TLDR

This article will give everything you need to know to buy Ripple (XRP).

Ripple, a FinTech company, actively innovates to tackle the challenges associated with cross-border payments. XRP is the native crypto token to process payments for banks, institutions, and retail investors.

Ripple XRP has gained wide adoption due to its speed, reliability, and environmental friendliness. It also ranks high with other digital tokens due to its market capitalization. XRP runs on Ripple’s open-source, decentralized blockchain network, which uses a unique consensus protocol to validate transactions.

You can buy Ripple XRP from eToro in the following way:

- Opening an account on eToro.

- Fund your account through bank transfers, debit cards, or other crypto assets.

- Buy XRP.

Introduction

Over the years, digital currencies or assets have become part of our evolving financial institutions. Cryptocurrency has changed the face of financial institutions by facilitating decentralized global exchanges of digital assets at record speed.

Ripple is another revolutionary technological company that has advanced the progress of decentralized exchanges with the creation of XRP as a crypto asset. Ripple XRP is the native currency of the Ripple network and processes cross-border payments at a low cost.

This step-by-step guide will offer an in-depth explanation of how to buy Ripple and identify the exchange platforms that support the buying and selling of Ripple.

Overview of Ripple

Although Ripple and XRP are commonly used interchangeably, there is a slight distinction between the two terms. Ripple refers to the fintech company whose primary objective is to build digital products that solve the challenge of global payment methods. Jed McCaleb and Chris Larsen co-founded the company.

On the other hand, XRP is a cryptocurrency used as a token by Ripple. XRP is similar in functionality to other cryptocurrencies, such as Bitcoin and Ethereum. The Ripple team launched the XRP ledger (XRPL) in 2012. It is a decentralized open-source blockchain network. XRP is widely adopted because of its speed, reliability, and environmental friendliness.

Since birth, XRP has claimed its spot as one of the market capitalization leaders among cryptocurrencies. Platforms like Coinbase and Binance actively trade it. This digital asset doesn’t just serve as an investment tool; it also flexes its muscle as a tradable crypto asset on various platforms.

XRP runs on the Ripple network, which is open source and operates as a peer-to-peer decentralized exchange platform. The network handles millions of transactions swiftly and lists large financial institutions like Bank of America and American Express as some of its users. Ripple has transacted about $168.41 billion worth of XRP globally in the last quarter of 2021.

The network is majorly reliable due to its independent consensus protocol to validate transactions and account balances on the system. Due to the nature of the system, you can transact and exchange other cryptocurrencies and fiat currency.

What is an XRP ledger?

The XRP ledger, which Ripple relies on, is an open-source and decentralized blockchain network, meaning a public developer community leads it. The XRP ledger has low transaction fees and ease of development, which aids its high performance.

How does the XRP ledger work? Unlike other cryptocurrencies that run on proof-of-work (PoW) or proof-of-stake (PoS), the Ripple network validates transactions on the XPRL using a unique consensus protocol.

The XRPL operates through an independent set of validators who determine the outcome of XRP transactions. For a successful outcome, a transaction must follow the protocol listed by the validators. The transaction process is transparent and made public, increasing the Ripple network’s reliability.

The consensus mechanism of the XRPL is super efficient and allows over 1500 transactions per second (TPS). Despite the large number of transactions conducted on the network, the processing speed is roughly 4 seconds. Even better, XRPL is energy-efficient, using only 0.0079 kWh per transaction as opposed to the high energy consumption of other blockchain networks.

How to buy Ripple (XRP)?

Due to the success of the Ripple XRP, it has become popular among investors, crypto wallet holders, and other crypto enthusiasts. If you fall into any of these categories or want to purchase XRP, here is a simple step-by-step guide on how to go about it.

Step #1: Identify a Crypto Exchange to Purchase XRP

It is essential to identify a safe and reliable platform to buy XRP. Often, your region dictates your choice of exchange platform. Although numerous exchanges previously featured Ripple XRP, its ongoing legal issues have led some cryptocurrency platforms to delist it actively.

SEE MORE OPTIONS: Check out our list of the Best Crypto Exchanges.

The popular digital asset’s founding company and executives are facing a legal battle with the Security Exchange Commission (SEC) for allegedly raising $1.3 billion through unregistered security offerings. The struggle with the exchange commission has led to a cryptocurrency exchange like Coinbase limiting XRP purchases on its platform.

