TLDR

This guide will take you through how to get Coinbase Pro documents you need to file your taxes.

- Log in to the Coinbase Pro website.

- Select your profile icon.

- Choose the taxes option.

- Select download to get your document.

These steps will work whether using a desktop or the Coinbase mobile app. We cover both of them.

Coinbase Pro’s simple interface makes it easy for active traders to file their Coinbase Pro taxes.

How to Get Your Coinbase Pro Tax Documents on Desktop

To access the complete transaction history for your cryptocurrency investments through your desktop, follow the instructions below.

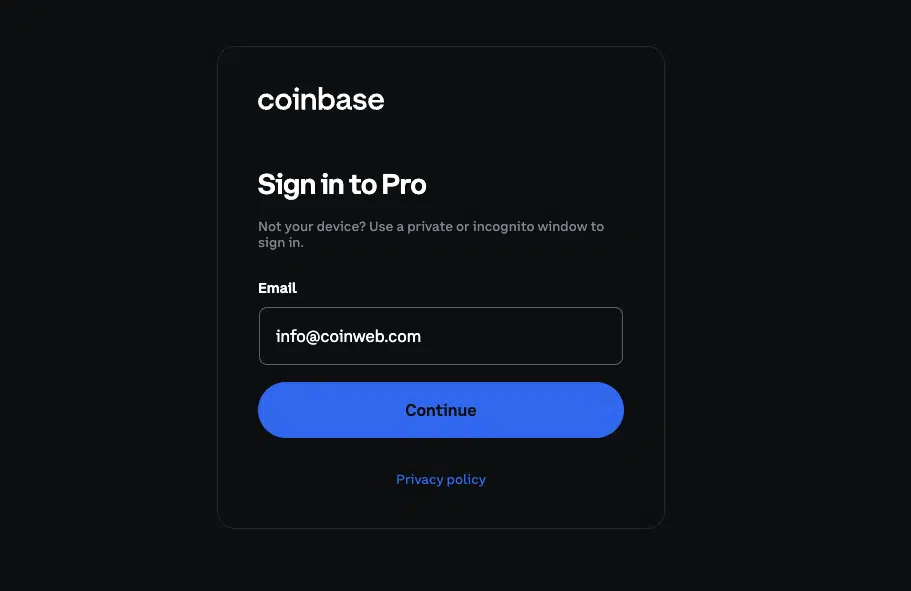

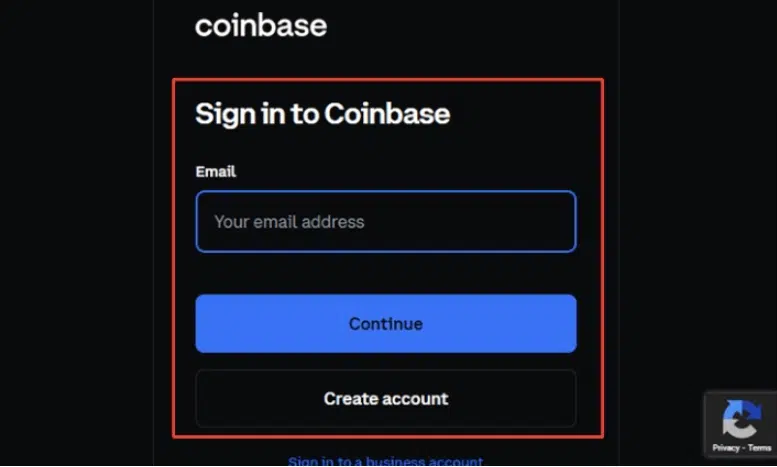

Step 1: Log in to the Coinbase Pro Website

Open your web browser, go to the Coinbase Pro website, and log in to your Coinbase Pro account.

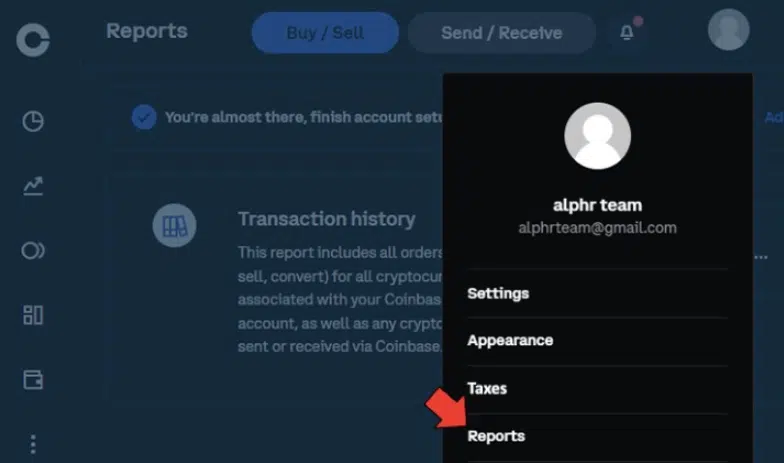

Step 2: Select Your Profile Icon

Click on your profile icon, which will be located at the top right corner of the webpage.

