journey. Their no leverage and lending policy prioritizes safety, setting them apart from platforms like Nexo.

The competitive 11% APY on stablecoins and various staking programs, though some with longer lock-in periods, add flexibility. However, limited crypto support and geographic restrictions may be drawbacks for certain users.

Yield App, a digital wealth platform, emphasizes security with measures like two-factor authentication, encryption, and bug bounty programs. Plus, the app uses market-neutral strategies.

Withdrawal times on the Yield App may vary but are generally quick, often processed within a few minutes to a few hours. Also, Yield app supports withdrawals in fiat and crypto.

To buy crypto, Yield App users typically need to deposit funds into their account (it supports 1,800+ banks) and then navigate the app to select and purchase the desired cryptocurrency.

Haven1 is incubated by the Yield App. Haven1 is a blockchain project aiming to enhance blockchain security and enable tokenization of real-world assets.

The yield App platform offers yield generation through DeFi and market-neutral strategies. Profitability depends on market conditions and the specific assets and strategies employed.

No, Yield App is not a decentralized platform. It combines DeFi elements like high yields with the convenience and safety of traditional banking.