Despite the delisting on most exchanges, there are still credible platforms to buy XRP. The major exchanges include:

Kraken

The San Francisco, California-based exchange platform is one of the few crypto platforms to buy XRP in the United States. Kraken is popular for its long time of existence and its broad service offering across the world. Although the platform allows you to buy XRP and send it to other crypto wallets, it does not support trading XRP.

Binance

Binance occupies a comfortable spot as one of the top global platforms for buying crypto and other digital assets. Even though buying XRP is allowed on the global version of Binance, this feature is limited for US-based residents.

More details

Binance is a great combination of low fees, deep liquidity and multiple cryptocurrencies and trading pairs. We have tested every aspect of it and it STILL holds its reign as the top exchange in the world. In our view, it is the perfect crypto exchange for both newbies and advanced traders alike.

-

Biggest exchange in the world.

-

Industry's lowest trading fees.

-

Advance trading options like leverage trading.

-

600+ crypto options, 150+ for the US.

-

Lucrative on-site staking options.

-

Hiccups in account verification.

-

Less regulated than some competitors.

-

The corporate structure is not transparently.

Uphold

Uphold is another US-based cryptocurrency company, and it still supports buying XRP. It is home to over seventy cryptocurrencies, of which Ripple XRP is one. The platform lets you buy and trade XRP and send your purchased crypto to an external wallet.

More details

Uphold is a secure, transparent digital asset exchange, ideal for no-hassle transactions. With no-fee transactions for assets over $100, it sets itself apart. Furthermore, its debit card facilitates instant cryptocurrency conversions, adding user convenience. However, it's important to note that equity trading isn't available on Uphold in the US and Europe.

-

Cross-asset trading in one platform.

-

Good educational content.

-

Transparent fee structure.

-

Easy user interface.

-

No advanced trading features.

-

Weak security as it has been hacked.

-

A less appealing mobile app.

eToro

eToro is an example of a secure trading platform where you can trade XRP. The exchange is fully authorized and licensed to be an online broker by the SEC and regulatory bodies of several other countries like the UK, Australia, and Cyprus. The website allows you to buy and trade XRP easily.