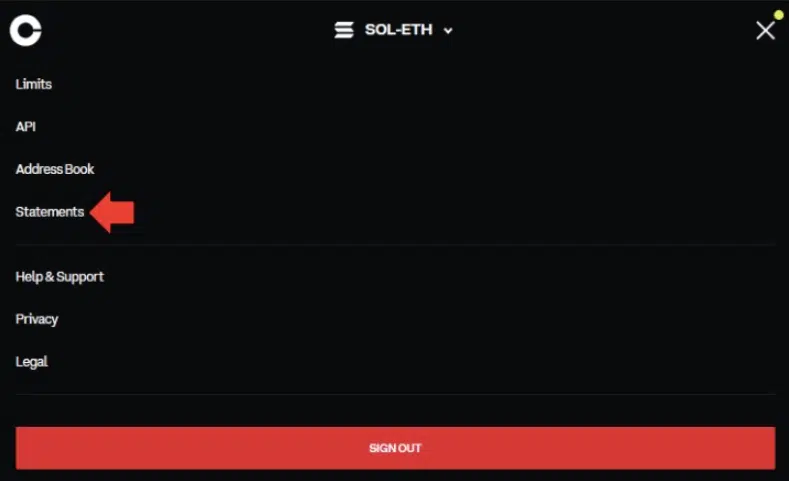

Step 3: Choose The Statements Option

Clicking on the [Statements] option will take you to the profile overview page, where you can generate your account report and download your tax reports.

