InsurAce.io is a decentralized multi-chain crypto insurance protocol launched in 2021, providing DeFi insurance services with low portfolio premiums and sustainable investment returns. This insurAce review will cover everything you need to know to ensure your crypto assets are secure.

The platform has covered assets valued over hundreds of millions and offers a unique portfolio-based product to enable coverage of a basket of DeFi protocols. It covers 20+ chains, offering protection against smart contract vulnerability, custodian risk, IDO event risk, and stablecoin de-peg risk.

Its claim process is designed to protect policyholders and promises upcoming insurance products such as NFT insurance and cross-chain bridge cover. This guide will explore all these features and determine whether they’re worth it. So, read the complete review for a detailed analysis.

Who should use InsurAce.io?

For Beginner Traders

InsurAce is a complex platform that requires time to understand. New individuals to the subject matter must review the documentation and comprehend the terms and conditions thoroughly.

Exploring the platform’s user interface and features is also essential. Seeking guidance from experienced users or customer support may help clarify doubts. By taking these steps, beginners can maximize the platform’s benefits.

Credibility and Transparency

InsurAce is committed to building a trustworthy platform, and one of the ways it does this is through transparency. InsurAce is available in the US and Singapore, where its headquarters is located.

The platform is built to operate entirely transparently and invests heavily in security measures. InsurAce’s dedicated security team ensures its system is always secure and protected.

Investor and Community Support

InsurAce is backed by some of the most reputable blockchain investors, including DeFiance Capital, Huobi Ventures, and Alameda Research. These investors provide solid endorsements and development advice, which gives InsurAce a competitive edge in the market.

InsurAce has a solid and active community that provides feedback and expands the project’s network. This community gives InsurAce the necessary driving force to differentiate itself from its competitors and ensure it continues providing its users with high-quality services.

What does Insurance.io offer?

Decentralized finance has given individuals greater autonomy over their funds and their usage. However, due to the nascent nature of DeFi, it’s not immune to mistakes and pitfalls. Smart contract flaws and unforeseen circumstances, such as stablecoin debugging, can cause users to lose their investments.

Unlike traditional banks, there is limited recourse available to affected parties. This is where crypto insurance comes into play. Companies like InsurAce.io allow users to protect their crypto portfolios against potential losses. They offer coverage for various types of crypto and issues, including an investment platform for better asset returns.

InsurAce Review: Types of Coverage of InsuRace.io

InsurAce offers comprehensive coverage for smart contract exploits, which can be divided into two broad categories:

1. InsurAce Coverage for Smart Contract Exploits

Reentrancy is an attack where malicious actors repeatedly execute the same function, causing it to behave unintendedly. On the other hand, math and arithmetic errors occur when code errors lead to unexpected results, often causing significant financial losses.

With InsurAce, users can hedge against these common vulnerabilities and mitigate the risks associated with intelligent contract exploits.

In the event of an insurance claim, users can submit their claim and receive reimbursement for their loss, provided they meet the eligibility requirements.

2. InsurAce Coverage for Stablecoin De-Peg

In addition to coverage for smart contract exploits, InsurAce also provides options for covering custodian and stablecoin de-peg risks.

Stablecoins, designed to maintain a fixed value, can experience de-pegging events resulting in significant financial losses for investors and traders.

By leveraging InsurAce’s coverage options, users can hedge against these risks and ensure they are protected during a de-pegging event. After submitting a claim, eligible users can receive reimbursement for their losses, helping mitigate these events’ financial impact.

Overall, InsurAce’s coverage options provide a valuable tool for managing risks associated with smart contracts and stablecoins.

Advantages of InsuRace

Decentralized exchanges

InsurAce protocol is being managed by the community members. Governance control happens through community voting, in which the insurance claim process, assessment, and overall management are decided upon.

Its board, composed of various experts in the field of insurance and trading, establishes rules and regularly reviews proposals to improve the protocol’s overall system.

Keep Assets Secure

InsurAce focuses its services on managing the risk of cyber security attacks that users experience. With its broad range of experts, it strives to offer premium services in DeFi protocols by offering a diversified risk management tool to monitor and manage risks.

Good Investment Returns

InsurAce offers sustainable investment returns assured by its broad range of secure DeFi insurance services, including flexible and reliable coverages.