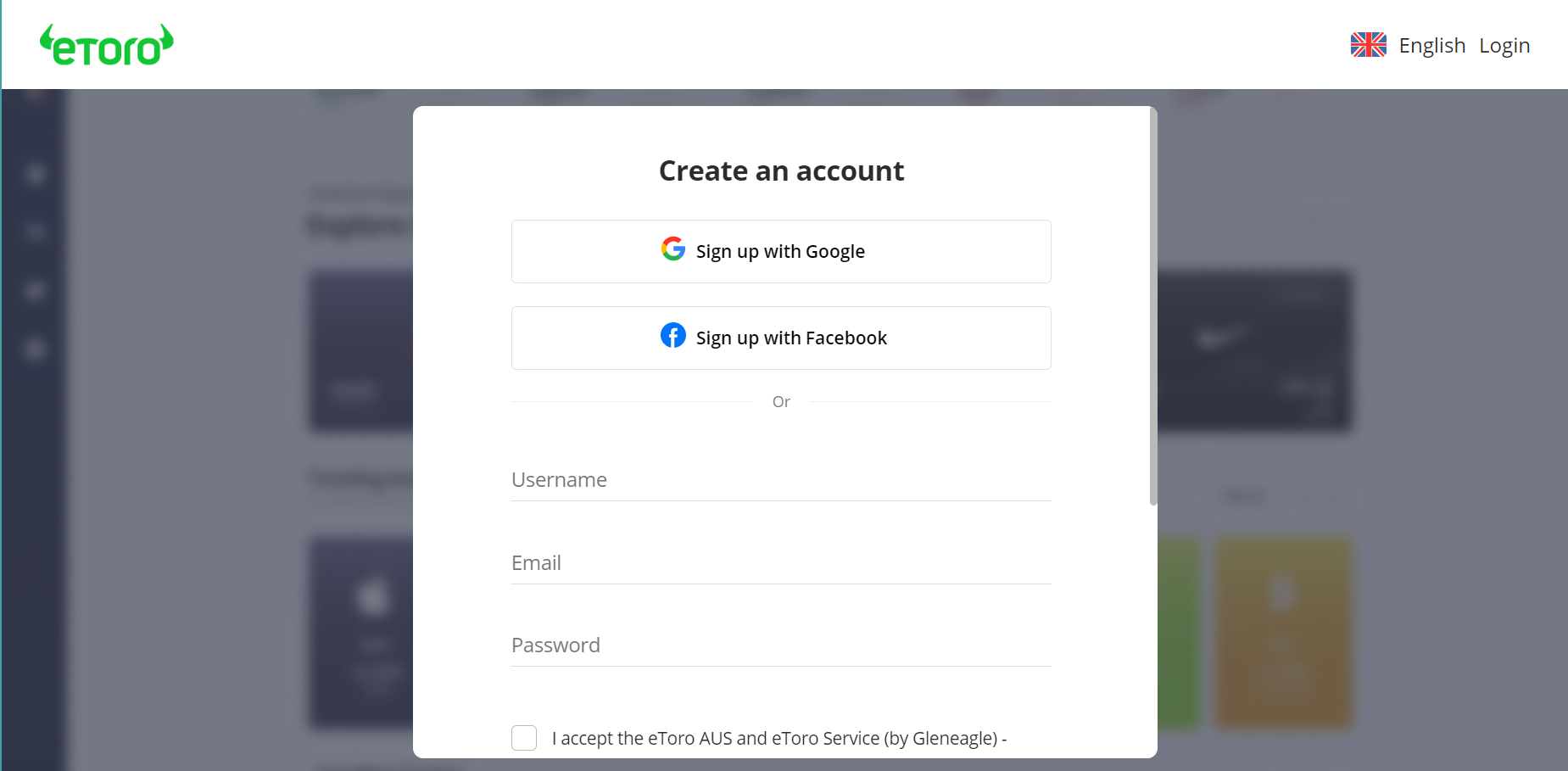

Step #2: Create an Account

After you have identified a crypto exchange that supports you in buying Ripple XRP in your region, then you need to create an account.

The need to create an account on these platforms mainly applies to new users; if you already have an account on the exchange, you might skip this stage and go directly for instant Ripple XRP.

If you do not have an account, we recommend you use eToro.

More details

eToro is a popular online trading platform for crypto assets, stocks, and ETFs, featuring low fees and a user-friendly interface. With a free eToro wallet and social features like messaging boards, users can copy experienced traders and access numerous assets. Take a look at what makes this platform perfect for starting your trading journey.

-

Provides an attractive, communal atmosphere.

-

Offers zero commission on ETFs.

-

Extensive selection of educational resources.

-

Mobile app with trading features.

-

Smooth account opening and bank transfer.

-

Limited number of cryptocurrencies.

-

Limited customer support.

-

No crypto-to-crypto trading pairs.

Sign up

Like most other platforms, you must sign up as a first-time user to get a free account.

For nearly all exchange platforms, you must provide personal details such as your name, e-mail address, mobile number, and password. Due to the sensitivity of the account, it is advisable to use a strong and unique password to protect your account.

Identity Verification

There are typically two types of exchange platforms: centralized exchanges and decentralized exchanges. For the latter, you do not have to provide your details. However, there are limited, decentralized exchanges that support you in buying ripple XRP.

Due to the “Know-Your-Customer” (KYC) regulations, you must verify your identity for centralized exchanges. Aside from compliance with KYC regulations, verification also helps you secure your account.

Depending on the platform, the verification process can engage you at multiple levels. It might require anything from simply providing your name to submitting tangible proof of residence.

Step #3: Add Funds to your Account

As obvious as it sounds, you must deposit funds into your trading account to buy Ripple. Different payment methods are available for most exchanges, which can also influence your decision when choosing an exchange platform to buy Ripple.

What are the best ways to buy XRP?

There are multiple purchasing options available to buy XRP. The common options include the following:

Bank account/bank transfer

A bank transfer is easily one of the top payment methods to fund your account and buy XRP. Bank transfers are also cheaper when compared with the other options available. Despite its cost-effectiveness, it is also a slower method, especially when using wire transfers, as it can take 3–5 working days before it reflects.

Credit card purchases/Debit card purchases

A credit or debit card is more common among crypto investors and accepted by most platforms. A debit card allows for faster payments than transfers from a bank account. Although, as part of the cons of this method, you might incur higher transaction fees. Some exchanges also support payment from Google Pay and Apple Pay, similar to card purchases.

Crypto Deposits

If you already hold crypto, you do not necessarily have to pay for XRP using fiat currencies. You can buy XRP using other digital assets as an exchange. Cryptocurrency deposits are usually faster than a wire transfer and have lower trading fees than card purchases.

XRP prices might vary slightly based on the different payment options used and the current price available in the market.