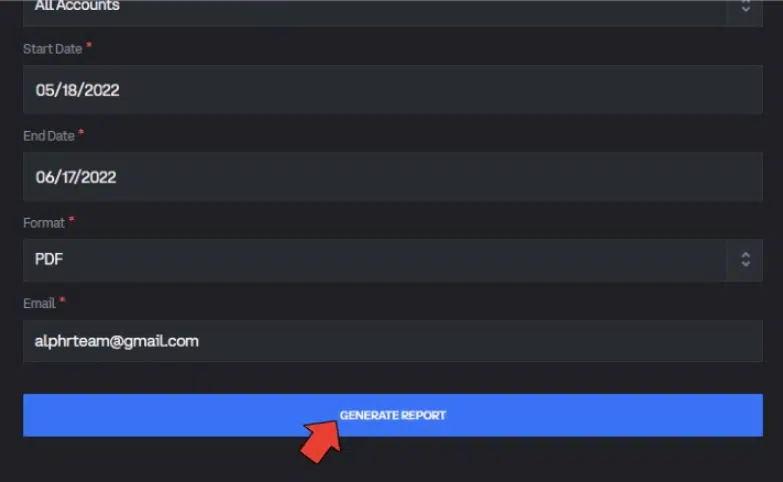

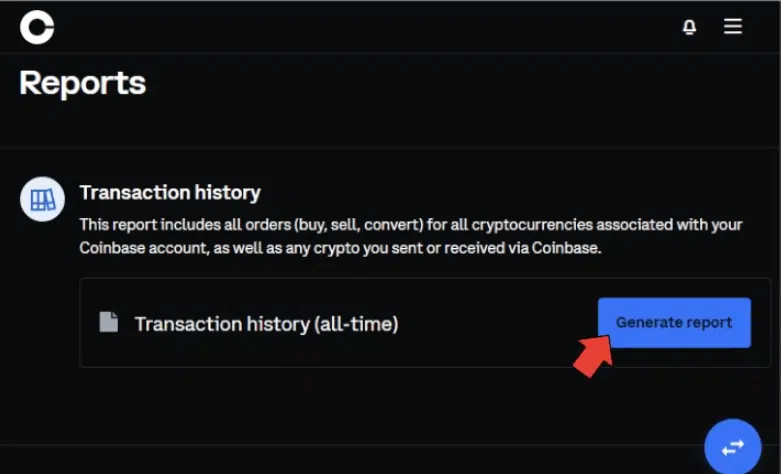

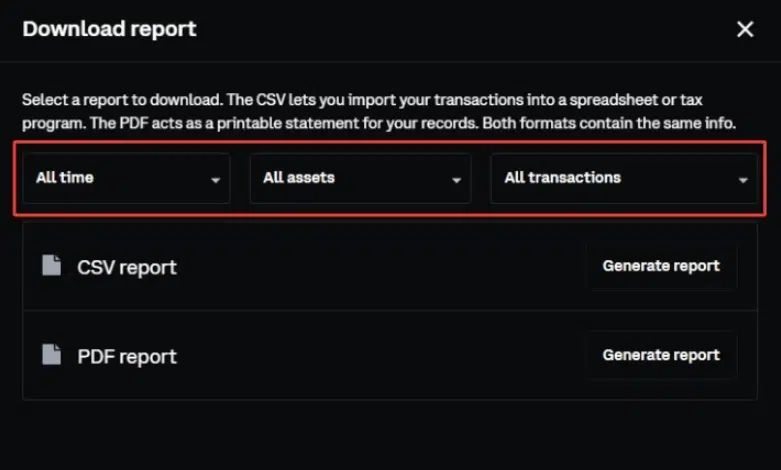

Step 4: Fill in all Metrics

Fill in the format you want to receive your document in and choose the start and end dates you desire.

Step 5: Click Generate Report to get Your Document

Navigate to the bottom of the page and click the [Generate Report] button. Your gains/loss report and 1099s will be available to download. No report will be available if you don’t have any recent gains/losses.

Getting Your Coinbase Pro Tax Reports on Mobile Phone

Let’s take you on generating tax reports through the Coinbase Pro mobile application.

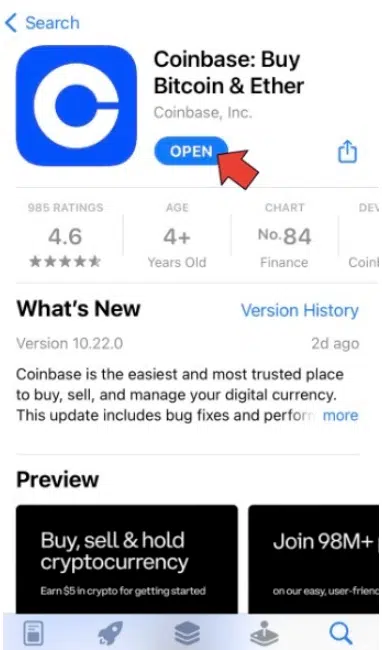

Step 1: Download the Coinbase Mobile App

Download and open the Coinbase Pro app from the IOS App Store or the Android Google Play Store.

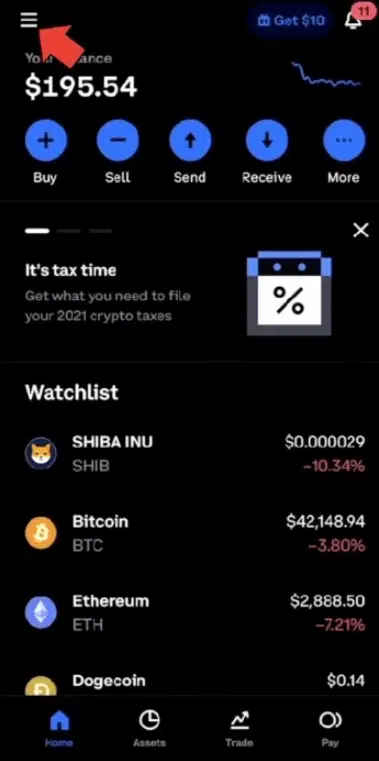

Step 2: Click the Options Menu

Click the options menu button on the top left corner of your screen.

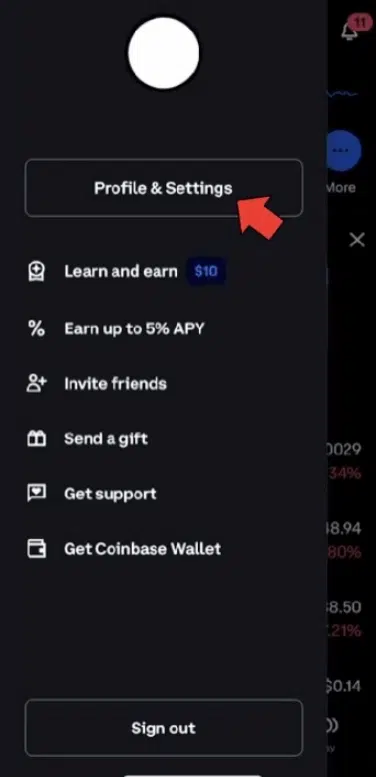

Step 3: Select Profile & Settings

Click on the [Profile & Settings] button on the menu bar.

