InSure DeFi markets itself as the first to offer a comprehensive insurance protection program to protect your digital assets from any harm and losses. This InSure DeFi review will put that to the test.

Its profound insurance coverage varies from 50% to 100% comprehensive coverage, allowing users to purchase and arrange their plans according to their own needs and budget.

It is a good feature for any Crypto portfolio owner, especially for those starting their Crypto trading journey and wanting to protect their money. This review will explore all its features and options, helping you decide to protect your crypto assets.

Who Should Use inSure DeFi?

New Users

inSure DeFi is a good starting place for beginner traders in the field of Cryptocurrency. It offers portfolio protection that guards traders against scammers and unanticipated losses.

In General, you need to be able to use and trade through DeFi and must have SURE tokens to be able to purchase a plan. However, the insurance service supports most cryptocurrencies and is therefore available for all Crypto portfolio investors who need to secure their investments.

For Beginner Traders

Beginner traders will find availing of InSure DeFi relatively straightforward, as they only need to purchase SURE tokens and gain access to the InSure DeFi dashboard; all processes will be made and prepared via the user’s private wallet accordingly. SURE tokens may be purchased through Bitcoin (BTC) or Ethereum(ETH).

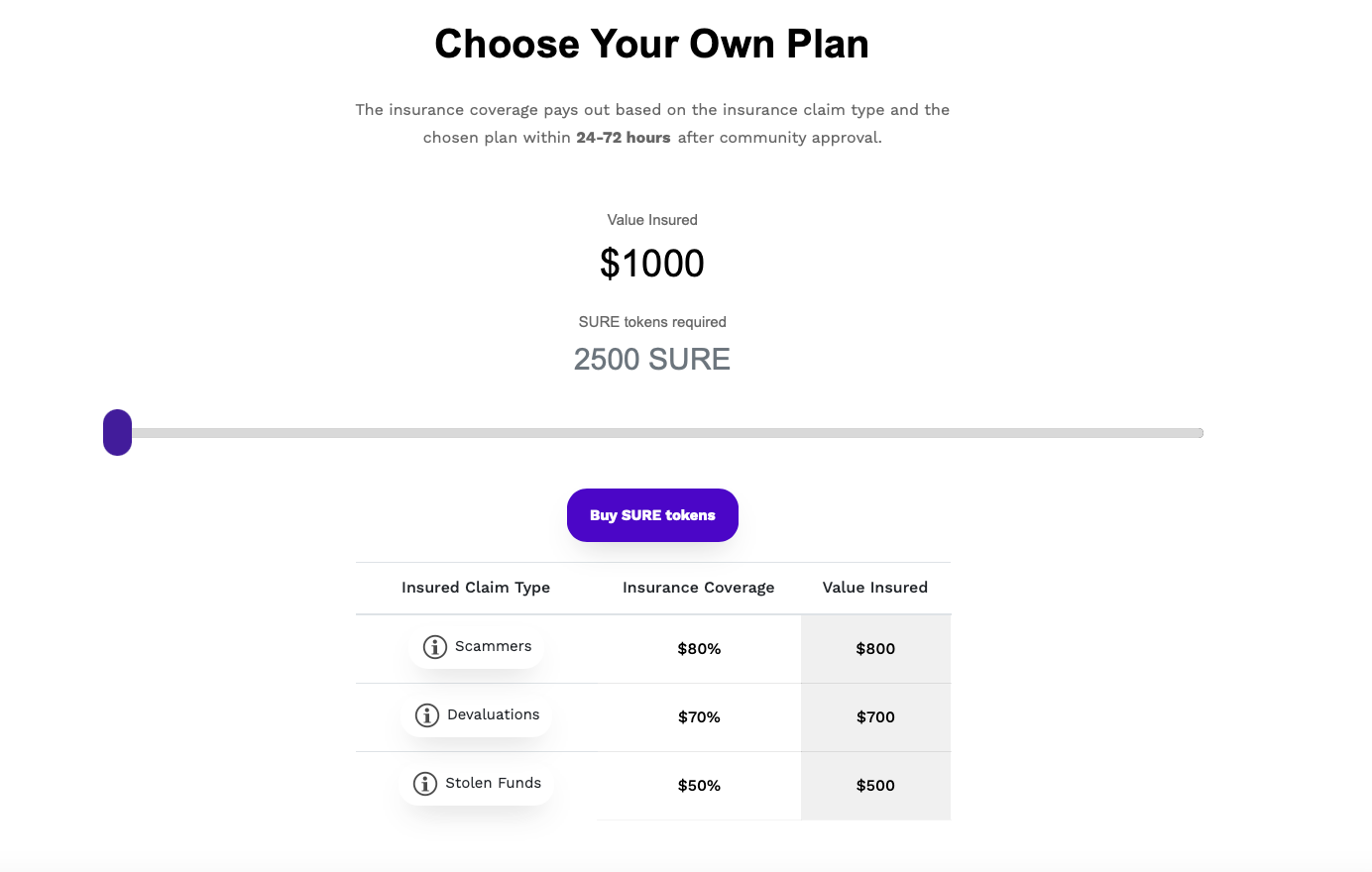

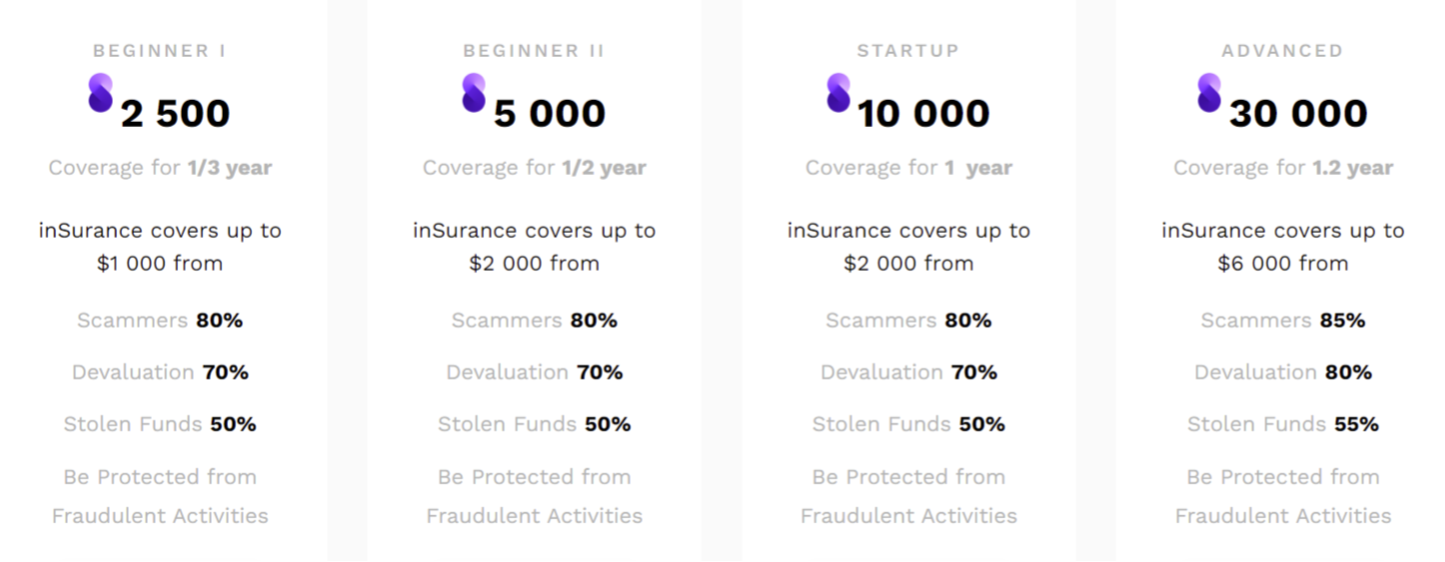

Insurance premiums also present a dynamic pricing model, offering an affordable plan for beginners, priced at 2,500 SURE tokens as the lowest premium. This will cover insurance for up to $1,000 and automatically protect your portfolio from fraudulent activities.

Drawbacks

The only way to maximize the services of InSure DeFi is to purchase its comprehensive coverage, which costs over 3.5 million SURE. This price may be expensive compared to other lower plans.