Step #4: Buy XRP Coins

Irrespective of the technique, whenever your account is funded, you can proceed to buy XRP. The process of buying XRP is somewhat similar but different for each exchange.

This guide will provide a step-by-step guide for buying Ripple XRP on eToro.

How to Buy Ripple XRP on eToro

Following the previously stated steps, you are expected to have opened an account on eToro. Then, you can fund your account using fiat currencies or crypto deposits to buy XRP.

1. Open your eToro Account

After opening an eToro account, return to the sign-in page and enter your correct login details. The login details requested at this stage are your e-mail address and password.

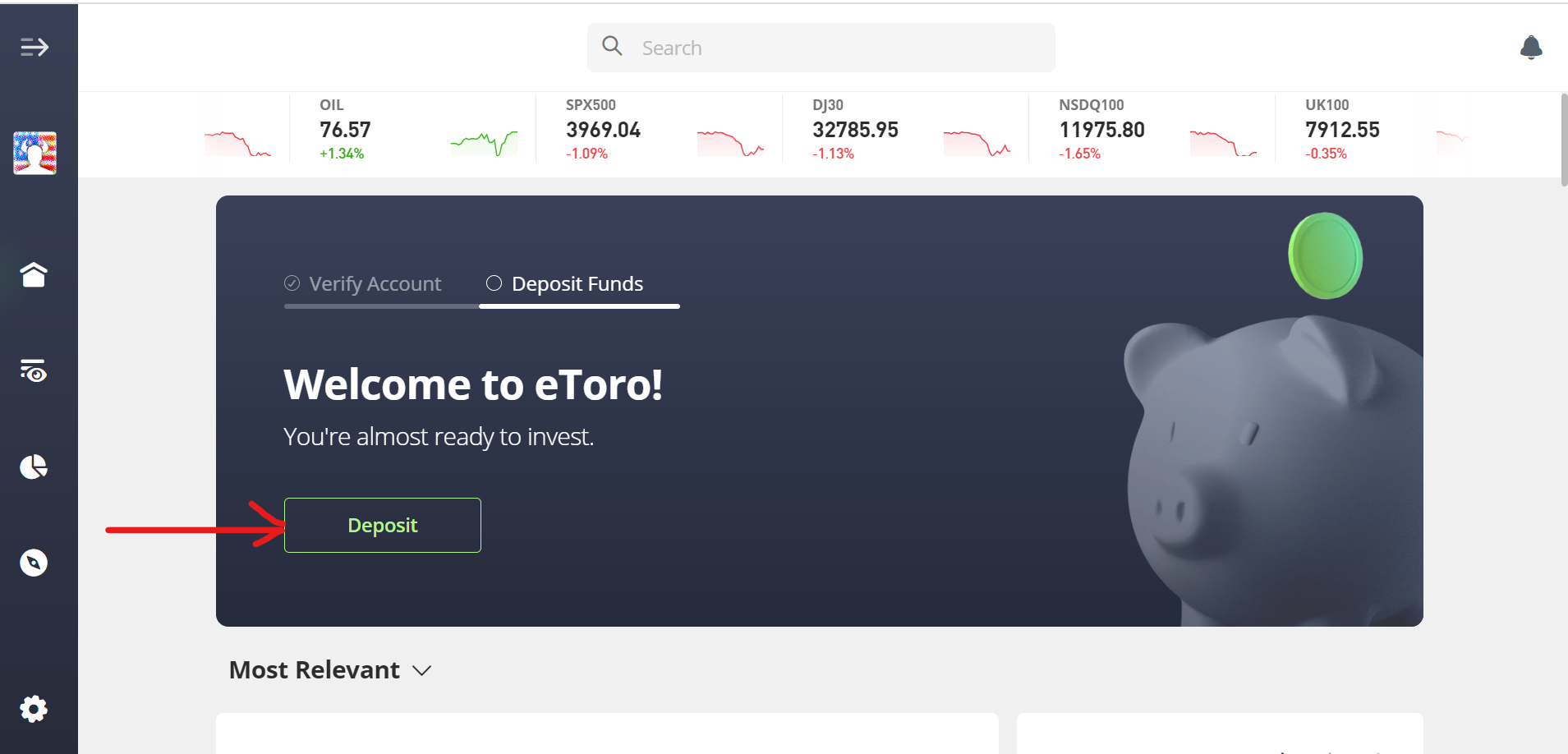

2. Fund your eToro account

Once you log in, you can access the account homepage. The interface might be slightly different depending on if you are using a mobile device or accessing the website from the web.