Disadvantages of Insurace.io

Uncertainty

DeFi projects face a significant disadvantage due to the instability of their host blockchain. In particular, if the blockchain supporting a DeFi project is unstable, the project may inherit that instability, resulting in potential losses for investors.

As many DeFi applications rely on the Ethereum blockchain, they use various cryptocurrencies as collateral. However, the volatile nature of digital assets can lead to decreased collateral value, creating liquidity risks and triggering a widespread sell-off.

Moreover, the values of tokens used in DeFi projects may decrease due to the uncertainty and instability caused by blockchain instability, which poses a significant risk to investors.

Problems with Smart Contracts

One problem with DeFi space and DeFi Assets, in general, is their exposure to Smart Contract Vulnerability. It subjects its users to constant attacks, which results in loss of funds on the part of the members.

InsurAce Review: Top Features & Perks

Live data and security

InsurAce sets itself apart from other insurance providers in several ways. One of its strengths is its integration with CER.live data, a trusted source for security ratings.

Every insurance product InsurAce offers has a security rating based on CER.live data. This feature allows investors to make informed decisions when purchasing coverage.

For instance, the USDC De-Peg product has a security rating of A, while the Ola Finance product has a rating of B.

Multichain support

Another strength of InsurAce is its support of multi-chains. Users can get coverage for protocols across various chains, including:

- Ethereum

- BSC

- Polygon

- Avalanche

- Solana

- Arbitrum

- Fantom

- Gnosis

- Moonriver

- Celo

- Harmony

- Boba

- Cronos

- ICON

- Ontology

- Moonbeam

- Bifrost

- Aurora

- Optimism

- Metis

This broad range of supported chains makes InsurAce more accessible to investors who may use different chains.

De-peg coverage option

Stablecoin de-peg coverage is another unique strength of InsurAce. The provider offers stablecoin de-peg coverage for USDC and BUSD, making it an ideal choice for those concerned about the potential risks associated with stablecoin de-peg.

Although other insurers may not offer this coverage, InsurAce has prioritized providing coverage for this risk.

Custom cover and reliability

The custom cover is another feature that sets InsurAce apart. Users who want their own bundle of protocols covered can apply for a customized bundled cover request.

To qualify, the user must purchase at least $500,000 in coverage amount. This feature allows users to tailor coverage to their specific needs.

InsurAce is a reliable and transparent insurer. The company partners with Hacken, a well-respected Web3 cybersecurity auditor, to assure users that it can be trusted.

InsurAce is transparent about its business practices, with public documentation, whitepapers, and good statistics.

Enhanced products

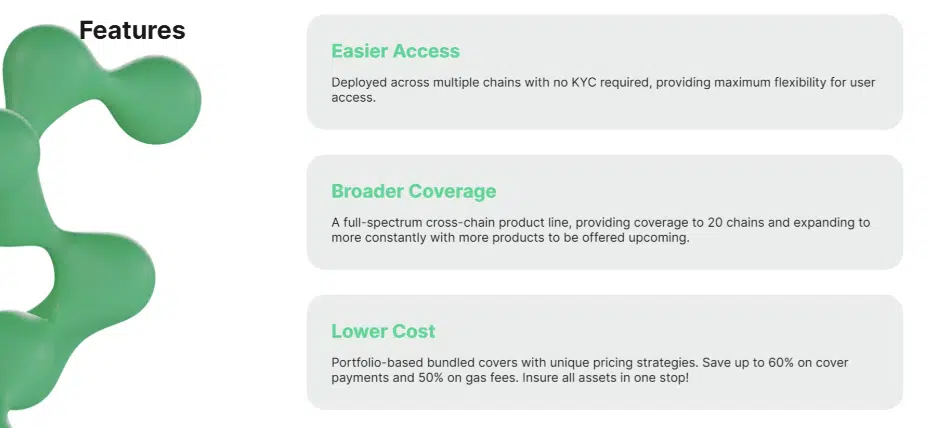

InsurAce has expanded its product line to offer portfolio-based coverage that caters to investors’ needs for a diversified risk management tool.

These products enable investors to cover multiple DeFi protocols simultaneously, providing comprehensive protection against risks associated with the DeFi space.