The problem with the other plans, however, is their limited coverage. This means the investment may not be reimbursed at full cost in case of breaches.

Geographical Availability

InSure DeFi is available all over the world. Anyone on its website may access it, and tokens may be purchased on most Exchange Platforms.

What makes InSure DeFi a Good Choice?

Decentralized Exchanges

Using a Decentralized Approach called the inSure DAO. InSure DeFi runs through a Decentralized Insurance Ecosystem. This protects community members’ portfolios against scams, drastic devaluations, and exchange closures.

InSure DeFi offers insurance solutions in the field of cryptocurrency to ensure DeFi and various types of Crypto portfolios.

Open and Transparent

InSure DeFi is entirely transparent and fully managed by the community. The portfolio owner contributes the purchased SURE tokens into a community vault, fueling the insurance procedure and operations.

InSure DeFi’s ecosystem also integrates with Google Cloud-blockchain Applications, so data are received efficiently and updated accordingly.

Smooth and Healthy Operations

InSure DeFi is the best response of DeFi to one of its biggest challenges: its constant exposure to cyber threats.

The inSure DeFi directly regulates community members’ accounts, allowing them to protect themselves and their crypto portfolio from hacking and cyber threats.

Insure DeFi Review: Disadvantages

Problems with Smart Contracts

Its regular use of Smart Contracts is an enormous door for hackers and threat actors to attack DeFi. Attacks such as flash loan hacks can directly attack smart contracts.

Currently, InSure DeFi is looking at integrating its Smart Contract and cloud platforms with Google Cloud Platform’s ML services.

Incomplete Features

Although InSure DeFi shows immense potential not just in DeFi, but the entire crypto ecosystem, it’s still in the developmental stage.

It’s important to note that while InSure DeFi offers significant coverage, it may not provide full coverage over claims. Its coverage is also limited, so it is crucial to weigh the benefits against the risks before utilizing it.

Lack of Security

The biggest problem of DeFi is its exposure to various exploits and vulnerabilities. Its lack of security led to different hacking attacks in 2020, which resulted in over $120 million worth of losses.

Its anonymity may pose a problem for InSure DeFi. A quick review of the website and the dashboard shows that there are not many details about the management team of InSure DeFi.

Although the community is responsible for managing the system, its lack of clear identity could pose challenges, particularly regarding insurance services and claims. Users will want assurance that platform managers are trustworthy in handling and safeguarding their investments.