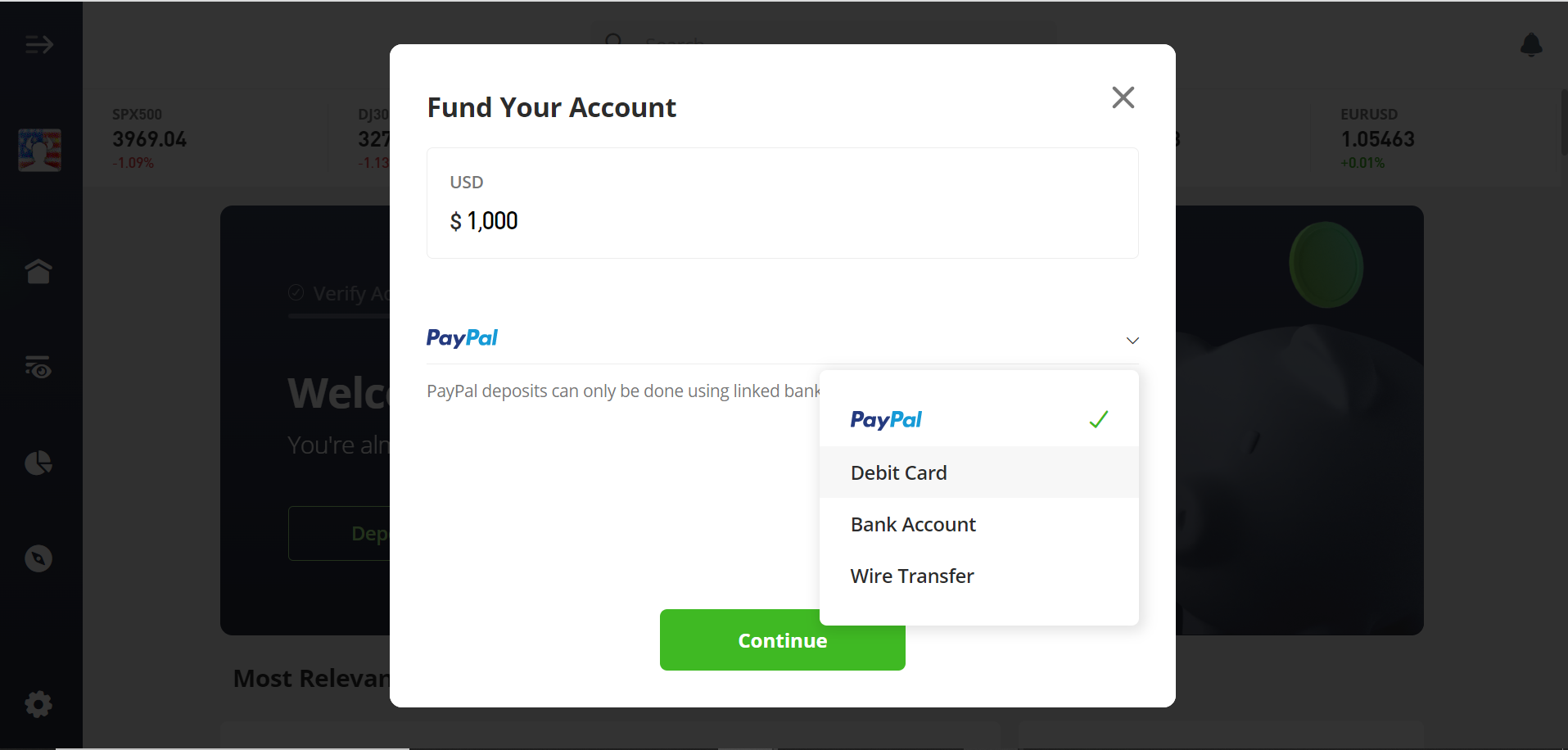

Select the deposit icon on the page, which will load the transaction wizard. You can specify how you want to fund your account from this page.

eToro allows payment in different forms but accepts one payment method simultaneously. The available methods include cards, bank accounts, and wire transfers.

You will need to select one of the options if you are adding an account or a card. A digital payment method like PayPal is also available, and you can link it to eToro to fund your account. eToro allows you to have a minimum deposit of USD as low as $10.

3. Buy XRP

This is the last stage for buying your digital asset after verifying and depositing your account. To buy XRP on eToro, click the [Markets] icon and select [Crypto].

