The crypto industry has helped investors get closer to financial freedom through cryptocurrencies like Bitcoin and Ethereum. However, this comes at a high cost. Taxes!

Did you know there are completely legal ways to avoid crypto taxes and potentially help you save thousands of dollars?

Luckily, our tax experts with a decade of experience will give you 13 simple and legal ways to avoid crypto taxes, allowing you to keep more profits.

Quick Look: 13 Ways to Avoid Tax on Crypto

- Buy Items with cryptocurrency.

- Invest using an IRA.

- Move to a tax-friendly state or country.

- Consider donating cryptocurrency.

- Invest for the long-term.

- Gift crypto to family members.

- Hire a crypto-specialized CPA.

- Take out a cryptocurrency loan.

- Pick the best cost-basis method.

- Keep accurate records of your crypto transactions.

- Harvest Your Losses.

- Sell crypto during low-income periods.

- Use crypto tax software.

A Detailed Guide to Avoid Tax on Crypto (Legally!)

Here is all you need to know about these strategies to help them avoid your taxes (legally!) or at least lower them.

1. Buy Items with Crypto

Starting our exploration of crypto tax avoidance strategies, the first step is buying items with cryptocurrency. You must understand that this strategy helps to reduce the overall tax burden but doesn’t directly lower taxes.

This is because there isn’t a law that states taxes on cryptocurrencies are reduced after making purchases. However, investors can exploit strategies like tax-loss harvesting and selling assets at a loss to reduce or offset capital gains taxes.

Let’s say you buy Bitcoin at $10,000 and decide to sell it for $8000 with a loss of $2000. If you decide to buy a laptop with the amount, the $2000 can be used to offset gains made by you and reduce your tax bill.

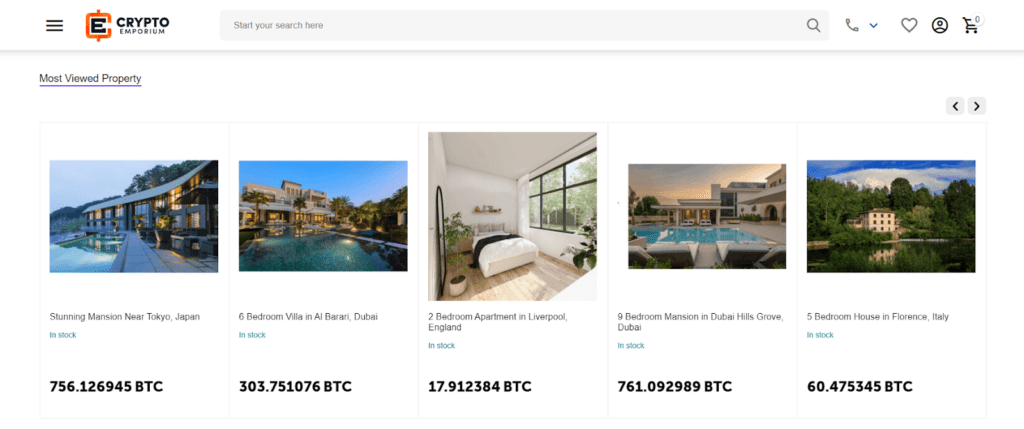

Who accepts Bitcoin, Ethereum, or other Altcoins in 2024? Crypto Emporium allows crypto holders to buy everything from small items to cars, property, watches, electronics, and clothes using Bitcoin and other cryptocurrencies.

2. Invest Using an IRA

Another way to avoid crypto taxes is investing using an Individual Retirement Account (IRA) – a retirement savings account that allows you to save money for retirement.

IRAs have been designed particularly for self-employed people who don’t have access to retirement accounts such as 401(k) through employers.

These IRAs have tax advantages such as income tax-free or deferred tax growth.

Crypto holders can use a traditional IRA to avoid paying taxes on capital gains until the money is withdrawn for retirement. This is because all contributions made to the IRA are tax-deductible.

Another option is a Roth IRA, where contributions are made in after-tax income. This means both capital gains made within the Roth IRA and withdrawals are tax-free.

Some of the best crypto IRAs include BitcoinIRA, Coin IRA, and iTrustCapital.

More details

Bitcoin IRA goes beyond digital currencies and presents an opportunity to invest in digital tokens. It offers seamlessly executed transactions to buy and sell digital crypto assets within a tax-advantaged individual retirement account (IRA). While this trading platform also provides attractive tax benefits, it incurs substantial account fees.

-

Invest in cryptocurrencies with tax deferment.

-

Diversify your portfolio with gold investments.

-

Transfer your IRA with full-service support.

-

Access a wide range of cryptocurrencies.

-

Ensure regulatory compliance with U.S. regulations.

-

Expensive fees.

-

Lack of fee transparency.

-

No crypto deposits.