Unlike other insurers, InsurAce offers products that cover non-Ethereum decentralized protocols, making them accessible to the broader DeFi industry.

SCR mining program

InsurAce’s solvency capital requirement (SCR) mining program is a unique feature of the token economy.

Users can stake eligible tokens such as ETH, DAI, and USDT to earn InsurAce Token (INSUR) by investing and participating in the liquidity pool. This program allows investors to earn sustainable returns while supporting the InsurAce ecosystem.

INSUR rewards

InsurAce offers other ways to obtain returns besides the SCR mining program. Users can invest directly in other DeFi protocols based on risk appetite or in the mutual pool.

By investing in the mutual pool, investors earn INSUR rewards, money they can use to purchase products or stake in other protocols. Additionally, the rewards can be sold on exchanges for other cryptocurrencies, providing further liquidity options.

Sustainable returns

InsurAce’s approach to sustainable returns aligns with its mission to provide a transparent and reliable insurance platform to the DeFi community.

The platform aims to create a decentralized insurance ecosystem that supports investors and buyers. InsurAce creates a sustainable and profitable user ecosystem by utilizing various investment options.

How to buy cover on Insurace.io

Thanks to its user-friendly landing page and interface, InsuRace is quite easy to navigate, and you can easily buy a cover within a few minutes. This InsurAce review gives you a few simple steps to get what you want.

Step 1: Visit InsurAce.io

Start off by visiting the website. Once there, click the [WebApp] button on the main landing page.

More details

If you're looking for a trustworthy option to protect your digital assets against possible threats, insurAce.io might be your solution. This innovative insurance protocol offers a range of insurance products catering to DeFi users and all users. InsurAce.io prides itself on being a complementary player in the DeFi Insurance space, providing essential coverage against fraudulent activities and other potential threats to your crypto assets and investments.

-

Low cover premiums.

-

Cross-chain coverage.

-

Multi-chain accessibility.

-

No KYC is required.

-

Lacks an interactive interface.

Step 2: Connect your wallet

Where you will be redirected to the InsurAce dApp. There you will see a [Connect Wallet] button. Tap it and connect your crypto wallet to move ahead.

We recommend Metamask Wallet.

Step 3: Buy a Cover from the Desktop App

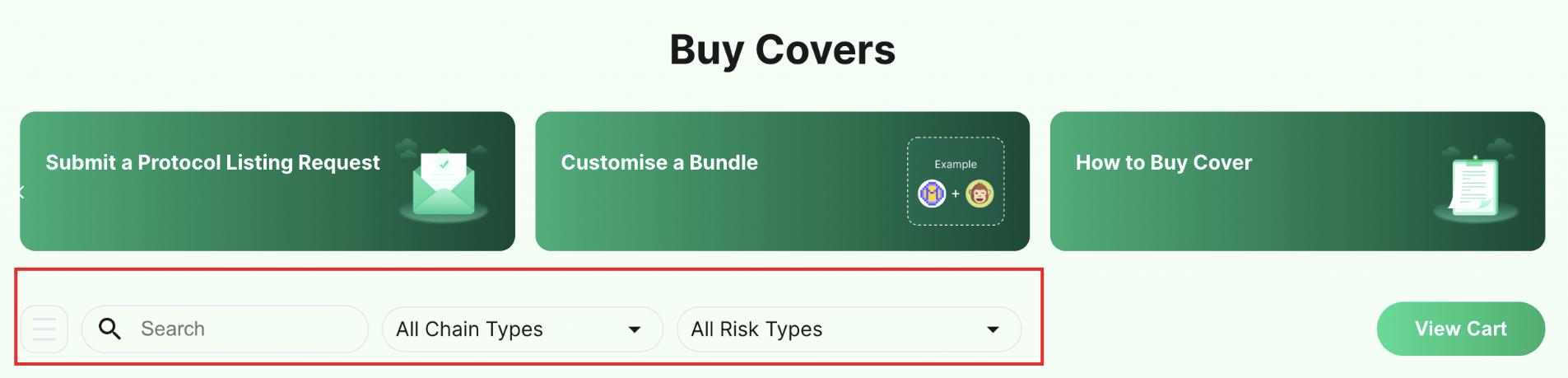

In the main Dashboard, click on [Buy Covers].