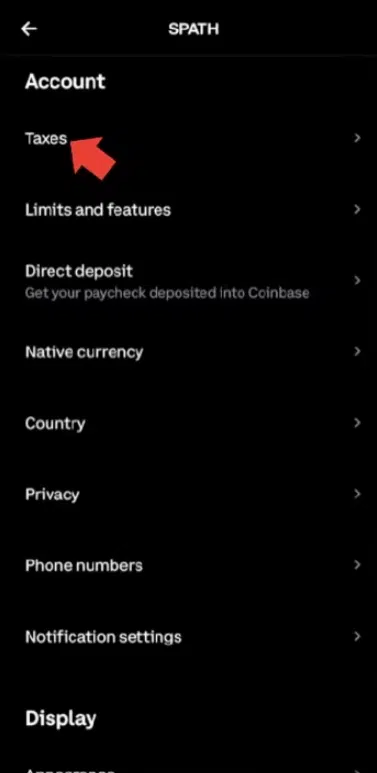

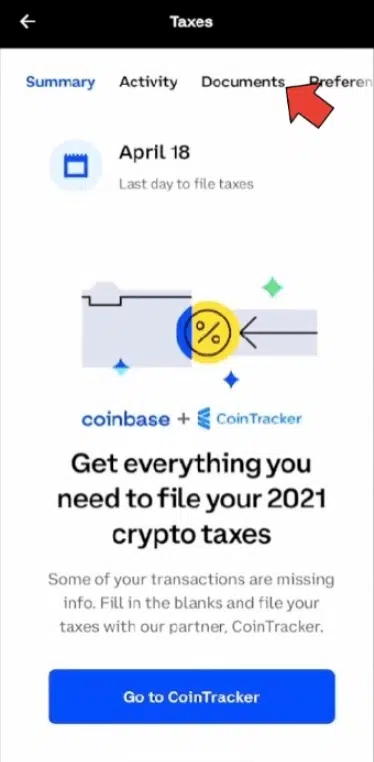

Step 4: Go to Taxes in Account and Choose Documents

Go to [Taxes] in the account section and click on documents.

Step 5: Download Your Tax Documents

You can download whatever tax reports by clicking on the download button next to the document.

The document will appear in your files app for iOS and file manager for Android.

The Best Crypto Tax Software With Coinbase Pro

You can link your Coinbase Pro with third-party crypto tax software.

We recommend Koinly or Coinledger.

More details

Koinly is one of the top leading crypto tax software. It leverages automation to directly import crypto transactions from supported integrations and calculate gains and losses to determine tax implications. Koinly supports more than 700 integrations and is available in over 20 countries and functions using the tax law of the supported countries. The use of Koinly is flexible and also functions as a portfolio tracker, giving an overview of all your assets in one place.

-

Multiple tax reports.

-

Numerous country support.

-

Easy to use.

-

Flexible plans.

-

Wide integration support.

-

Does not accept cryptocurrency payments.

-

Slightly expensive.

More details

Coinledger is a cost-effective way of filing crypto taxes without manually inputting transactions into your tax forms. The software integrates with major exchanges and wallets using APIs or public wallet addresses, automatically importing transaction data. It also identifies investments to sell at a loss to reduce your tax bill.

-

Smooth integration of exchanges.

-

Easy import and export of data.

-

Effective tax management.

-

Save money on tax.

-

Limited international country support.

How to Integrate Your Crypto Tax Software with API

You can integrate your Coinbase Pro with your crypto tax software via APIs by following the steps below.

- Sign in to your account,

- Go to profile and select API from the dropdown menu,

- Select the new API keys, and choose a name for your new API key.

- Make sure the view checkbox is enabled.

- Generate an API key passphrase and store it safely for later.

- Check your mobile for the 2-step authentication code and input it

- Safely store the displayed secret key and API keys; loss of the API key will make you unable to import transactions from Coinbase Pro.

Afterward, you will head to your third-party software (like Koinly) and integrate your Coinbase Pro API key.

How to get Coinbase Pro Transaction History

You can get your Coinbase Pro tax report by following the steps below:

- Open the Coinbase Pro website on your pc browser and sign in to your account.

- Look for the profile icon on the top right corner of the page and click on the dropdown arrow beside it. Select reports in the menu tray, directing you to a new page.