3. Move to a Tax-Friendly State or Country

The third option is moving to a tax-friendly state in the US. Where taxes vary, including federal income tax, state income tax, and local taxes.

State income tax is a tax on income earned in that state and ranges from 1 to 13%, which may lead to tax savings for high-income earners. However, some states, including Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington, and Wyoming, have no annual income taxes.

You may also consider relocating to countries that don’t tax capital gains, including the United Arab Emirates, Belarus, Puerto Rico, and Malta. For US citizens, Puerto Rico is one of the most popular countries. Though it is a US territory, they do not tax profits from investing in crypto. Before relocating to Puerto Rico, unrealized gains would be subject to taxation as per US laws.

Let’s say you buy Ethereum for $50,000 and see its value rise to $100,000. Since you live in Puerto Rico, there are no capital gains taxes. This benefit applies even if the purchase was made in the US before moving to Puerto Rico.

4. Consider Donating Cryptocurrency

Donations are another great way to reduce taxes as they are tax deductible in the US. However, note that the charity must be registered in the US for these conditions to be applicable.

For example, consider donating to a registered entity like Save the Children. They were the first INGO to accept Bitcoin donations in 2013 in response to Typhoon Haiyan, which devastated the Philippines.

For example, if you purchased Cardano for $5000, and the current market leads to $8000, donating to a charity can deduct the full fair market value of $8,000 when filing cryptocurrency taxes.

The actual deductions are based on your adjusted gross income (AGI). As a result, the entire amount can’t be deducted. If the person has a total AGI of $80,000, the crypto donation would reduce their taxable income to $72,000. However, they must still pay taxes on crypto for the rest of the taxable income.

5. Invest for the Long-Term

In addition to donating crypto, holding onto the crypto assets for at least one year can be effective.

Several countries, including the US, encourage long-term crypto investments by lowering tax liability if crypto investors don’t sell for 12 months as they fall outside short-term capital gains tax.

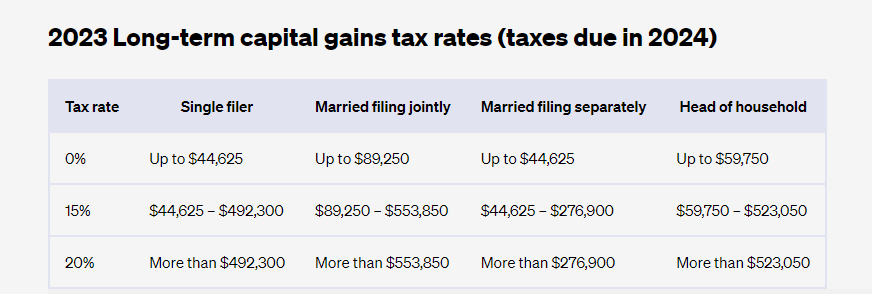

For instance, the tax for long-term capital gains ranges from 0% to 20%, while for short-term, it ranges from 10% to 37%.

6. Gift Crypto to Family Members

Gifting crypto to your family and trusted friends is not a taxable event.

In the US, crypto investors can gift up to $17,000 per person annually without reporting a gift tax return to the IRS.

The lifetime gift limit for US Citizens is $12.92 million under the gift and estate tax exemption regulation.

While this method doesn’t eliminate taxes, it allows you to transfer crypto assets without immediate crypto tax liability. Yet, the recipient who got the crypto as a gift is still liable to pay taxes on any capital gains made through it.

7. Hire a Crypto-Specialized CPA

Crypto investors needing to pay a lot of taxes can consider hiring a Crypto-specialized Certified Public Accountant (CPA).

They can provide you with a customized strategy best suited to your situation. For example, let’s consider a scenario where you have a diverse crypto holding involving trading, mining, and staking.

Based on tax implications, the CPA can advise on strategic timing for liquidating assets. They can also provide a tax-efficient approach for ordinary income from staking.

Taking their advice can save thousands or even tens of thousands of dollars by overlooking an eligible tax deduction and optimizing tax strategy.

However, hiring a CPA can cost hundreds of dollars per hour, so choosing verified CPAs with crypto experience is important.

8. Take out a cryptocurrency loan

Moving on to a different approach, taking out a crypto loan can access liquidity while avoiding the capital gains from selling the cryptocurrency.

You use your crypto portfolio as collateral to take out a loan. While an interest expense might be associated with the loan, you won’t need to pay taxes. The interest on a loan is also tax-deductible.

For example, you take out a loan of $20,000 using your crypto portfolio with a 10% interest. This money is used to grow your business. You need to pay $1000 in interest annually, which can be deducted to offset your overall taxable income.

Some platforms where you can take a crypto loan include Nexo, YouHodler, and Compound.