This will automatically redirect your page to a broad list of covers users may go through and invest in.

Step 4: Filter to make an advanced search

Using the drop-down, filter through the different types of risk and chain that would better suit your needs.

InsurAce offers support on a broad range of assets, and it can be filtered by providing the following information:

- Cover wording – terms and conditions needed in the cover

- Daily Cost – features the daily rate breakdown versus the cover amount

- Risk Type – what type of cover do you intend to have

- Chains – list of chains that covers your protocol

- Capacity – the amount of coverage that may be purchased

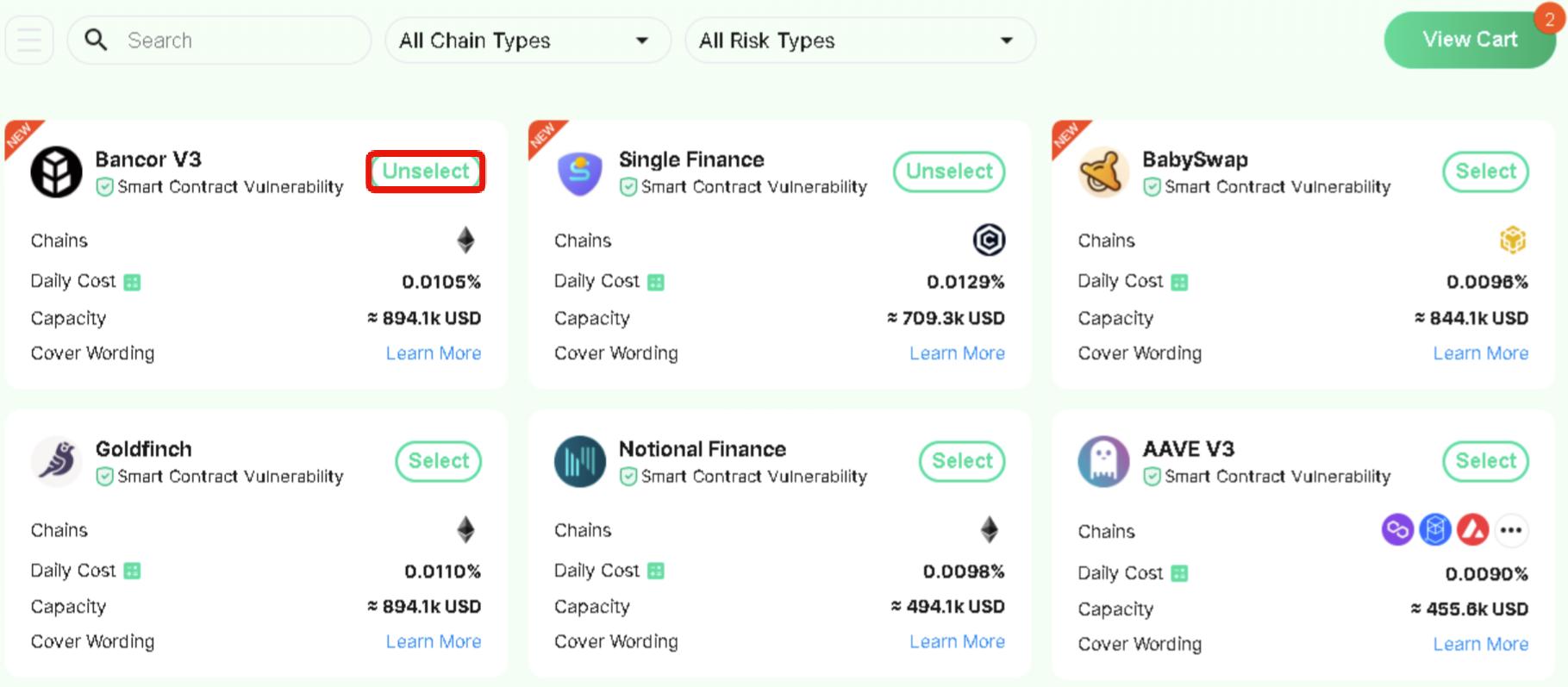

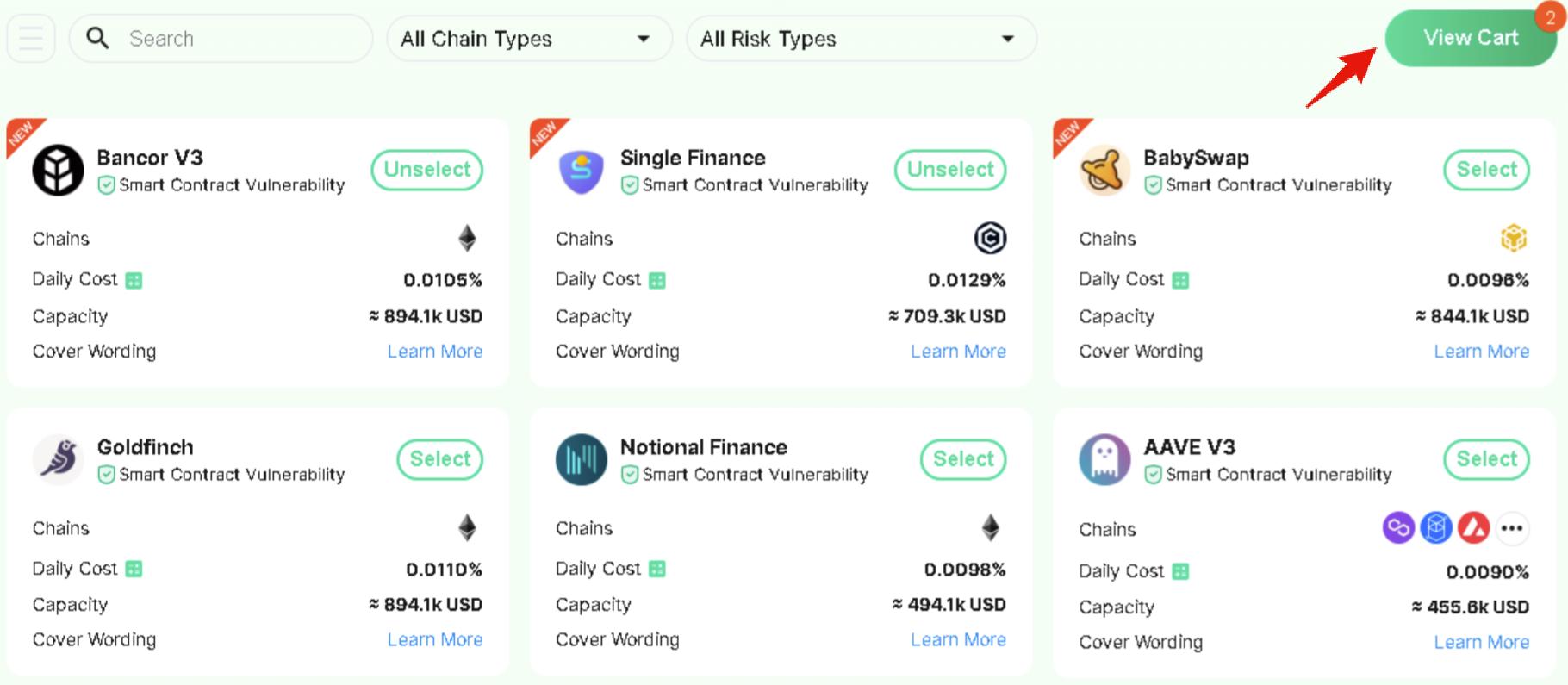

Step 5: Select preferred protocols

Select the cover type that will support all your needs. Once done, click [Select], and it will automatically add it to your cart.

Step 6: Got to the cart

Then, click [View Cart] to check out at the top of the same page.