Insure DeFi Review: Top Features & Perks

Supported wallets

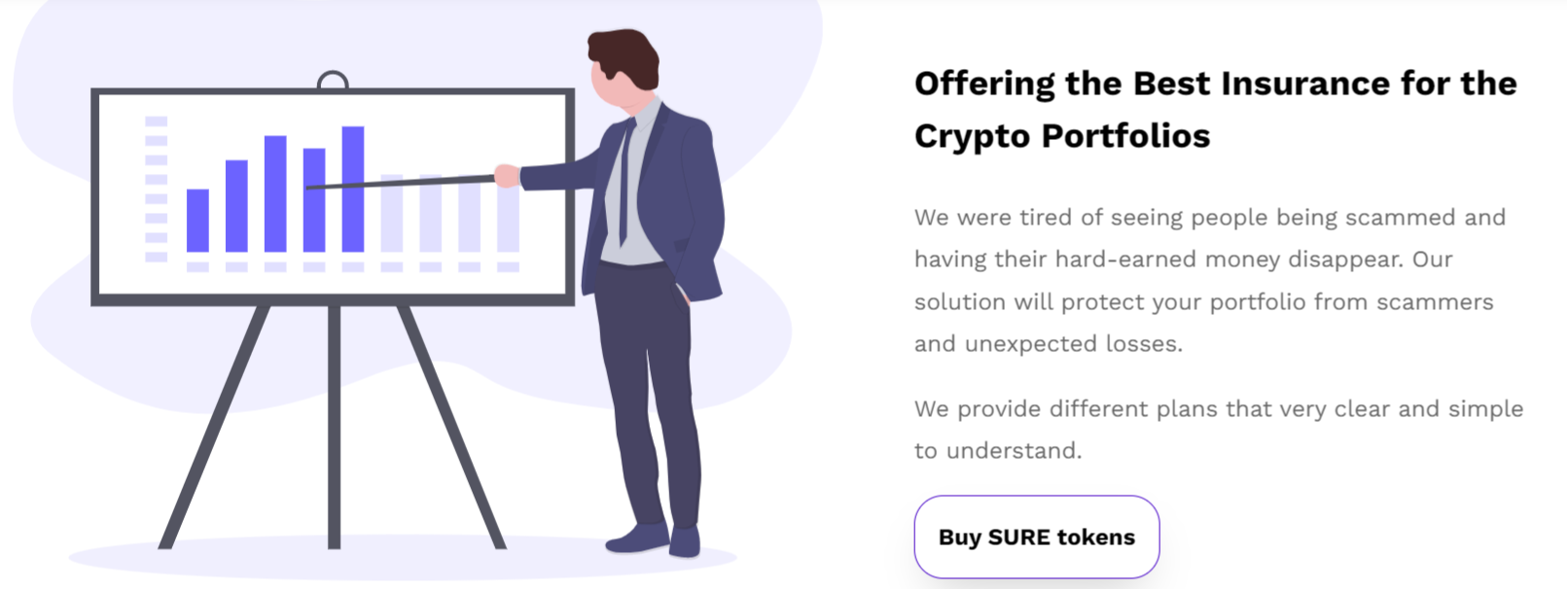

InSure DeFi supports several popular wallets that include:

- MetaMask

- Trust Wallet

- Mist

- Ledger Live

- MyEther Wallet

- Crypto.com DeFi Wallet

These wallets allow users to interact with the DeFi protocol and access various features, such as purchasing insurance plans and submitting claims. It’s essential to ensure that your wallet is compatible with InSure DeFi before using the platform to avoid any issues during the transaction process.

Games and Lottery Features

The No-Loss Lottery is a novel concept in the DeFi space that has gained much traction. It allows individuals to earn rewards without risking their investment capital, and it’s an innovative way to engage more people in DeFi.

As the DeFi space continues to evolve, the No-Loss Lottery is poised to become a significant ecosystem component.

Capital and Surplus Pool

InSure DeFi secures its Capital Pool through Community Funds. The user who purchases an insurance plan submits their contribution from their private wallet directly into the Community Funds, which will be available to everyone. These tokens will then be used for production, to sell in the market, and to earn premiums.

Apart from the Capital Pool, InSure DeFi also offers a Surplus Pool, which increases for every purchase of an insurance premium. With each purchase, the pool accumulates over 40% of the premium’s cost and in the absence of any claims, transfers all claim allotments into the Surplus pool.

The budget for paying claims and interest will come from the Surplus pool before taking any deficits to the Capital pool. Once the investment pool matures, all SURE token holders will receive a percentage from the Surplus Pool as an incentive.

NFT

In 2021, InSure DeFi introduced NFT insurance as part of its product offerings. This feature enables investors and customers to enroll and subscribe to an insurance plan designed for their NFTs.

This holds immense importance for the NFT market as it presents an added level of protection for NFT asset holders, shielding them from potential theft, loss, and damage.

With support for this new insurance offering, InSure DeFi continues to innovate and expand its services to cater to the evolving needs of the crypto community.

How to Open an InSure DeFi Account

Follow this easy step-by-step guide to open an InSure DeFi account and insure your crypto.

Step 1: Visit inSure DeFi website

Navigate to the inSure DeFis website using your phone or laptop.

More details

If you're worried about the risks of investing in cryptocurrencies, InSure DeFi offers an excellent insurance system for your crypto portfolio. They use several layers of protection to ensure any damages are taken care of quickly. This is especially helpful for anyone concerned about cyber-attacks or hacking incidents. It's a pretty affordable option for beginners and pros, but it might be expensive for those with bigger portfolios since fewer features are available.

-

Portfolio protection on digital assets.

-

Offers a decentralized approach.

-

50-100% asset protection.

-

Offers 24/7 Support.

-

Has limited features and offerings.

-

Insufficient risk assessment for pricing premiums.

-

Expensive pricing for full coverage.