More details

Nexo is an advanced and regulated crypto platform that offers a secure, fast way to own 40+ cryptocurrencies. Its users can access highly attractive earning rates on various crypto assets. Nexo also provides easy-to-use loans backed by cryptocurrency. This exchange offers a crypto-backed debit card to make everyday use of crypto a breeze.

-

Loyalty earning opportunities.

-

Up to 16% APY on digital assets.

-

Swap between 500+ market pairs.

-

Loan options for users.

-

Licensed and regulated.

-

No benefits without a native token.

-

No live chat support.

-

No anonymous option.

More details

YouHodler, a crypto exchange and lending platform, offers high interest on crypto deposits and provides clear information about its risks, rates, and fees. Users can collateralize digital assets for short-term loans, which can be used for advanced trading. However, its unavailability in the US and high loan APR might dissuade some investors.

-

Earn interest in your digital assets.

-

Borrow against your crypto.

-

Access advanced trading tools.

-

Effective customer service.

-

High APR on loans.

-

Regional restrictions in some countries.

-

Lacks transparency in the interest rate rates.

9. Pick the best cost-basis method

Cost-basis means the original value you paid for the asset at the time of purchase. This is crucial for calculating the capital gains/losses.

The formula to calculate Capital Gains/Loss is:

Capital Gain/Loss = Selling Price – Cost Basis

Since the IRS lets taxpayers choose the type of cost basis method for their calculations, the right choice can reduce your tax liability.

Highest In, First Out (HIFO) is the default option that produces the lowest tax burden. We recommend this method since the assets with the highest cost basis are sold first, which leads to lower capital gains.

An alternative to HIFO is First In, First Out (FIFO), where the first unit purchased is also sold in the context of taxes on cryptocurrency. This method helps to increase the chances of taking tax benefits of the long-term capital gains rates. This is because it accounts for spending your longest-held assets first.

Some less popular options are Specific Identification(Spec ID) and Last In, First Out (LIFO).

The best cost-basis method is dependent on individual cases. You may consider choosing tax software that can help compare savings based on various methods.

10. Keep Accurate Records of your Crypto Transactions

One common mistake investors make when dealing with cryptocurrency taxes is not keeping accurate records.

For instance, a lack of proper records can lead to the wrong cost basis. In such cases, all of your proceeds from the sale may be viewed as a capital gain. This can significantly increase the taxes you need to pay on cryptocurrencies.

Additionally, it is common for investors to use multiple crypto exchange platforms. For instance, an investor transacting across three crypto exchanges might miss some cryptocurrency transactions and need help getting accurate records.

To avoid it, consider maintaining the data when & at how much the crypto was acquired and sold. If you are having a hard time keeping track, crypto tax software helps consolidate all information in one place

11. Tax Harvest Your Losses

Now, let’s dive into a popular strategy used in the equity markets to lower taxes called Tax-loss harvesting. It can used with equal effectiveness for crypto, too.

When you sell a crypto asset for a loss, it is viewed as a capital loss. This can be used to offset the crypto gains made elsewhere.

Consider a case where an investor makes a gain of $3000 from their Ethereum investment but makes a loss of $1000 in their Cardano investment. In this case, the investor $2000 would be subject to capital gains, not $3000.

Currently, the claimable amount is $3000 per year. Claims above this amount are carried over to the next year.

Accointing, and CoinLedger offers crypto tax loss harvesting features.

More details

Coinledger is a cost-effective way of filing crypto taxes without manually inputting transactions into your tax forms. The software integrates with major exchanges and wallets using APIs or public wallet addresses, automatically importing transaction data. It also identifies investments to sell at a loss to reduce your tax bill.

-

Smooth integration of exchanges.

-

Easy import and export of data.

-

Effective tax management.

-

Save money on tax.

-

Limited international country support.

12. Sell Crypto During Low-Income Periods

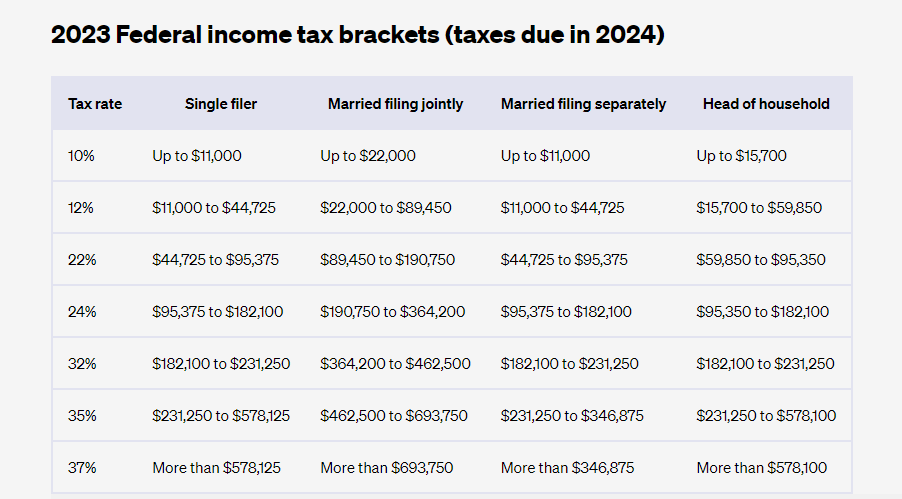

Since you are taxed based on your total annual income, selling crypto during low-income periods is a good idea. The goal is to avoid a higher tax bracket and only pay lower tax rates.