The list of available crypto assets is displayed, and you can select XRP. Alternatively, you can search the keyword [XRP] to quickly locate digital support.

After selecting XRP, you should fill in the XRP coins you need. You can enter the amount of fiat currency you want to spend or the amount of XRP you want to buy. EToro will provide the purchase rate or the equivalent XRP for the fiat amount input, regardless of which one you choose.

It’s as simple as it gets! Once you select the confirm button, you will be credited with the right amount of XRP either immediately or after the stipulated time for other payment methods. Finally, you can hold XRP in your account.

Step #5: Have an XRP Investment Strategy

It is not enough for you to own XRP; having an investment strategy for your coin is equally essential. An investment strategy will help you determine how much you need to spend and how to profit from your XRP purchase.

Some of the guides that are essential for an effective investment plan include:

- Your investment goals

- The duration of achieving the goals

- Your risk appetite for investment

It would help if you typically had an investment strategy before buying an asset. This will help you focus on what is essential to achieving your XRP goals.

Pros and Cons of using XRP

Like most other cryptocurrencies, XRP has pros and cons, and you should put these into perspective when buying, investing in, or using XRP or the Ripple network.

Here are some of the pros associated with:

Pros

Transparency and Reliability

Ripple uses the XRP ledger, which over 150 independent validators maintain. These validators comprise financial institutions, universities, and pre-vetted individuals.

The validators agree on the protocol for transactions and verify transactions. The transactions are also made public, increasing transparency and reliability in the system.

High Transaction Speed

Ripple generates the XRP ledger in about 4 seconds. The current record of the XRP ledger supports 1,500 transactions per second, with an estimated increase to 65,000 TPS. This is a whopping speed compared with other popular networks operating at a rate of 15 TPS.

Environmental friendliness

One of the significant cryptocurrency concerns globally is its high energy consumption, making it unconducive and unsustainable for the environment.

XRP creates a distinction as it minimally consumes energy through its consensus protocol mechanism. This eco-friendliness feature makes it a top choice cryptocurrency.

Huge Traction

Ripple aims to rival and solve the bottlenecks of cross-border payment, and it has gained massive traction among global financial institutions. Using XRP as its native token increases the adoption of digital assets.

Cost-effectiveness

Ripple XRP boasts of having one of the lowest transaction fees, a big challenge for other major blockchain networks. The network fee on the XRP ledger is as low as $0.0003. This cost-effective strategy makes it cheaper for cross-border payments than traditional payment networks.

Cons

Here are some of the cons associated with the use of Ripple XRP.

Legal and Regulatory Sanction

It is important to note that Ripple Labs and some of its executives have been involved in a legal dispute since December 2020, which has yet to be resolved. Ripple Labs and two of its executives allegedly breached the SEC Act.

Although the CEO of Ripple has speculated that the case would end in 2023, the outcome of the legal battle can impact the future performance of both the company and its native coin.

Delisting on Major Exchanges

As a result of the legal affairs of Ripple, it has led to the delisting of XRP from significant exchanges, especially those based in the US. The delisting has limited the number of users who purchase XRP and add it to their portfolios.

Tight Competition

Ripple has challenged traditional payment portals, including top players such as SWIFT. In addition to the competition with the conventional system, it faces competition from the cryptocurrency space.

Also, because XRP is a native coin of Ripple, the currency has resultant effects based on the mother company’s competition.

Notwithstanding the challenges Ripple and XRP face, there is no denying their significant contribution to the global financial ecosystem. Even with these challenges, XRP continues to make a list as one of the top-leading cryptocurrencies in market cap.

Conclusion

Ripple has gained traction among many users in the financial ecosystem since its inception. It has massively contributed to solving the challenges faced in cross-border payments. The token has become more reliable due to its unique consensus mechanism for validating transactions on the blockchain network.

XRP remains highly ranked based on market capitalization; it is also widely adopted due to its low transaction fees, high speed, and, ultimately, its eco-friendliness. You can buy XRP from exchanges that support the coin and make it available in your region.

Few crypto exchanges have the coin listed on their platforms due to the ongoing legal issues facing the company over unregistered securities. However, there are predictions about the court case closing in the first half of 2024.

You have the opportunity to purchase XRP on the well-regarded trading platform, eToro.

Should you seek an affordable entry point into cryptocurrency investing, XRP presents a promising option due to its potential for growth.

Despite its unavailability on Coinbase's ecosystem, which encompasses various payment systems including PayPal, you can actively purchase XRP on trading platforms such as eToro and Uphold.