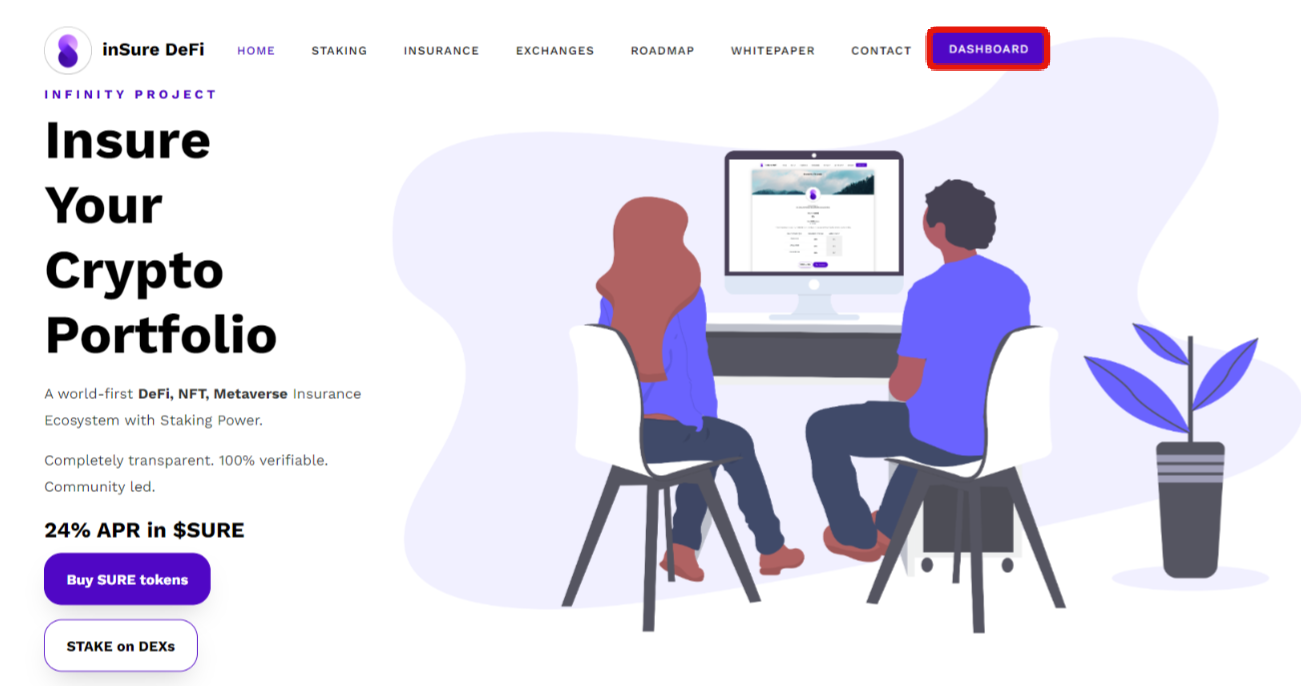

Step 2: Start the process

Click the [Dashboard] button at the top right of the main landing page.