For example, suppose you face a temporary dip in ordinary income during a gap year between employment. In that case, you can sell your crypto and avoid higher capital gains tax.

Careful considerations need to be made regarding tax brackets to implement this strategy effectively.

13. Use Crypto Tax Software

Filing for crypto taxes can get complicated, along with the risk of getting penalties for not following the law.

Choosing the right crypto tax software can remove the hassle of the entire process. These software have built-in tax advice, accelerated reporting, and the ability to consolidate data from multiple crypto exchanges.

Once the information is ready, the crypto taxes can be filed with either TurboTax or TaxAct.

Some popular crypto tax software options include Koinly and Coinpanda.

More details

Koinly is one of the top leading crypto tax software. It leverages automation to directly import crypto transactions from supported integrations and calculate gains and losses to determine tax implications. Koinly supports more than 700 integrations and is available in over 20 countries and functions using the tax law of the supported countries. The use of Koinly is flexible and also functions as a portfolio tracker, giving an overview of all your assets in one place.

-

Multiple tax reports.

-

Numerous country support.

-

Easy to use.

-

Flexible plans.

-

Wide integration support.

-

Does not accept cryptocurrency payments.

-

Slightly expensive.

What Are Crypto Taxes and their Types?

Crypto taxes are the taxes associated with transactions and income involving cryptocurrencies.

“For federal tax purposes, digital assets are treated as property. General tax principles applicable to property transactions apply to transactions using digital assets.”

As per the IRS

There are two major types of Crypto taxes:

1. Capital Gains Tax

Capital gains tax is charged when an investor who sells a crypto asset makes a profit.

The capital gains tax can vary by filing status, such as single, married, or head of household. It is also separated as short-term for assets held for less than one year and long-term for those held for more than one year.

Short-term capital gains are subject to current income tax rates ranging from 10% to 37%. Meanwhile, long-term capital gains tax rates range from 0% to 20%.

2. Income Tax

Crypto Income Tax is charged for any income from crypto assets such as staking, mining, and referral bonuses.

Individuals need to pay anywhere from 10% to 37% based on the level of personal income and relationship status that the person has.

Any person getting paid via crypto will need to pay the ordinary tax bill.

What are common mistakes to avoid when saving on crypto taxes?

Try avoiding the following mistakes in the process of trying to avoid crypto taxes.

Not reporting all cryptocurrency transactions

Regardless of the size of your transactions, failing to report all transactions leads to serious consequences. This can include penalties and interest charges from the IRS.

Not understanding the tax laws

As crypto tax laws can seem complex, people may act based on their assumptions. Always stay on the safe side. If necessary, take crypto tax insights from a vetted professional.

Not considering the tax implications of mining and staking

Some crypto enthusiasts see mining and staking as an unregulated area with no implications to pay taxes on crypto. This might have been true when they started, but now they are not!

As per the new regulations, these activities fall under income earned from crypto and are subject to ordinary income taxes.

Can you Legally Avoid Taxes on Crypto?

Yes, it is legal to avoid taxes on Crypto as long as they aren’t considered illegal. This distinction can be made by understanding tax avoidance and tax evasion.

Tax avoidance is the legal method that the government accepts to lower taxes or avoid them. The strategies mentioned above are tax avoidance strategies.

Conversely, tax evasion is the illegal non-payment or underpayment of taxes. Depending on your country, tax evasion can have serious consequences, including time in jail and hefty fines.

For example, intentionally underreporting crypto profits to reduce your tax bill is tax evasion. In the process of trying to answer how to avoid crypto taxes, it’s important to stay within the tax system.

Overall, legal strategies such as investing through IRAs, moving to tax-friendly locations, and donating crypto can help significantly lower your crypto tax bill and keep more of your profits!

Consider strategies such as tax-loss harvesting, gifting crypto to family members, and investing using an IRA to minimize crypto taxes.

Being eligible for long-term capital gains by holding crypto for at least 1 year and selling crypto during a low-income year helps to pay tax rates much less on crypto legally.

Some notable countries without crypto tax burden include Puerto Rico, the United Arab Emirates, Belarus, and Malta.

You need to pay capital gains taxes on any profits made from a sale regardless if you choose to reinvest the crypto or spend it.

Based on your country or state, there may be penalties and jail time for tax evasion.