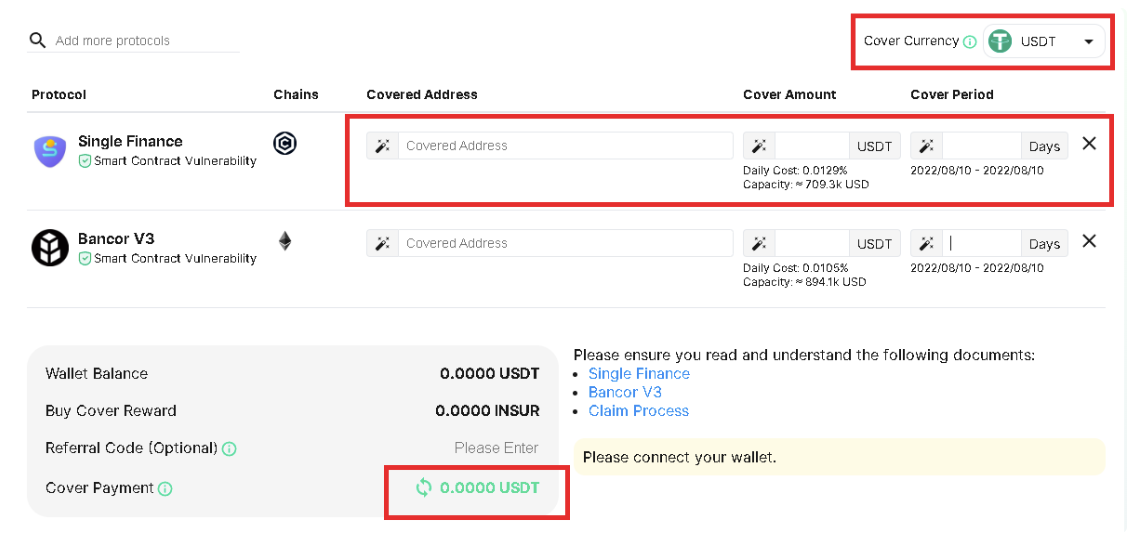

Step 7: Provide payment details

After reviewing the cart, provide details and proceed with payment.

Enter your Covered Address, [Cover Amount], and [Cover Period] for each protocol. After that, the system will calculate the total [Cover Payment].

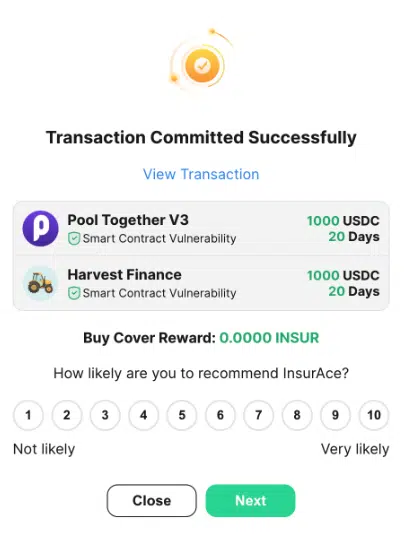

Step 8: Confirm the transaction

After that, tick the check box and select [Approve & Confirm] when agreeing to the above terms and conditions.

Confirm the transaction in your wallet. Once payment has been made and confirmed, your assets will be protected by the InsurAce protocol.

Improvements

InsurAce offered improvement updates that are being reflected through its roadmap:

Expanded Premiums

InsurAce is working on offering a wider range of products and services that will insure users. This includes Bridge Cover, which will address insurance coverage of assets transferred between blockchains.

The other is the Post-Audit cover, which will cover a broader range of protection for your digital funds against various online dangers.