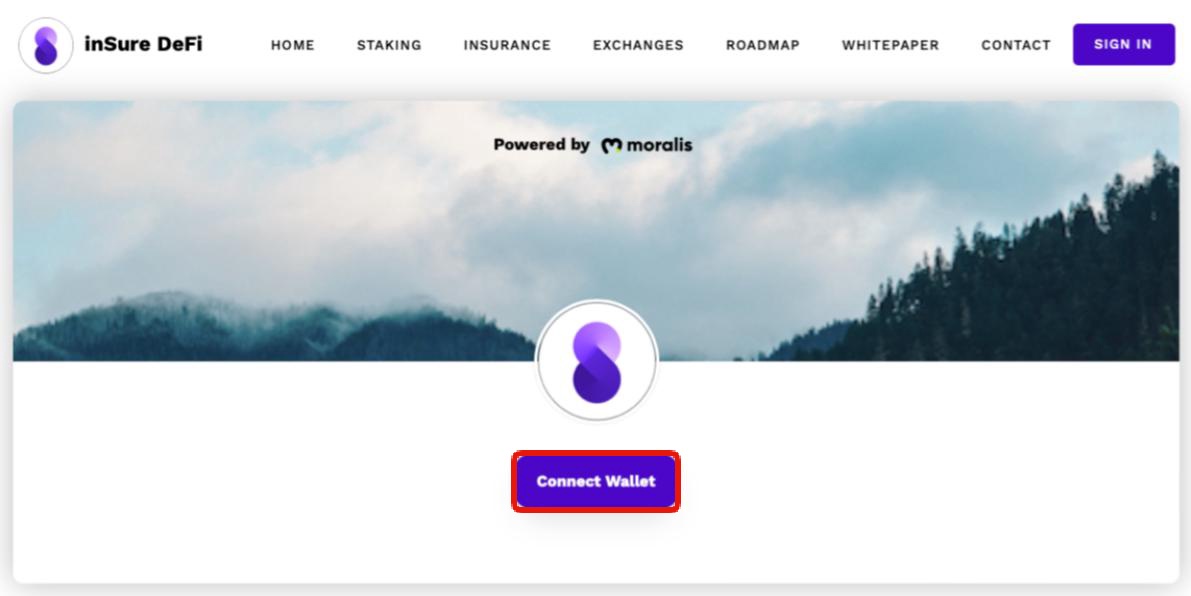

Step 3: Connect your wallet to inSure DeFi Platform

After clicking, you will be taken to a new window, where you need to connect your wallet. The site supports popular Web3 wallets like MetaMask and Mist.

Step 4: Purchase a sure token on Crypto exchange platforms

You must purchase SURE tokens to get an insurance premium over your crypto portfolios and other digital assets.

This can be done at popular exchanges like UniSwap, PancakeSwap, and QuickSwap, or directly on the platform through TraderJoe. Here you can purchase SURE tokens.

Once purchased, the tokens will be transferred to your wallet, and you can see them in your Dashboard.

Step 5: Choose your plan

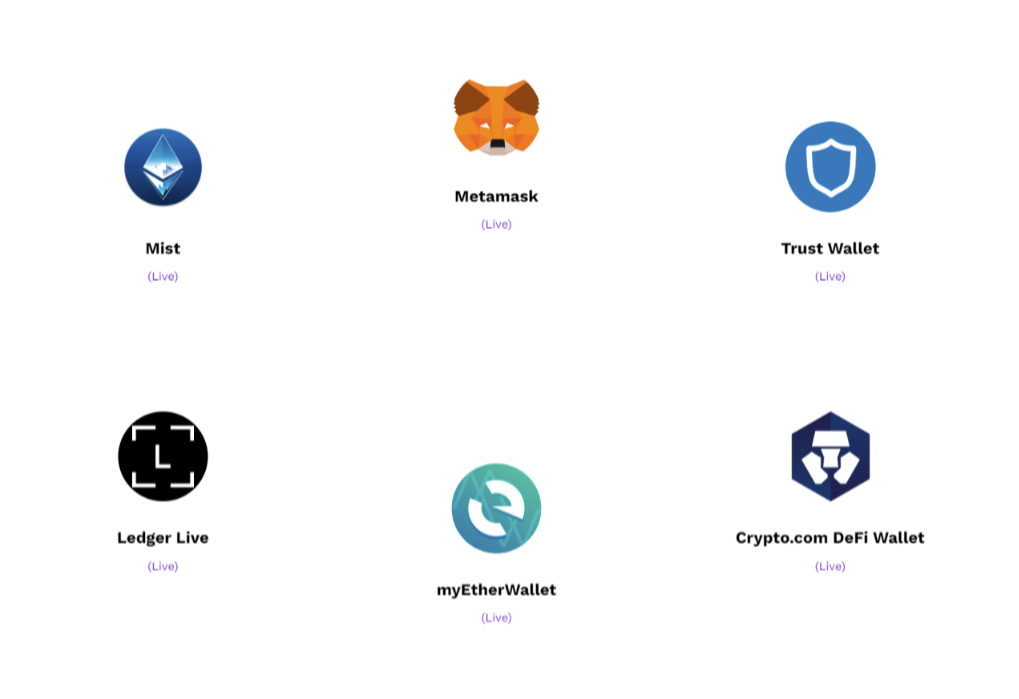

Once you have secured your SURE token, you may buy the plan that suits your needs.