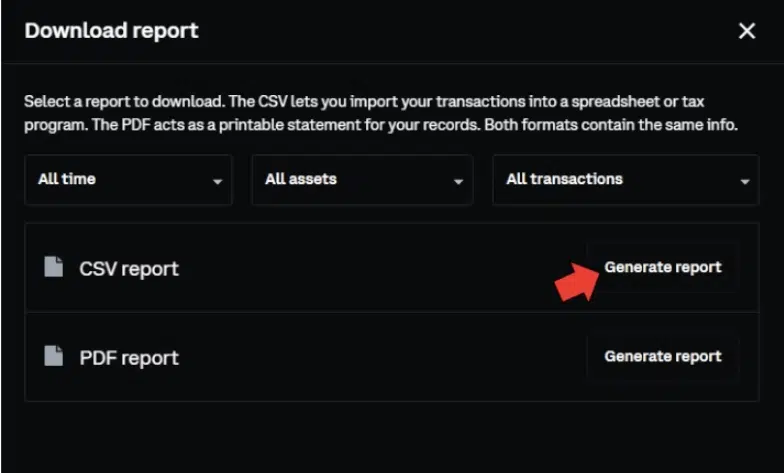

- Click on [Generate Report] on the new page.

- Choose which history report you want to generate.

- Select either the CSV or PDF report option.

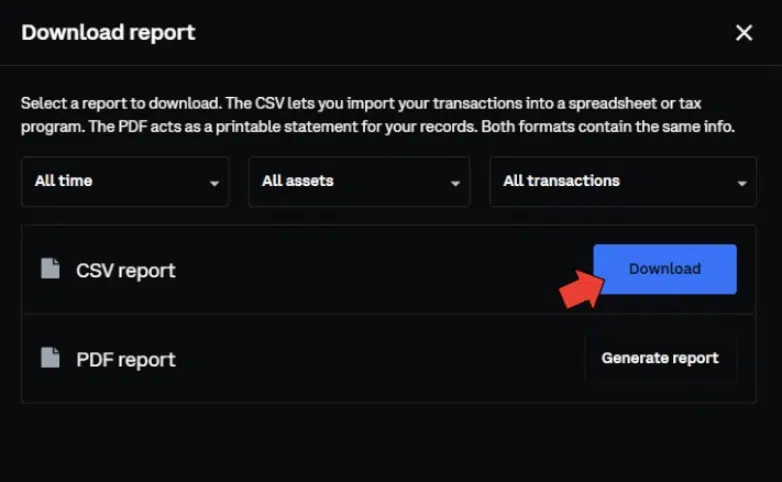

- After selecting your preferred format, click on [Download].

The report will be set to your email address shortly after you generate the report. To develop your Coinbase Pro report on your mobile devices, you must use your mobile browser to visit the Coinbase Pro website.

How do Coinbase Pro Taxes Work?

Coinbase Pro can give you all the details you need to trade like a dedicated crypto trader, but it can only help with some of your crypto tax reporting.

To file your crypto taxes from your Coinbase Pro account:

- Integrate your crypto tax software with your Coinbase Pro CSV file; you can export your Coinbase Pro transactions as a CSV file and import them to your third-party platform.

- Integrate Coinbase Pro with your crypto tax software via API; you can also grant access to your Coinbase Pro account, which will automatically sync your transactions.

What is Coinbase Pro?

Coinbase Pro is one of the world’s leading cryptocurrency exchanges. It is popular for its trading APIs that provide secure trading bots and a web socket that gives users access to real live feeds.

Coinbase Pro is Coinbases institutional version for seasoned investors and advanced traders.

Coinbase Global owns Coinbase Pro. It is the same company that owns Coinbase. Unlike Coinbase, which focuses on helping new crypto investors make their first purchases, Coinbase Pro focuses on more in-depth data on crypto assets.

With the current IRS tax laws that include capital gains on crypto transactions as taxable income and profits you make from trades to the Coinbase Pro exchange platform are liable to be taxed.

Conclusion

Getting transactions from your Coinbase Pro to fill out crypto tax for all income from cryptocurrency investment is so easy. With the easy-to-use website interface, Coinbase Pro makes it easy for users to get their tax reporting to the relevant tax authorities.

Yes, Coinbase allows you to access your tax forms and document through Coinbase taxes. Tax forms, including 1099s, are available while you have an active Coinbase account.

You can get tax reports from Coinbase Pro through your profile on the coin base website on your PC, visit Coinbase and login to your account, Click on the profile icon and click taxes, then documents, and search till you see the Coinbase Pro statement and click it.

While Coinbase and Coinbase Pro look similar and provide similar crypto services, they are not the same, with Coinbase Pro having some minor differences from Coinbase, especially with the user interface.

You need a Tax Form from Coinbase if you have made any capital gains or miscellaneous income from your Coinbase Pro transactions.