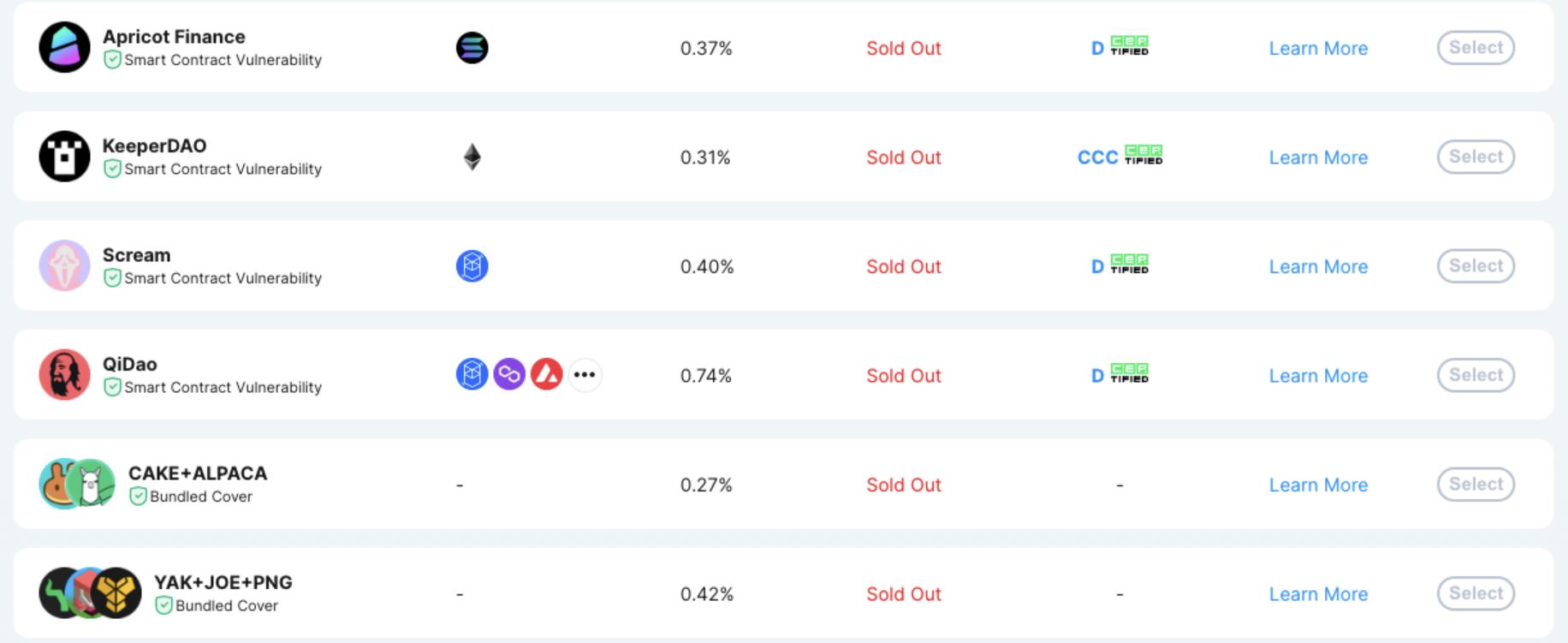

Lack of offers

While InsurAce has numerous strengths, it also has some weaknesses. The most significant problem is the unavailability of lucrative offers, which tend to sell out quickly. InsurAce acknowledges this issue and introduces new products frequently. Recently, it launched new covers for:

- Stader

- Compound V3

- USDC De-Peg

- Ola Finance

- Hubble

- Aura Finance

However, potential users should be aware that these products can sell out rapidly, and they should not wait too long.

Coverage for Web3 Projects

Crypto insurance can help protect Web3 projects from losses due to smart contract exploits or extreme market volatility. InsurAce provides adequate insurance coverage for such risks and is a reliable provider in this area. Using InsurAce, DeFi enthusiasts can explore the field without worrying about losses. Crypto insurance is essential for ensuring the stability and longevity of Web3 projects, and InsurAce is a trustworthy provider that can offer this protection.

Our Verdict

InsurAce is a reliable and secure platform that utilizes a multi-chain decentralized model to provide dependable insurance services. With a team of experienced insurance experts, the platform offers a unique pricing model that optimizes insurance costs, resulting in zero-premium insurance and substantial investment returns.

The platform is built and operated with complete transparency and security and is supported by a community of investors and users who provide feedback and expand the project’s network.

Despite some of its flaws in the user interface, the platform’s credibility, investment yield, and transparency make it a promising option for those seeking reliable DeFi insurance services.

Ensuring credibility is a primary objective for InsurAce. The platform is constructed and managed with utmost transparency and emphasizes security measures. This is evident in the presence of a dedicated security team.

InsurAce offers coverage for protocols across multiple blockchain networks, including but not limited to Ethereum, BSC, Polygon, Avalanche, Solana, Arbitrum, Fantom, Gnosis, Moonriver, Celo, Harmony, Boba, Cronos, ICON, Ontology, Moonbeam, Bifrost, Aurora, Optimism, and Metis.

Obtaining insurance coverage for your Web3 project is a practical solution. A trustworthy insurance provider offering sufficient coverage can protect your project against losses caused by smart contract vulnerabilities or significant market fluctuations.