Depending on the type of insurance plan, coverage may range from 55% – 100% reimbursements in case of scammers, devaluations, or stolen funds.

Depending on your needs, insurance coverage may range from as low as 2500 SURE up to as high as 3.5 million SURE.

Your funds will be sent to the Community vault. InSure Team will review and approve your plan within 24 – 72 hours.

Once approved, you can use your dashboard to make your claims.

Availing an insurance claim on InSure DeFi

If users experience fraudulent activities, such as scams, stolen funds, or significant devaluation in their investments, they can actively avail themselves of an insurance claim. Our team conducts thorough investigations for all claims, and eligible claims will be reimbursed with SURE tokens based on the purchased insurance plan.

Step 1: Determine the Reason for Claim

InSure DeFi’s insurance coverage clearly outlines three instances where an insurance claim is applicable: drastic devaluation, scams, or stolen funds. Retaining a screenshot of your dashboard as proof is advisable, as it may be required during the claim process.

Step 2: Provide all relevant details

InSure DeFi’s Whitepaper outlines all the needed processes to make a claim:

- Provide the name of the Crypto coin/ Token that was affected

- Provide the Address of the Affected Wallet

- Provide the Date of the Event

- Provide the Policyholder’s Wallet where the SURE token is found

- Provide any relevant information needed to make your case. You may want to identify the type of claim and reason. You may also want to provide screenshots to strengthen your case further.

- Provide an undertaking within your request for a claim. Sign the undertaking and include the following statement: “I am the holder of SURE tokens requesting inSure team to process my request: (include all points from 1 – 5).”

Step 3: Send your e-mail or submit your request

Once completed, you may send your claim request via your private wallet in your InSure DeFi dashboard. Alternatively, you may also e-mail [email protected] to submit a request.

Step 4: Review and claim

All the insurance claims will be received by the InSure DeFi team, who will then investigate and verify if these are qualified for reimbursement. Claims will be processed within 3 to 4 business days.

Once approved, the reimbursement will be returned as a SURE token to your wallet. Note that the reimbursement will depend on the coverage in your purchased plan. This means that the highest price paid for your claim may not be full 100% unless your comprehensive plan covers such.

Insure DeFi Review: Fees and plans

Insure DeFi Review: Improvements

Mobile Wallets

InSure DeFi made transactions and Insurance purchases much more accessible for the community by integrating their platform on mobile devices. In the future, users may track and access their data through mobile devices.

Broader Compatibility

Besides expanding to mobile devices, InSure DeFi pointed out that the system will be safe regardless of the OS users use on their desktops. InSure DeFi is therefore compatible with Windows, Mac, and Linux desktop wallets to provide a broader range of service coverage.

Ongoing Project/ Improvements

- Additional Platform Exchanges – New platform exchanges are being integrated into the InSure DeFi platform to offer broader transaction options to users.

- Automation of Insurance Payment – Another ongoing project that InSure DeFi aims to have is establishing an automated system for automatic or hybrid processing of claims payout. This will make the process easier and faster.

- Crypto Hedge Fund – Creating a Hedge Fund is another InSure Defi project offering more options for interested members. This will allow a better and broader approach to secure the crypto portfolio and the crypto space.

Our Verdict

As a whole, the Crypto space is rapidly expanding, with several options for trading and investment. The Crypto market is a broad world, and should you decide to invest, it is necessary to protect yourself from any fraudulent activities that go with it.

As a trader, it is well advised to conduct due diligence to investigate and find ways to protect yourself. Buying InSure DeFi Insurance plans is an excellent start to guarantee safe trading and protect your digital assets.

To ensure your crypto portfolio, you can purchase SURE tokens and utilize them to activate an insurance policy from the Dashboard. Select a plan that fits your insurance requirements.

The inSure ecosystem employs several measures to prevent fraud, including ensuring publicly verifiable information, auditing transactions, and request additional details from the policyholder if necessary. Requests must be signed with the wallet that holds SURE tokens, meaning only SURE owners can submit a claim. This ensures that no fraudulent claims will be processed.

The insurance plan must be active on the wallet for at least seven days before it becomes effective, and a claim can be validly submitted.